- Bitcoin options see bullish sentiment, with rising whales hinting at potential gains in November.

- Ethereum options show indecision as prices hover near lows, contrasting Bitcoin’s strong momentum.

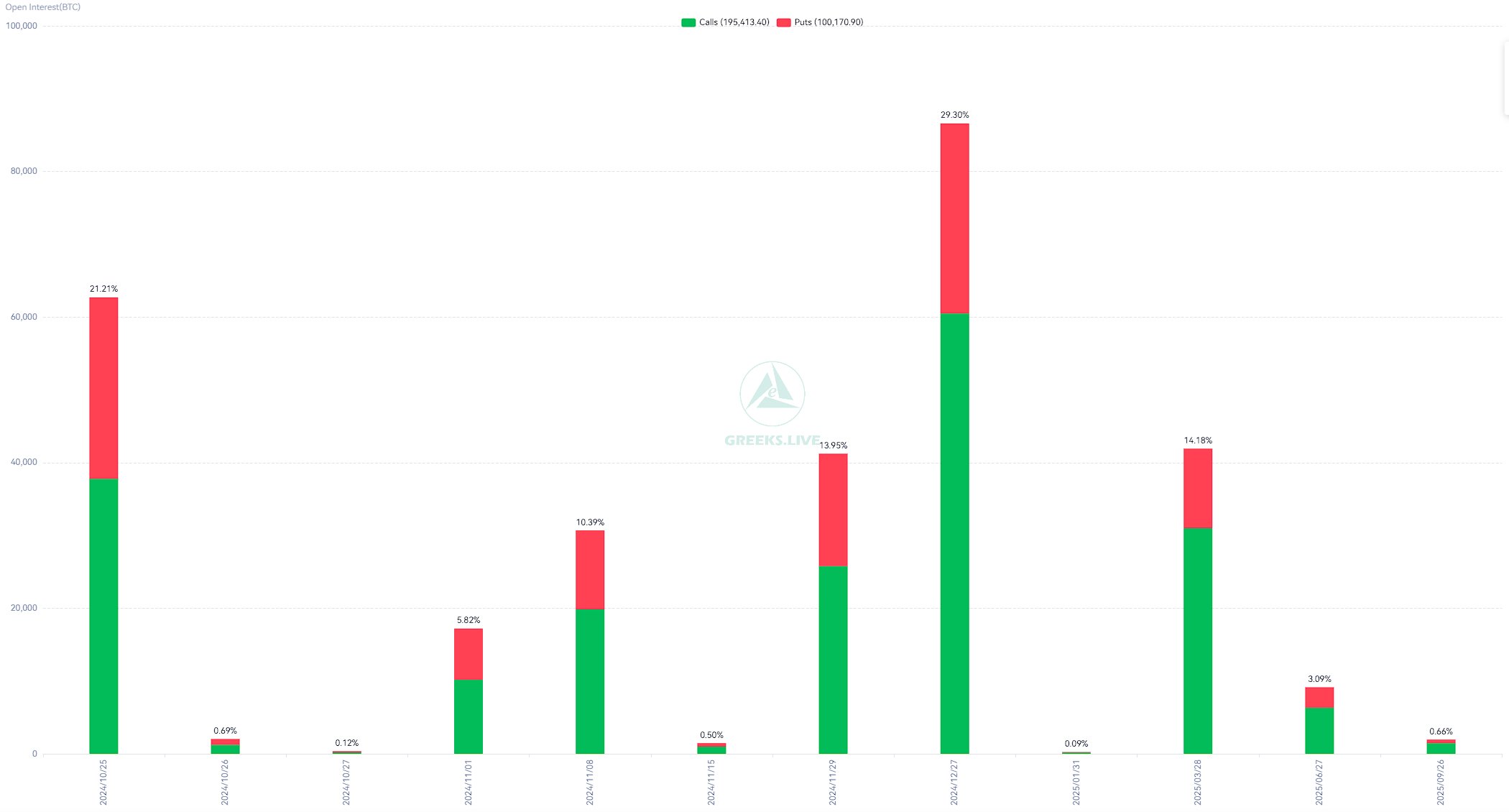

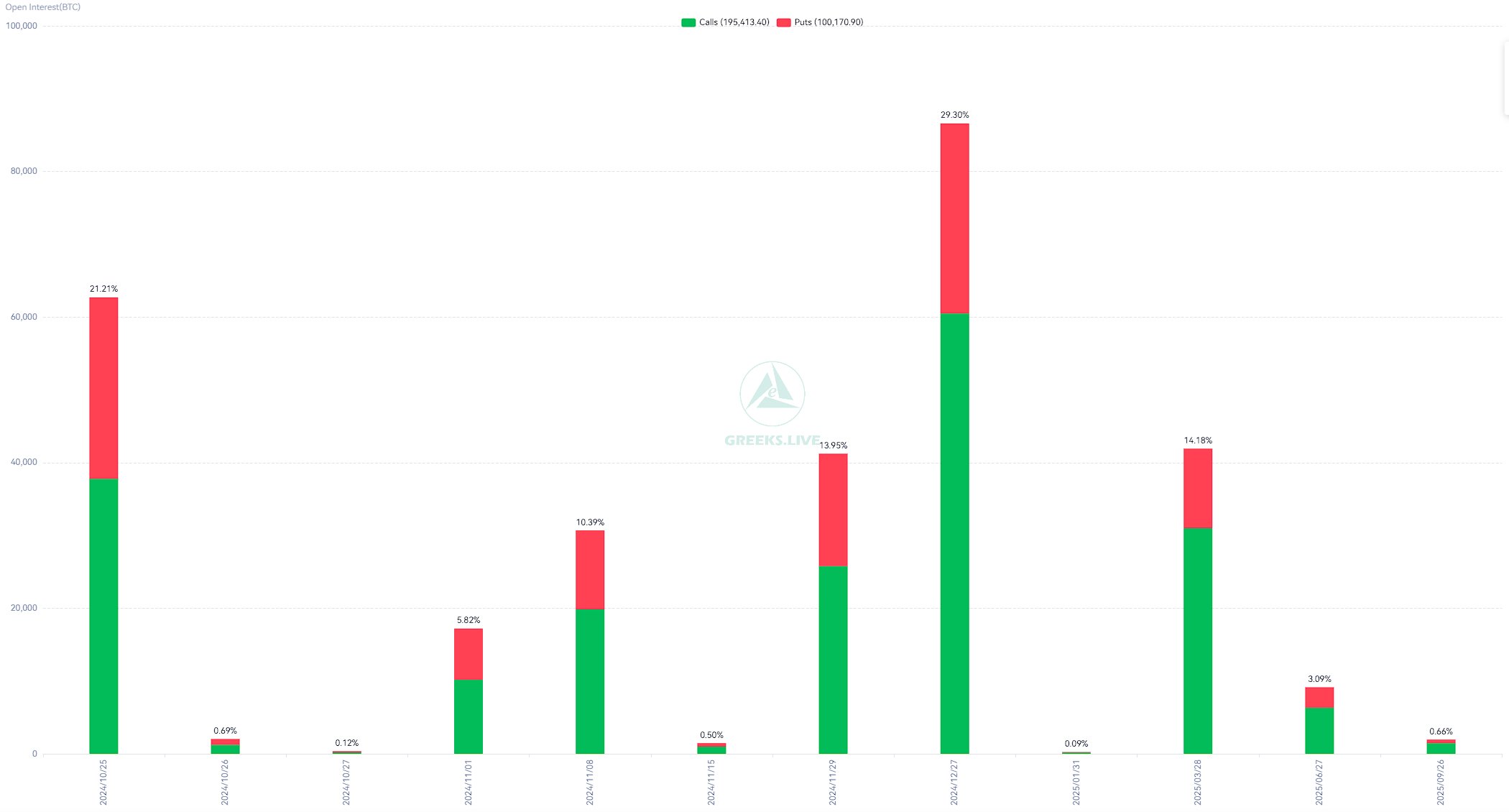

The crypto options expiration, dated the 25th of October, yielded varied results for Bitcoin [BTC] and Ethereum [ETH], according to data from Greeks.live.

