- CryptoQuant data shows that Bitcoin and Ethereum exchange balance has been on a decline.

- Technical analysis indicates significant price movements for both cryptocurrencies if key resistance levels are broken.

Bitcoin [BTC] was trading just shy of $70,000 at press time, reflecting a moderate upswing of 2% in the last 24 hours, though it remains below its March peak of over $73,000.

This continued growth from the asset is part of a broader narrative that underscores the complexities of crypto market movements.

Conversely, Ethereum [ETH] has shown remarkable stability, maintaining a position above $3,800. This steadiness comes despite a slight 2.5% drop over the last day, stabilizing with a minimal 0.7% increase today.

The stability in Ethereum’s price points to a sustained interest in the asset amid fluctuating market conditions.

Bitcoin & Ethereum market shifts

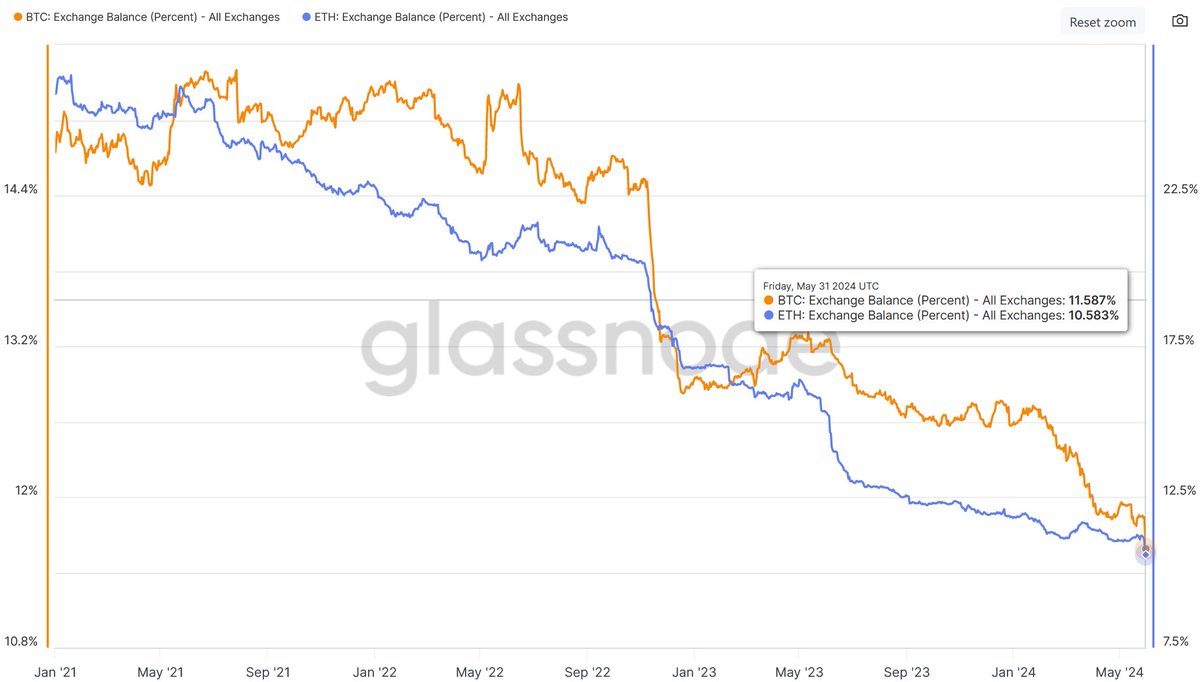

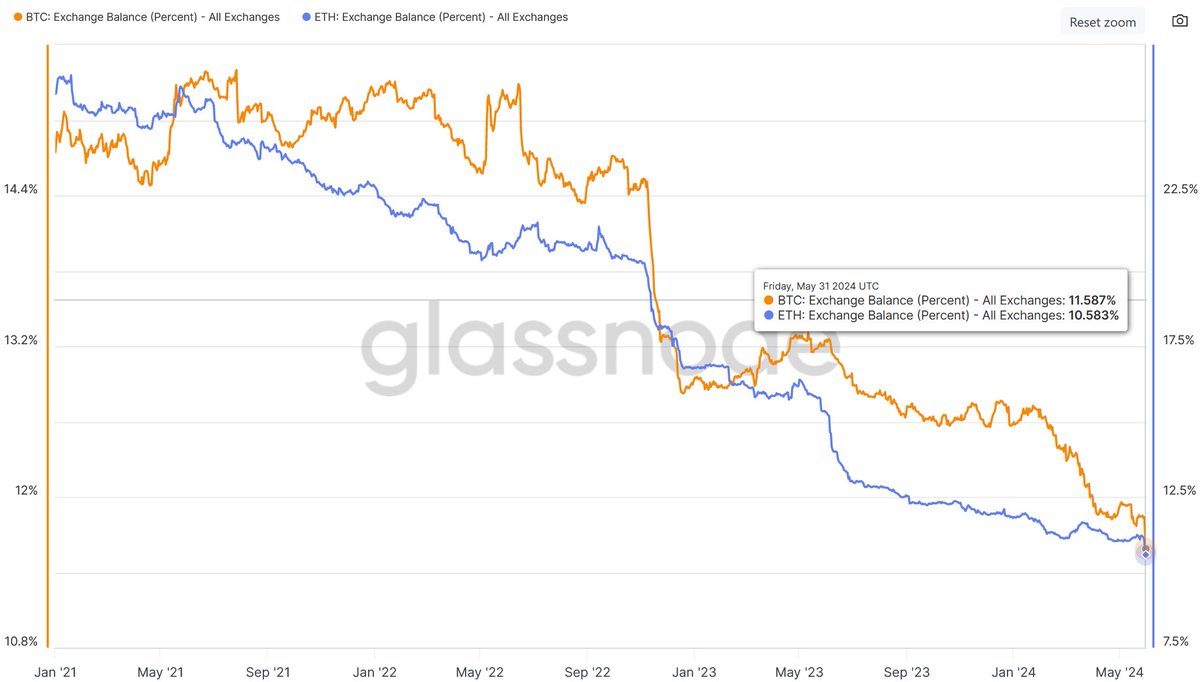

Recent analysis by BTC-ECHO’s Leon Waidmann revealed that both Bitcoin and Ethereum have witnessed their lowest exchange balance levels in years.

Specifically, Bitcoin’s presence on exchanges has reduced to 11.6% while Ethereum’s has dipped to 10.6%.

Source: Leon Waidmann on X

This trend suggests a significant movement of these assets away from exchanges and potentially indicates a strategy among investors to hold onto their coins for longer periods.

