- BTC ETFs ramped up accumulation despite recent drawdowns.

- Glassnode founders were bullish on BTC despite overhead obstacles on price charts.

Despite Bitcoin [BTC] declining by nearly 20%, U.S. spot BTC ETFs scooped the dip even though the largest digital asset dropped below $55K.

In June, BTC dropped from $71.9K to $58.4K. Further negative sentiment in July saw it drop to a new low of $53.4K before reclaiming $58K as of press time.

Bitcoin ETFs holding steady

While acknowledging the recent drawdown as “nasty,” Bloomberg ETF analyst Eric Balchunas noted that ETFs’ AUM (assets under management) and YTD (year-to-date) flows remained steady.

‘Bitcoin had 20% drawdown in a month flat. Pretty nasty. I would have been impressed if 90% of aum hung in there, but it was over 100% as they saw inflows…kept the all-important YTD net number at +$15B.’

Balchunas added that BTC ETFs’, which he equated to boomers’ holdings, were “hanging tough” during drawdowns.

Farside Investors data supported Balchunas’s statement, as YTD flows reclaimed the $15 billion mark after dropping to $14.3 billion in late June.

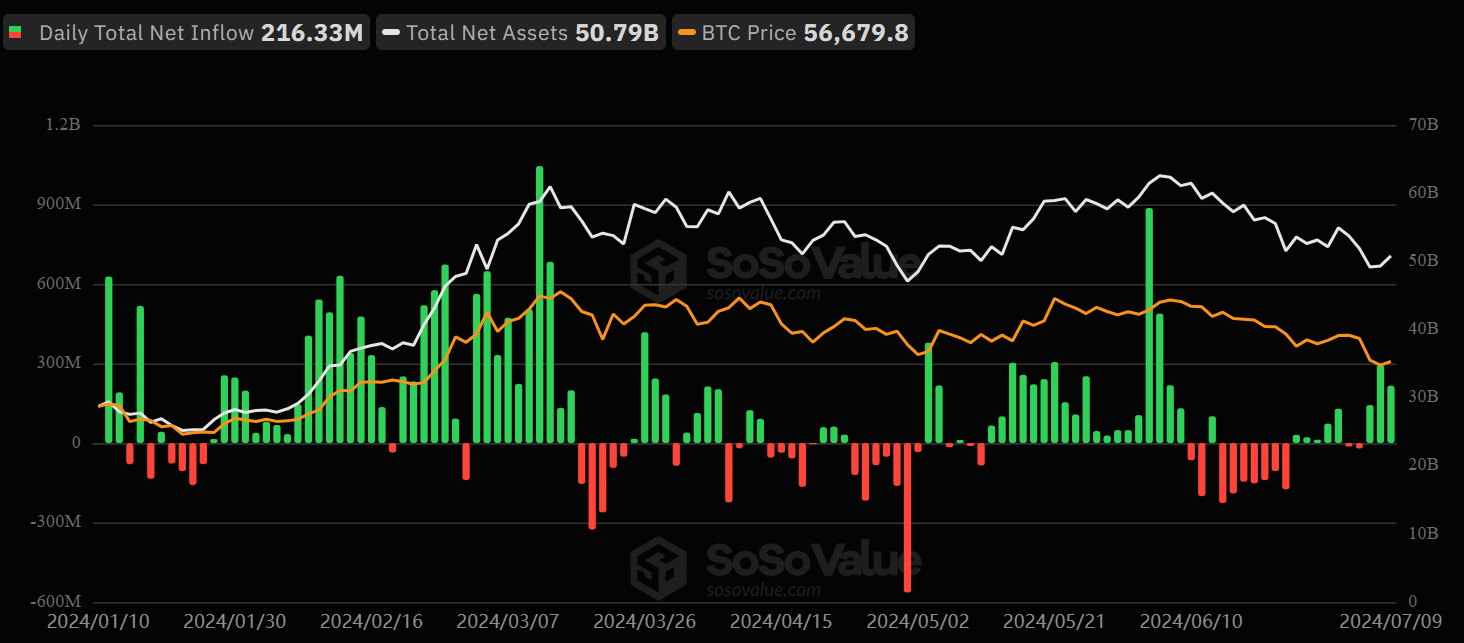

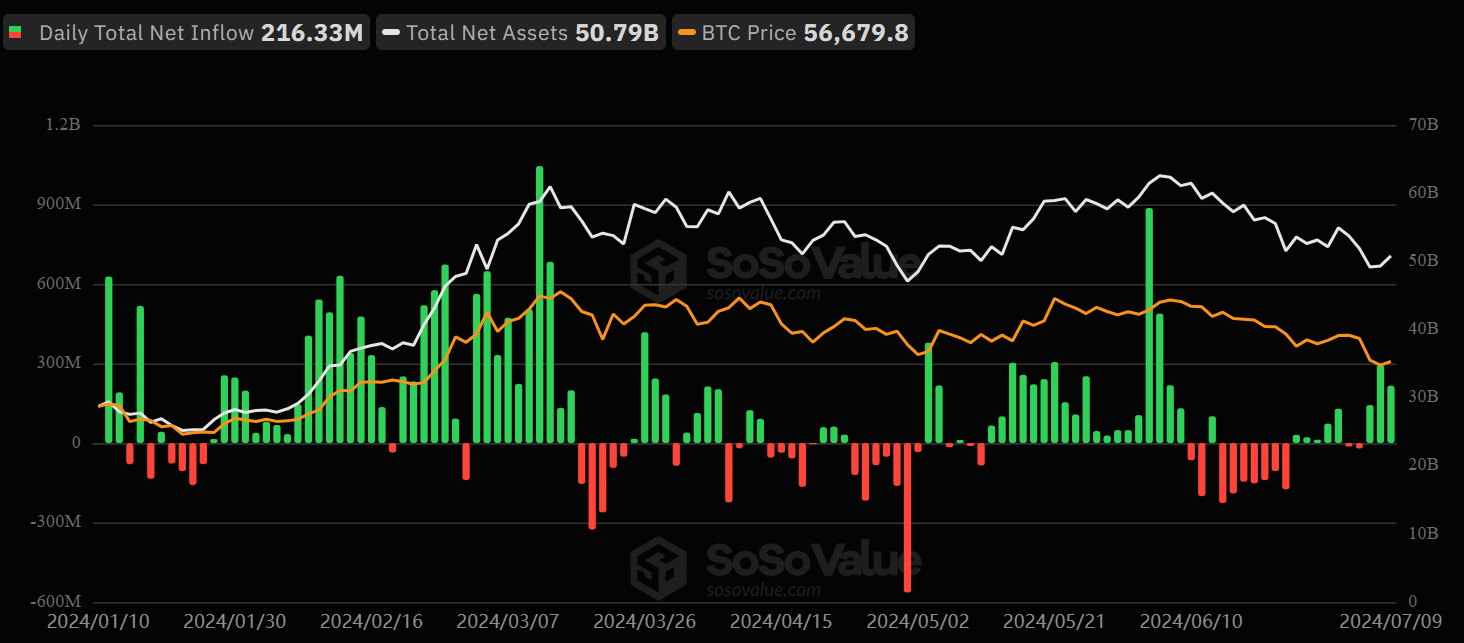

Source: Bitcoin ETF

But Soso Value data revealed that BTC ETFs’ AUM declined by nearly $10B. Amidst recent drawdowns, it dropped from $62.5 billion to below $50 billion.

Community reactions on BTC ETFs

However, AUM has since recovered as flows improved at the start of the week. The products have seen positive net flows since last Friday.

On Monday and Tuesday, BTC ETFs saw $294.9 million and $216.3 million in inflows, respectively.

Nevertheless, other market observers viewed the improved ETF flows as irrelevant to BTC price action on the chart.

In fact, one user claimed the inflows were hedge funds to short BTC on the futures market through cash and carry trade.

Another market analyst, Jim Bianco, countered Balchunas’ boomer narrative in BTC ETFs.

Bianco underscored that boomers held a “tiny percentage,” with the majority of BTC ETF holders coming from ‘self-directed investors.’

How’s Bitcoin price action?

