- Bitcoin’s price faced a bearish downturn after surpassing $66,000, raising market uncertainty.

- Technical indicators suggested bullish sentiment, but potential trend reversal looms with rising volatility.

After surging past the $66,000 milestone, sparking excitement across the crypto community, and fueling hopes for an imminent bull run, Bitcoin [BTC] found itself under a bearish cloud.

According to the latest data from CoinMarketCap, BTC was trading at $64,519, after a 1.65% dip in the last 24 hours.

This sudden downturn has tempered the optimism of many investors, leaving the market uncertain about what lies ahead for the leading cryptocurrency.

Bitcoin turns bearish

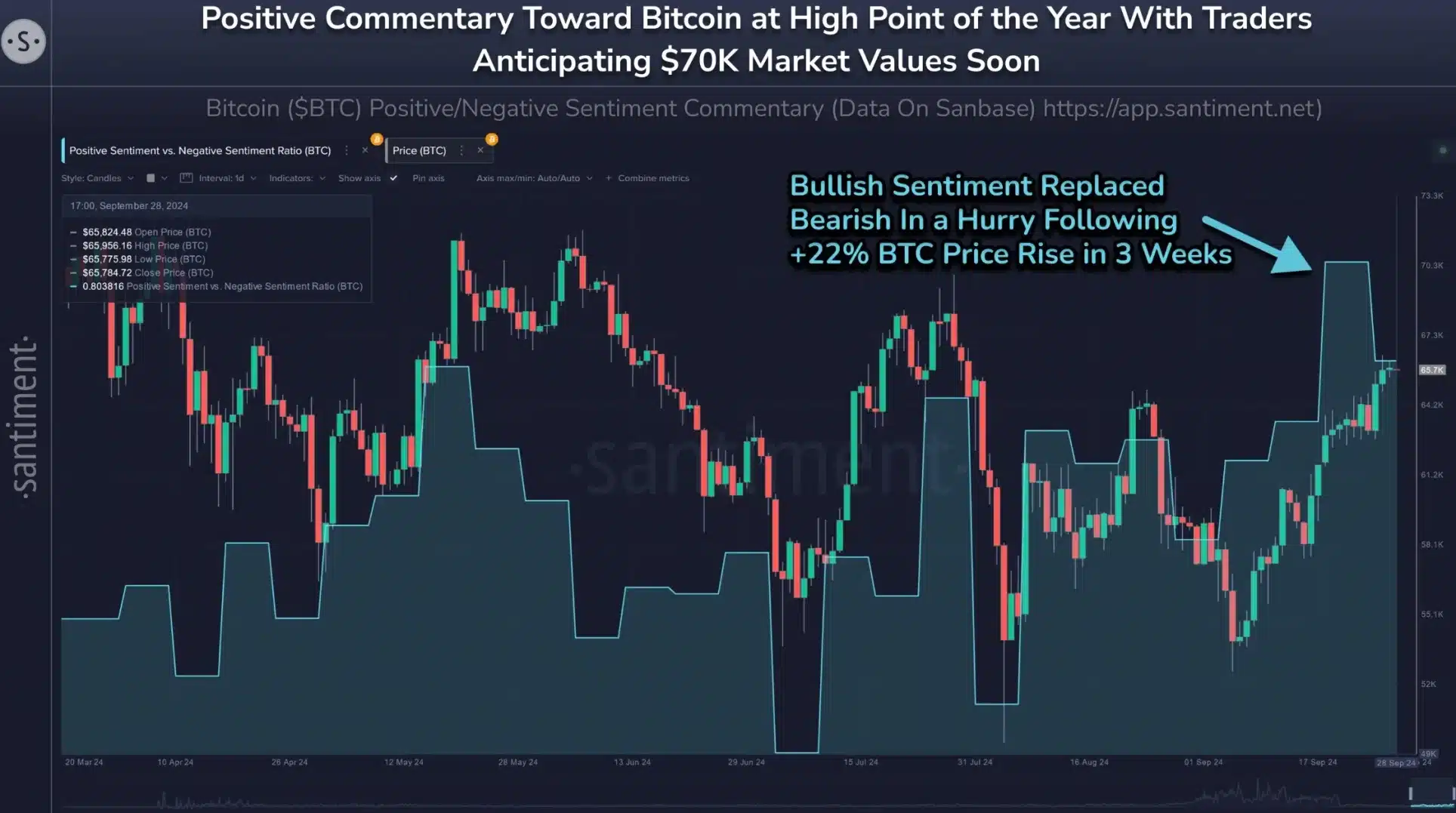

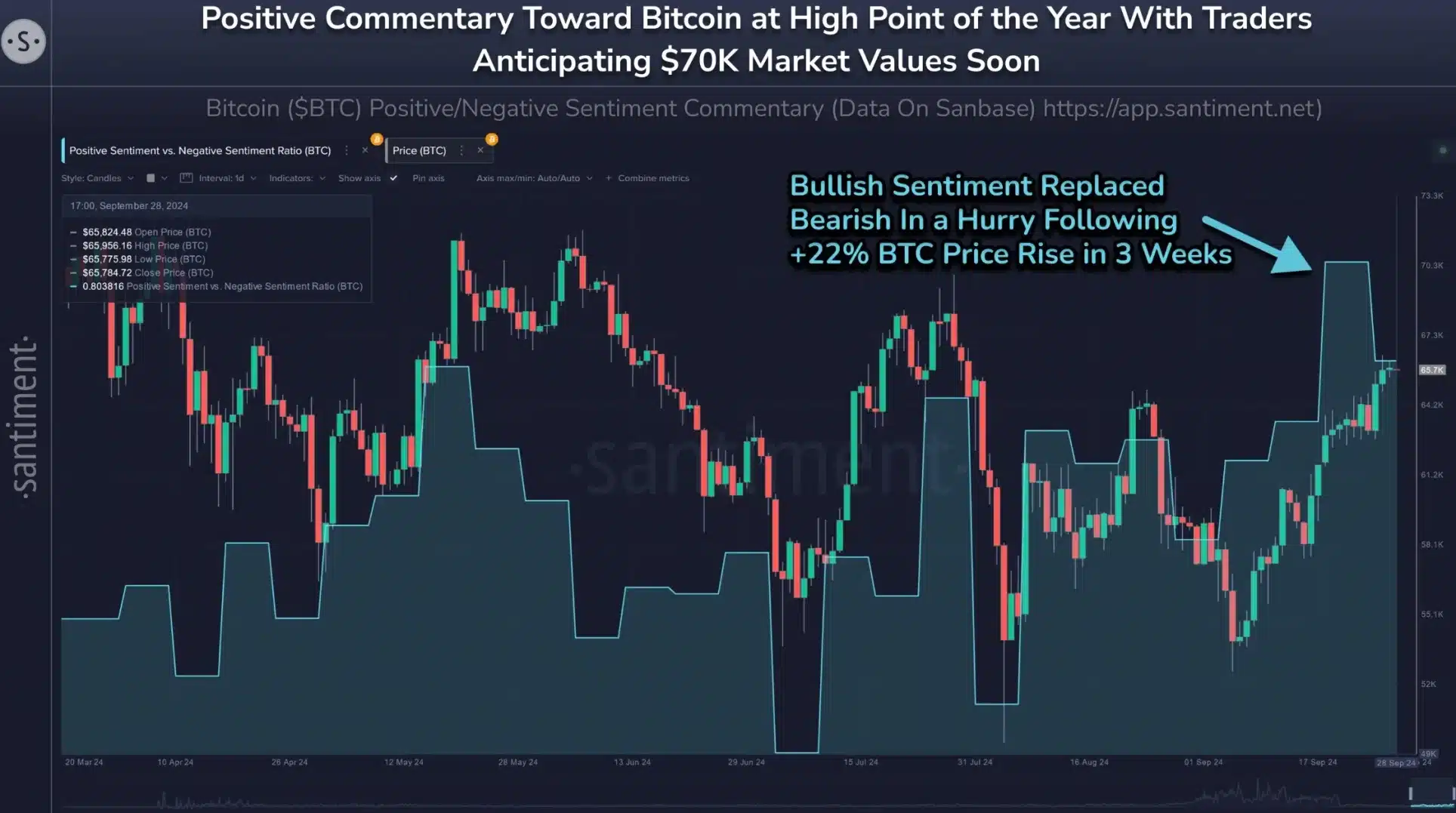

Noticing the bearish divergence, on-chain analytics platform Santiment shared its insights on X (formerly Twitter) on the 29th of September and noted,

“If you’re awaiting Bitcoin’s new all-time high, it may need to wait until the crowd slows down their own expectations.”

Source: Santiment/X

In its latest post, Santiment emphasized that there are now approximately “1.8 bullish posts toward BTC for every 1 bearish post”, reflecting the ongoing optimism despite recent market downturns.

