- At press time, Bitcoin was trading at around $69,000

- Open Interest figures were around $36 billion, despite BTC’s price decline

Following several days of uptrends, Bitcoin’s recent ascent above $71,000 sparked optimism among certain traders. However, its subsequent dip below $70,000 elicited mixed sentiments, with buying and selling sentiment both displaying comparable figures.

A weak bull trend?

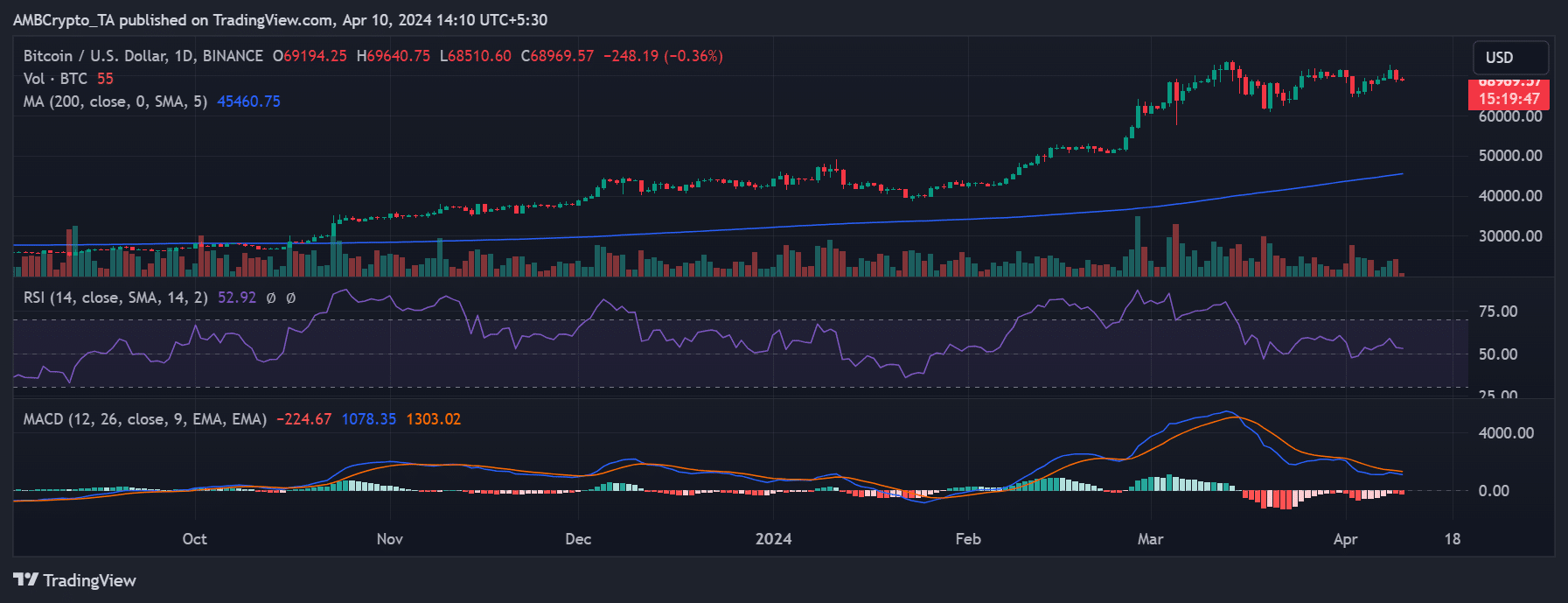

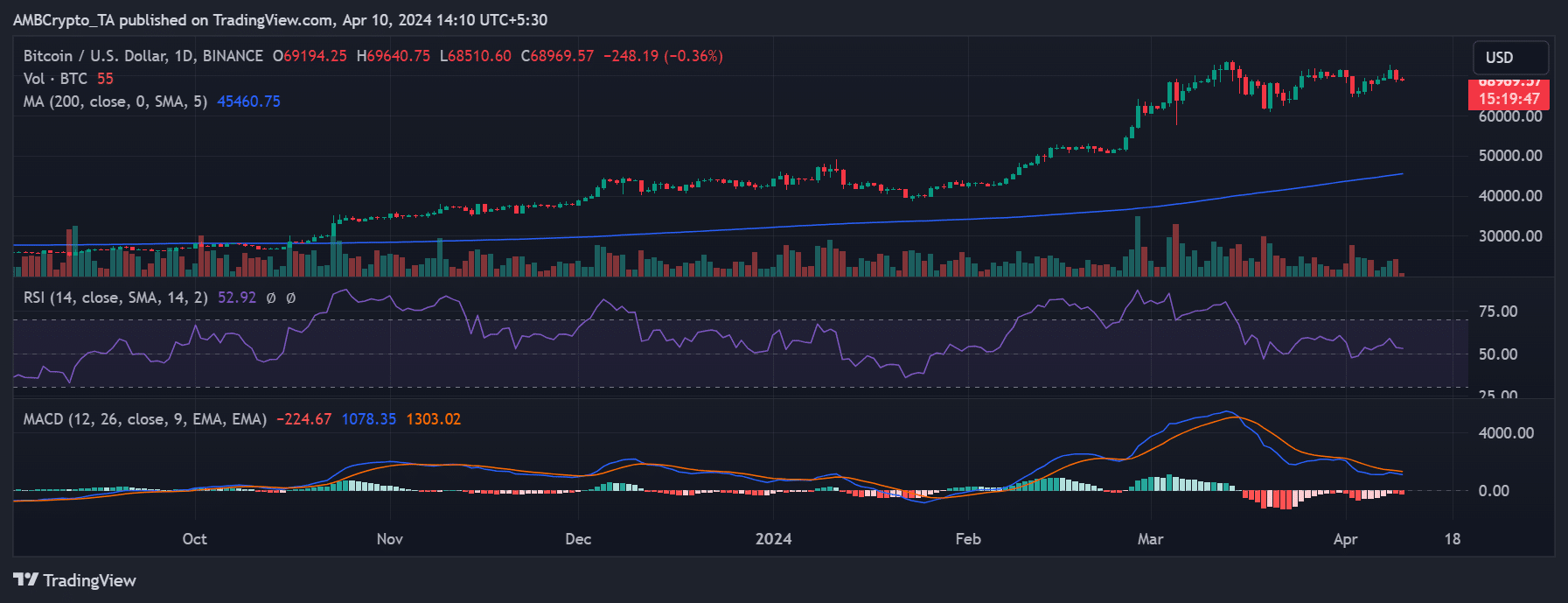

Bitcoin registered a significant setback on 9 April, deviating from the expected price trend with a decline of nearly 3% on the charts. Analysis of the daily timeframe price chart revealed a drop to around $69,217 by the end of the trading session, down from its starting point above $71,000.

This decline outweighed the previous day’s gains of over 2.7%.

Source: TradingView

At the time of writing, this downtrend persisted, albeit marginally. The Relative Strength Index (RSI) line appeared almost flat too, hovering slightly above the neutral line. This position suggested that Bitcoin was still in a bullish uptrend, but it was a weak one.

Buy or sell?

The aforementioned decline in Bitcoin’s price has sparked great discussion about whether to buy or sell the asset. In fact, Social dominance and volume on Santiment indicated a relatively balanced debate between these positions. Consider this – An analysis of social volume showed around 164 mentions of buy sentiment, compared to 125 mentions of sell sentiment.

Furthermore, an examination of social dominance revealed that the buy sentiment was around 4.9%, while the sell sentiment was around 3.7%. Additionally, at the time of writing, “Bitcoin halving” ranked as the second-highest trending word. These metrics suggest that despite the price decline, traders remain largely focused on the potential impact of the upcoming halving event.

