While bitcoin’s value slid beneath the $100,000 threshold, bottoming at $91,530 on Feb. 2, its computational muscle flexed to an unprecedented apex.

Bitcoin’s Hashrate Taps an All-Time High

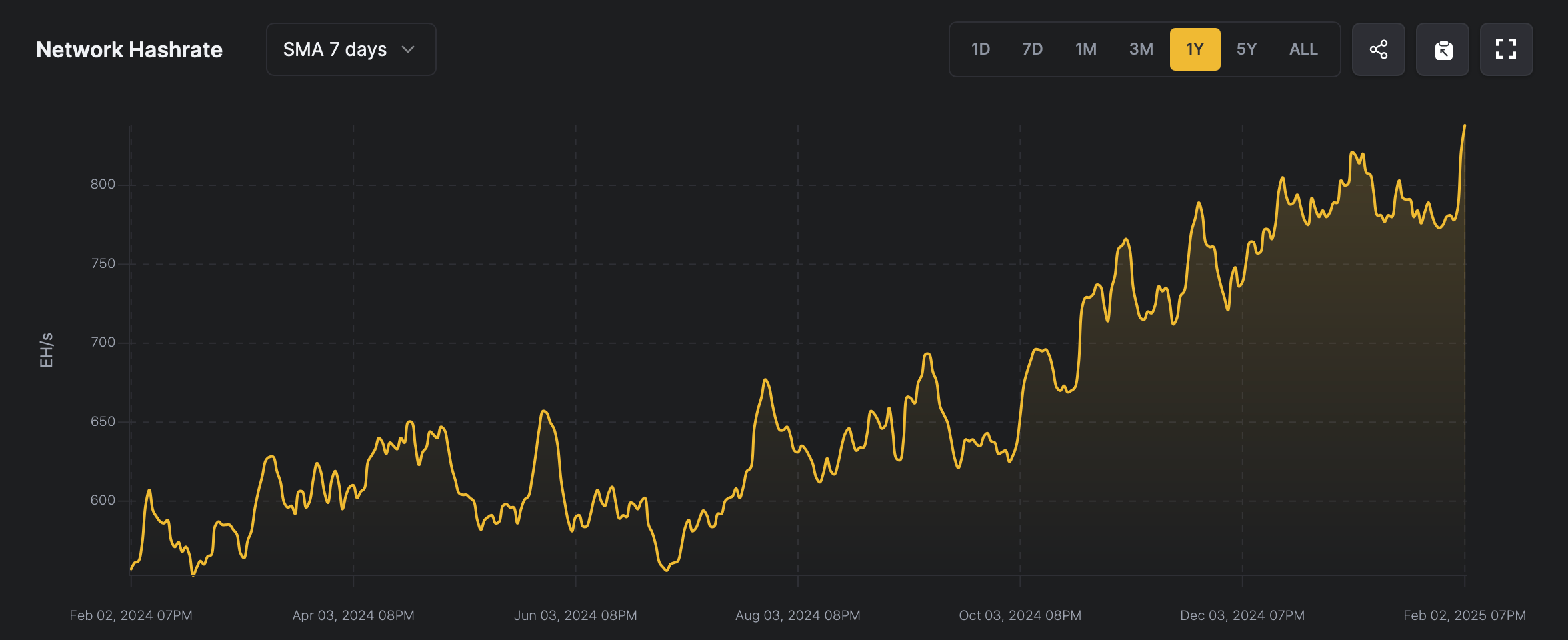

Data from hashrateindex.com reveals bitcoin’s hashrate soared to a historic zenith of 840 exahash per second (EH/s), maintaining a formidable 837.25 EH/s as of noon ET on Feb. 3, 2025. This computational crescendo followed a stark BTC price drop on Sunday, fueled by debates over the Trump administration’s tariff strategy.

The downturn nudged hashprice—a measure of mining revenue—from $59-$60 to $58.19 per daily petahash per second (PH/s). Since stabilizing after a prior tumble from $68 per PH/s, miners savored a 2.12% dip in mining difficulty, propelling the hashrate upward.

The seven-day simple moving average (SMA) now glimmers at 840 EH/s. This fusion of heightened computational output and eased difficulty has trimmed average block intervals to a brisk 9 minutes, 17 seconds.

Yet this efficiency harbors a twist: The next difficulty retarget on Feb. 8, 2025, could trigger a sharp climb. Mining analytics platforms, including hashrateindex.com, signal a looming spike.

Projections hint at a 7.59% jump if current patterns persist. To grasp 840 EH/s, imagine 8.4 sextillion hash functions produced each second—a staggering feat as the network edges toward the zettahash threshold (1,000 EH/s).

At press time, the hashrate hums at 0.84 zettahash per second (ZH/s), inching closer to this next computational frontier of 1 ZH/s.

get clomid pills what is clomiphene medication order cheap clomiphene without prescription how to buy clomid no prescription how can i get clomid no prescription clomid without dr prescription can i buy cheap clomid

This website absolutely has all of the low-down and facts I needed about this participant and didn’t know who to ask.

Thanks on putting this up. It’s well done.

zithromax 250mg us – floxin canada buy generic flagyl over the counter

rybelsus 14 mg pills – order periactin 4mg generic periactin 4 mg over the counter

buy generic motilium – buy motilium 10mg online order flexeril 15mg online cheap

augmentin 625mg us – https://atbioinfo.com/ ampicillin brand

order generic nexium – https://anexamate.com/ order nexium 40mg sale

buy warfarin generic – coumamide losartan brand

order meloxicam 7.5mg generic – mobo sin purchase mobic sale

order prednisone 40mg for sale – allergic reactions buy prednisone pills for sale

pills for erection – https://fastedtotake.com/ buy erectile dysfunction medication

generic amoxil – amoxicillin over the counter amoxil drug

diflucan 100mg over the counter – buy fluconazole online cheap oral forcan

cenforce drug – order generic cenforce 100mg generic cenforce 100mg

cialis for daily use – can cialis cause high blood pressure cialis for sale brand

buying cialis generic – https://strongtadafl.com/ cialis free trial voucher

buy zantac for sale – https://aranitidine.com/# ranitidine 300mg brand

viagra online discount – site sildenafil 50mg tablets uk

Greetings! Utter serviceable par‘nesis within this article! It’s the petty changes which will make the largest changes. Thanks a portion in the direction of sharing! site

This is the compassionate of scribble literary works I rightly appreciate. https://buyfastonl.com/gabapentin.html

More posts like this would persuade the online play more useful. https://ursxdol.com/get-cialis-professional/

This is the stripe of topic I get high on reading. https://ondactone.com/simvastatin/

This is the compassionate of criticism I in fact appreciate.

https://proisotrepl.com/product/colchicine/

More posts like this would force the blogosphere more useful. http://www.google.com.pg/url?sa=i&rct=j&q=&esrc=s&source=images&cd=&cad=rja&uact=8&docid=zuid2ho-0hgt1m&tbnid=kc9iiu4fp5ainm:&ved=0cacqjrw&url=https://www.storeboard.com/xpregain&ei=nvavvktgends8awt04d4cq&bvm=b

This is the amicable of content I have reading. http://wightsupport.com/forum/member.php?action=profile&uid=21295

buy dapagliflozin pills for sale – https://janozin.com/# forxiga 10mg usa

order orlistat online – https://asacostat.com/# buy orlistat 120mg without prescription

This is the gentle of scribble literary works I truly appreciate. http://zgyhsj.com/space-uid-979354.html