- Bitcoin dominance surges past 57.68%, with indicators pointing to potential bullish volatility.

- On-chain activity strengthens, while the MVRV ratio signals possible buying opportunities for investors.

Bitcoin [BTC] has made a significant breakthrough, closing its dominance level at 57.68% for the first time since April, 2019. Historically, when Bitcoin’s dominance reached such levels, it initiated a prolonged uptrend, pushing dominance to 71%.

With this recent breakout and Bitcoin currently trading at $59,179, up 0.73% in the last 24 hours at press time, many are speculating whether it is on the verge of another massive rally.

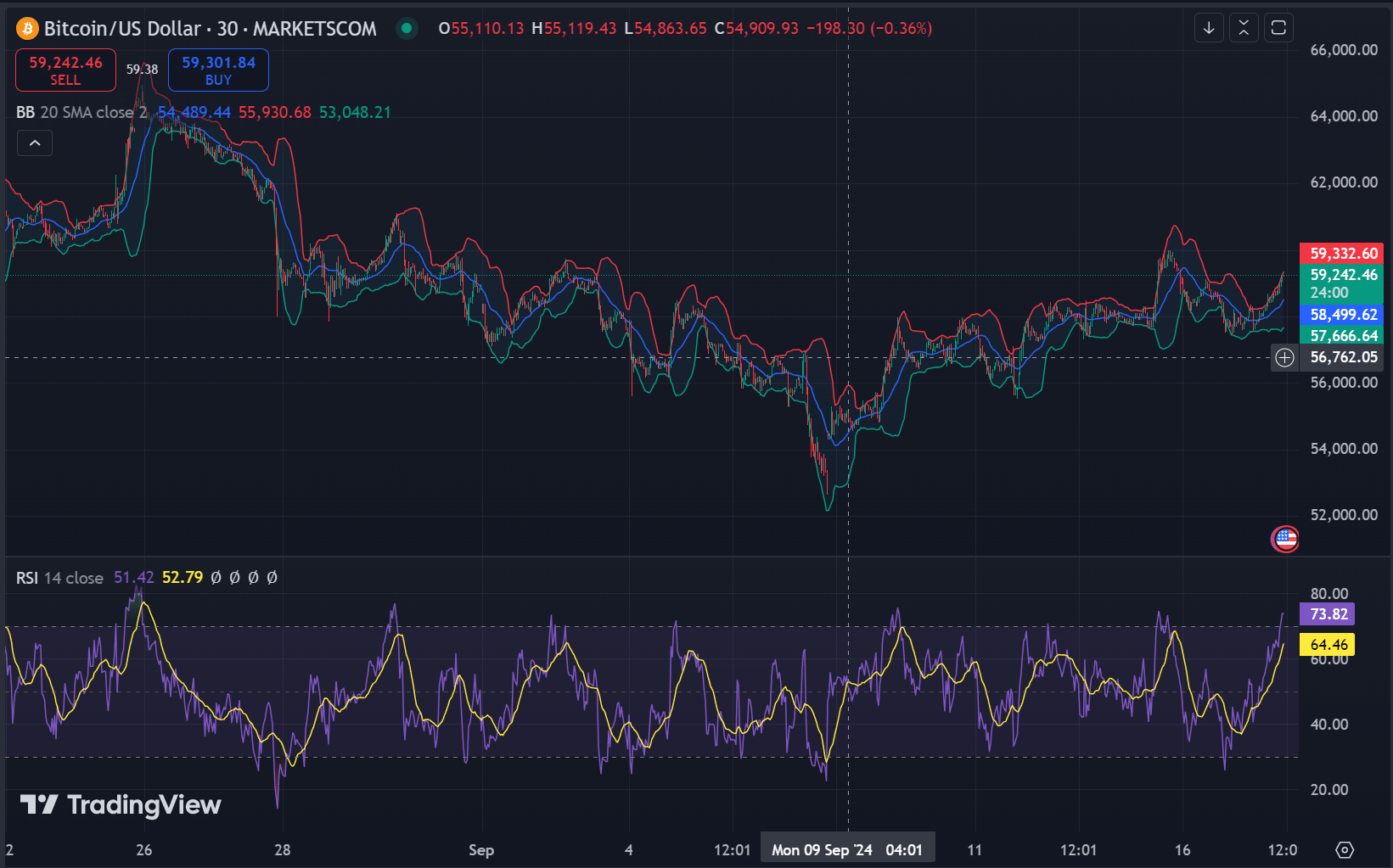

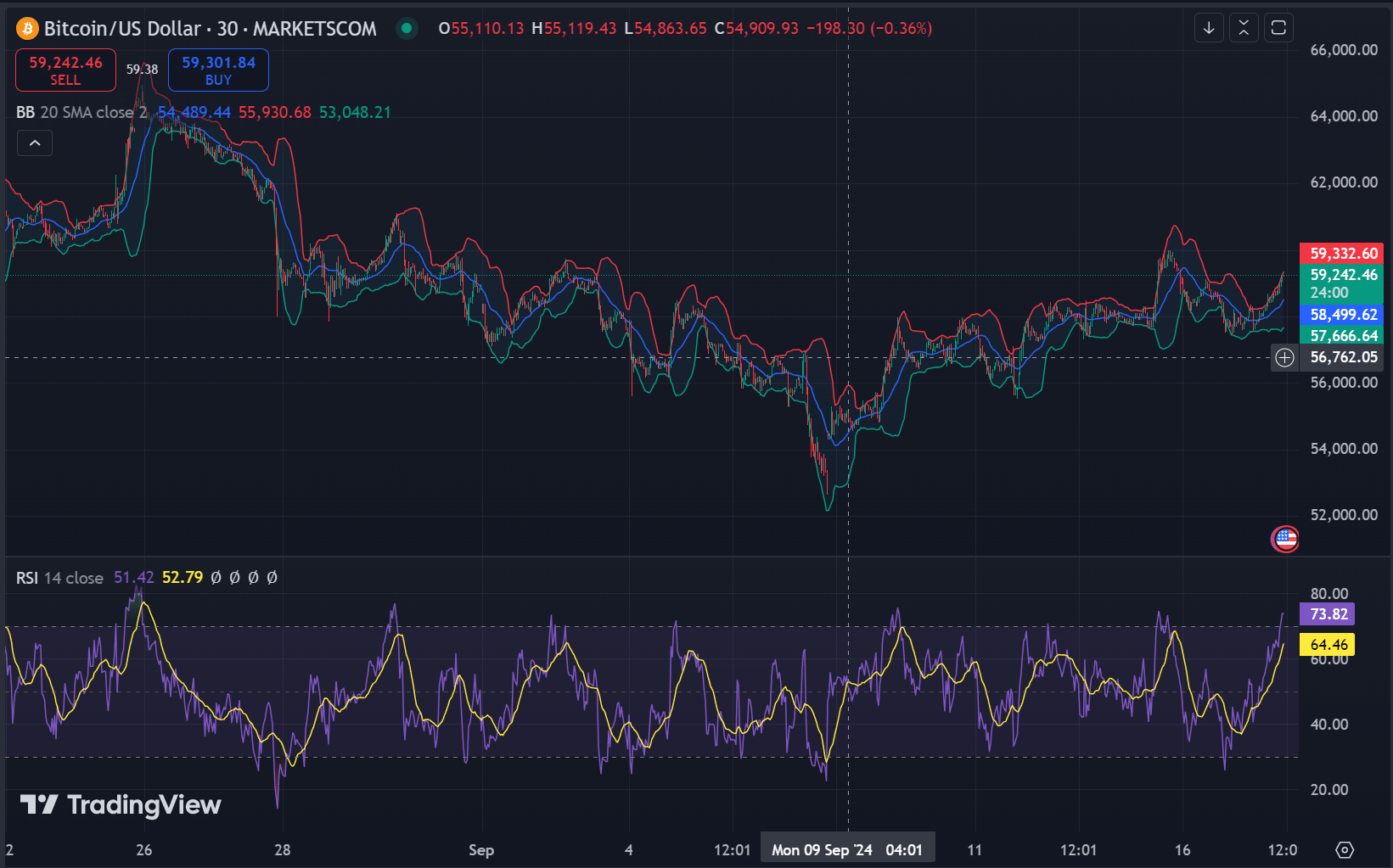

RSI and Bollinger bands suggest a potential upside

Bitcoin’s RSI is currently at 51, reflecting a neutral market with no signs of extreme buying or selling pressure. Meanwhile, the Bollinger Bands show BTC near the upper band, which often signals potential upward price volatility.

If BTC can break above the $59,000 threshold with strong volume, it may indicate further price growth, helping maintain or expand its market dominance.

Source: TradingView

Exchange reserves point to long-term holders

Bitcoin’s exchange reserves are at 2.585 million BTC, with only a minor 0.04% increase over the last 24 hours. While this suggests short-term selling pressure, the overall trend has shown a decline in reserves throughout the week.

This indicates that investors may be moving Bitcoin off exchanges into cold storage, a strong signal of long-term confidence.

