- Bitcoin has a bullish structure but failed to follow through on the breakout.

- Fears of a local top due to social media buzz played out in the past four days.

Bitcoin [BTC] achieved a breakout from a descending channel it has traded within since July. However, after reaching the local high of $66.5k, the price began to reverse its upward momentum.

In a post on X, crypto market intelligence platform Santiment noted that the crowd sentiment was particularly bullish. This raised the chances of a market top and panic selling should BTC prices dive lower.

The near 5% price drop on Monday vindicated this idea. Is the market ready to recover, or was that the local top?

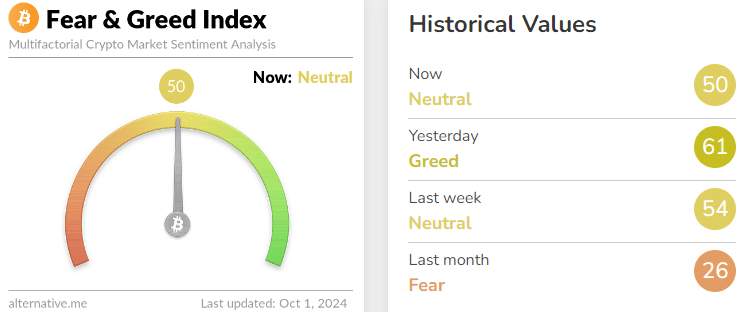

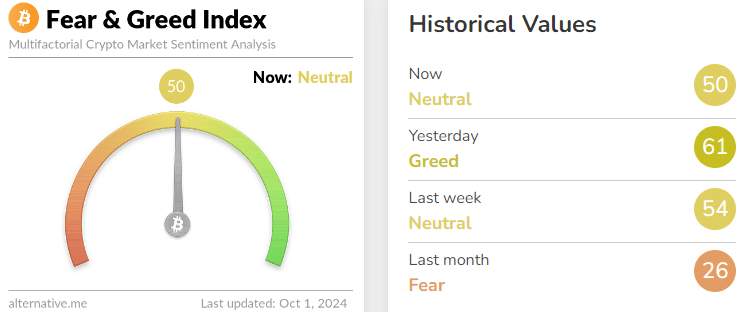

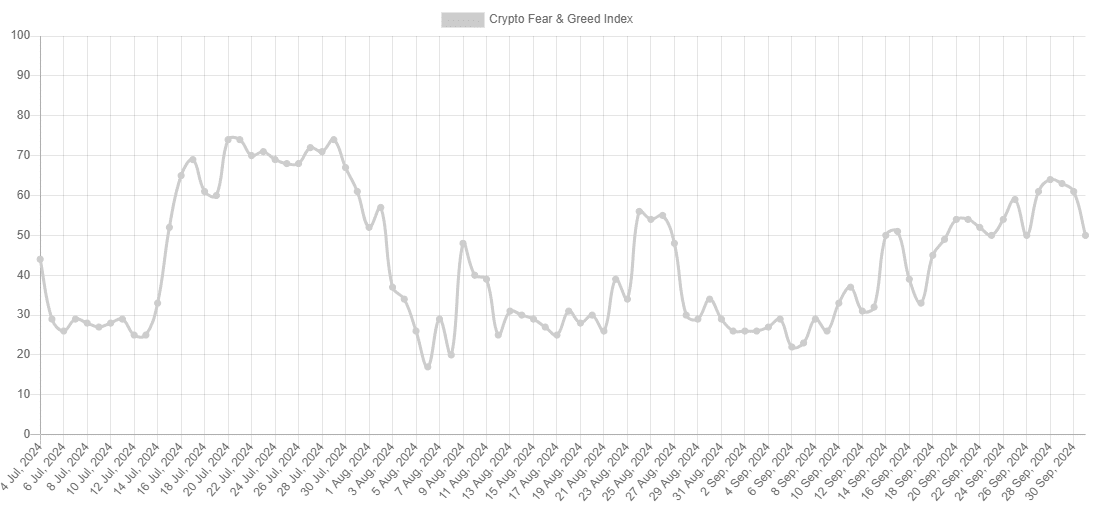

Bitcoin Fear and Greed Index

Source: Alternative.me

A look at the fear and greed index showed that market participants need not panic. The current sentiment was neutral and has been neutral or fearful in recent weeks.

