- Bitcoin ETFs surpassed $20 billion in inflows in their debut year, outpacing Gold ETFs by 10 times.

- BTC exchange inflows drop by 95.93% in 48 hours, while its social volume rises steadily.

U.S. Bitcoin [BTC] ETFs have surpassed an impressive $20 billion in inflows within their first year, as mentioned in a recent tweet by MartyParty.

This stands in great contrast to Gold ETFs, which attracted much lower inflows in their first year.

The rapid adoption of BTC ETFs underlines increasing interest in digital assets, further cementing Bitcoin’s position as a key player in the investment universe.

Bitcoin exchange inflows dip

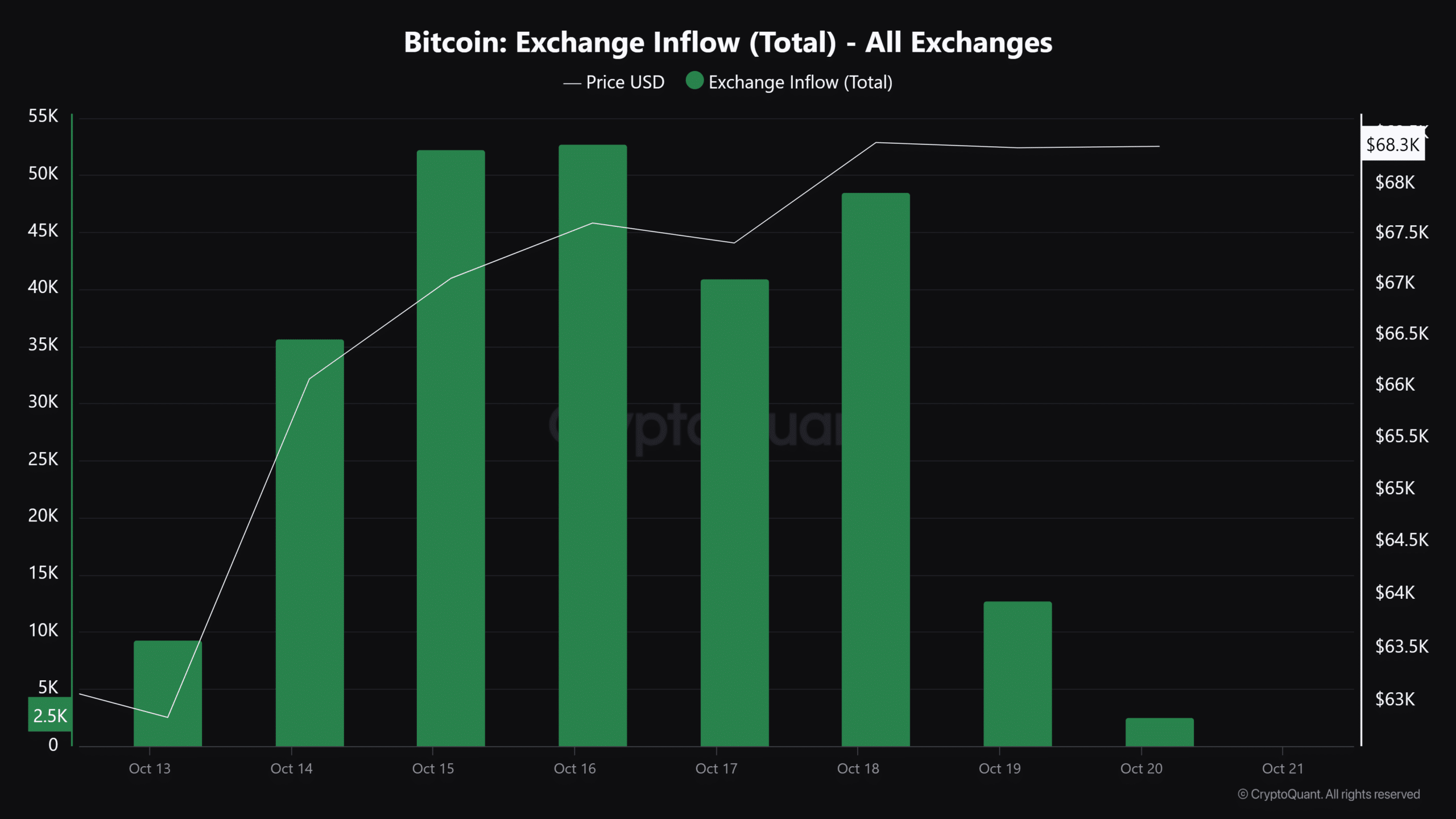

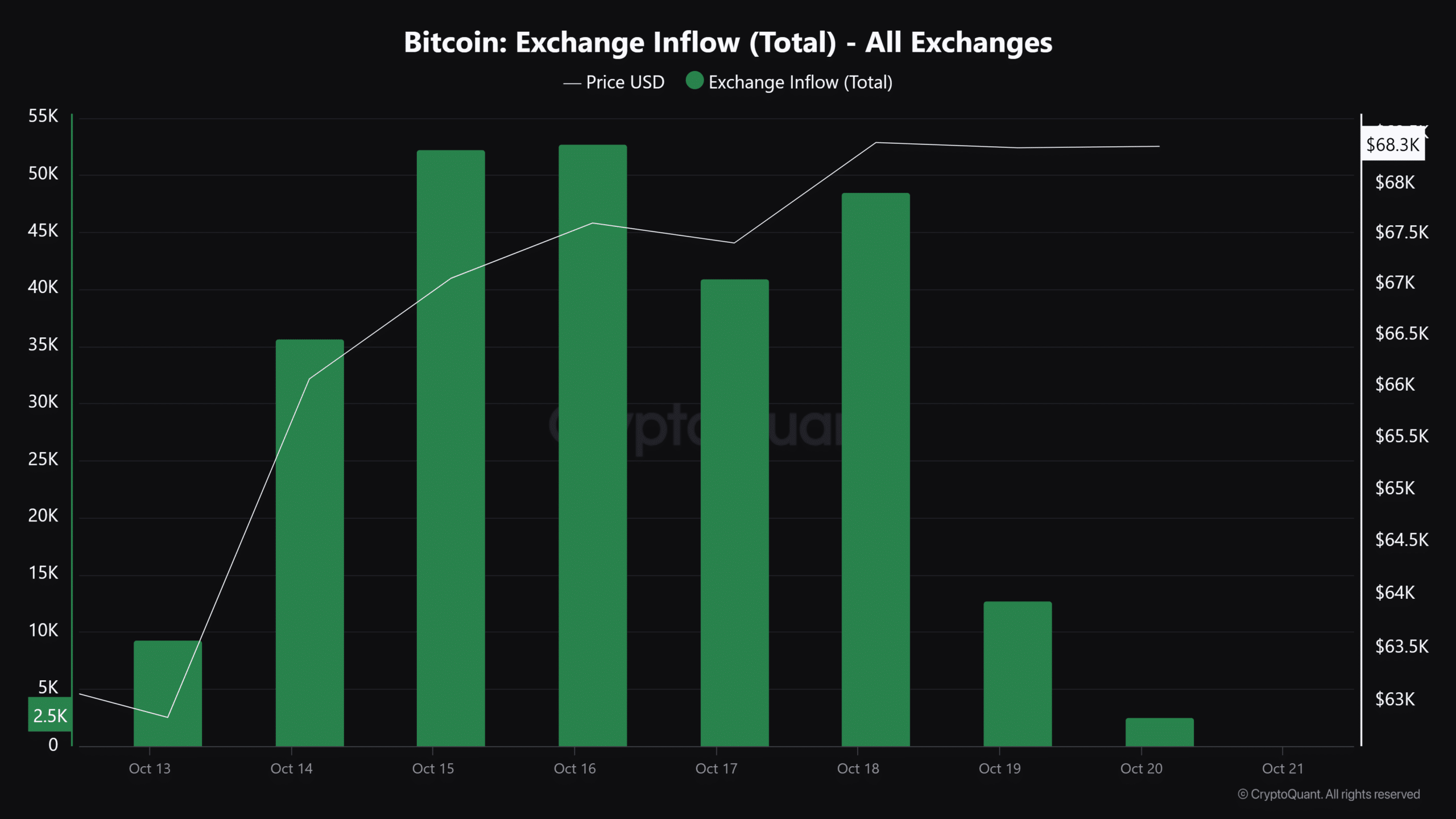

While ETFs are seeing heavy inflows, Bitcoin’s exchange inflows have dropped significantly by over 95.93% in the last 48 hours.

This suggests a shift in investor behavior as fewer participants are moving their BTC to exchanges.

Consequently, the reduction in inflow may be an indicator of the holders’ bullish attitude, as they are opting to hold the assets rather than sell.

