- The FOMC’s rate decision draws criticism; Peter Schiff and David Solomon predict ‘no cuts’ soon.

- The crypto market faces a downturn — resilience is observed, with a focus on long-term strategies.

Amidst concerns about the rising inflation in the U.S., the Federal Reserve has decided to hold interest rates steady.

Minutes from the Federal Open Market Committee (FOMC) meeting revealed policymakers’ apprehension about easing rates.

The minutes pointed to the fact that despite some progress, inflation has remained above the FOMC’s 2% target, with many consumer sentiment surveys showing growing worries about future inflation.

FOMC’s decision receives criticism

Criticizing the decision, Peter Schiff, CEO and Chief Global Strategist of Euro Pacific Capital, in an X (formerly Twitter) post, noted,

Source: Peter Schiff/X

Joining a similar train of thought, David Solomon, CEO of Goldman Sachs Group Inc., stated at a Boston College event that he currently predicted “zero” rate cuts. He said,

“I still don’t see the data that’s compelling to see we’re going to cut rates here.”

Negative impact on the crypto market

Needless to say, experts began questioning the effects of the FOMC’s decision on the overall market conditions.

The impact was notably negative, as evidenced by its direct effect on leading cryptocurrencies.

On the 22nd of May, Bitcoin [BTC] dropped below the $70K mark, and Ethereum [ETH], which had recently surged from $3,064 to $3,790, turned red as well.

In fact, at the time of writing, most top coins showed red bars on the daily charts.