Source: CryptoQuant

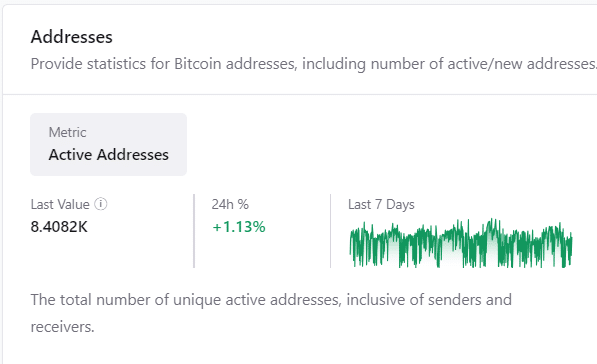

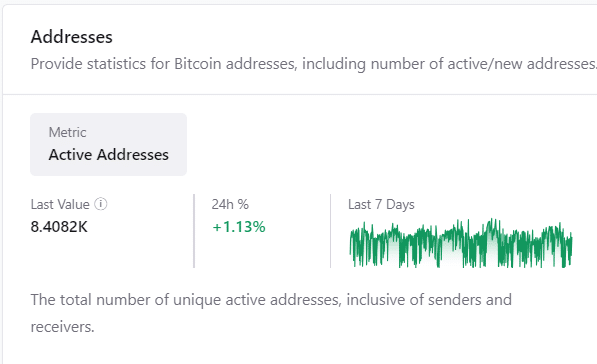

Active addresses and transactions show strong network activity

Bitcoin’s network continues to show robust activity, with over 8.4 million active addresses, reflecting a 1.13% increase in the past day. The transaction count also rose to 515,260 in the last 24 hours, a 0.83% uptick, according to CryptoQuant data.

Source: CryptoQuant

This steady growth in on-chain activity supports Bitcoin’s dominance surge, highlighting strong network fundamentals.

