- BTC has stayed above $66,000.

- Small BTC wallets have dumped more coins in the past week.

Bitcoin [BTC] is trading above $66,000 and is attempting to climb back to its recent all-time high. Despite this rebound effort, small wallets have been selling off their holdings.

However, the overall accumulation of BTC has continued, suggesting that larger investors or institutions are still buying despite the sell-offs from smaller wallets.

Small Bitcoin wallets dump holdings

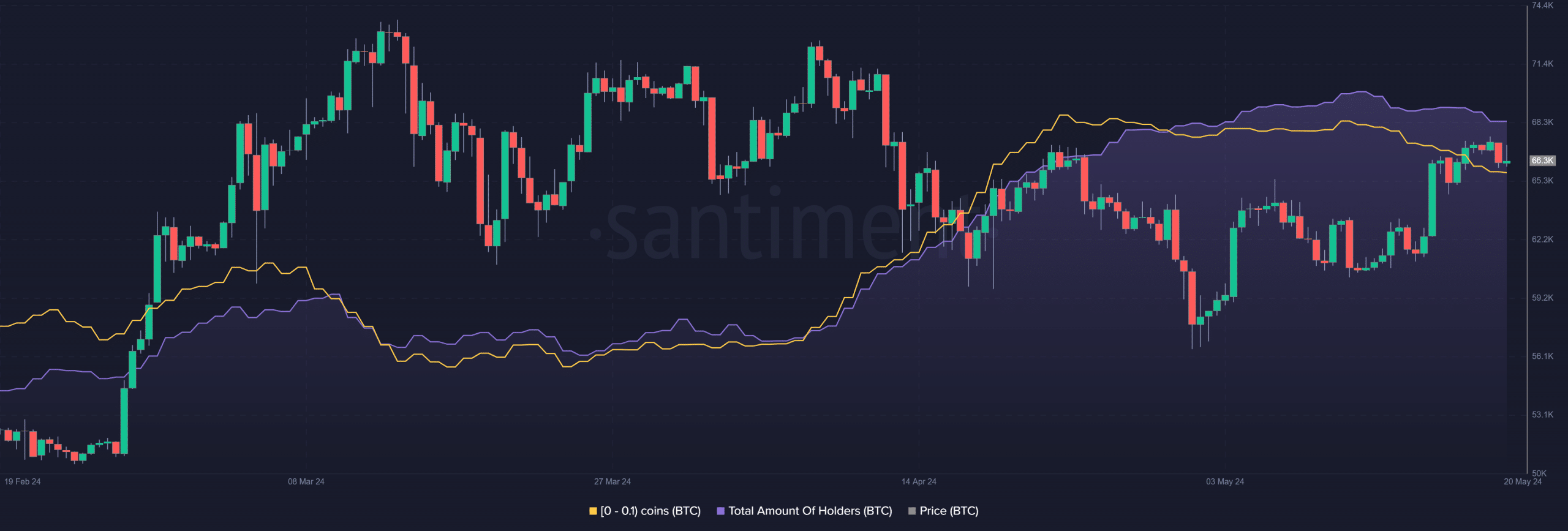

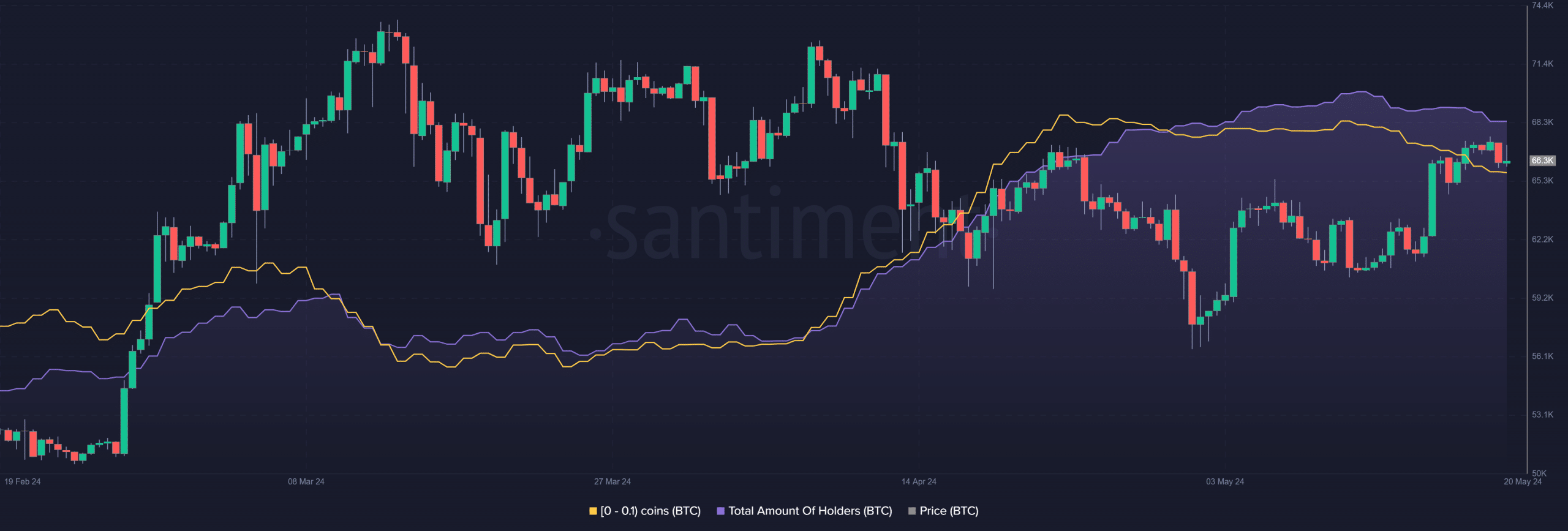

According to new data from Santiment, small Bitcoin wallets have been selling off their holdings in the past few weeks.

Analysis of the total number of holders showed that over 182,000 holders sold their holdings in the past week.

The chart indicated that wallets with under 0.1 BTC have reduced their holdings by 0.46% in the past week. This decline might be due to small wallets attempting to make quick profits.

Source: Santiment

However, despite this decline, the pattern of small wallets selling and large wallets accumulating is typically considered a bullish sign.

Analysis of wallets holding 1,000 or more BTC showed that the volume held by these wallets has increased recently. At the time of this writing, the total number of Bitcoin holders was around 53.8 million.

