- BTC ETF inflows remained steady despite Bitcoin’s price correction.

- Miner revenue soared over the past month.

After crossing the $70,000 mark, Bitcoin[BTC] witnessed a massive correction and came back to the $67,000 mark. Despite the correction in price, the interest in BTC was relatively high.

All about the inflows

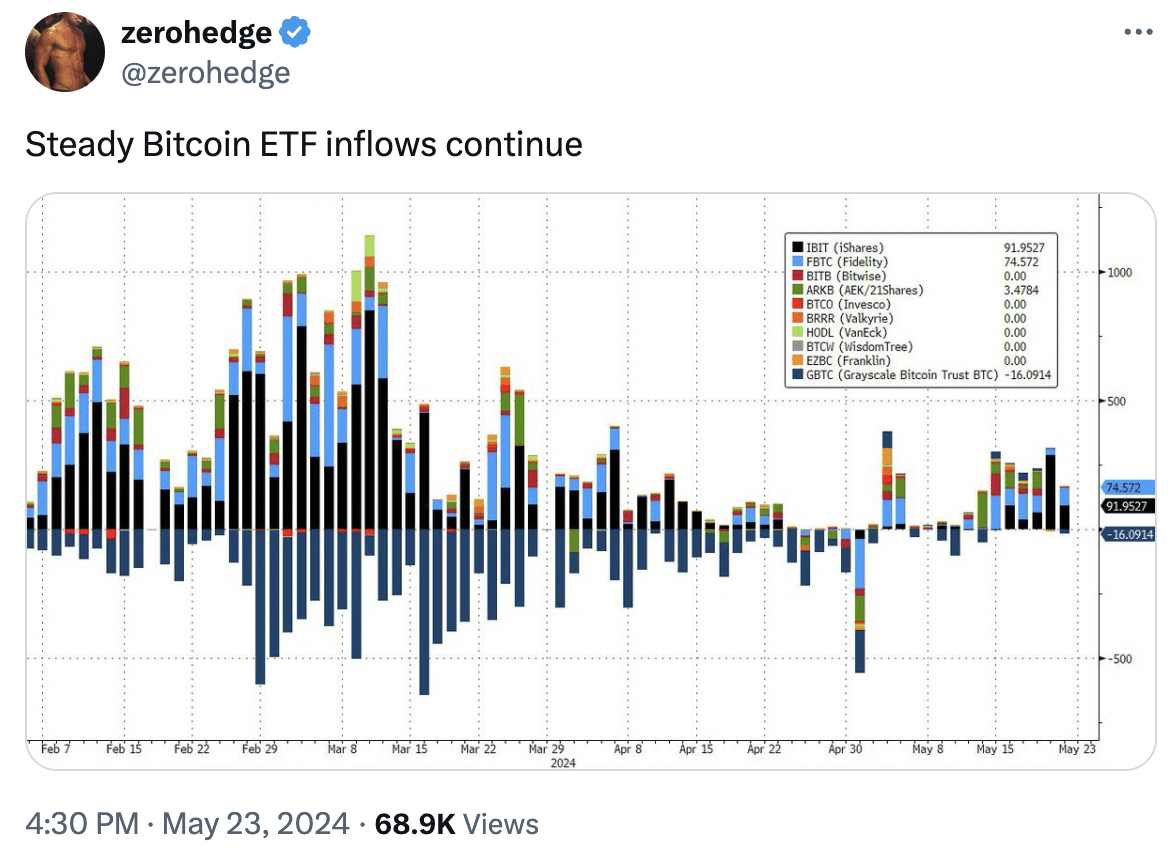

This was showcased by the steady BTC ETF inflows flowing into the market. Recent reports indicate that U.S. Bitcoin ETFs have accumulated a total of 850,707 BTC since January this year.

This significant accumulation is led by Grayscale’s GBTC ETF, which, despite a notable reduction from its initial reserves, retains the largest share at 289,280 BTC.