Source: CryptoQuant

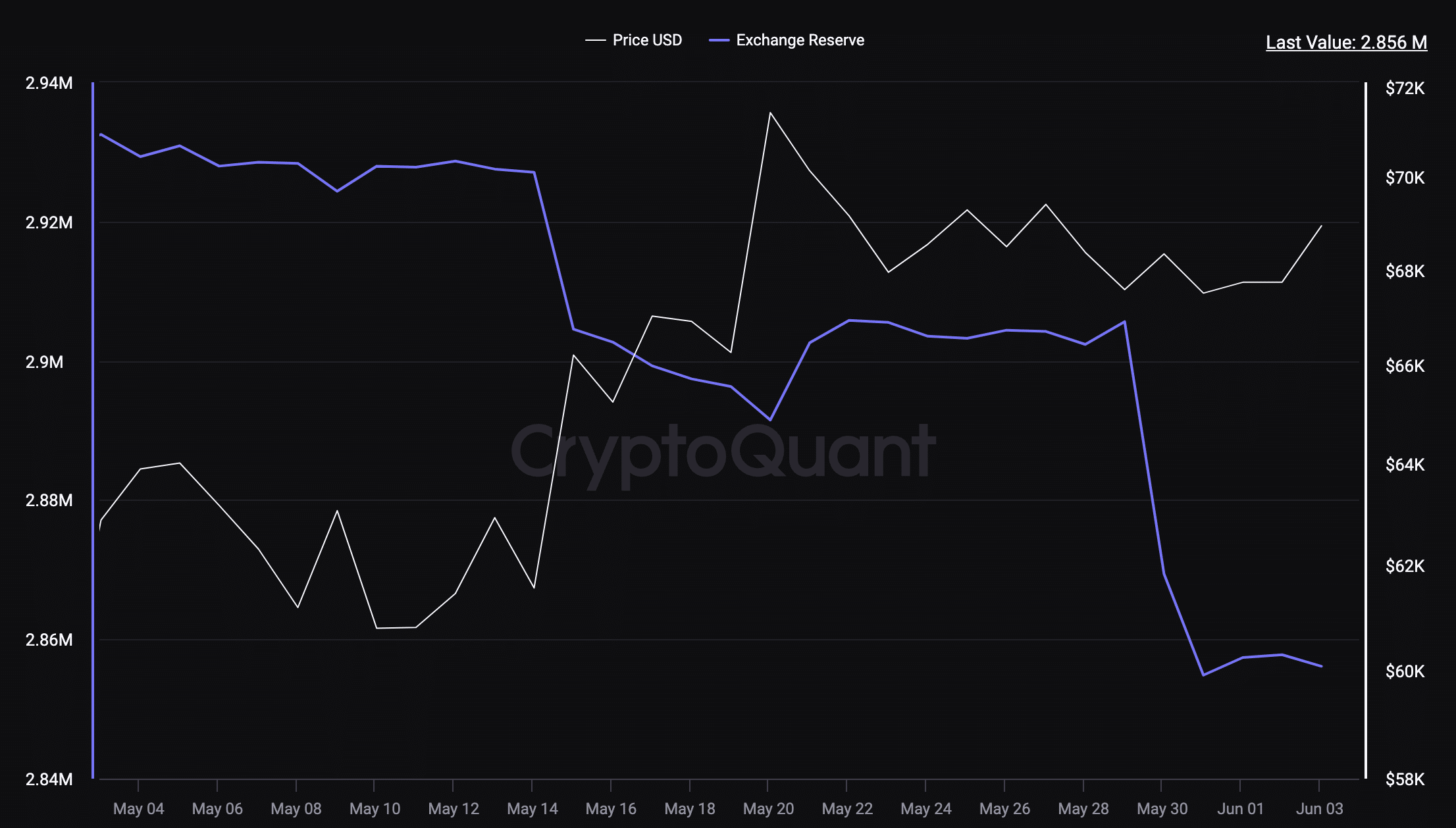

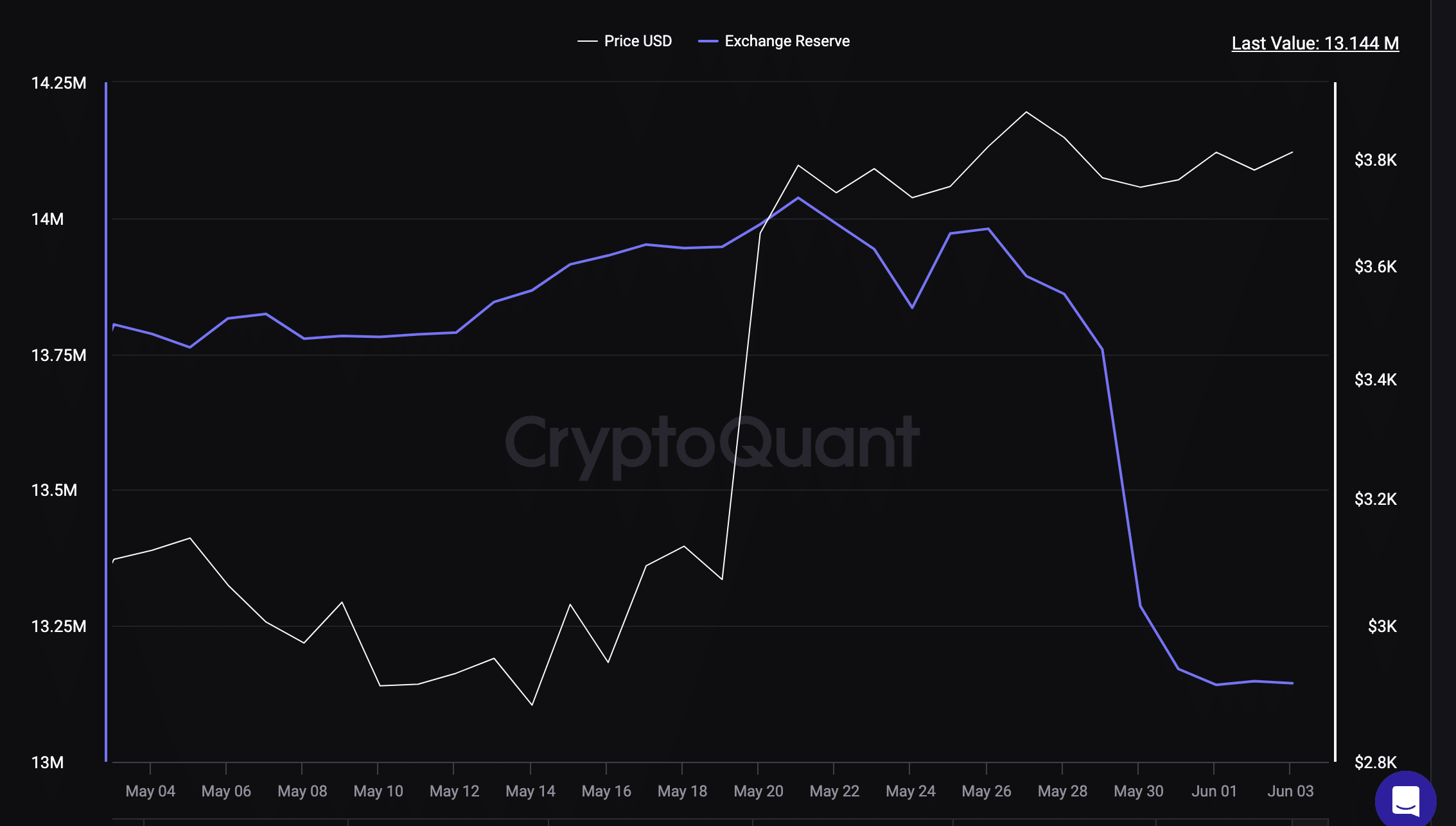

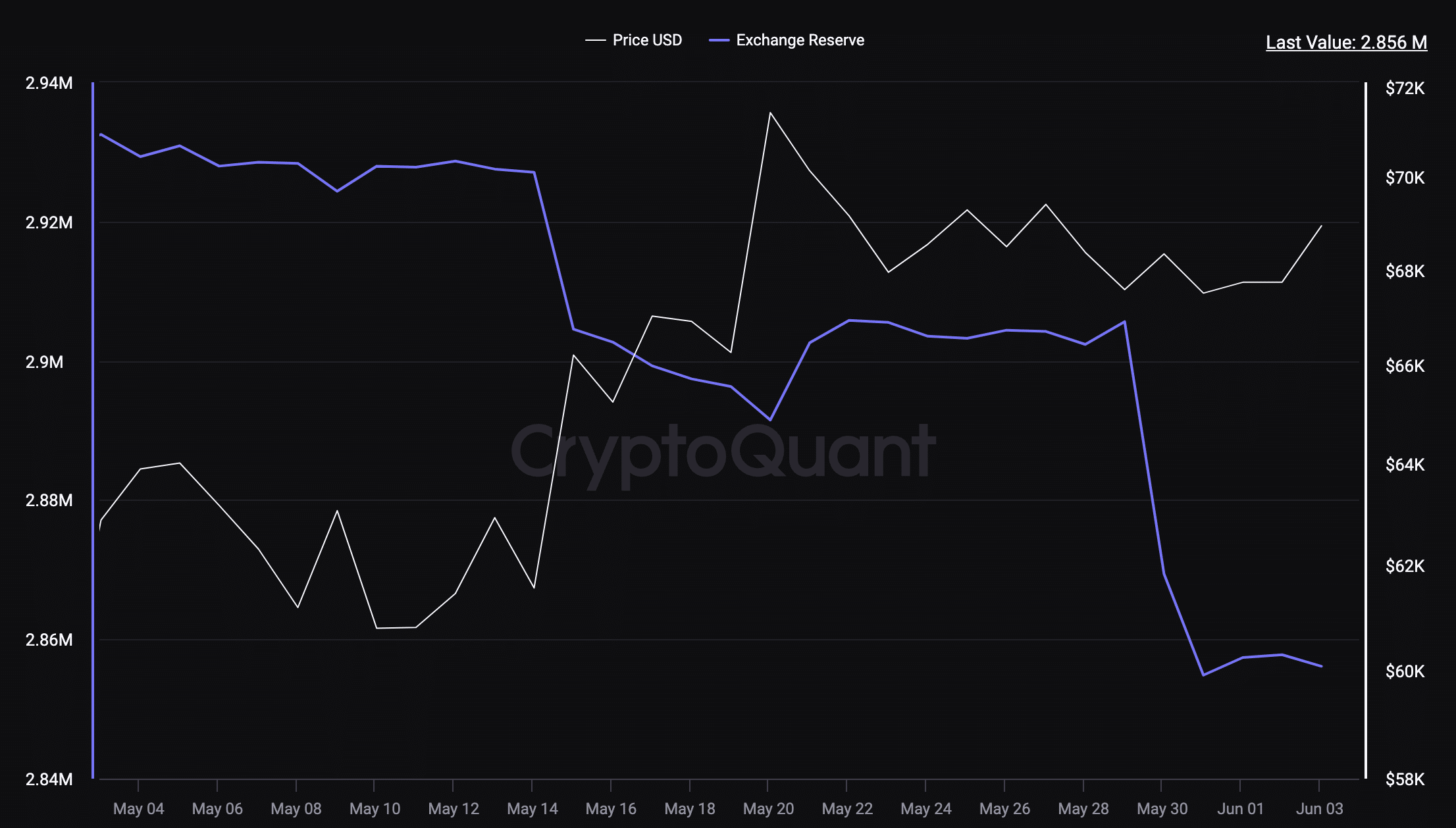

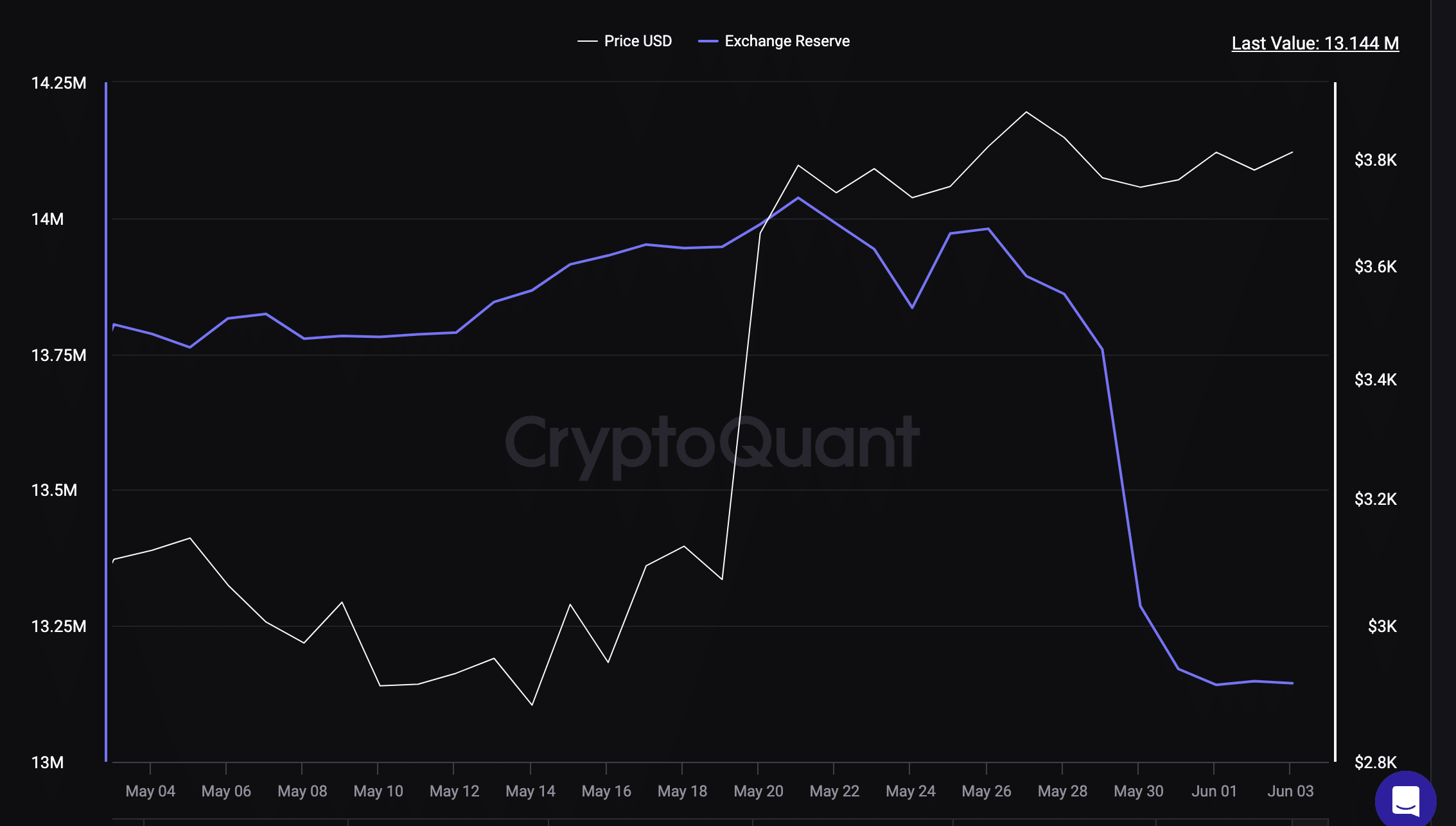

AMBCrypto’s examination of CryptoQuant data further revealed a substantial outflow of these cryptocurrencies from exchanges.

Over $5 million worth of Bitcoin and more than $1 billion in Ethereum have withdrawn from exchanges since early May.

This movement is noteworthy as it follows the approval of spot Ethereum ETFs in the US, hinting at a possible supply squeeze on the horizon.

Source: CryptoQuant

The reduction in exchange reserves implies that fewer coins are now available for immediate trading, pointing to a potential price increase due to scarcity.

Waidmann anticipates this will lead to a supply squeeze, urging investors to prepare for significant market movements, noting:

“Whales continue to accumulate. Supply squeeze incoming. Get ready for the next big move.”

