- Bitcoin’s dominance was around 55% at press time.

- The market remained in Bitcoin season despite a drop in its dominance.

Recently, Bitcoin [BTC] has experienced significant declines, causing its price to drop below the $60,000 mark.

This downturn in Bitcoin’s price also impacted its market dominance, which decreased, giving rise to a slight momentum in the altcoin market.

Bitcoin suffers price drops

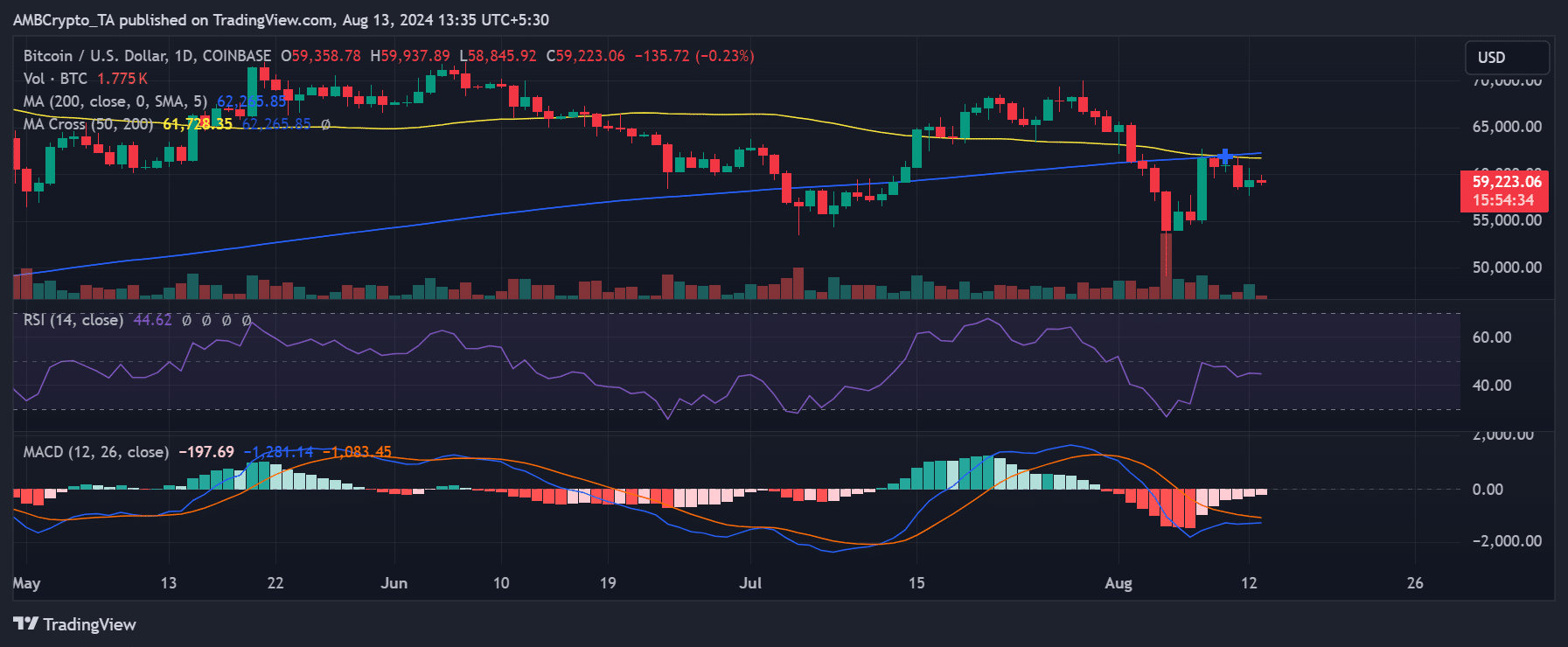

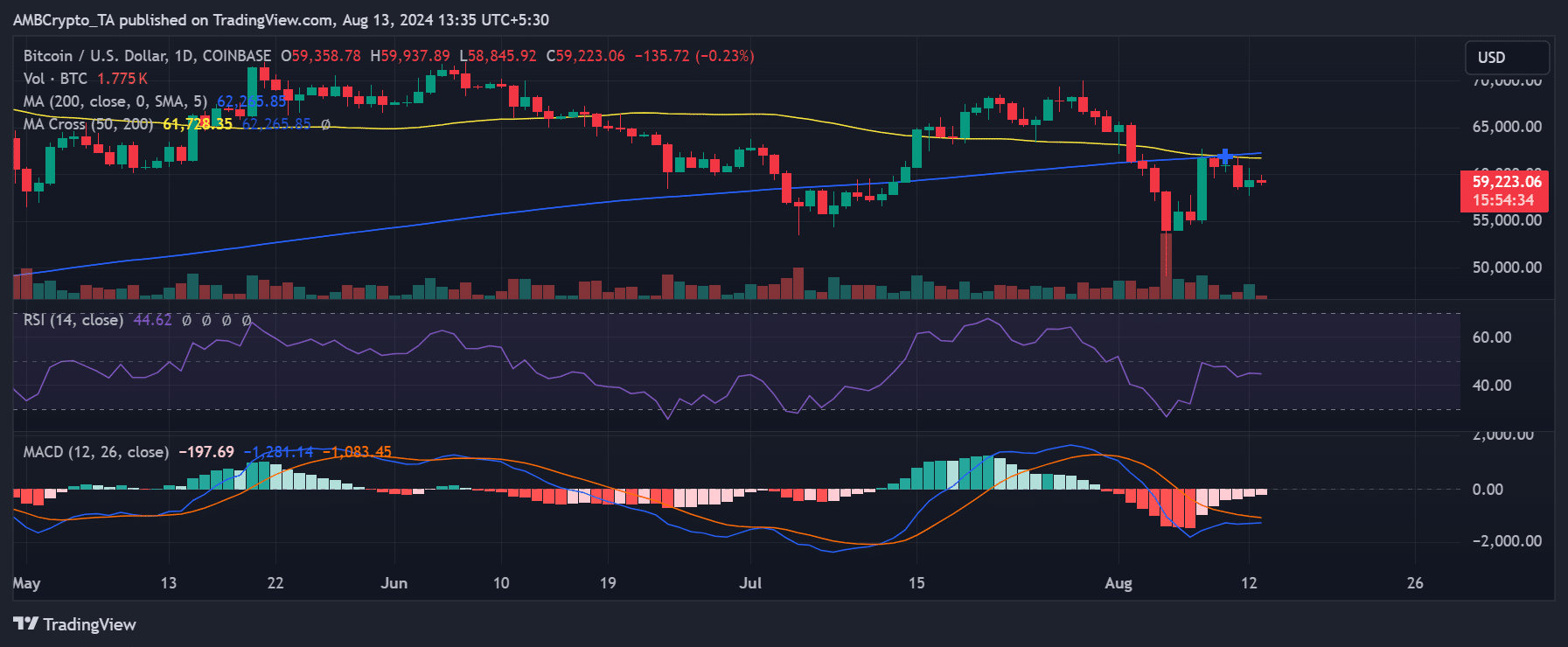

AMBCrypto’s analysis of Bitcoin on a daily timeframe chart indicated a challenging start to August. The chart showed that BTC experienced consecutive declines that dropped its price below the critical $60,000 mark.

Also, the chart showed a low cost of around $49,000, which impacted the Bitcoin dominance.

However, a notable rebound recently pushed its price back to the $60,000 range, but it has since slipped again. At the close of the latest trading session, BTC saw a modest increase of 1.08%, ending at approximately $59,358.

Source: TradingView

It continued to hover around the $59,000 level at press time, with a slight decline of less than 1%.

Furthermore, the Relative Strength Index (RSI) remained below the neutral threshold, signaling that it was still entrenched in a bearish trend.

