- News of repayments in Bitcoin and Bitcoin Cash is likely to put additional downward pressure on the two assets.

- The metrics and futures data showed that the next week is likely to see more losses.

Bitcoin [BTC] was in a tough spot after persistent selling pressure forced prices down from $71.9k on the 6th of June to $61.4k at press time. The $60.5k level was visited just a few hours earlier and came on the back of news from the Bitcoin exchange Mt. Gox.

The now-defunct exchange saw a massive hack in 2014 that resulted in a loss of approximately 740,000 BTC, worth $15 billion at current market prices.

It was once the world’s top exchange, but a lot has changed since then. The repayments of the assets stolen from clients faced years of delayed deadlines, but finally, an announcement came on the 24th of June, Monday, that repayments would commence in July 2024.

Rehabilitation Trustee Nobuaki Kobayashi stated that the Rehabilitation Plan will see repayments made in Bitcoin and Bitcoin Cash [BCH], which could add to the selling pressure in the market on these assets.

Exploring the impact of this news

In late May, an AMBCrypto report highlighted that the exchange moved 140,000 BTC, worth $9.4 billion back then. The movement did not immediately impact prices, but a week later, BTC formed a local top just below the $72k mark.

It is possible that the wave of selling pressure in the weeks since then anticipated developments of this sort. If a sizeable portion of that amount enters the markets, it could add to Bitcoin’s woes and heighten the selling pressure.

From the 8th to the 14th of May 2024, BTC bulls fought valiantly to defend the $60k support zone and succeeded in driving prices higher to $71.9k on the 21st of May.

Therefore, another retest of the $60.2k-$61.5k region is likely to see a positive reaction.

