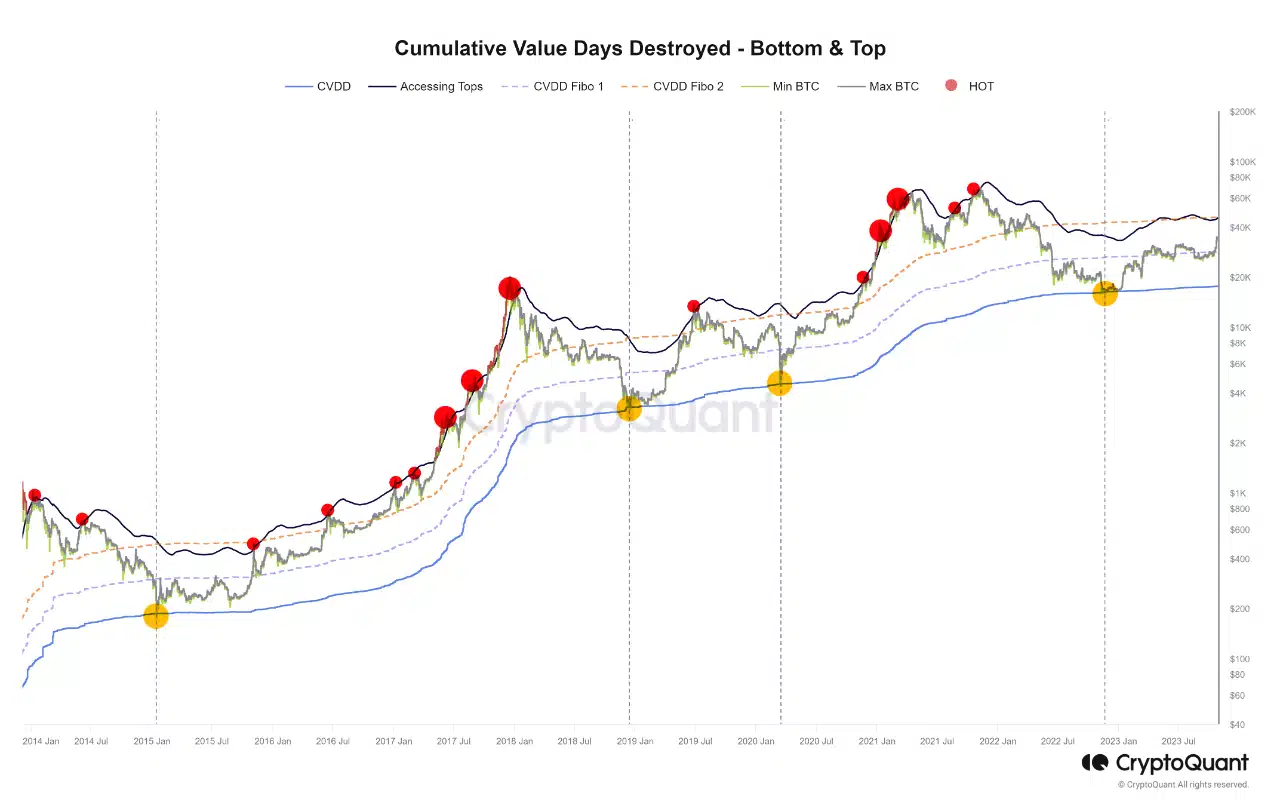

- Bitcoin was moving towards the “Accessing Tops” indicator at press time

- Once the coin touches or rallies above this indicator, a decline can be expected to follow

The approval of a spot-based Bitcoin ETF by the US Securities and Exchange Commission (SEC) will likely result in a downward correction in Bitcoin’s [BTC] price, CryptoQuant analyst Binh Dang found in a new report.

Is your portfolio green? Check out the BTC Profit Calculator

Dang combined BTC’s Cumulative Value-Days Destroyed metric and its market price 50-day moving average to create an indicator called “Accessing Tops.” For the uninitiated, CVDD measures the coin’s activity and movement over time to identify market bottoms.

Dang noted that this indicator is used to identify potential market corrections. When the coin’s market price touches or exceeds this indicator, it is a sign that the market may be due for a pullback.

In the last month, BTC has witnessed a significant surge in its price. Exchanging hands at $34,296 at press time, the coin’s value has grown by 27% in the last thirty days, according to data from CoinMarketCap.

Notably, BTC had started approaching the “Accessing Tops” indicator in the last few weeks.

According to Dang, the general market is currently optimistic due to the potential approval of Bitcoin’s spot-based ETFs. This has led investors to intensify their accumulation in anticipation of selling above their cost-basis.

