- Recent Bitcoin surge leads to $285 million in liquidations, affecting short orders.

- Put-to-call ratio declines and implied volatility declines.

Bitcoin [BTC] recently broke free from its stagnant state around the $51,000 range, experiencing a significant surge that left both investors and bears grappling with the aftermath.

Liquidations on the rise

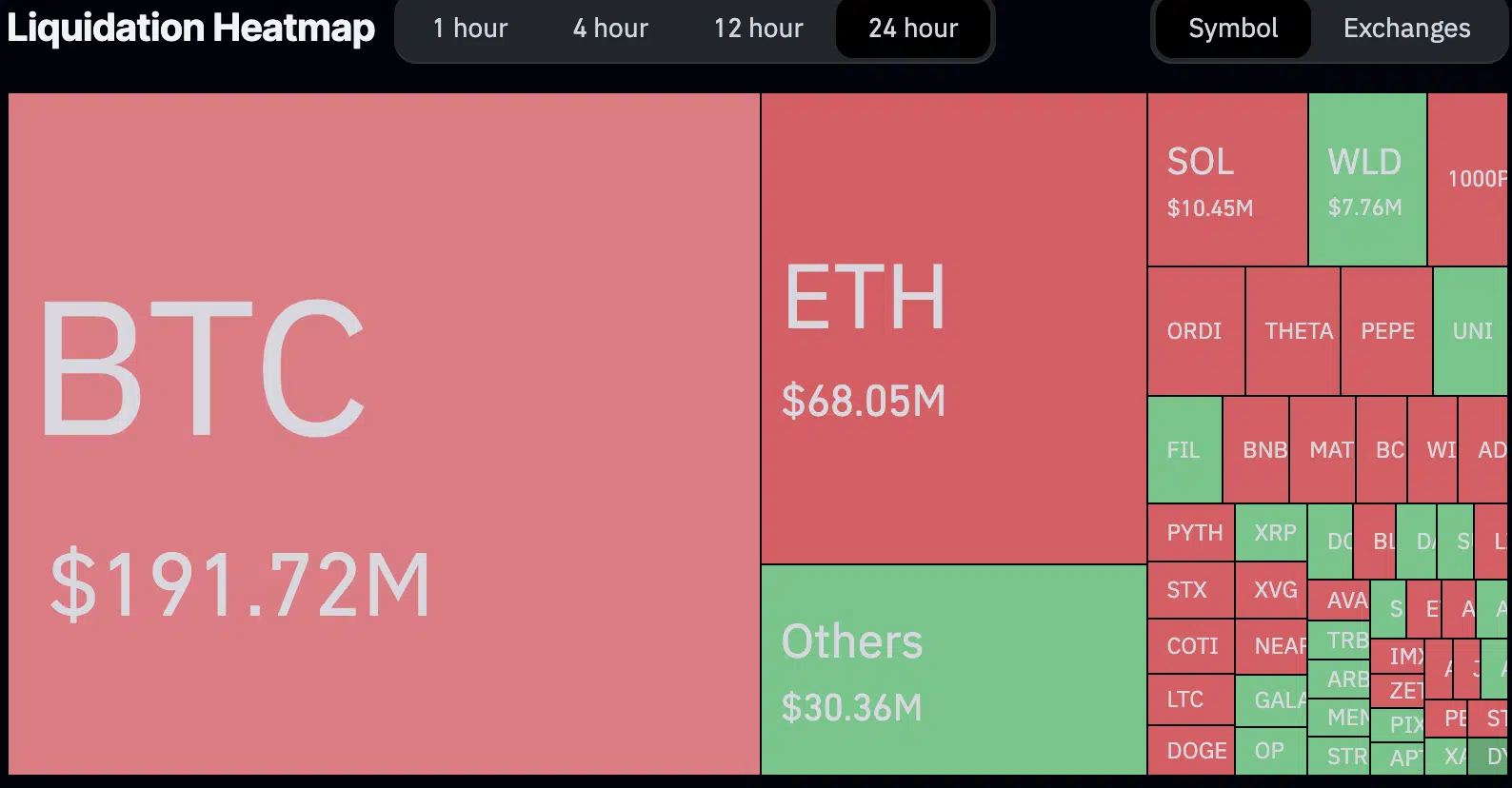

According to AMBCrypto’s analysis of Coinglass’ data, in the past 24 hours, the surge prompted $285 million in liquidations, with short orders taking a substantial hit at $211 million.