Positive sentiments persist

Despite the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, noted,

Source: Crypto King/X

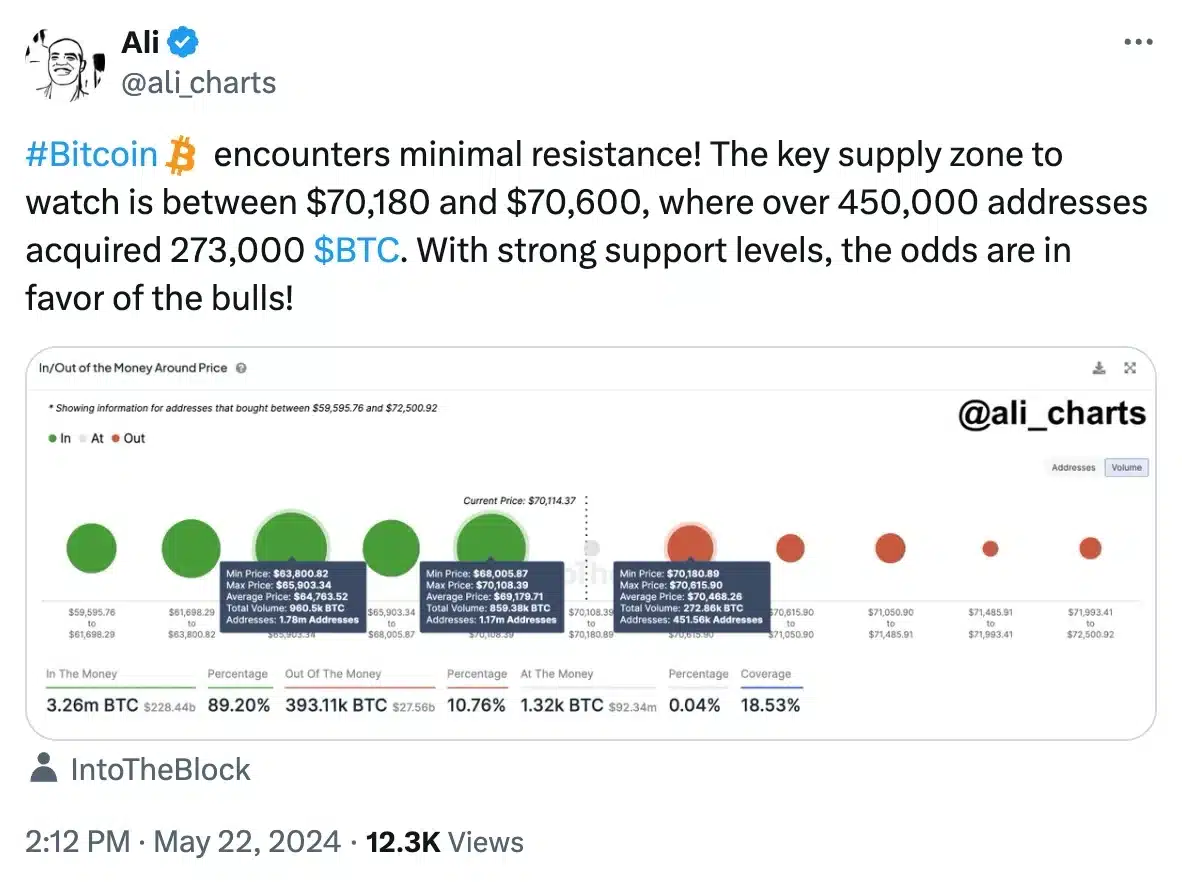

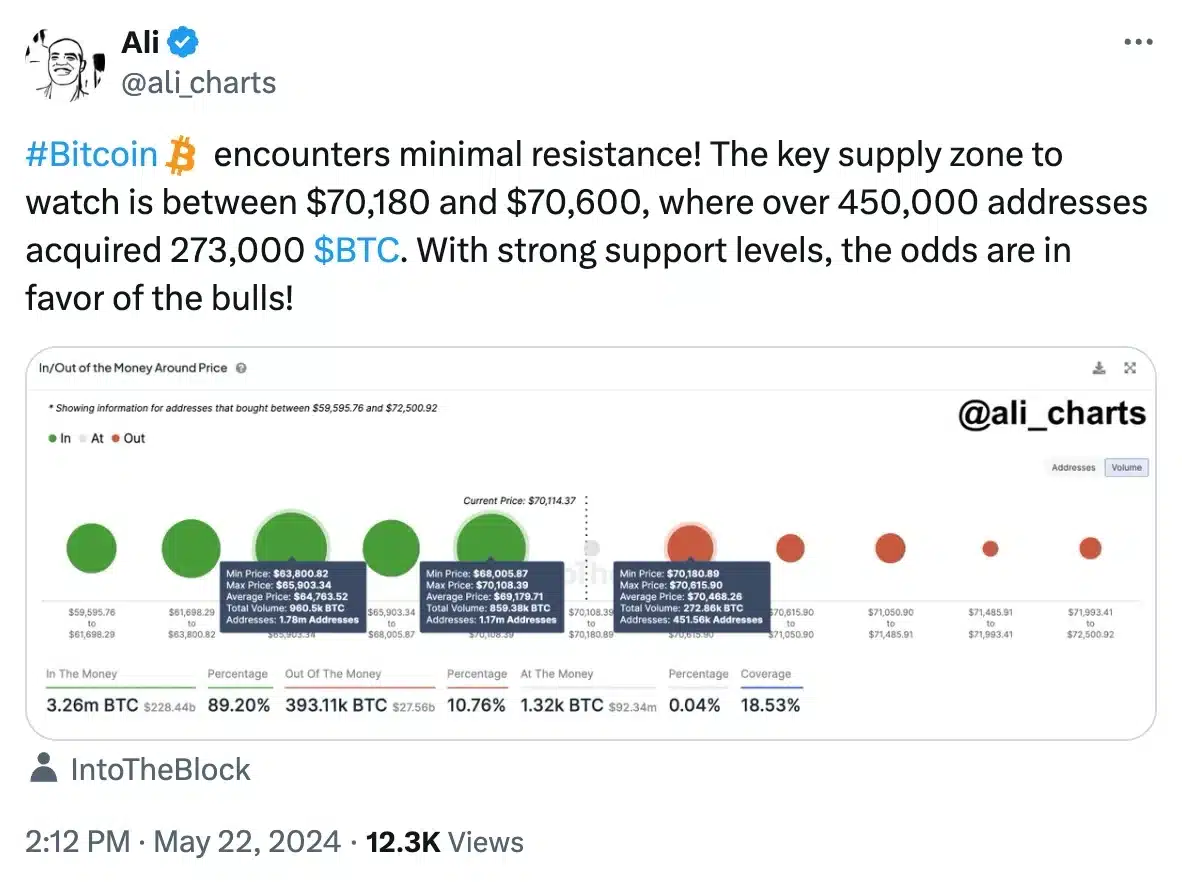

Ali Martinez, the technical and on-chain analyst, echoed a similar sentiment and said,

Source: Ali/X

Glassnode’s Bitcoin liveliness metric further confirmed this, by showing a rise in coinday creation versus destruction, indicating a shift towards long-term holding over profit-taking.

Source: Glassnode

Expecting ETH to experience a significant price increase due to the anticipation of an exchange-traded fund (ETF) approval, Satoshi Flipper, an investor/trader added,

“$ETH will deliver an epic ETF pump this week. Market prices can’t stay irrational forever.”

Stock market declined

Despite the prevailing positive sentiment surrounding cryptocurrencies, attention should also be paid to the performance of the stock market, which experienced a decline on the 22nd of May.

The Dow Jones Industrial Average dropped by 201.95 points, or 0.51%, closing at 39,671.04, marking its worst session of the month.

Similarly, the S&P 500 fell by 0.27% to reach 5,307.01, while the Nasdaq Composite, focusing on tech stocks, recorded a loss of 0.18%, ending at 16,801.54.

- The FOMC’s rate decision draws criticism; Peter Schiff and David Solomon predict ‘no cuts’ soon.

- The crypto market faces a downturn — resilience is observed, with a focus on long-term strategies.

Amidst concerns about the rising inflation in the U.S., the Federal Reserve has decided to hold interest rates steady.

