- Stablecoin reserves surged to 48 billion USDT equivalent, suggesting significant dry powder on the sidelines

- Bitcoin exchange outflows intensified while ETH saw mixed flows

The cryptocurrency market is seeing a significant slowdown as capital inflows fall and trading volume hits historic lows – A sign of growing investor hesitation in the current market environment. In fact, data revealed a dramatic 56.70% fall in capital inflows, dropping from $134 billion to $58 billion, while trading activity has fallen to levels not seen since before the U.S elections last year.

Crypto market trading volume hits pre-election lows

Trading volume across major crypto sectors, including memecoins, AI/Big Data projects, and Layer 1 and Layer 2 protocols, has hit its lowest point since 4 November.

According to Santiment, this decline in activity alludes to a form of “trading paralysis” as investors struggle to make decisive moves in the prevailing market conditions. An analysis of the chart revealed a consistent downtrend across all segments, with particularly notable drops in previously active sectors like AI and memecoins.

Exchange net positions show mixed signals

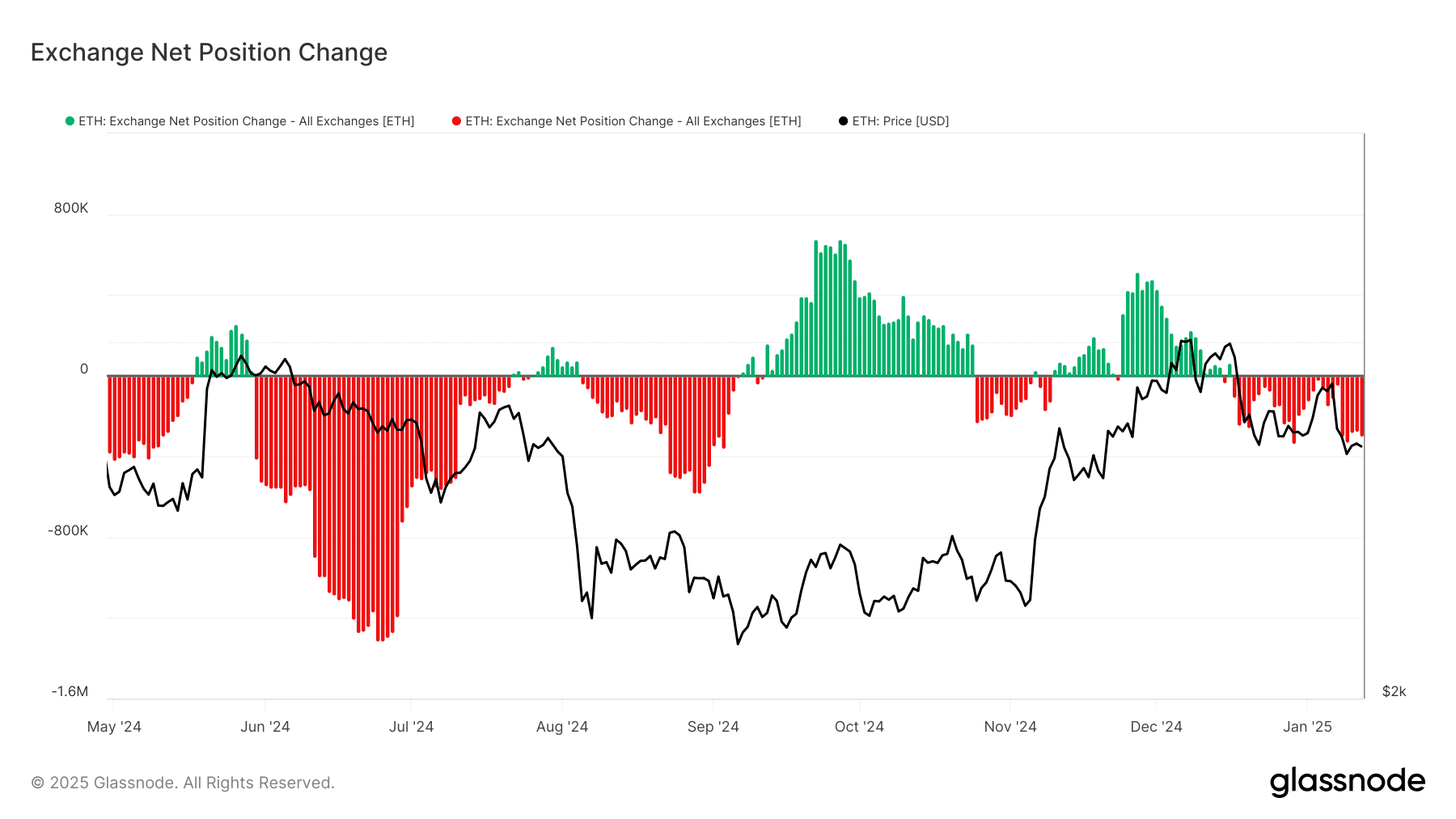

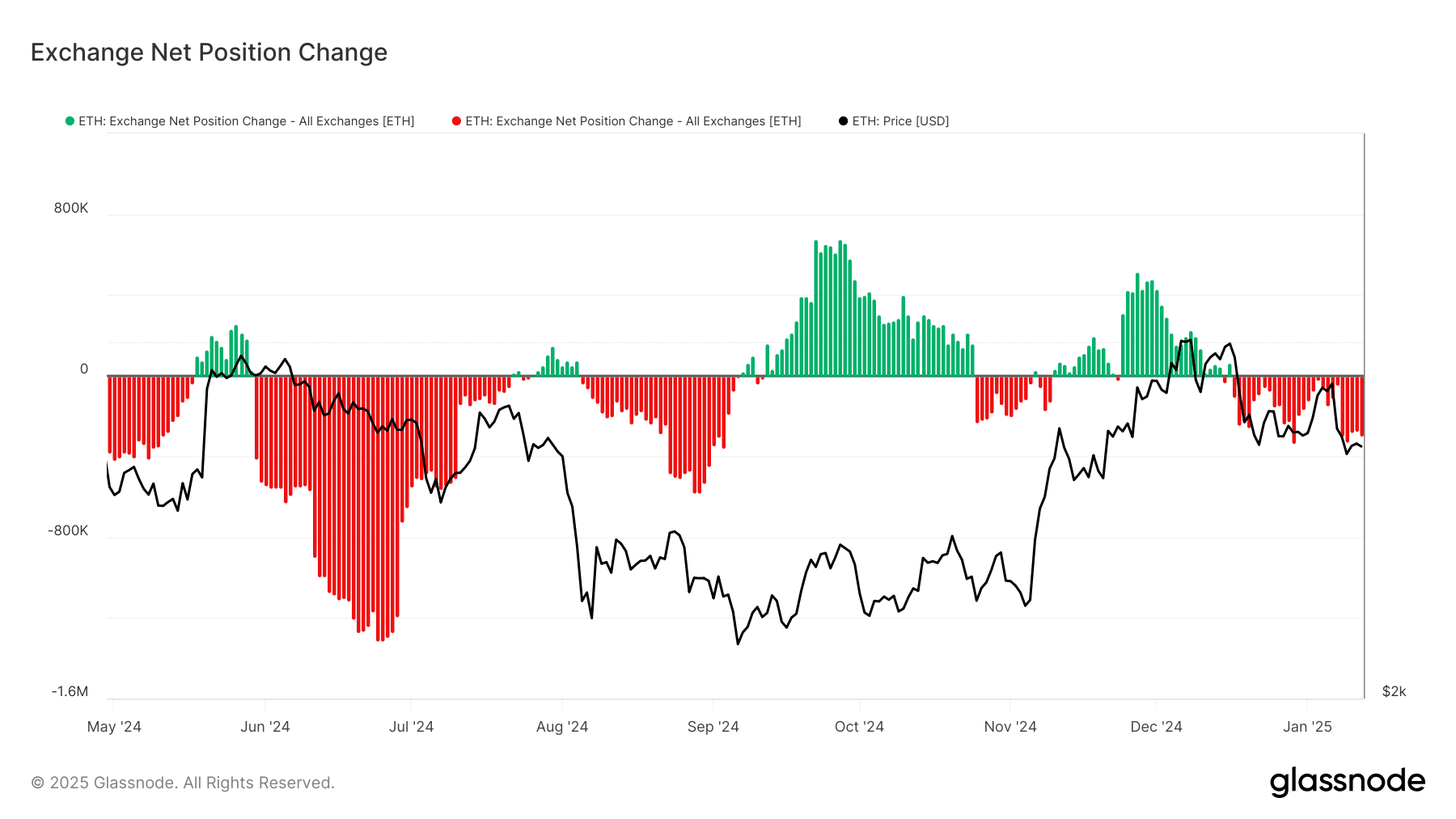

Exchange flow data highlighted contrasting patterns between Ethereum and Bitcoin throughout 2024. Ethereum saw its most significant outflows in July 2024, with approximately 1.6 million ETH leaving exchanges, followed by a notable accumulation phase in October when inflows peaked at 700,000 ETH.

