- Bitcoin’s back-to-back ‘Super Signals’ hint at explosive gains—last seen before 10,000% rallies.

- Over 94% of Bitcoin holders were in profit as volume trends suggested strong bullish sentiment ahead.

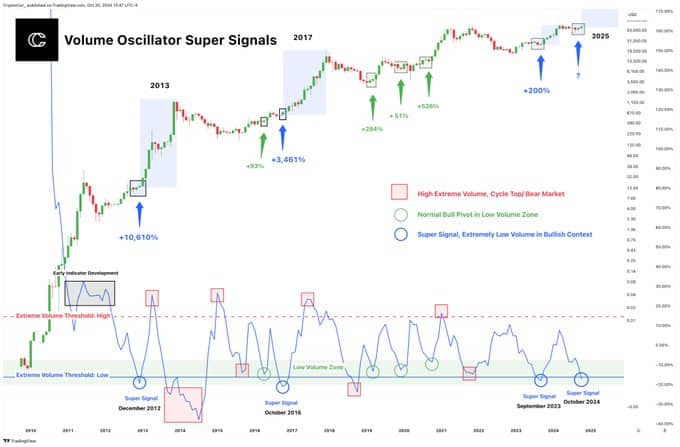

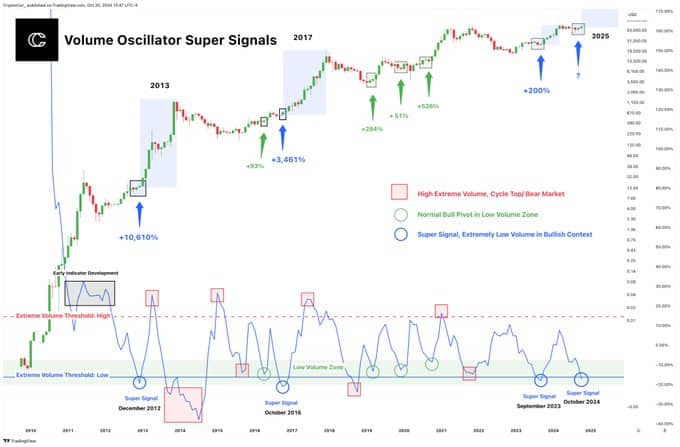

Bitcoin’s [BTC] volume oscillator has recently signaled back-to-back ‘Super Signals,’ a rare event that has only occurred during major bull runs.

Historically, such signals preceded massive rallies, including gains of over 10,000% in 2012 and 3,000% in 2016.

The latest occurrence, seen in September 2023, followed a +200% rise in Bitcoin’s price, with another super signal appearing in October 2024.

Source: X

The ‘Super Signal’ appears when trading volume is extremely low in a bullish market. Analysts suggest that these conditions indicate accumulation, as sellers dwindle while buying interest remains steady.

The absence of prior high-volume spikes further supports a bullish outlook, differentiating this phase from bearish low-volume patterns.

Bitcoin’s price gains and market data

As of press time, Bitcoin was priced at $68,378.05, with a market cap of $1.35 trillion and a 24-hour trading volume of $24.5 billion.

This marks a 5.96% increase over the past seven days, showcasing steady gains. Bitcoin’s circulating supply stands at 20 million BTC.

Open Interest in Bitcoin Futures has risen by 2.39%, at $40.69 billion at press time, indicating increased trading activity and potential bullish sentiment.

CoinGlass data showed a 90.33% jump in trading volume to $42.62 billion, while options volume soared by 182.07% to $1.60 billion.

Options Open Interest also increased by 2.29%, now at $24.31 billion. The alignment of these metrics with Bitcoin’s price movements suggests growing optimism among traders.

Bullish sentiment

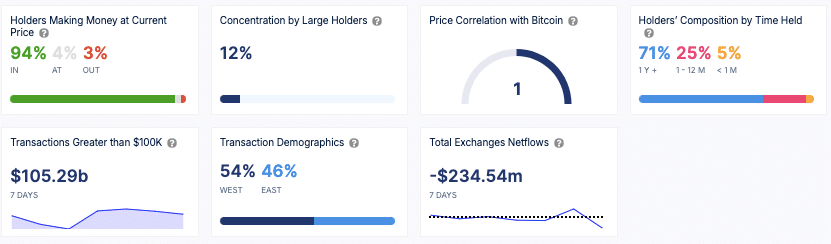

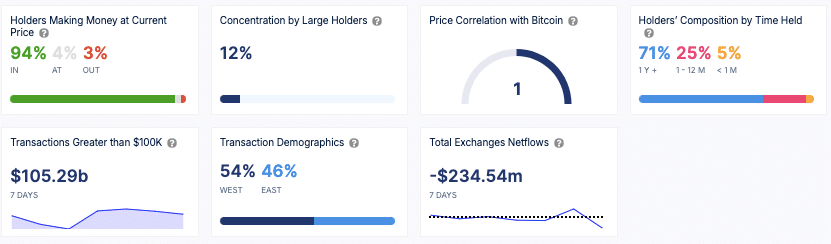

Data from IntoTheBlock showed that 94% of Bitcoin holders were in profit at current prices, signaling positive market sentiment.

The analysis also revealed that 71% of Bitcoin holders have maintained their positions for over a year, suggesting strong long-term holding behavior.

Meanwhile, 12% of Bitcoin’s supply were held by large holders, indicating a moderate concentration of ownership among whales.

Source: IntoTheBlock

Additionally, there has been a net outflow of $234.54 million from exchanges over the past week, pointing to potential accumulation as investors move assets into cold storage.