BlackRock’s iShares Bitcoin Trust (IBIT) has demonstrated remarkable growth, expanding its reserve from just 225 BTC at launch to an impressive 283,203 BTC.

Other key players in the U.S. market include Fidelity’s Wise Bitcoin ETF with 160,620 BTC and the Ark 21Shares ETF (ARKB) with 48,414 BTC.

Additionally, smaller contributors such as the Bitwise Bitcoin ETF (BITB), VanEck Bitcoin Trust (HODL), and Valkyrie BTC ETF (BRRR) have notable holdings of 36,092 BTC, 9,729 BTC, and 8,561 BTC, respectively.

Further contributions come from Invesco Galaxy’s BTCO ETF, Franklin Templeton’s EZBC, and WisdomTree and Hashdex Bitcoin ETFs, with BTCO, EZBC, BTCW, and DEFI holding 7,245 BTC, 6,148 BTC, 1,237 BTC, and 178 BTC, respectively.

On a global scale, Bitcoin ETFs have collectively amassed 986,769 BTC. Canada’s Purpose Bitcoin ETF is at the forefront outside the U.S., holding 27,407 BTC.

Germany’s ETC Group Physical Bitcoin Fund follows with 20,808 BTC, while the newly launched Hong Kong Bitcoin ETFs have accumulated a reserve of 3,608 BTC.

Source: X

This surge in accumulation of BTC ETFs despite the decline in price indicated that interest in the king coin had continued to grow across the globe. As adoption rises, BTC stands to benefit.