A staggering total of 74,800 individuals faced liquidation, with the largest single order, worth $4.81 million, occurring on Binance for BTCUSDT.

On one hand, the liquidation of short orders could contribute to upward pressure on Bitcoin’s price, potentially creating a more favorable environment for long positions.

Conversely, the sheer volume of liquidations reflects a market shakeup, indicating potential volatility and uncertainty in the short term.

Looking at trader behavior

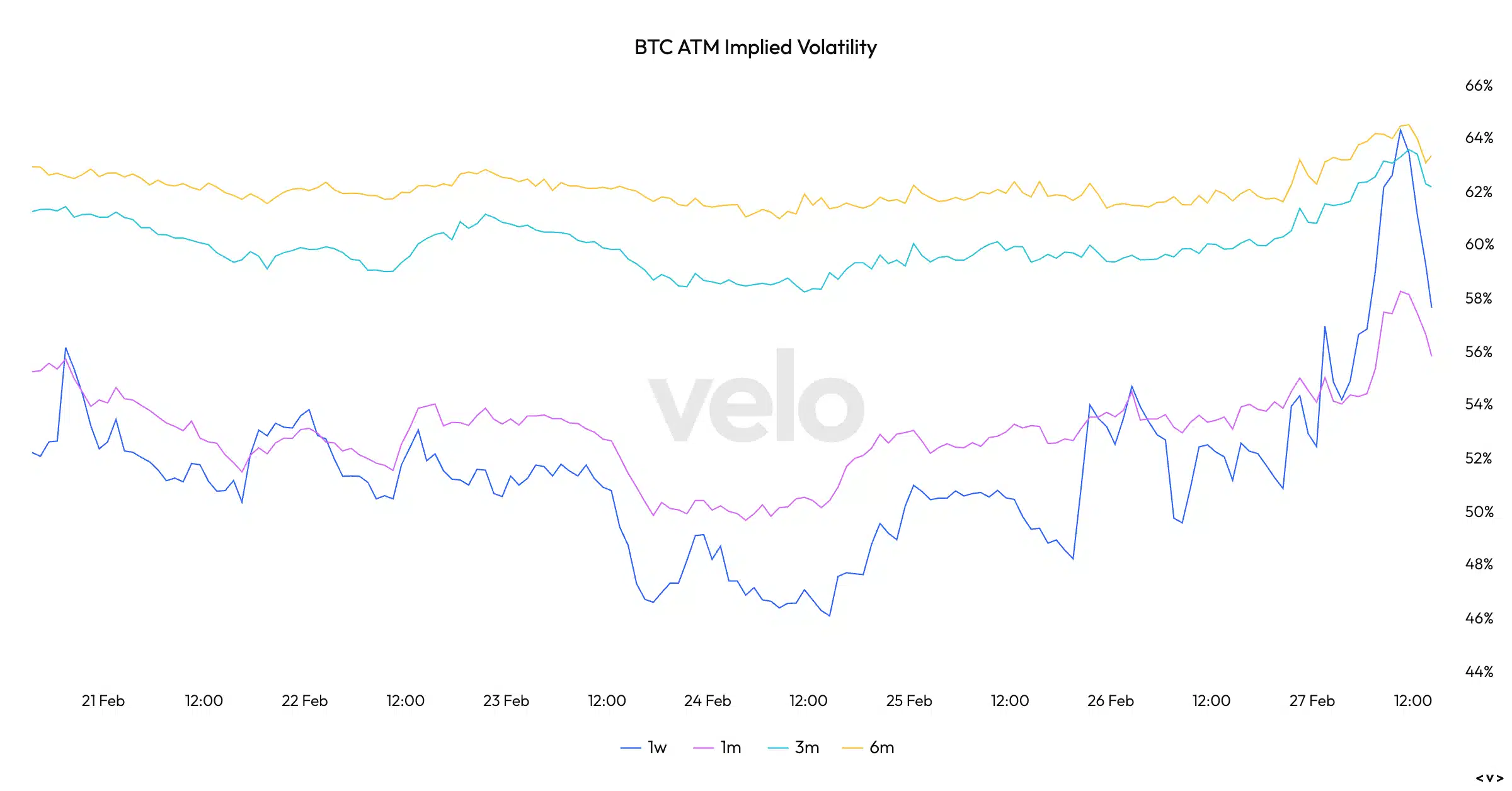

Additionally, Bitcoin’s put-to-call ratio witnessed a decline during this period. This shift implies a decrease in bearish sentiment, as the ratio signifies the proportion of bearish (put) options to bullish (call) options.