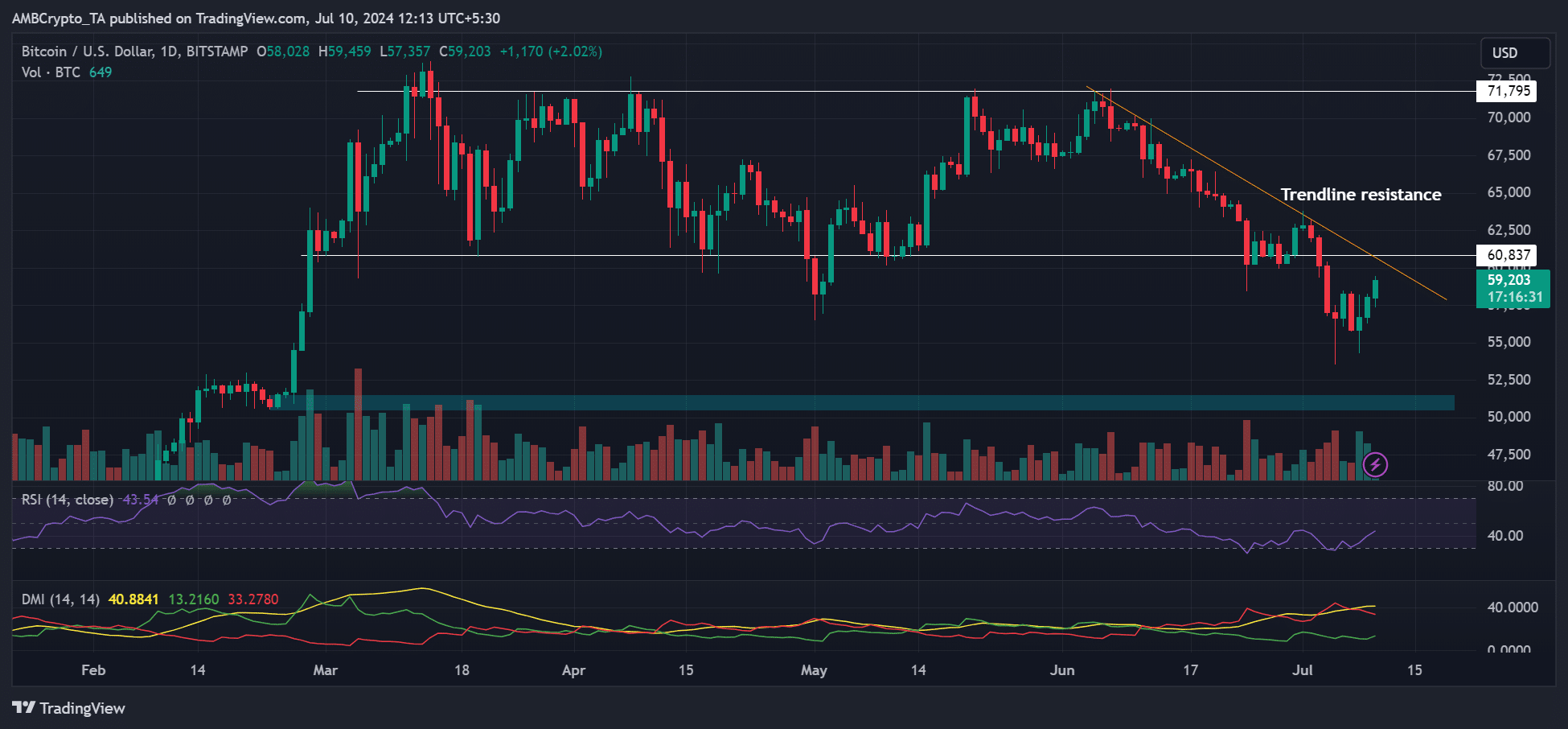

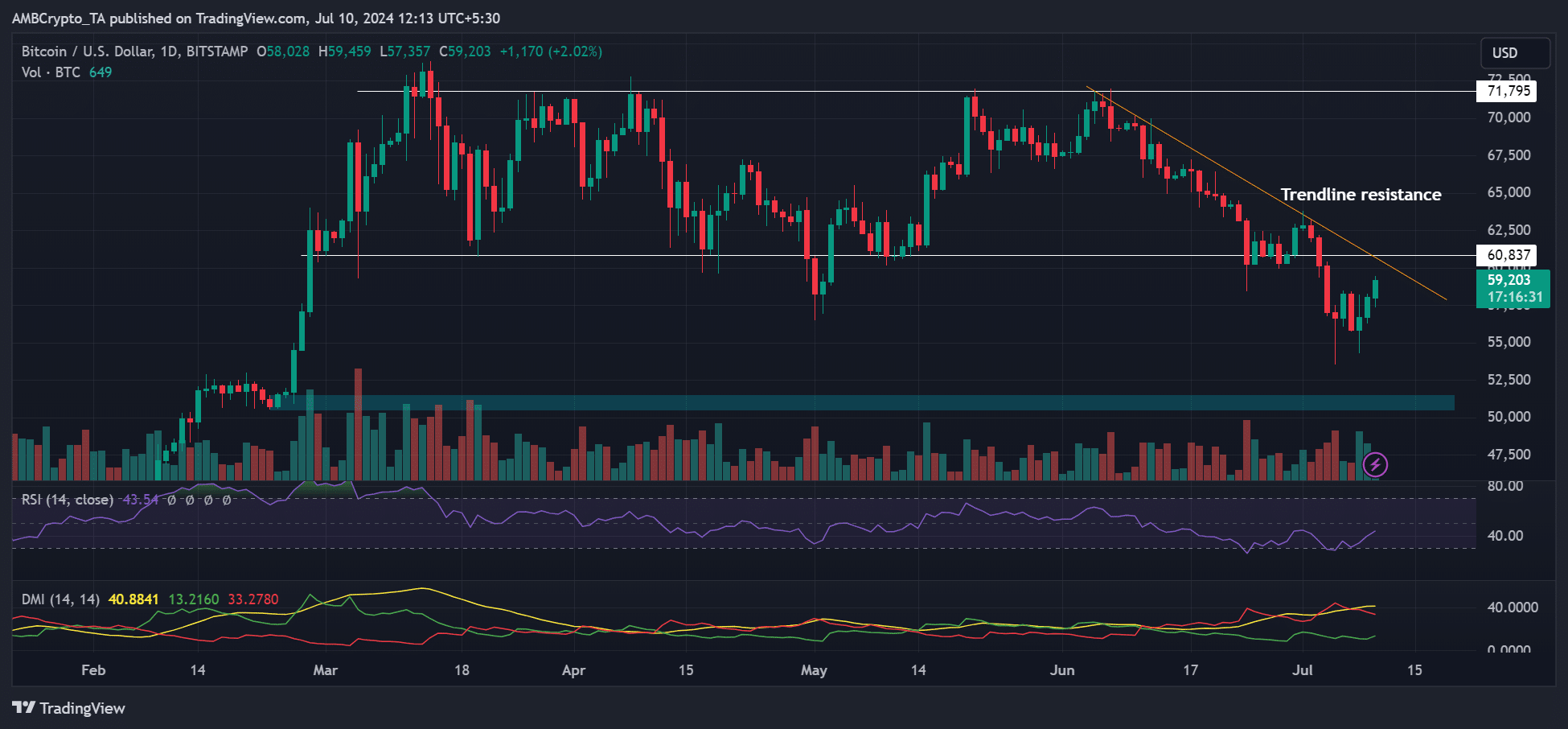

Source: BTC/USD, TradingView

As of press time, BTC was up 5.8% on a weekly basis and slightly above $59K. However, to show further strength, the recovery must clear the trendline resistance and reclaim the range-low of $60.8K.

The RSI (Relative Strength Index) and the Directional Movement Index (DMI) showed remarkable positive strengthening.

However, RSI was below average, and DMI was far from a positive crossover, indicating that bulls still didn’t have absolute market leverage.

Interestingly, Glassnode founders, Negentropic, claimed that BTC’s RSI has bottomed on the daily chart, tipping them to take a bullish stance on BTC.

- BTC ETFs ramped up accumulation despite recent drawdowns.

- Glassnode founders were bullish on BTC despite overhead obstacles on price charts.

Despite Bitcoin [BTC] declining by nearly 20%, U.S. spot BTC ETFs scooped the dip even though the largest digital asset dropped below $55K.

In June, BTC dropped from $71.9K to $58.4K. Further negative sentiment in July saw it drop to a new low of $53.4K before reclaiming $58K as of press time.

Bitcoin ETFs holding steady

While acknowledging the recent drawdown as “nasty,” Bloomberg ETF analyst Eric Balchunas noted that ETFs’ AUM (assets under management) and YTD (year-to-date) flows remained steady.

‘Bitcoin had 20% drawdown in a month flat. Pretty nasty. I would have been impressed if 90% of aum hung in there, but it was over 100% as they saw inflows…kept the all-important YTD net number at +$15B.’

