- U.S. Bitcoin ETF outflows continued into the new week.

- BTC price has remained muted amid weak demand from U.S. investors.

U.S. spot Bitcoin [BTC] ETFs (exchange-traded funds) saw a significant bleed-out post-Labor Day, underscoring a sustained risk-off mode from investors.

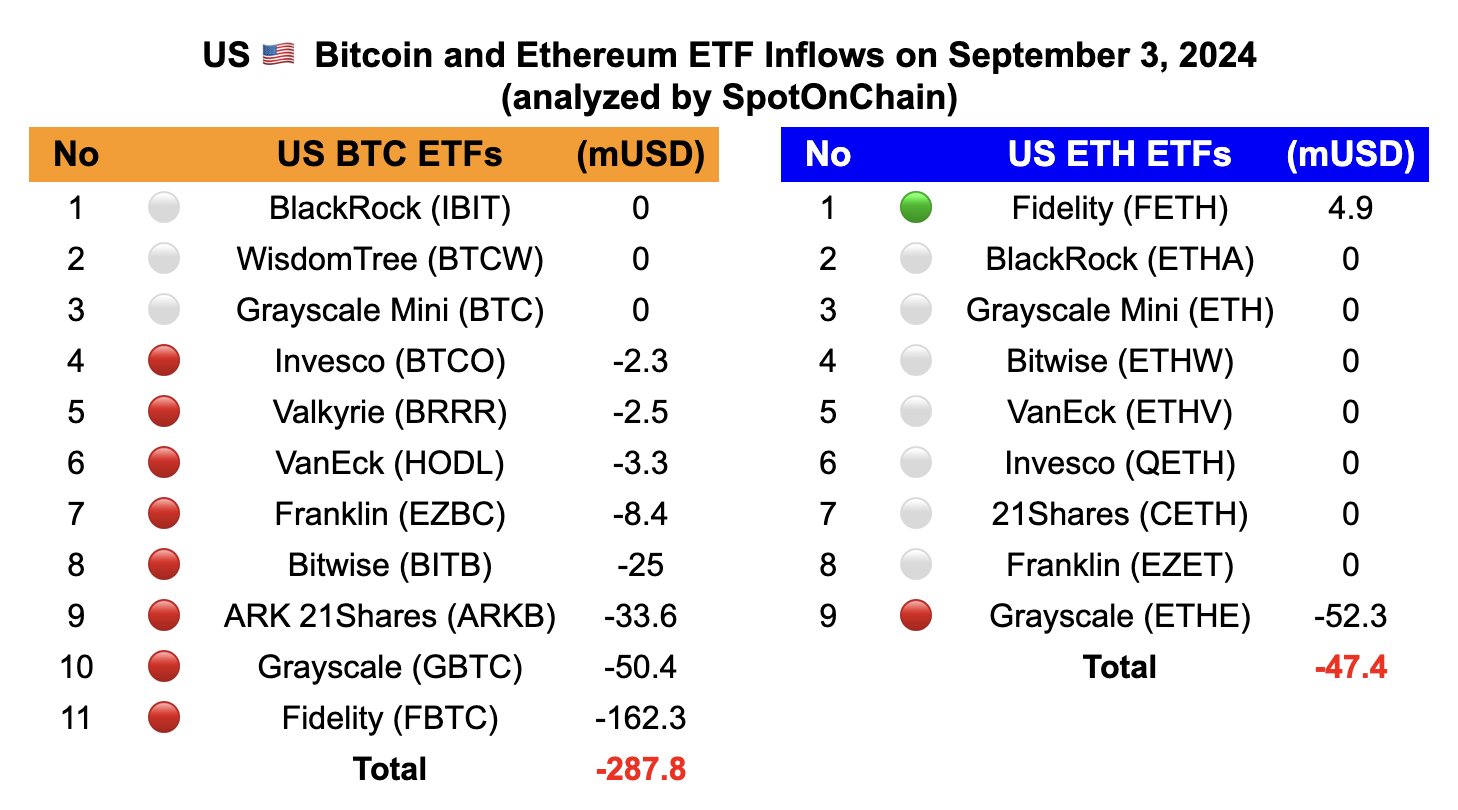

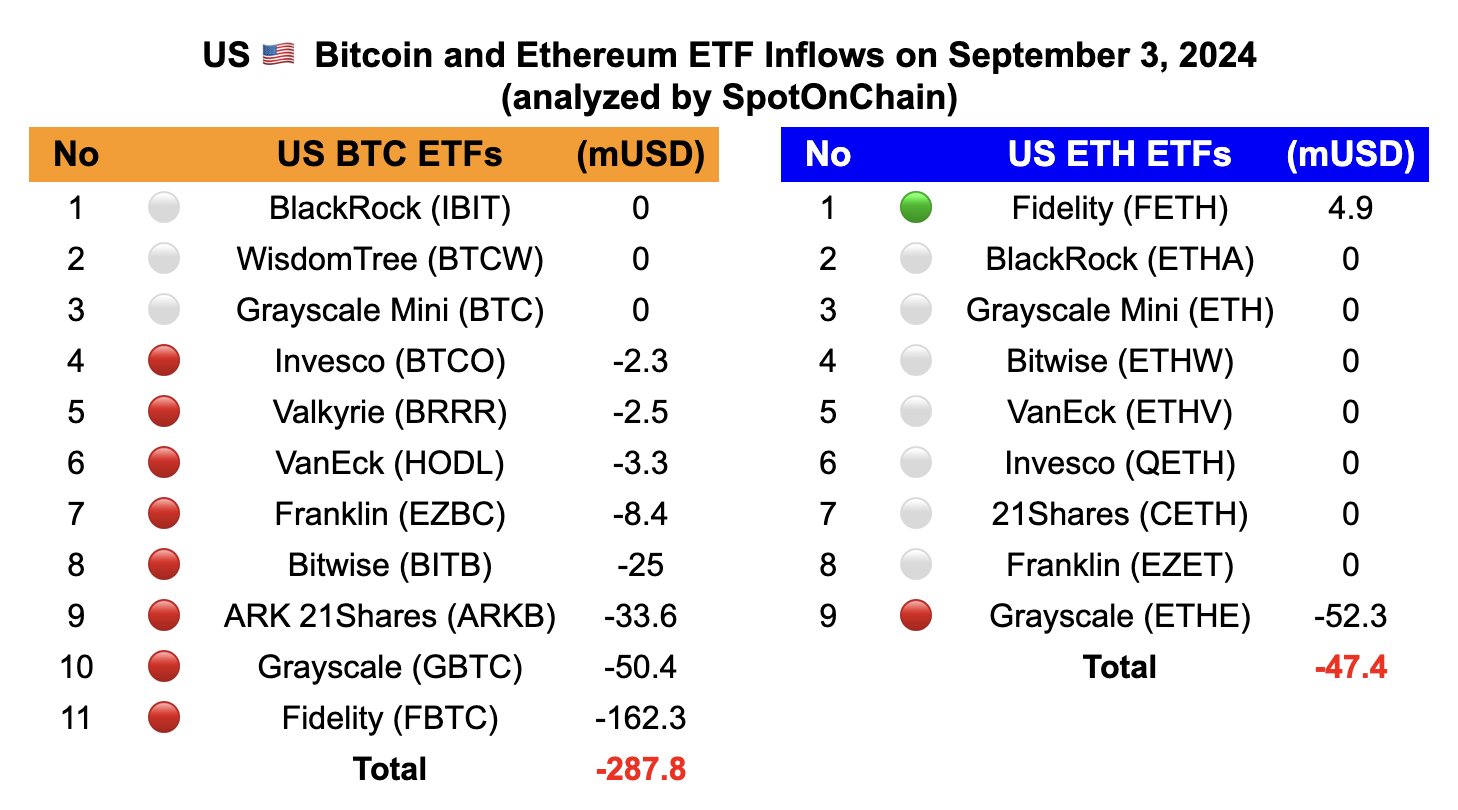

After an extended U.S. weekend, the products recorded $288 million in outflows on the 3rd of September.

