- Bitcoin’s exchange reserve dropped to the level that was seen in 2018.

- Long-term investors were confident in BTC, but a few indicators were bearish.

Bitcoin [BTC] has once again gained bullish momentum as it was fast approaching the $60k target. This just might be the tip of the iceberg, as the coin has the potential to reach new highs soon. Let’s have a look at why that was the case with BTC.

Is a big move likely?

As per CoinMarketCap’s data, BTC’s price increased by over 6% in the past seven days. In the last 24 hours also, the bullish trend continued as the king of crypto’s price rose by more than 1%.

At the time of writing, BTC was trading at $59,256.11 with a market capitalization of over $1.17 trillion.

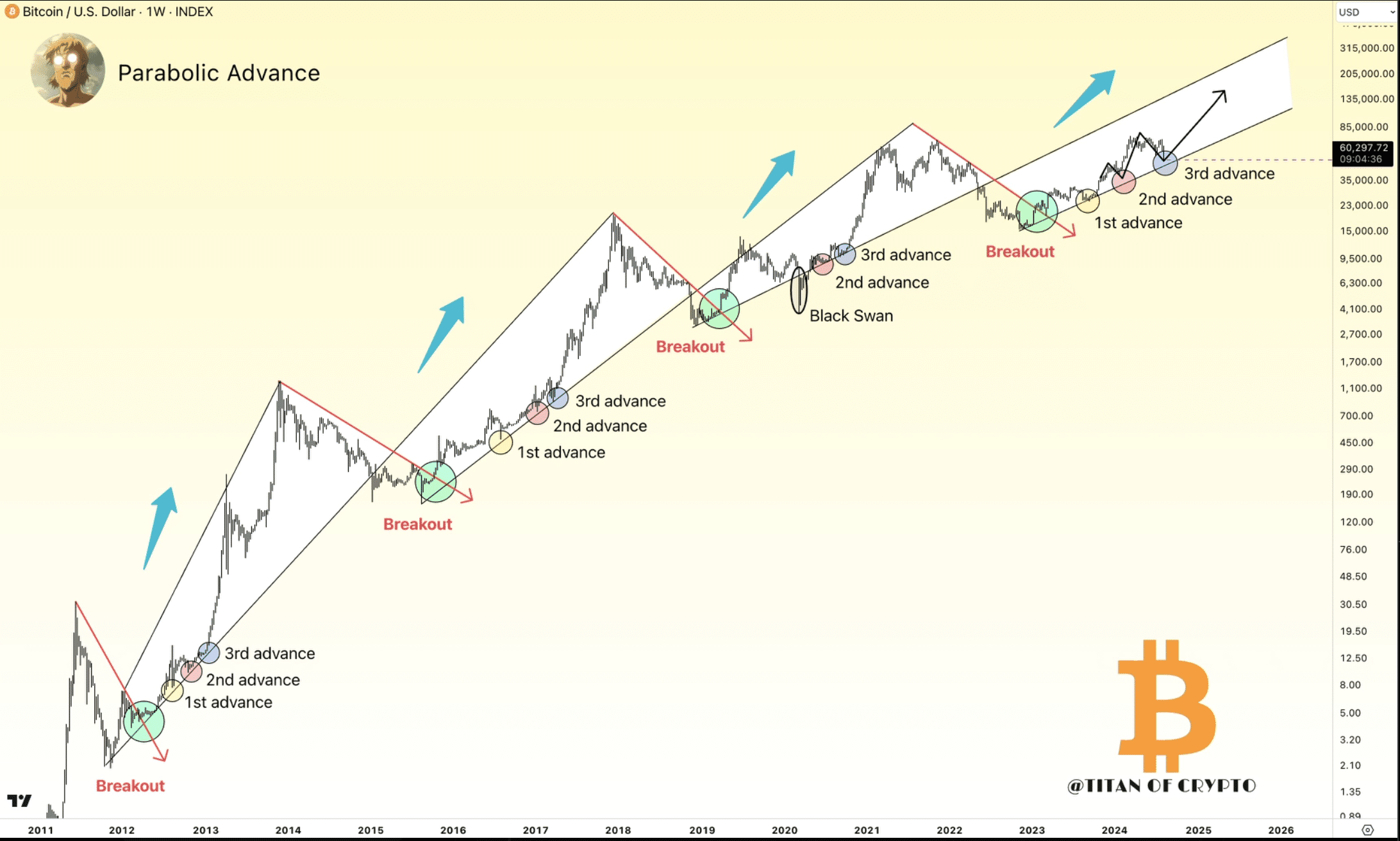

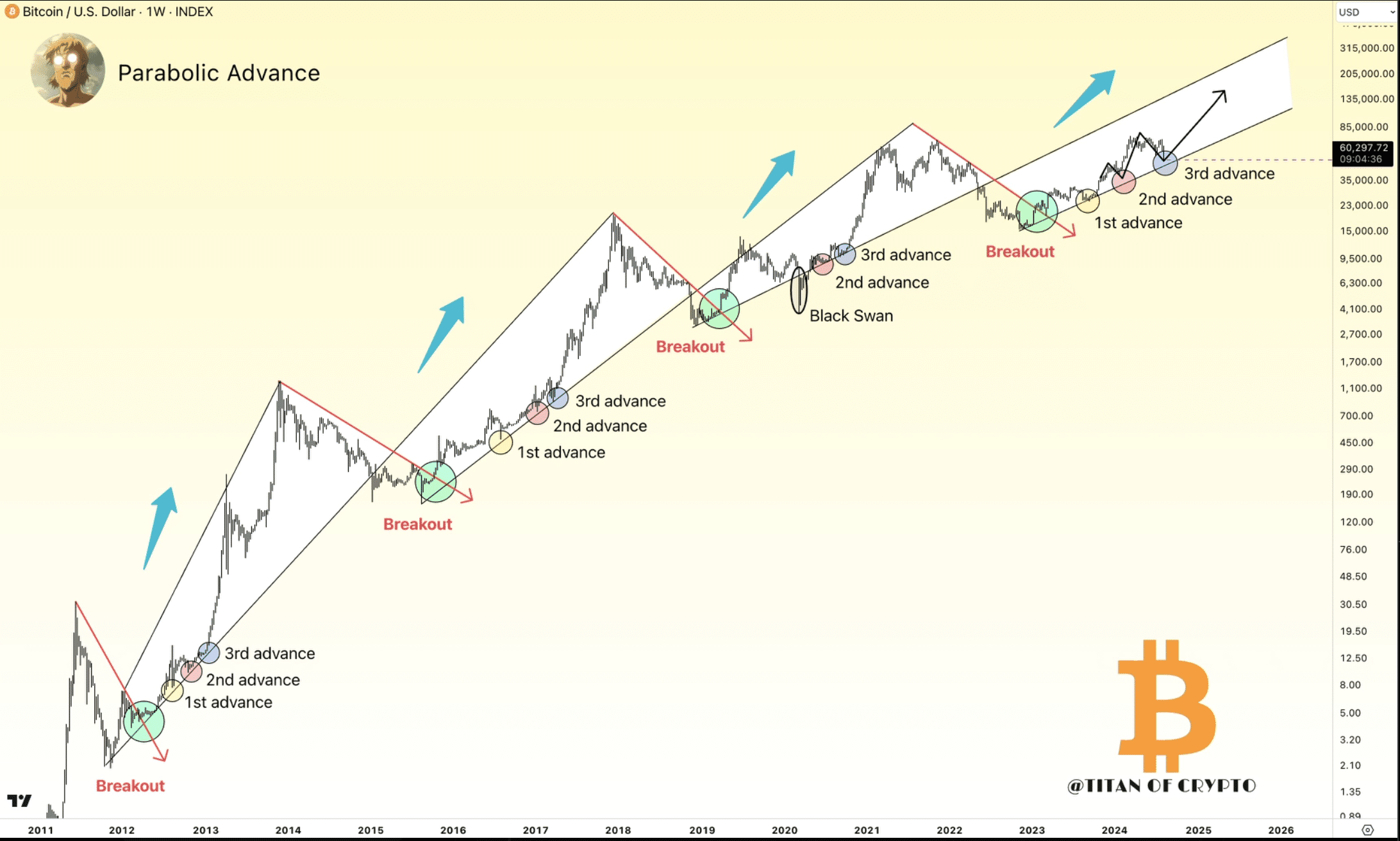

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet highlighting that BTC was following a past trend. As per the tweet, in past cycles, BTC has always reached new highs after beginning its 3rd parabolic advance stage.

To be precise, such episodes happened back in 2013, 2017, and 2021. At the time of writing, BTC had reached the support level from which it could begin its third advance.

Therefore, there were chances of this bull rally pushing BTC to an all-time high in the coming months.

Source: X

Odds of Bitcoin reaching an ATH in 2024

Since there were chances of a massive bull rally, AMBCrypto planned to have a closer look at the king of cryptos’ state.