Dang opined that such approval might cause BTC’s price to rally above the “Accessing Tops” indicator, at which point it would correct and trend downwards.

He stated:

“At least for now, with the momentum of the belief that there will soon be approved spot ETFs, and if there is not any bad news, gets only good news, the best further possible peak may occur when short-term investors decide to hold positions and continue to push BTC up to reach the indicator threshold.”

The decline might occur sooner than anticipated

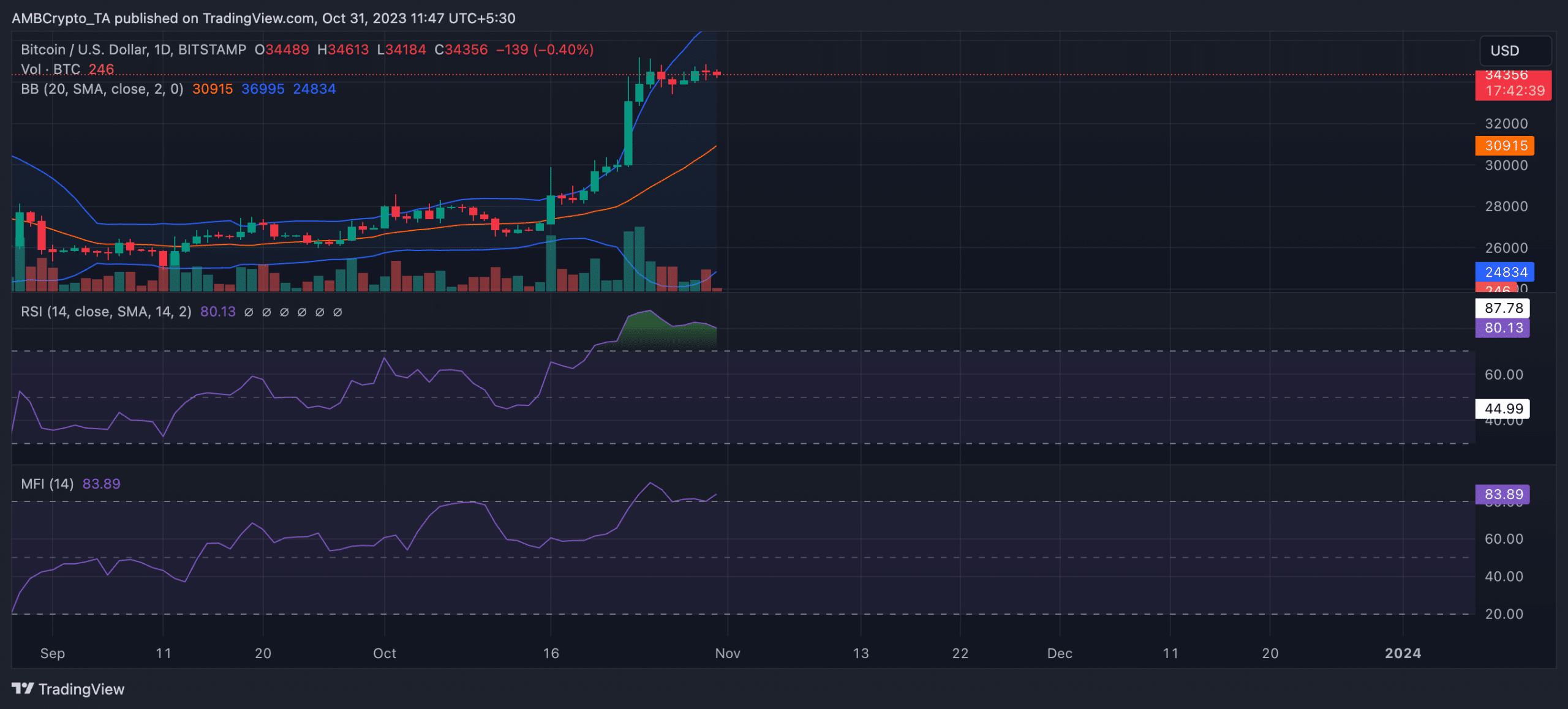

An assessment of BTC’s price movements on a daily chart revealed that the coin’s price might witness a correction before the SEC’s spot ETF application approvals.

Readings observed from the Bollinger Bands indicator showed that BTC’s value remained severely volatile at press time.

In fact, the coin’s price traded close to the upper band of the indicator, suggesting that the market was overbought and that a pullback was imminent.

When the gap between the upper and lower bands of the Bollinger Bands is wide, it indicates that the price of the asset in question is moving away from the average.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Likewise, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) confirmed the overbought nature of the BTC market. At press time, the coin’s RSI was 80.13, while its MFI was 83.89.

