- Global liquidity in stablecoins could push crypto prices higher.

- Key indicators say Bitcoin is poised for break out.

September is often a bearish month for Bitcoin and other asset classes. However, October typically marks a strong bullish period, with Bitcoin [BTC] showing positive returns in 8 out of the last 9 Octobers.

On average, BTC price gains 22.9% during this month. This historical trend may explain why there’s consistent buying in the options market.

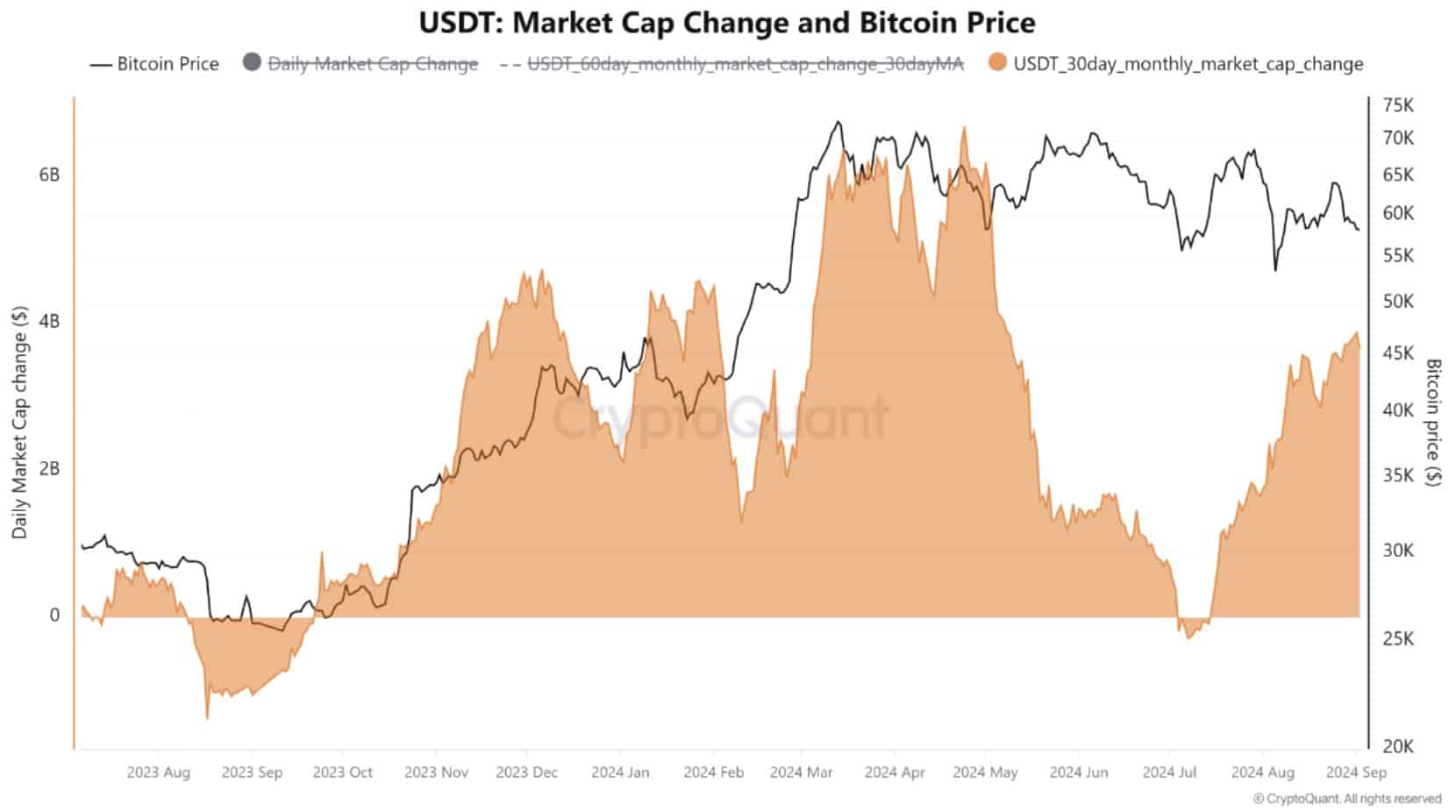

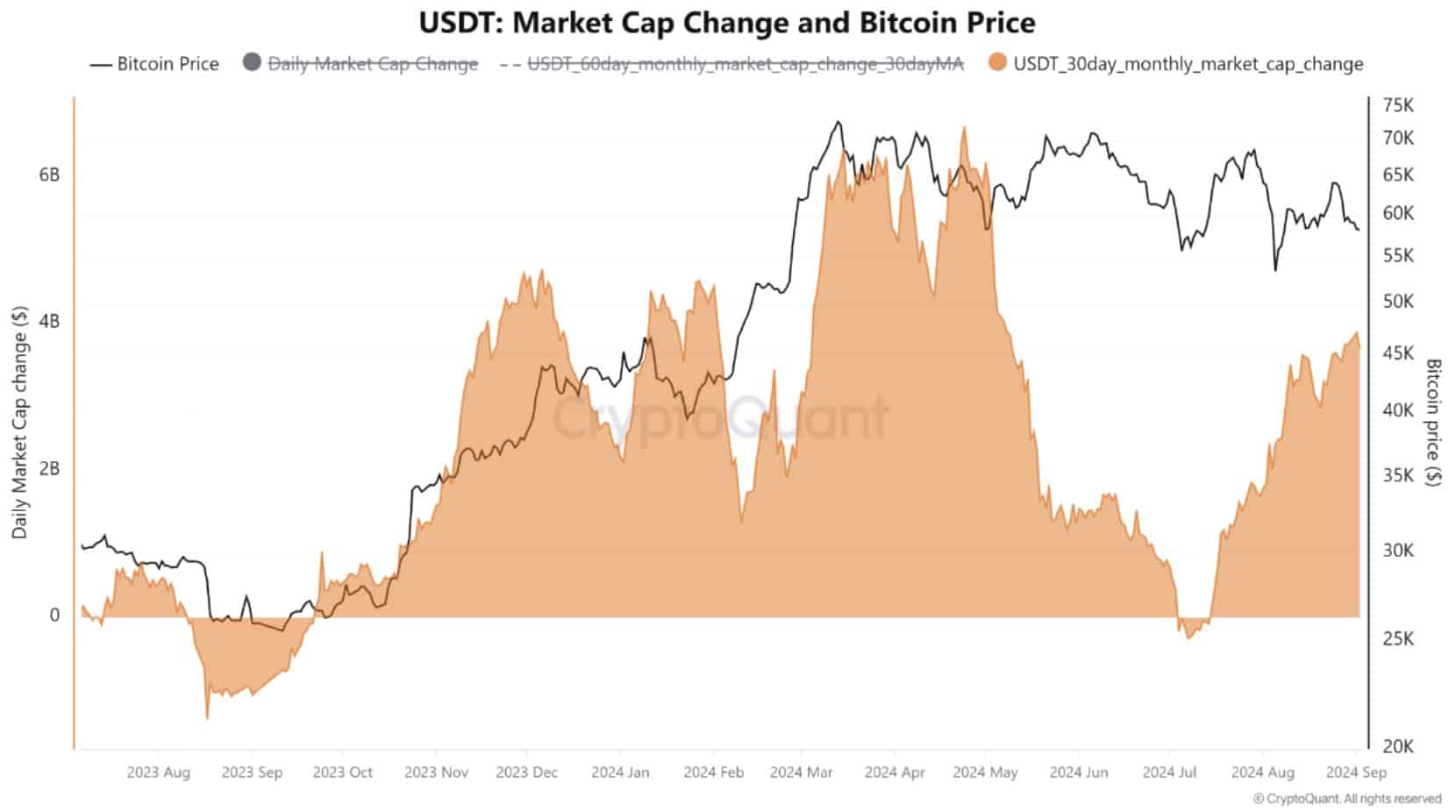

While global liquidity is increasing in the crypto market, it hasn’t yet been fully allocated. Much of this capital is currently tied up in stablecoins, waiting to impact the BTC price.

When this “firepower” eventually enters the market, it could lead to a significant move.

Source: CryptoQuant

Bitcoin is in consolidation

Bitcoin has been trading within a very narrow range for the past month. This compression usually precedes a large move in either direction.

If Bitcoin experiences another solid drop, it could complete its current cycle and bounce back strongly. The weekly timeframe shows some weakness, which is not ideal if BTC price is expected to reach new highs in October.

However, it’s not too late for this to happen. The key is for Bitcoin to break out of its current consolidation without looking back.

Source: TradingView

Once the capital currently held in stablecoins is allocated to Bitcoin, the price could break through either side of this range, potentially leading to a continuation of the ongoing bull run.