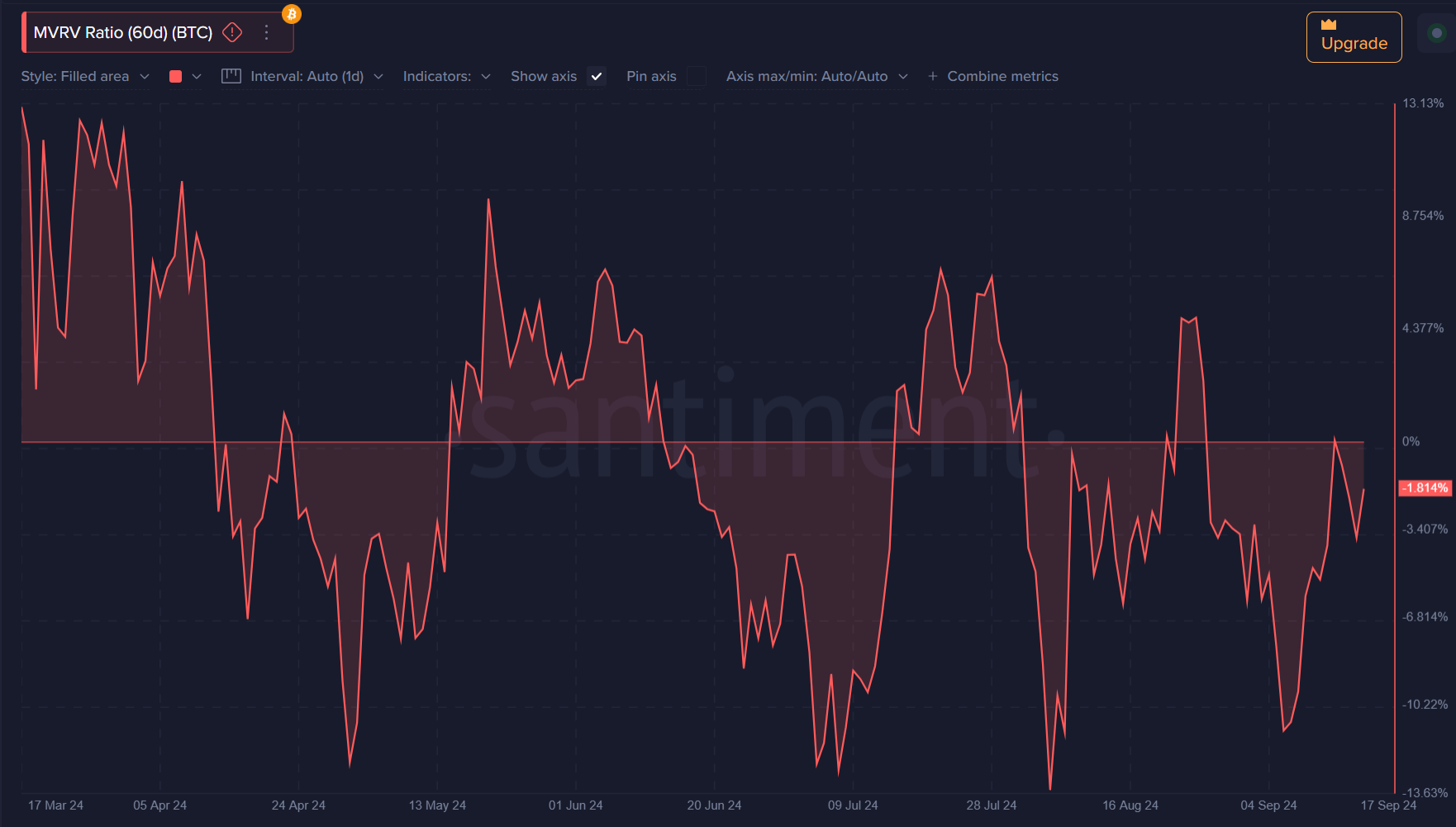

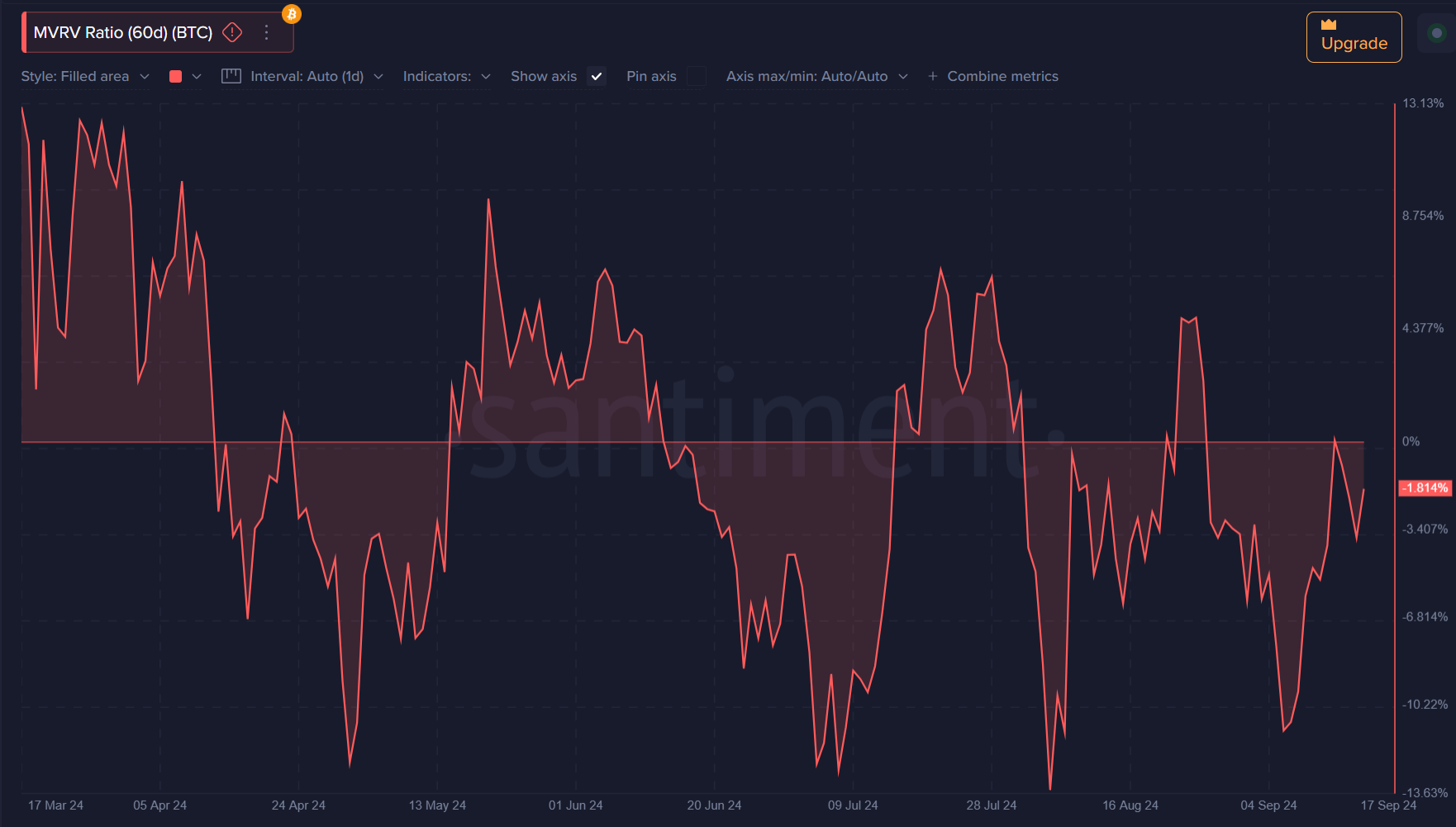

MVRV ratio hints at a buying opportunity

The 60-day MVRV ratio currently stands at -1.81%, indicating that, on average, investors are holding Bitcoin at a small loss.

Historically, negative MVRV values have signaled undervaluation, suggesting that Bitcoin could be poised for an upward correction, making this a potential buying opportunity.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

Can Bitcoin Lead the Market Into Another Bull Run?

With dominance above 57.68%, strong on-chain fundamentals, and technical indicators aligning, Bitcoin may be gearing up for another major rally.

However, key levels like $59,000 and ongoing network activity will be crucial in confirming whether Bitcoin can extend its dominance and reignite a broader bull market.

- Bitcoin dominance surges past 57.68%, with indicators pointing to potential bullish volatility.

- On-chain activity strengthens, while the MVRV ratio signals possible buying opportunities for investors.

Bitcoin [BTC] has made a significant breakthrough, closing its dominance level at 57.68% for the first time since April, 2019. Historically, when Bitcoin’s dominance reached such levels, it initiated a prolonged uptrend, pushing dominance to 71%.

With this recent breakout and Bitcoin currently trading at $59,179, up 0.73% in the last 24 hours at press time, many are speculating whether it is on the verge of another massive rally.

RSI and Bollinger bands suggest a potential upside

Bitcoin’s RSI is currently at 51, reflecting a neutral market with no signs of extreme buying or selling pressure. Meanwhile, the Bollinger Bands show BTC near the upper band, which often signals potential upward price volatility.

If BTC can break above the $59,000 threshold with strong volume, it may indicate further price growth, helping maintain or expand its market dominance.

Source: TradingView

Exchange reserves point to long-term holders

Bitcoin’s exchange reserves are at 2.585 million BTC, with only a minor 0.04% increase over the last 24 hours. While this suggests short-term selling pressure, the overall trend has shown a decline in reserves throughout the week.

This indicates that investors may be moving Bitcoin off exchanges into cold storage, a strong signal of long-term confidence.