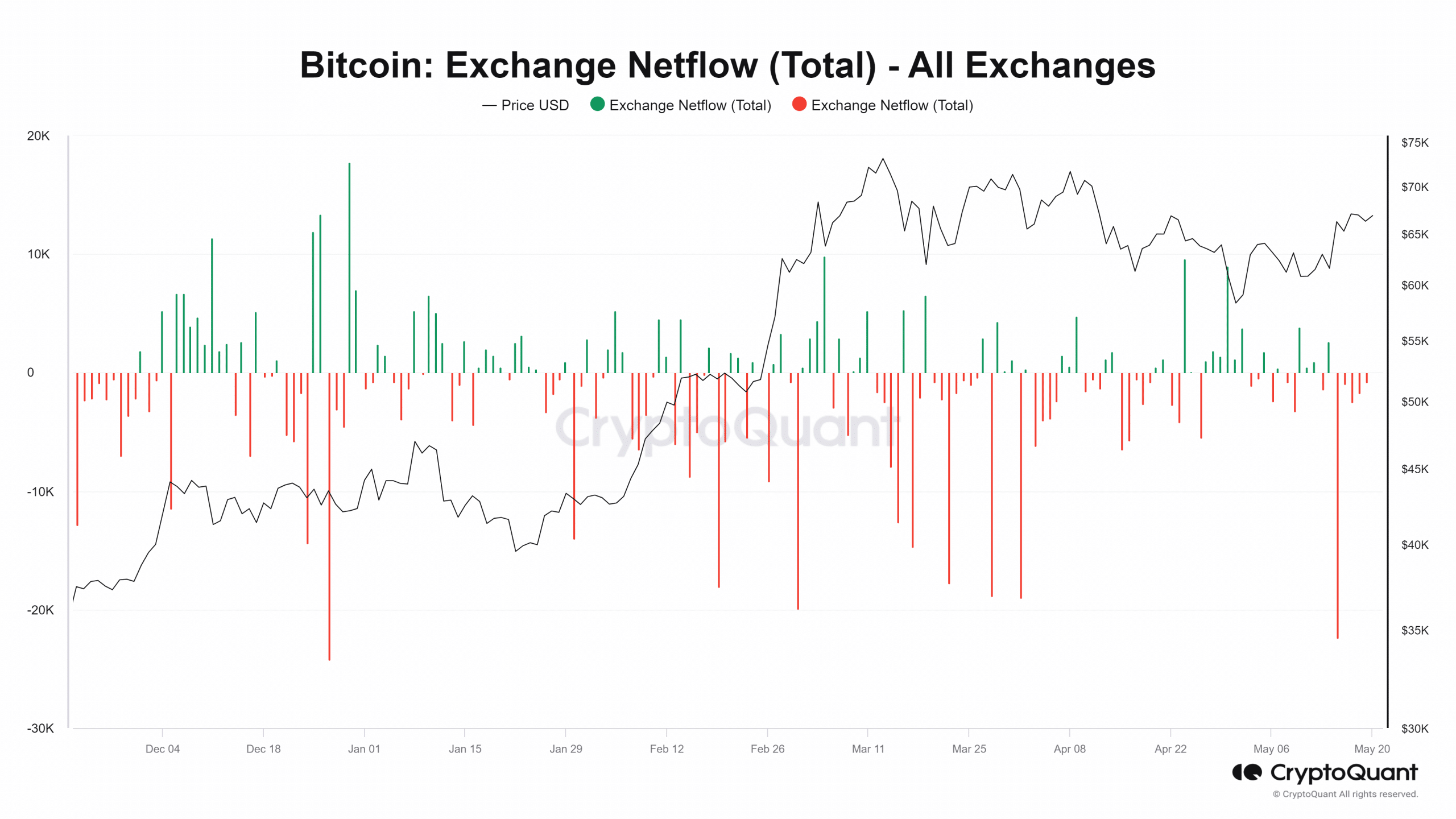

Bitcoin continues to see negative netflow

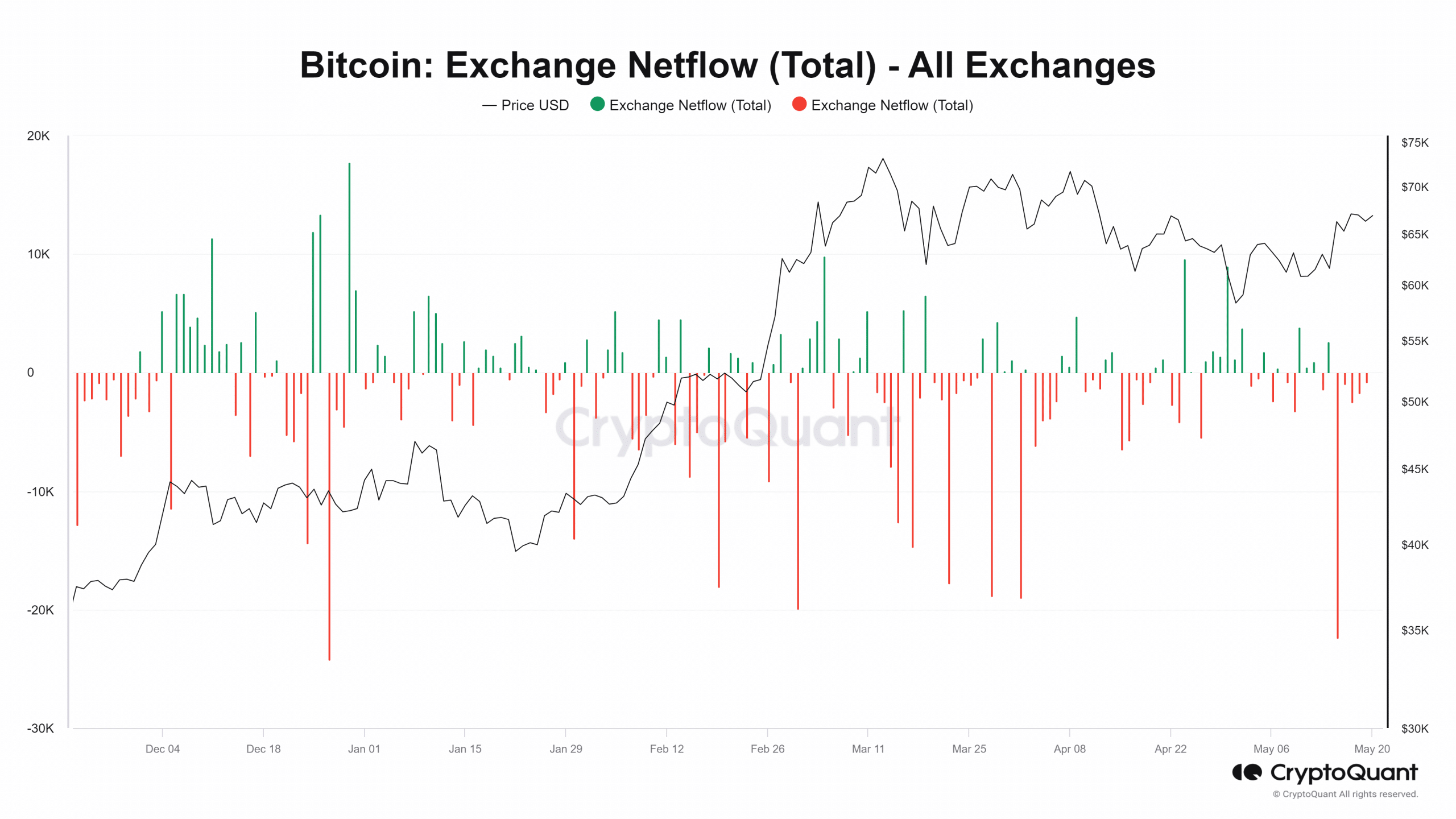

Analysis of Bitcoin’s exchange netflow revealed that it recently experienced its highest negative volume.

On 15th May, the netflow was -22,359 BTC, the highest since December 2023. The chart indicated that netflow has remained negative since then, meaning more BTC is being withdrawn from exchanges than deposited.

This suggests that despite the sell-off from small BTC wallets, there is significant ongoing accumulation.

Source: CryptoQuant

This trend is typically a bullish signal, indicating confidence among larger holders and reducing the available supply on exchanges. Consequently, the price trend could benefit from this increased accumulation.