Market dynamics and technical analysis

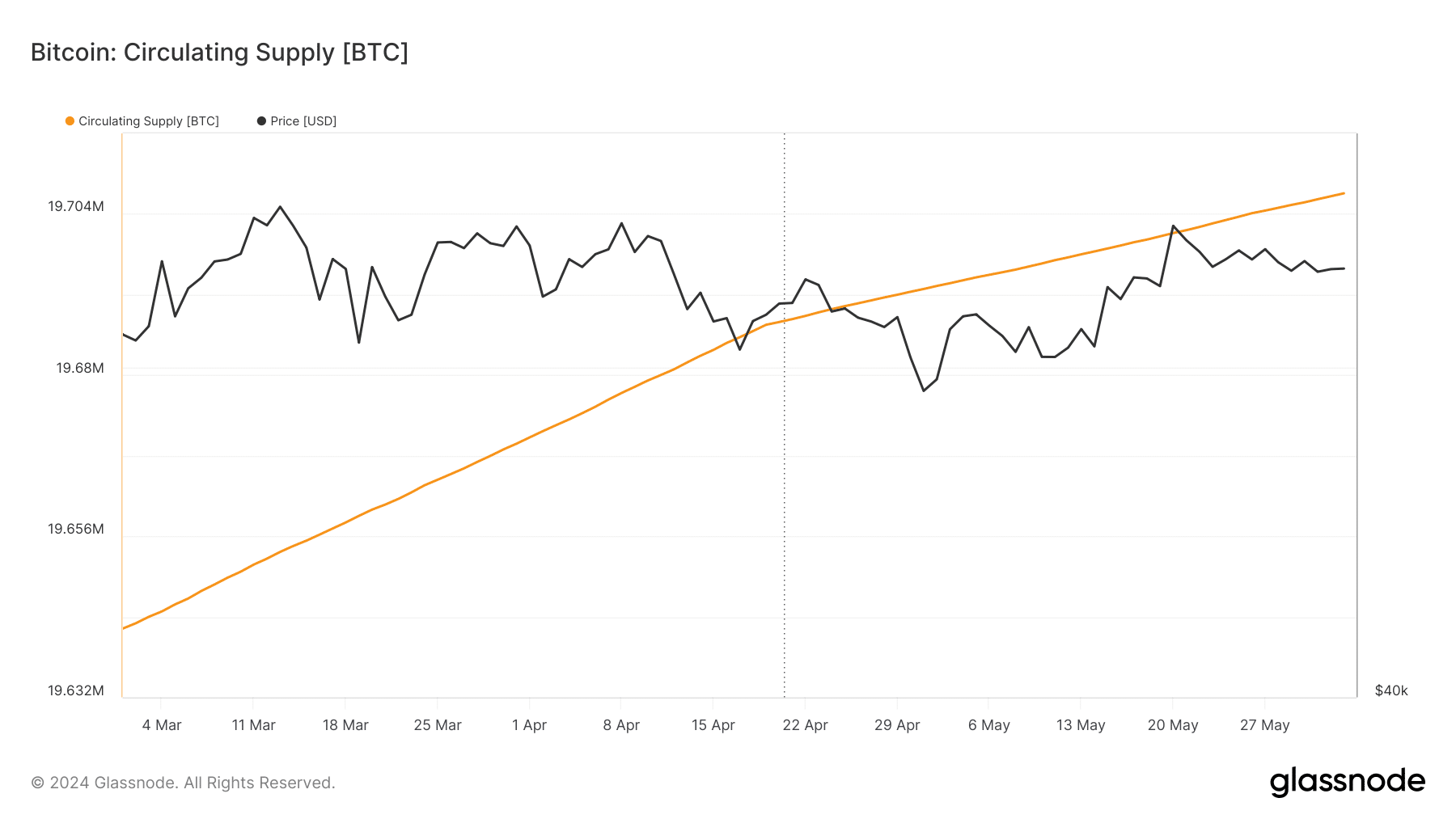

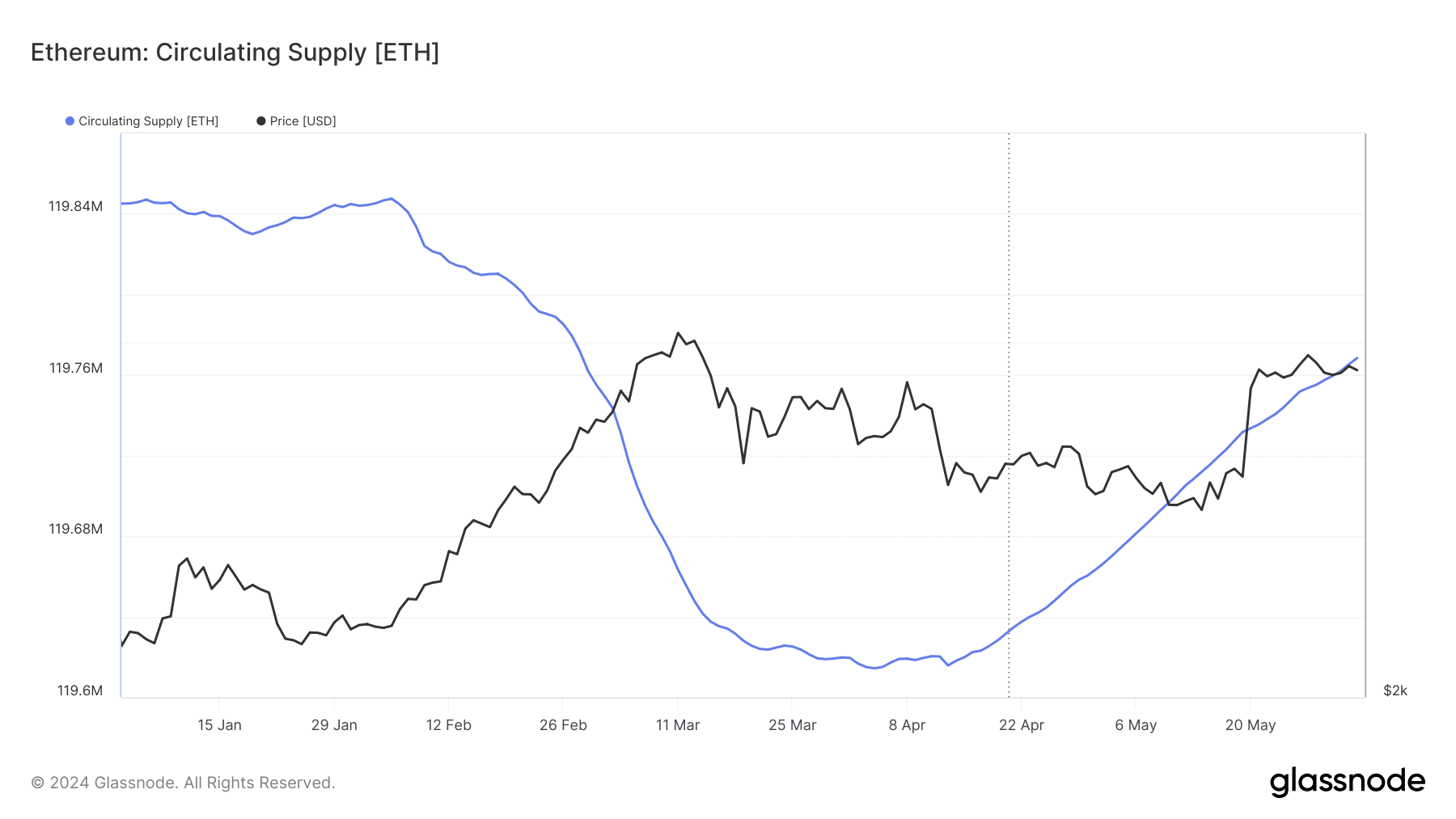

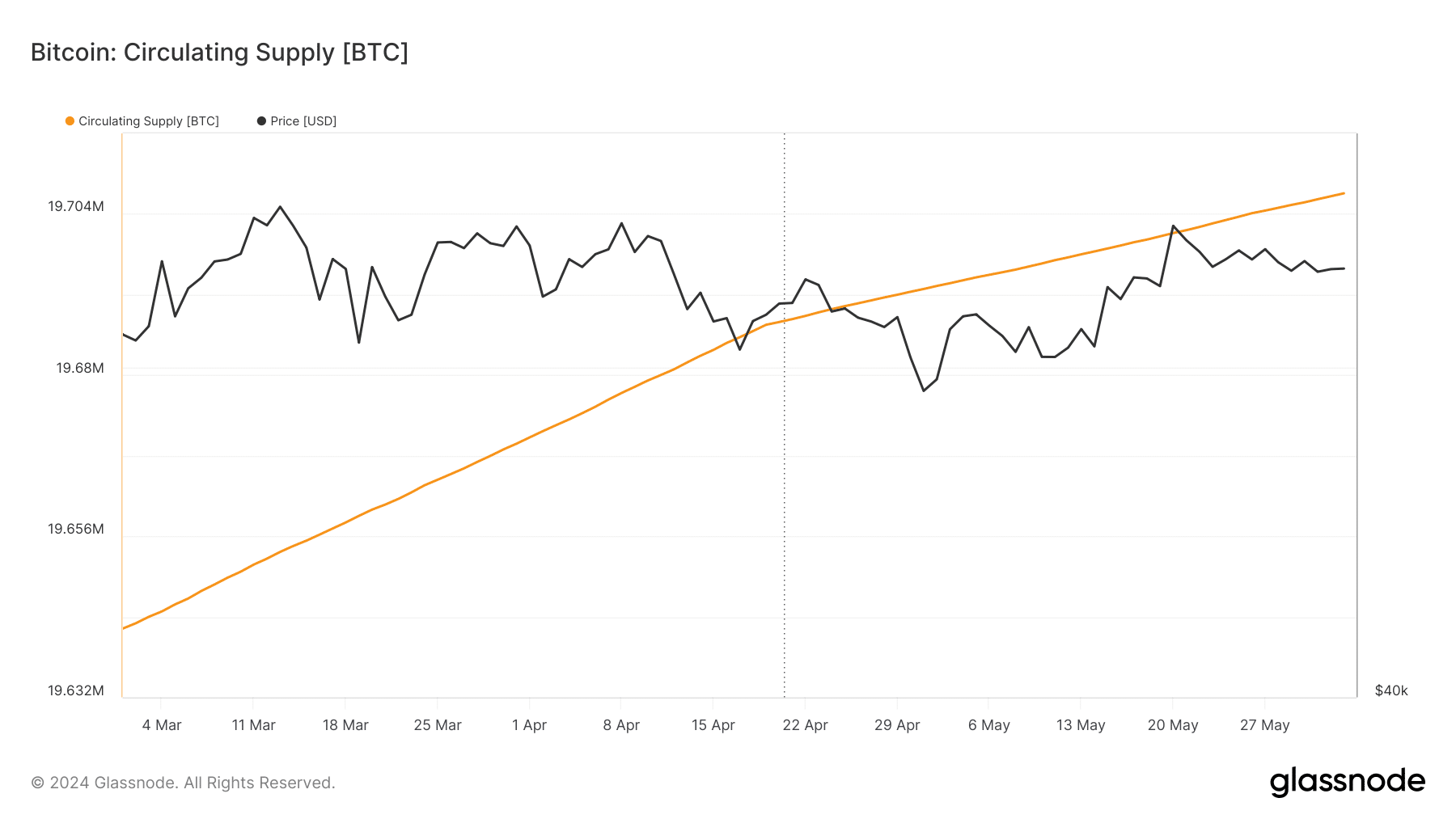

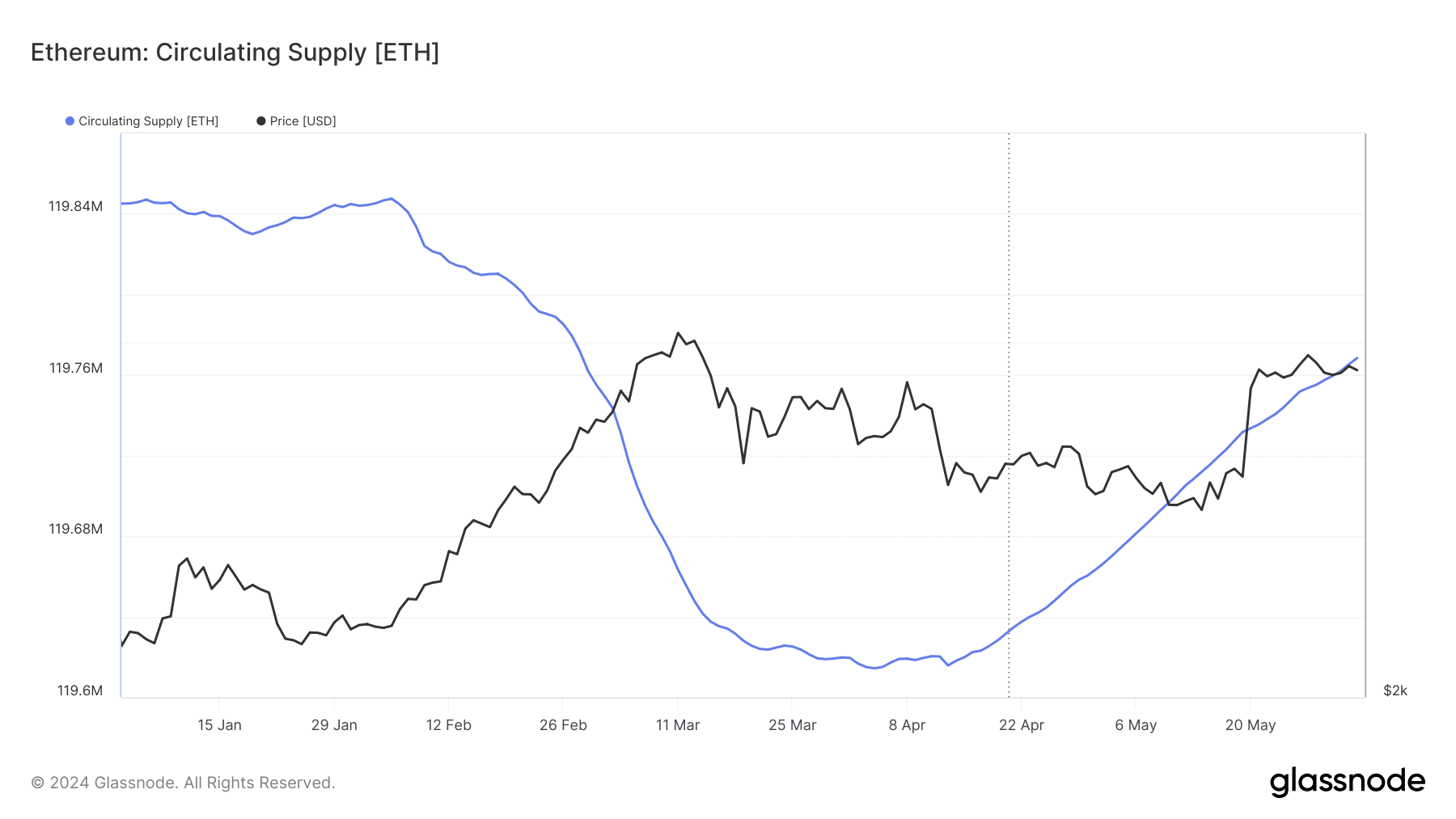

However, Glassnode data presents a contrasting view, showing an increase in the circulating supply for both cryptocurrencies, suggesting that despite reduced exchange availability, the overall market supply remains high.

Source: Glasssnode

This scenario sets the stage for potential price corrections if demand fails to keep pace with the increasing supply. However, the current market indicators suggest demand is keeping up, as there has been no notable price dip despite the growing supply.

