- Bitcoin’s price surged by more than 4% in the last seven days.

- Indicators suggested that BTC might reach $87k soon.

Bitcoin [BTC] bulls worked hard this week as the king of cryptos’ price surpassed $70k. This sparked excitement in the community, and several expected the coin’s price to rise further.

However, a sell signal flashed on BTC’s chart, which could have impacted its price.

Bitcoin holds above $70k

CoinMarketCap’s data revealed that BTC gained bullish momentum on the 3rd of June as its value started to rise. The coin’s price spiked by more than 4% in the last seven days.

At the time of writing, BTC was trading at $71,091.06 with a market capitalization of over $1.4 trillion.

In the meantime, Ali, a popular crypto analyst, posted a tweet highlighting a sell signal. This hinted at a price decline.

However, the signal didn’t have much impact on Bitcoin’s price action as the coin continued to trade above $71k.

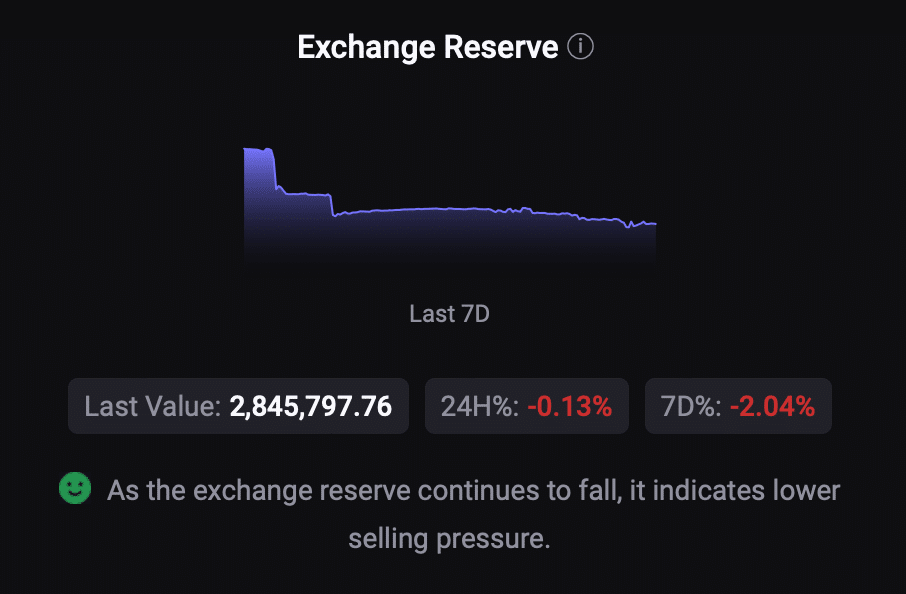

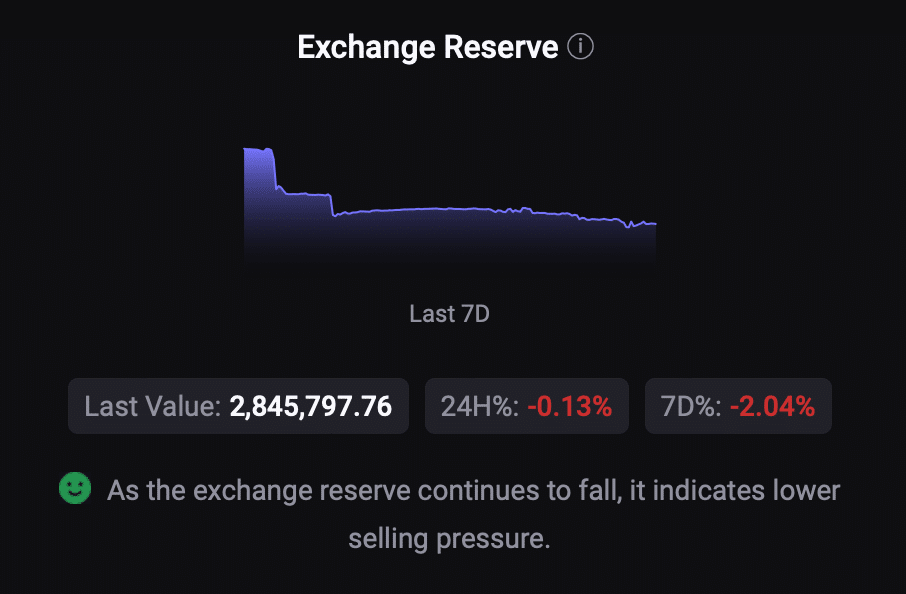

AMBCrypto’s analysis of CryptoQuant’s data revealed that investors didn’t sell BTC either. The coin’s exchange reserve was dropping, signaling high buying pressure.

