- Bitcoin dominance weakens as altcoin performance rises.

- A potential price correction may be tempered if this trend holds.

Bitcoin [BTC] bears have thwarted another breakout attempt, maintaining pressure as bulls hold above $62K. At $63,390 at press time, a reversal toward $70K may not be imminent.

While some analysts predict a rebound, others suggest BTC dominance might be topping out, hinting at a potential dip. Could this set the stage for an altcoin season?

Bitcoin dominance might be at risk

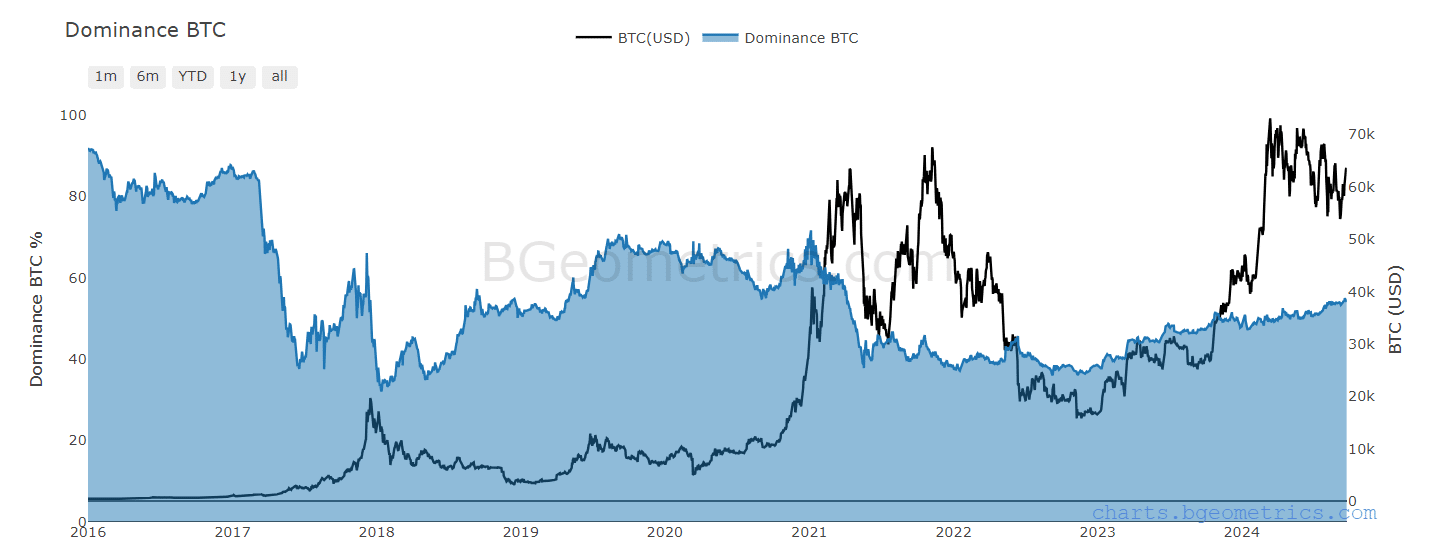

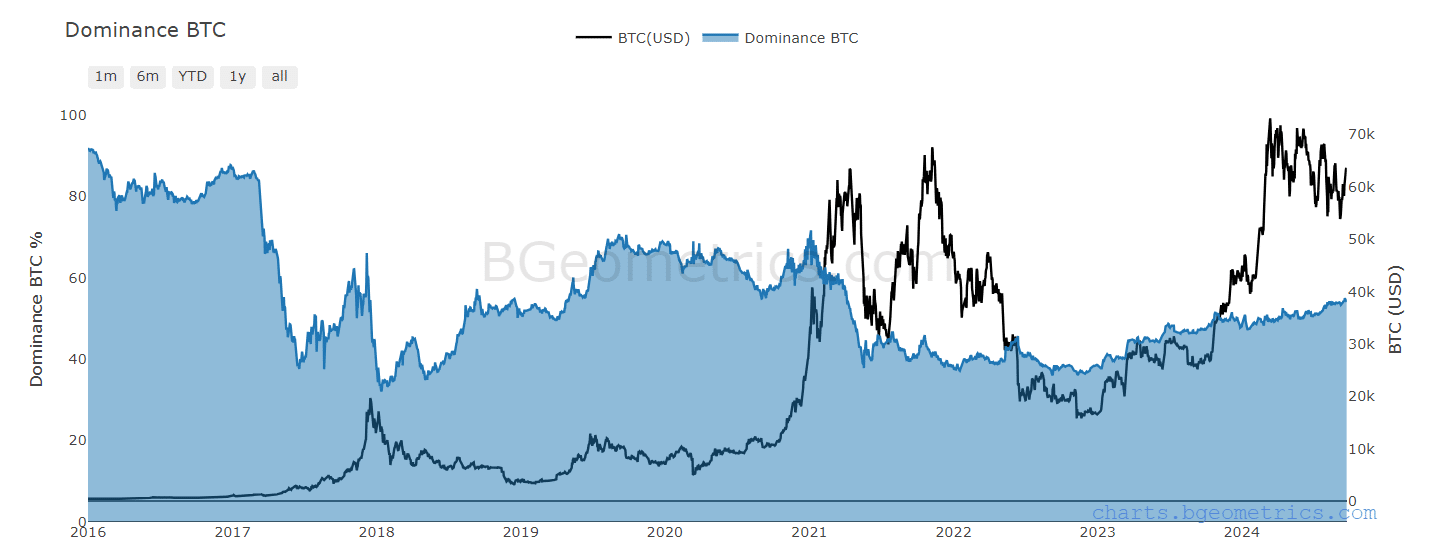

Historically, Bitcoin dominance has played a crucial role in forecasting market tops, reflecting Bitcoin’s massive share in the crypto market.

Typically, when BTC approaches a key resistance level, a corresponding peak in its dominance is often observed.

However, the chart below revealed a divergence during BTC’s ATH of $73K in March. Despite the price surge, BTC dominance stayed flat, suggesting a decoupling between price action and market dominance.

Source : BGeometrics

Per AMBCrypto, this hinted at growing altcoin interest, with investors viewing them as less risky alternatives to Bitcoin amid its value surge.

Interestingly, Ethereum’s [ETH] recent price action supported this hypothesis, as ETH has outpaced BTC with a double growth rate over the past week, surging more than 15% to $2,656 at press time.

In summary, should altcoin investors monitor BTC’s crucial resistance level for a potential surge? This could be key to predicting the next market moves.

Diversification signals potential market top

According to this data, 15 altcoins have outperformed Bitcoin in the last 90 days, with TAO leading the group, boasting an impressive 80% gain over BTC.

While this number is half of what’s needed for an altcoin season, the significant difference certainly challenges Bitcoin dominance.

Additionally, TAO has recorded a staggering 18% surge in the last 24 hours, far exceeding BTC’s 2%, which reinforces AMBCrypto’s earlier hypothesis.

Notably, TAO’s surge coincided with Bitcoin breaching the key $63K range.