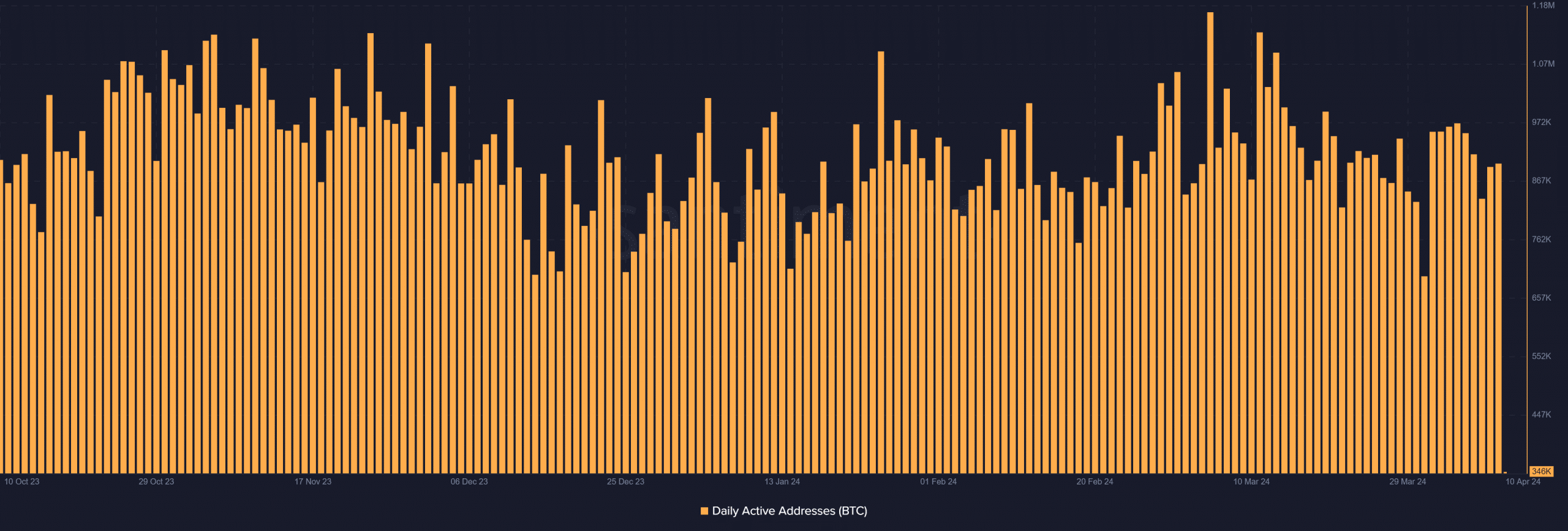

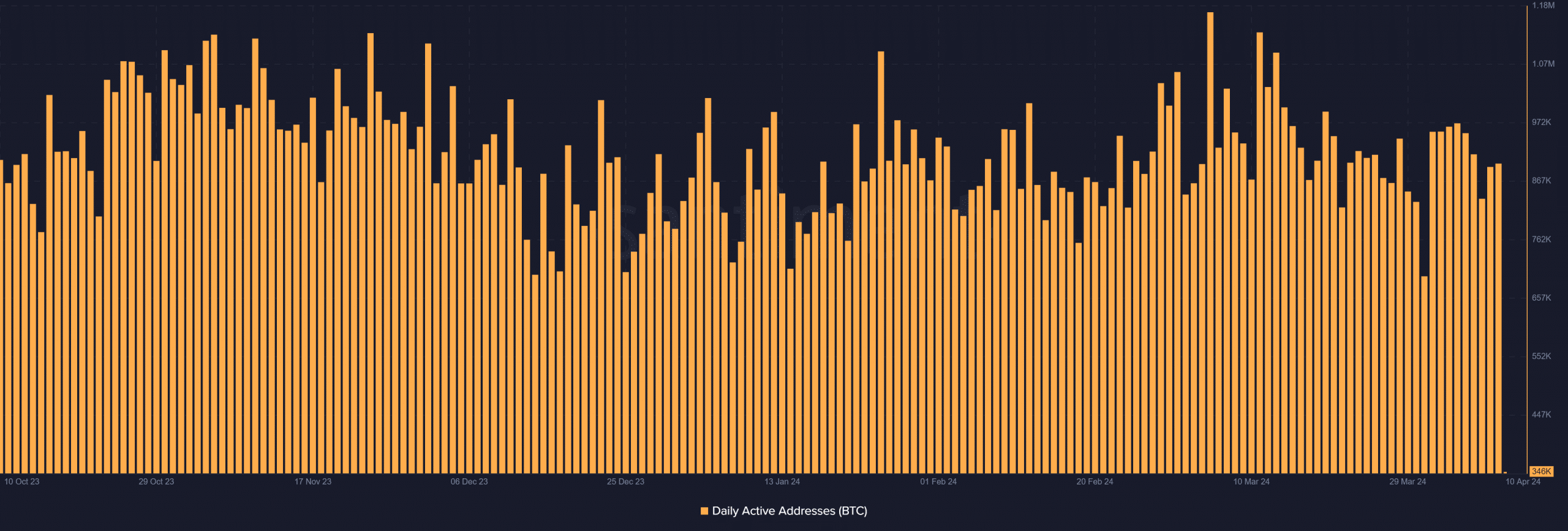

Minimal activity in active addresses

An analysis of Bitcoin‘s daily active addresses revealed a slight increase over the past four days too, with the same hovering around the 800,000 threshold. Between 7 and 8 April, active addresses rose from around 835,000 to over 892,000, with a further hike to over 898,000 by 9 April.

Source: Santiment

On the contrary, the 7-day active addresses chart highlighted a recent decline. From 7 to 10 April, active addresses decreased from over 4.9 million to approximately 4.7 million. These metrics suggest that while a notable number of active wallets exist, many participants may be adopting a wait-and-see approach.

– Read Bitcoin (BTC) Price Prediction 2024-25

At press time, Bitcoin’s Open Interest had fallen too. Data from Coinglass revealed that Open Interest stood at approximately $36.89 billion, down from $37.84 billion on 9 April. What can be inferred here? Well, despite figures for the same falling, a considerable amount of capital is still entering the market. Bitcoin’s short-term price action is unlikely to make a dent here either.

- At press time, Bitcoin was trading at around $69,000

- Open Interest figures were around $36 billion, despite BTC’s price decline

Following several days of uptrends, Bitcoin’s recent ascent above $71,000 sparked optimism among certain traders. However, its subsequent dip below $70,000 elicited mixed sentiments, with buying and selling sentiment both displaying comparable figures.