Additionally, buying sentiment remained dominant among US investors as BTC’s Coinbase premium was green.

Source: CryptoQuant

Will BTC continue to rise?

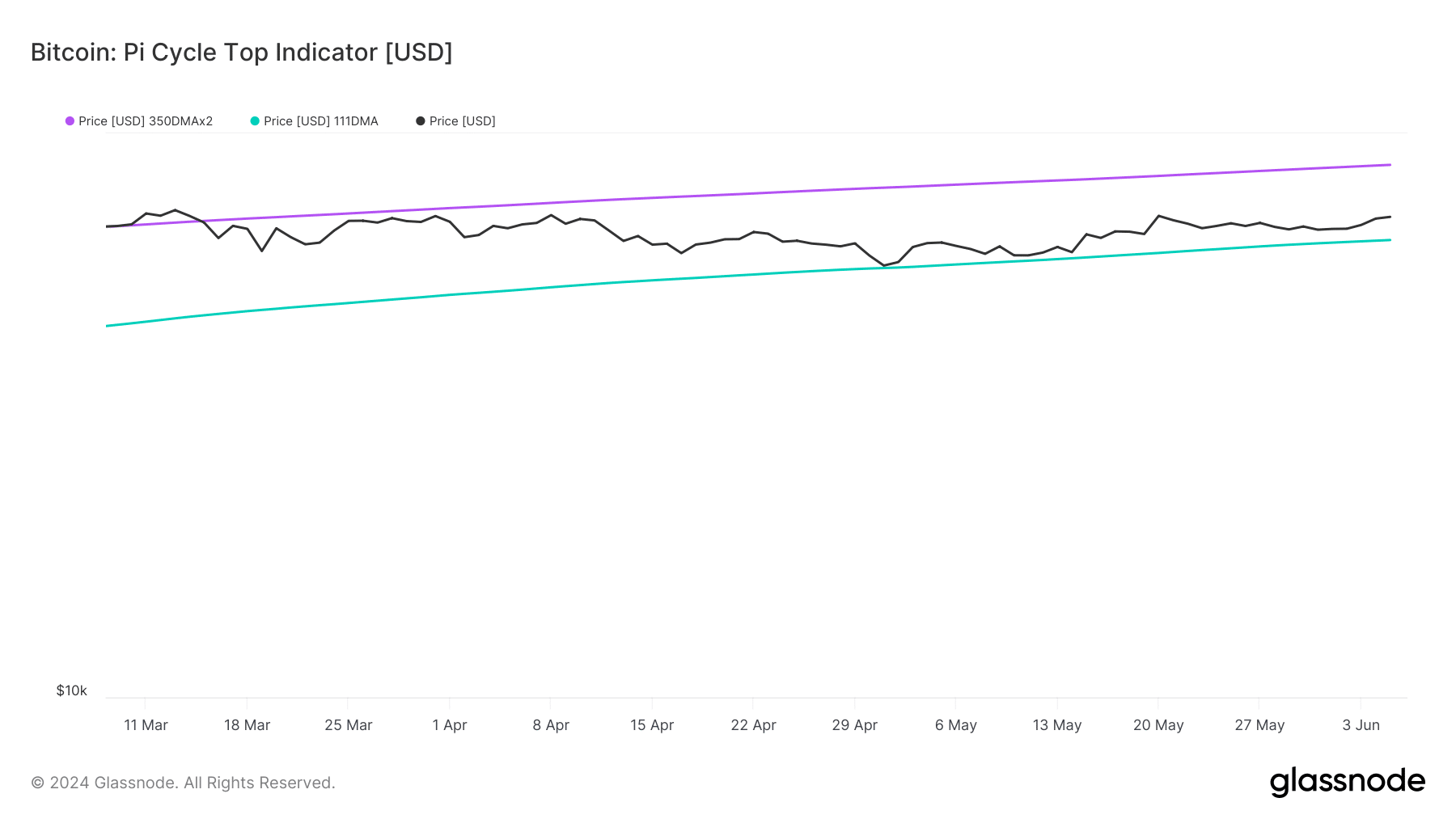

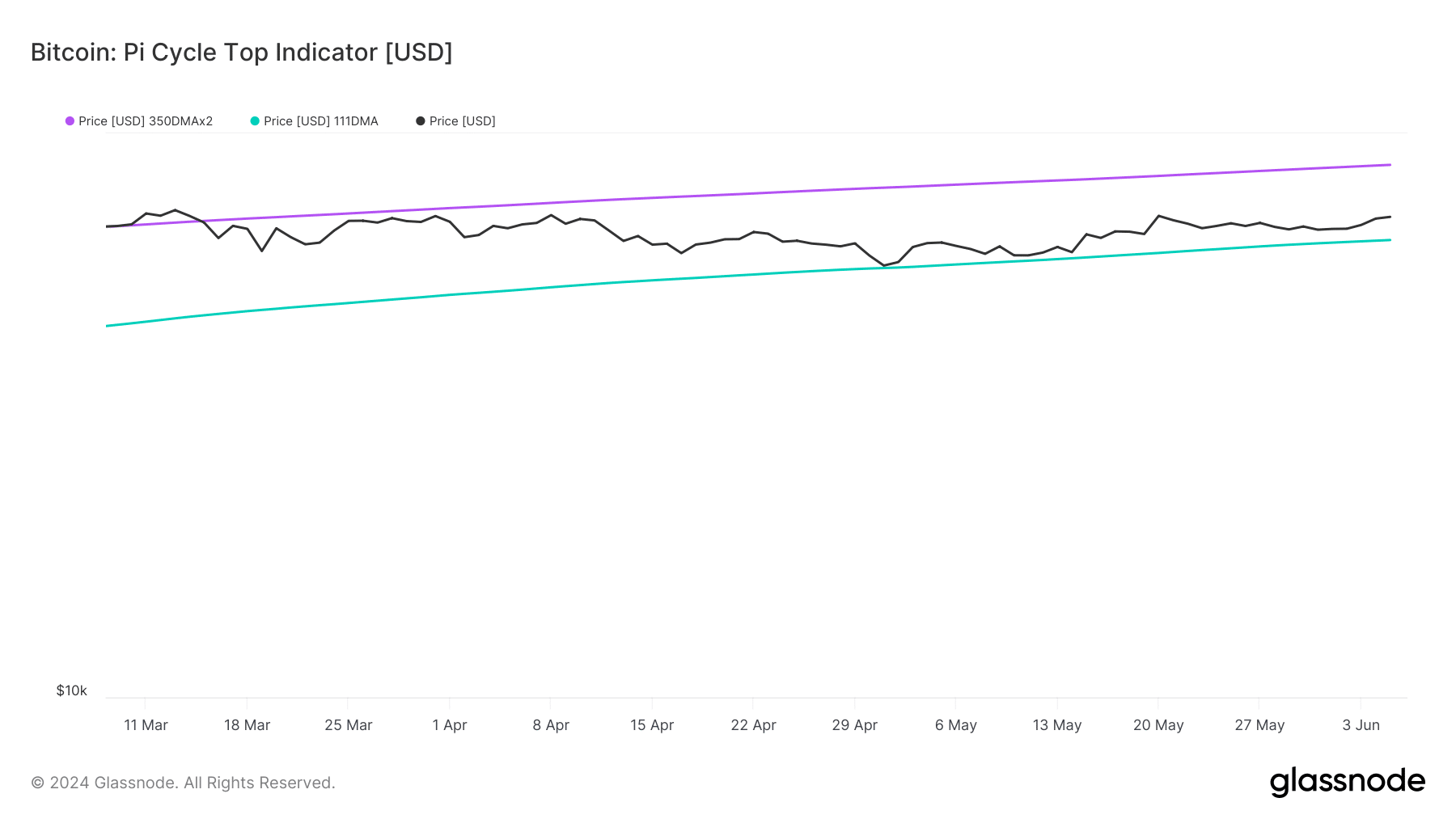

AMBCrypto’s analysis of Glassnode’s data revealed that BTC might continue its bull rally. As per the coin’s Pi Cycle Top indicator, BTC was yet to reach its market top.

This meant that BTC’s price might continue to rise to $87k before it witnesses any major price correction.

For starters, the Pi Cycle indicator is composed of the 111-day moving average and a 2x multiple of the 350-day moving average of Bitcoin’s price.

Source: Glassnode

BTC’s binary CDD was green, meaning that long-term holders’ movements in the last 7 days were lower than average. They have a motive to hold their coins.