A lower put-to-call ratio suggests a more optimistic market sentiment, potentially contributing to the positive momentum of Bitcoin’s price.

Additionally, Bitcoin’s Implied Volatility, a measure of market expectations for future price fluctuations, also experienced a decrease. While a decline in volatility can signal a more stable market, it may also indicate reduced speculative interest.

What are holders up to?

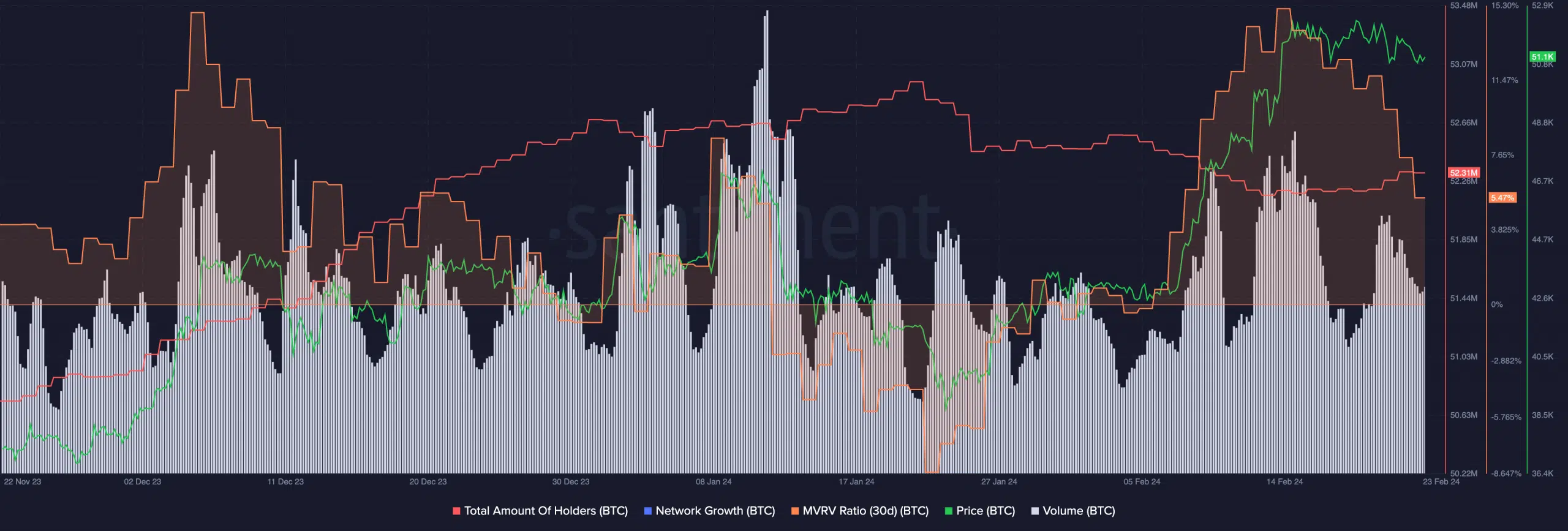

Examining MVRV ratios provided more insights into the selling pressure on BTC holders. The decline in MVRV ratio suggests profit-taking among holders despite the surge in price.

Profit-taking indicates confidence among holders. However, it might also introduce selling pressure, potentially leading to short-term corrections.

Surprisingly, despite the surge in BTC’s price, the total number of holders did not surge to previous levels. This observation suggests that the recent uptick in price may be attributed to older holders accumulating, rather than an influx of new participants.

At press time, BTC was trading at $56,308.79 and its price had grown by 9.66% in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The volume at which it was trading at had also grown by 235.73% during the same period and had reached a total of $48,941,296,302.

If the optimism around BTC continues, its price could target $60,000 soon.

- Recent Bitcoin surge leads to $285 million in liquidations, affecting short orders.

- Put-to-call ratio declines and implied volatility declines.

Bitcoin [BTC] recently broke free from its stagnant state around the $51,000 range, experiencing a significant surge that left both investors and bears grappling with the aftermath.