Metrics indicate that the correction could be coming to an end

Source: Axel Adler on X

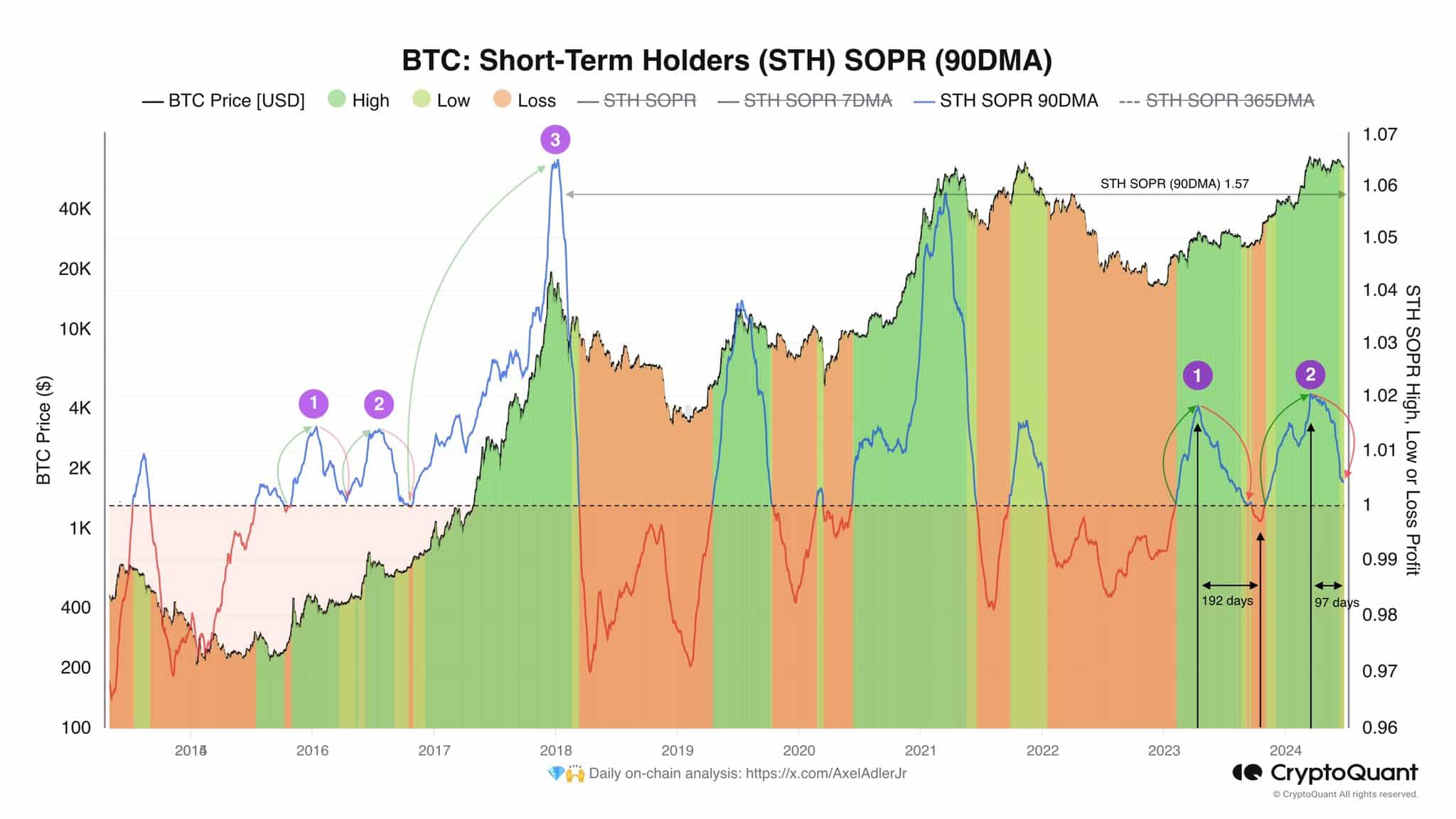

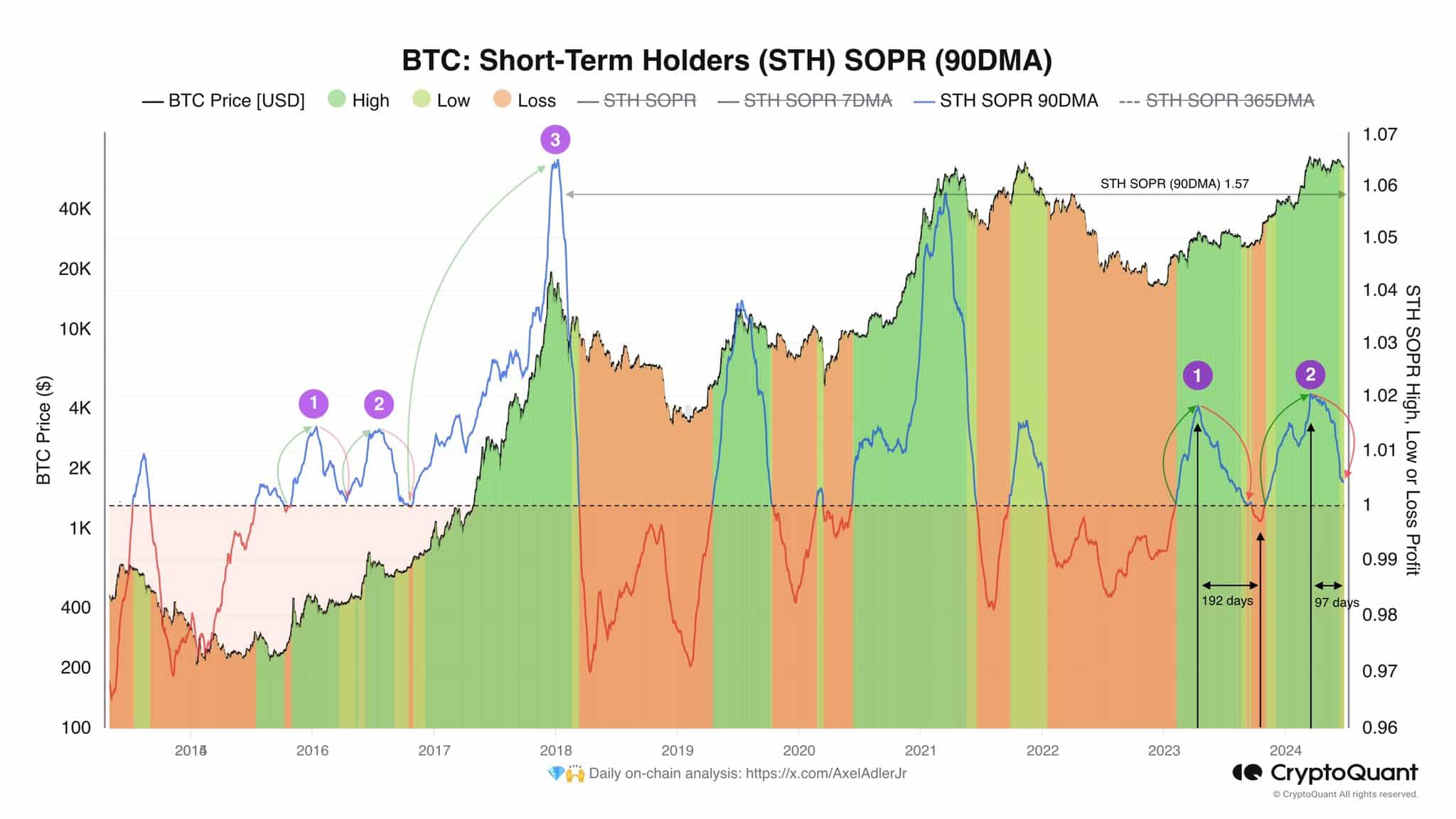

Crypto analyst Axel Adler posted on X (formerly Twitter) and drew attention to the short-term holders’ (STH) spent output profit ratio (SOPR) metric.

The 90-day moving average (90DMA) was just above 1 at press time. Compared to the 2016 cycle, it is possible that Bitcoin could continue its correction until this metric falls below 1.

Thereafter, the possibility of a trend reversal in favor of the bulls would become more likely, he observed. This process could take time, and traders and investors might see more losses or consolidation for BTC in the coming weeks.

Source: Ali Martinez on X

Another analyst, Ali Martinez, noted that the daily RSI was once more in the oversold region, below the 30 value. The previous three times it happened saw a subsequent recovery in Bitcoin prices measuring 60%, 63%, and 198%.

