- BTC failed to rally despite a dovish FOMC meeting on 31st July.

- July Jobs report on Friday could add volatility and set the next BTC price direction.

Bitcoin [BTC] decoupled from US equities after a dovish FOMC meeting on Wednesday, 1st August, sliding below $65k while stocks hit record highs.

The Fed kept interest rates unchanged as expected at the recent meeting, but chair Jerome Powell signaled a likely September rate cut.

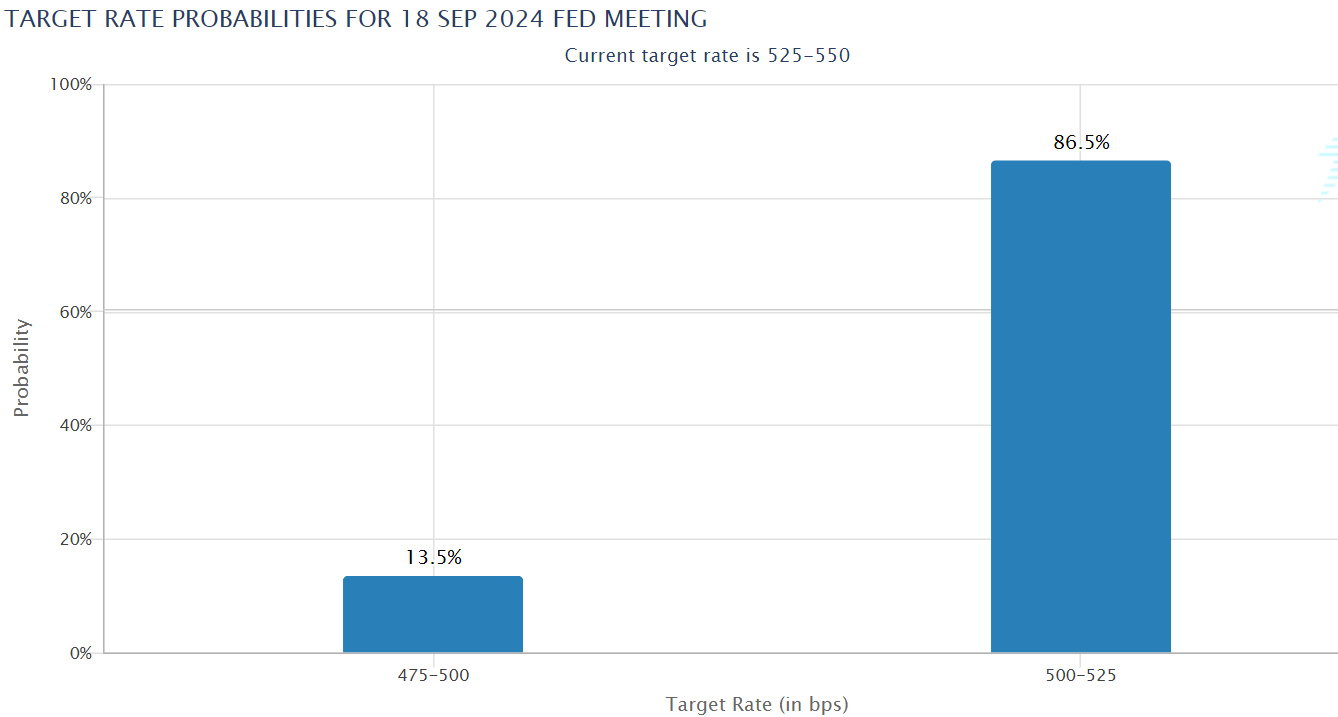

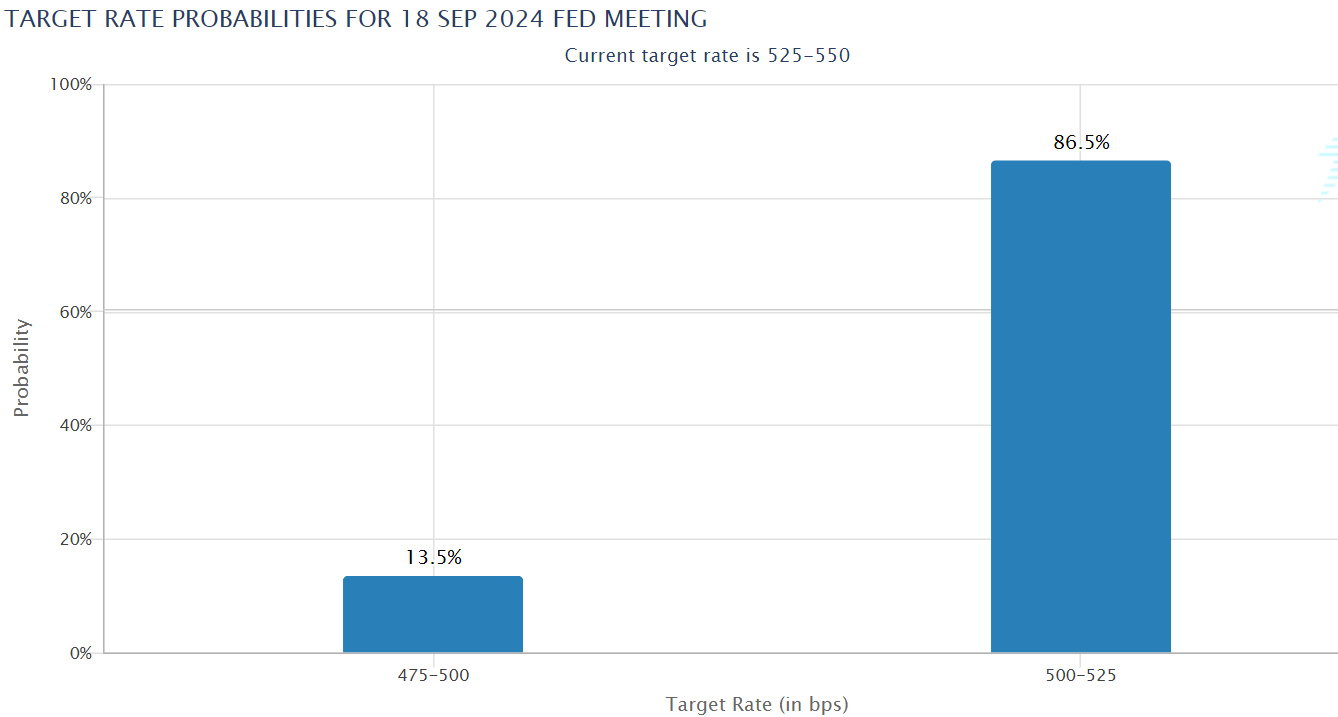

As of press time, interest rate traders are now pricing 86.5% odds of a September cut, an overall bullish cue that boosted US stocks.

Source: CME Fed watch tool

So, why didn’t Bitcoin follow the US equities rally, given the Fed’s dovish announcement?

Galaxy’s Mike Novogratz blames US government

Galaxy Digital’s Mike Novogratz agreed that the US government could be the market risk factor. He argued that the US could sell Bitcoin for political reasons after Trump announced that he would create a strategic reserve.

‘I agree it feels like someone is leaning on $BTC. No idea, but it could be the US Marshall’s office. They report to DOJ… I wish they weren’t selling.’

QCP Capital reinforced a similar market caution linked to the U.S. government’s movement of $2 billion of BTC last week.

‘The recent movement of 30k worth of Silk Road BTC by the US government has introduced uncertainty into the cryptocurrency market.’

As a result, QCP Capital projected that BTC could remain constrained in the range after failing to clear the $70k range-high.

That said, the next market mover could be the US July 2024 Jobs report, which will be released on Friday (2nd August).