Bitcoin still has room to grow

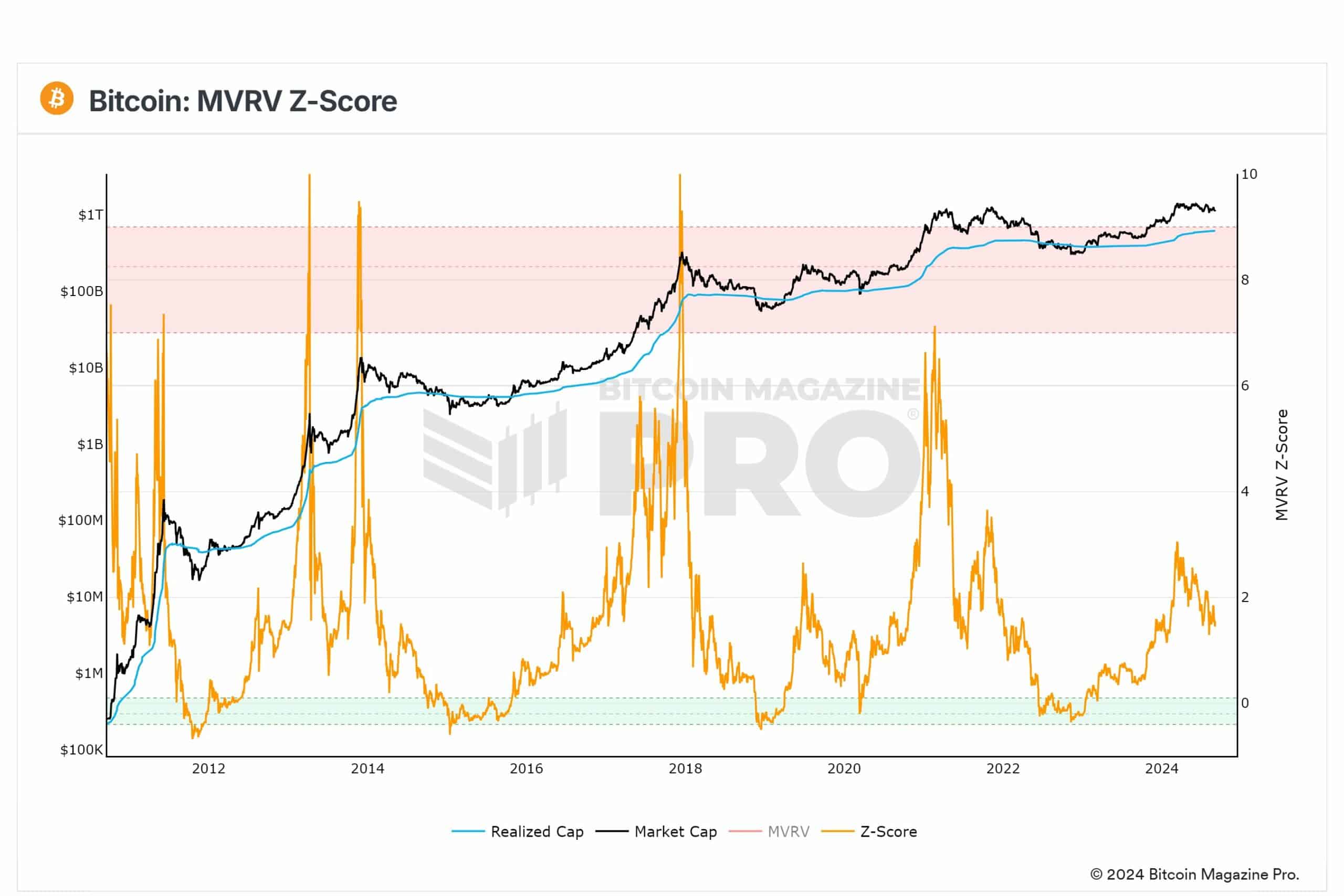

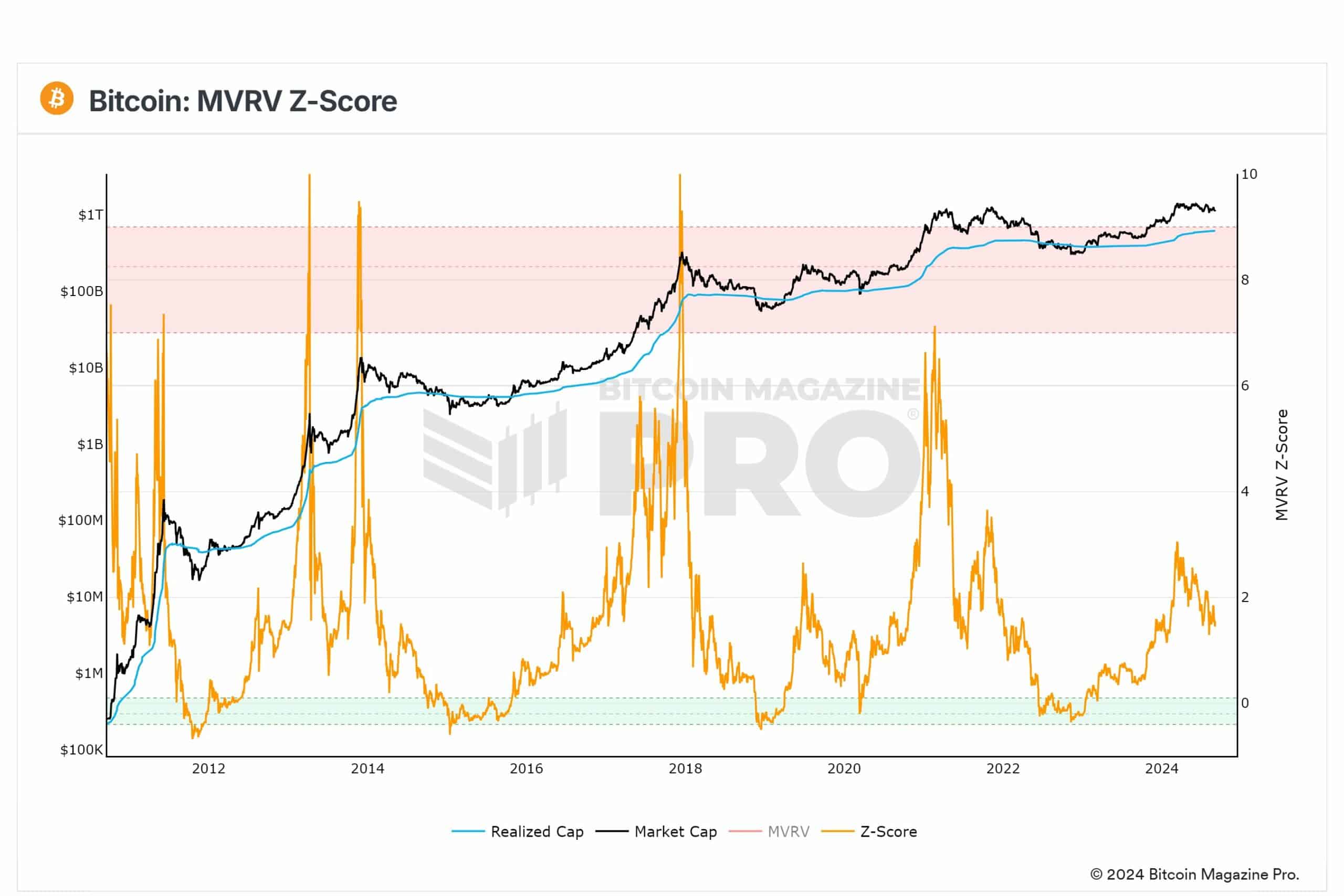

The MVRV Z-Score, which currently reads around 1.8, suggests that the market is moderately optimistic but not at an extreme point.

This score indicates that while Bitcoin still has room to grow, caution is needed as the market could become overvalued if the score continues to rise.

The 1.8 reading implies that the cycle is far from over and may just be beginning. As the BTC price moves higher, it’s important to monitor this score closely, as it could provide early warnings of a market peak.

