- Bearish sentiment across the crypto sector was on the rise.

- Bitcoin and Ethereum witnessed a decline in profitable and short-term holders.

AMBCrypto’s analysis of Santiment’s data revealed that the bearish sentiment across the crypto sector was on the rise.

Bears leap forward

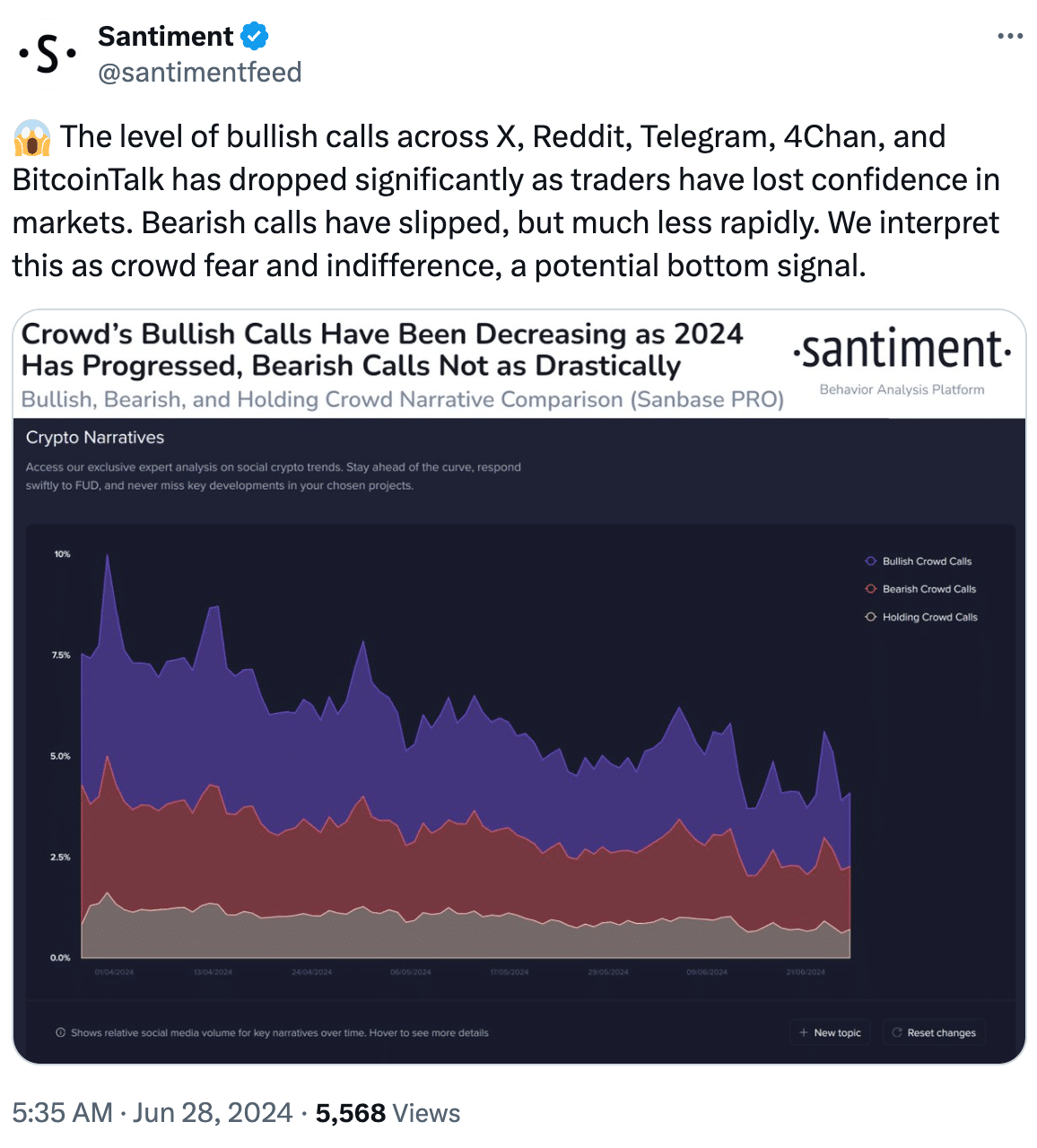