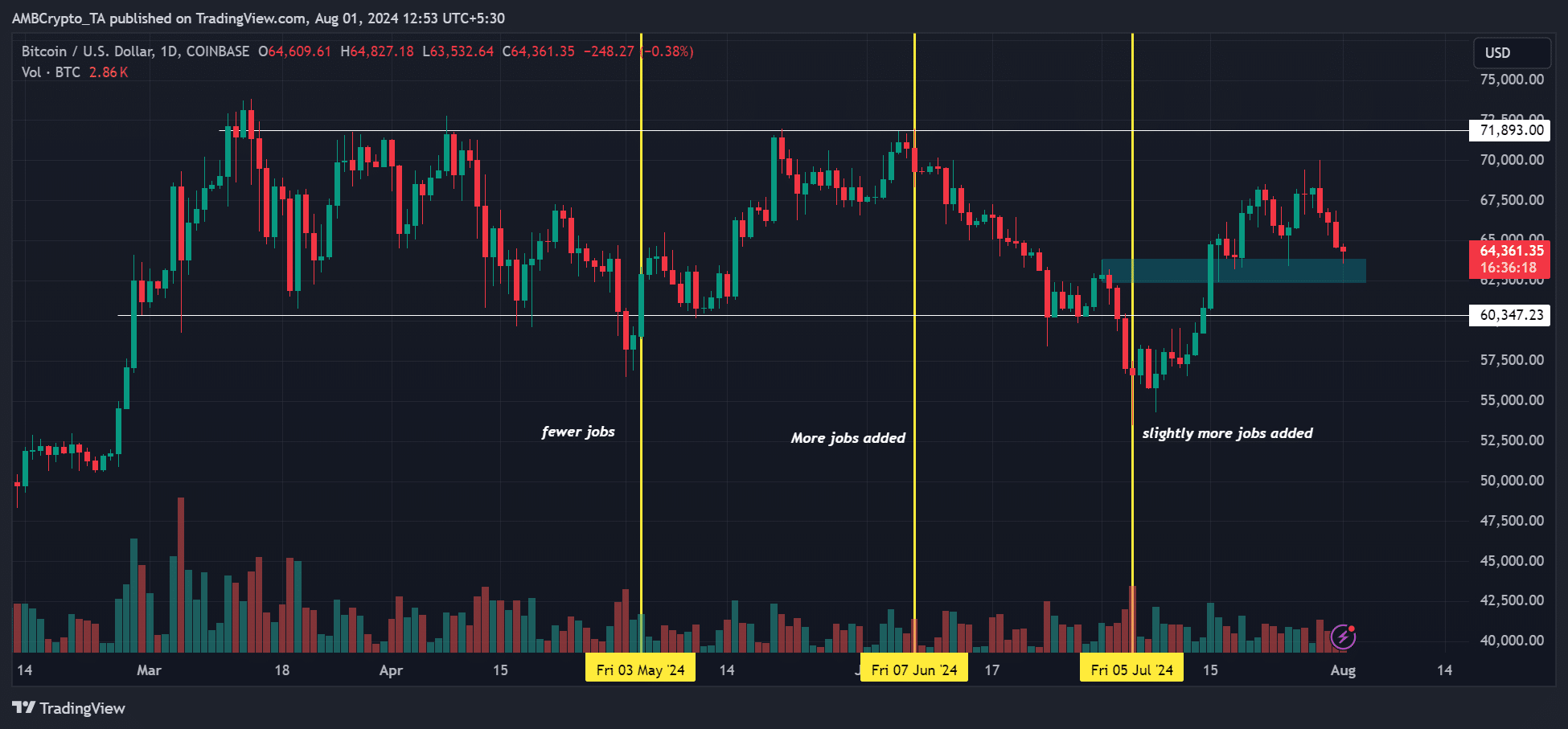

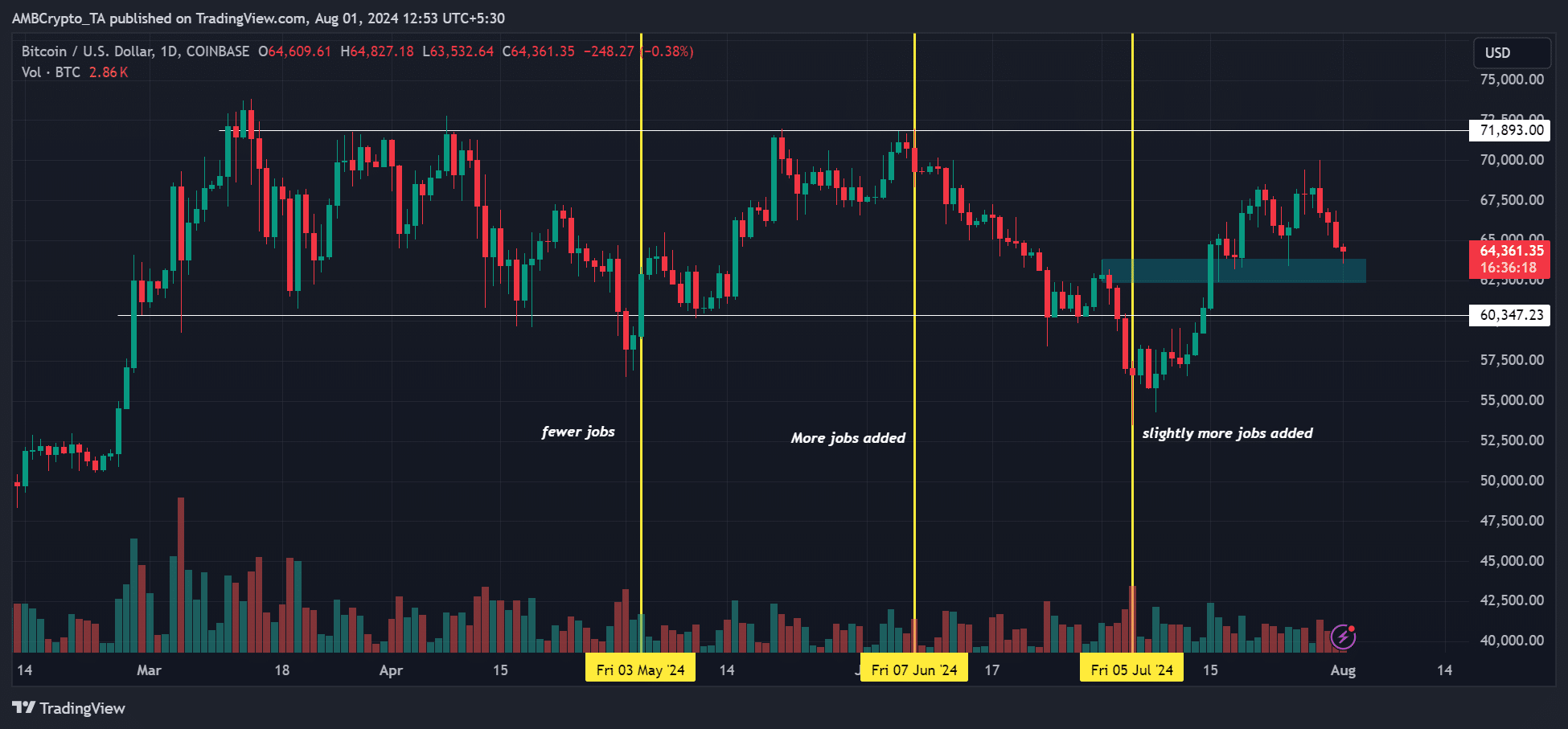

Based on the past jobs reports, fewer added job scenarios corresponded to a rally for BTC, as they reinforced a cooling US labor market and supported the Fed’s likely cut rate possibility.

Source: BTC/USD, TradingView

Such a scenario happened in the April Jobs report, released on 3rd May, tipping BTC to rally about 6%.

However, subsequent jobs reports released in June and July dragged BTC lower after they showed improvement in US labor markets.

So, a cooler Jobs report on Friday could boost BTC to reverse recent losses. However, a hotter Jobs report, with more job additions, could drag it even further towards the range-low.

Quinn Thompson of the crypto hedge fund Lekker Capital shared the same outlook. While acknowledging how crucial Friday could be for markets, he maintained a positive outlook for H2 2024.

‘I remain positively inclined on the medium-term (2H 2024) macro outlook….I expect tomorrow’s FOMC/Friday’s NFP to be two the most important events of the week.’