Minutes from the Federal Open Market Committee (FOMC) meeting revealed policymakers’ apprehension about easing rates.

The minutes pointed to the fact that despite some progress, inflation has remained above the FOMC’s 2% target, with many consumer sentiment surveys showing growing worries about future inflation.

FOMC’s decision receives criticism

Criticizing the decision, Peter Schiff, CEO and Chief Global Strategist of Euro Pacific Capital, in an X (formerly Twitter) post, noted,

Source: Peter Schiff/X

Joining a similar train of thought, David Solomon, CEO of Goldman Sachs Group Inc., stated at a Boston College event that he currently predicted “zero” rate cuts. He said,

“I still don’t see the data that’s compelling to see we’re going to cut rates here.”

Negative impact on the crypto market

Needless to say, experts began questioning the effects of the FOMC’s decision on the overall market conditions.

The impact was notably negative, as evidenced by its direct effect on leading cryptocurrencies.

On the 22nd of May, Bitcoin [BTC] dropped below the $70K mark, and Ethereum [ETH], which had recently surged from $3,064 to $3,790, turned red as well.

In fact, at the time of writing, most top coins showed red bars on the daily charts.

Positive sentiments persist

Despite the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, noted,

Source: Crypto King/X

Ali Martinez, the technical and on-chain analyst, echoed a similar sentiment and said,

Source: Ali/X

Glassnode’s Bitcoin liveliness metric further confirmed this, by showing a rise in coinday creation versus destruction, indicating a shift towards long-term holding over profit-taking.

Source: Glassnode

Expecting ETH to experience a significant price increase due to the anticipation of an exchange-traded fund (ETF) approval, Satoshi Flipper, an investor/trader added,

“$ETH will deliver an epic ETF pump this week. Market prices can’t stay irrational forever.”

Stock market declined

Despite the prevailing positive sentiment surrounding cryptocurrencies, attention should also be paid to the performance of the stock market, which experienced a decline on the 22nd of May.

The Dow Jones Industrial Average dropped by 201.95 points, or 0.51%, closing at 39,671.04, marking its worst session of the month.

Similarly, the S&P 500 fell by 0.27% to reach 5,307.01, while the Nasdaq Composite, focusing on tech stocks, recorded a loss of 0.18%, ending at 16,801.54.

generic clomid online cost of generic clomid without rx where can i get cheap clomiphene pill can you buy clomid prices where to get generic clomiphene no prescription can i purchase generic clomid without a prescription clomid challenge test protocol

More posts like this would create the online play more useful.

More content pieces like this would create the интернет better.

azithromycin 250mg drug – order tinidazole for sale order metronidazole generic

rybelsus cost – buy cyproheptadine cheap buy generic cyproheptadine 4mg

order domperidone 10mg sale – order domperidone 10mg online order flexeril 15mg without prescription

order amoxiclav sale – atbio info buy acillin no prescription

order nexium 40mg capsules – https://anexamate.com/ purchase nexium online

coumadin 5mg cheap – coumamide buy cozaar 50mg generic

meloxicam tablet – https://moboxsin.com/ mobic cost

prednisone 5mg cost – corticosteroid buy deltasone 20mg generic

ed pills online – fast ed to take site best ed pills online

cheap amoxicillin generic – comba moxi buy amoxil cheap

order diflucan 200mg generic – https://gpdifluca.com/# diflucan 100mg price

cenforce where to buy – https://cenforcers.com/ order cenforce 50mg online cheap

where to get generic cialis without prescription – how to get cialis for free buy voucher for cialis daily online

zantac sale – https://aranitidine.com/# zantac 150mg over the counter

generic cialis vs brand cialis reviews – https://strongtadafl.com/ tadalafil generic reviews

More posts like this would make the online elbow-room more useful. sitio web

order viagra online in the uk – https://strongvpls.com/ do need prescription order viagra

More text pieces like this would urge the web better. https://buyfastonl.com/furosemide.html

I’ll certainly return to review more. https://ursxdol.com/provigil-gn-pill-cnt/

Good blog you be undergoing here.. It’s severely to assign elevated quality article like yours these days. I really appreciate individuals like you! Take care!! https://prohnrg.com/product/loratadine-10-mg-tablets/

I am actually delighted to glitter at this blog posts which consists of tons of of use facts, thanks representing providing such data. clenbuterol en ligne

This website exceedingly has all of the tidings and facts I needed adjacent to this thesis and didn’t identify who to ask. https://ondactone.com/simvastatin/

I couldn’t turn down commenting. Adequately written!

https://proisotrepl.com/product/domperidone/

Thanks on putting this up. It’s evidently done. http://www.01.com.hk/member.php?Action=viewprofile&username=Olpudl

dapagliflozin for sale – https://janozin.com/ dapagliflozin without prescription

buy xenical pill – https://asacostat.com/ buy orlistat 120mg generic

More posts like this would persuade the online time more useful. http://wightsupport.com/forum/member.php?action=profile&uid=22063