While this sounds reassuring, it does not imply that the downtrend is at an end, nor does it guarantee an uptrend is around the corner.

A violent move southward, potentially pushing below $60k in search of liquidity, before consolidation or recovery is anticipated in the coming weeks.

BTC futures market data shows bulls were going through much pain

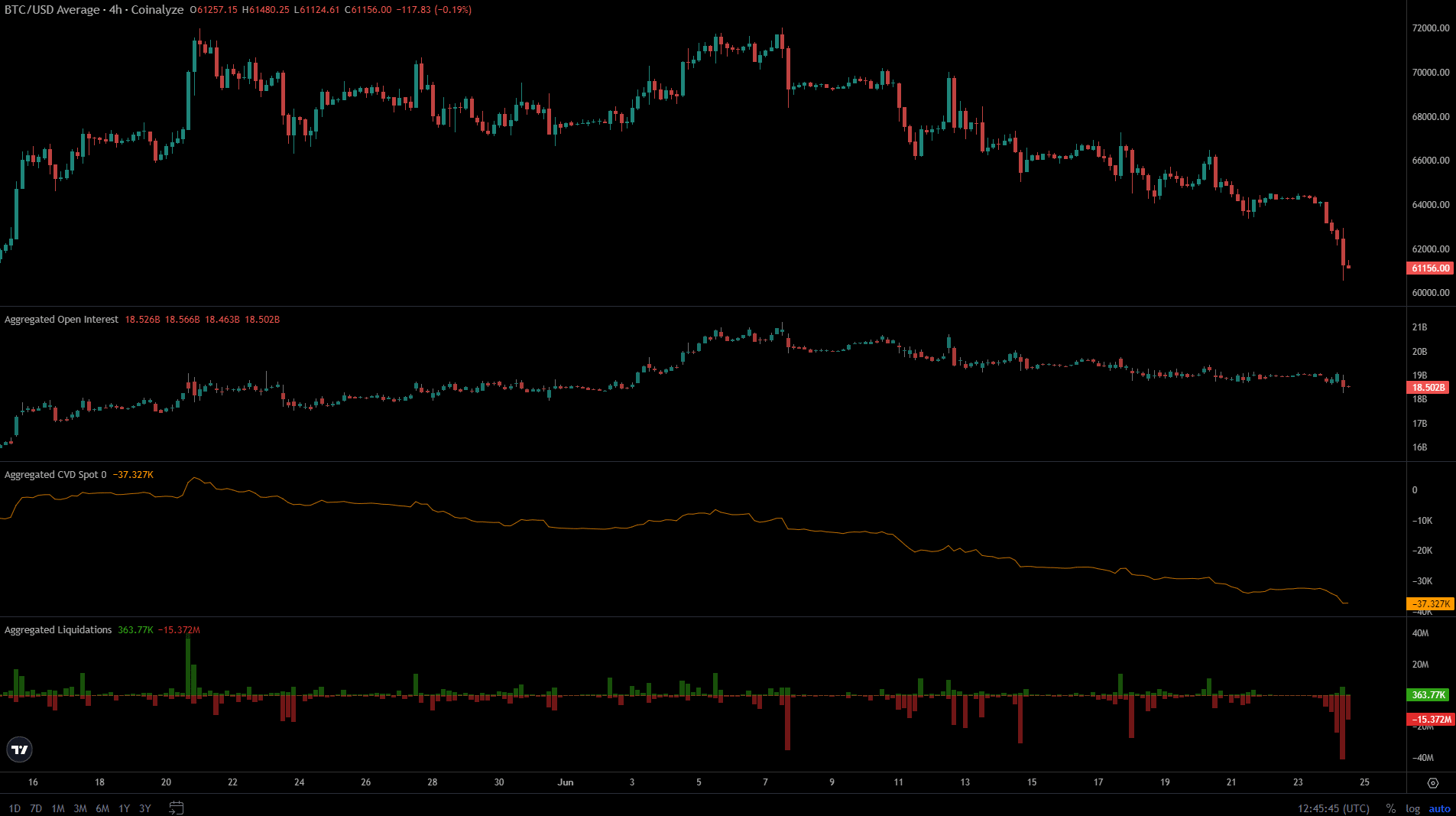

Source: Coinalyze

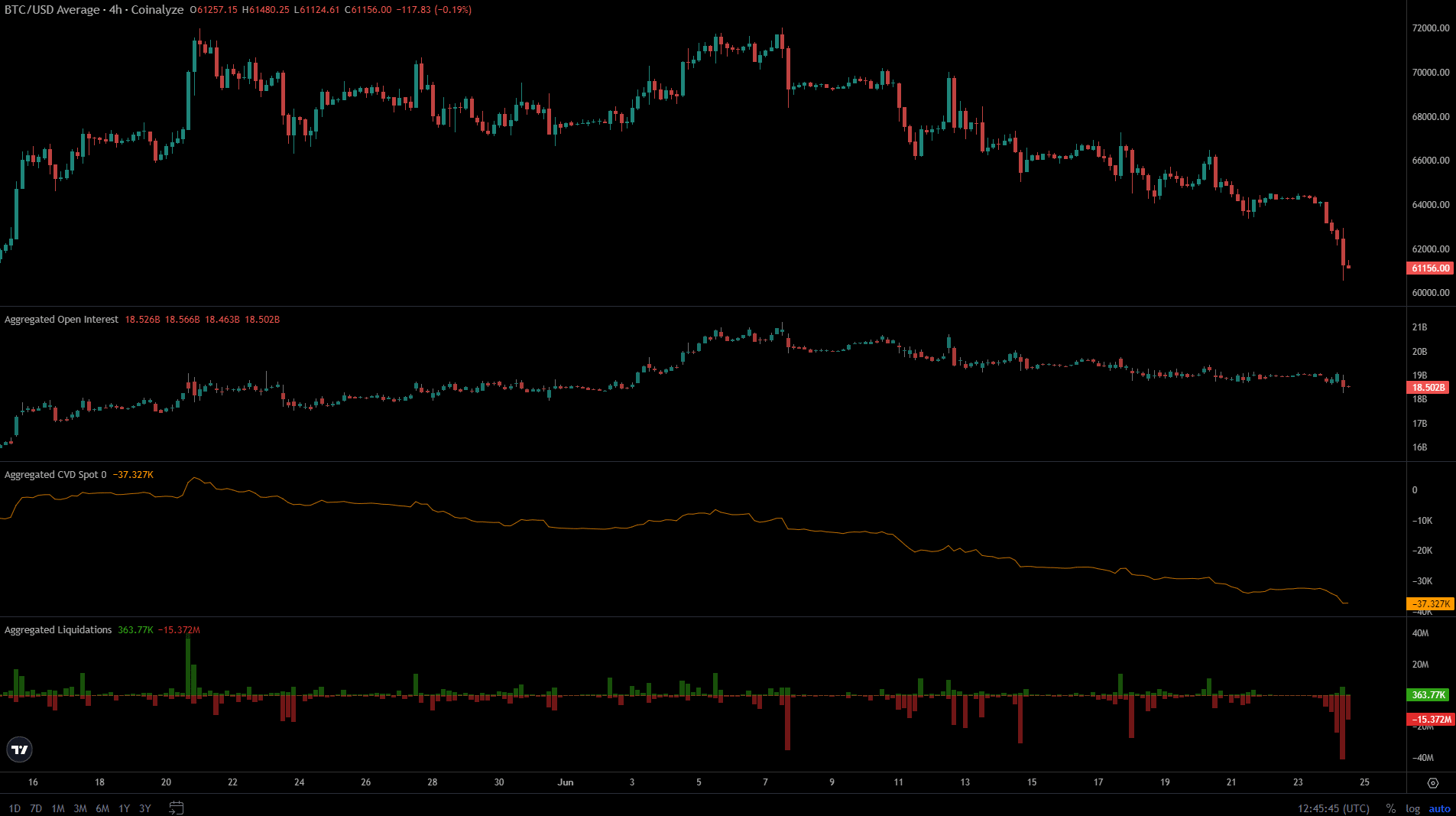

Data from Coinalyze showed that the spot CVD has steadily declined over the past month. This was a sign of selling pressure in the spot market and underlined Bitcoin’s weakness.

The Open Interest bounced higher in early June but after the first week, began to decline as well.

Together, it indicated bearish sentiment over the past three weeks. Futures traders were unwilling to bet on a BTC recovery and spot traders continued to sell their assets.

On top of this, sudden spikes of long liquidations pushed prices deeper and added to the stress on the bulls.

The past 24 hours also saw a flurry of long liquidations, with nearly $75 million in long liquidations in a 12-hour gap on the 24th of June based on Coinalyze data.