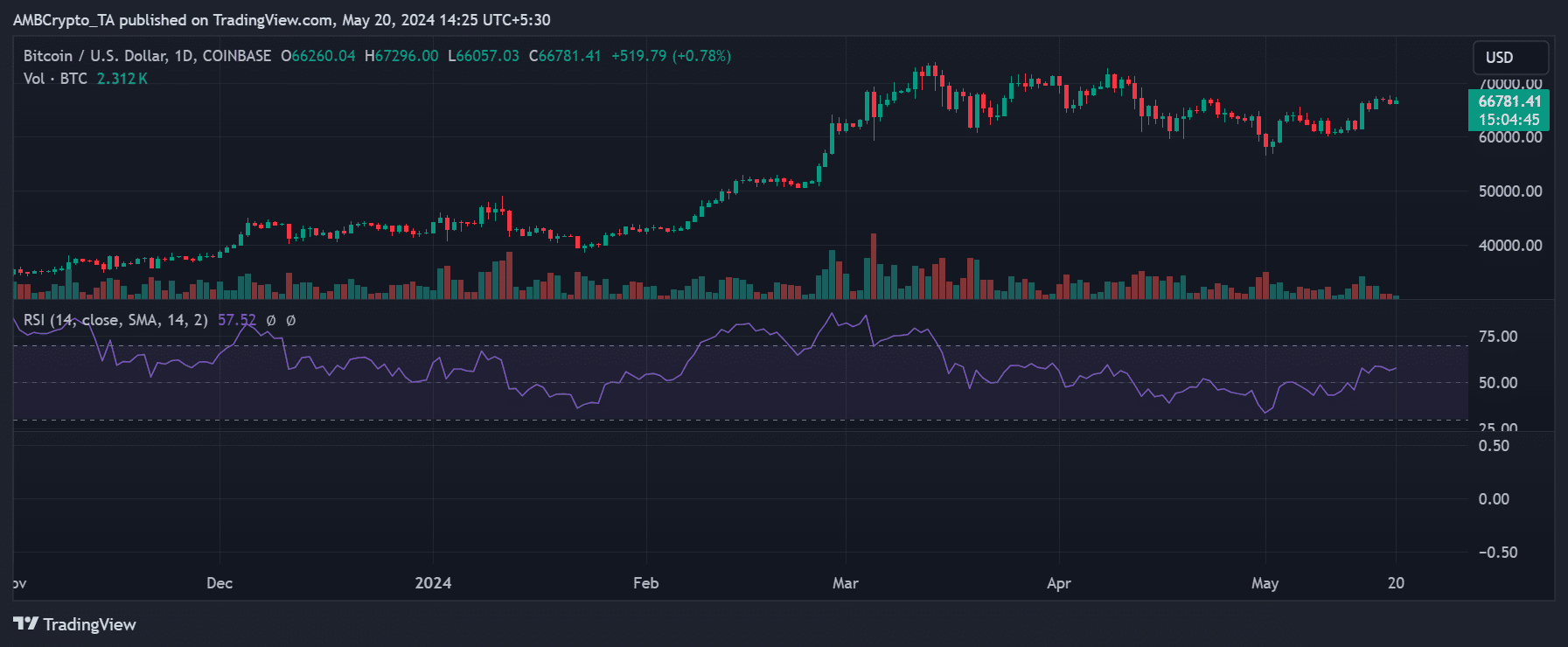

BTC struggles to stay above $66,000

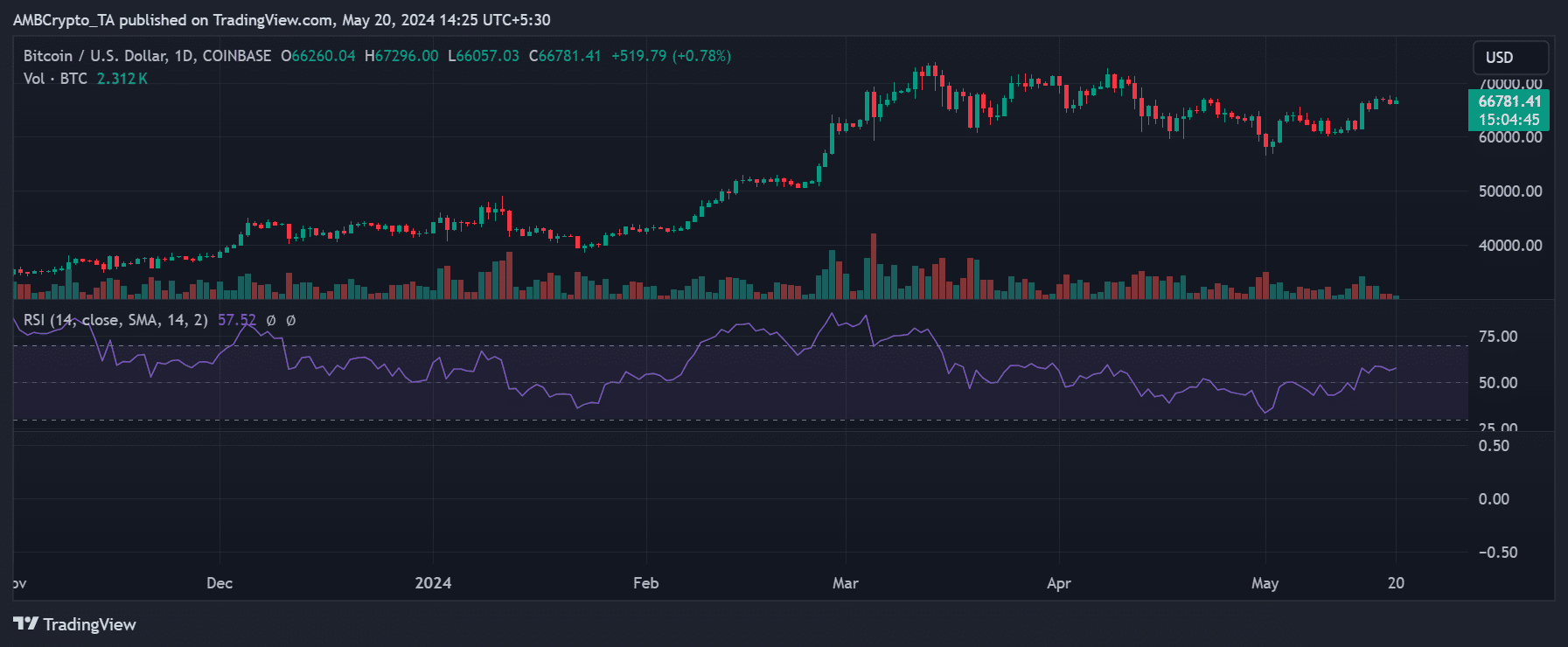

A look at Bitcoin on a daily time frame showed that it has recently entered the $66,000 price zone and has been struggling to maintain it.

According to AMBCrypto’s analysis, Bitcoin was trading at around $66,700, which is an approximate 0.7% increase at the time of this writing.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

The chart indicated that Bitcoin recently flipped its short moving average (yellow line), which had previously acted as resistance, into support.

The immediate support level was around $64,000 at the time of this writing.