Source: SpotOnChain

Apart from BlackRock, Wisdom Tree, and Grayscale Mini, which recorded zero flows, the rest posted negative flows.

Fidelity led the outflows as investors withdrew $162.3 million from its Bitcoin trust fund. Grayscale and Ark 21Shares followed closely, with $50.4 million and $33.6 million, respectively.

BTC ETF investors’ risk-off mode persist

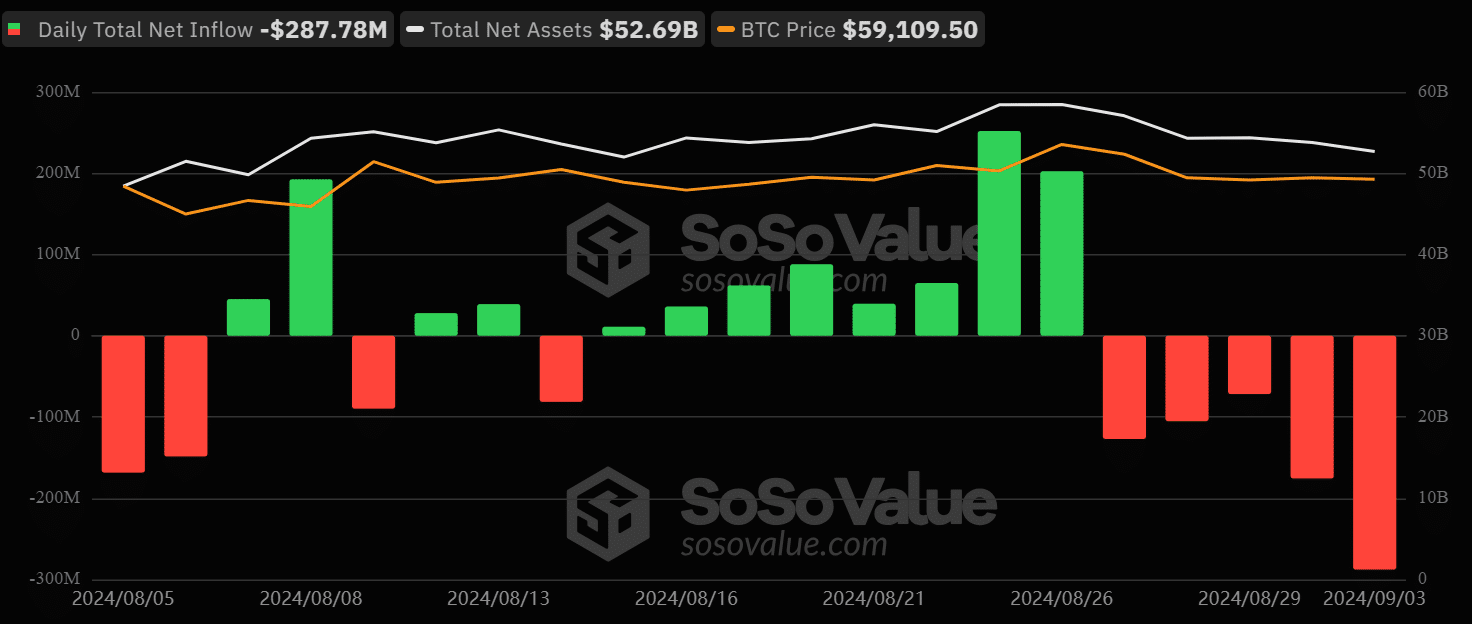

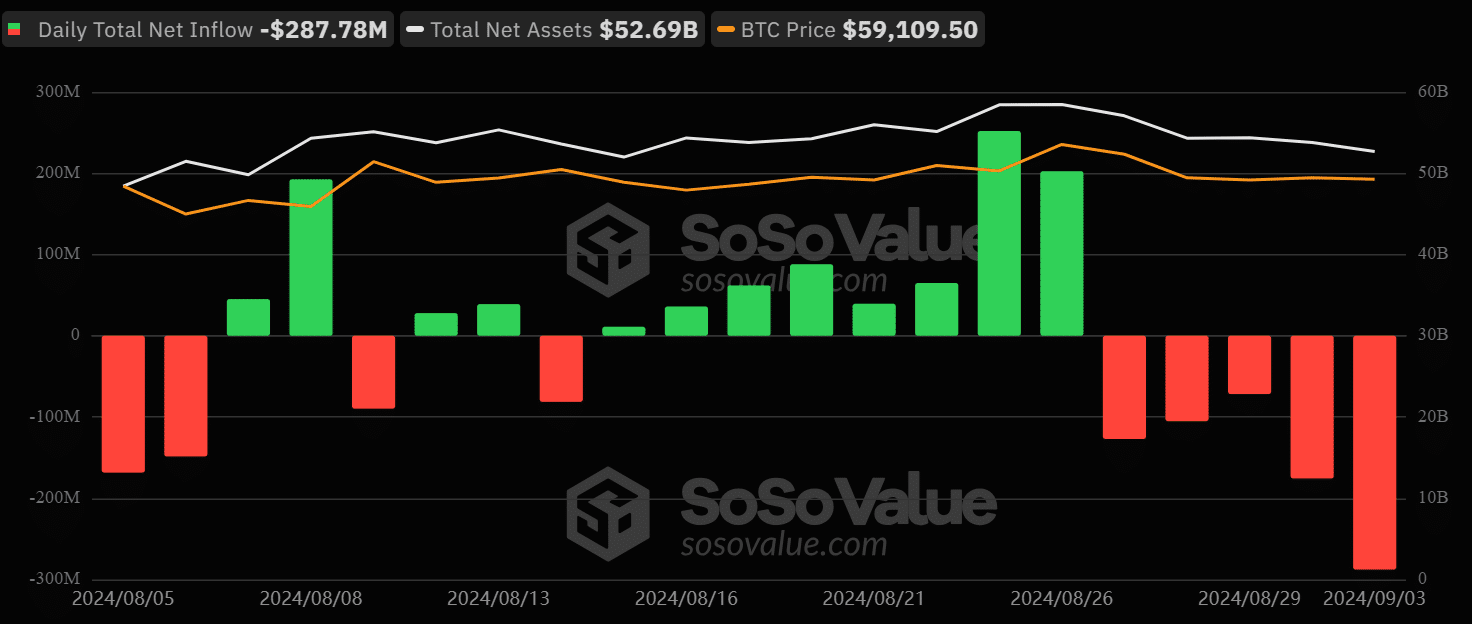

The post-Labor Day outflows reinforced the weak trend that began last week. Soso Value data showed that the products have seen negative daily outflows in the past five trading days.

Source: Soso Value

The weak trend suggested that ETF investors’ risk-off mode has been sustained into the new week. Last week, the products recorded a cumulative outflow of $277 million.

BTC’s price has remained muted amidst sustained BTC ETF outflows.