In January 2025, Ethereum has seen negative net flows of roughly 400,000 ETH, indicating a return to withdrawal behavior.

Source: Glassnode

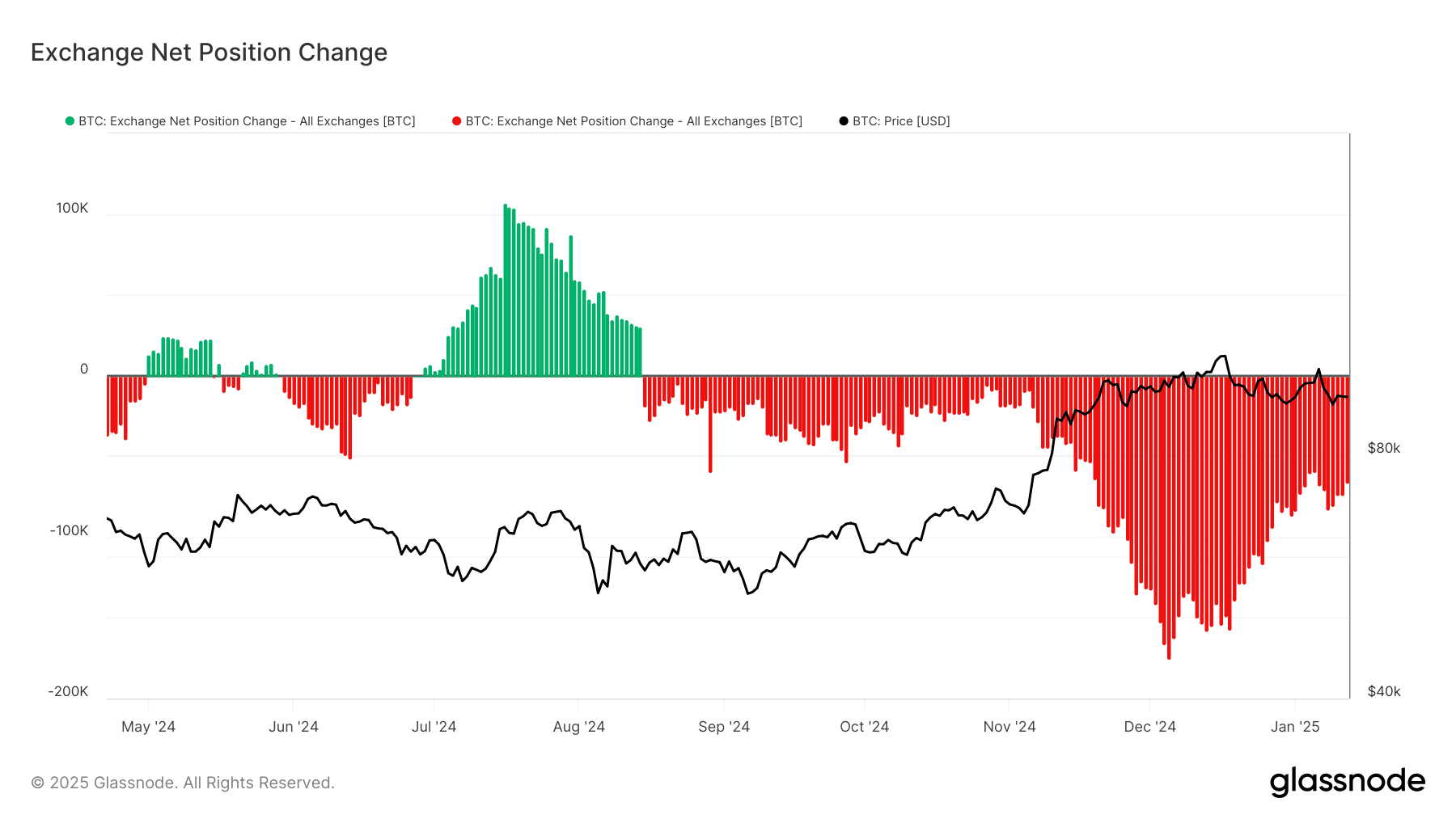

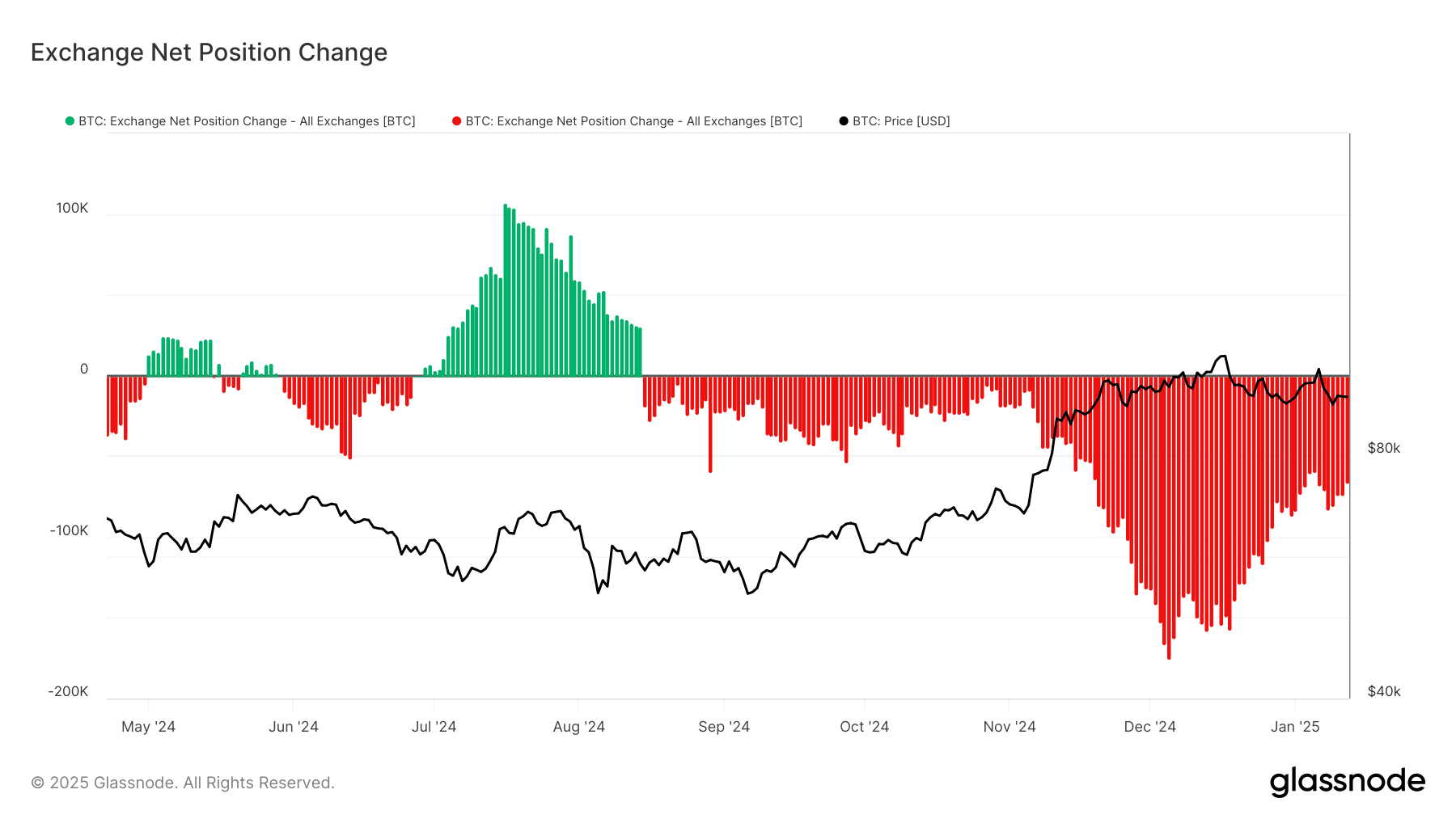

Bitcoin’s exchange positions presented a different narrative though.

August 2024 marked peak accumulation with net inflows of 100,000 BTC. However, December 2024 saw a dramatic shift as outflows intensified to nearly 200,000 BTC – The largest withdrawal volume in the observed period. This trend has persisted into early 2025, with sustained outflows averaging at 80,000 BTC.