How price decline affected the Bitcoin Dominance

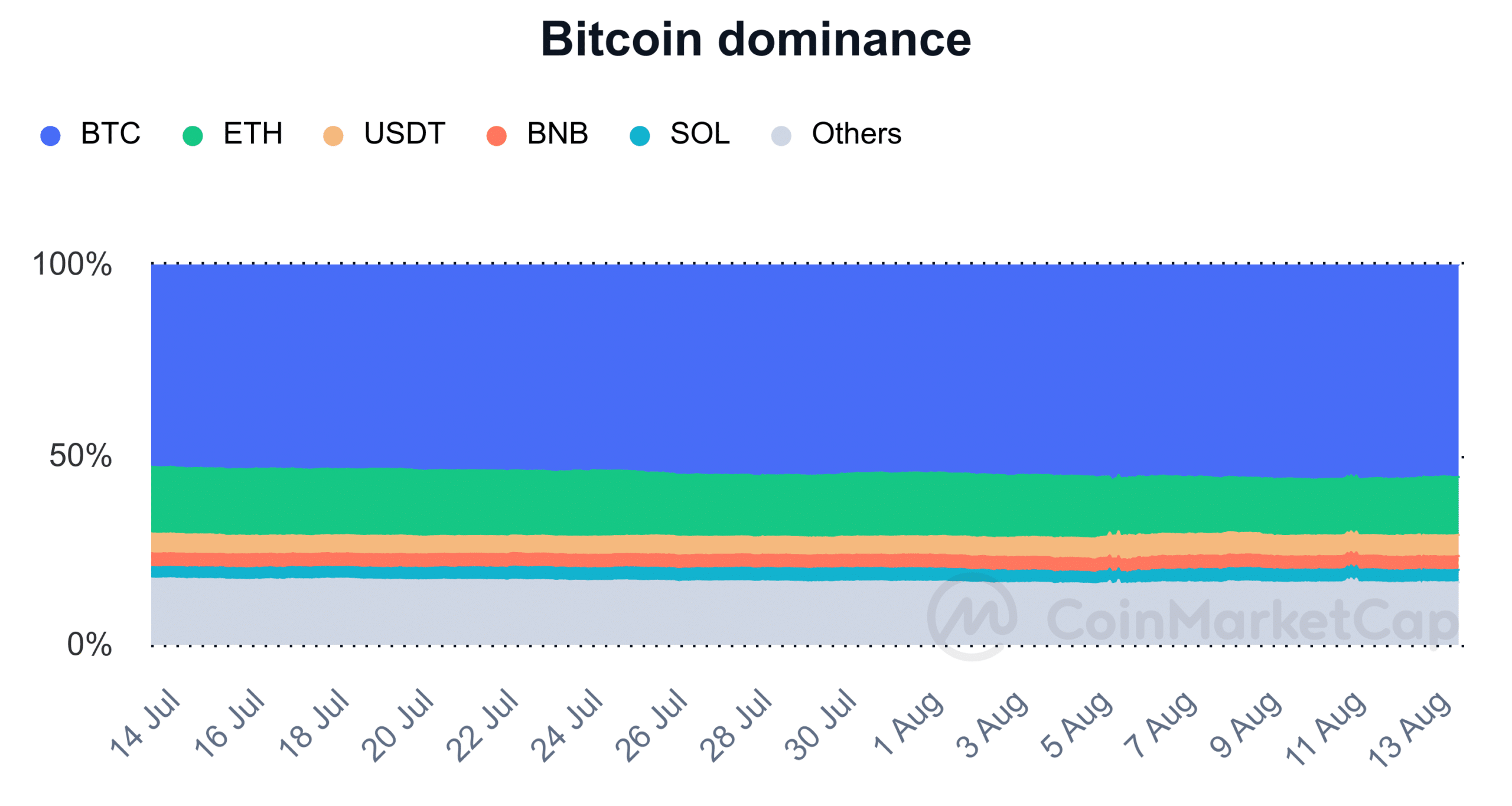

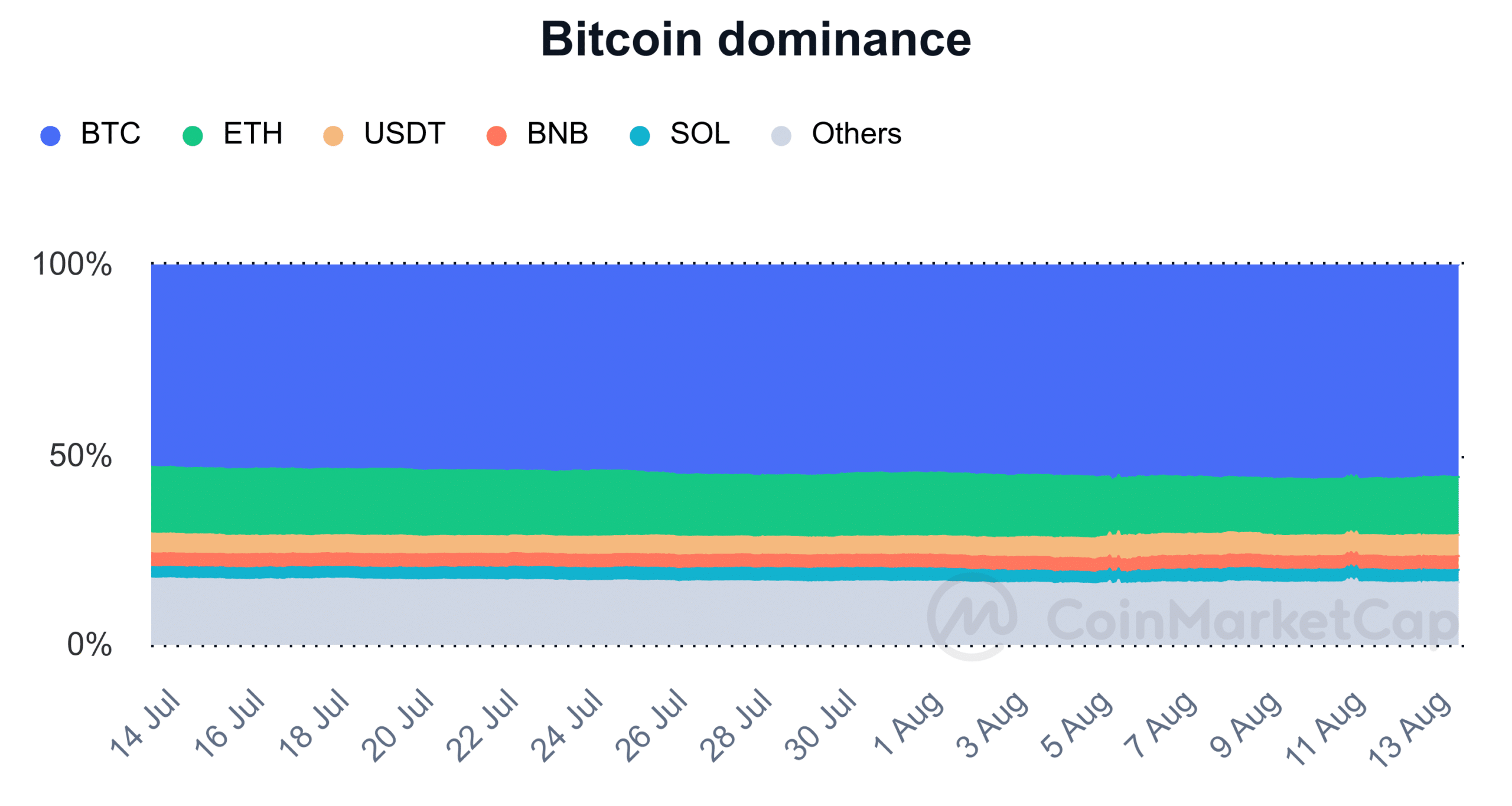

Bitcoin’s dominance in the cryptocurrency market revealed a significant downturn in August, correlating with a decrease in its price.

Data illustrated that Bitcoin’s market dominance dipped to approximately 53%, with the highest dominance recorded this month being around 56.5%.

At press time, Bitcoin’s dominance was at 55%. This was a slight recovery, attributed to a minor uptick in its price and declines in other cryptocurrencies.

Source: CoinMarketCap

The market cap trend indicated that Bitcoin accounted for over 55% of the total crypto market capitalization, totaling around $2.09 trillion.

Furthermore, Bitcoin’s market capitalization surpassed $1.1 trillion, underscoring its substantial influence within the market.

Bitcoin dominance vs. altcoin season

AMBCrypto’s analysis indicated that while Bitcoin’s dominance has experienced a decline, it has allowed a slight momentum gain for the altcoin season.

According to charts from the Blockchain Center, there has been an uptick in altcoin activity recently.

However, despite this, the market remained in a Bitcoin-dominated phase, as altcoins have yet to outperform Bitcoin consistently.

Read Bitcoin’s [BTC] Price Prediction 2024-25

For an official altcoin season to be declared, 75% of the top 50 coins must perform better than Bitcoin over the last 90 days.

Current data shows that this threshold has yet to be met, as many of these assets have also experienced declines similar to Bitcoin’s downturn.

- Bitcoin’s dominance was around 55% at press time.

- The market remained in Bitcoin season despite a drop in its dominance.

Recently, Bitcoin [BTC] has experienced significant declines, causing its price to drop below the $60,000 mark.

