- Bitcoin realized $5.42 billion in profits

- With rising netflows, BTC faced short-term selling pressure near $90k

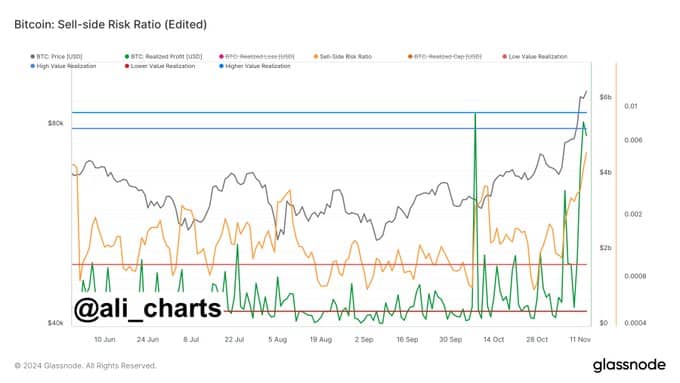

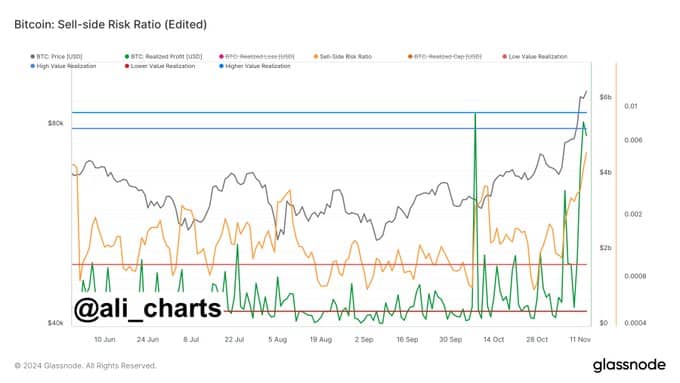

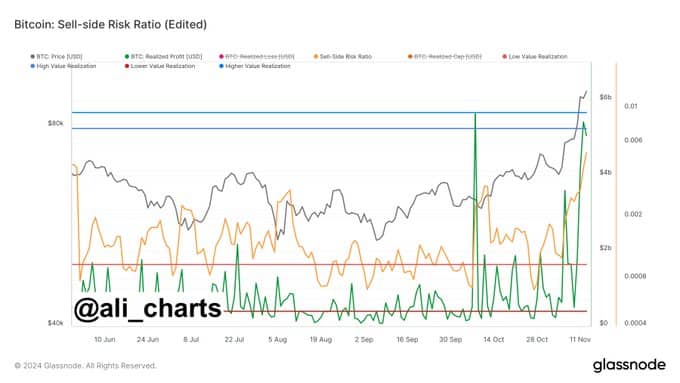

Bitcoin (BTC) has seen a realization of $5.42 billion in profits, according to market analyst Ali, as the Sell-side Risk Ratio surged to 0.524%. This metric, which evaluates the risk-reward balance for sellers, remains below historical highs, with the same suggesting that selling pressure is not yet at extreme levels.

Despite this, however, traders are advised to exercise caution as profit-taking intensifies.

Source: Glassnode

The realized profit figures surged ahead of realized losses, with profits spiking towards $8 billion while losses remained subdued at roughly $1 billion at press time. Such an imbalance is a sign of market optimism, as more investors capitalize on gains rather than selling at a loss.

Bitcoin’s market remains resilient despite recent price drop

Bitcoin was trading above $91,000 at press time, with a 24-hour trading volume of $84.43 billion. While the cryptocurrency did correct on the charts recently, BTC hiked by just under 4% in the last 24 hours.

At the same time, data from IntoTheBlock revealed that 307,000 addresses accumulated Bitcoin around an average price of $89,200. This level could act as a crucial zone of support or resistance, depending on the market direction.

Source: IntoTheBlock

Bitcoin’s ability to sustain its price near this level is being closely watched as market participants assess the next move.