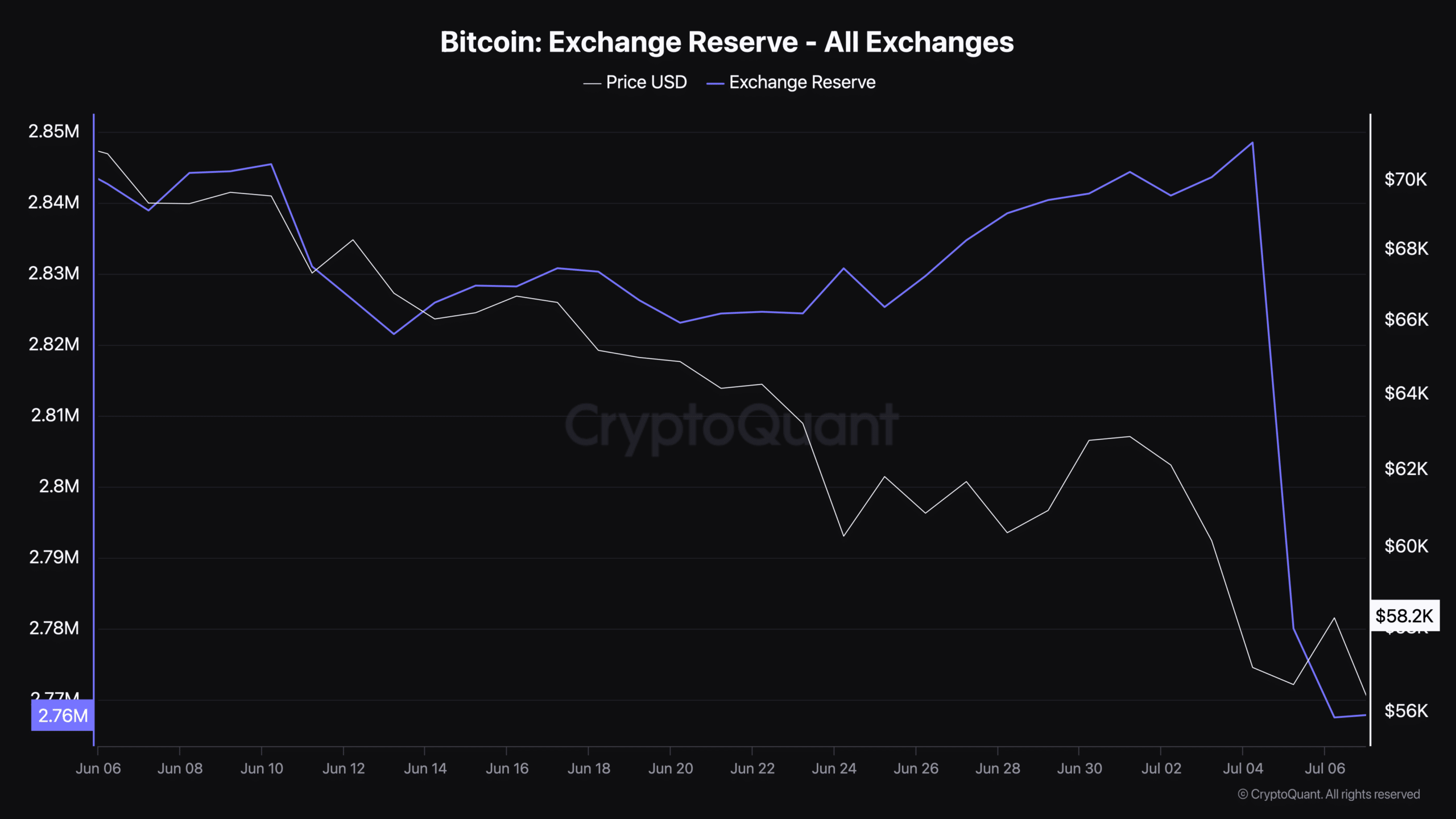

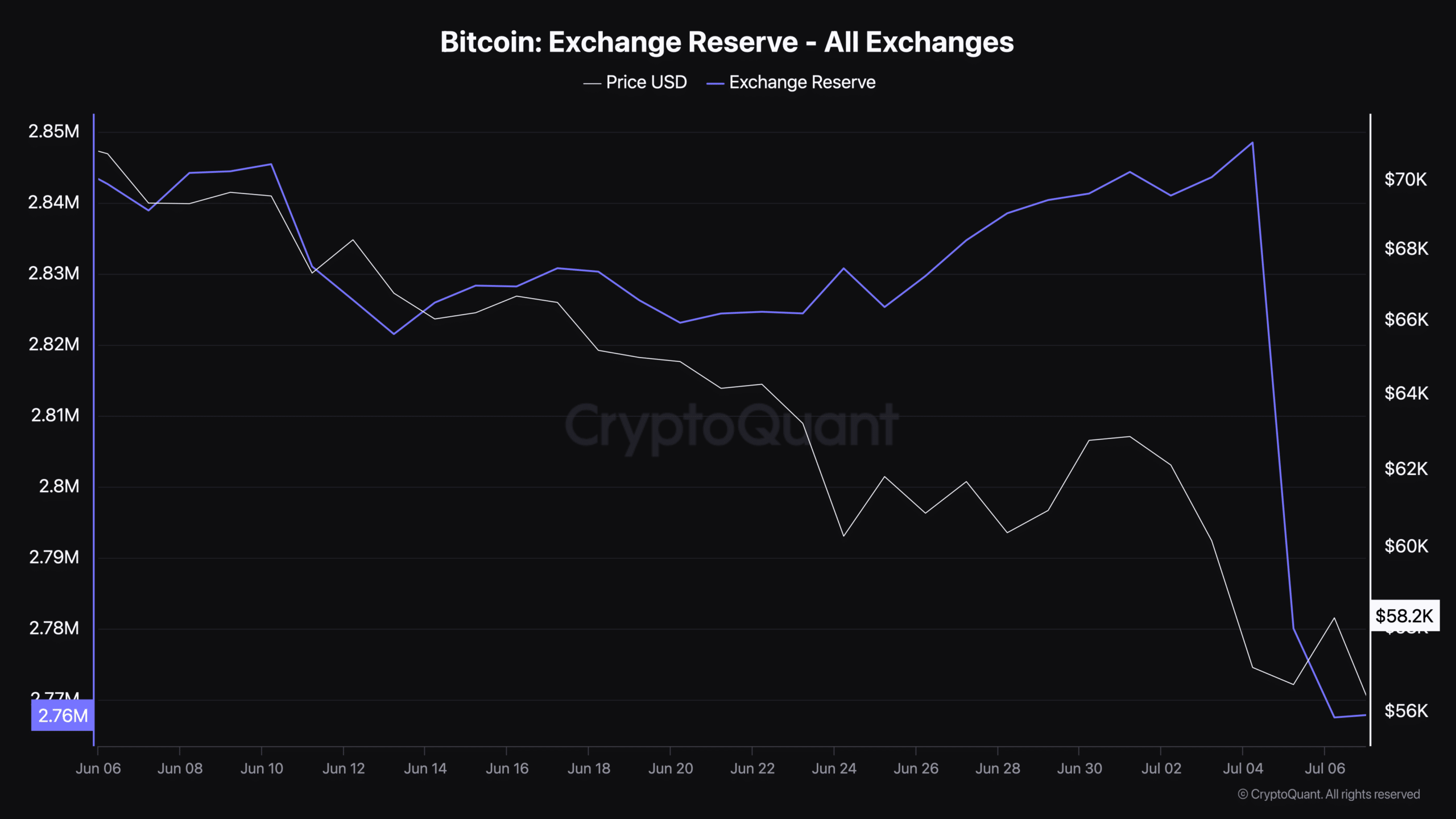

As per our analysis of CryptoQuant’s data, Bitcoin’s exchange reserve reached as low as it was seen back in 2018. This clearly indicated that buying pressure on the coin was increasing, which is considered a bullish signal.

