- After touching $61k, BTC witnessed a price correction.

- Selling pressure on the coin increased over the last 24 hours.

In the last 24 hours, optimism in the crypto market increased as Bitcoin [BTC], the king of cryptos, reclaimed $61k. However, the trend didn’t last long as the coin witnessed a price correction. Let’s have a closer look at what’s going on with BTC.

Bitcoin turns bearish again

The king of cryptos gained bullish momentum and managed to go above $61k on the 20th of August. But the scenario changed soon as the bears took over the market.

According to CoinMarketCap, BTC’s price dropped by over 2.5% in the last 24 hours. At the time of writing, the coin was trading at $59,378.99 with a market capitalization of over $1.17 trillion.

The interesting bit was that this recent price correction wasn’t unforeseen.

Ali, a popular crypto analyst, posted a tweet revealing that BTC’s TD sequential flagged a sell signal. Soon after the signal got revealed, the coin’s price witnessed a correction.

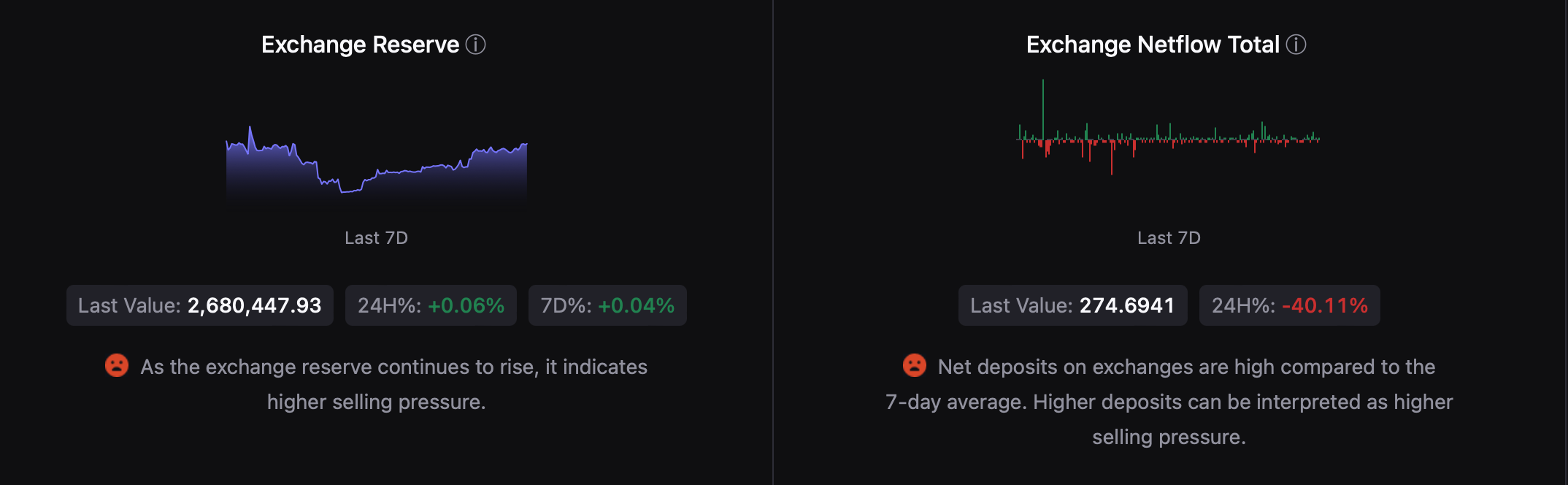

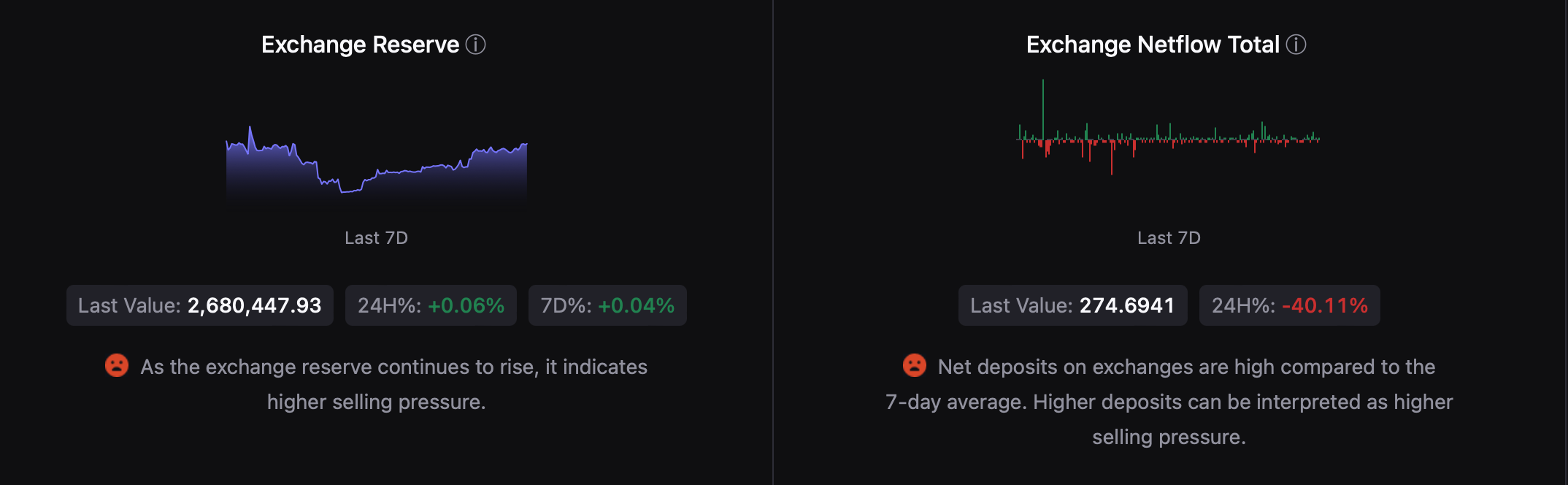

AMBCrypto’s look at CryptoQuant’s data pointed out quite a few factors that might have played a role in cursing BTC to plummet. As per our analysis, BTC’s exchange reserve was rising, indicating an increase in selling pressure.

The fact that investors were selling Bitcoin was further proven by its exchange netflow as it increased.

To be precise, BTC’s net deposit on exchanges was high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure. Nonetheless, BTC’s Coinbase Premium remained green, suggesting that buying sentiment was dominant among US investors.

Source: CryptoQuant

Will this trend continue?