Source: Glassnode

Stablecoin reserves signal untapped potential

The stablecoin landscape has transformed significantly since March 2024, with total aggregate supply expanding from 16 billion to 48 billion USDT equivalent.

USDT maintains market dominance, growing from 16 billion to 32 billion, while USDC maintains a stable position between 4-5 billion throughout the period. The aggregate supply demonstrated particular strength in November 2024, surging from 24 billion to 40 billion – A sign of significant dry powder waiting on the sidelines.

Source: Glassnode

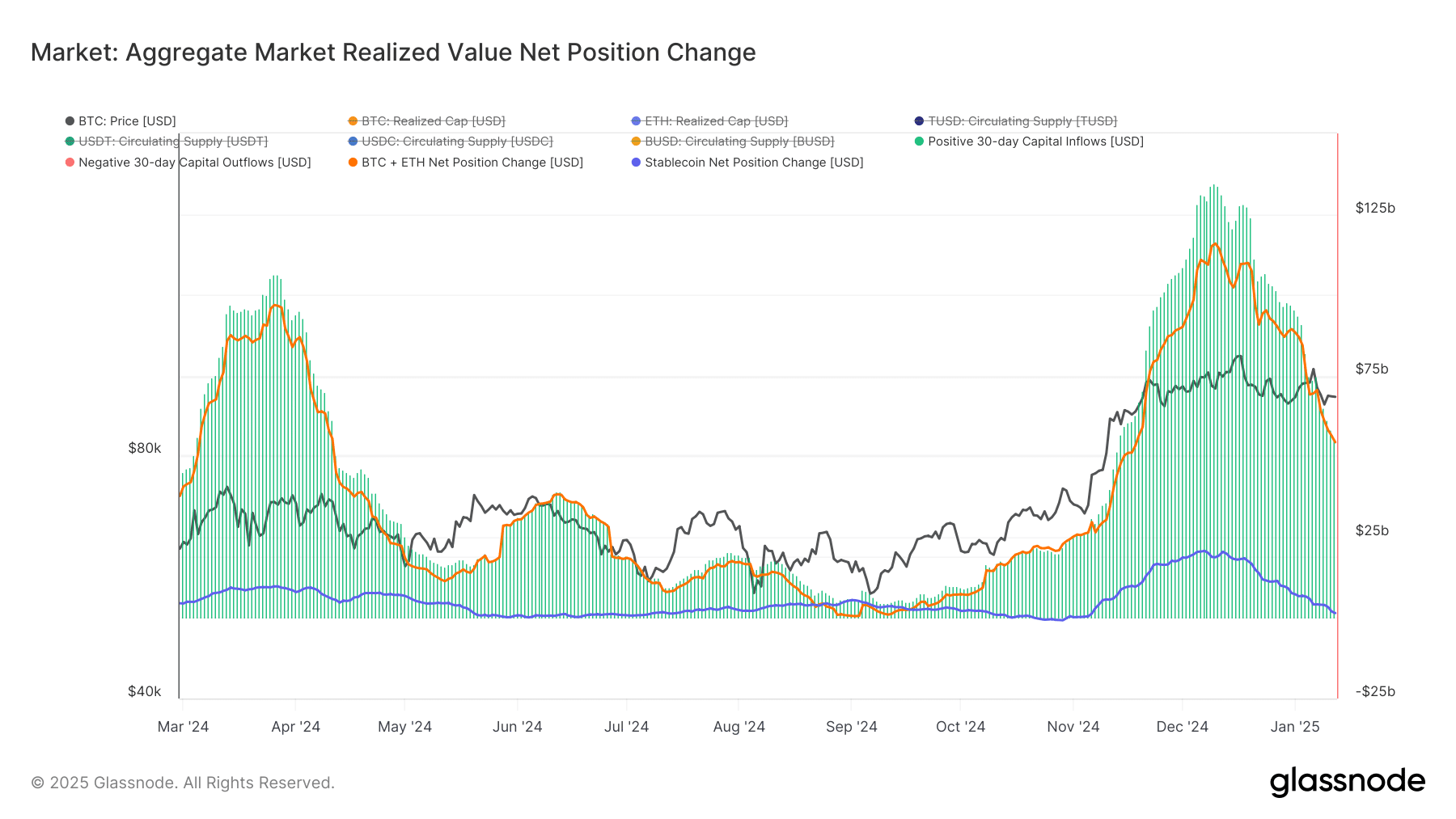

Market realized value shows declining confidence

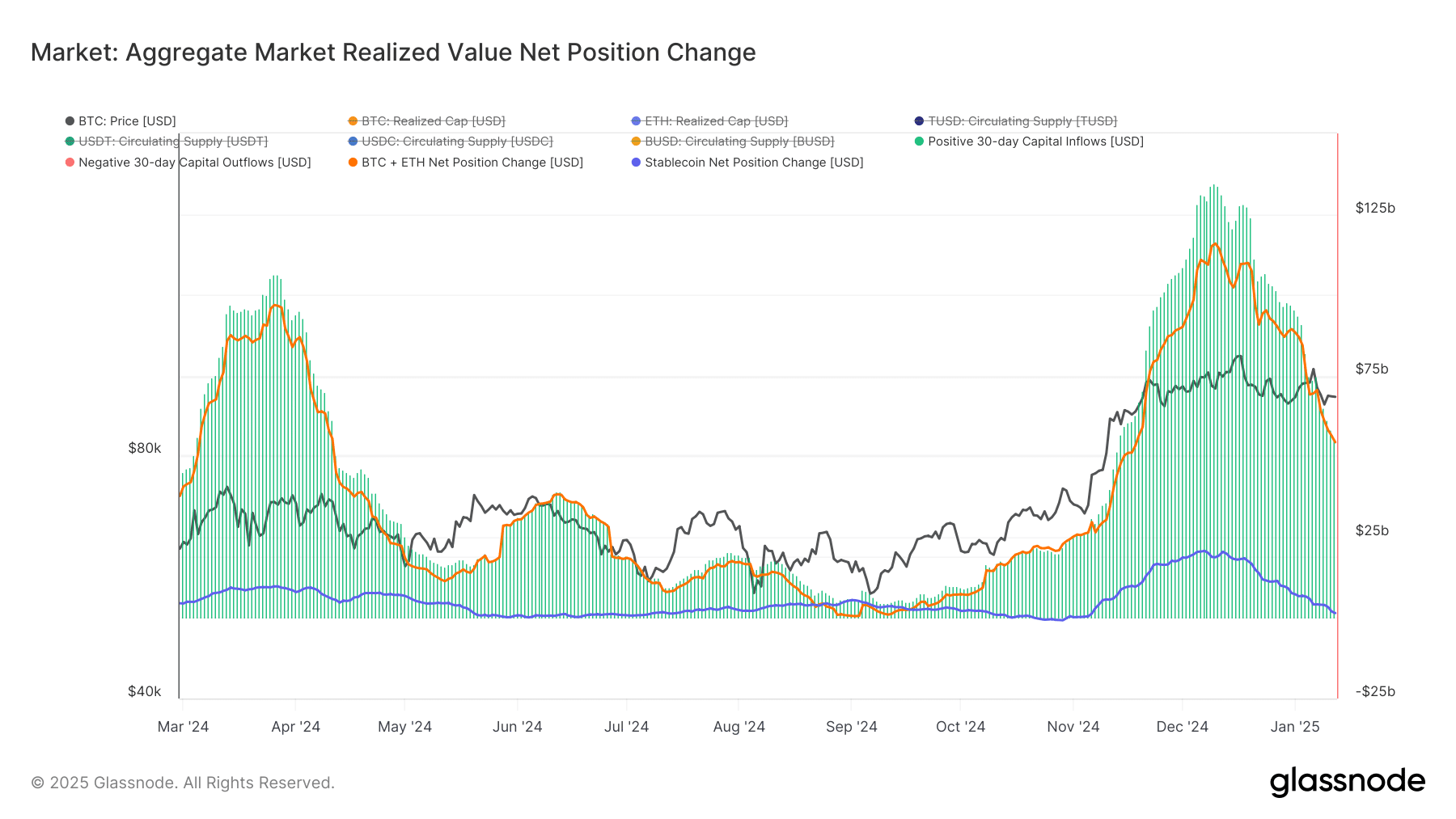

The market realized value demonstrated distinct phases throughout 2024, with capital flows hitting their zenith at $100 billion during March-April, before entering a sustained low period averaging $25 billion from May through September.

A sharp recovery followed in October-November, with inflows touching $125 billion before the latest decline to approximately $58 billion in early 2025.

Source: Glassnode

The drop highlighted weakening liquidity and diminished appetite for risk, particularly following December’s robust market activity. This shift also reflected the broader sentiment across the cryptocurrency space, possibly due to macroeconomic uncertainty, deterring new investments.