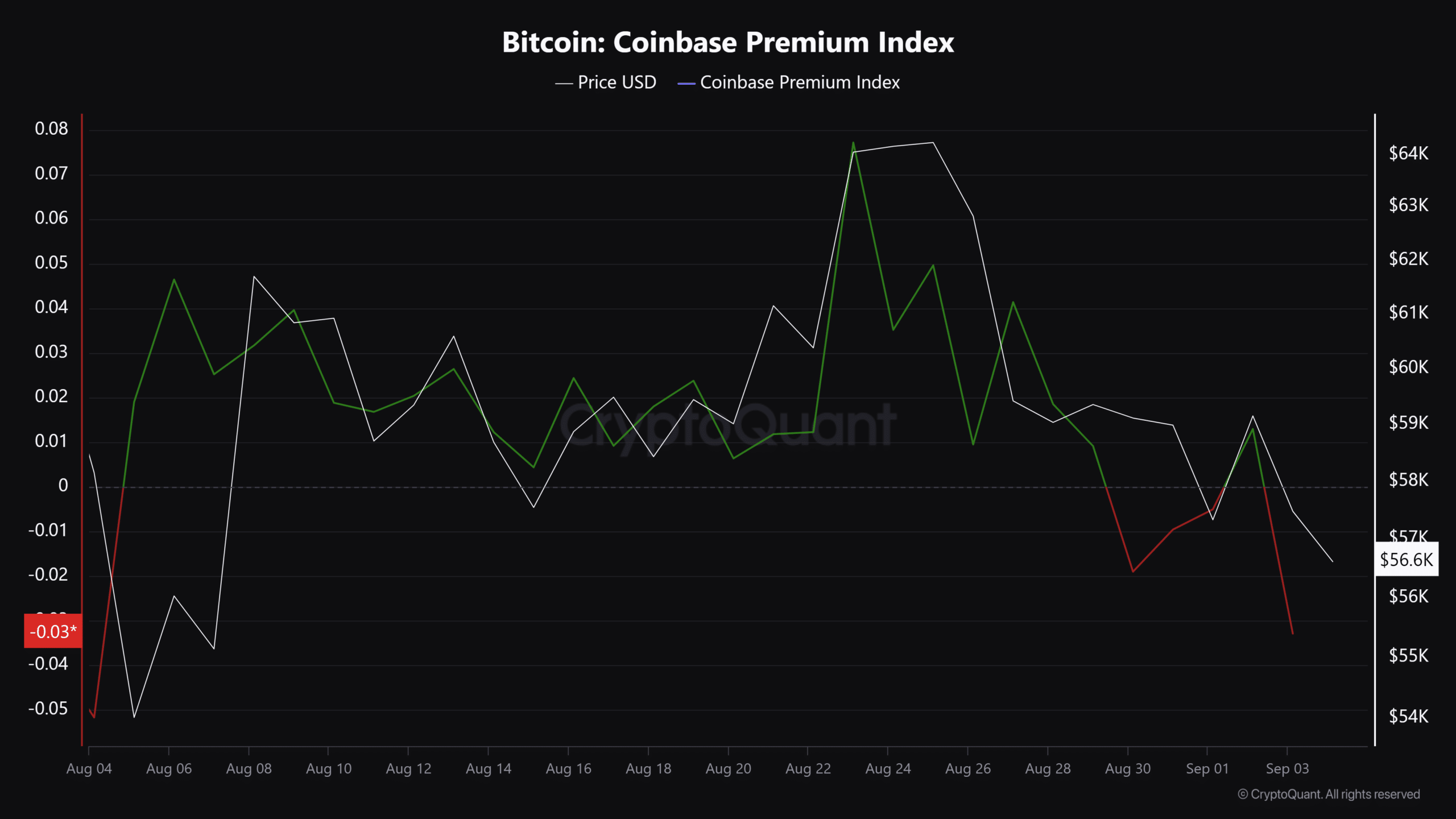

Since last week, the digital asset has dropped below $60K and weakened further as the risk-off mode persists across the market. BTC was valued at $56.6K at press time, down over 12% from a recent high of $64K.

That said, the low demand from U.S. investors could weigh on the crypto asset’s price in the short term.