As of press time, BTC traded below $65k and could only bounce back from the short-term support near $65k, marked cyan, if Jobs’ report favors bulls.

So, macro factors and US politics still have an influence on BTC price, and it is worth tracking these fronts for risk management.

- BTC failed to rally despite a dovish FOMC meeting on 31st July.

- July Jobs report on Friday could add volatility and set the next BTC price direction.

Bitcoin [BTC] decoupled from US equities after a dovish FOMC meeting on Wednesday, 1st August, sliding below $65k while stocks hit record highs.

The Fed kept interest rates unchanged as expected at the recent meeting, but chair Jerome Powell signaled a likely September rate cut.

As of press time, interest rate traders are now pricing 86.5% odds of a September cut, an overall bullish cue that boosted US stocks.

Source: CME Fed watch tool

So, why didn’t Bitcoin follow the US equities rally, given the Fed’s dovish announcement?

Galaxy’s Mike Novogratz blames US government

Galaxy Digital’s Mike Novogratz agreed that the US government could be the market risk factor. He argued that the US could sell Bitcoin for political reasons after Trump announced that he would create a strategic reserve.

‘I agree it feels like someone is leaning on $BTC. No idea, but it could be the US Marshall’s office. They report to DOJ… I wish they weren’t selling.’

QCP Capital reinforced a similar market caution linked to the U.S. government’s movement of $2 billion of BTC last week.

‘The recent movement of 30k worth of Silk Road BTC by the US government has introduced uncertainty into the cryptocurrency market.’

As a result, QCP Capital projected that BTC could remain constrained in the range after failing to clear the $70k range-high.

That said, the next market mover could be the US July 2024 Jobs report, which will be released on Friday (2nd August).

Based on the past jobs reports, fewer added job scenarios corresponded to a rally for BTC, as they reinforced a cooling US labor market and supported the Fed’s likely cut rate possibility.

Source: BTC/USD, TradingView

Such a scenario happened in the April Jobs report, released on 3rd May, tipping BTC to rally about 6%.

However, subsequent jobs reports released in June and July dragged BTC lower after they showed improvement in US labor markets.

So, a cooler Jobs report on Friday could boost BTC to reverse recent losses. However, a hotter Jobs report, with more job additions, could drag it even further towards the range-low.

Quinn Thompson of the crypto hedge fund Lekker Capital shared the same outlook. While acknowledging how crucial Friday could be for markets, he maintained a positive outlook for H2 2024.

‘I remain positively inclined on the medium-term (2H 2024) macro outlook….I expect tomorrow’s FOMC/Friday’s NFP to be two the most important events of the week.’

As of press time, BTC traded below $65k and could only bounce back from the short-term support near $65k, marked cyan, if Jobs’ report favors bulls.

So, macro factors and US politics still have an influence on BTC price, and it is worth tracking these fronts for risk management.

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

can i get cheap clomiphene no prescription where buy clomiphene without prescription get cheap clomid without rx buying clomiphene without prescription can i buy cheap clomid no prescription clomiphene medication cost clomid generic

More posts like this would create the online time more useful.

This is the compassionate of scribble literary works I in fact appreciate.

zithromax 500mg usa – buy metronidazole 400mg without prescription buy generic flagyl over the counter

rybelsus 14mg canada – cyproheptadine 4mg ca purchase periactin online cheap

domperidone ca – buy sumycin paypal cyclobenzaprine online order

order augmentin 1000mg generic – atbioinfo order ampicillin sale

nexium 40mg oral – anexamate.com esomeprazole order

order warfarin generic – coumamide buy cozaar pills

meloxicam drug – https://moboxsin.com/ mobic 15mg canada

buy prednisone 10mg sale – https://apreplson.com/ prednisone 20mg oral

buy erectile dysfunction drugs over the counter – fastedtotake.com medications for ed

buy amoxicillin pills – https://combamoxi.com/ order amoxicillin online cheap

buy diflucan for sale – order fluconazole generic forcan over the counter

buy lexapro 20mg for sale – https://escitapro.com/ buy lexapro 10mg for sale

cenforce price – https://cenforcers.com/# cenforce generic