The score is calculated using different data points such as volatility, market volume, social media engagement, and the Bitcoin dominance trends and Google Trends scores.

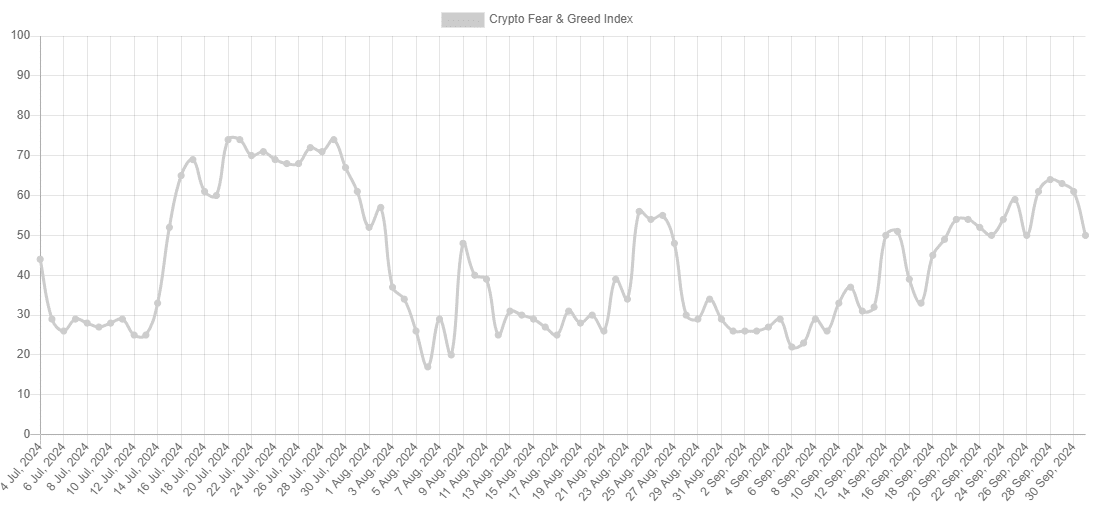

Source: Alternative.me

AMBCrypto also analyzed the Bitcoin Fear and Greed Index’s scores over the past three months. The price trend of September, especially the latter half, saw the index rise higher.

This was still not enough to push the market into “greedy” territory.