A weak bull trend?

Bitcoin registered a significant setback on 9 April, deviating from the expected price trend with a decline of nearly 3% on the charts. Analysis of the daily timeframe price chart revealed a drop to around $69,217 by the end of the trading session, down from its starting point above $71,000.

This decline outweighed the previous day’s gains of over 2.7%.

Source: TradingView

At the time of writing, this downtrend persisted, albeit marginally. The Relative Strength Index (RSI) line appeared almost flat too, hovering slightly above the neutral line. This position suggested that Bitcoin was still in a bullish uptrend, but it was a weak one.

Buy or sell?

The aforementioned decline in Bitcoin’s price has sparked great discussion about whether to buy or sell the asset. In fact, Social dominance and volume on Santiment indicated a relatively balanced debate between these positions. Consider this – An analysis of social volume showed around 164 mentions of buy sentiment, compared to 125 mentions of sell sentiment.

Furthermore, an examination of social dominance revealed that the buy sentiment was around 4.9%, while the sell sentiment was around 3.7%. Additionally, at the time of writing, “Bitcoin halving” ranked as the second-highest trending word. These metrics suggest that despite the price decline, traders remain largely focused on the potential impact of the upcoming halving event.

Minimal activity in active addresses

An analysis of Bitcoin‘s daily active addresses revealed a slight increase over the past four days too, with the same hovering around the 800,000 threshold. Between 7 and 8 April, active addresses rose from around 835,000 to over 892,000, with a further hike to over 898,000 by 9 April.

Source: Santiment

On the contrary, the 7-day active addresses chart highlighted a recent decline. From 7 to 10 April, active addresses decreased from over 4.9 million to approximately 4.7 million. These metrics suggest that while a notable number of active wallets exist, many participants may be adopting a wait-and-see approach.

– Read Bitcoin (BTC) Price Prediction 2024-25

At press time, Bitcoin’s Open Interest had fallen too. Data from Coinglass revealed that Open Interest stood at approximately $36.89 billion, down from $37.84 billion on 9 April. What can be inferred here? Well, despite figures for the same falling, a considerable amount of capital is still entering the market. Bitcoin’s short-term price action is unlikely to make a dent here either.

can i buy generic clomid tablets can i buy cheap clomiphene without prescription can i order cheap clomiphene pills how to get generic clomid tablets how to buy generic clomiphene price cheap clomiphene pills where can i buy cheap clomid pill

I am in fact delighted to gleam at this blog posts which consists of tons of useful facts, thanks representing providing such data.

I’ll certainly carry back to skim more.

order azithromycin 500mg pills – buy tindamax 300mg pills buy metronidazole online

order rybelsus 14 mg generic – buy generic rybelsus 14mg order periactin 4mg online

motilium 10mg for sale – buy flexeril generic order flexeril 15mg pill

oral augmentin 1000mg – atbioinfo generic acillin

buy nexium 40mg online cheap – anexa mate buy esomeprazole 20mg for sale

where to buy medex without a prescription – blood thinner buy hyzaar tablets

purchase mobic sale – https://moboxsin.com/ meloxicam cheap

deltasone 20mg pills – https://apreplson.com/ buy deltasone 5mg pills

erection pills viagra online – buying ed pills online buy ed pills gb

cheap amoxicillin without prescription – comba moxi amoxicillin for sale

buy cenforce generic – https://cenforcers.com/# buy cenforce 50mg generic

cialis super active plus reviews – https://ciltadgn.com/# cialis tadalafil

buy tadalafil online canada – https://strongtadafl.com/ cialis and melanoma

buy ranitidine online cheap – https://aranitidine.com/# buy zantac cheap

goodrx viagra 100mg – https://strongvpls.com/ viagra buy india

More articles like this would remedy the blogosphere richer. https://gnolvade.com/es/fildena/

This is the big-hearted of scribble literary works I truly appreciate. buy generic zithromax 500mg

This website really has all of the tidings and facts I needed there this thesis and didn’t identify who to ask. https://ursxdol.com/provigil-gn-pill-cnt/

The sagacity in this tune is exceptional. https://prohnrg.com/

Thanks towards putting this up. It’s well done. https://aranitidine.com/fr/viagra-professional-100-mg/

Facts blog you possess here.. It’s intricate to find high worth script like yours these days. I justifiably recognize individuals like you! Go through guardianship!! https://ondactone.com/product/domperidone/

With thanks. Loads of conception!

sumycin for sale

More peace pieces like this would urge the интернет better. http://www.orlandogamers.org/forum/member.php?action=profile&uid=28883

order forxiga sale – https://janozin.com/ where can i buy dapagliflozin

order xenical – on this site purchase orlistat without prescription