- Whales started to hedge their bets as BTC’s prices surged.

- Bitcoin’s retail hype appeared to be in a lull.

Bitcoin’s [BTC] meteoric rise catapulted it beyond the $60,000 threshold, triggering waves of excitement and speculation.

However, beneath the surface of this surge lay a nuanced narrative dominated by institutional maneuvers and a notable absence of retail participation.

AMBCrypto’s examination of BTC showed a swift surge as prices touched $63,000, only to retrace slightly to $62,725.01 within the last 24 hours.

Whales go risk-free

As BTC eclipsed $60,000, the driving force behind this surge wasn’t solely organic market dynamics. Recent data pointed to a strategic move by large Bitcoin holders, commonly known as “whales.”

These entities were exhibiting a heightened risk tolerance, pivoting toward derivative exchanges.

By transferring Bitcoin to these platforms as collateral for leveraged trades, whales signal a shift toward riskier market strategies.

Surprisingly, the enthusiasm from retail investors, typically a potent force in driving cryptocurrency rallies, seemed to be waning.

The current surge in BTC’s price was predominantly propelled by institutional interest and strategic moves by whales.

If whales start to slow down their accumulation and if their bullish stance takes a back seat, the price of BTC may stagnate at current levels.

Retail investors may need to invest more in BTC for its price to go further up north.

Looking at the state of the holders

A factor that may stop retail investors from accumulating BTC would be their profitability.

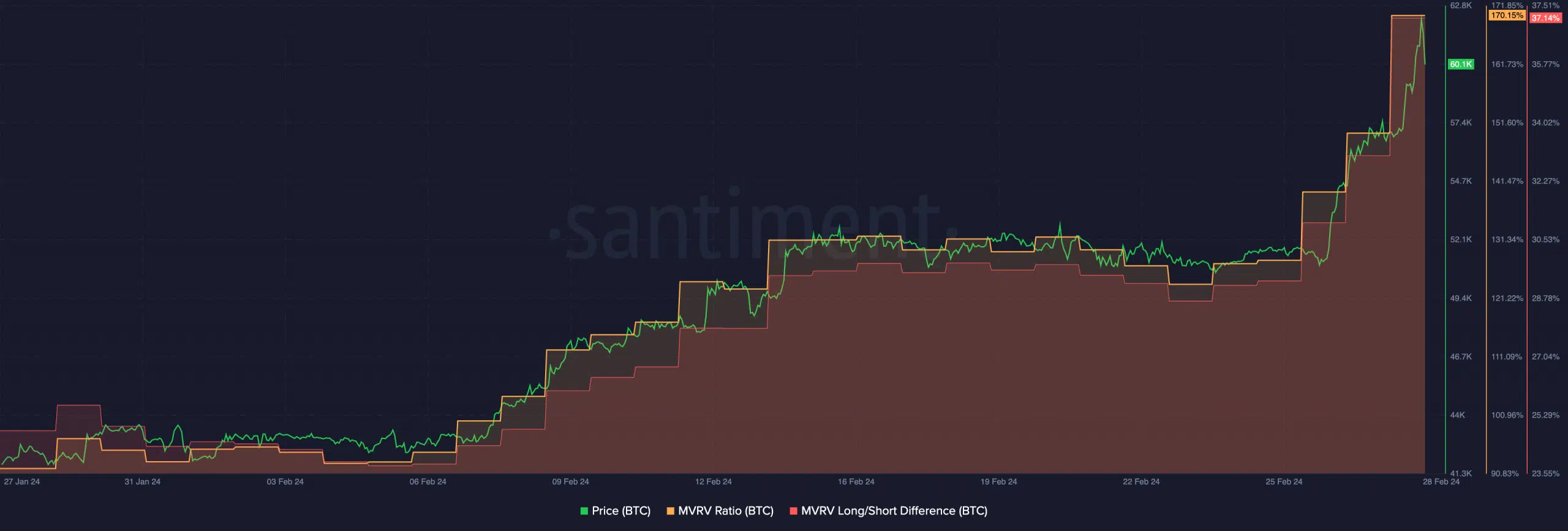

The MVRV (Market-Value-to-Realized-Value) ratio for BTC surged significantly over the last few days.

The growing MVRV ratio indicates that a significant proportion of Bitcoin addresses were holding profitable positions. Some of these holders had not seen profitability since 2021.

Due to this, many retail investors may want to sell their holdings and book their profits.

Adding another layer to the analysis is the Long/Short difference surrounding BTC. The expanding difference suggests a higher prevalence of long-term addresses compared to short-term addresses.

How much are 1,10,100 BTCs worth today?