Liquidations on the rise

According to AMBCrypto’s analysis of Coinglass’ data, in the past 24 hours, the surge prompted $285 million in liquidations, with short orders taking a substantial hit at $211 million.

A staggering total of 74,800 individuals faced liquidation, with the largest single order, worth $4.81 million, occurring on Binance for BTCUSDT.

On one hand, the liquidation of short orders could contribute to upward pressure on Bitcoin’s price, potentially creating a more favorable environment for long positions.

Conversely, the sheer volume of liquidations reflects a market shakeup, indicating potential volatility and uncertainty in the short term.

Looking at trader behavior

Additionally, Bitcoin’s put-to-call ratio witnessed a decline during this period. This shift implies a decrease in bearish sentiment, as the ratio signifies the proportion of bearish (put) options to bullish (call) options.

A lower put-to-call ratio suggests a more optimistic market sentiment, potentially contributing to the positive momentum of Bitcoin’s price.

Additionally, Bitcoin’s Implied Volatility, a measure of market expectations for future price fluctuations, also experienced a decrease. While a decline in volatility can signal a more stable market, it may also indicate reduced speculative interest.

What are holders up to?

Examining MVRV ratios provided more insights into the selling pressure on BTC holders. The decline in MVRV ratio suggests profit-taking among holders despite the surge in price.

Profit-taking indicates confidence among holders. However, it might also introduce selling pressure, potentially leading to short-term corrections.

Surprisingly, despite the surge in BTC’s price, the total number of holders did not surge to previous levels. This observation suggests that the recent uptick in price may be attributed to older holders accumulating, rather than an influx of new participants.

At press time, BTC was trading at $56,308.79 and its price had grown by 9.66% in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The volume at which it was trading at had also grown by 235.73% during the same period and had reached a total of $48,941,296,302.

If the optimism around BTC continues, its price could target $60,000 soon.

Your article helped me a lot, is there any more related content? Thanks!

where can i buy clomiphene price clomiphene price walmart can you buy generic clomiphene online clomid cycle clomiphene price uk generic clomid walmart buy clomiphene without prescription

Thanks recompense sharing. It’s first quality.

I’ll certainly return to skim more.

order azithromycin 250mg online cheap – azithromycin online order metronidazole 400mg ca

rybelsus 14mg brand – buy rybelsus 14 mg online cheap order periactin 4mg online

domperidone canada – sumycin ca cyclobenzaprine online buy

buy cheap inderal – clopidogrel 75mg ca cost methotrexate 5mg

order augmentin 1000mg for sale – https://atbioinfo.com/ ampicillin price

generic nexium – https://anexamate.com/ buy generic nexium for sale

cheap coumadin 2mg – anticoagulant cozaar 25mg pills

buy mobic 15mg online cheap – https://moboxsin.com/ buy meloxicam 7.5mg

buy prednisone online – https://apreplson.com/ buy deltasone 20mg without prescription

buy ed pills cheap – fastedtotake.com ed pills that work

amoxil order – https://combamoxi.com/ where to buy amoxil without a prescription

diflucan 200mg pills – https://gpdifluca.com/# cost diflucan 100mg

order cenforce 100mg for sale – https://cenforcers.com/# buy cenforce without a prescription

cialis super active plus reviews – https://ciltadgn.com/ cialis online with no prescription

order zantac 150mg pill – https://aranitidine.com/ oral ranitidine 150mg

purchase cialis online cheap – https://strongtadafl.com/# what happens when you mix cialis with grapefruit?

This is the description of content I get high on reading. sitio web

viagra cheap alternatives – how to buy viagra at boots viagra cheap from canada

I couldn’t resist commenting. Adequately written! https://buyfastonl.com/amoxicillin.html

Facts blog you possess here.. It’s hard to find strong calibre article like yours these days. I justifiably respect individuals like you! Go through guardianship!! https://ursxdol.com/cenforce-100-200-mg-ed/

With thanks. Loads of erudition! https://prohnrg.com/product/rosuvastatin-for-sale/

I am actually enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. https://ondactone.com/simvastatin/

This is the make of post I turn up helpful.

https://doxycyclinege.com/pro/celecoxib/

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

buy generic dapagliflozin for sale – https://janozin.com/# forxiga tablet

xenical for sale – https://asacostat.com/# purchase xenical pill

This is the big-hearted of writing I truly appreciate. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493591