This downturn in Bitcoin’s price also impacted its market dominance, which decreased, giving rise to a slight momentum in the altcoin market.

Bitcoin suffers price drops

AMBCrypto’s analysis of Bitcoin on a daily timeframe chart indicated a challenging start to August. The chart showed that BTC experienced consecutive declines that dropped its price below the critical $60,000 mark.

Also, the chart showed a low cost of around $49,000, which impacted the Bitcoin dominance.

However, a notable rebound recently pushed its price back to the $60,000 range, but it has since slipped again. At the close of the latest trading session, BTC saw a modest increase of 1.08%, ending at approximately $59,358.

Source: TradingView

It continued to hover around the $59,000 level at press time, with a slight decline of less than 1%.

Furthermore, the Relative Strength Index (RSI) remained below the neutral threshold, signaling that it was still entrenched in a bearish trend.

How price decline affected the Bitcoin Dominance

Bitcoin’s dominance in the cryptocurrency market revealed a significant downturn in August, correlating with a decrease in its price.

Data illustrated that Bitcoin’s market dominance dipped to approximately 53%, with the highest dominance recorded this month being around 56.5%.

At press time, Bitcoin’s dominance was at 55%. This was a slight recovery, attributed to a minor uptick in its price and declines in other cryptocurrencies.

Source: CoinMarketCap

The market cap trend indicated that Bitcoin accounted for over 55% of the total crypto market capitalization, totaling around $2.09 trillion.

Furthermore, Bitcoin’s market capitalization surpassed $1.1 trillion, underscoring its substantial influence within the market.

Bitcoin dominance vs. altcoin season

AMBCrypto’s analysis indicated that while Bitcoin’s dominance has experienced a decline, it has allowed a slight momentum gain for the altcoin season.

According to charts from the Blockchain Center, there has been an uptick in altcoin activity recently.

However, despite this, the market remained in a Bitcoin-dominated phase, as altcoins have yet to outperform Bitcoin consistently.

Read Bitcoin’s [BTC] Price Prediction 2024-25

For an official altcoin season to be declared, 75% of the top 50 coins must perform better than Bitcoin over the last 90 days.

Current data shows that this threshold has yet to be met, as many of these assets have also experienced declines similar to Bitcoin’s downturn.

can i purchase clomid for sale where can i get generic clomid pill buying generic clomid tablets order cheap clomiphene without prescription how to buy generic clomid price get cheap clomiphene pills clomiphene one fallopian tube

More posts like this would make the online elbow-room more useful.

This is the amicable of topic I take advantage of reading.

buy azithromycin pills – zithromax for sale online order metronidazole 200mg

buy semaglutide pills – buy rybelsus cyproheptadine 4 mg us

motilium canada – buy flexeril 15mg sale purchase cyclobenzaprine sale

buy generic augmentin 375mg – atbioinfo.com buy acillin sale

buy generic nexium 40mg – https://anexamate.com/ purchase nexium pills

buy coumadin 2mg for sale – https://coumamide.com/ order cozaar 25mg pill

purchase mobic online – https://moboxsin.com/ mobic brand

buy generic deltasone – asthma buy deltasone 40mg sale

cheap erectile dysfunction pill – https://fastedtotake.com/ best erection pills

buy amoxicillin online cheap – combamoxi.com cheap amoxil

buy forcan without a prescription – site order diflucan 200mg pill

buy cenforce 100mg – this cenforce us

india pharmacy cialis – fast ciltad cialis coupon free trial

cialis prices in mexico – cialis before and after pictures tadalafil long term usage

buy zantac generic – order ranitidine generic zantac 150mg canada

cheap viagra for women – https://strongvpls.com/ buy legal viagra

This website really has all of the information and facts I needed about this thesis and didn’t positive who to ask. como se toma synthroid 50mg

The thoroughness in this break down is noteworthy. https://buyfastonl.com/furosemide.html

The vividness in this serving is exceptional. Usa pharmacy sildenafil

This website really has all of the information and facts I needed there this participant and didn’t comprehend who to ask. https://aranitidine.com/fr/ivermectine-en-france/

Thanks for putting this up. It’s understandably done.

spironolactone usa

The depth in this piece is exceptional. http://mi.minfish.com/home.php?mod=space&uid=1411824

dapagliflozin for sale – click buy generic forxiga

More articles like this would make the blogosphere richer. http://sols9.com/batheo/Forum/User-Yyvwro