State of BTC

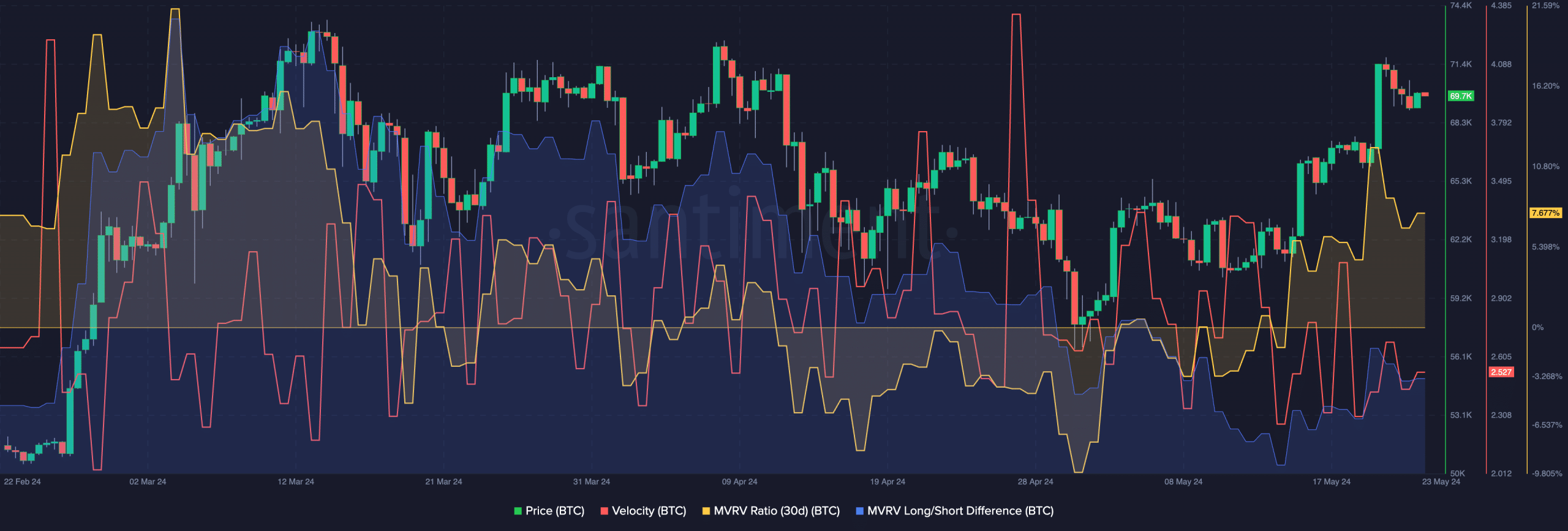

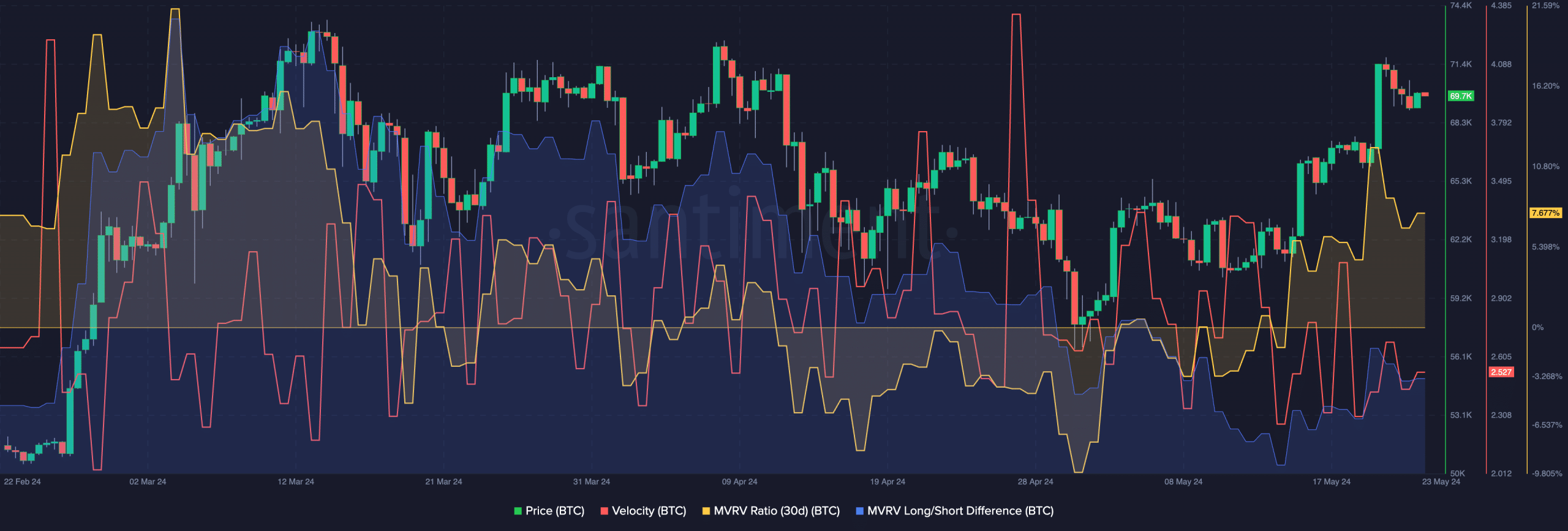

At press time, BTC was trading at $66,865.51 as its price had declined by 3.85% in the last 24 hours. One of the reasons for the decline in price would be the fact that most short-term holders had turned profitable due to the recent uptick in BTC’s price, causing them to indulge in profit-taking.

Even though massive sell offs of BTC had occurred in the last few days, the MVRV ratio remained high, implying that the number of addresses in profit was relatively high.

The danger of a massive sell off still looms around BTC. However, on a positive note, the Long/Short difference for BTC grew implying that the number of long term holders had surged.

Long term holders are less likely to sell their holdings during market fluctuations. Moreover, the velocity of BTC also fell, indicating that the frequency with which BTC was being traded had fallen.