Source: Glasssnode

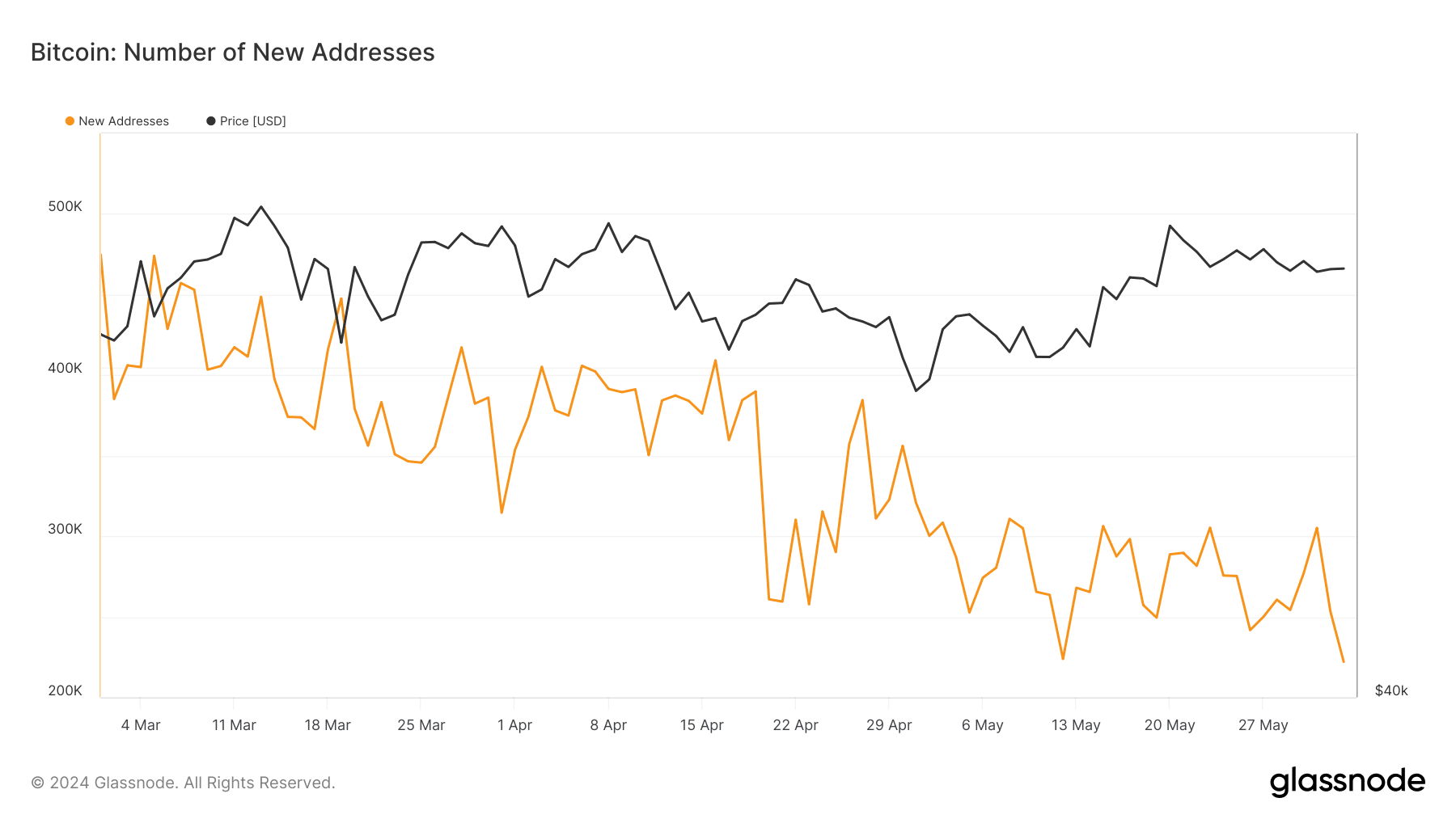

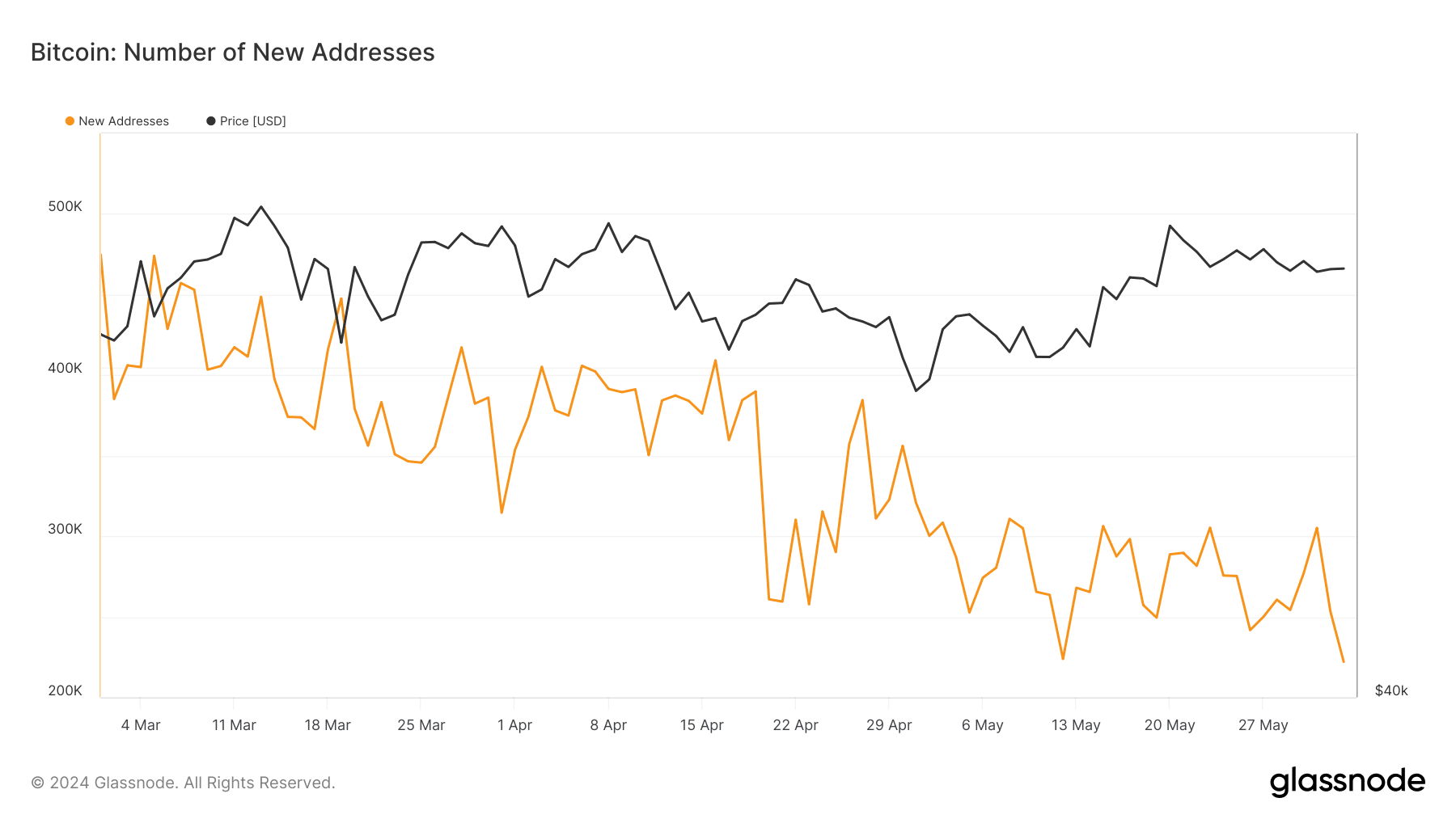

Meanwhile, there is a decline in new addresses for both Bitcoin and Ethereum which could indicate a cooling interest among new investors, potentially impacting future demand.