Source: CryptoQuant

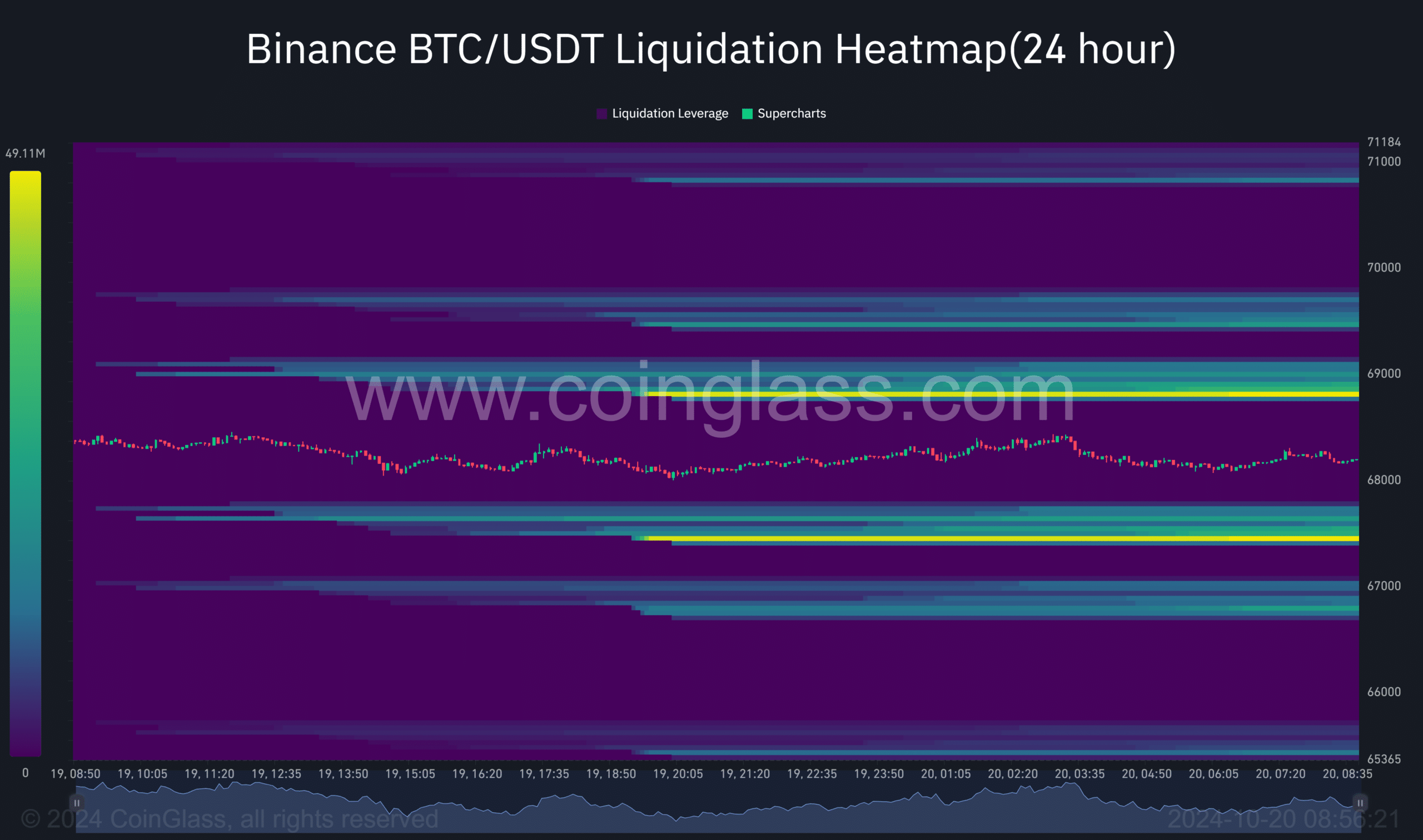

Liquidity heatmap settles at equilibrium

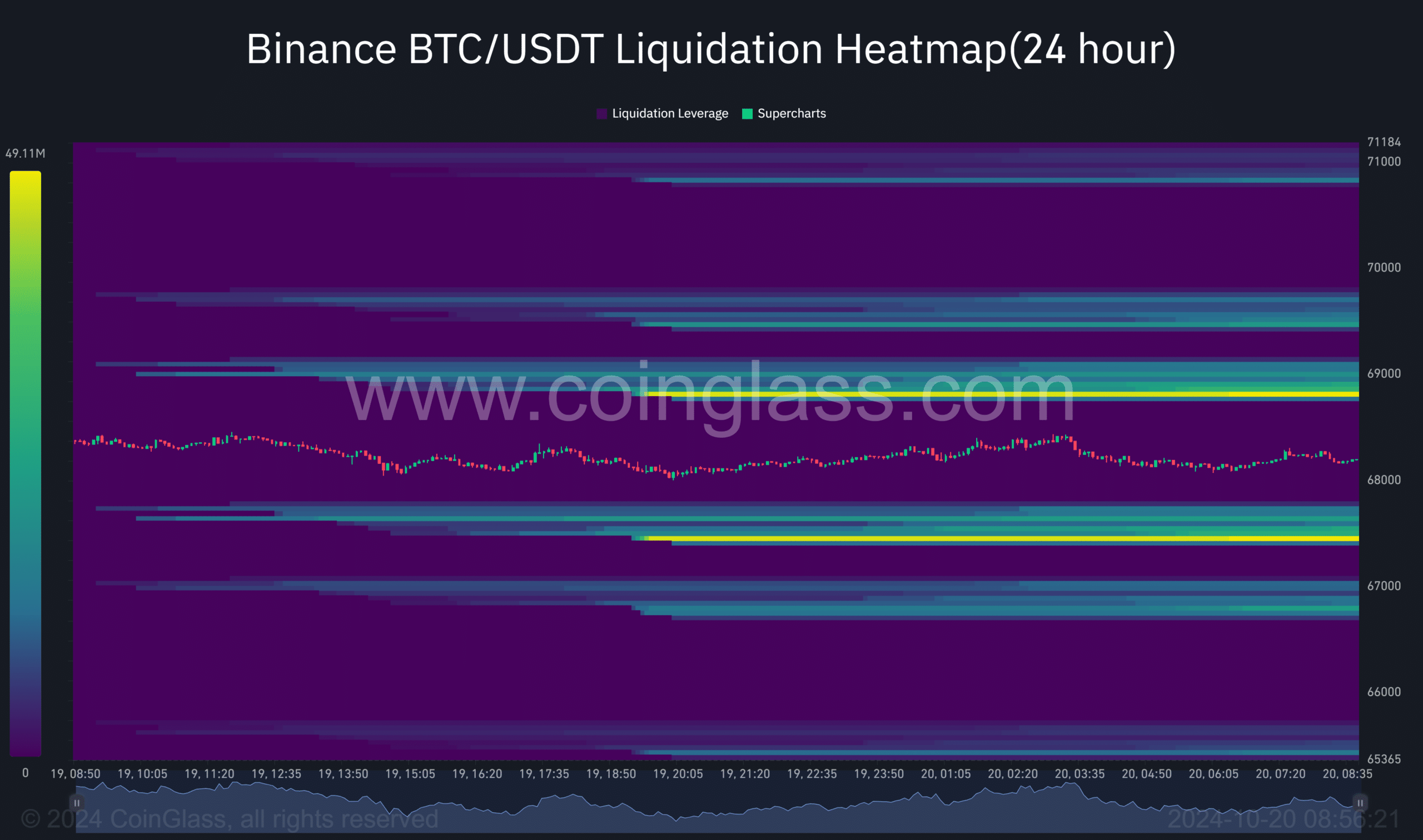

AMBCrypto analysis of the liquidity heatmap data revealed a balance in Bitcoin’s liquidity levels.

Over the past 24 hours alone, liquidity at the $68.8k and $67.5k price levels has reached equilibrium, with 49.12 million at both points.

Perhaps this would indicate that BTC is going into consolidation, gathering energy to propel prices.