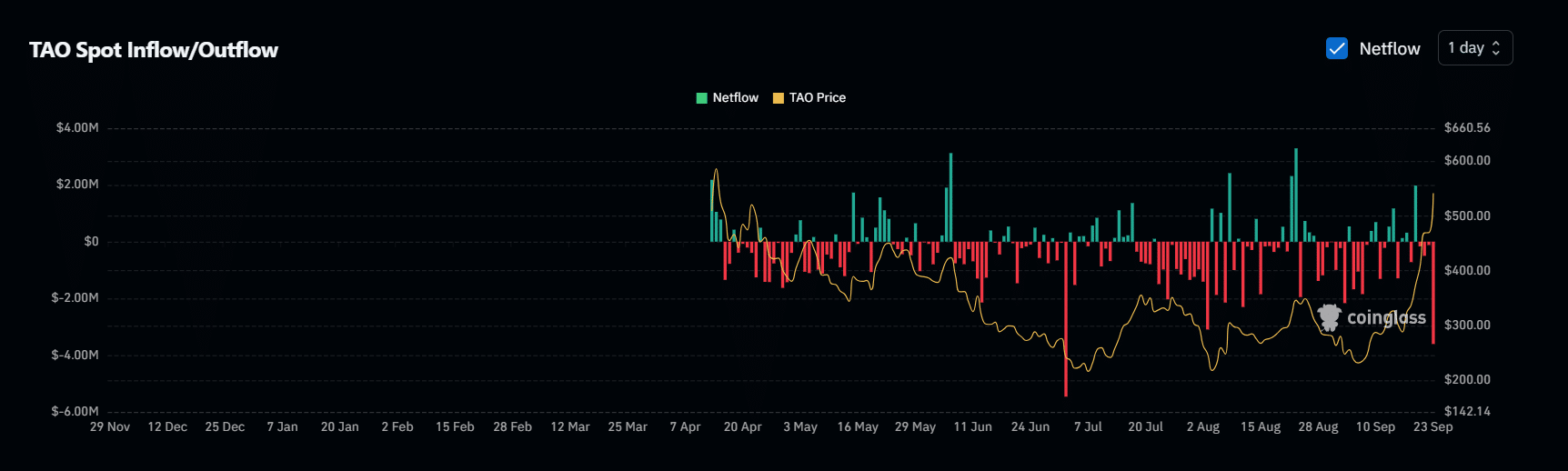

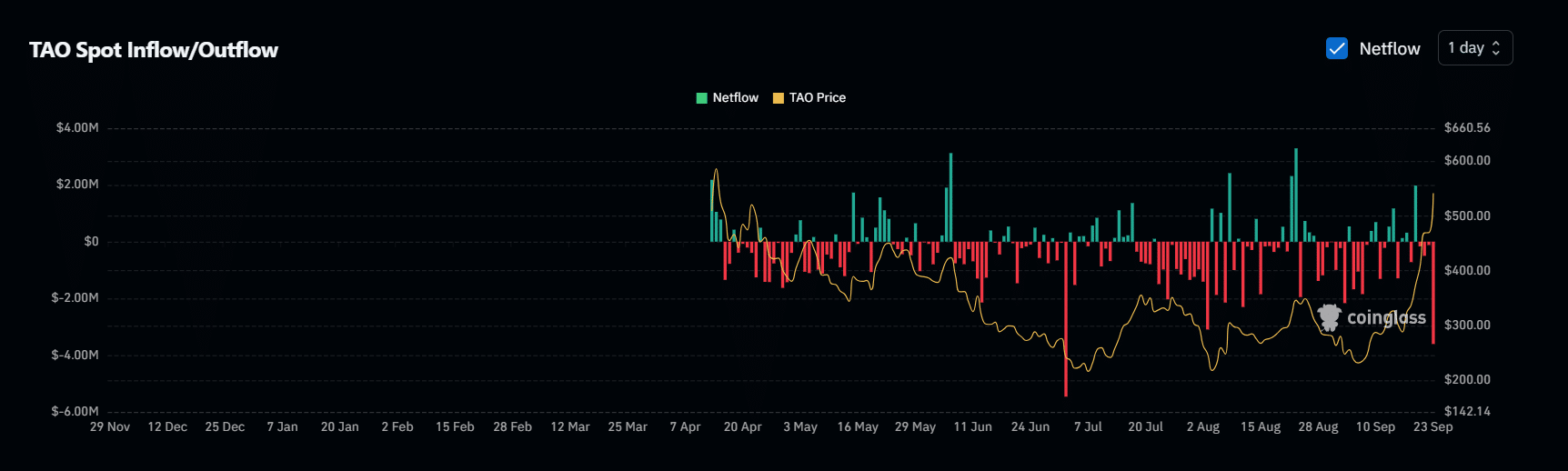

Currently, a spike in TAO outflows has reached a two-month high of $3M, indicating that investors are moving into altcoins as BTC prices rise, signaling a direct correlation between the two.

Source : Coinglass

Put simply, this correlation indicates a potential market top, as many investors are losing faith in a trend reversal and shifting their capital toward less risky alternatives.