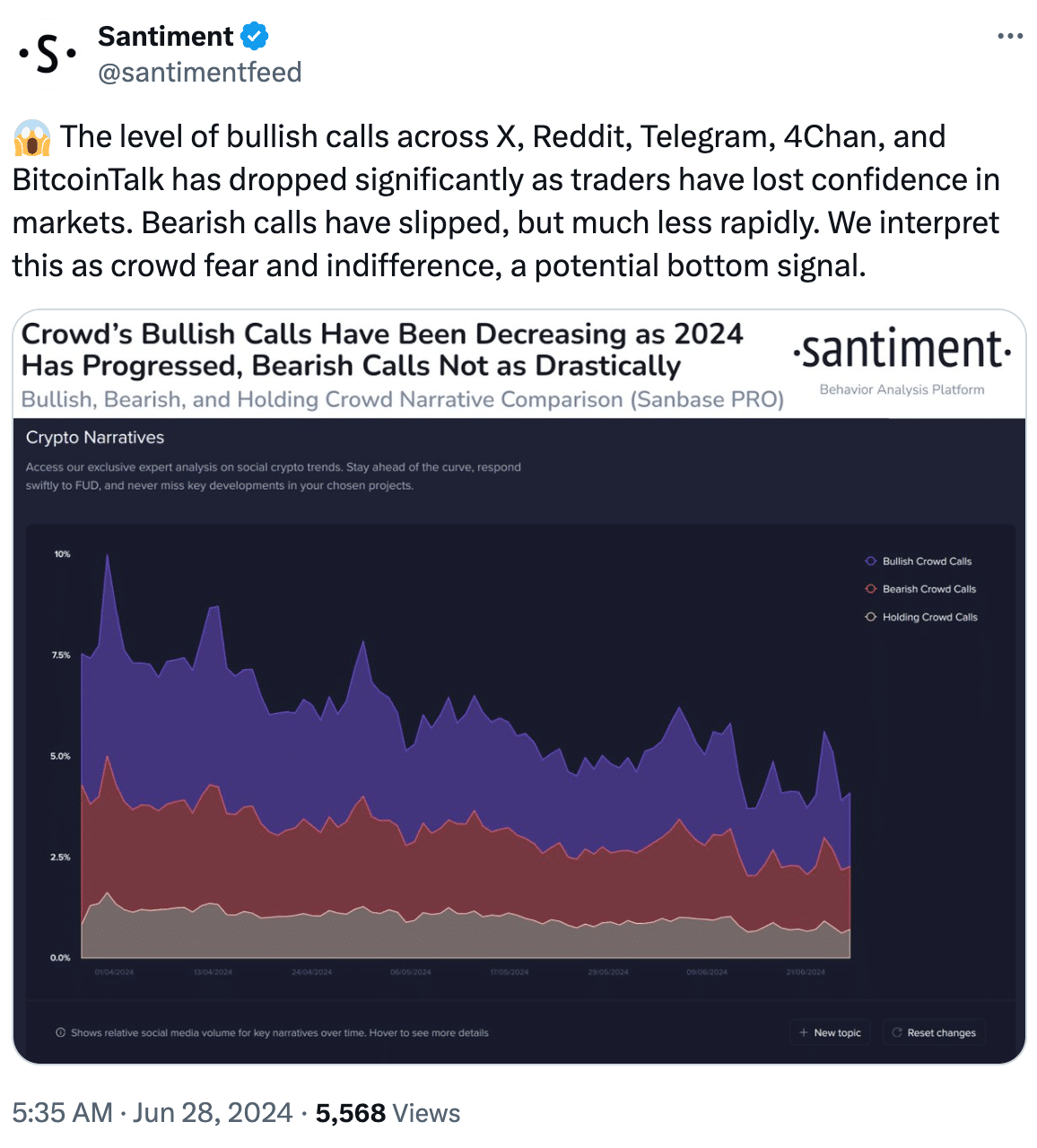

According to the data, there’s been a dramatic plunge in bullish sentiment across online forums like X, Reddit, Telegram, 4Chan, and BitcoinTalk.

Traders have seemingly lost faith in the markets, with bullish calls dropping significantly. Interestingly, bearish calls have also decreased, but at a much slower pace.