Source: Glasssnode

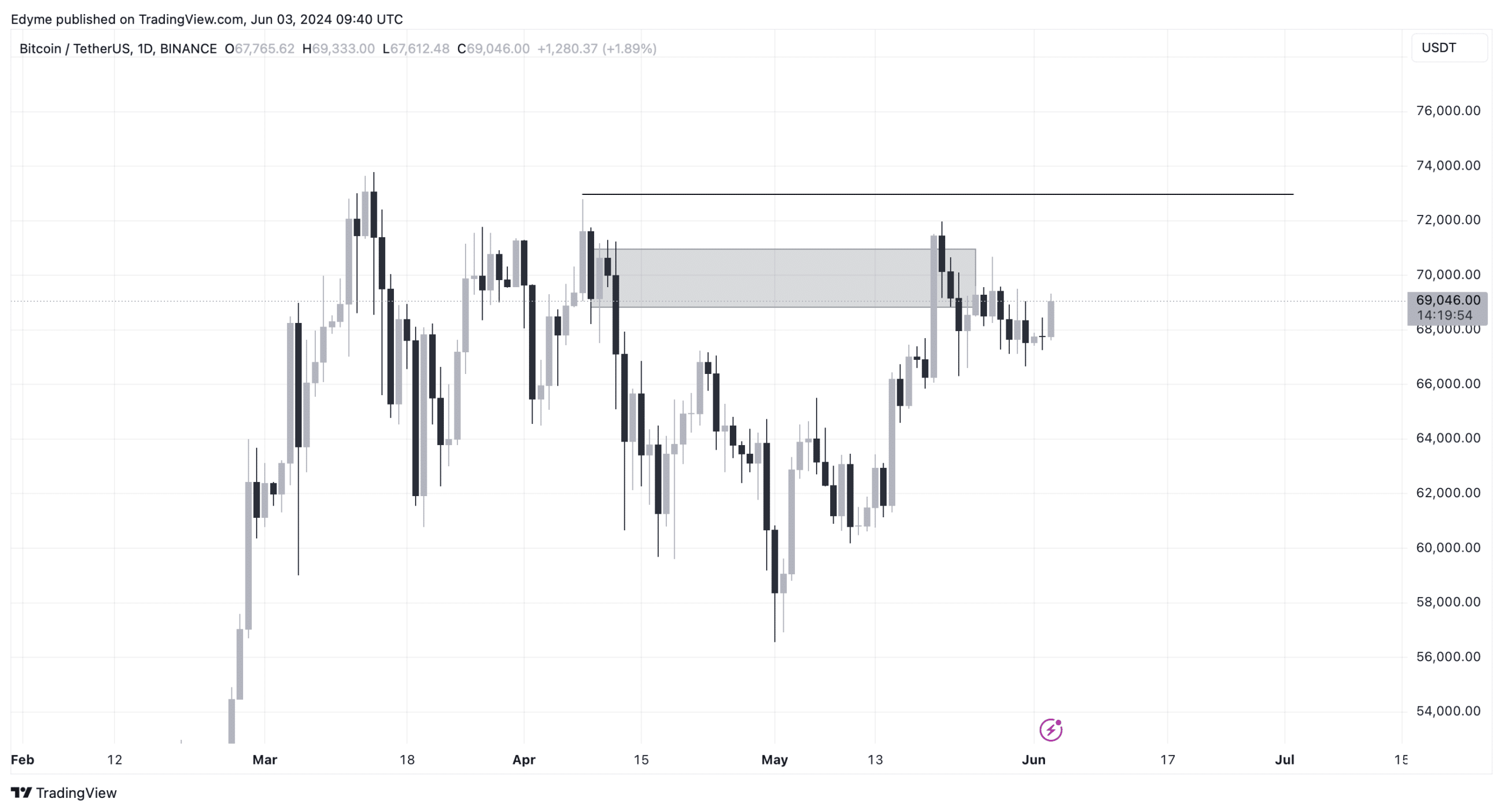

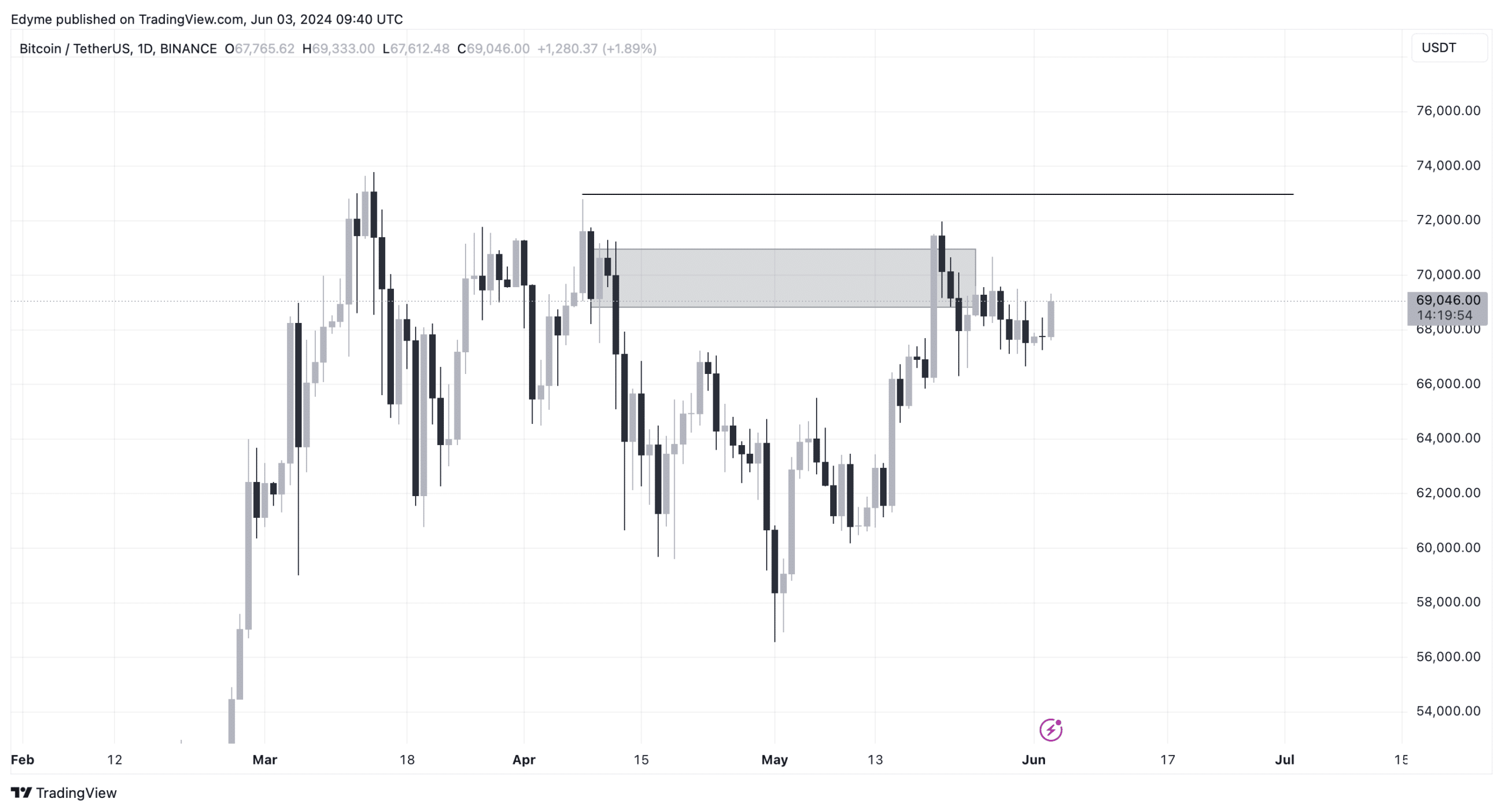

Meanwhile, technical analysis of both Bitcoin and Ethereum’s charts reveals a potentially intriguing performance on the horizon.

Focusing on Bitcoin’s daily chart, it illustrates a pattern where the cryptocurrency has been breaking through lower support levels, recently reversing to tap into a major supply zone.

Source: TradingView

This movement typically signals a continuation of the downtrend. However, if Bitcoin surpasses the $72,000 mark, breaking the previous lower high and negating the bearish setup, this could suggest a reversal to an upward trend.

AMBCrypto, citing an analyst from XBTManager on CryptoQuant, reported that Bitcoin is poised for a notable ascent. The analyst suggests,

“Bitcoin is gathering strength for the next rise. When it gathers enough strength, a sharp rise seems to be imminent. It seems likely that rises akin to those seen in Q3-Q4 will continue.”