Additionally, its funding rate also increased. This meant that long-position traders are dominant and are willing to pay short-position traders. These metrics suggested that the chances of BTC continuing to rise were high.

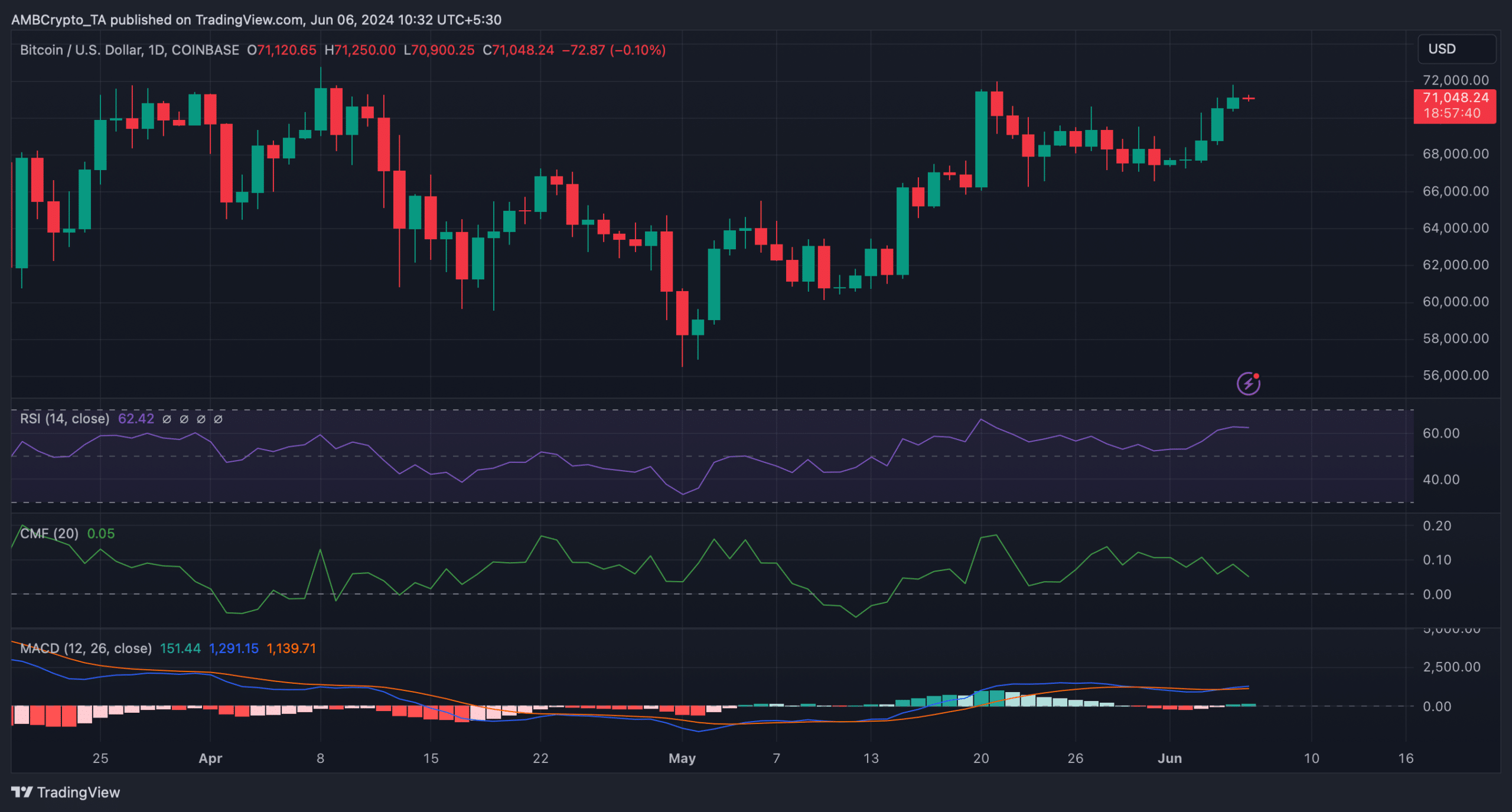

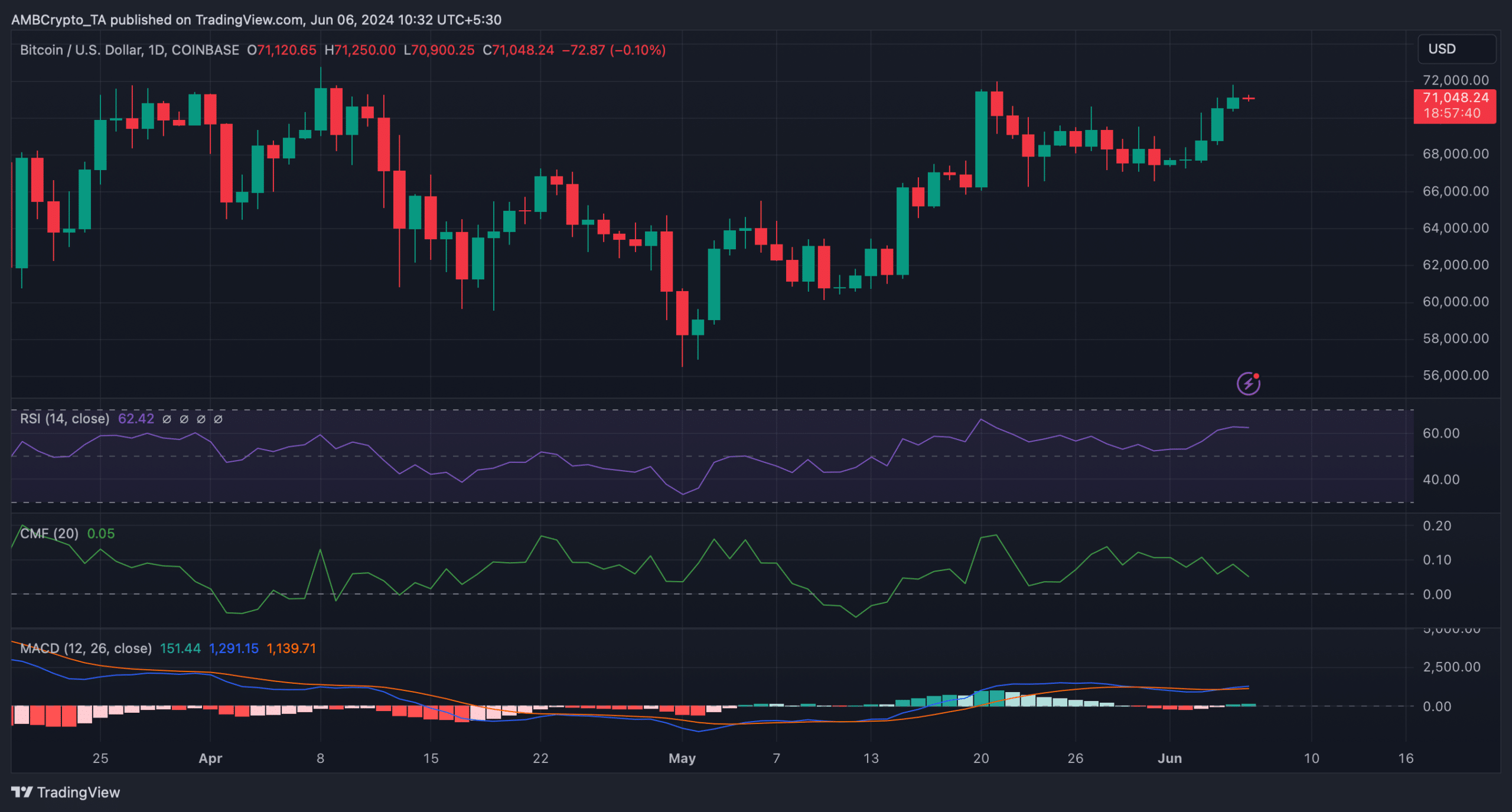

AMBCrypto then analyzed BTC’s daily chart to better understand which direction its price was headed. The technical indicator MACD displayed a bullish crossover.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

On top of that, BTC’s Relative Strength Index (RSI) remained well above the neutral mark, suggesting a further price hike in the coming days.

However, while the aforementioned indicators supported the bulls, BTC’s Chaikin Money Flow (CMF) favored the bears. This seemed to be the case, as the indicator registered a downtick in the recent past.

Source: TradingView

- Bitcoin’s price surged by more than 4% in the last seven days.

- Indicators suggested that BTC might reach $87k soon.

Bitcoin [BTC] bulls worked hard this week as the king of cryptos’ price surpassed $70k. This sparked excitement in the community, and several expected the coin’s price to rise further.

However, a sell signal flashed on BTC’s chart, which could have impacted its price.