Fearful investors who were previously bullish might now be more likely to sell their holdings, driving down prices of Bitcoin [BTC] and Ethereum [ETH] in the short term. This could trigger a domino effect as others panic-sell, further increasing the decline.

However, the significant drop in bullish calls could also indicate a capitulation event, where investors have exhausted their hope and are forced to sell.

The selling pressure might eventually wane, leading to a period of consolidation and potentially a market bottom for BTC and ETH.

Source: X

A tale of two holders

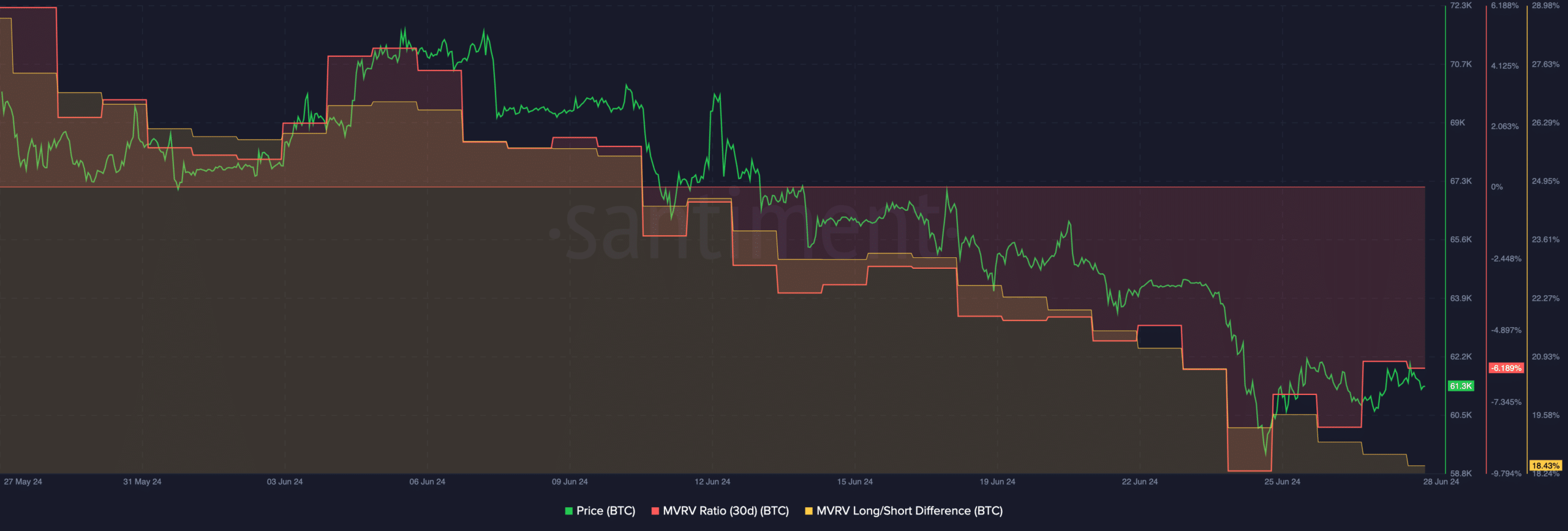

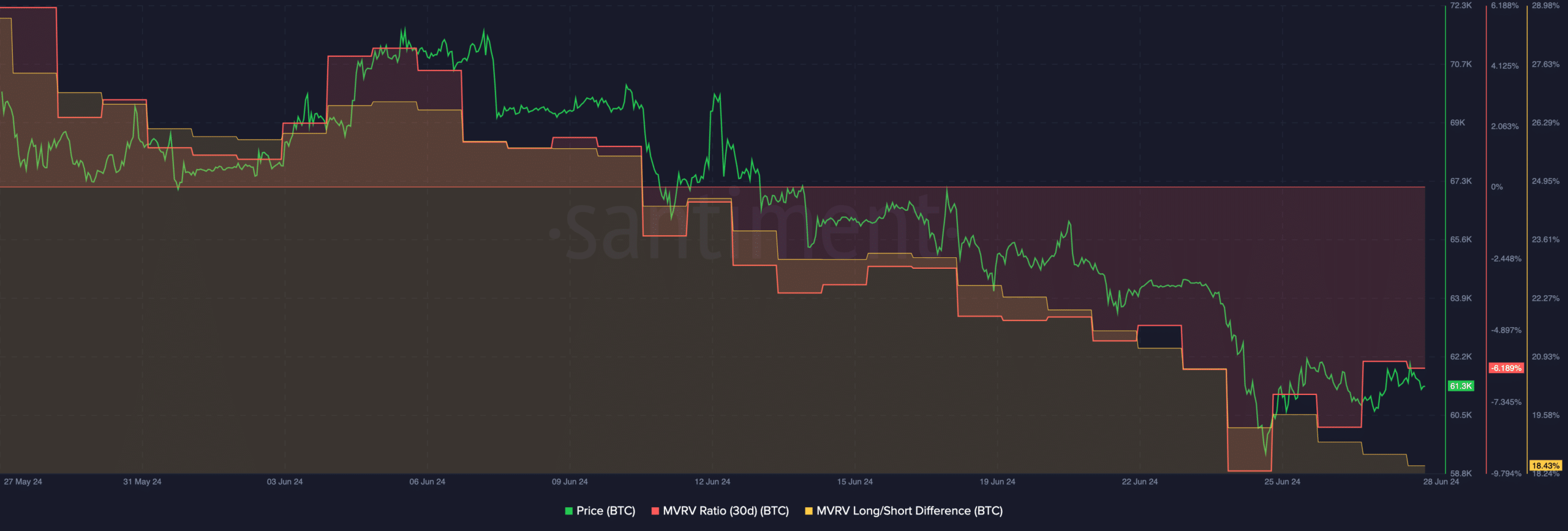

At press time, BTC was trading at $61,361.69 and its price had fallen by 0.67% in the last 24 hours.

During this period, the MVRV ratio for BTC declined significantly. A fall in the MVRV ratio implied that along with the price, the profitability of most holders had also decreased.

Coupled with that, the Long/Short difference of BTC had also fallen. A declining Long/Short ratio indicated that the number of long-term holders had declined compared to the number of short-term holders who were flooding the market.

These short-term holders are unreliable and could be swayed significantly by market fluctuations. If volatility persists, there could be more downward pressure on BTC in the long run.