This was further confirmed by Jameson Lopp, Chief Security Officer at Casa, who said,

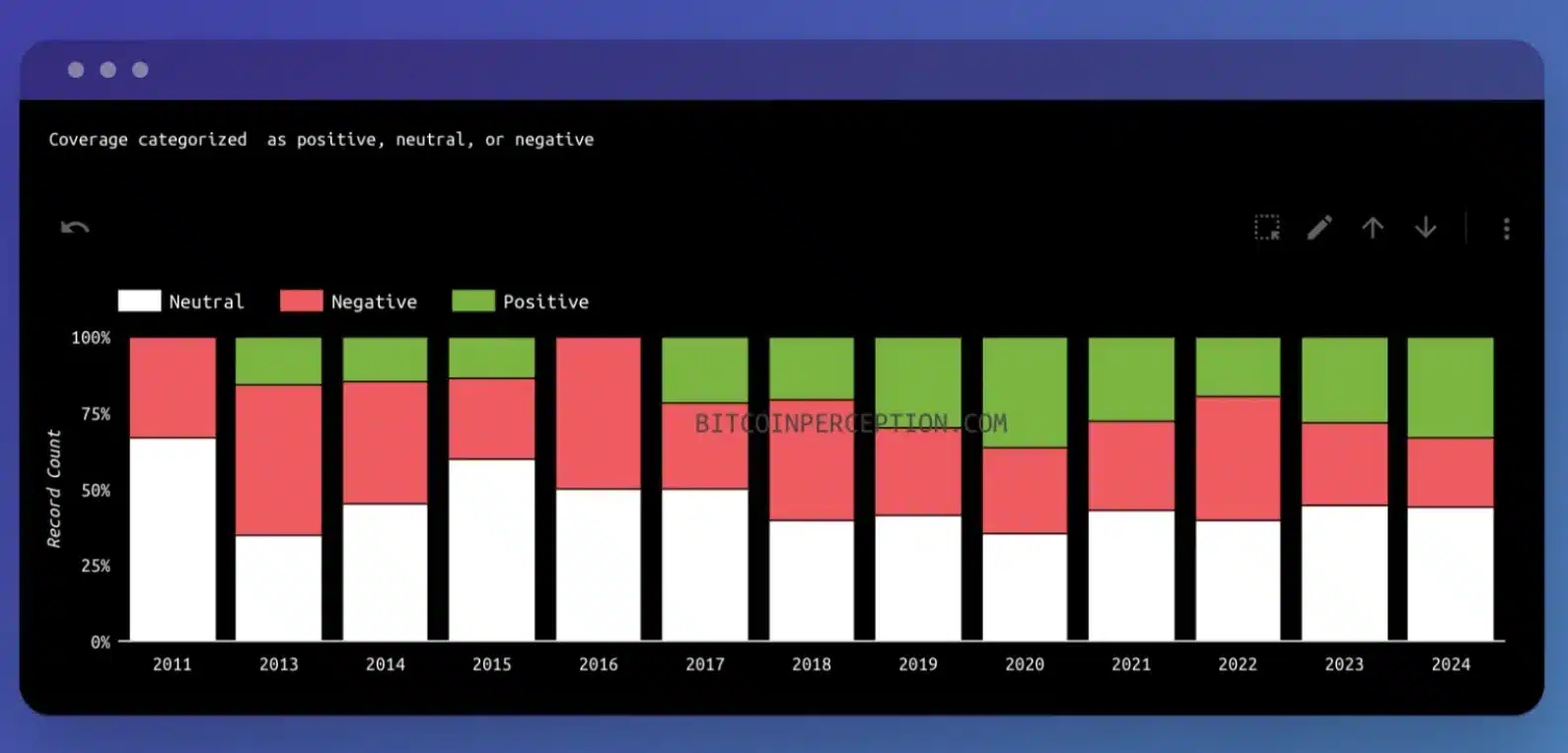

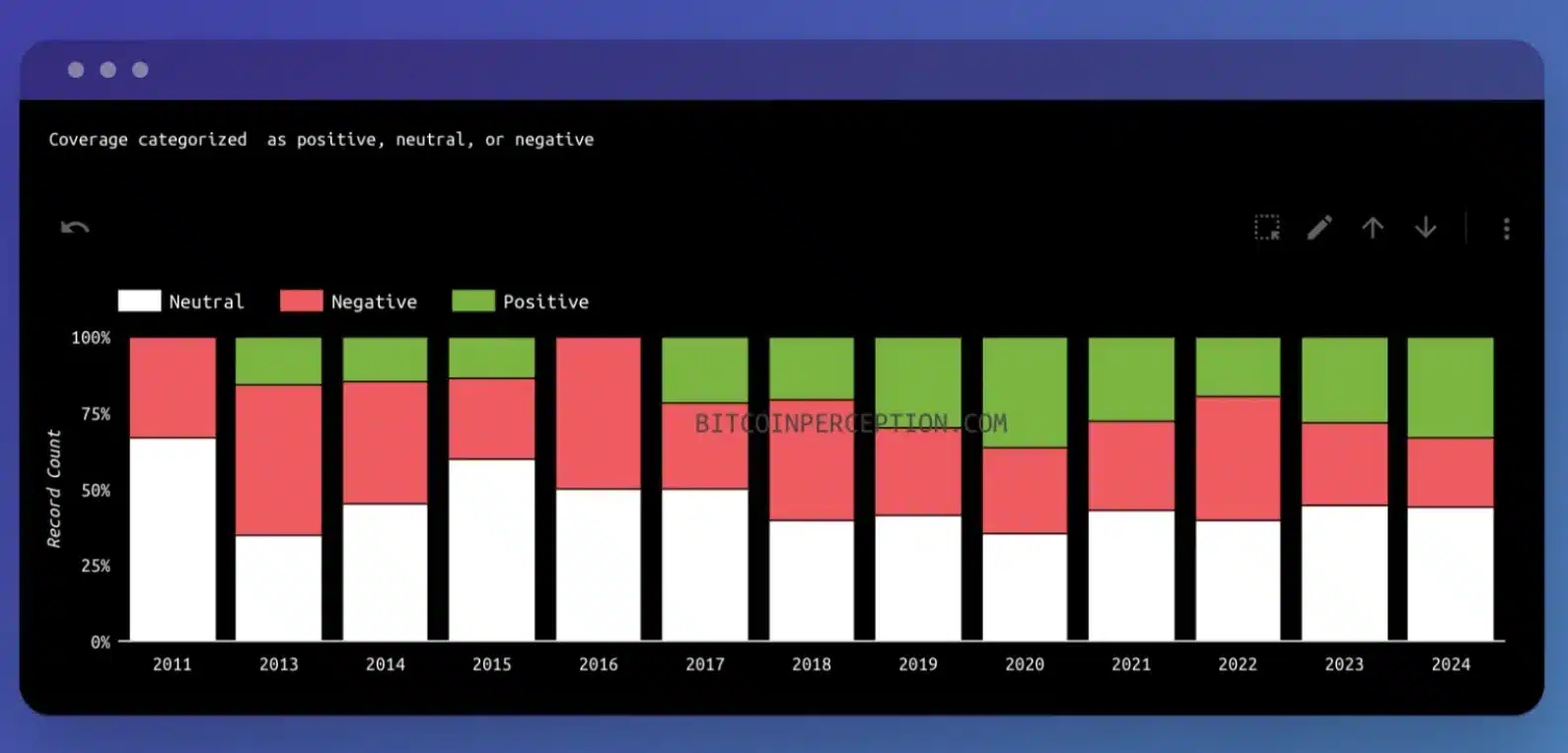

“Bitcoin sentiment is shifting positively in mainstream media as FUD fails to withstand the test of time.”

Source: Jameson Lopp/X

However, drawing a parallel to past performance, Santiment added,

“Markets historically always move the opposite direction of crowd’s expectations.”

Are technical indicators painting a different picture?

While discussions suggest that Bitcoin may take time to reach a new all-time high, technical indicators paint a more nuanced picture.

For instance, the Relative Strength Index (RSI) currently sits above the neutral zone at 59, reflecting a bullish sentiment.

However, it’s worth noting that the RSI has been trending downward since the 29th of September, signaling a potential trend reversal.

This cautious outlook is further supported by the Bollinger Bands, which have widened, indicating increased volatility and possible shifts in market sentiment.

Source: Trading View

However, the community still looks positive as noted by an X user — Crypto Rover who said,

“The #Bitcoin bull market starts here!”

Source: Crypto Rover/X

- Bitcoin’s price faced a bearish downturn after surpassing $66,000, raising market uncertainty.

- Technical indicators suggested bullish sentiment, but potential trend reversal looms with rising volatility.

After surging past the $66,000 milestone, sparking excitement across the crypto community, and fueling hopes for an imminent bull run, Bitcoin [BTC] found itself under a bearish cloud.

According to the latest data from CoinMarketCap, BTC was trading at $64,519, after a 1.65% dip in the last 24 hours.