Balchunas added that BTC ETFs’, which he equated to boomers’ holdings, were “hanging tough” during drawdowns.

Farside Investors data supported Balchunas’s statement, as YTD flows reclaimed the $15 billion mark after dropping to $14.3 billion in late June.

Source: Bitcoin ETF

But Soso Value data revealed that BTC ETFs’ AUM declined by nearly $10B. Amidst recent drawdowns, it dropped from $62.5 billion to below $50 billion.

Community reactions on BTC ETFs

However, AUM has since recovered as flows improved at the start of the week. The products have seen positive net flows since last Friday.

On Monday and Tuesday, BTC ETFs saw $294.9 million and $216.3 million in inflows, respectively.

Nevertheless, other market observers viewed the improved ETF flows as irrelevant to BTC price action on the chart.

In fact, one user claimed the inflows were hedge funds to short BTC on the futures market through cash and carry trade.

Another market analyst, Jim Bianco, countered Balchunas’ boomer narrative in BTC ETFs.

Bianco underscored that boomers held a “tiny percentage,” with the majority of BTC ETF holders coming from ‘self-directed investors.’

How’s Bitcoin price action?

Source: BTC/USD, TradingView

As of press time, BTC was up 5.8% on a weekly basis and slightly above $59K. However, to show further strength, the recovery must clear the trendline resistance and reclaim the range-low of $60.8K.

The RSI (Relative Strength Index) and the Directional Movement Index (DMI) showed remarkable positive strengthening.

However, RSI was below average, and DMI was far from a positive crossover, indicating that bulls still didn’t have absolute market leverage.

Interestingly, Glassnode founders, Negentropic, claimed that BTC’s RSI has bottomed on the daily chart, tipping them to take a bullish stance on BTC.

can you get generic clomiphene prices how to buy cheap clomiphene without dr prescription can i get clomiphene without rx where buy generic clomiphene tablets order generic clomid for sale clomiphene costo where can i buy clomiphene pill

Proof blog you possess here.. It’s intricate to espy great calibre belles-lettres like yours these days. I justifiably appreciate individuals like you! Go through mindfulness!!

I’ll certainly carry back to skim more.

zithromax 250mg over the counter – metronidazole without prescription purchase flagyl for sale

order rybelsus 14 mg pills – order rybelsus 14 mg pill buy periactin generic

domperidone oral – generic flexeril 15mg buy flexeril pill

order augmentin 1000mg generic – atbio info ampicillin online buy

purchase esomeprazole for sale – anexamate buy nexium 20mg

order medex pills – cou mamide order cozaar pill

order mobic 7.5mg online cheap – https://moboxsin.com/ mobic 15mg cheap

purchase deltasone generic – https://apreplson.com/ order prednisone generic

buy ed meds online – buy erectile dysfunction meds buy best erectile dysfunction pills

where can i buy amoxicillin – combamoxi.com order amoxicillin for sale

fluconazole brand – https://gpdifluca.com/# fluconazole pills

cost cenforce 100mg – https://cenforcers.com/# buy generic cenforce 50mg

canadian pharmacy online cialis – para que sirve las tabletas cialis tadalafil de 5mg buy cialis online free shipping

buy generic tadalafil online cheap – https://strongtadafl.com/# buy cialis online without prescription

oral ranitidine 300mg – https://aranitidine.com/# buy zantac 150mg online cheap

can you buy viagra qatar – https://strongvpls.com/# buy viagra with paypal

More posts like this would persuade the online time more useful. sitio web

More posts like this would force the blogosphere more useful. zithromax 500mg pill

Greetings! Very serviceable recommendation within this article! It’s the little changes which liking espy the largest changes. Thanks a portion towards sharing! https://ursxdol.com/get-cialis-professional/

I am in point of fact happy to glance at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://prohnrg.com/product/metoprolol-25-mg-tablets/

More posts like this would create the online time more useful. click

This is the kind of post I unearth helpful. https://ondactone.com/spironolactone/

More peace pieces like this would make the интернет better.

plavix drug

Thanks for sharing. It’s outstrip quality. http://sols9.com/batheo/Forum/User-Fjpkyz

dapagliflozin usa – buy dapagliflozin dapagliflozin buy online

purchase orlistat without prescription – orlistat over the counter order orlistat 60mg pills