Network activity reflects growing adoption

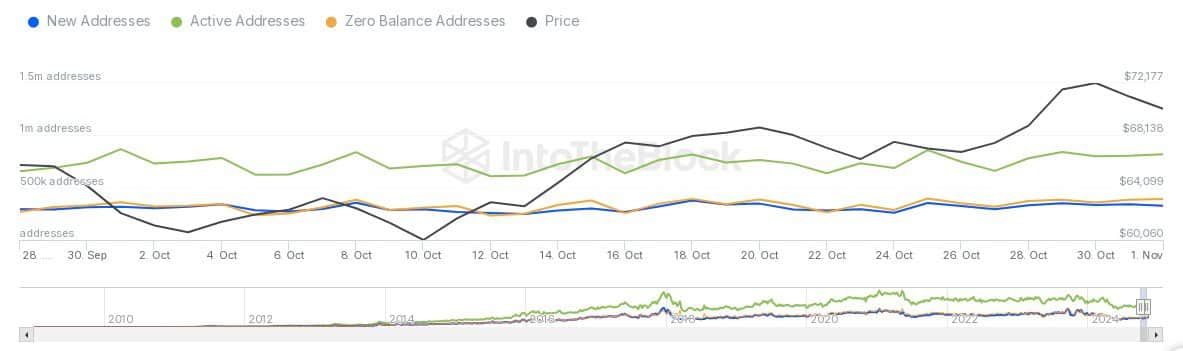

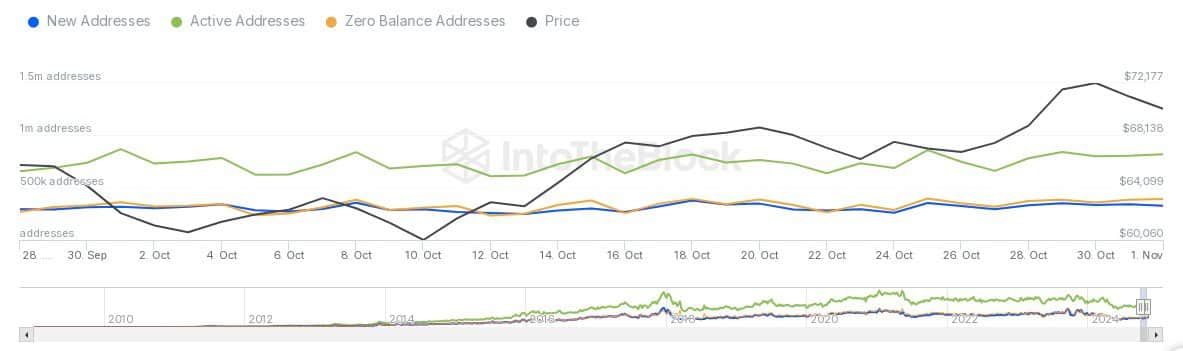

The hike in Bitcoin’s price correlated with a hike in network activity. In fact, data showed an uptick in both new addresses and active addresses – A sign of heightened participation.

New addresses have risen steadily too, reflecting fresh inflows of users into the ecosystem. Active addresses, representing daily transaction participants, also climbed to ~1.1 million, showcasing sustained network engagement.

Source: IntoTheBlock

Meanwhile, the number of zero balance addresses has remained relatively flat, indicating no noticeable increase in dormant or abandoned wallets.

This trend can be interpreted to suggest sustained trust and engagement from the community, even as Bitcoin’s price fluctuates on the charts.

Short-term selling pressure?