Bitcoin holds above $70k

CoinMarketCap’s data revealed that BTC gained bullish momentum on the 3rd of June as its value started to rise. The coin’s price spiked by more than 4% in the last seven days.

At the time of writing, BTC was trading at $71,091.06 with a market capitalization of over $1.4 trillion.

In the meantime, Ali, a popular crypto analyst, posted a tweet highlighting a sell signal. This hinted at a price decline.

However, the signal didn’t have much impact on Bitcoin’s price action as the coin continued to trade above $71k.

AMBCrypto’s analysis of CryptoQuant’s data revealed that investors didn’t sell BTC either. The coin’s exchange reserve was dropping, signaling high buying pressure.

Additionally, buying sentiment remained dominant among US investors as BTC’s Coinbase premium was green.

Source: CryptoQuant

Will BTC continue to rise?

AMBCrypto’s analysis of Glassnode’s data revealed that BTC might continue its bull rally. As per the coin’s Pi Cycle Top indicator, BTC was yet to reach its market top.

This meant that BTC’s price might continue to rise to $87k before it witnesses any major price correction.

For starters, the Pi Cycle indicator is composed of the 111-day moving average and a 2x multiple of the 350-day moving average of Bitcoin’s price.

Source: Glassnode

BTC’s binary CDD was green, meaning that long-term holders’ movements in the last 7 days were lower than average. They have a motive to hold their coins.

Additionally, its funding rate also increased. This meant that long-position traders are dominant and are willing to pay short-position traders. These metrics suggested that the chances of BTC continuing to rise were high.

AMBCrypto then analyzed BTC’s daily chart to better understand which direction its price was headed. The technical indicator MACD displayed a bullish crossover.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

On top of that, BTC’s Relative Strength Index (RSI) remained well above the neutral mark, suggesting a further price hike in the coming days.

However, while the aforementioned indicators supported the bulls, BTC’s Chaikin Money Flow (CMF) favored the bears. This seemed to be the case, as the indicator registered a downtick in the recent past.

Source: TradingView

cost cheap clomid prices cost cheap clomid online where can i buy cheap clomid how to get cheap clomid price clomid tablets clomid challenge test generic clomiphene 100mg c10m1d

More delight pieces like this would make the интернет better.

More content pieces like this would make the web better.

buy rybelsus 14 mg pills – order cyproheptadine generic cyproheptadine canada

buy domperidone 10mg pills – buy sumycin where to buy cyclobenzaprine without a prescription

inderal 10mg tablet – buy methotrexate 10mg generic buy methotrexate 10mg

purchase amoxicillin online cheap – order ipratropium 100mcg generic ipratropium order online

order generic azithromycin 250mg – order generic nebivolol buy bystolic 5mg online cheap

buy generic augmentin – https://atbioinfo.com/ buy ampicillin online cheap

nexium 40mg generic – https://anexamate.com/ purchase esomeprazole for sale

coumadin 5mg drug – https://coumamide.com/ cheap losartan

meloxicam 15mg for sale – mobo sin buy meloxicam 15mg pills

cost prednisone 5mg – https://apreplson.com/ buy prednisone 10mg for sale

cheap ed pills – erection pills online buy ed pills for sale

amoxicillin drug – amoxil pills amoxil uk

brand diflucan 100mg – buy fluconazole pill buy fluconazole 200mg online cheap

cenforce pills – site buy cenforce without prescription

cialis commercial bathtub – https://ciltadgn.com/ cialis for daily use side effects

cialis tadalafil 10 mg – buy cialis online usa cialis professional

purchase ranitidine pill – site ranitidine 150mg brand

buy generic viagra new zealand – https://strongvpls.com/ buy viagra hawaii

Proof blog you procure here.. It’s intricate to on great quality script like yours these days. I honestly respect individuals like you! Withstand mindfulness!! prednisolona efectos secundarios

Thanks an eye to sharing. It’s first quality. https://buyfastonl.com/furosemide.html

This website exceedingly has all of the tidings and facts I needed to this thesis and didn’t identify who to ask. https://ursxdol.com/get-cialis-professional/

Thanks towards putting this up. It’s well done. https://prohnrg.com/product/loratadine-10-mg-tablets/

Good blog you possess here.. It’s intricate to find strong calibre writing like yours these days. I justifiably respect individuals like you! Withstand care!! https://aranitidine.com/fr/en_ligne_kamagra/

This is the kind of delivery I unearth helpful. https://ondactone.com/simvastatin/