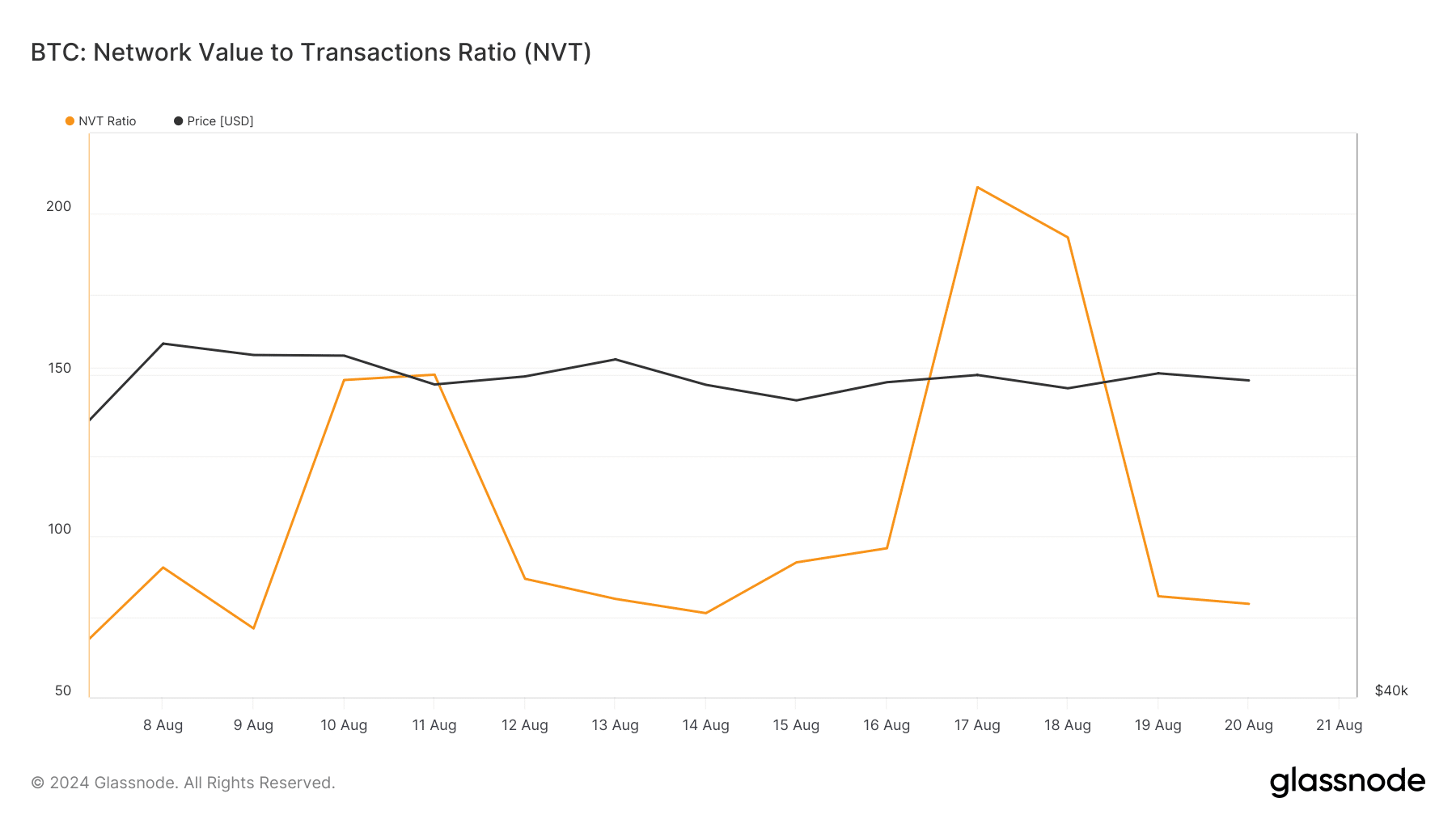

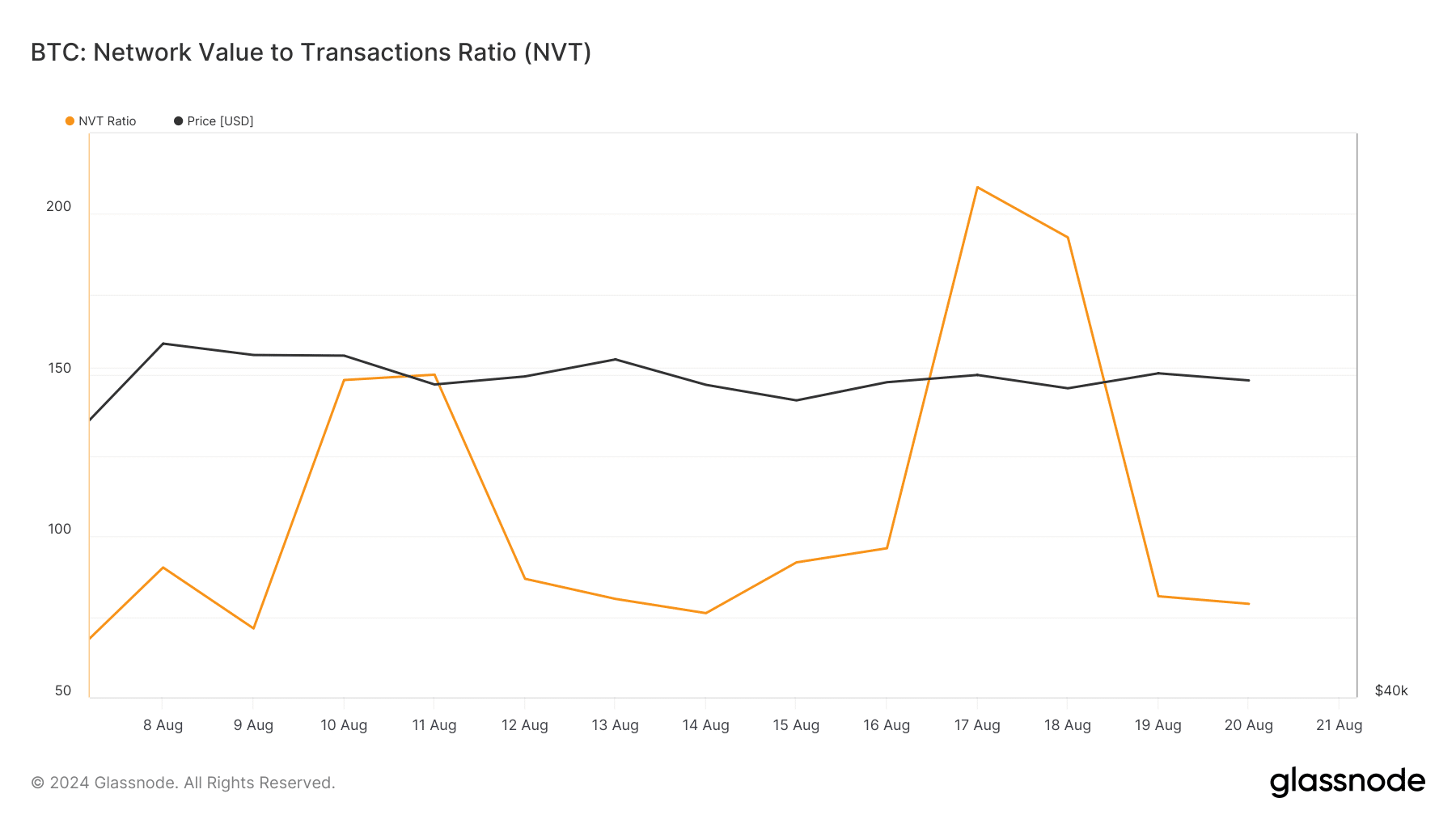

AMBCrypto then took a look at Glassnode’s data to find out the odds of this bearish trend continuing. We found that Bitcoin’s NVT ratio dropped significantly.

A decline in the metric means that an asset is undervalued, hinting at a price increase. For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD.

Source: Glassnode

But things in the derivatives market didn’t look in buyers’ favor. For instance, BTC’s taker buy/sell ratio turned red. This clearly meant that selling sentiment was dominant in the futures market.