Source: Coinglass

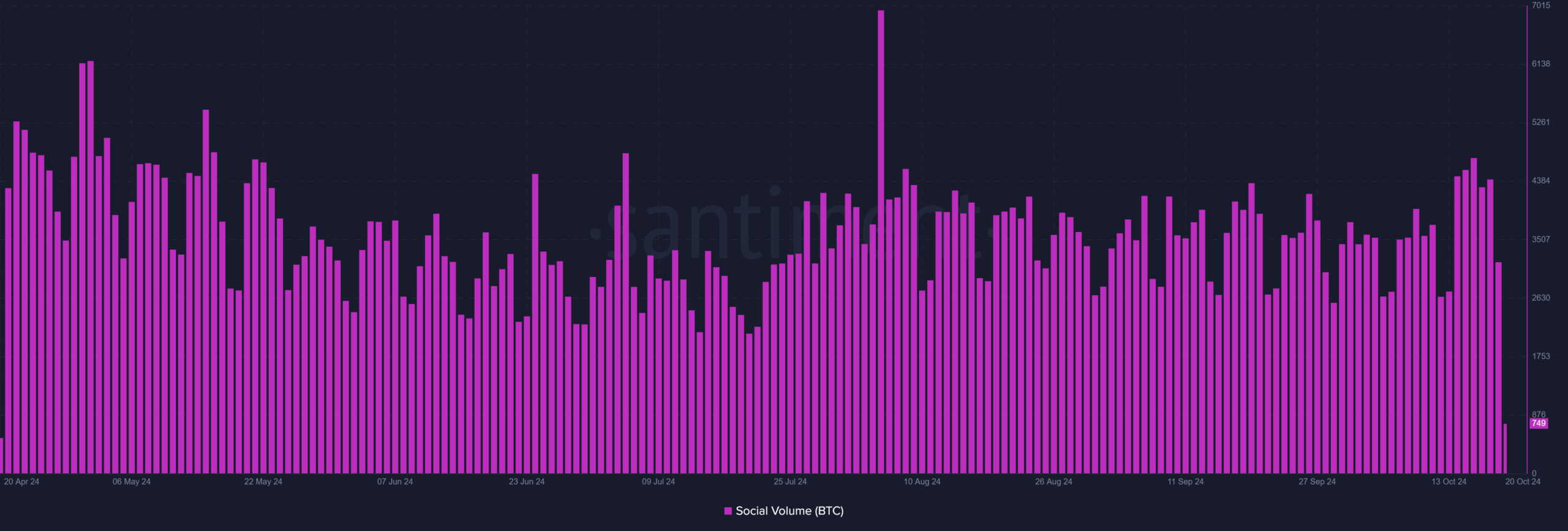

Bitcoin social volume on the rise

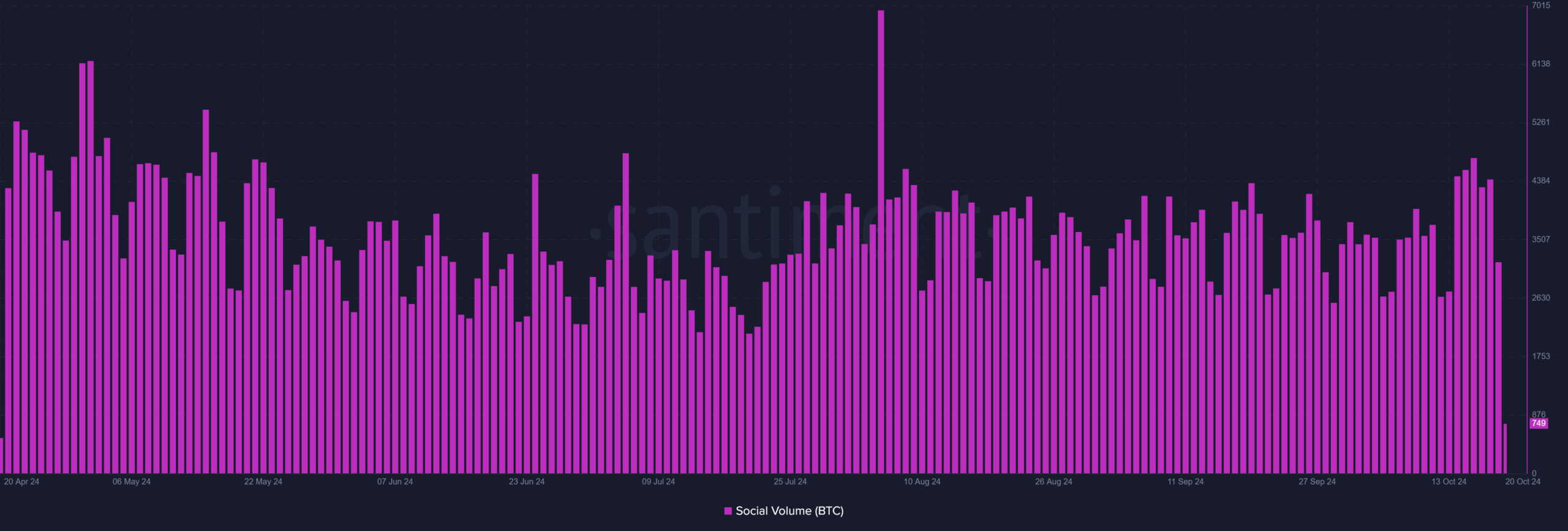

Complementing the inflows into the ETF and stability of the market is the gradually increasing BTC social volume.

Since the 12th of October, the social volume of Bitcoin has kept upwards, indicating higher engagement and interest across communities.

This surge in social activity suggests that Bitcoin is once again a hot topic, and more people than analysts and investors are talking about its price, technology, and future potential.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, as social volume rises, so does market interest and activity.

Source: Santiment

BTC ETFs’ success, declining exchange inflows, balanced liquidity, and rising social engagement all point to a bullish market outlook for Bitcoin.

- Bitcoin ETFs surpassed $20 billion in inflows in their debut year, outpacing Gold ETFs by 10 times.

- BTC exchange inflows drop by 95.93% in 48 hours, while its social volume rises steadily.

U.S. Bitcoin [BTC] ETFs have surpassed an impressive $20 billion in inflows within their first year, as mentioned in a recent tweet by MartyParty.

This stands in great contrast to Gold ETFs, which attracted much lower inflows in their first year.

The rapid adoption of BTC ETFs underlines increasing interest in digital assets, further cementing Bitcoin’s position as a key player in the investment universe.