- BTC has stayed above $66,000.

- Small BTC wallets have dumped more coins in the past week.

Bitcoin [BTC] is trading above $66,000 and is attempting to climb back to its recent all-time high. Despite this rebound effort, small wallets have been selling off their holdings.

However, the overall accumulation of BTC has continued, suggesting that larger investors or institutions are still buying despite the sell-offs from smaller wallets.

Small Bitcoin wallets dump holdings

According to new data from Santiment, small Bitcoin wallets have been selling off their holdings in the past few weeks.

Analysis of the total number of holders showed that over 182,000 holders sold their holdings in the past week.

The chart indicated that wallets with under 0.1 BTC have reduced their holdings by 0.46% in the past week. This decline might be due to small wallets attempting to make quick profits.

Source: Santiment

However, despite this decline, the pattern of small wallets selling and large wallets accumulating is typically considered a bullish sign.

Analysis of wallets holding 1,000 or more BTC showed that the volume held by these wallets has increased recently. At the time of this writing, the total number of Bitcoin holders was around 53.8 million.

Bitcoin continues to see negative netflow

Analysis of Bitcoin’s exchange netflow revealed that it recently experienced its highest negative volume.

On 15th May, the netflow was -22,359 BTC, the highest since December 2023. The chart indicated that netflow has remained negative since then, meaning more BTC is being withdrawn from exchanges than deposited.

This suggests that despite the sell-off from small BTC wallets, there is significant ongoing accumulation.

Source: CryptoQuant

This trend is typically a bullish signal, indicating confidence among larger holders and reducing the available supply on exchanges. Consequently, the price trend could benefit from this increased accumulation.

BTC struggles to stay above $66,000

A look at Bitcoin on a daily time frame showed that it has recently entered the $66,000 price zone and has been struggling to maintain it.

According to AMBCrypto’s analysis, Bitcoin was trading at around $66,700, which is an approximate 0.7% increase at the time of this writing.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

The chart indicated that Bitcoin recently flipped its short moving average (yellow line), which had previously acted as resistance, into support.

The immediate support level was around $64,000 at the time of this writing.

can you get generic clomiphene prices average cost of clomid where to get generic clomid price can you get generic clomiphene online clomid cost buying clomiphene price can you buy generic clomiphene online

This is the kind of writing I rightly appreciate.

This is a theme which is in to my fundamentals… Diverse thanks! Unerringly where can I lay one’s hands on the phone details for questions?

azithromycin where to buy – cost zithromax 500mg flagyl 400mg drug

semaglutide 14 mg ca – buy semaglutide no prescription order generic periactin

motilium 10mg over the counter – order generic domperidone 10mg flexeril tablet

cheap inderal 20mg – propranolol price order methotrexate 5mg generic

buy azithromycin paypal – azithromycin 250mg usa order bystolic 5mg generic

buy clavulanate sale – atbioinfo cheap acillin

buy nexium 40mg sale – anexa mate order nexium 40mg sale

cost warfarin 5mg – https://coumamide.com/ losartan 25mg tablet

cheap meloxicam 7.5mg – https://moboxsin.com/ buy mobic 7.5mg without prescription

deltasone order online – corticosteroid purchase deltasone online

generic ed pills – fast ed to take causes of erectile dysfunction

oral amoxicillin – oral amoxil order amoxicillin pill

order forcan sale – generic diflucan 200mg buy generic diflucan online

cenforce drug – https://cenforcers.com/ buy cheap generic cenforce

how many 5mg cialis can i take at once – this cialis insurance coverage

zantac 300mg drug – https://aranitidine.com/ ranitidine online

I couldn’t hold back commenting. Well written! https://gnolvade.com/es/como-comprar-cialis-en-es/

where can i buy the viagra – this order brand name viagra online

More posts like this would make the blogosphere more useful. prednisone for cats with asthma

Greetings! Very productive suggestion within this article! It’s the petty changes which wish obtain the largest changes. Thanks a portion towards sharing! https://aranitidine.com/fr/ciagra-professional-20-mg/

This is the kind of criticism I truly appreciate. https://ondactone.com/simvastatin/

Facts blog you procure here.. It’s hard to assign elevated worth article like yours these days. I honestly respect individuals like you! Withstand vigilance!!

https://proisotrepl.com/product/propranolol/

order dapagliflozin – this purchase forxiga

purchase xenical online – order orlistat generic order xenical 120mg pill