Source: Santiment

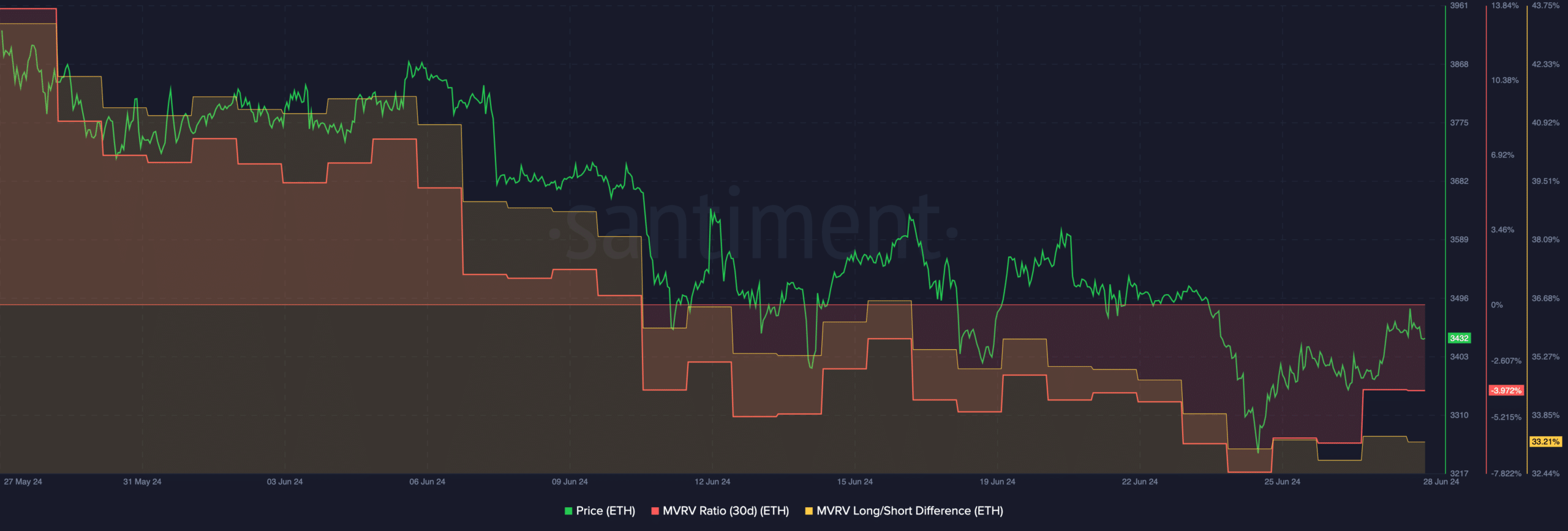

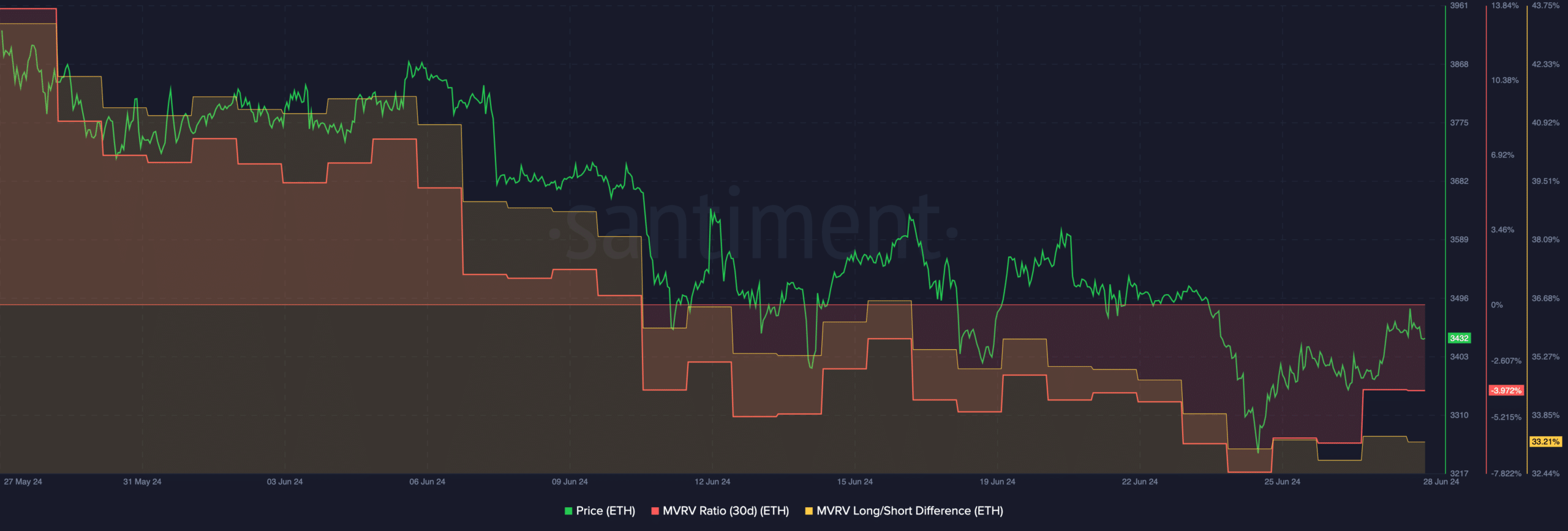

Coupled with BTC, ETH could also face significant selling pressure. This is because of the fact that Ethereum and Bitcoin are heavily correlated. IntotheBlock’s data revealed that the co-relation between both these tokens 0.86 at the time of writing.

Read Ethereum (ETH) Price Prediction 2024-25

In terms of price, ETH was trading at $3,432.61 and over the last 24 hours, it had grown by 1.37%.

The MVRV ratio and Long/Short difference for ETH had declined as well, implying deciding number of profitable addresses and short term holders.

Source; Santiment

- Bearish sentiment across the crypto sector was on the rise.

- Bitcoin and Ethereum witnessed a decline in profitable and short-term holders.

AMBCrypto’s analysis of Santiment’s data revealed that the bearish sentiment across the crypto sector was on the rise.

Bears leap forward

According to the data, there’s been a dramatic plunge in bullish sentiment across online forums like X, Reddit, Telegram, 4Chan, and BitcoinTalk.

Traders have seemingly lost faith in the markets, with bullish calls dropping significantly. Interestingly, bearish calls have also decreased, but at a much slower pace.