Bitcoin exchange inflows dip

While ETFs are seeing heavy inflows, Bitcoin’s exchange inflows have dropped significantly by over 95.93% in the last 48 hours.

This suggests a shift in investor behavior as fewer participants are moving their BTC to exchanges.

Consequently, the reduction in inflow may be an indicator of the holders’ bullish attitude, as they are opting to hold the assets rather than sell.

Source: CryptoQuant

Liquidity heatmap settles at equilibrium

AMBCrypto analysis of the liquidity heatmap data revealed a balance in Bitcoin’s liquidity levels.

Over the past 24 hours alone, liquidity at the $68.8k and $67.5k price levels has reached equilibrium, with 49.12 million at both points.

Perhaps this would indicate that BTC is going into consolidation, gathering energy to propel prices.

Source: Coinglass

Bitcoin social volume on the rise

Complementing the inflows into the ETF and stability of the market is the gradually increasing BTC social volume.

Since the 12th of October, the social volume of Bitcoin has kept upwards, indicating higher engagement and interest across communities.

This surge in social activity suggests that Bitcoin is once again a hot topic, and more people than analysts and investors are talking about its price, technology, and future potential.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, as social volume rises, so does market interest and activity.

Source: Santiment

BTC ETFs’ success, declining exchange inflows, balanced liquidity, and rising social engagement all point to a bullish market outlook for Bitcoin.

generic clomid c10m1d where can i buy clomiphene tablets can i purchase clomid without rx can you get generic clomid pills where buy cheap clomid tablets get cheap clomiphene without a prescription where can i buy cheap clomiphene without prescription

Proof blog you procure here.. It’s obdurate to on strong worth writing like yours these days. I really comprehend individuals like you! Go through mindfulness!!

Thanks on putting this up. It’s understandably done.

purchase zithromax generic – order tinidazole 300mg order metronidazole

buy generic semaglutide 14 mg – buy semaglutide 14mg without prescription cyproheptadine online buy

order motilium 10mg for sale – buy tetracycline 500mg generic cyclobenzaprine 15mg sale

buy generic propranolol online – clopidogrel sale order methotrexate 10mg generic

buy amoxicillin without a prescription – order diovan 160mg buy ipratropium 100 mcg sale

brand zithromax 250mg – cheap zithromax order generic bystolic 5mg

buy augmentin online – atbioinfo cost acillin

order nexium 20mg pill – https://anexamate.com/ order generic nexium

coumadin 5mg drug – https://coumamide.com/ buy losartan 50mg

mobic uk – https://moboxsin.com/ buy generic mobic

order deltasone 5mg pill – corticosteroid prednisone 5mg pills

erection pills – fastedtotake buy erectile dysfunction drugs

purchase diflucan without prescription – purchase fluconazole without prescription fluconazole us

buy generic cenforce over the counter – purchase cenforce sale buy cenforce pill

how to get cialis prescription online – site non prescription cialis

cialis price cvs – https://strongtadafl.com/# buying cialis online safely

order ranitidine 300mg sale – https://aranitidine.com/# ranitidine 300mg cheap

cheap viagra bulk – https://strongvpls.com/# viagra 50mg

Facts blog you possess here.. It’s intricate to on elevated calibre script like yours these days. I justifiably comprehend individuals like you! Go through mindfulness!! para que es neurontin 300 mg

The vividness in this piece is exceptional. https://buyfastonl.com/

I couldn’t weather commenting. Well written! https://ursxdol.com/propecia-tablets-online/

Thanks for sharing. It’s acme quality. https://aranitidine.com/fr/acheter-cenforce/

I’ll certainly carry back to read more. https://ondactone.com/spironolactone/

Facts blog you possess here.. It’s hard to assign great calibre script like yours these days. I really respect individuals like you! Take care!!

https://proisotrepl.com/product/propranolol/

Thanks on putting this up. It’s well done. http://iawbs.com/home.php?mod=space&uid=915033

cheap orlistat – xenical pills purchase orlistat sale