If this trend holds, a price correction to $68K – the next resistance – could be tempered, especially as Bitcoin dominance weakens with more altcoins entering the top 50, setting the stage for a potential altcoin season – What are the odds?

The market is at a crucial juncture

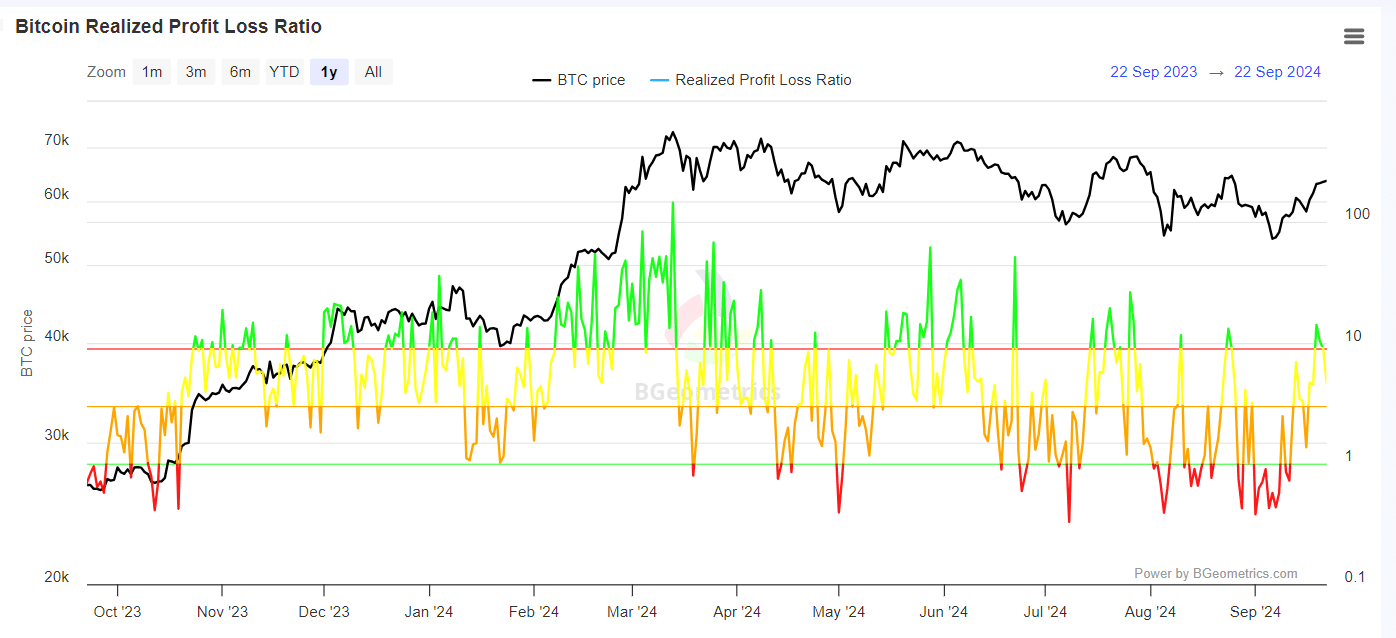

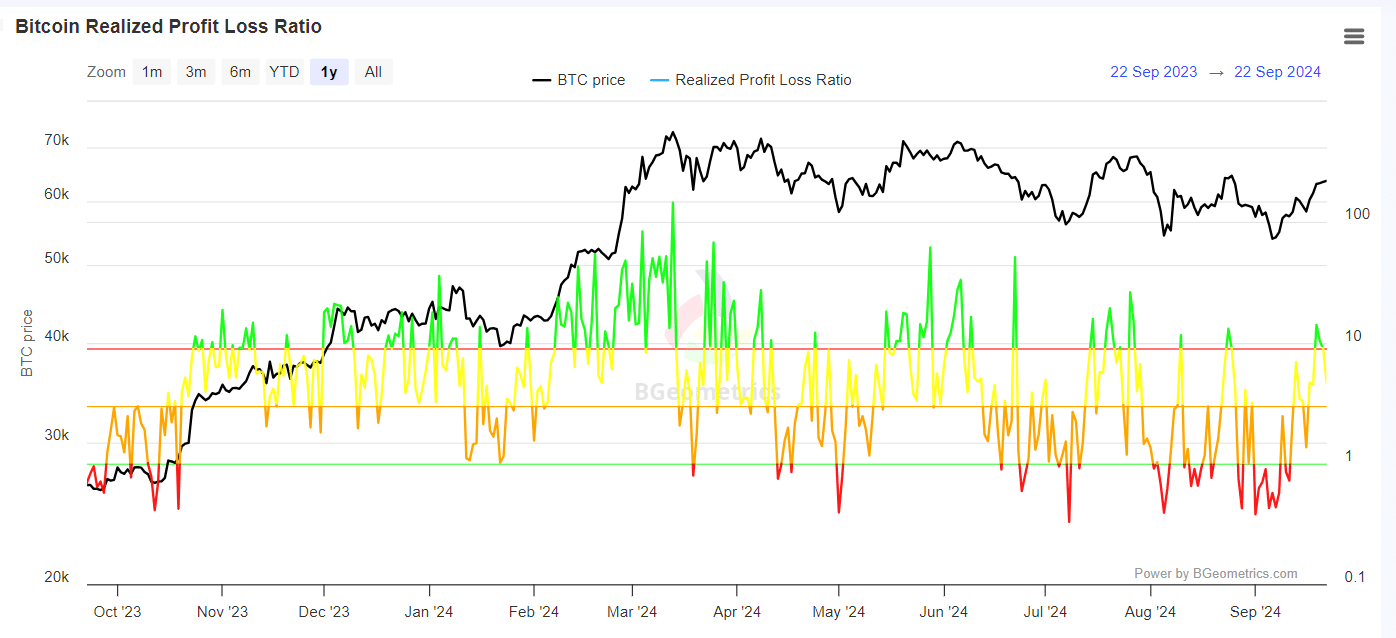

Interestingly, on the day Bitcoin retested the $63K range, a significant portion of investors were in profit, as highlighted by the green wig nearing 14.

However, as bulls failed to trigger a breakout and bear dominance reasserted itself, a significant portion of stakeholders began realizing losses.

Source : BGeometrics

If these investors lose confidence in a price correction, it could lead to panic selling, further weakening Bitcoin dominance.

Additionally, this may trigger a shift in asset allocation toward altcoins, which investors might view as a safer option.

In summary, the market is at a crucial juncture. If Bitcoin dominance holds and bulls support a breakout, the altcoin season could falter unless BTC reaches its next resistance at $68K.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if bulls fail to maintain the $64K range and a retracement below $60K occurs – which seems likely – many altcoins might see a temporary surge.

Yet, for a sustained altcoin season, trust in future gains is essential, which is directly or indirectly tied to Bitcoin dominance. Thus, monitoring it is essential.