Between fear and opportunity

While the current market conditions might appear bearish at first glance, historical patterns suggest that periods of extreme fear and low trading volume often precede significant market rebounds. The significant stablecoin reserves on exchanges, particularly the growth to 48 billion USDT equivalent, could provide the necessary fuel for a recovery once market sentiment improves.

However, risks remain. The sustained decline in trading volume and capital inflows could prolong market stagnation if confidence doesn’t return. The sharp reduction in realized value since December 2024, marking a 56.70% fall from its November peak, underscores the current market uncertainty.

The convergence of declining inflows, historic low trading volumes, and growing stablecoin reserves presents a complex market picture. The substantial withdrawal of Bitcoin from exchanges and Ethereum’s fluctuating patterns suggest varying strategies among different holder groups. Meanwhile, the accumulation of stablecoin reserves alludes to significant potential energy for future market movements.

As the market navigates through this period of reduced activity, the build-up of stable assets on exchanges might signal opportunities for those prepared to act when sentiment shifts. The key will be monitoring how these various metrics evolve in the coming weeks, from exchange flows to stablecoin supplies.

- Stablecoin reserves surged to 48 billion USDT equivalent, suggesting significant dry powder on the sidelines

- Bitcoin exchange outflows intensified while ETH saw mixed flows

The cryptocurrency market is seeing a significant slowdown as capital inflows fall and trading volume hits historic lows – A sign of growing investor hesitation in the current market environment. In fact, data revealed a dramatic 56.70% fall in capital inflows, dropping from $134 billion to $58 billion, while trading activity has fallen to levels not seen since before the U.S elections last year.

Crypto market trading volume hits pre-election lows

Trading volume across major crypto sectors, including memecoins, AI/Big Data projects, and Layer 1 and Layer 2 protocols, has hit its lowest point since 4 November.

According to Santiment, this decline in activity alludes to a form of “trading paralysis” as investors struggle to make decisive moves in the prevailing market conditions. An analysis of the chart revealed a consistent downtrend across all segments, with particularly notable drops in previously active sectors like AI and memecoins.

Exchange net positions show mixed signals

Exchange flow data highlighted contrasting patterns between Ethereum and Bitcoin throughout 2024. Ethereum saw its most significant outflows in July 2024, with approximately 1.6 million ETH leaving exchanges, followed by a notable accumulation phase in October when inflows peaked at 700,000 ETH.

In January 2025, Ethereum has seen negative net flows of roughly 400,000 ETH, indicating a return to withdrawal behavior.

Source: Glassnode

Bitcoin’s exchange positions presented a different narrative though.

August 2024 marked peak accumulation with net inflows of 100,000 BTC. However, December 2024 saw a dramatic shift as outflows intensified to nearly 200,000 BTC – The largest withdrawal volume in the observed period. This trend has persisted into early 2025, with sustained outflows averaging at 80,000 BTC.

Source: Glassnode

Stablecoin reserves signal untapped potential

The stablecoin landscape has transformed significantly since March 2024, with total aggregate supply expanding from 16 billion to 48 billion USDT equivalent.

USDT maintains market dominance, growing from 16 billion to 32 billion, while USDC maintains a stable position between 4-5 billion throughout the period. The aggregate supply demonstrated particular strength in November 2024, surging from 24 billion to 40 billion – A sign of significant dry powder waiting on the sidelines.

Source: Glassnode

Market realized value shows declining confidence

The market realized value demonstrated distinct phases throughout 2024, with capital flows hitting their zenith at $100 billion during March-April, before entering a sustained low period averaging $25 billion from May through September.

A sharp recovery followed in October-November, with inflows touching $125 billion before the latest decline to approximately $58 billion in early 2025.

Source: Glassnode

The drop highlighted weakening liquidity and diminished appetite for risk, particularly following December’s robust market activity. This shift also reflected the broader sentiment across the cryptocurrency space, possibly due to macroeconomic uncertainty, deterring new investments.

Between fear and opportunity

While the current market conditions might appear bearish at first glance, historical patterns suggest that periods of extreme fear and low trading volume often precede significant market rebounds. The significant stablecoin reserves on exchanges, particularly the growth to 48 billion USDT equivalent, could provide the necessary fuel for a recovery once market sentiment improves.