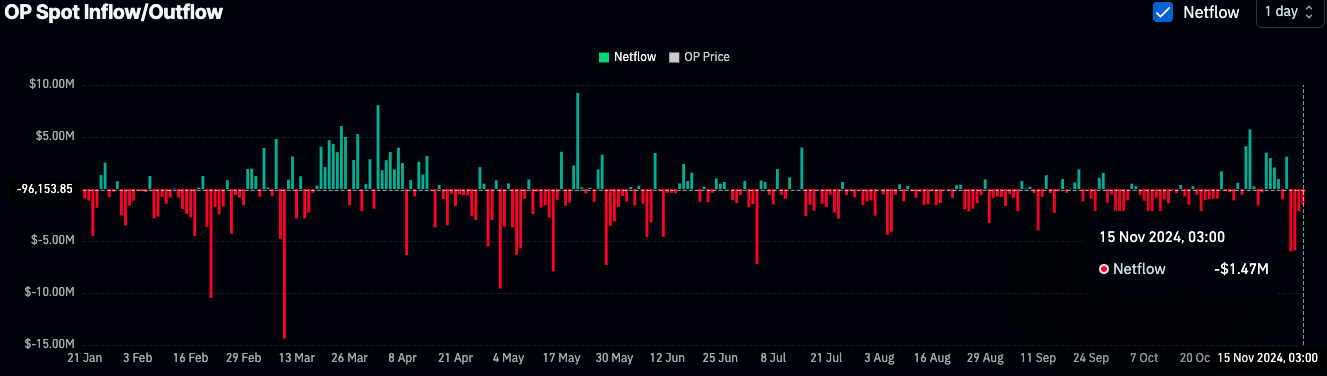

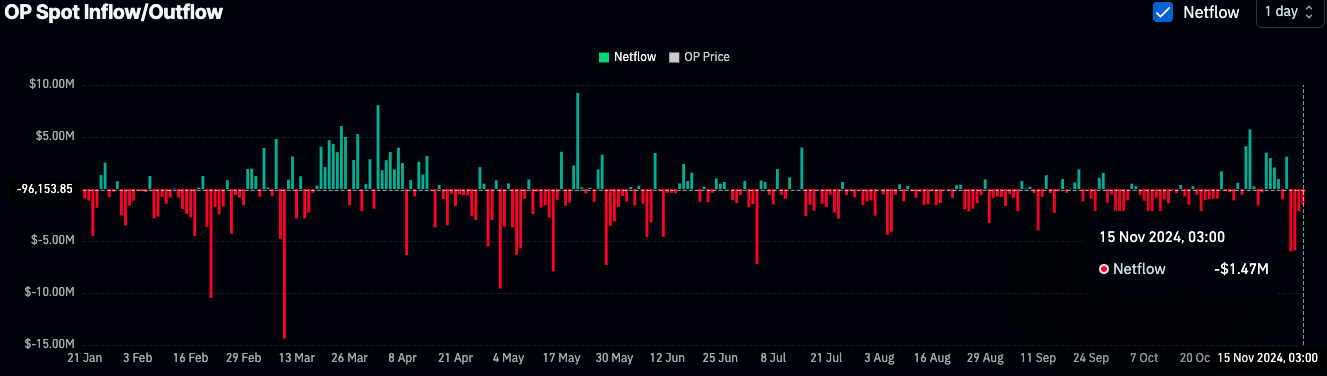

On 15 November , net inflows of $128.46 million were recorded, suggesting a possible hike in selling pressure.

Historically, higher inflows to exchanges have been associated with short-term corrections as traders look to capitalize on recent gains.

Source: Coinglass

And yet, Bitcoin’s performance has remained strong, supported by periods of accumulation earlier in the year. Between May and August, consistent negative netflows indicated large-scale withdrawals from exchanges, often linked to institutional investors or long-term holders.

This accumulation phase likely fueled Bitcoin’s recent rally, which saw the price climb from $25k to over $90k.

Broader economic factors could shape Bitcoin’s future

According to a recent AMBCrypto report, uncertainty surrounding regulatory policies and national debt levels could influence Bitcoin’s price trajectory.

The new administration may introduce fiscal measures to address debt concerns, which could heighten inflationary risks.

Moreover, with the Bitcoin/Gold ratio peaking at 35, Bitcoin is now valued at 35 times gold’s price, marking a yearly high. This is a sign of Bitcoin’s ongoing outperformance against traditional assets, even amid macroeconomic uncertainty.

- Bitcoin realized $5.42 billion in profits

- With rising netflows, BTC faced short-term selling pressure near $90k

Bitcoin (BTC) has seen a realization of $5.42 billion in profits, according to market analyst Ali, as the Sell-side Risk Ratio surged to 0.524%. This metric, which evaluates the risk-reward balance for sellers, remains below historical highs, with the same suggesting that selling pressure is not yet at extreme levels.

Despite this, however, traders are advised to exercise caution as profit-taking intensifies.

Source: Glassnode

The realized profit figures surged ahead of realized losses, with profits spiking towards $8 billion while losses remained subdued at roughly $1 billion at press time. Such an imbalance is a sign of market optimism, as more investors capitalize on gains rather than selling at a loss.

Bitcoin’s market remains resilient despite recent price drop

Bitcoin was trading above $91,000 at press time, with a 24-hour trading volume of $84.43 billion. While the cryptocurrency did correct on the charts recently, BTC hiked by just under 4% in the last 24 hours.

At the same time, data from IntoTheBlock revealed that 307,000 addresses accumulated Bitcoin around an average price of $89,200. This level could act as a crucial zone of support or resistance, depending on the market direction.

Source: IntoTheBlock

Bitcoin’s ability to sustain its price near this level is being closely watched as market participants assess the next move.

Network activity reflects growing adoption

The hike in Bitcoin’s price correlated with a hike in network activity. In fact, data showed an uptick in both new addresses and active addresses – A sign of heightened participation.