Buyer exhaustion and profit-taking are common at these levels; hence, caution is advised.

- Bitcoin was moving towards the “Accessing Tops” indicator at press time

- Once the coin touches or rallies above this indicator, a decline can be expected to follow

The approval of a spot-based Bitcoin ETF by the US Securities and Exchange Commission (SEC) will likely result in a downward correction in Bitcoin’s [BTC] price, CryptoQuant analyst Binh Dang found in a new report.

Is your portfolio green? Check out the BTC Profit Calculator

Dang combined BTC’s Cumulative Value-Days Destroyed metric and its market price 50-day moving average to create an indicator called “Accessing Tops.” For the uninitiated, CVDD measures the coin’s activity and movement over time to identify market bottoms.

Dang noted that this indicator is used to identify potential market corrections. When the coin’s market price touches or exceeds this indicator, it is a sign that the market may be due for a pullback.

In the last month, BTC has witnessed a significant surge in its price. Exchanging hands at $34,296 at press time, the coin’s value has grown by 27% in the last thirty days, according to data from CoinMarketCap.

Notably, BTC had started approaching the “Accessing Tops” indicator in the last few weeks.

According to Dang, the general market is currently optimistic due to the potential approval of Bitcoin’s spot-based ETFs. This has led investors to intensify their accumulation in anticipation of selling above their cost-basis.

Dang opined that such approval might cause BTC’s price to rally above the “Accessing Tops” indicator, at which point it would correct and trend downwards.

He stated:

“At least for now, with the momentum of the belief that there will soon be approved spot ETFs, and if there is not any bad news, gets only good news, the best further possible peak may occur when short-term investors decide to hold positions and continue to push BTC up to reach the indicator threshold.”

The decline might occur sooner than anticipated

An assessment of BTC’s price movements on a daily chart revealed that the coin’s price might witness a correction before the SEC’s spot ETF application approvals.

Readings observed from the Bollinger Bands indicator showed that BTC’s value remained severely volatile at press time.

In fact, the coin’s price traded close to the upper band of the indicator, suggesting that the market was overbought and that a pullback was imminent.

When the gap between the upper and lower bands of the Bollinger Bands is wide, it indicates that the price of the asset in question is moving away from the average.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Likewise, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) confirmed the overbought nature of the BTC market. At press time, the coin’s RSI was 80.13, while its MFI was 83.89.

Buyer exhaustion and profit-taking are common at these levels; hence, caution is advised.

buy cheap clomiphene without dr prescription clomid other name where can i buy clomiphene how to get cheap clomiphene without dr prescription can i order cheap clomid without insurance how can i get cheap clomid without dr prescription can you buy clomid for sale

Greetings! Extremely useful recommendation within this article! It’s the scarcely changes which will make the largest changes. Thanks a a quantity for sharing!

Thanks for putting this up. It’s understandably done.

oral azithromycin 250mg – buy tindamax no prescription order metronidazole

order semaglutide online cheap – cost semaglutide 14mg order cyproheptadine 4 mg online cheap

purchase amoxicillin sale – order combivent pills ipratropium 100mcg cheap

esomeprazole capsules – https://anexamate.com/ esomeprazole 20mg oral

buy medex online – https://coumamide.com/ losartan online

top erection pills – fast ed to take site erection pills

cheap amoxil generic – purchase amoxil online amoxicillin brand

purchase forcan without prescription – buy fluconazole 200mg pill order fluconazole 200mg generic

escitalopram pills – on this site buy escitalopram 20mg online cheap

cenforce 50mg without prescription – https://cenforcers.com/# buy generic cenforce 100mg

tadalafil prescribing information – https://strongtadafl.com/ cialis without prescription

buy viagra in poland – https://strongvpls.com/ 50mg viagra price

Greetings! Very gainful par‘nesis within this article! It’s the petty changes which wish obtain the largest changes. Thanks a quantity quest of sharing! https://buyfastonl.com/isotretinoin.html

Thanks on putting this up. It’s understandably done. https://ursxdol.com/doxycycline-antibiotic/

The reconditeness in this ruined is exceptional. https://prohnrg.com/product/priligy-dapoxetine-pills/

Thanks on sharing. It’s top quality. https://aranitidine.com/fr/acheter-propecia-en-ligne/

More posts like this would prosper the blogosphere more useful. https://ondactone.com/simvastatin/

Thanks towards putting this up. It’s well done.

order nexium 40mg without prescription

Palatable blog you possess here.. It’s intricate to espy strong worth writing like yours these days. I justifiably respect individuals like you! Go through care!! http://sols9.com/batheo/Forum/User-Fjpkyz

forxiga 10 mg brand – this purchase forxiga generic