However, risks remain. The sustained decline in trading volume and capital inflows could prolong market stagnation if confidence doesn’t return. The sharp reduction in realized value since December 2024, marking a 56.70% fall from its November peak, underscores the current market uncertainty.

The convergence of declining inflows, historic low trading volumes, and growing stablecoin reserves presents a complex market picture. The substantial withdrawal of Bitcoin from exchanges and Ethereum’s fluctuating patterns suggest varying strategies among different holder groups. Meanwhile, the accumulation of stablecoin reserves alludes to significant potential energy for future market movements.

As the market navigates through this period of reduced activity, the build-up of stable assets on exchanges might signal opportunities for those prepared to act when sentiment shifts. The key will be monitoring how these various metrics evolve in the coming weeks, from exchange flows to stablecoin supplies.

I am not sure where youre getting your info but good topic I needs to spend some time learning much more or understanding more Thanks for magnificent info I was looking for this information for my mission

Great awesome issues here. I?¦m very satisfied to see your post. Thank you so much and i’m taking a look forward to touch you. Will you please drop me a mail?

You can certainly see your expertise in the work you write. The arena hopes for more passionate writers like you who aren’t afraid to say how they believe. All the time go after your heart. “Every man serves a useful purpose A miser, for example, makes a wonderful ancestor.” by Laurence J. Peter.

F*ckin¦ amazing issues here. I¦m very happy to peer your post. Thanks a lot and i’m looking ahead to touch you. Will you please drop me a e-mail?

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

can i order generic clomiphene prices cost of generic clomiphene for sale order generic clomid without rx where buy clomiphene price where can i get cheap clomiphene without prescription clomiphene generic name how can i get generic clomid without dr prescription

Thanks on putting this up. It’s well done.

The reconditeness in this tune is exceptional.

buy azithromycin – flagyl 400mg price buy flagyl medication

order semaglutide 14mg – order semaglutide 14 mg without prescription buy cheap generic periactin

domperidone 10mg generic – order sumycin 250mg sale cyclobenzaprine pills

amoxiclav us – https://atbioinfo.com/ generic acillin

purchase esomeprazole pills – nexiumtous purchase nexium sale

buy coumadin 5mg sale – https://coumamide.com/ purchase losartan

buy mobic 15mg for sale – https://moboxsin.com/ meloxicam online order

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. All the best

order deltasone 20mg pills – https://apreplson.com/ order deltasone 40mg online cheap

hims ed pills – https://fastedtotake.com/ buy ed pills online usa

amoxicillin us – amoxil drug buy amoxicillin

diflucan where to buy – https://gpdifluca.com/# buy diflucan medication

cenforce usa – https://cenforcers.com/ order cenforce generic

buy cialis without doctor prescription – https://strongtadafl.com/# tadalafil tablets 20 mg global

ranitidine medication – purchase ranitidine online cheap purchase zantac generic

I couldn’t hold back commenting. Well written! this

Thanks on putting this up. It’s understandably done. purchase amoxicillin pills

I’ll certainly return to read more. https://ursxdol.com/propecia-tablets-online/

This is a keynote which is near to my fundamentals… Many thanks! Exactly where can I find the acquaintance details for questions? https://prohnrg.com/product/acyclovir-pills/

Some really nice and utilitarian information on this site, also I believe the style has got wonderful features.

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

This is a question which is near to my fundamentals… Many thanks! Quite where can I upon the phone details due to the fact that questions? https://ondactone.com/spironolactone/

This is the amicable of topic I take advantage of reading.

oral celebrex

It is the best time to make some plans for the future and it is time to be happy. I have read this post and if I could I want to suggest you some interesting things or advice. Maybe you could write next articles referring to this article. I want to read even more things about it!

This is a theme which is virtually to my heart… Numberless thanks! Exactly where can I upon the phone details an eye to questions? http://ledyardmachine.com/forum/User-Smlzbr

I have been exploring for a little for any high quality articles or blog posts in this sort of house . Exploring in Yahoo I ultimately stumbled upon this web site. Reading this info So i?¦m happy to convey that I’ve an incredibly just right uncanny feeling I discovered exactly what I needed. I such a lot surely will make sure to do not forget this web site and give it a glance on a relentless basis.

I really like your writing style, excellent info, appreciate it for posting :D. “Every moment of one’s existence one is growing into more or retreating into less.” by Norman Mailer.

order dapagliflozin 10 mg online cheap – site forxiga 10 mg usa