- SOL and XRP defied the prevailing market trend, attracting $8.9 million and $8.5 million, respectively.

- With Bitcoin’s dominance under pressure, are we witnessing the dawn of an altcoin takeover?

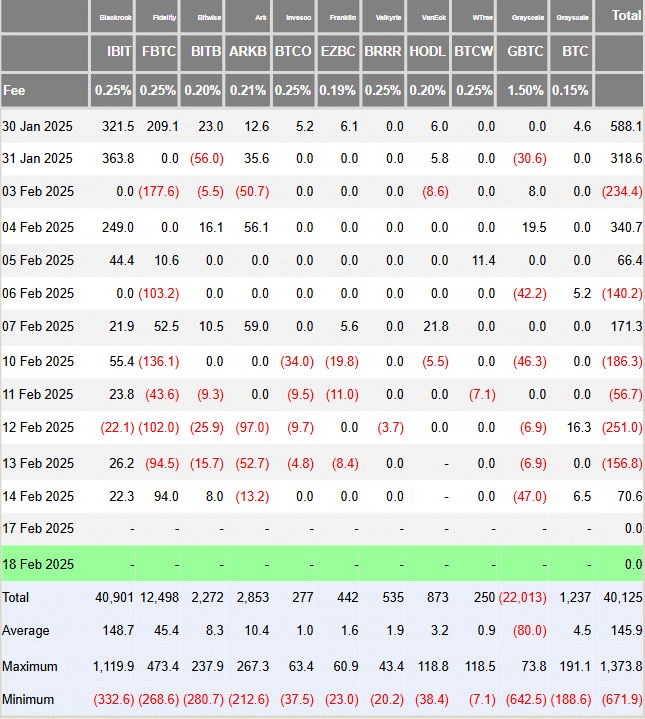

Bitcoin [BTC] defied Trump’s tariff threats, holding strong above $90k on the charts. And yet, it couldn’t escape the sell-offs, shedding $430 million as major U.S Bitcoin ETFs – Fidelity, Ark 21Shares, and Grayscale – saw heavy withdrawals.

Is Bitcoin’s grip slipping, giving altcoins their moment to shine as investors chase high-cap opportunities?

SOL & XRP defy the trend

After 19 weeks of gains, digital asset funds took a hit, seeing $415 million in outflows last week, according to CoinShares.

Bitcoin took the biggest hit, shedding $430 million, while Ethereum saw modest outflows of $7.2 million. And yet, it was still up $785 million in net inflows this month.

Source: FarsideInvestors (BTC ETFs)

Meanwhile, Solana and XRP broke the trend, pulling in $8.9 million and $8.5 million, respectively. With rising institutional interest in high-caps, the buzz around potential ETFs in 2025 and an altcoin season is stronger than ever.

Why? Well, CoinShares’ Head of Research, James Butterfill, linked the outflows to concerns over U.S monetary policy and higher-than-expected inflation data.

And, that might just be the beginning – Trump’s reciprocal tariffs, a skyrocketing dollar and gold prices, and 25% tariffs on key metals are only adding fuel to the Fed’s hawkish stance on rate cuts.

Is Bitcoin’s dominance under threat?

Bitcoin’s current consolidation has everyone talking “breakout,” with history suggesting that slumps often set the stage for major price surges.

What about this cycle? It’s a different story. Unlike past runs, it’s deeply intertwined with macro trends – Like the recent dip below $100k, sparked by Trump’s tariff policy.

In fact, Bitcoin dominance (BTC.D) slipped below 61% as investors flocked to alternatives.

Source: TradingView (BTC.D)

With SOL and XRP riding the ETF wave, backed by strong communities and real use cases, it’s looking like BTC.D could face serious competition.

This shift is one to watch closely in the coming months, especially with rising macro uncertainty. How BTC and high-caps like SOL and XRP respond will be key to proving this theory.

- SOL and XRP defied the prevailing market trend, attracting $8.9 million and $8.5 million, respectively.

- With Bitcoin’s dominance under pressure, are we witnessing the dawn of an altcoin takeover?

Bitcoin [BTC] defied Trump’s tariff threats, holding strong above $90k on the charts. And yet, it couldn’t escape the sell-offs, shedding $430 million as major U.S Bitcoin ETFs – Fidelity, Ark 21Shares, and Grayscale – saw heavy withdrawals.