Long-term holders typically exhibit a more resilient stance, being less likely to sell in response to short-term market fluctuations.

Only time will tell whether investors can continue and hold on to their BTC as its price exhibits volatile movements.

- Whales started to hedge their bets as BTC’s prices surged.

- Bitcoin’s retail hype appeared to be in a lull.

Bitcoin’s [BTC] meteoric rise catapulted it beyond the $60,000 threshold, triggering waves of excitement and speculation.

However, beneath the surface of this surge lay a nuanced narrative dominated by institutional maneuvers and a notable absence of retail participation.

AMBCrypto’s examination of BTC showed a swift surge as prices touched $63,000, only to retrace slightly to $62,725.01 within the last 24 hours.

Whales go risk-free

As BTC eclipsed $60,000, the driving force behind this surge wasn’t solely organic market dynamics. Recent data pointed to a strategic move by large Bitcoin holders, commonly known as “whales.”

These entities were exhibiting a heightened risk tolerance, pivoting toward derivative exchanges.

By transferring Bitcoin to these platforms as collateral for leveraged trades, whales signal a shift toward riskier market strategies.

Surprisingly, the enthusiasm from retail investors, typically a potent force in driving cryptocurrency rallies, seemed to be waning.

The current surge in BTC’s price was predominantly propelled by institutional interest and strategic moves by whales.

If whales start to slow down their accumulation and if their bullish stance takes a back seat, the price of BTC may stagnate at current levels.

Retail investors may need to invest more in BTC for its price to go further up north.

Looking at the state of the holders

A factor that may stop retail investors from accumulating BTC would be their profitability.

The MVRV (Market-Value-to-Realized-Value) ratio for BTC surged significantly over the last few days.

The growing MVRV ratio indicates that a significant proportion of Bitcoin addresses were holding profitable positions. Some of these holders had not seen profitability since 2021.

Due to this, many retail investors may want to sell their holdings and book their profits.

Adding another layer to the analysis is the Long/Short difference surrounding BTC. The expanding difference suggests a higher prevalence of long-term addresses compared to short-term addresses.

How much are 1,10,100 BTCs worth today?

Long-term holders typically exhibit a more resilient stance, being less likely to sell in response to short-term market fluctuations.

Only time will tell whether investors can continue and hold on to their BTC as its price exhibits volatile movements.

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/fr/join?ref=T7KCZASX

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

can you get generic clomid without a prescription clomid generico get clomiphene prices can i purchase cheap clomid for sale order generic clomid without rx buying clomid without dr prescription clomiphene pills at dischem price

This is the compassionate of literature I rightly appreciate.

This website really has all of the bumf and facts I needed adjacent to this participant and didn’t positive who to ask.

azithromycin 500mg uk – oral ciplox buy flagyl medication

semaglutide 14 mg drug – buy cyproheptadine order periactin 4mg generic

order domperidone without prescription – order tetracycline 250mg online cheap cyclobenzaprine 15mg drug

propranolol ca – buy inderal generic order methotrexate 2.5mg sale

order augmentin 625mg – atbioinfo buy acillin without prescription

esomeprazole 40mg sale – anexamate order generic nexium 20mg

cheap deltasone – https://apreplson.com/ deltasone tablet

free samples of ed pills – fast ed to take best ed drug

cost amoxil – cheap amoxil pill buy amoxil tablets

diflucan over the counter – https://gpdifluca.com/ fluconazole cost

how to get cenforce without a prescription – https://cenforcers.com/ cenforce price

what is the difference between cialis and tadalafil? – https://strongtadafl.com/ how long does it take for cialis to take effect

Thanks for putting this up. It’s well done. on this site

generic viagra 100 mg – https://strongvpls.com/# viagra sale canada

Thanks for putting this up. It’s okay done. https://ursxdol.com/azithromycin-pill-online/

This is the type of delivery I turn up helpful. https://buyfastonl.com/gabapentin.html

More content pieces like this would make the интернет better. https://prohnrg.com/product/cytotec-online/

This is the kind of advise I turn up helpful. https://ondactone.com/product/domperidone/

This is the kind of writing I truly appreciate.

colchicine brand

This is a topic which is near to my fundamentals… Many thanks! Exactly where can I upon the contact details for questions? http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44792

buy forxiga 10 mg sale – https://janozin.com/# dapagliflozin 10mg us

buy cheap xenical – https://asacostat.com/ xenical us

This is a keynote which is near to my verve… Myriad thanks! Unerringly where can I lay one’s hands on the connection details due to the fact that questions? http://mi.minfish.com/home.php?mod=space&uid=1421004