The expiration event, involving a combined notional value of $5.28 billion, illustrated different investor behavior for the two leading cryptocurrencies.

BTC options expiration

On the 25th of October, 63,000 Bitcoin options contracts expired, showcasing a Put-Call Ratio of 0.66, signaling a generally bullish sentiment among traders.

The ratio indicated that the number of call options exceeded put options, suggesting that traders were more inclined toward upward price movements.

Meanwhile, the Max Pain point, where the most options would expire worthless, was recorded at $64,000.

The total notional value of expired BTC options was $4.26 billion, highlighting significant activity in the market.

Bitcoin traded around $67,000 at the time of expiration, retracing from a recent high of $68,000. Yet, BTC remained close to its all-time high of $70,000.

Source: X

Bitcoin’s implied volatility (IV) — dated the 8th of November — has stabilized at 55%, indicating a potential opportunity for traders as they anticipated the U.S. elections, which could introduce significant market shifts.

Rise in Bitcoin whales

Supporting the bullish sentiment, recent data from Santiment revealed a rise in the number of Bitcoin whales over the past two weeks.

During this period, 297 new wallets holding at least 100 BTC were added, reflecting a 1.93% increase and bringing the total number of such wallets to 16,338.

Historically, an increase in large Bitcoin holders often aligns with upward price momentum, suggesting possible further gains for Bitcoin.

Source: X

The increase in whale addresses coincided with Bitcoin’s recent price action, where it briefly surpassed $68,000 before a minor correction back to $67,000.

This whale accumulation could indicate sustained interest among large investors, potentially supporting Bitcoin’s resilience ahead of anticipated market volatility in November.

ETH options expiration

On the 25th of October, 403,426 Ethereum options contracts expired as well, with a Put-Call Ratio of 0.97, reflecting an almost balanced sentiment between bullish and bearish positions.

The Max Pain point was set at $2,600, indicating where the highest number of options would expire worthless.

The notional value of expired ETH options reached $1.02 billion, emphasizing Ethereum’s significant market presence, though its performance remained more stagnant compared to Bitcoin.

Source: X

Realistic or not, here’s ETH’s market cap in BTC’s terms

At the press time, Ethereum traded at $2,468, near its Max Pain point, suggesting limited price movement.

This contrasted with Bitcoin’s stronger price dynamics, as the former’s market behavior showed signs of investor indecision, compounded by challenges related to spot Ethereum ETFs.

- Bitcoin options see bullish sentiment, with rising whales hinting at potential gains in November.

- Ethereum options show indecision as prices hover near lows, contrasting Bitcoin’s strong momentum.

The crypto options expiration, dated the 25th of October, yielded varied results for Bitcoin [BTC] and Ethereum [ETH], according to data from Greeks.live.

The expiration event, involving a combined notional value of $5.28 billion, illustrated different investor behavior for the two leading cryptocurrencies.

BTC options expiration

On the 25th of October, 63,000 Bitcoin options contracts expired, showcasing a Put-Call Ratio of 0.66, signaling a generally bullish sentiment among traders.

The ratio indicated that the number of call options exceeded put options, suggesting that traders were more inclined toward upward price movements.

Meanwhile, the Max Pain point, where the most options would expire worthless, was recorded at $64,000.

The total notional value of expired BTC options was $4.26 billion, highlighting significant activity in the market.

Bitcoin traded around $67,000 at the time of expiration, retracing from a recent high of $68,000. Yet, BTC remained close to its all-time high of $70,000.