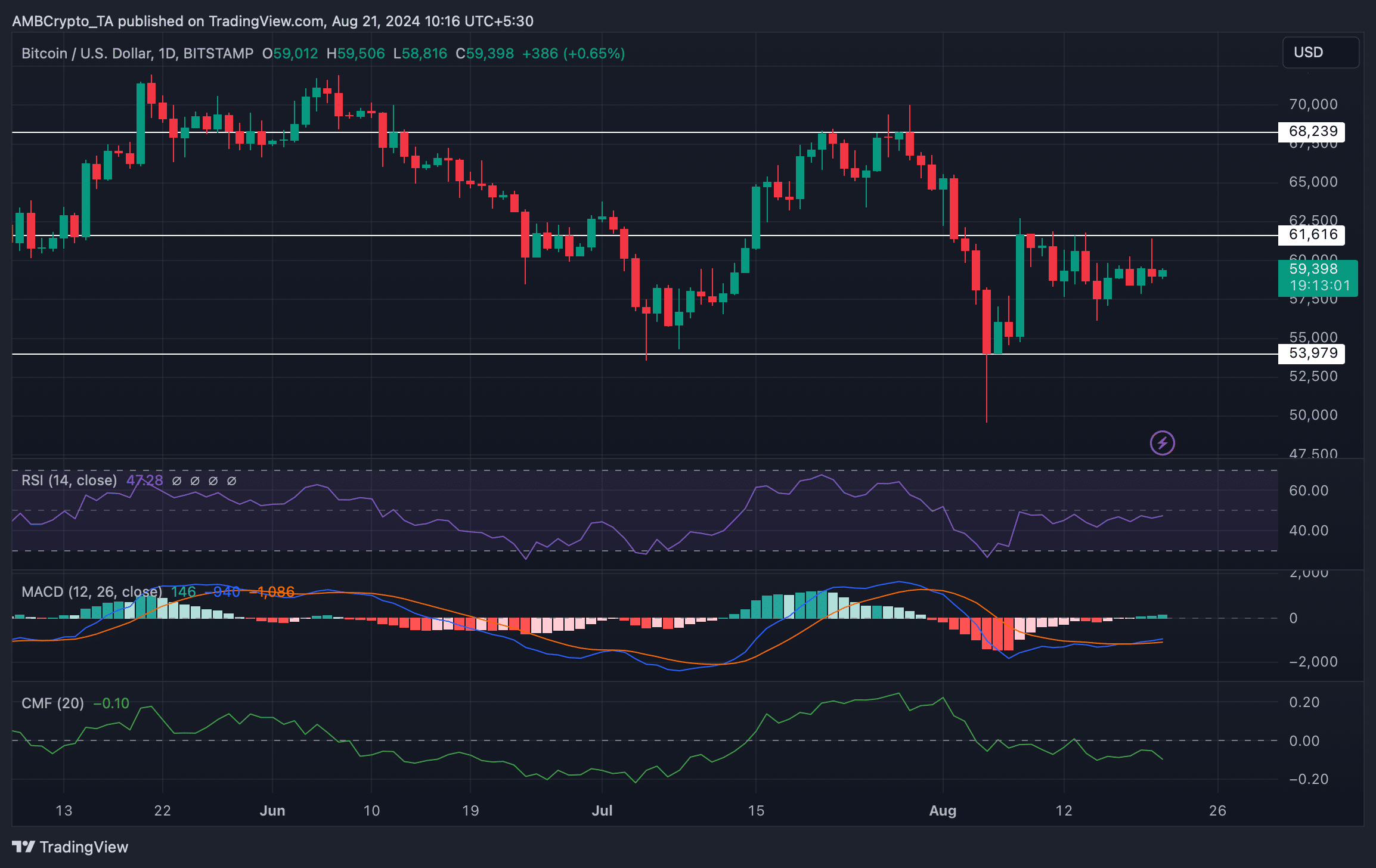

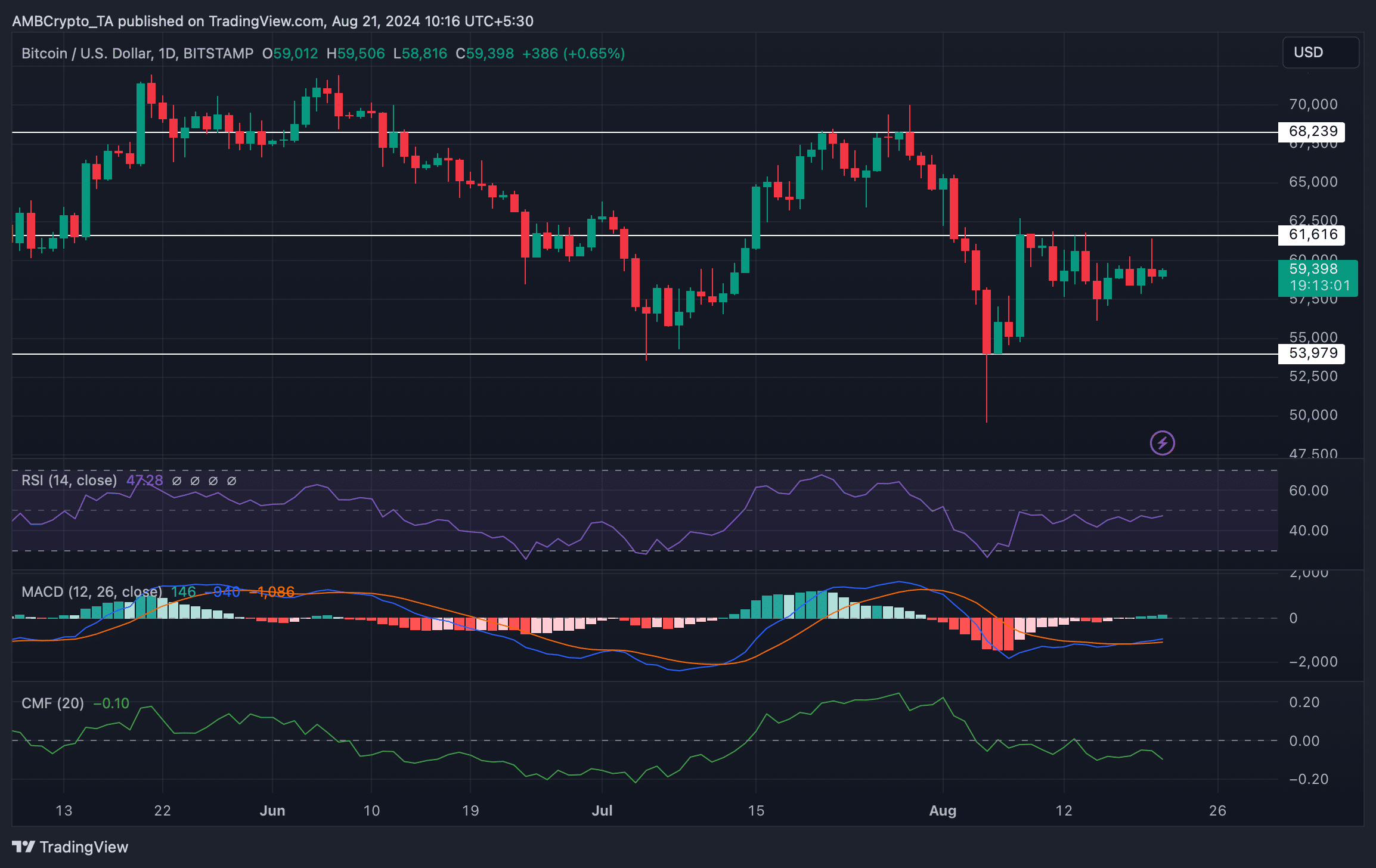

Therefore, AMBCrypto checked BTC’s daily chart to better understand what to expect. The technical indicator MACD displayed a bullish crossover.

Is your portfolio green? Check out the BTC Profit Calculator

BTC’s Relative Strength Index (RSI) was slowly approaching the neutral mark, which was a bullish signal.

Nonetheless, the Chaikin Money Flow (CMF) turned bearish as it registered a downtick.

Source: TradingView

- After touching $61k, BTC witnessed a price correction.

- Selling pressure on the coin increased over the last 24 hours.

In the last 24 hours, optimism in the crypto market increased as Bitcoin [BTC], the king of cryptos, reclaimed $61k. However, the trend didn’t last long as the coin witnessed a price correction. Let’s have a closer look at what’s going on with BTC.

Bitcoin turns bearish again

The king of cryptos gained bullish momentum and managed to go above $61k on the 20th of August. But the scenario changed soon as the bears took over the market.

According to CoinMarketCap, BTC’s price dropped by over 2.5% in the last 24 hours. At the time of writing, the coin was trading at $59,378.99 with a market capitalization of over $1.17 trillion.

The interesting bit was that this recent price correction wasn’t unforeseen.

Ali, a popular crypto analyst, posted a tweet revealing that BTC’s TD sequential flagged a sell signal. Soon after the signal got revealed, the coin’s price witnessed a correction.

AMBCrypto’s look at CryptoQuant’s data pointed out quite a few factors that might have played a role in cursing BTC to plummet. As per our analysis, BTC’s exchange reserve was rising, indicating an increase in selling pressure.