Is your portfolio green? Check the Bitcoin Profit Calculator

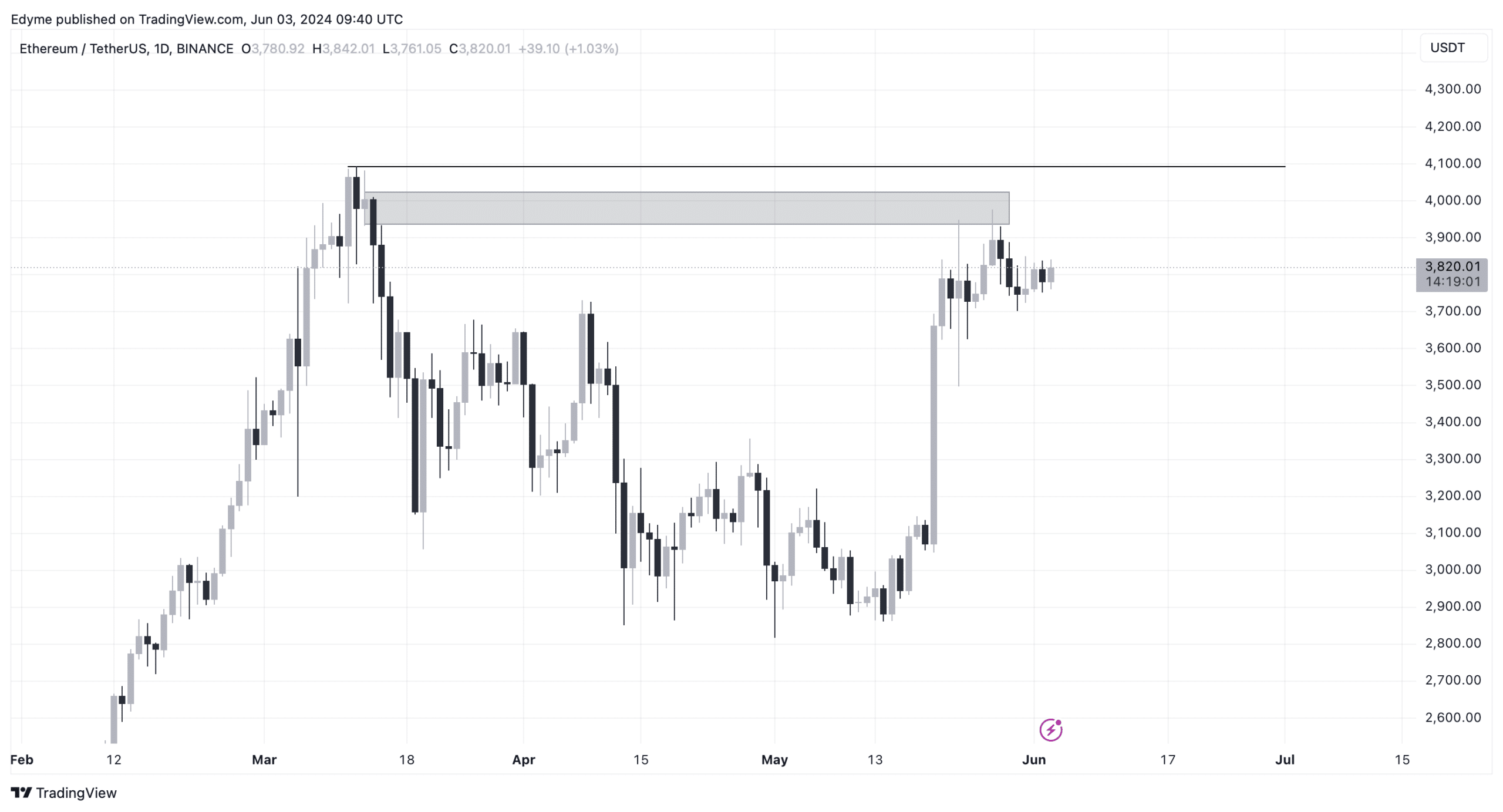

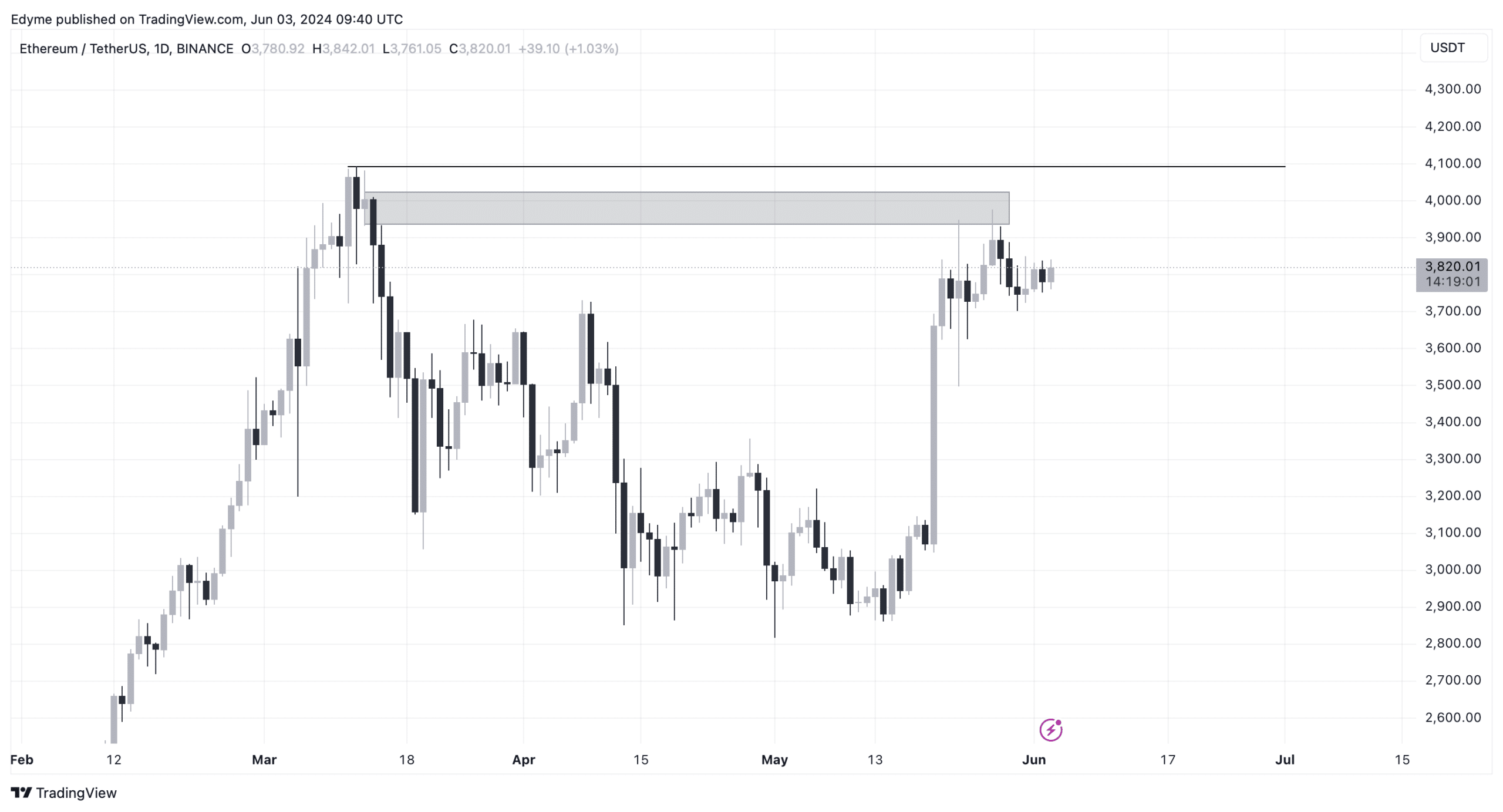

A similar pattern emerges on Ethereum’s daily chart. Ethereum has recently entered a major supply zone, suggesting an impending sell-off.

Nonetheless, if Ethereum breaks above the $4,000 threshold, surpassing the recent lower high and overturning the current sell signal, this could pave the way for an upward movement.

Source: TradingView

- CryptoQuant data shows that Bitcoin and Ethereum exchange balance has been on a decline.

- Technical analysis indicates significant price movements for both cryptocurrencies if key resistance levels are broken.

Bitcoin [BTC] was trading just shy of $70,000 at press time, reflecting a moderate upswing of 2% in the last 24 hours, though it remains below its March peak of over $73,000.

This continued growth from the asset is part of a broader narrative that underscores the complexities of crypto market movements.

Conversely, Ethereum [ETH] has shown remarkable stability, maintaining a position above $3,800. This steadiness comes despite a slight 2.5% drop over the last day, stabilizing with a minimal 0.7% increase today.

The stability in Ethereum’s price points to a sustained interest in the asset amid fluctuating market conditions.

Bitcoin & Ethereum market shifts

Recent analysis by BTC-ECHO’s Leon Waidmann revealed that both Bitcoin and Ethereum have witnessed their lowest exchange balance levels in years.

Specifically, Bitcoin’s presence on exchanges has reduced to 11.6% while Ethereum’s has dipped to 10.6%.

Source: Leon Waidmann on X

This trend suggests a significant movement of these assets away from exchanges and potentially indicates a strategy among investors to hold onto their coins for longer periods.

Source: CryptoQuant

AMBCrypto’s examination of CryptoQuant data further revealed a substantial outflow of these cryptocurrencies from exchanges.

Over $5 million worth of Bitcoin and more than $1 billion in Ethereum have withdrawn from exchanges since early May.

This movement is noteworthy as it follows the approval of spot Ethereum ETFs in the US, hinting at a possible supply squeeze on the horizon.

Source: CryptoQuant

The reduction in exchange reserves implies that fewer coins are now available for immediate trading, pointing to a potential price increase due to scarcity.

Waidmann anticipates this will lead to a supply squeeze, urging investors to prepare for significant market movements, noting:

“Whales continue to accumulate. Supply squeeze incoming. Get ready for the next big move.”

Market dynamics and technical analysis

However, Glassnode data presents a contrasting view, showing an increase in the circulating supply for both cryptocurrencies, suggesting that despite reduced exchange availability, the overall market supply remains high.

Source: Glasssnode

This scenario sets the stage for potential price corrections if demand fails to keep pace with the increasing supply. However, the current market indicators suggest demand is keeping up, as there has been no notable price dip despite the growing supply.

Source: Glasssnode

Meanwhile, there is a decline in new addresses for both Bitcoin and Ethereum which could indicate a cooling interest among new investors, potentially impacting future demand.

Source: Glasssnode

Meanwhile, technical analysis of both Bitcoin and Ethereum’s charts reveals a potentially intriguing performance on the horizon.

Focusing on Bitcoin’s daily chart, it illustrates a pattern where the cryptocurrency has been breaking through lower support levels, recently reversing to tap into a major supply zone.

Source: TradingView

This movement typically signals a continuation of the downtrend. However, if Bitcoin surpasses the $72,000 mark, breaking the previous lower high and negating the bearish setup, this could suggest a reversal to an upward trend.

AMBCrypto, citing an analyst from XBTManager on CryptoQuant, reported that Bitcoin is poised for a notable ascent. The analyst suggests,

“Bitcoin is gathering strength for the next rise. When it gathers enough strength, a sharp rise seems to be imminent. It seems likely that rises akin to those seen in Q3-Q4 will continue.”

Is your portfolio green? Check the Bitcoin Profit Calculator

A similar pattern emerges on Ethereum’s daily chart. Ethereum has recently entered a major supply zone, suggesting an impending sell-off.

Nonetheless, if Ethereum breaks above the $4,000 threshold, surpassing the recent lower high and overturning the current sell signal, this could pave the way for an upward movement.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

can i buy clomiphene tablets how can i get generic clomid no prescription how can i get clomid without prescription can i buy generic clomiphene pill how to buy generic clomid pill how to get generic clomiphene no prescription where to buy generic clomiphene price

I am in point of fact happy to glance at this blog posts which consists of tons of worthwhile facts, thanks for providing such data.

This is the stripe of content I take advantage of reading.

buy zithromax 250mg for sale – order azithromycin 250mg sale flagyl 400mg brand

oral semaglutide 14mg – order cyproheptadine pills order periactin 4 mg generic

buy domperidone 10mg – cyclobenzaprine oral flexeril generic