This meant that an increasing number of addresses were holding on to their BTC.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

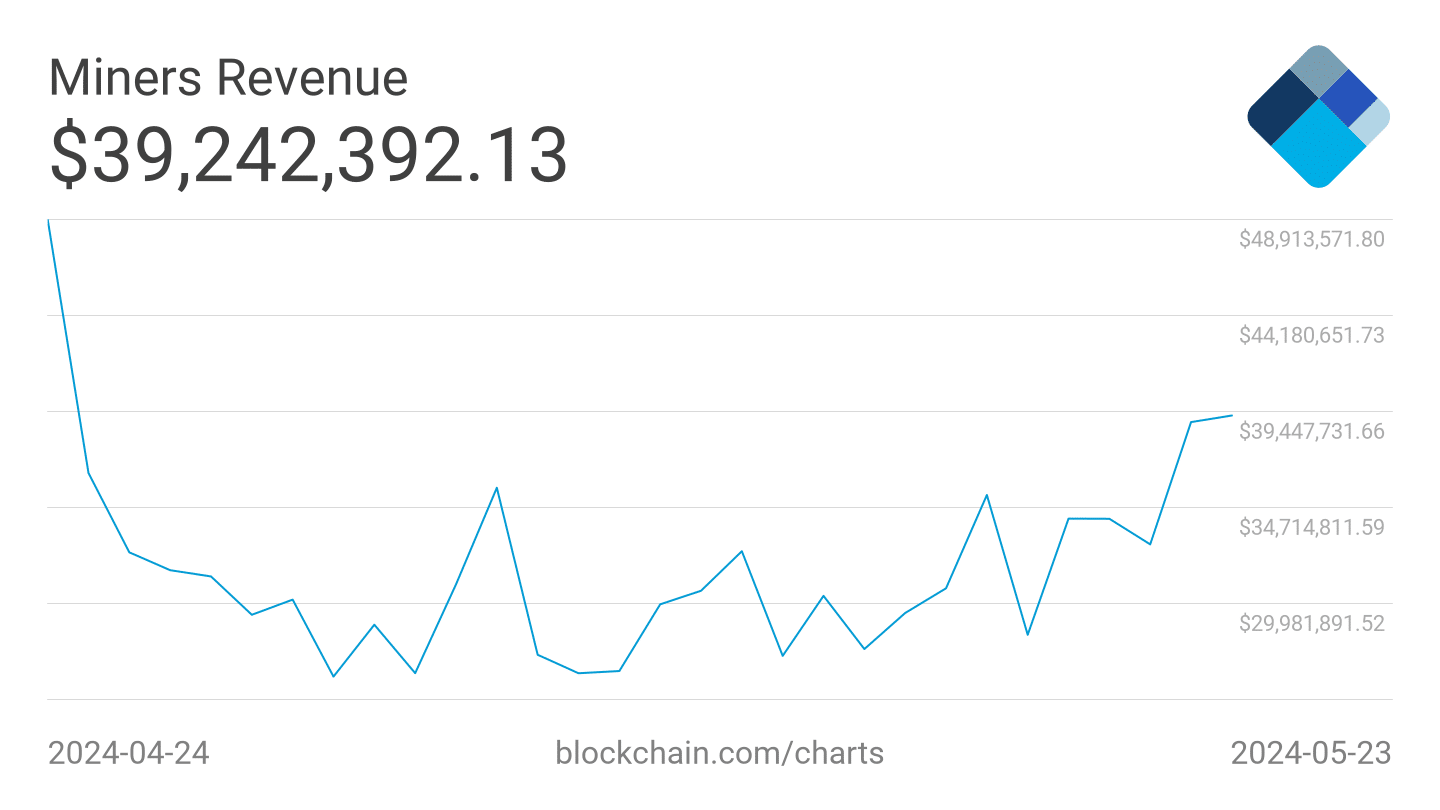

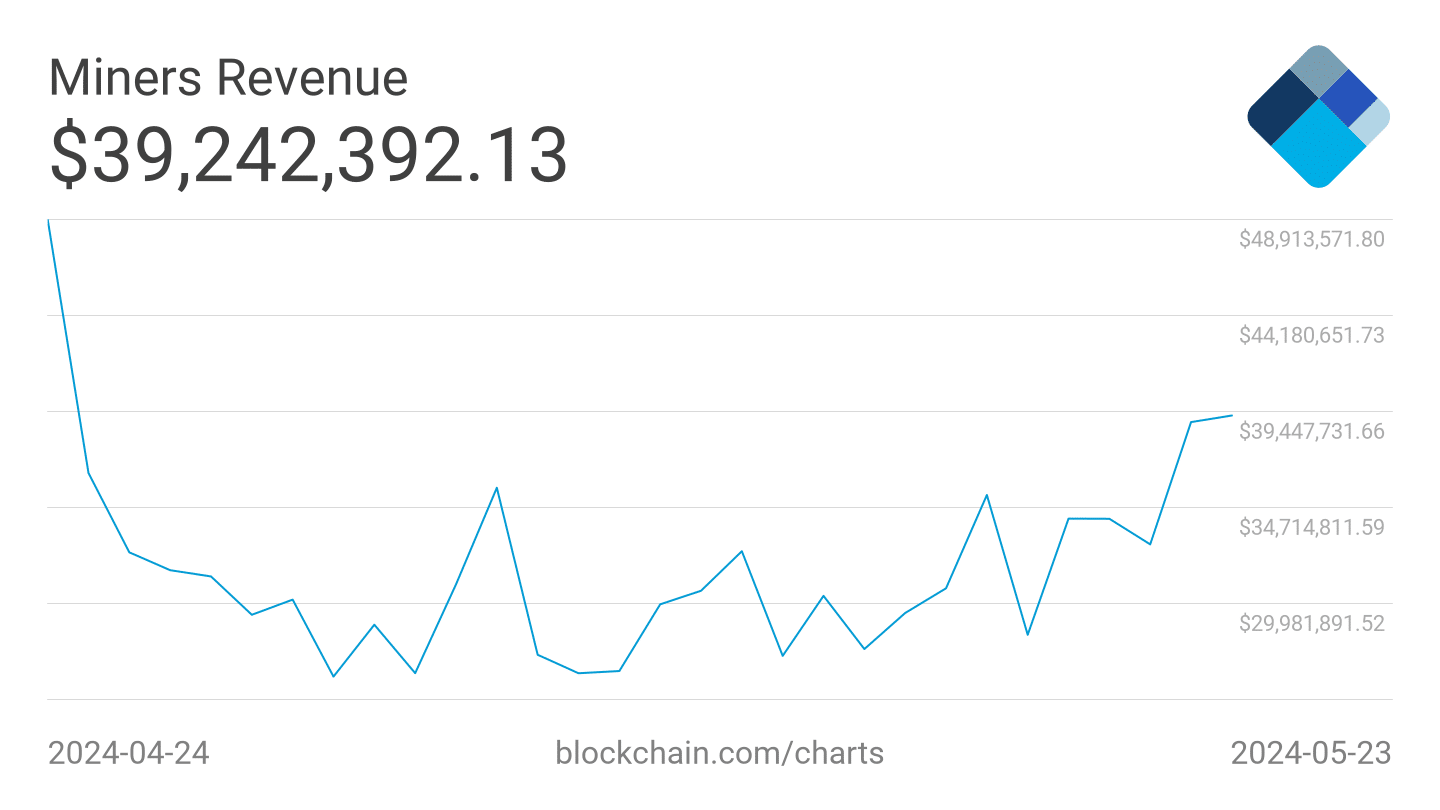

A factor that could influence the price of BTC would be the state of the Bitcoin miners. If the revenue generated by miners declines, it incentivizes them to sell their holdings to stay afloat.