Fearful investors who were previously bullish might now be more likely to sell their holdings, driving down prices of Bitcoin [BTC] and Ethereum [ETH] in the short term. This could trigger a domino effect as others panic-sell, further increasing the decline.

However, the significant drop in bullish calls could also indicate a capitulation event, where investors have exhausted their hope and are forced to sell.

The selling pressure might eventually wane, leading to a period of consolidation and potentially a market bottom for BTC and ETH.

Source: X

A tale of two holders

At press time, BTC was trading at $61,361.69 and its price had fallen by 0.67% in the last 24 hours.

During this period, the MVRV ratio for BTC declined significantly. A fall in the MVRV ratio implied that along with the price, the profitability of most holders had also decreased.

Coupled with that, the Long/Short difference of BTC had also fallen. A declining Long/Short ratio indicated that the number of long-term holders had declined compared to the number of short-term holders who were flooding the market.

These short-term holders are unreliable and could be swayed significantly by market fluctuations. If volatility persists, there could be more downward pressure on BTC in the long run.

Source: Santiment

Coupled with BTC, ETH could also face significant selling pressure. This is because of the fact that Ethereum and Bitcoin are heavily correlated. IntotheBlock’s data revealed that the co-relation between both these tokens 0.86 at the time of writing.

Read Ethereum (ETH) Price Prediction 2024-25

In terms of price, ETH was trading at $3,432.61 and over the last 24 hours, it had grown by 1.37%.

The MVRV ratio and Long/Short difference for ETH had declined as well, implying deciding number of profitable addresses and short term holders.

Source; Santiment

where to get cheap clomiphene no prescription how can i get cheap clomiphene without prescription where to buy cheap clomiphene pill order generic clomiphene for sale how to buy clomid how to buy generic clomid tablets buying cheap clomid pill

More posts like this would bring about the blogosphere more useful.

This is a keynote which is in to my verve… Myriad thanks! Exactly where can I find the connection details an eye to questions?

buy zithromax cheap – ofloxacin online buy purchase metronidazole

purchase rybelsus online cheap – buy semaglutide 14 mg without prescription buy generic cyproheptadine over the counter

buy motilium 10mg generic – cyclobenzaprine 15mg usa order flexeril online

buy inderal 20mg generic – buy clopidogrel online cheap methotrexate 5mg ca

buy zithromax for sale – buy generic nebivolol purchase nebivolol pills

purchase augmentin pill – https://atbioinfo.com/ buy acillin pill

esomeprazole 40mg canada – nexiumtous esomeprazole over the counter

order generic coumadin – https://coumamide.com/ cozaar 50mg sale

buy meloxicam tablets – swelling meloxicam 7.5mg for sale

buy prednisone 20mg – corticosteroid order deltasone sale

over the counter ed pills that work – buy ed pills tablets best male ed pills

amoxil buy online – https://combamoxi.com/ amoxil tablet

generic forcan – https://gpdifluca.com/ brand forcan

cost lexapro – order lexapro 20mg generic cost escitalopram 10mg

cenforce 50mg sale – cenforcers.com cenforce canada

ordering tadalafil online – tadalafil 5mg once a day buy cialis generic online 10 mg

order ranitidine 150mg generic – aranitidine oral ranitidine

cialis walmart – strong tadafl cialis soft

The depth in this ruined is exceptional. buy generic tamoxifen online

viagra sale china – https://strongvpls.com/# buy viagra hyderabad india

More articles like this would frame the blogosphere richer. order neurontin without prescription

More posts like this would make the online play more useful. https://ursxdol.com/get-metformin-pills/

Thanks on sharing. It’s outstrip quality. https://prohnrg.com/product/acyclovir-pills/

More posts like this would add up to the online elbow-room more useful. https://aranitidine.com/fr/clenbuterol/

This is the kind of enter I turn up helpful. https://ondactone.com/spironolactone/

More posts like this would persuade the online time more useful.

sumatriptan ca

I couldn’t turn down commenting. Well written! https://sportavesti.ru/forums/users/ovoix-2/

order forxiga 10mg generic – https://janozin.com/ dapagliflozin 10 mg cheap

buy generic xenical online – click orlistat for sale

Thanks recompense sharing. It’s acme quality. https://lzdsxxb.com/home.php?mod=space&uid=5111771