Source: Bitcoin Magazine PRO

The short to medium term open interest

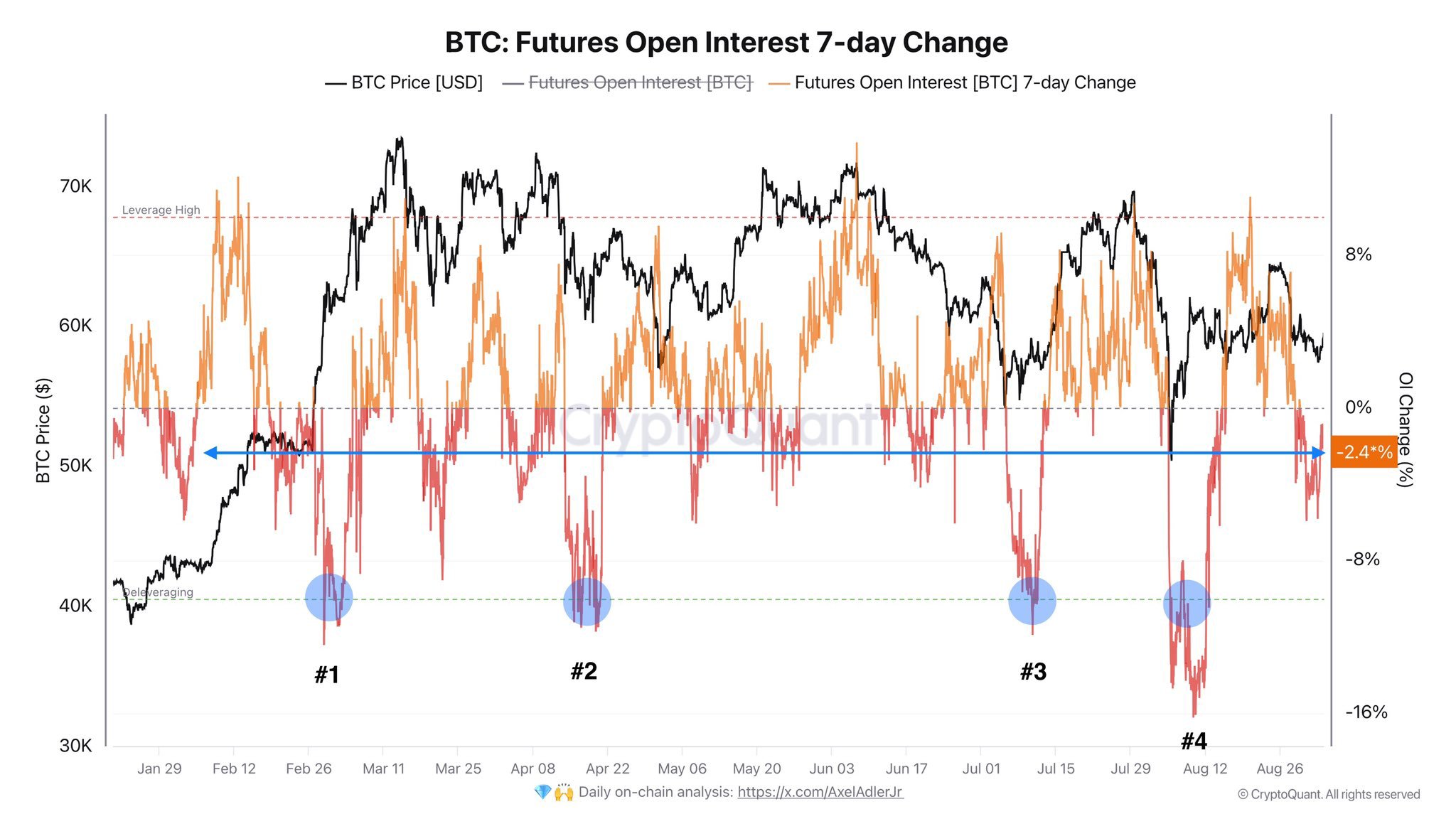

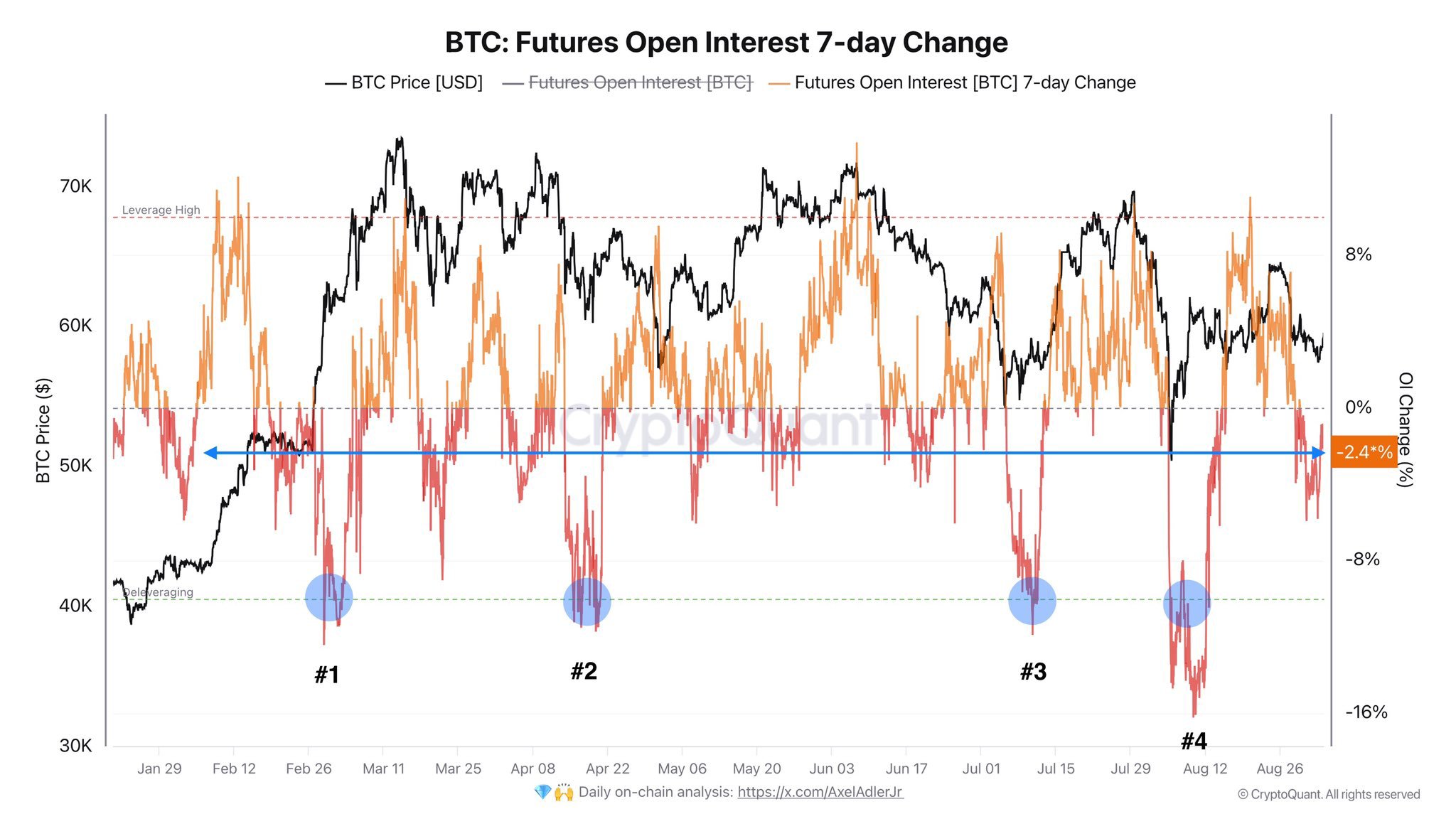

In the short to medium term, open interest (OI) is relatively high, which could hinder sustainable upward movement. For a healthier market, OI would need to decrease by around 10%.

Recently, OI has reset following a short-term rise during the latest drop, bringing BTC price back to where it started.

This reset is a positive sign, as it reduces the likelihood of a major market downturn and increases the chances of continued range trading on lower timeframes. If market conditions improve, Bitcoin’s price could surge higher.