At the time of writing, the miners were doing relatively well. Over the past month, the daily revenue generated by miners had surged from $29,981,891 to $39,242,392.

Source: Santiment

- BTC ETF inflows remained steady despite Bitcoin’s price correction.

- Miner revenue soared over the past month.

After crossing the $70,000 mark, Bitcoin[BTC] witnessed a massive correction and came back to the $67,000 mark. Despite the correction in price, the interest in BTC was relatively high.

All about the inflows

This was showcased by the steady BTC ETF inflows flowing into the market. Recent reports indicate that U.S. Bitcoin ETFs have accumulated a total of 850,707 BTC since January this year.

This significant accumulation is led by Grayscale’s GBTC ETF, which, despite a notable reduction from its initial reserves, retains the largest share at 289,280 BTC.

BlackRock’s iShares Bitcoin Trust (IBIT) has demonstrated remarkable growth, expanding its reserve from just 225 BTC at launch to an impressive 283,203 BTC.

Other key players in the U.S. market include Fidelity’s Wise Bitcoin ETF with 160,620 BTC and the Ark 21Shares ETF (ARKB) with 48,414 BTC.

Additionally, smaller contributors such as the Bitwise Bitcoin ETF (BITB), VanEck Bitcoin Trust (HODL), and Valkyrie BTC ETF (BRRR) have notable holdings of 36,092 BTC, 9,729 BTC, and 8,561 BTC, respectively.

Further contributions come from Invesco Galaxy’s BTCO ETF, Franklin Templeton’s EZBC, and WisdomTree and Hashdex Bitcoin ETFs, with BTCO, EZBC, BTCW, and DEFI holding 7,245 BTC, 6,148 BTC, 1,237 BTC, and 178 BTC, respectively.

On a global scale, Bitcoin ETFs have collectively amassed 986,769 BTC. Canada’s Purpose Bitcoin ETF is at the forefront outside the U.S., holding 27,407 BTC.

Germany’s ETC Group Physical Bitcoin Fund follows with 20,808 BTC, while the newly launched Hong Kong Bitcoin ETFs have accumulated a reserve of 3,608 BTC.

Source: X

This surge in accumulation of BTC ETFs despite the decline in price indicated that interest in the king coin had continued to grow across the globe. As adoption rises, BTC stands to benefit.

State of BTC

At press time, BTC was trading at $66,865.51 as its price had declined by 3.85% in the last 24 hours. One of the reasons for the decline in price would be the fact that most short-term holders had turned profitable due to the recent uptick in BTC’s price, causing them to indulge in profit-taking.

Even though massive sell offs of BTC had occurred in the last few days, the MVRV ratio remained high, implying that the number of addresses in profit was relatively high.

The danger of a massive sell off still looms around BTC. However, on a positive note, the Long/Short difference for BTC grew implying that the number of long term holders had surged.

Long term holders are less likely to sell their holdings during market fluctuations. Moreover, the velocity of BTC also fell, indicating that the frequency with which BTC was being traded had fallen.

This meant that an increasing number of addresses were holding on to their BTC.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

A factor that could influence the price of BTC would be the state of the Bitcoin miners. If the revenue generated by miners declines, it incentivizes them to sell their holdings to stay afloat.

At the time of writing, the miners were doing relatively well. Over the past month, the daily revenue generated by miners had surged from $29,981,891 to $39,242,392.

Source: Santiment

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

order cheap clomiphene tablets can you buy clomid without insurance get clomid without a prescription where can i buy generic clomid without prescription can i get cheap clomiphene can you buy clomid without rx can you get cheap clomiphene without rx

This is the make of advise I unearth helpful.

This is the amicable of content I take advantage of reading.

order zithromax – buy ciprofloxacin 500mg pill metronidazole 200mg price

order semaglutide 14 mg pill – buy cyproheptadine cheap purchase cyproheptadine sale

motilium 10mg uk – tetracycline 250mg without prescription flexeril 15mg usa