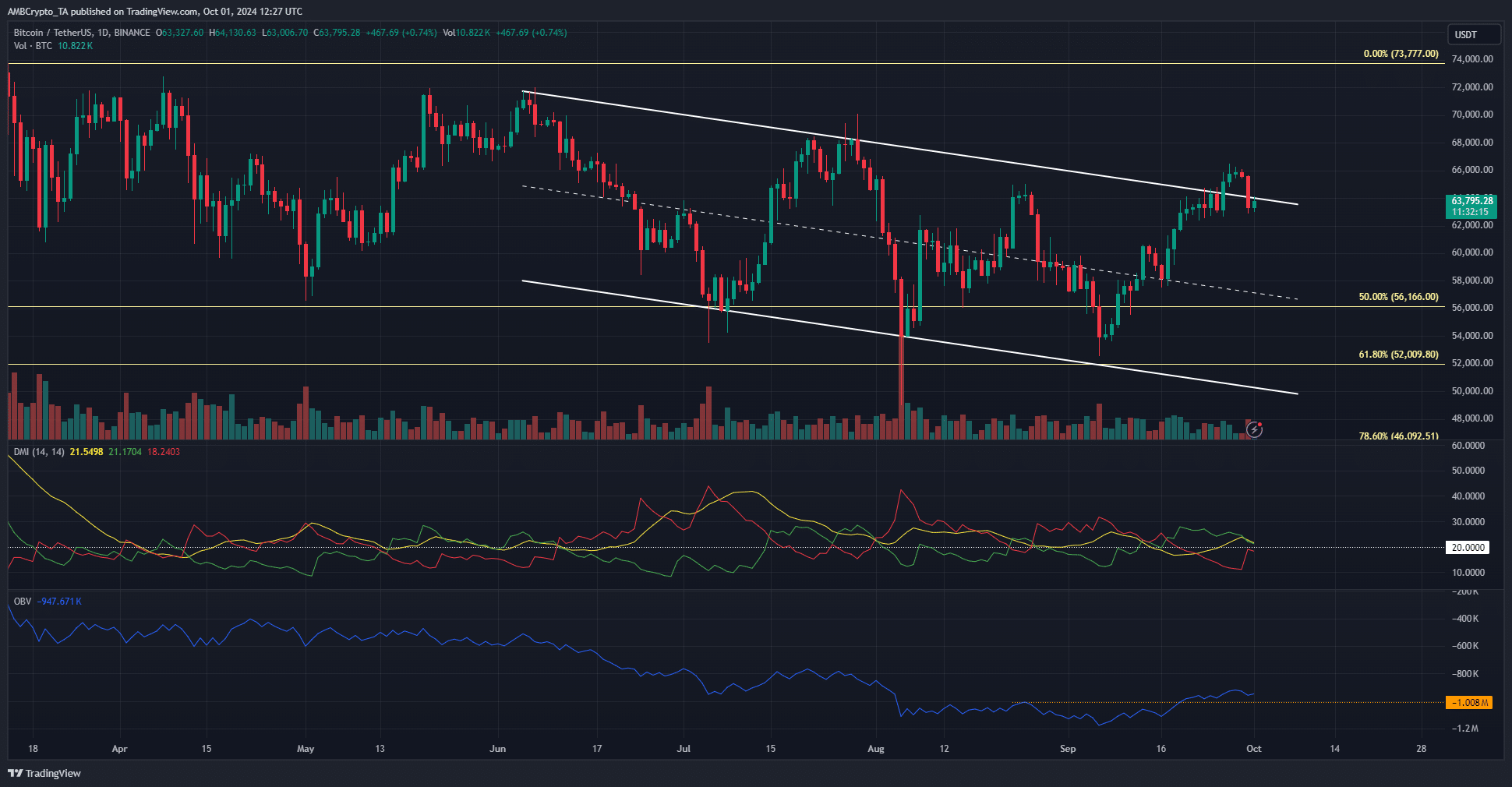

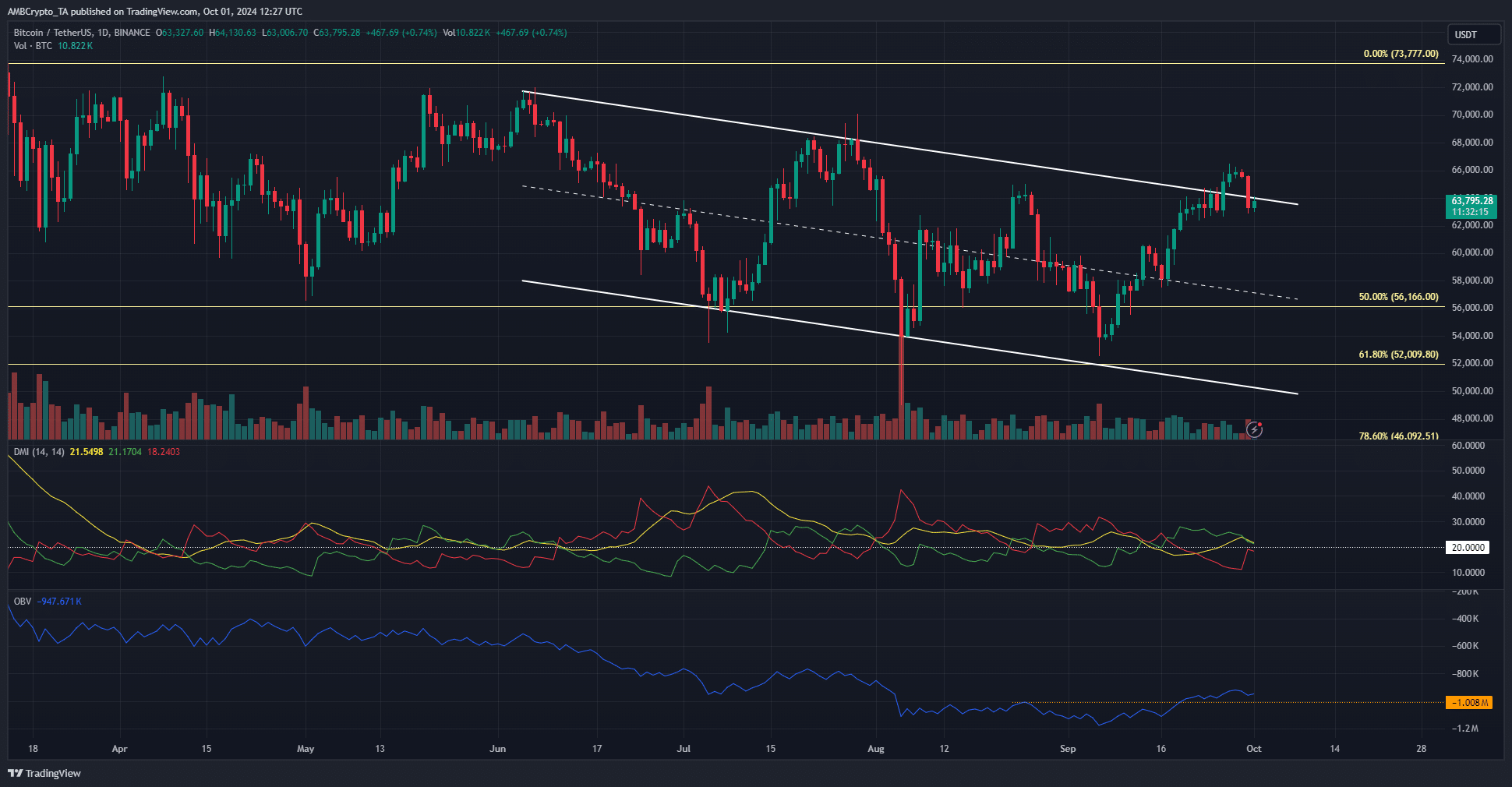

The failed channel breakout

Source: BTC/USDT on TradingView

The price action since June has been characterized by a series of lower highs and lower lows. The most recent lower high at $65k from the 25th of August was breached, as were the descending channel’s highs.

This breakout did not last long. Within four days, BTC saw a 4.7% correction to fall back into the range and below the $64k-$66k resistance zone.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The OBV has cleared the local high from August, but not by a substantial margin. A failure to follow through from the price meant that bulls lacked conviction in the short term and were more comfortable taking profits.

The DMI had signaled a strong uptrend during the breakout. The +DI and ADX were both above 20, and they still are, but were falling lower. It is likely that the $60k-$61.5k support zone next.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Bitcoin has a bullish structure but failed to follow through on the breakout.

- Fears of a local top due to social media buzz played out in the past four days.

Bitcoin [BTC] achieved a breakout from a descending channel it has traded within since July. However, after reaching the local high of $66.5k, the price began to reverse its upward momentum.

In a post on X, crypto market intelligence platform Santiment noted that the crowd sentiment was particularly bullish. This raised the chances of a market top and panic selling should BTC prices dive lower.

The near 5% price drop on Monday vindicated this idea. Is the market ready to recover, or was that the local top?

Bitcoin Fear and Greed Index

Source: Alternative.me

A look at the fear and greed index showed that market participants need not panic. The current sentiment was neutral and has been neutral or fearful in recent weeks.

The score is calculated using different data points such as volatility, market volume, social media engagement, and the Bitcoin dominance trends and Google Trends scores.