Source: CryptoQuant

HODL cycles and periodicity

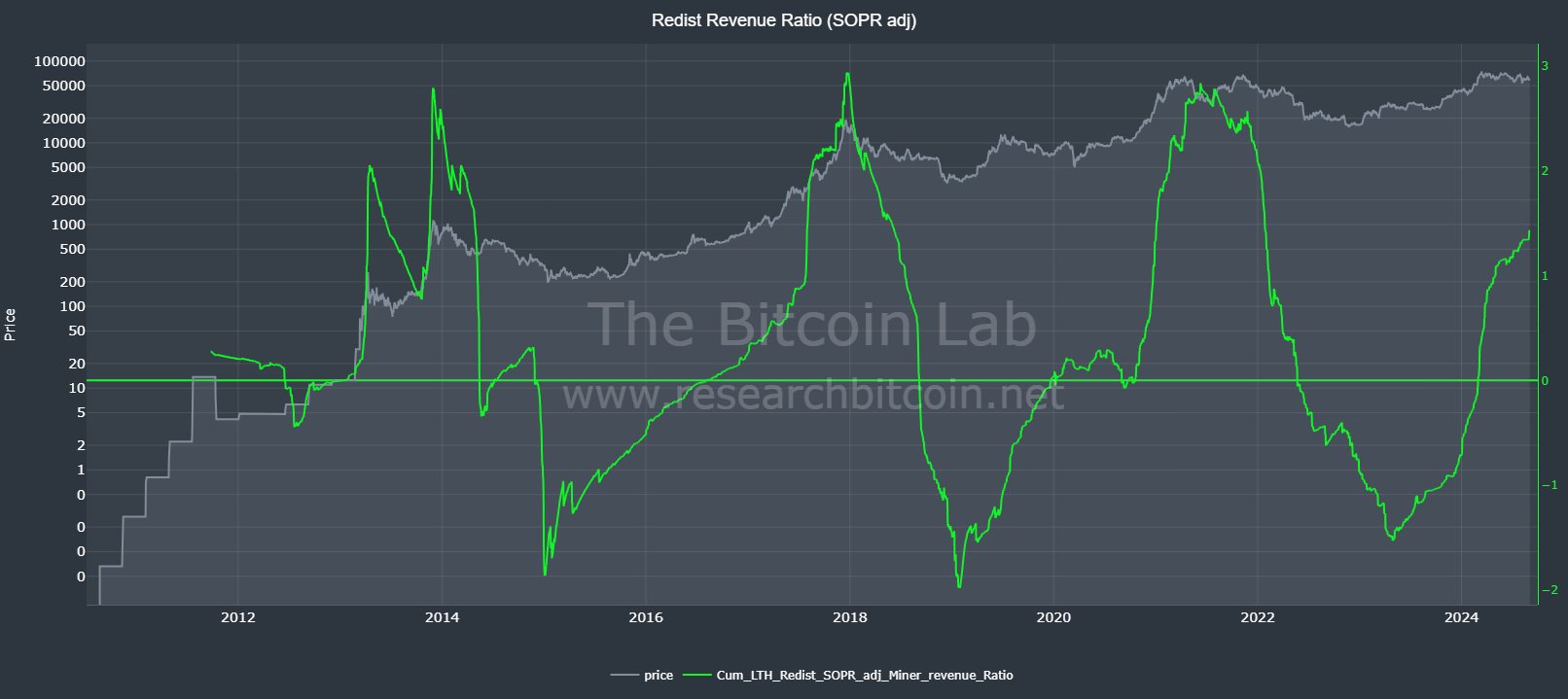

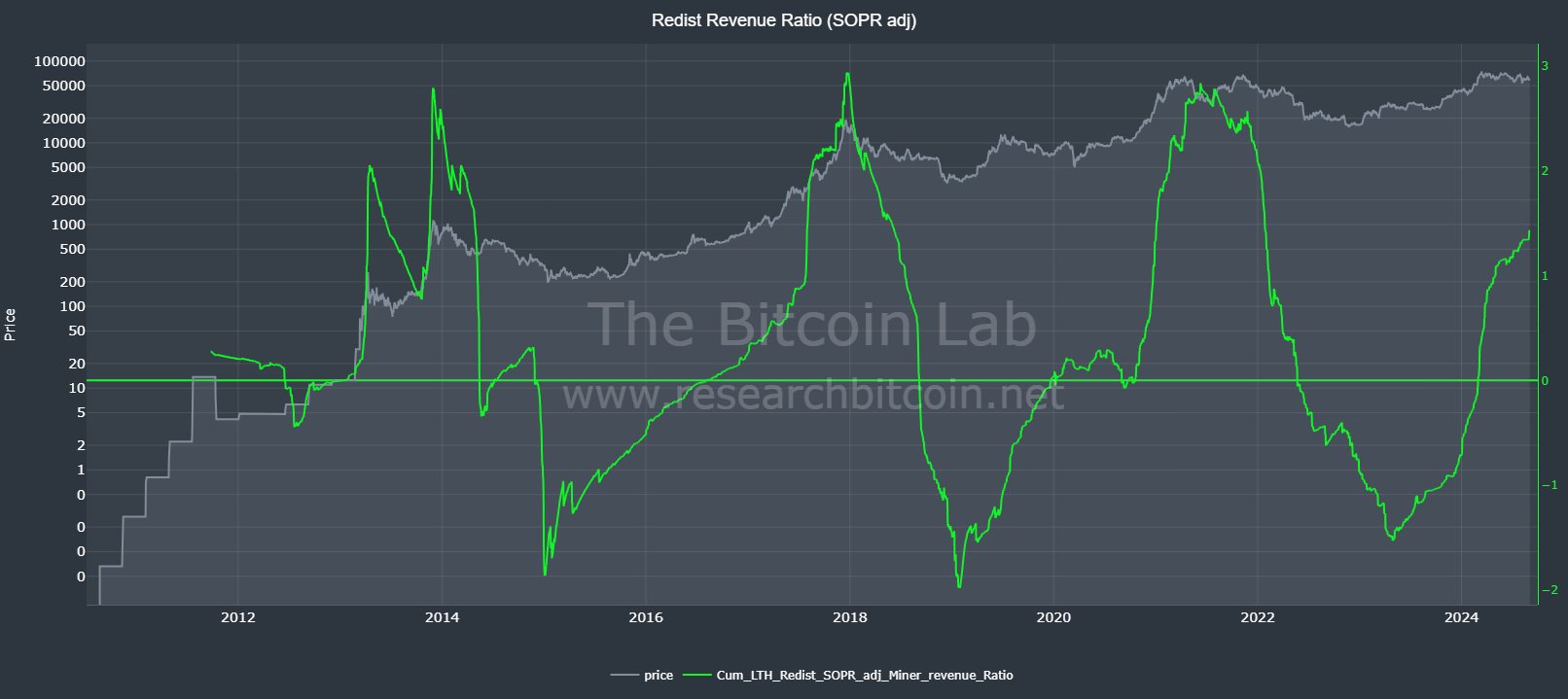

The Redistributed Revenue Ratio, which compares long-term holder activity to Proof of Work incentives, shows a clear pattern of HODL cycles.