This sudden downturn has tempered the optimism of many investors, leaving the market uncertain about what lies ahead for the leading cryptocurrency.

Bitcoin turns bearish

Noticing the bearish divergence, on-chain analytics platform Santiment shared its insights on X (formerly Twitter) on the 29th of September and noted,

“If you’re awaiting Bitcoin’s new all-time high, it may need to wait until the crowd slows down their own expectations.”

Source: Santiment/X

In its latest post, Santiment emphasized that there are now approximately “1.8 bullish posts toward BTC for every 1 bearish post”, reflecting the ongoing optimism despite recent market downturns.

This was further confirmed by Jameson Lopp, Chief Security Officer at Casa, who said,

“Bitcoin sentiment is shifting positively in mainstream media as FUD fails to withstand the test of time.”

Source: Jameson Lopp/X

However, drawing a parallel to past performance, Santiment added,

“Markets historically always move the opposite direction of crowd’s expectations.”

Are technical indicators painting a different picture?

While discussions suggest that Bitcoin may take time to reach a new all-time high, technical indicators paint a more nuanced picture.

For instance, the Relative Strength Index (RSI) currently sits above the neutral zone at 59, reflecting a bullish sentiment.

However, it’s worth noting that the RSI has been trending downward since the 29th of September, signaling a potential trend reversal.

This cautious outlook is further supported by the Bollinger Bands, which have widened, indicating increased volatility and possible shifts in market sentiment.

Source: Trading View

However, the community still looks positive as noted by an X user — Crypto Rover who said,

“The #Bitcoin bull market starts here!”

Source: Crypto Rover/X

selamat datang di situs slot terbaik, hongkong lotto daftar

where buy cheap clomiphene tablets buy generic clomid tablets where to buy cheap clomiphene without prescription how to get generic clomid without prescription how to buy generic clomiphene no prescription order clomiphene without insurance can you buy generic clomiphene pills

This is the type of post I unearth helpful.

With thanks. Loads of conception!

order azithromycin generic – buy tindamax 300mg pill buy generic flagyl online

cheap semaglutide 14 mg – order rybelsus online buy periactin generic

order motilium 10mg for sale – purchase tetracycline pills buy flexeril pills for sale

inderal 10mg us – buy inderal pills for sale cost methotrexate 2.5mg

cheap generic amoxicillin – diovan 80mg drug order ipratropium 100 mcg pill

buy azithromycin 250mg pills – nebivolol tablet buy bystolic without prescription

buy augmentin 625mg for sale – https://atbioinfo.com/ buy cheap generic acillin

nexium usa – https://anexamate.com/ nexium online

buy medex generic – https://coumamide.com/ order cozaar 25mg

mobic 15mg pill – https://moboxsin.com/ buy mobic 7.5mg online cheap

prednisone 10mg oral – https://apreplson.com/ prednisone 40mg us

otc ed pills that work – fastedtotake ed pills gnc

amoxicillin order online – https://combamoxi.com/ cheap amoxicillin pills

fluconazole 100mg without prescription – https://gpdifluca.com/ diflucan 100mg sale

purchase cenforce for sale – https://cenforcers.com/# cheap cenforce

take cialis the correct way – tadalafil professional review cialis by mail

cialis going generic – this tadalafil walgreens

order zantac 150mg pills – on this site purchase zantac without prescription

how to order viagra cheap – https://strongvpls.com/ order viagra ireland

More content pieces like this would create the web better. buy amoxil cheap

Thanks recompense sharing. It’s acme quality. https://ursxdol.com/levitra-vardenafil-online/

This website positively has all of the tidings and facts I needed adjacent to this case and didn’t know who to ask. https://prohnrg.com/product/atenolol-50-mg-online/

Good blog you be undergoing here.. It’s intricate to espy strong quality belles-lettres like yours these days. I honestly comprehend individuals like you! Withstand guardianship!! https://aranitidine.com/fr/viagra-professional-100-mg/

More posts like this would add up to the online play more useful. https://ondactone.com/simvastatin/

With thanks. Loads of knowledge!

cheap levofloxacin 500mg

Greetings! Jolly serviceable recommendation within this article! It’s the petty changes which liking turn the largest changes. Thanks a lot for sharing! http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98491

purchase dapagliflozin pills – https://janozin.com/ order dapagliflozin online cheap

generic xenical – https://asacostat.com/ order xenical 120mg generic

This is the tolerant of delivery I turn up helpful. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7113294