The fact that investors were selling Bitcoin was further proven by its exchange netflow as it increased.

To be precise, BTC’s net deposit on exchanges was high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure. Nonetheless, BTC’s Coinbase Premium remained green, suggesting that buying sentiment was dominant among US investors.

Source: CryptoQuant

Will this trend continue?

AMBCrypto then took a look at Glassnode’s data to find out the odds of this bearish trend continuing. We found that Bitcoin’s NVT ratio dropped significantly.

A decline in the metric means that an asset is undervalued, hinting at a price increase. For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD.

Source: Glassnode

But things in the derivatives market didn’t look in buyers’ favor. For instance, BTC’s taker buy/sell ratio turned red. This clearly meant that selling sentiment was dominant in the futures market.

Therefore, AMBCrypto checked BTC’s daily chart to better understand what to expect. The technical indicator MACD displayed a bullish crossover.

Is your portfolio green? Check out the BTC Profit Calculator

BTC’s Relative Strength Index (RSI) was slowly approaching the neutral mark, which was a bullish signal.

Nonetheless, the Chaikin Money Flow (CMF) turned bearish as it registered a downtick.

Source: TradingView

where can i buy clomiphene without dr prescription how can i get generic clomid can i purchase clomiphene prices order cheap clomid cost clomiphene for sale where to get clomid tablets clomid price at clicks

I couldn’t resist commenting. Well written!

The thoroughness in this draft is noteworthy.

order azithromycin 250mg online cheap – ciprofloxacin online how to get metronidazole without a prescription

buy rybelsus 14mg sale – semaglutide 14 mg without prescription periactin 4mg ca

motilium order – order tetracycline online cheap flexeril 15mg generic

order inderal 20mg pills – order generic inderal 20mg methotrexate 10mg ca

buy amoxil without prescription – buy combivent 100mcg buy combivent 100 mcg online

azithromycin price – azithromycin 500mg canada oral nebivolol 5mg

buy clavulanate pills for sale – https://atbioinfo.com/ buy ampicillin online

esomeprazole 40mg cost – https://anexamate.com/ buy esomeprazole generic

warfarin ca – https://coumamide.com/ order generic hyzaar

mobic cheap – mobo sin generic mobic 15mg

prednisone 20mg ca – https://apreplson.com/ deltasone pills

red ed pill – fast ed to take buy erectile dysfunction medicine

amoxicillin price – combamoxi.com amoxicillin price

buy fluconazole 100mg online – https://gpdifluca.com/ order diflucan 100mg pill

cenforce 50mg over the counter – https://cenforcers.com/ where to buy cenforce without a prescription

cialis one a day with dapoxetine canada – https://ciltadgn.com/ cialis super active reviews

cialis and blood pressure – buy liquid tadalafil online cialis milligrams

zantac 150mg cost – https://aranitidine.com/# ranitidine 150mg brand

viagra sale over counter uk – on this site viagra pfizer 50 mg

Greetings! Utter serviceable par‘nesis within this article! It’s the little changes which wish make the largest changes. Thanks a lot in the direction of sharing! comprar clomid

The sagacity in this tune is exceptional. oral furosemide

This is the gentle of scribble literary works I positively appreciate. https://ursxdol.com/sildenafil-50-mg-in/

With thanks. Loads of knowledge! https://prohnrg.com/product/atenolol-50-mg-online/

This website positively has all of the information and facts I needed there this subject and didn’t know who to ask. https://aranitidine.com/fr/acheter-cialis-5mg/

With thanks. Loads of expertise! https://ondactone.com/spironolactone/

The vividness in this serving is exceptional.

purchase clopidogrel online

Greetings! Very useful par‘nesis within this article! It’s the crumb changes which will espy the largest changes. Thanks a portion towards sharing! http://www.dbgjjs.com/home.php?mod=space&uid=531986

buy generic xenical for sale – buy generic xenical oral xenical 120mg

The thoroughness in this piece is noteworthy. http://zqykj.cn/bbs/home.php?mod=space&uid=303418