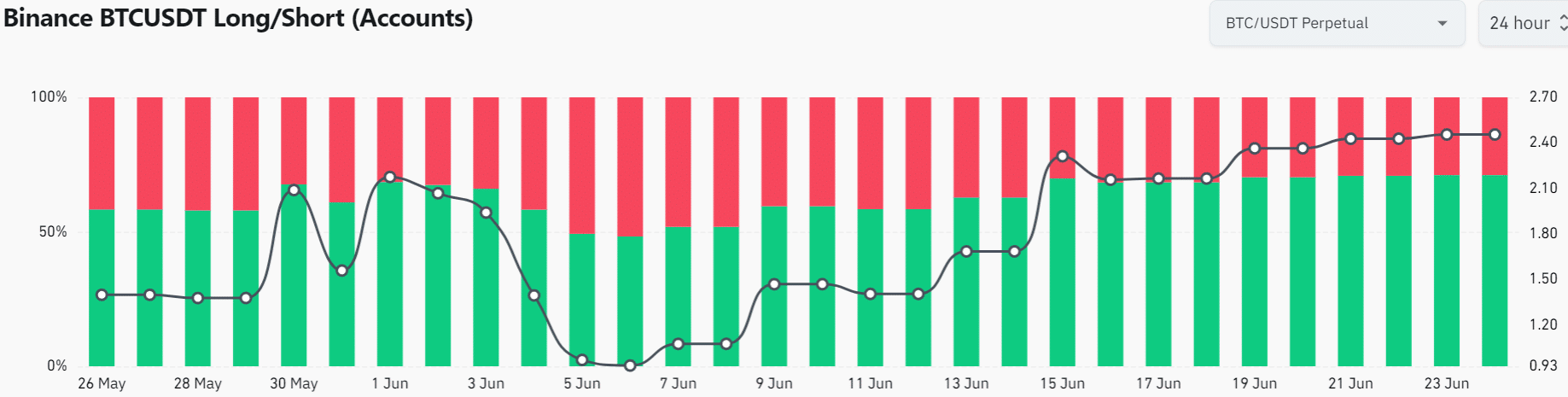

Source: Coinglass

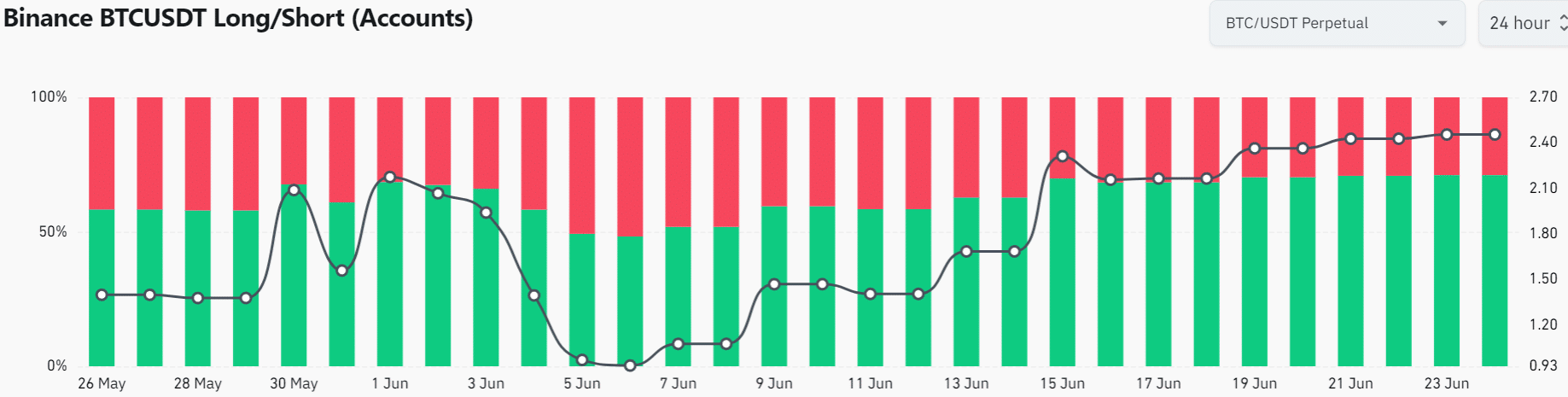

The long/short accounts ratio was at 2.46 at press time. This meant that there were 2.46 times as many accounts holding long positions as there were short positions.

In other words, smaller retail traders were betting on a Bitcoin bounce but the larger accounts continued to remain short.

Is your portfolio green? Check the Bitcoin Profit Calculator

Putting the pieces together, it appeared highly likely that Bitcoin bulls would continue to dance to the sellers’ tune over the next 2-4 weeks.

A sudden drop in prices is also possible given the daily RSI’s dive into the oversold territory.

- News of repayments in Bitcoin and Bitcoin Cash is likely to put additional downward pressure on the two assets.

- The metrics and futures data showed that the next week is likely to see more losses.

Bitcoin [BTC] was in a tough spot after persistent selling pressure forced prices down from $71.9k on the 6th of June to $61.4k at press time. The $60.5k level was visited just a few hours earlier and came on the back of news from the Bitcoin exchange Mt. Gox.

The now-defunct exchange saw a massive hack in 2014 that resulted in a loss of approximately 740,000 BTC, worth $15 billion at current market prices.

It was once the world’s top exchange, but a lot has changed since then. The repayments of the assets stolen from clients faced years of delayed deadlines, but finally, an announcement came on the 24th of June, Monday, that repayments would commence in July 2024.

Rehabilitation Trustee Nobuaki Kobayashi stated that the Rehabilitation Plan will see repayments made in Bitcoin and Bitcoin Cash [BCH], which could add to the selling pressure in the market on these assets.

Exploring the impact of this news

In late May, an AMBCrypto report highlighted that the exchange moved 140,000 BTC, worth $9.4 billion back then. The movement did not immediately impact prices, but a week later, BTC formed a local top just below the $72k mark.

It is possible that the wave of selling pressure in the weeks since then anticipated developments of this sort. If a sizeable portion of that amount enters the markets, it could add to Bitcoin’s woes and heighten the selling pressure.

From the 8th to the 14th of May 2024, BTC bulls fought valiantly to defend the $60k support zone and succeeded in driving prices higher to $71.9k on the 21st of May.

Therefore, another retest of the $60.2k-$61.5k region is likely to see a positive reaction.

Metrics indicate that the correction could be coming to an end

Source: Axel Adler on X

Crypto analyst Axel Adler posted on X (formerly Twitter) and drew attention to the short-term holders’ (STH) spent output profit ratio (SOPR) metric.

The 90-day moving average (90DMA) was just above 1 at press time. Compared to the 2016 cycle, it is possible that Bitcoin could continue its correction until this metric falls below 1.