Source: CryptoQuant

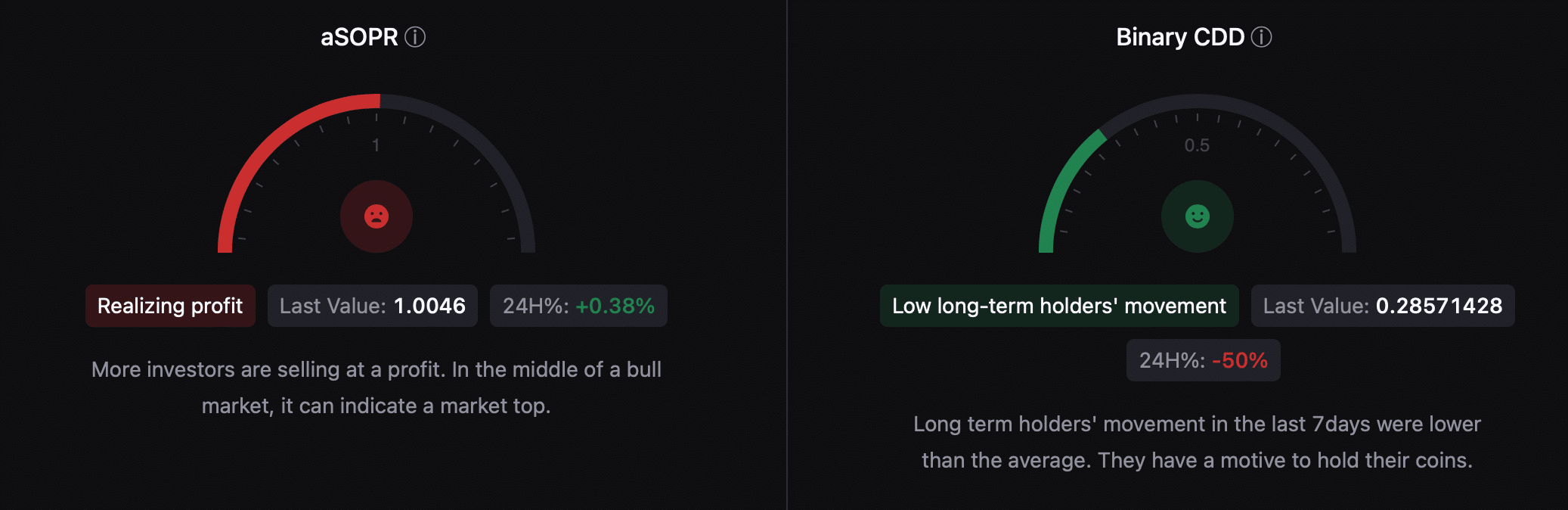

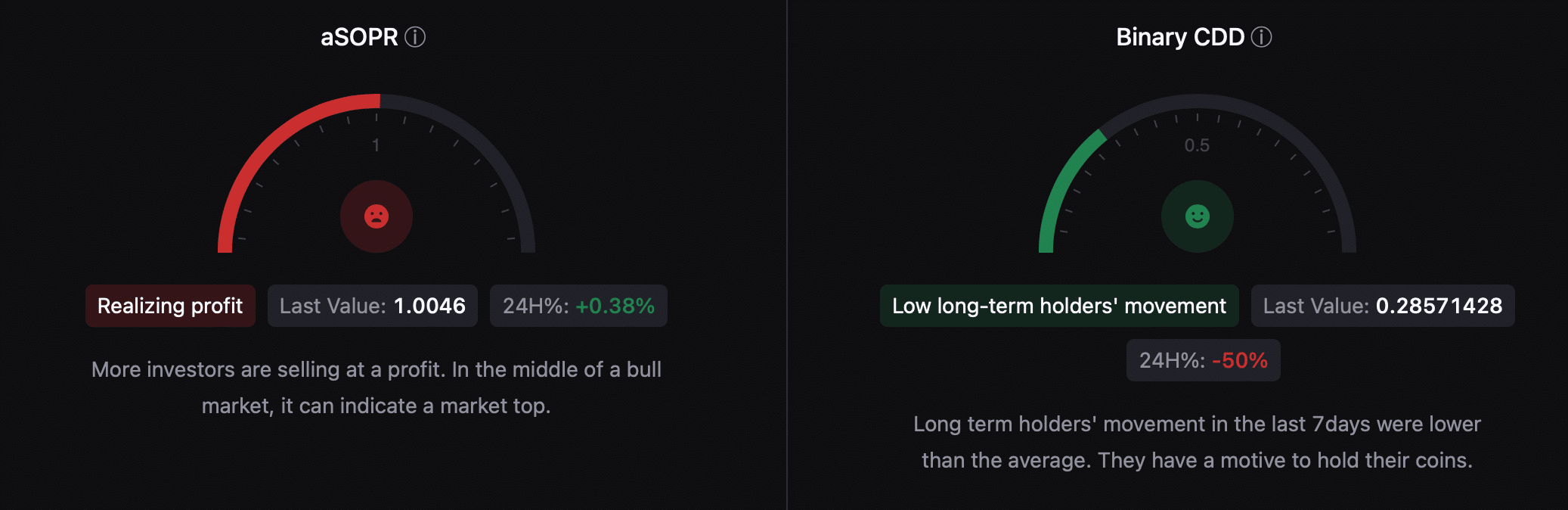

Apart from that, BTC’s Binary CDD was green, meaning that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

However, the aSORP looked troublesome as it was red. This suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Source: CryptoQuant

Therefore, AMBCrypto planned to have a look at the daily chart of Bitcoin to better understand whether it could sustain this upward trajectory.