Over $105.29 billion in transactions greater than $100K occurred over the last week, driven by institutional investors and large traders.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

The geographical distribution of transactions is fairly balanced, with 54% from Western regions and 46% from Eastern regions.

Overall, the presence of back-to-back super signals a unique event in Bitcoin’s history, creating anticipation for potential price movements similar to previous bull cycles.

- Bitcoin’s back-to-back ‘Super Signals’ hint at explosive gains—last seen before 10,000% rallies.

- Over 94% of Bitcoin holders were in profit as volume trends suggested strong bullish sentiment ahead.

Bitcoin’s [BTC] volume oscillator has recently signaled back-to-back ‘Super Signals,’ a rare event that has only occurred during major bull runs.

Historically, such signals preceded massive rallies, including gains of over 10,000% in 2012 and 3,000% in 2016.

The latest occurrence, seen in September 2023, followed a +200% rise in Bitcoin’s price, with another super signal appearing in October 2024.

Source: X

The ‘Super Signal’ appears when trading volume is extremely low in a bullish market. Analysts suggest that these conditions indicate accumulation, as sellers dwindle while buying interest remains steady.

The absence of prior high-volume spikes further supports a bullish outlook, differentiating this phase from bearish low-volume patterns.

Bitcoin’s price gains and market data

As of press time, Bitcoin was priced at $68,378.05, with a market cap of $1.35 trillion and a 24-hour trading volume of $24.5 billion.

This marks a 5.96% increase over the past seven days, showcasing steady gains. Bitcoin’s circulating supply stands at 20 million BTC.

Open Interest in Bitcoin Futures has risen by 2.39%, at $40.69 billion at press time, indicating increased trading activity and potential bullish sentiment.

CoinGlass data showed a 90.33% jump in trading volume to $42.62 billion, while options volume soared by 182.07% to $1.60 billion.

Options Open Interest also increased by 2.29%, now at $24.31 billion. The alignment of these metrics with Bitcoin’s price movements suggests growing optimism among traders.

Bullish sentiment

Data from IntoTheBlock showed that 94% of Bitcoin holders were in profit at current prices, signaling positive market sentiment.

The analysis also revealed that 71% of Bitcoin holders have maintained their positions for over a year, suggesting strong long-term holding behavior.

Meanwhile, 12% of Bitcoin’s supply were held by large holders, indicating a moderate concentration of ownership among whales.

Source: IntoTheBlock

Additionally, there has been a net outflow of $234.54 million from exchanges over the past week, pointing to potential accumulation as investors move assets into cold storage.

Over $105.29 billion in transactions greater than $100K occurred over the last week, driven by institutional investors and large traders.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

The geographical distribution of transactions is fairly balanced, with 54% from Western regions and 46% from Eastern regions.

Overall, the presence of back-to-back super signals a unique event in Bitcoin’s history, creating anticipation for potential price movements similar to previous bull cycles.

Blue Techker I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

The photographs and visuals used in this blog are always stunning They really add a beautiful touch to the posts

how to buy clomiphene without prescription where to buy clomid price cost clomiphene online where to get cheap clomid price where to get cheap clomiphene pill how to buy generic clomid price how can i get clomiphene price

I’ll certainly return to read more.

The depth in this tune is exceptional.

zithromax 500mg pills – order sumycin 250mg pill order metronidazole 200mg for sale

buy rybelsus 14 mg online cheap – buy cyproheptadine 4mg for sale purchase cyproheptadine generic

motilium oral – oral domperidone 10mg buy flexeril 15mg online cheap

buy inderal 10mg sale – buy cheap plavix methotrexate 2.5mg generic

buy amoxicillin online cheap – buy generic diovan for sale buy ipratropium 100mcg sale

azithromycin 500mg pills – buy generic zithromax order bystolic pills

generic augmentin 1000mg – https://atbioinfo.com/ ampicillin for sale online

generic nexium – https://anexamate.com/ buy generic nexium over the counter

generic medex – https://coumamide.com/ buy losartan 50mg for sale

purchase mobic without prescription – https://moboxsin.com/ mobic online buy

prednisone medication – https://apreplson.com/ brand prednisone 10mg

where can i buy ed pills – https://fastedtotake.com/ buy erectile dysfunction pills

order amoxicillin online cheap – comba moxi where to buy amoxicillin without a prescription

buy diflucan 200mg pills – https://gpdifluca.com/ buy diflucan 100mg generic

buy generic cenforce 50mg – buy cenforce 50mg for sale buy cenforce 50mg without prescription

cialis for daily use reviews – https://ciltadgn.com/# cialis manufacturer coupon

buy generic ranitidine – online ranitidine over the counter

cialis indications – on this site comprar tadalafil 40 mg en walmart sin receta houston texas

how to buy viagra in canada – generic viagra 50mg viagra buy walgreens

This is the big-hearted of literature I truly appreciate. buy lasix pills for sale

More posts like this would make the online elbow-room more useful. https://ursxdol.com/furosemide-diuretic/

More posts like this would make the online elbow-room more useful. https://prohnrg.com/product/diltiazem-online/

This is the stripe of content I take advantage of reading. prednisolone angine posologie

This is the kind of glad I get high on reading. https://ondactone.com/spironolactone/

The thoroughness in this break down is noteworthy.

how to buy colchicine

The sagacity in this tune is exceptional. http://www.01.com.hk/member.php?Action=viewprofile&username=Ymvnrm

purchase dapagliflozin sale – purchase dapagliflozin forxiga 10 mg cost

cheap xenical – https://asacostat.com/# buy orlistat 120mg

The thoroughness in this section is noteworthy. https://lzdsxxb.com/home.php?mod=space&uid=5112565