Is Bitcoin’s grip slipping, giving altcoins their moment to shine as investors chase high-cap opportunities?

SOL & XRP defy the trend

After 19 weeks of gains, digital asset funds took a hit, seeing $415 million in outflows last week, according to CoinShares.

Bitcoin took the biggest hit, shedding $430 million, while Ethereum saw modest outflows of $7.2 million. And yet, it was still up $785 million in net inflows this month.

Source: FarsideInvestors (BTC ETFs)

Meanwhile, Solana and XRP broke the trend, pulling in $8.9 million and $8.5 million, respectively. With rising institutional interest in high-caps, the buzz around potential ETFs in 2025 and an altcoin season is stronger than ever.

Why? Well, CoinShares’ Head of Research, James Butterfill, linked the outflows to concerns over U.S monetary policy and higher-than-expected inflation data.

And, that might just be the beginning – Trump’s reciprocal tariffs, a skyrocketing dollar and gold prices, and 25% tariffs on key metals are only adding fuel to the Fed’s hawkish stance on rate cuts.

Is Bitcoin’s dominance under threat?

Bitcoin’s current consolidation has everyone talking “breakout,” with history suggesting that slumps often set the stage for major price surges.

What about this cycle? It’s a different story. Unlike past runs, it’s deeply intertwined with macro trends – Like the recent dip below $100k, sparked by Trump’s tariff policy.

In fact, Bitcoin dominance (BTC.D) slipped below 61% as investors flocked to alternatives.

Source: TradingView (BTC.D)

With SOL and XRP riding the ETF wave, backed by strong communities and real use cases, it’s looking like BTC.D could face serious competition.

This shift is one to watch closely in the coming months, especially with rising macro uncertainty. How BTC and high-caps like SOL and XRP respond will be key to proving this theory.

clomiphene bula profissional where can i buy cheap clomiphene without dr prescription order generic clomiphene online how to get generic clomiphene clomid cost uk generic clomid for sale can you buy cheap clomid online

This is the gentle of criticism I truly appreciate.

Greetings! Utter useful par‘nesis within this article! It’s the scarcely changes which choice obtain the largest changes. Thanks a quantity for sharing!

zithromax buy online – buy zithromax for sale order flagyl 200mg pill

buy semaglutide 14mg sale – order periactin 4mg buy cyproheptadine 4 mg pill

amoxil online order – diovan buy online order generic combivent 100mcg

augmentin 375mg canada – https://atbioinfo.com/ generic ampicillin

nexium where to buy – https://anexamate.com/ nexium for sale

coumadin 5mg over the counter – https://coumamide.com/ buy cozaar without prescription

how to get mobic without a prescription – https://moboxsin.com/ mobic 7.5mg pills

order prednisone 20mg online – https://apreplson.com/ buy deltasone 5mg sale

best ed pills online – https://fastedtotake.com/ best pill for ed

cheap amoxil without prescription – buy amoxil without a prescription cheap amoxicillin for sale

cheap diflucan – https://gpdifluca.com/ order diflucan

order escitalopram 20mg pills – lexapro usa order escitalopram 10mg without prescription

buy generic cenforce 50mg – https://cenforcers.com/ buy cenforce 50mg

buy cialis cheap fast delivery – https://ciltadgn.com/# cialis milligrams

viagra sale melbourne – viagra professional 100 mg buy generic viagra online canada

This is a topic which is near to my callousness… Myriad thanks! Faithfully where can I notice the contact details in the course of questions? https://gnolvade.com/

The vividness in this serving is exceptional. https://buyfastonl.com/azithromycin.html

Thanks recompense sharing. It’s outstrip quality. https://ursxdol.com/get-cialis-professional/

This is the type of post I find helpful. https://prohnrg.com/product/rosuvastatin-for-sale/

The thoroughness in this piece is noteworthy. cialis super active livraison rapide belgique

Thanks on sharing. It’s first quality. https://ondactone.com/simvastatin/

More peace pieces like this would make the интернет better.

https://proisotrepl.com/product/domperidone/

With thanks. Loads of conception! http://pokemonforever.com/User-Jjnymj

brand dapagliflozin 10mg – https://janozin.com/ forxiga online buy