Is your portfolio green? Check out the BTC Profit Calculator

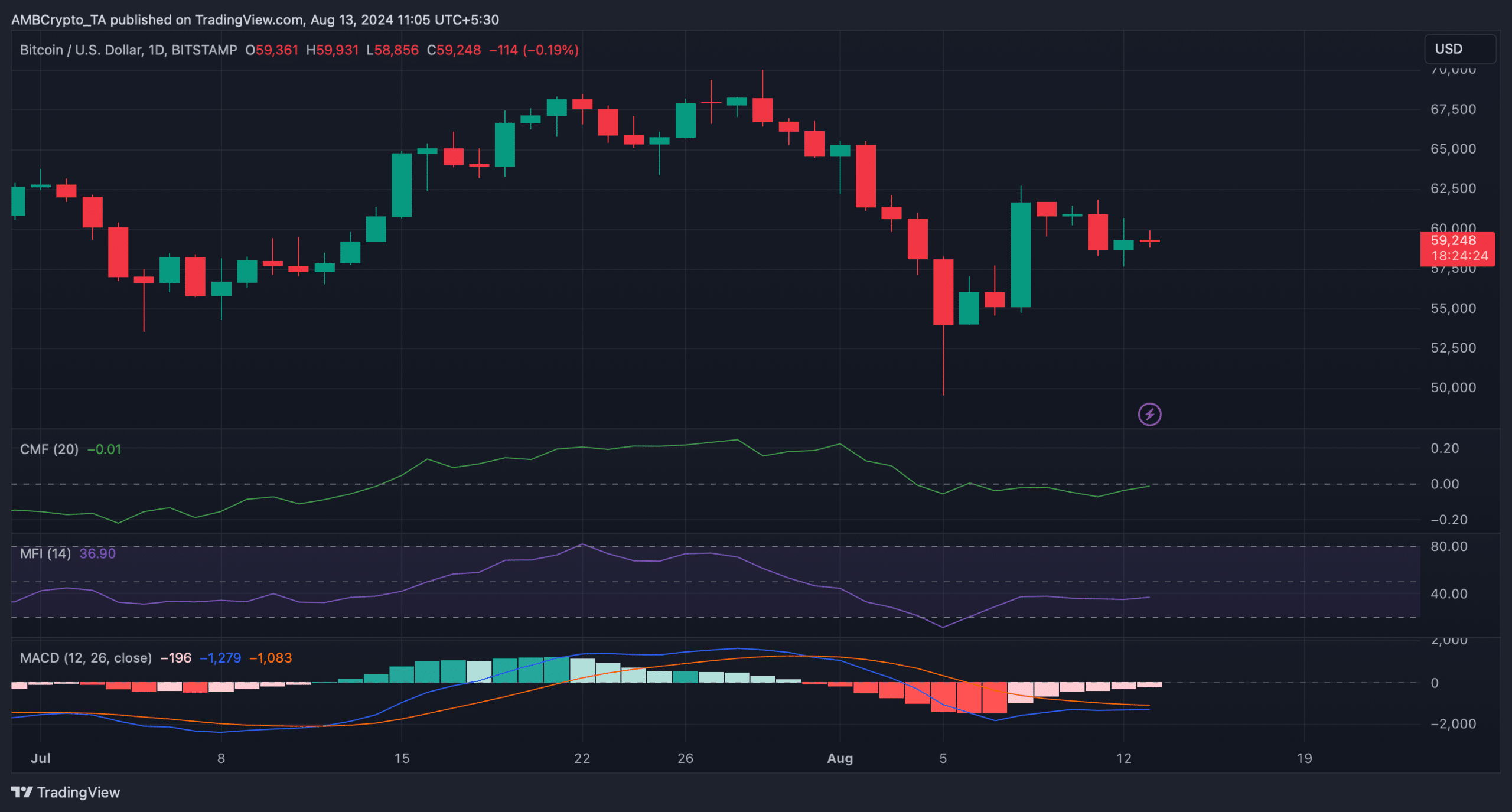

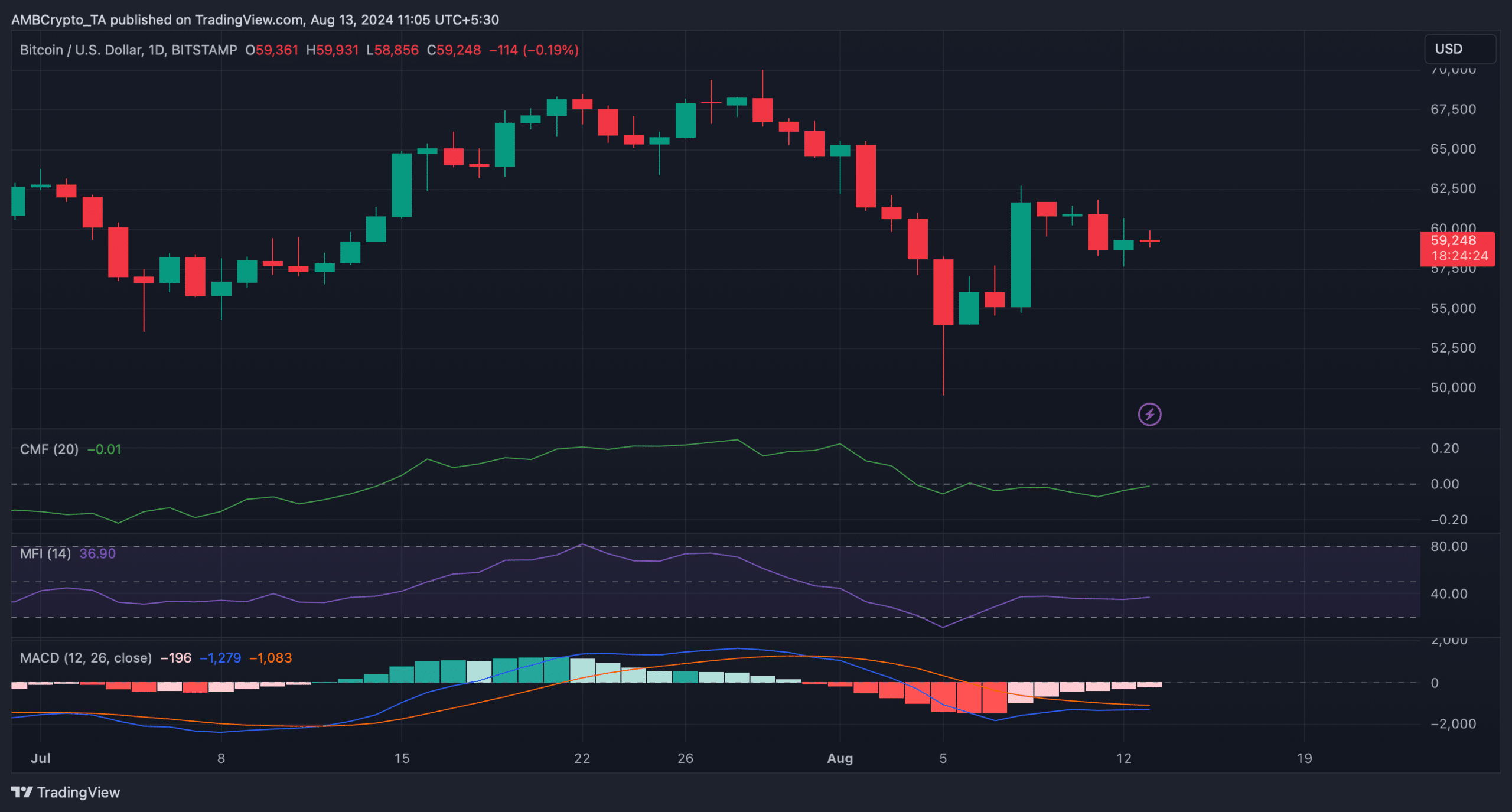

The technical indicator MACD displayed that the bulls were trying to catch up with the bears.

BTC’s Chaikin Money Flow (CMF) gave hope of a bullish takeover as it went northward. Nonetheless, the Money Flow Index (MFI) moved sideways, indicating a few slow-moving days ahead.

Source: TradingView

- Bitcoin’s exchange reserve dropped to the level that was seen in 2018.

- Long-term investors were confident in BTC, but a few indicators were bearish.

Bitcoin [BTC] has once again gained bullish momentum as it was fast approaching the $60k target. This just might be the tip of the iceberg, as the coin has the potential to reach new highs soon. Let’s have a look at why that was the case with BTC.

Is a big move likely?

As per CoinMarketCap’s data, BTC’s price increased by over 6% in the past seven days. In the last 24 hours also, the bullish trend continued as the king of crypto’s price rose by more than 1%.

At the time of writing, BTC was trading at $59,256.11 with a market capitalization of over $1.17 trillion.