New addresses have risen steadily too, reflecting fresh inflows of users into the ecosystem. Active addresses, representing daily transaction participants, also climbed to ~1.1 million, showcasing sustained network engagement.

Source: IntoTheBlock

Meanwhile, the number of zero balance addresses has remained relatively flat, indicating no noticeable increase in dormant or abandoned wallets.

This trend can be interpreted to suggest sustained trust and engagement from the community, even as Bitcoin’s price fluctuates on the charts.

Short-term selling pressure?

On 15 November , net inflows of $128.46 million were recorded, suggesting a possible hike in selling pressure.

Historically, higher inflows to exchanges have been associated with short-term corrections as traders look to capitalize on recent gains.

Source: Coinglass

And yet, Bitcoin’s performance has remained strong, supported by periods of accumulation earlier in the year. Between May and August, consistent negative netflows indicated large-scale withdrawals from exchanges, often linked to institutional investors or long-term holders.

This accumulation phase likely fueled Bitcoin’s recent rally, which saw the price climb from $25k to over $90k.

Broader economic factors could shape Bitcoin’s future

According to a recent AMBCrypto report, uncertainty surrounding regulatory policies and national debt levels could influence Bitcoin’s price trajectory.

The new administration may introduce fiscal measures to address debt concerns, which could heighten inflationary risks.

Moreover, with the Bitcoin/Gold ratio peaking at 35, Bitcoin is now valued at 35 times gold’s price, marking a yearly high. This is a sign of Bitcoin’s ongoing outperformance against traditional assets, even amid macroeconomic uncertainty.

can you get clomiphene for sale cost cheap clomid without a prescription can you buy clomiphene online can i buy clomiphene without dr prescription clomiphene tablets price in pakistan can i get clomiphene prices can you get cheap clomid for sale

Thanks for some other informative web site. Where else could I am getting that type of info written in such a perfect means? I have a challenge that I’m simply now working on, and I’ve been at the look out for such information.

More posts like this would prosper the blogosphere more useful.

Greetings! Utter productive par‘nesis within this article! It’s the little changes which choice obtain the largest changes. Thanks a a quantity towards sharing!

zithromax order – ofloxacin price metronidazole brand

buy rybelsus 14mg generic – buy periactin 4 mg without prescription buy cyproheptadine generic

domperidone usa – tetracycline online flexeril without prescription

purchase augmentin for sale – https://atbioinfo.com/ acillin canada

buy esomeprazole 40mg capsules – nexium to us order esomeprazole 40mg without prescription

coumadin 5mg canada – https://coumamide.com/ hyzaar cost

cheap meloxicam – moboxsin.com buy mobic paypal

It’s exhausting to search out knowledgeable folks on this subject, but you sound like you recognize what you’re speaking about! Thanks

order generic deltasone 10mg – adrenal buy generic prednisone over the counter

new ed drugs – site buy ed pills best price

Thanks an eye to sharing. It’s acme quality.

This is the stripe of glad I take advantage of reading.

diflucan 100mg drug – this buy diflucan generic

which is better cialis or levitra – https://ciltadgn.com/ sildenafil vs tadalafil which is better

ranitidine 150mg usa – online purchase zantac generic

buying cialis – https://strongtadafl.com/# where to buy cialis

viagra 50 mg – strong vpls order viagra cialis canada

I couldn’t hold back commenting. Well written! https://buyfastonl.com/isotretinoin.html

I am in truth enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks for providing such data. https://ursxdol.com/provigil-gn-pill-cnt/

More articles like this would frame the blogosphere richer. https://prohnrg.com/product/cytotec-online/

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but definitely you’re going to a famous blogger if you are not already 😉 Cheers!

Palatable blog you procure here.. It’s severely to on great status article like yours these days. I truly respect individuals like you! Take care!! https://ondactone.com/simvastatin/

More delight pieces like this would urge the web better.

https://doxycyclinege.com/pro/celecoxib/

I like this site its a master peace ! Glad I discovered this on google .

More posts like this would bring about the blogosphere more useful. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3616674

Some truly nice stuff on this website , I enjoy it.

I’m not sure why but this weblog is loading extremely slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later and see if the problem still exists.

Some truly great info , Sword lily I detected this.

I?¦ve recently started a web site, the information you offer on this website has helped me greatly. Thank you for all of your time & work.

how to get dapagliflozin without a prescription – https://janozin.com/# dapagliflozin 10 mg generic