The ratio adjusted with the Spent Output Profit Ratio (SOPR) is around 1.5, suggesting that Bitcoin has not peaked yet.

Source: The Bitcoin Lab

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As global liquidity continues to grow, and once stablecoins are allocated to Bitcoin, the price could rise significantly.

Bitcoin is likely to be one of the primary beneficiaries when this capital finally enters the market, potentially pushing BTC price higher.

- Global liquidity in stablecoins could push crypto prices higher.

- Key indicators say Bitcoin is poised for break out.

September is often a bearish month for Bitcoin and other asset classes. However, October typically marks a strong bullish period, with Bitcoin [BTC] showing positive returns in 8 out of the last 9 Octobers.

On average, BTC price gains 22.9% during this month. This historical trend may explain why there’s consistent buying in the options market.

While global liquidity is increasing in the crypto market, it hasn’t yet been fully allocated. Much of this capital is currently tied up in stablecoins, waiting to impact the BTC price.

When this “firepower” eventually enters the market, it could lead to a significant move.

Source: CryptoQuant

Bitcoin is in consolidation

Bitcoin has been trading within a very narrow range for the past month. This compression usually precedes a large move in either direction.

If Bitcoin experiences another solid drop, it could complete its current cycle and bounce back strongly. The weekly timeframe shows some weakness, which is not ideal if BTC price is expected to reach new highs in October.

However, it’s not too late for this to happen. The key is for Bitcoin to break out of its current consolidation without looking back.

Source: TradingView

Once the capital currently held in stablecoins is allocated to Bitcoin, the price could break through either side of this range, potentially leading to a continuation of the ongoing bull run.

Bitcoin still has room to grow

The MVRV Z-Score, which currently reads around 1.8, suggests that the market is moderately optimistic but not at an extreme point.

This score indicates that while Bitcoin still has room to grow, caution is needed as the market could become overvalued if the score continues to rise.

The 1.8 reading implies that the cycle is far from over and may just be beginning. As the BTC price moves higher, it’s important to monitor this score closely, as it could provide early warnings of a market peak.

Source: Bitcoin Magazine PRO

The short to medium term open interest

In the short to medium term, open interest (OI) is relatively high, which could hinder sustainable upward movement. For a healthier market, OI would need to decrease by around 10%.

Recently, OI has reset following a short-term rise during the latest drop, bringing BTC price back to where it started.

This reset is a positive sign, as it reduces the likelihood of a major market downturn and increases the chances of continued range trading on lower timeframes. If market conditions improve, Bitcoin’s price could surge higher.

Source: CryptoQuant

HODL cycles and periodicity

The Redistributed Revenue Ratio, which compares long-term holder activity to Proof of Work incentives, shows a clear pattern of HODL cycles.

The ratio adjusted with the Spent Output Profit Ratio (SOPR) is around 1.5, suggesting that Bitcoin has not peaked yet.

Source: The Bitcoin Lab

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As global liquidity continues to grow, and once stablecoins are allocated to Bitcoin, the price could rise significantly.

Bitcoin is likely to be one of the primary beneficiaries when this capital finally enters the market, potentially pushing BTC price higher.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

how to get clomid tablets where to buy cheap clomid price where can i buy cheap clomiphene without dr prescription where buy cheap clomid price clomiphene without dr prescription how can i get cheap clomiphene price where can i get cheap clomiphene no prescription

With thanks, Good information!

casino en ligne fiable

Incredible loads of valuable tips.

casino en ligne francais

Helpful forum posts, Kudos!

meilleur casino en ligne

Cheers, An abundance of facts.

casino en ligne

Regards, I appreciate it.

casino en ligne

Nicely put. Thanks a lot!

casino en ligne

Very good data, With thanks!

casino en ligne France

Many thanks! Terrific stuff!

casino en ligne

Position well taken..

meilleur casino en ligne

Many thanks! A lot of info.

casino en ligne francais

I couldn’t resist commenting. Profoundly written!

Proof blog you procure here.. It’s severely to espy great status belles-lettres like yours these days. I truly comprehend individuals like you! Rent mindfulness!!

zithromax 250mg tablet – buy tinidazole without prescription order metronidazole 200mg sale

semaglutide sale – semaglutide 14mg ca order periactin 4 mg online

buy domperidone 10mg for sale – sumycin 500mg usa buy flexeril cheap