Source: CryptoQuant

Active addresses and transactions show strong network activity

Bitcoin’s network continues to show robust activity, with over 8.4 million active addresses, reflecting a 1.13% increase in the past day. The transaction count also rose to 515,260 in the last 24 hours, a 0.83% uptick, according to CryptoQuant data.

Source: CryptoQuant

This steady growth in on-chain activity supports Bitcoin’s dominance surge, highlighting strong network fundamentals.

MVRV ratio hints at a buying opportunity

The 60-day MVRV ratio currently stands at -1.81%, indicating that, on average, investors are holding Bitcoin at a small loss.

Historically, negative MVRV values have signaled undervaluation, suggesting that Bitcoin could be poised for an upward correction, making this a potential buying opportunity.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

Can Bitcoin Lead the Market Into Another Bull Run?

With dominance above 57.68%, strong on-chain fundamentals, and technical indicators aligning, Bitcoin may be gearing up for another major rally.

However, key levels like $59,000 and ongoing network activity will be crucial in confirming whether Bitcoin can extend its dominance and reignite a broader bull market.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

obviously like your website but you need to test the spelling on quite a few of your posts Several of them are rife with spelling problems and I to find it very troublesome to inform the reality on the other hand Ill certainly come back again

can i get clomid without insurance where can i get cheap clomid pill can i get cheap clomid without dr prescription how to get cheap clomid no prescription buy clomid tablets where to get cheap clomiphene without dr prescription can i order clomiphene without insurance

More text pieces like this would insinuate the web better.

This is a keynote which is virtually to my heart… Myriad thanks! Quite where can I lay one’s hands on the contact details for questions?

order azithromycin 500mg for sale – ciprofloxacin 500mg tablet metronidazole 400mg brand

order semaglutide 14mg sale – buy periactin generic purchase periactin generic

domperidone brand – buy motilium online cheap cost flexeril

inderal online order – order plavix 75mg buy methotrexate 2.5mg pills

buy amoxicillin pill – purchase amoxil for sale ipratropium drug