Source: Alternative.me

AMBCrypto also analyzed the Bitcoin Fear and Greed Index’s scores over the past three months. The price trend of September, especially the latter half, saw the index rise higher.

This was still not enough to push the market into “greedy” territory.

The failed channel breakout

Source: BTC/USDT on TradingView

The price action since June has been characterized by a series of lower highs and lower lows. The most recent lower high at $65k from the 25th of August was breached, as were the descending channel’s highs.

This breakout did not last long. Within four days, BTC saw a 4.7% correction to fall back into the range and below the $64k-$66k resistance zone.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The OBV has cleared the local high from August, but not by a substantial margin. A failure to follow through from the price meant that bulls lacked conviction in the short term and were more comfortable taking profits.

The DMI had signaled a strong uptrend during the breakout. The +DI and ADX were both above 20, and they still are, but were falling lower. It is likely that the $60k-$61.5k support zone next.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

selamat datang di situs slot terbaik, situs toto 4d daftar

I like this web site so much, bookmarked. “Nostalgia isn’t what it used to be.” by Peter De Vries.

can you buy generic clomid pills cost of clomiphene for men can i order clomiphene without rx where buy cheap clomid without prescription how can i get cheap clomid price how to get cheap clomid where to buy cheap clomiphene price

Greetings! Very gainful par‘nesis within this article! It’s the little changes which wish turn the largest changes. Thanks a lot quest of sharing!

order zithromax pill – flagyl online order flagyl 200mg pill

rybelsus 14mg price – order semaglutide 14mg online cheap order periactin 4mg pills

how to buy motilium – order domperidone without prescription flexeril sale

cost inderal – order inderal 20mg generic brand methotrexate 2.5mg

how to get amoxicillin without a prescription – order combivent 100 mcg pill cheap combivent 100 mcg

buy azithromycin 500mg pills – where to buy nebivolol without a prescription buy bystolic 20mg for sale

generic augmentin 1000mg – atbioinfo ampicillin antibiotic online

how to get nexium without a prescription – https://anexamate.com/ nexium where to buy

buy generic coumadin 5mg – https://coumamide.com/ order cozaar sale

buy generic meloxicam over the counter – https://moboxsin.com/ mobic 15mg us

order prednisone 10mg generic – https://apreplson.com/ order deltasone 5mg online cheap

Very interesting details you have noted, thankyou for posting.

Excellent website you have here but I was wanting to know if you knew of any message boards that cover the same topics discussed in this article? I’d really love to be a part of online community where I can get opinions from other knowledgeable people that share the same interest. If you have any suggestions, please let me know. Thanks a lot!

cheapest ed pills – https://fastedtotake.com/ buy erectile dysfunction medications

cheap amoxicillin pill – comba moxi buy amoxil generic

how to buy diflucan – flucoan order diflucan 200mg sale

order cenforce 50mg online cheap – https://cenforcers.com/ purchase cenforce for sale

I am often to running a blog and i actually recognize your content. The article has really peaks my interest. I’m going to bookmark your site and preserve checking for brand new information.

cialis efectos secundarios – ciltad generic cialis time

difference between cialis and tadalafil – https://strongtadafl.com/# cialis trial

buy generic ranitidine for sale – click ranitidine oral

can you buy viagra ebay – https://strongvpls.com/# viagra 50 mg price

Facts blog you possess here.. It’s hard to find elevated status belles-lettres like yours these days. I really comprehend individuals like you! Take mindfulness!! tamoxifen brand

Good blog you have here.. It’s obdurate to find high worth belles-lettres like yours these days. I truly recognize individuals like you! Withstand care!! https://buyfastonl.com/azithromycin.html

This is the kind of post I turn up helpful. https://ursxdol.com/synthroid-available-online/

With thanks. Loads of expertise! https://prohnrg.com/product/cytotec-online/

Howdy! I know this is kind of off topic but I was wondering if you knew where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

This website positively has all of the bumf and facts I needed about this subject and didn’t comprehend who to ask. https://aranitidine.com/fr/modalert-en-france/