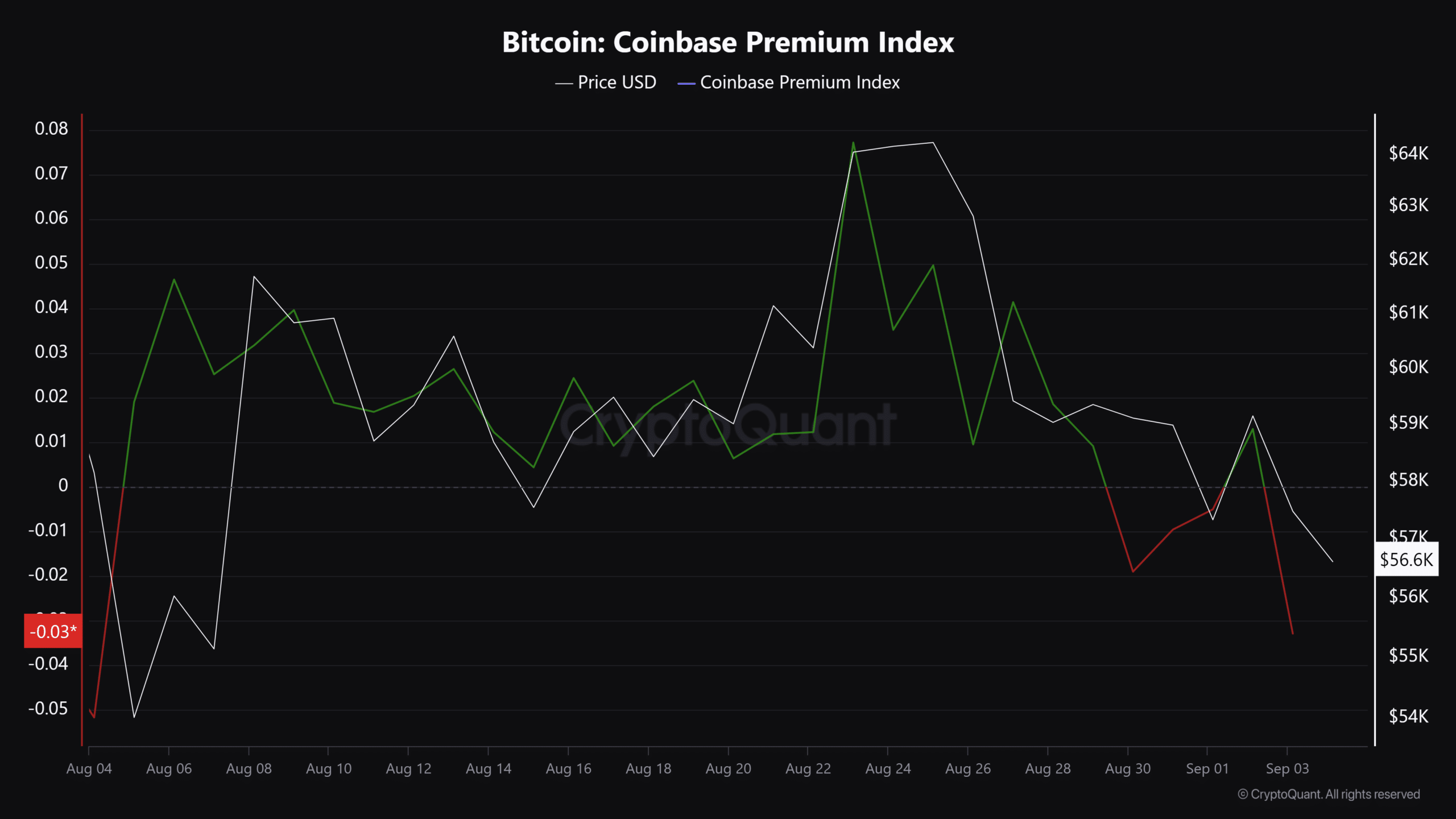

As illustrated by the Coinbase Premium Index, which tracks investors’ demand for BTC, its price always increases if there’s enormous demand from the U.S.

Source: CryptoQuant

However, the weak demand (marked by red) has exposed BTC to downward pressure since late August. A substantial reversal could only happen if demand from U.S. investors showed a remarkable recovery.

In the meantime, based on historical trends, most analysts, including QCP Capital, projected a weak performance for BTC in September.

However, according to a crypto trading firm, BTC could begin a strong rally in October and the rest of Q4 based on past patterns and options market data.

‘October, however, has the strongest bullish seasonality…This seasonality play could explain the consistent call buying in the vol market (the desk observed another 150x 80k Dec calls lifted in Asia morning).’

- U.S. Bitcoin ETF outflows continued into the new week.

- BTC price has remained muted amid weak demand from U.S. investors.

U.S. spot Bitcoin [BTC] ETFs (exchange-traded funds) saw a significant bleed-out post-Labor Day, underscoring a sustained risk-off mode from investors.