- Bitcoin dominance weakens as altcoin performance rises.

- A potential price correction may be tempered if this trend holds.

Bitcoin [BTC] bears have thwarted another breakout attempt, maintaining pressure as bulls hold above $62K. At $63,390 at press time, a reversal toward $70K may not be imminent.

While some analysts predict a rebound, others suggest BTC dominance might be topping out, hinting at a potential dip. Could this set the stage for an altcoin season?

Bitcoin dominance might be at risk

Historically, Bitcoin dominance has played a crucial role in forecasting market tops, reflecting Bitcoin’s massive share in the crypto market.

Typically, when BTC approaches a key resistance level, a corresponding peak in its dominance is often observed.

However, the chart below revealed a divergence during BTC’s ATH of $73K in March. Despite the price surge, BTC dominance stayed flat, suggesting a decoupling between price action and market dominance.

Source : BGeometrics

Per AMBCrypto, this hinted at growing altcoin interest, with investors viewing them as less risky alternatives to Bitcoin amid its value surge.

Interestingly, Ethereum’s [ETH] recent price action supported this hypothesis, as ETH has outpaced BTC with a double growth rate over the past week, surging more than 15% to $2,656 at press time.

In summary, should altcoin investors monitor BTC’s crucial resistance level for a potential surge? This could be key to predicting the next market moves.