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet highlighting that BTC was following a past trend. As per the tweet, in past cycles, BTC has always reached new highs after beginning its 3rd parabolic advance stage.

To be precise, such episodes happened back in 2013, 2017, and 2021. At the time of writing, BTC had reached the support level from which it could begin its third advance.

Therefore, there were chances of this bull rally pushing BTC to an all-time high in the coming months.

Source: X

Odds of Bitcoin reaching an ATH in 2024

Since there were chances of a massive bull rally, AMBCrypto planned to have a closer look at the king of cryptos’ state.

As per our analysis of CryptoQuant’s data, Bitcoin’s exchange reserve reached as low as it was seen back in 2018. This clearly indicated that buying pressure on the coin was increasing, which is considered a bullish signal.

Source: CryptoQuant

Apart from that, BTC’s Binary CDD was green, meaning that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

However, the aSORP looked troublesome as it was red. This suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Source: CryptoQuant

Therefore, AMBCrypto planned to have a look at the daily chart of Bitcoin to better understand whether it could sustain this upward trajectory.

Is your portfolio green? Check out the BTC Profit Calculator

The technical indicator MACD displayed that the bulls were trying to catch up with the bears.

BTC’s Chaikin Money Flow (CMF) gave hope of a bullish takeover as it went northward. Nonetheless, the Money Flow Index (MFI) moved sideways, indicating a few slow-moving days ahead.

Source: TradingView

This really answered my problem, thank you!

I know this if off topic but I’m looking into starting my own weblog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100 certain. Any recommendations or advice would be greatly appreciated. Thanks

Hello my friend! I want to say that this post is amazing, nice written and include almost all important infos. I would like to see more posts like this.

whoah this weblog is wonderful i love studying your posts. Stay up the good paintings! You know, many people are hunting around for this information, you can aid them greatly.

There are some attention-grabbing cut-off dates in this article however I don’t know if I see all of them middle to heart. There may be some validity however I will take maintain opinion until I look into it further. Good article , thanks and we wish more! Added to FeedBurner as nicely

Hi, Neat post. There’s a problem along with your website in internet explorer, might test this… IE nonetheless is the market chief and a big section of other folks will miss your wonderful writing due to this problem.

I simply could not go away your web site prior to suggesting that I actually enjoyed the standard info an individual provide on your visitors? Is going to be back incessantly to check up on new posts.

I do not even know how I finished up here, however I believed this post was once good. I don’t realize who you’re however certainly you’re going to a well-known blogger if you are not already 😉 Cheers!

buying cheap clomid price how to buy cheap clomiphene cost clomiphene without rx where to buy clomid no prescription can you buy clomid without rx cost cheap clomiphene prices order cheap clomid

More posts like this would force the blogosphere more useful.

The thoroughness in this break down is noteworthy.

how to buy azithromycin – ciprofloxacin price order metronidazole 200mg without prescription

buy motilium online cheap – buy flexeril tablets order cyclobenzaprine 15mg sale

augmentin 1000mg oral – https://atbioinfo.com/ acillin uk

esomeprazole capsules – anexa mate cost nexium

buy warfarin generic – cou mamide losartan buy online

meloxicam order online – https://moboxsin.com/ mobic 7.5mg oral

order prednisone sale – aprep lson order prednisone 5mg for sale

I view something genuinely special in this site.

medicine for impotence – https://fastedtotake.com/ ed pills

purchase amoxicillin pills – where can i buy amoxicillin buy amoxil generic

cenforce 50mg cost – on this site cost cenforce 50mg

brand cialis australia – ciltad gn difference between cialis and tadalafil

online cialis no prescription – https://strongtadafl.com/# cialis manufacturer coupon 2018

The sagacity in this ruined is exceptional. https://gnolvade.com/

viagra sale online pharmacy – on this site buy herbal viagra online

More posts like this would create the online space more useful. https://buyfastonl.com/

More posts like this would add up to the online play more useful. https://ursxdol.com/levitra-vardenafil-online/

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

This is the big-hearted of writing I truly appreciate. acheter xenical 120 mg pas cher

I precisely wanted to appreciate you all over again. I’m not certain what I would have achieved in the absence of the entire opinions documented by you relating to my situation. This has been the traumatic case in my position, but being able to see the very specialized mode you solved it made me to leap over happiness. I am thankful for this information and thus sincerely hope you comprehend what a powerful job you are always putting in teaching many people with the aid of your websites. Most likely you have never met all of us.

I am actually delighted to glance at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. https://ondactone.com/simvastatin/