Thereafter, the possibility of a trend reversal in favor of the bulls would become more likely, he observed. This process could take time, and traders and investors might see more losses or consolidation for BTC in the coming weeks.

Source: Ali Martinez on X

Another analyst, Ali Martinez, noted that the daily RSI was once more in the oversold region, below the 30 value. The previous three times it happened saw a subsequent recovery in Bitcoin prices measuring 60%, 63%, and 198%.

While this sounds reassuring, it does not imply that the downtrend is at an end, nor does it guarantee an uptrend is around the corner.

A violent move southward, potentially pushing below $60k in search of liquidity, before consolidation or recovery is anticipated in the coming weeks.

BTC futures market data shows bulls were going through much pain

Source: Coinalyze

Data from Coinalyze showed that the spot CVD has steadily declined over the past month. This was a sign of selling pressure in the spot market and underlined Bitcoin’s weakness.

The Open Interest bounced higher in early June but after the first week, began to decline as well.

Together, it indicated bearish sentiment over the past three weeks. Futures traders were unwilling to bet on a BTC recovery and spot traders continued to sell their assets.

On top of this, sudden spikes of long liquidations pushed prices deeper and added to the stress on the bulls.

The past 24 hours also saw a flurry of long liquidations, with nearly $75 million in long liquidations in a 12-hour gap on the 24th of June based on Coinalyze data.

Source: Coinglass

The long/short accounts ratio was at 2.46 at press time. This meant that there were 2.46 times as many accounts holding long positions as there were short positions.

In other words, smaller retail traders were betting on a Bitcoin bounce but the larger accounts continued to remain short.

Is your portfolio green? Check the Bitcoin Profit Calculator

Putting the pieces together, it appeared highly likely that Bitcoin bulls would continue to dance to the sellers’ tune over the next 2-4 weeks.

A sudden drop in prices is also possible given the daily RSI’s dive into the oversold territory.

Some genuinely good articles on this web site, thanks for contribution. “Gratitude is not only the greatest of virtues, but the parent of all others.” by Cicero.

Hello. Great job. I did not expect this. This is a excellent story. Thanks!

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Thank you, I have just been looking for info about this subject for ages and yours is the greatest I have discovered till now. But, what about the conclusion? Are you sure about the source?

I like the valuable information you provide in your articles. I’ll bookmark your weblog and check again here regularly. I am quite certain I’ll learn many new stuff right here! Good luck for the next!

This is a topic close to my heart cheers, where are your contact details though?

I enjoy your piece of work, appreciate it for all the great blog posts.

Great tremendous issues here. I?¦m very glad to see your post. Thank you a lot and i am looking forward to contact you. Will you kindly drop me a mail?

I?¦ve learn several good stuff here. Certainly price bookmarking for revisiting. I wonder how a lot effort you set to create any such great informative site.

I carry on listening to the news lecture about getting free online grant applications so I have been looking around for the finest site to get one. Could you advise me please, where could i acquire some?

Rattling great info can be found on web blog. “It is fast approaching the point where I don’t want to elect anyone stupid enough to want the job.” by Erma Bombeck.

You really make it appear really easy with your presentation but I in finding this topic to be actually one thing that I believe I might by no means understand. It kind of feels too complicated and extremely broad for me. I’m having a look forward to your next submit, I?¦ll attempt to get the hold of it!

Thanks – Enjoyed this blog post, is there any way I can get an email every time you write a new update?

I’m still learning from you, as I’m making my way to the top as well. I absolutely love reading everything that is posted on your blog.Keep the posts coming. I liked it!

I have been surfing online more than three hours as of late, but I by no means found any interesting article like yours. It¦s beautiful worth enough for me. In my view, if all website owners and bloggers made just right content as you did, the internet will be a lot more useful than ever before.

There are actually lots of details like that to take into consideration. That could be a nice point to carry up. I supply the thoughts above as normal inspiration however clearly there are questions just like the one you deliver up the place an important factor will likely be working in sincere good faith. I don?t know if greatest practices have emerged round issues like that, however I’m positive that your job is clearly identified as a fair game. Each girls and boys really feel the impact of just a moment’s pleasure, for the remainder of their lives.

I’d need to check with you here. Which isn’t something I normally do! I get pleasure from studying a put up that can make individuals think. Also, thanks for permitting me to remark!

I’m still learning from you, but I’m making my way to the top as well. I absolutely liked reading everything that is written on your blog.Keep the aarticles coming. I enjoyed it!

Terrific work! This is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my website . Thanks =)

Loving the information on this internet site, you have done great job on the posts.

Wow! This could be one particular of the most useful blogs We have ever arrive across on this subject. Basically Excellent. I’m also an expert in this topic therefore I can understand your hard work.

Kantorbola99 menawarkan pengalaman bermain slot online yang menyenangkan. Platform ini menyediakan beragam pilihan game menarik. Pemain dapat menikmati tampilan grafis berkualitas tinggi.

Kantorbola merupakan pilihan terbaik bagi para penggemar slot online di Indonesia. Dengan berbagai permainan menarik, bonus melimpah, keamanan terjamin, dan layanan pelanggan yang unggul.