After an extended U.S. weekend, the products recorded $288 million in outflows on the 3rd of September.

Source: SpotOnChain

Apart from BlackRock, Wisdom Tree, and Grayscale Mini, which recorded zero flows, the rest posted negative flows.

Fidelity led the outflows as investors withdrew $162.3 million from its Bitcoin trust fund. Grayscale and Ark 21Shares followed closely, with $50.4 million and $33.6 million, respectively.

BTC ETF investors’ risk-off mode persist

The post-Labor Day outflows reinforced the weak trend that began last week. Soso Value data showed that the products have seen negative daily outflows in the past five trading days.

Source: Soso Value

The weak trend suggested that ETF investors’ risk-off mode has been sustained into the new week. Last week, the products recorded a cumulative outflow of $277 million.

BTC’s price has remained muted amidst sustained BTC ETF outflows.

Since last week, the digital asset has dropped below $60K and weakened further as the risk-off mode persists across the market. BTC was valued at $56.6K at press time, down over 12% from a recent high of $64K.

That said, the low demand from U.S. investors could weigh on the crypto asset’s price in the short term.

As illustrated by the Coinbase Premium Index, which tracks investors’ demand for BTC, its price always increases if there’s enormous demand from the U.S.

Source: CryptoQuant

However, the weak demand (marked by red) has exposed BTC to downward pressure since late August. A substantial reversal could only happen if demand from U.S. investors showed a remarkable recovery.

In the meantime, based on historical trends, most analysts, including QCP Capital, projected a weak performance for BTC in September.

However, according to a crypto trading firm, BTC could begin a strong rally in October and the rest of Q4 based on past patterns and options market data.

‘October, however, has the strongest bullish seasonality…This seasonality play could explain the consistent call buying in the vol market (the desk observed another 150x 80k Dec calls lifted in Asia morning).’

can you get clomid without insurance generic clomiphene walmart where to buy cheap clomid without dr prescription can i buy cheap clomiphene tablets clomiphene costo generic clomid for sale generic clomid without prescription

The vividness in this ruined is exceptional.

This is the gentle of scribble literary works I positively appreciate.

buy zithromax generic – tetracycline 250mg uk generic flagyl 400mg

order rybelsus pill – order periactin 4mg without prescription buy periactin tablets

how to buy motilium – cheap cyclobenzaprine order cyclobenzaprine 15mg without prescription

buy augmentin 375mg without prescription – atbio info buy generic ampicillin over the counter

order esomeprazole 40mg pill – anexa mate buy nexium 20mg without prescription

mobic 15mg usa – https://moboxsin.com/ mobic 15mg without prescription

prednisone 40mg oral – corticosteroid order deltasone pill

erection pills viagra online – fastedtotake erection pills online

purchase amoxil sale – combamoxi.com order amoxicillin without prescription

fluconazole usa – fluconazole 200mg sale buy forcan medication

cenforce cost – https://cenforcers.com/# cenforce 50mg us

where to buy cialis – ciltad genesis cialis generic overnite shipping

zantac 300mg canada – https://aranitidine.com/# buy ranitidine no prescription

when to take cialis for best results – https://strongtadafl.com/ what doe cialis look like

The thoroughness in this section is noteworthy. https://gnolvade.com/

viagra buy no prescription canada – mexican viagra 100mg sales@cheap-generic-viagra

This is the description of topic I have reading. neurontin 600mg price

Palatable blog you possess here.. It’s severely to find strong status article like yours these days. I honestly respect individuals like you! Rent vigilance!! Low cost sildenafil

This is the big-hearted of literature I positively appreciate. https://prohnrg.com/product/atenolol-50-mg-online/

More content pieces like this would create the интернет better. https://aranitidine.com/fr/levitra_francaise/

I am in truth enchant‚e ‘ to gleam at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://ondactone.com/spironolactone/

More posts like this would prosper the blogosphere more useful.

spironolactone over the counter

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of profitable facts, thanks towards providing such data. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29105

order dapagliflozin 10mg sale – https://janozin.com/# order forxiga 10 mg