Source: X

Bitcoin’s implied volatility (IV) — dated the 8th of November — has stabilized at 55%, indicating a potential opportunity for traders as they anticipated the U.S. elections, which could introduce significant market shifts.

Rise in Bitcoin whales

Supporting the bullish sentiment, recent data from Santiment revealed a rise in the number of Bitcoin whales over the past two weeks.

During this period, 297 new wallets holding at least 100 BTC were added, reflecting a 1.93% increase and bringing the total number of such wallets to 16,338.

Historically, an increase in large Bitcoin holders often aligns with upward price momentum, suggesting possible further gains for Bitcoin.

Source: X

The increase in whale addresses coincided with Bitcoin’s recent price action, where it briefly surpassed $68,000 before a minor correction back to $67,000.

This whale accumulation could indicate sustained interest among large investors, potentially supporting Bitcoin’s resilience ahead of anticipated market volatility in November.

ETH options expiration

On the 25th of October, 403,426 Ethereum options contracts expired as well, with a Put-Call Ratio of 0.97, reflecting an almost balanced sentiment between bullish and bearish positions.

The Max Pain point was set at $2,600, indicating where the highest number of options would expire worthless.

The notional value of expired ETH options reached $1.02 billion, emphasizing Ethereum’s significant market presence, though its performance remained more stagnant compared to Bitcoin.

Source: X

Realistic or not, here’s ETH’s market cap in BTC’s terms

At the press time, Ethereum traded at $2,468, near its Max Pain point, suggesting limited price movement.

This contrasted with Bitcoin’s stronger price dynamics, as the former’s market behavior showed signs of investor indecision, compounded by challenges related to spot Ethereum ETFs.

can you buy generic clomid without insurance clomid order where buy clomid tablets rx clomid clomiphene medication for women buying clomiphene pill where buy cheap clomid without dr prescription

More posts like this would make the blogosphere more useful.

More peace pieces like this would insinuate the интернет better.

buy zithromax 500mg without prescription – oral flagyl 200mg brand metronidazole 400mg

domperidone online – generic domperidone 10mg flexeril pill

buy propranolol without a prescription – buy propranolol buy generic methotrexate

order amoxicillin – buy amoxicillin no prescription order combivent pills

buy generic azithromycin 250mg – buy generic zithromax purchase bystolic online cheap

amoxiclav cheap – https://atbioinfo.com/ order ampicillin online cheap

buy esomeprazole pills for sale – https://anexamate.com/ buy generic nexium online

buy medex without prescription – https://coumamide.com/ buy losartan 25mg generic

prednisone 20mg without prescription – https://apreplson.com/ purchase deltasone sale

non prescription ed pills – erection pills viagra online best ed pill for diabetics

buy generic amoxil – https://combamoxi.com/ where to buy amoxicillin without a prescription

forcan pills – https://gpdifluca.com/ order diflucan 200mg generic

buy cenforce generic – site buy cenforce 100mg online

side effects cialis – https://ciltadgn.com/# what does cialis treat

buy zantac pills – https://aranitidine.com/# order zantac generic

More posts like this would make the online space more useful. cialis efectos secundarios a largo plazo

can you really buy viagra online – click buy viagra at cvs

Thanks for sharing. It’s acme quality. zithromax 250mg drug

The thoroughness in this break down is noteworthy. https://ursxdol.com/prednisone-5mg-tablets/

I am in truth enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. https://prohnrg.com/product/loratadine-10-mg-tablets/

Greetings! Extremely useful advice within this article! It’s the petty changes which will make the largest changes. Thanks a lot for sharing! https://aranitidine.com/fr/ciagra-professional-20-mg/

With thanks. Loads of knowledge! https://ondactone.com/spironolactone/

I’ll certainly return to be familiar with more.

https://doxycyclinege.com/pro/tamsulosin/

forxiga ca – janozin.com order forxiga 10 mg online

xenical over the counter – https://asacostat.com/# orlistat 60mg cheap