Daftar dan login ke Kantorbola versi terbaru untuk pengalaman bermain bola online terbaik. Ikuti panduan lengkap kami untuk akses mudah, fitur unggulan, dan keamanan terjamin.

Very interesting subject , regards for putting up.

Just want to say your article is as amazing. The clearness in your post is simply great and i can assume you’re an expert in this subject. Well together with your permission allow me to grab your RSS feed to stay up to date with imminent post. Thanks a million and please carry on the gratifying work.

I do not even know how I ended up here, but I thought this post was great. I do not know who you are but definitely you are going to a famous blogger if you aren’t already 😉 Cheers!

hi!,I love your writing so much! proportion we be in contact extra about your article on AOL? I require an expert in this space to solve my problem. May be that is you! Taking a look forward to see you.

What’s Happening i am new to this, I stumbled upon this I have discovered It absolutely useful and it has helped me out loads. I am hoping to contribute & aid different users like its aided me. Good job.

I together with my buddies happened to be looking at the best suggestions found on your web blog and then immediately came up with a horrible suspicion I never expressed respect to the site owner for those secrets. These ladies happened to be as a result joyful to learn them and already have surely been having fun with those things. Many thanks for getting quite helpful and then for deciding upon certain incredible subject matter most people are really desperate to be informed on. My very own sincere apologies for not saying thanks to sooner.

Greetings! I know this is kind of off topic but I was wondering which blog platform are you using for this site? I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be awesome if you could point me in the direction of a good platform.

Terrific paintings! That is the kind of info that should be shared around the internet. Shame on the search engines for no longer positioning this post upper! Come on over and consult with my website . Thanks =)

What i do not understood is if truth be told how you are not actually much more smartly-liked than you may be now. You are very intelligent. You understand therefore significantly in terms of this topic, made me in my opinion consider it from so many varied angles. Its like men and women aren’t interested until it’s something to accomplish with Lady gaga! Your own stuffs nice. Always deal with it up!

You really make it appear really easy with your presentation however I find this topic to be actually something which I feel I would never understand. It sort of feels too complicated and extremely extensive for me. I’m taking a look forward for your next put up, I will attempt to get the grasp of it!

Excellent weblog right here! Additionally your website lots up very fast! What web host are you using? Can I get your associate hyperlink for your host? I wish my website loaded up as quickly as yours lol

Hello.This article was really fascinating, particularly since I was searching for thoughts on this issue last Wednesday.

There is clearly a bundle to know about this. I consider you made various good points in features also.

Excellent post. I was checking constantly this blog and I am impressed! Very helpful info particularly the last part 🙂 I care for such information a lot. I was looking for this particular info for a long time. Thank you and best of luck.

Hey very cool site!! Man .. Beautiful .. Amazing .. I’ll bookmark your website and take the feeds also…I’m happy to find so many useful information here in the post, we need develop more techniques in this regard, thanks for sharing. . . . . .

Hey very nice website!! Man .. Excellent .. Amazing .. I will bookmark your web site and take the feeds also…I am happy to find so many useful info here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

With the whole thing which appears to be developing throughout this specific subject material, a significant percentage of viewpoints are fairly refreshing. Nonetheless, I am sorry, but I do not subscribe to your whole plan, all be it stimulating none the less. It would seem to me that your remarks are actually not completely rationalized and in simple fact you are yourself not even fully confident of the point. In any event I did enjoy reading it.

I’m not sure where you’re getting your information, but good topic. I needs to spend some time learning more or understanding more. Thanks for magnificent info I was looking for this information for my mission.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

You have mentioned very interesting points! ps nice internet site. “Formal education will make you a living self-education will make you a fortune.” by Jim Rohn.

I like this site so much, bookmarked. “Respect for the fragility and importance of an individual life is still the mark of an educated man.” by Norman Cousins.

My spouse and I stumbled over here by a different page and thought I should check things out. I like what I see so now i am following you. Look forward to finding out about your web page again.

You have brought up a very fantastic details, appreciate it for the post.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something informative to read?

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

Hiya! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My weblog looks weird when browsing from my iphone4. I’m trying to find a theme or plugin that might be able to fix this problem. If you have any suggestions, please share. Appreciate it!

Good – I should definitely pronounce, impressed with your website. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, web site theme . a tones way for your client to communicate. Excellent task..

I really prize your work, Great post.

I am always browsing online for posts that can benefit me. Thank you!

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Wonderful blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thank you

I got what you mean , appreciate it for posting.Woh I am thankful to find this website through google. “Since the Exodus, freedom has always spoken with a Hebrew accent.” by Heinrich Heine.

It’s a pity you don’t have a donate button! I’d definitely donate to this excellent blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will share this website with my Facebook group. Chat soon!

Thanks a bunch for sharing this with all people you actually realize what you are speaking approximately! Bookmarked. Please additionally consult with my website =). We may have a hyperlink alternate arrangement among us!

Keep up the fantastic work, I read few articles on this site and I believe that your website is real interesting and has got circles of good information.

Thank you for helping out, great info. “The laws of probability, so true in general, so fallacious in particular.” by Edward Gibbon.

can you get clomiphene without rx clomid chart cheap clomiphene without insurance can i order clomiphene without a prescription can you buy cheap clomiphene without rx where to get cheap clomiphene no prescription buy clomiphene tablets

I am continuously browsing online for ideas that can aid me. Thanks!