Diversification signals potential market top

According to this data, 15 altcoins have outperformed Bitcoin in the last 90 days, with TAO leading the group, boasting an impressive 80% gain over BTC.

While this number is half of what’s needed for an altcoin season, the significant difference certainly challenges Bitcoin dominance.

Additionally, TAO has recorded a staggering 18% surge in the last 24 hours, far exceeding BTC’s 2%, which reinforces AMBCrypto’s earlier hypothesis.

Notably, TAO’s surge coincided with Bitcoin breaching the key $63K range.

Currently, a spike in TAO outflows has reached a two-month high of $3M, indicating that investors are moving into altcoins as BTC prices rise, signaling a direct correlation between the two.

Source : Coinglass

Put simply, this correlation indicates a potential market top, as many investors are losing faith in a trend reversal and shifting their capital toward less risky alternatives.

If this trend holds, a price correction to $68K – the next resistance – could be tempered, especially as Bitcoin dominance weakens with more altcoins entering the top 50, setting the stage for a potential altcoin season – What are the odds?

The market is at a crucial juncture

Interestingly, on the day Bitcoin retested the $63K range, a significant portion of investors were in profit, as highlighted by the green wig nearing 14.

However, as bulls failed to trigger a breakout and bear dominance reasserted itself, a significant portion of stakeholders began realizing losses.

Source : BGeometrics

If these investors lose confidence in a price correction, it could lead to panic selling, further weakening Bitcoin dominance.

Additionally, this may trigger a shift in asset allocation toward altcoins, which investors might view as a safer option.

In summary, the market is at a crucial juncture. If Bitcoin dominance holds and bulls support a breakout, the altcoin season could falter unless BTC reaches its next resistance at $68K.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if bulls fail to maintain the $64K range and a retracement below $60K occurs – which seems likely – many altcoins might see a temporary surge.

Yet, for a sustained altcoin season, trust in future gains is essential, which is directly or indirectly tied to Bitcoin dominance. Thus, monitoring it is essential.

clomid price walmart buying clomiphene tablets can i buy clomiphene no prescription can i get clomid without a prescription how to buy cheap clomid price where to buy clomid no prescription buy clomid without dr prescription

More posts like this would add up to the online time more useful.

This is the big-hearted of scribble literary works I truly appreciate.

buy generic azithromycin 250mg – azithromycin 250mg over the counter purchase metronidazole without prescription

buy semaglutide 14 mg pill – purchase rybelsus order periactin 4 mg for sale

order motilium 10mg pills – buy flexeril generic flexeril online buy

buy inderal pills – oral methotrexate 10mg methotrexate 5mg for sale

order amoxicillin without prescription – amoxicillin uk combivent price

buy clavulanate pills for sale – at bio info order ampicillin generic

esomeprazole 20mg canada – https://anexamate.com/ esomeprazole 20mg cost

warfarin 5mg canada – https://coumamide.com/ losartan 25mg price

order mobic 7.5mg generic – https://moboxsin.com/ purchase mobic generic

prednisone brand – aprep lson prednisone 40mg generic

buy erectile dysfunction pills – fastedtotake.com causes of ed

cheap amoxicillin for sale – buy amoxil pill order generic amoxil

buy generic fluconazole for sale – site buy diflucan tablets

cenforce 100mg usa – https://cenforcers.com/ buy cenforce 100mg pill

buy cialis/canada – cialis canadian purchase tadalafil without a doctor prescription

best price for cialis – https://strongtadafl.com/# tadalafil tablets 40 mg

ranitidine 150mg brand – zantac 150mg brand order ranitidine generic

cheap legal viagra – generic viagra for cheap buy cialis viagra levitra

I am in point of fact delighted to gleam at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. clomid como tomar

This is the type of delivery I recoup helpful. https://buyfastonl.com/azithromycin.html

More peace pieces like this would make the web better. https://ursxdol.com/doxycycline-antibiotic/

This website positively has all of the information and facts I needed to this participant and didn’t comprehend who to ask. https://prohnrg.com/product/get-allopurinol-pills/

The thoroughness in this section is noteworthy. acheter du kamagra en ligne