I like this post, enjoyed this one thank you for putting up. “The world is round and the place which may seem like the end may also be only the beginning.” by George Baker.

I am actually enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks representing providing such data.

The sagacity in this tune is exceptional.

buy azithromycin 250mg generic – buy azithromycin 500mg metronidazole 200mg without prescription

order semaglutide generic – purchase rybelsus sale oral periactin 4 mg

excellent submit, very informative. I wonder why the other experts of this sector do not realize this. You must continue your writing. I am confident, you’ve a great readers’ base already!

motilium 10mg for sale – buy cyclobenzaprine no prescription flexeril usa

naturally like your website however you need to check the spelling on quite a few of your posts. A number of them are rife with spelling issues and I find it very troublesome to tell the reality nevertheless I will definitely come back again.

amei este site. Para saber mais detalhes acesse nosso site e descubra mais. Todas as informações contidas são conteúdos relevantes e exclusivos. Tudo que você precisa saber está está lá.

cost amoxiclav – https://atbioinfo.com/ ampicillin antibiotic

Thanks a bunch for sharing this with all people you really recognize what you’re talking about! Bookmarked. Kindly additionally talk over with my site =). We will have a link alternate agreement between us!

buy nexium generic – https://anexamate.com/ esomeprazole online buy

warfarin 5mg pill – https://coumamide.com/ losartan buy online

purchase meloxicam generic – https://moboxsin.com/ mobic 7.5mg pills

I was wondering if you ever considered changing the structure of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or 2 images. Maybe you could space it out better?

I conceive this web site has some very excellent info for everyone : D.

generic prednisone 10mg – aprep lson buy prednisone pills

I regard something really interesting about your weblog so I saved to favorites.

buy amoxicillin for sale – comba moxi amoxicillin price

Thanks for putting this up. It’s evidently done.

I am actually thrilled to glance at this blog posts which consists of tons of useful facts, thanks for providing such data.

fluconazole 100mg cost – https://gpdifluca.com/ diflucan 200mg price

cenforce 50mg oral – order cenforce 50mg pills buy cenforce 100mg pills

pictures of cialis – cialis and poppers mantra 10 tadalafil tablets

ranitidine 150mg pills – https://aranitidine.com/ ranitidine drug

Thanks for the post, can you make it so I receive an email when you publish a new post?

viagra online – sildenafil 100mg price cvs cheap viagra cialis uk

More posts like this would persuade the online elbow-room more useful. on this site

More posts like this would create the online play more useful. https://buyfastonl.com/furosemide.html

I’ll certainly bring to read more. https://ursxdol.com/ventolin-albuterol/

I am in point of fact happy to glitter at this blog posts which consists of tons of useful facts, thanks object of providing such data. https://prohnrg.com/product/loratadine-10-mg-tablets/

Hey this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get advice from someone with experience. Any help would be enormously appreciated!

With havin so much content do you ever run into any issues of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the web without my authorization. Do you know any techniques to help stop content from being stolen? I’d truly appreciate it.

This is a keynote which is near to my heart… Myriad thanks! Faithfully where can I notice the acquaintance details an eye to questions? posologie stromectol gale

Hello my friend! I wish to say that this article is amazing, nice written and include almost all important infos. I’d like to see more posts like this.

I will immediately seize your rss as I can not in finding your e-mail subscription hyperlink or newsletter service. Do you have any? Kindly let me recognise in order that I could subscribe. Thanks.

This is the gentle of writing I in fact appreciate. https://ondactone.com/spironolactone/

I think that is among the most significant information for me. And i am glad studying your article. But wanna remark on some normal issues, The site style is great, the articles is really great : D. Good activity, cheers

More posts like this would add up to the online time more useful.

https://doxycyclinege.com/pro/tamsulosin/

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something enlightening to read?

This is a keynote which is near to my heart… Many thanks! Exactly where can I notice the contact details an eye to questions? http://wightsupport.com/forum/member.php?action=profile&uid=21396

Terrific post however , I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more. Thank you!

My spouse and I absolutely love your blog and find the majority of your post’s to be what precisely I’m looking for. Would you offer guest writers to write content available for you? I wouldn’t mind composing a post or elaborating on many of the subjects you write related to here. Again, awesome site!

As soon as I found this web site I went on reddit to share some of the love with them.

order dapagliflozin without prescription – on this site purchase forxiga for sale

I went over this internet site and I think you have a lot of superb information, bookmarked (:.

I’m not that much of a online reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back down the road. Many thanks

Good day! Do you use Twitter? I’d like to follow you if that would be ok. I’m undoubtedly enjoying your blog and look forward to new updates.

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

I truly enjoy looking through on this website, it holds wonderful content. “A short saying oft contains much wisdom.” by Sophocles.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how can we communicate?

With thanks. Loads of erudition! http://iawbs.com/home.php?mod=space&uid=916884

I’ve been absent for some time, but now I remember why I used to love this site. Thank you, I¦ll try and check back more frequently. How frequently you update your web site?

Great blog here! Also your site loads up fast! What web host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol