- Bitcoin’s market cycle bottom ROI has hit a new low, signaling the start of a bullish cycle.

- There was massive liquidation above $72K, as MicroStrategy completed a stock split.

The return on investment (ROI) from the bottom of the last Bitcoin [BTC] market cycle has hit a new low. Alongside, the percentage of Bitcoin in profit also dropped to its lowest since October 2023.

As prices surpassed $54K, 71% of holders were in profit. The last time this happened, Bitcoin was priced at $28K.

So, the market has cooled off from overheated levels to yearly lows, but at double the previous price. This phase in the Bitcoin market cycle aligns with typical patterns seen in past cycles.

Understanding the current cycle can help investors make better decisions as history suggests we are on track, staying informed and adaptable is crucial as the market changes.

Source: IntoTheCryptoVerse

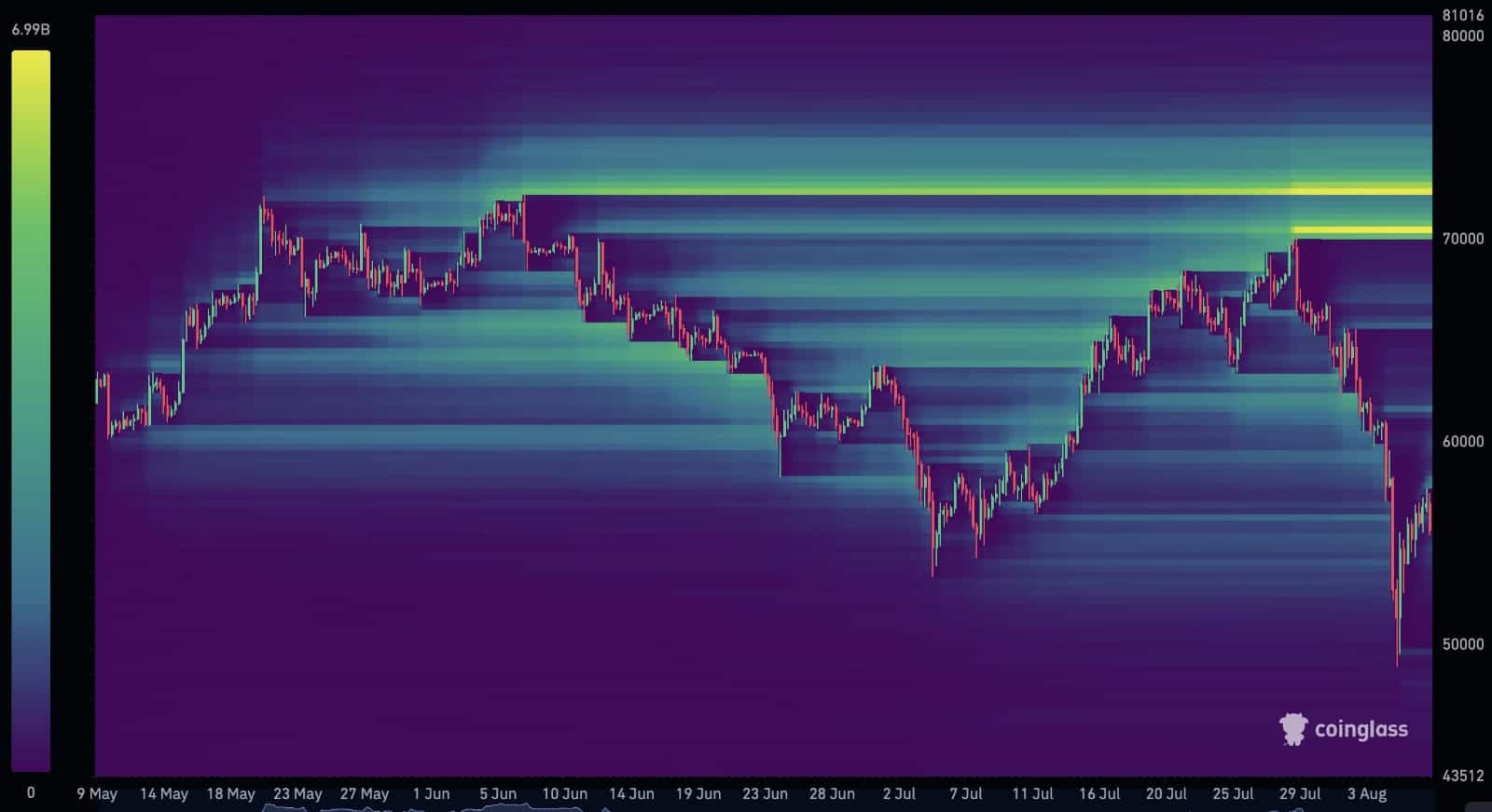

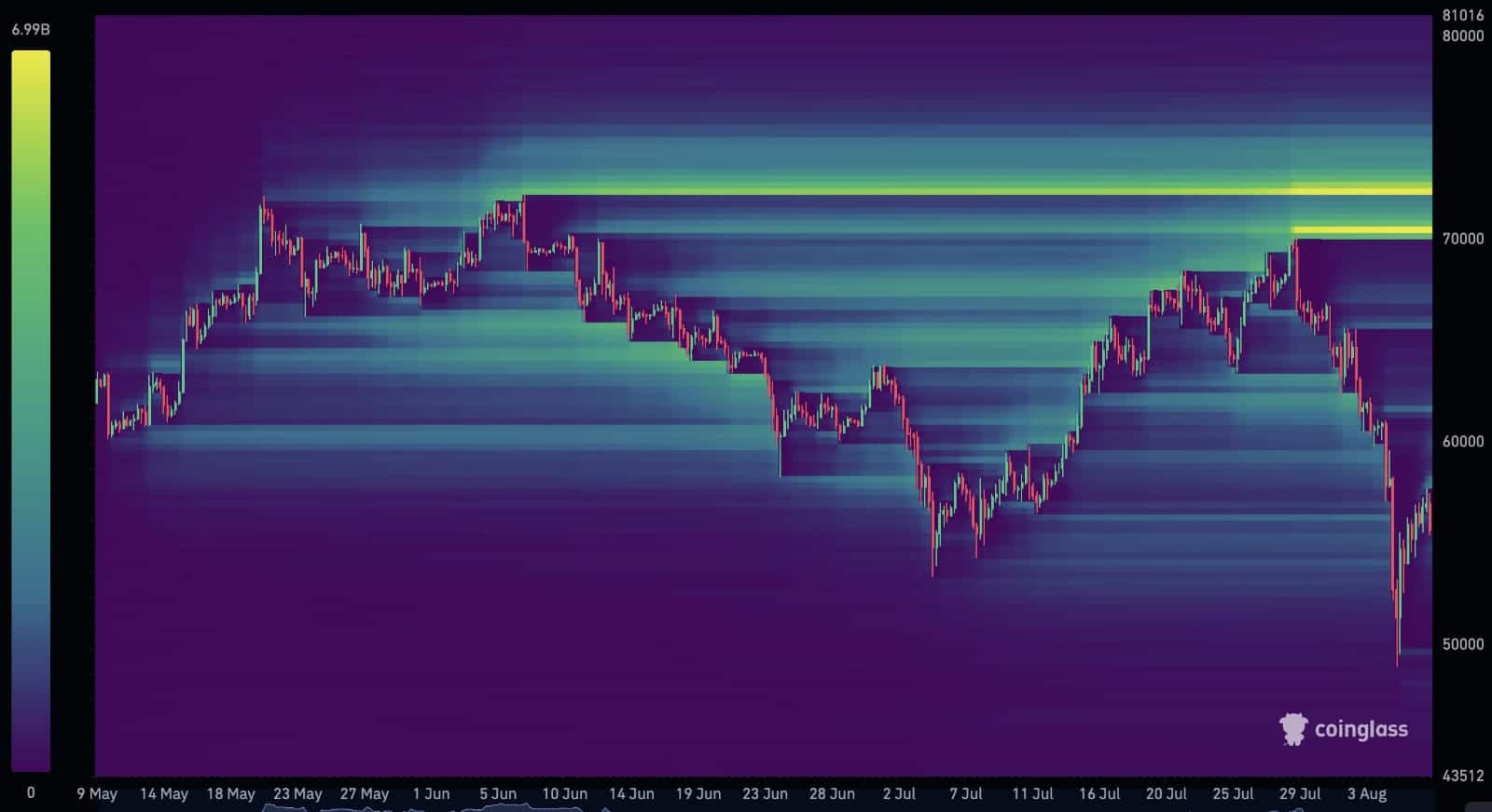

Massive liquidation resting above $72K

Over $15 billion in Bitcoin short positions are set to be liquidated between $70K and $72K, according to AMBcrypto’s look at Coinglass data.

This suggests that the next Bitcoin market cycle could begin soon, as the price approaches the critical $72K resistance level.

Traders and investors should monitor this metric closely, as it could influence decisions on their long-term view of Bitcoin, which appeared bullish at press time.

Source: Coinglass

Bitcoin bull flag still holding

Bitcoin’s bull flag pattern remained intact at press time. The longer it holds, the more likely a significant breakout becomes. If the pattern continues to consolidate, we could see a major price surge.

This is an exciting time for those following Bitcoin. The best-case scenario in this situation would be for Bitcoin to break through the $72K mark, signaling strong upward momentum.

Source: TradingView

MicroStrategy completes stock split

Moreover, MicroStrategy recently completed a 1:10 stock split, making its shares 10 times more accessible to investors X (formerly Twitter) user and market analyst Crypto Rover noted.

The company plans to sell up to $2 Billion in shares to invest more in Bitcoin and support its operations.

Is your portfolio green? Check out the BTC Profit Calculator

This move could be a great opportunity to diversify your portfolio. While a stock split doesn’t change the company’s fundamental value, it can make the stock feel more affordable.

The market’s recent rebound has boosted shares of Coinbase and MicroStrategy, with increases of 7.5% and 9%, respectively.

Source: Crypto Rover on X

- Bitcoin’s market cycle bottom ROI has hit a new low, signaling the start of a bullish cycle.

- There was massive liquidation above $72K, as MicroStrategy completed a stock split.

The return on investment (ROI) from the bottom of the last Bitcoin [BTC] market cycle has hit a new low. Alongside, the percentage of Bitcoin in profit also dropped to its lowest since October 2023.

As prices surpassed $54K, 71% of holders were in profit. The last time this happened, Bitcoin was priced at $28K.

So, the market has cooled off from overheated levels to yearly lows, but at double the previous price. This phase in the Bitcoin market cycle aligns with typical patterns seen in past cycles.

Understanding the current cycle can help investors make better decisions as history suggests we are on track, staying informed and adaptable is crucial as the market changes.

Source: IntoTheCryptoVerse

Massive liquidation resting above $72K

Over $15 billion in Bitcoin short positions are set to be liquidated between $70K and $72K, according to AMBcrypto’s look at Coinglass data.

This suggests that the next Bitcoin market cycle could begin soon, as the price approaches the critical $72K resistance level.

Traders and investors should monitor this metric closely, as it could influence decisions on their long-term view of Bitcoin, which appeared bullish at press time.

Source: Coinglass

Bitcoin bull flag still holding

Bitcoin’s bull flag pattern remained intact at press time. The longer it holds, the more likely a significant breakout becomes. If the pattern continues to consolidate, we could see a major price surge.

This is an exciting time for those following Bitcoin. The best-case scenario in this situation would be for Bitcoin to break through the $72K mark, signaling strong upward momentum.

Source: TradingView

MicroStrategy completes stock split

Moreover, MicroStrategy recently completed a 1:10 stock split, making its shares 10 times more accessible to investors X (formerly Twitter) user and market analyst Crypto Rover noted.

The company plans to sell up to $2 Billion in shares to invest more in Bitcoin and support its operations.

Is your portfolio green? Check out the BTC Profit Calculator

This move could be a great opportunity to diversify your portfolio. While a stock split doesn’t change the company’s fundamental value, it can make the stock feel more affordable.

The market’s recent rebound has boosted shares of Coinbase and MicroStrategy, with increases of 7.5% and 9%, respectively.

Source: Crypto Rover on X

My brother suggested I might like this website He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks

generic clomiphene pill clomiphene pregnancy can i purchase generic clomiphene pills clomiphene for sale in mexico how to buy clomiphene tablets can i order generic clomiphene without rx cost of generic clomid without rx

The vividness in this serving is exceptional.

This website positively has all of the information and facts I needed about this subject and didn’t comprehend who to ask.

order zithromax 500mg pills – where to buy floxin without a prescription metronidazole 200mg drug

semaglutide canada – semaglutide 14mg canada buy cyproheptadine 4 mg for sale

generic domperidone 10mg – order flexeril 15mg pills flexeril medication

propranolol brand – buy methotrexate online cheap methotrexate 10mg generic

cheap amoxil generic – amoxil over the counter how to buy combivent

brand zithromax 250mg – nebivolol sale bystolic cost

oral augmentin 1000mg – https://atbioinfo.com/ buy ampicillin generic

buy nexium paypal – anexa mate nexium 20mg capsules

mobic canada – https://moboxsin.com/ cheap meloxicam 7.5mg

buy deltasone 40mg without prescription – apreplson.com order deltasone 20mg sale

natural pills for erectile dysfunction – fast ed to take site best ed pills

amoxicillin online order – amoxicillin pills amoxil us

order diflucan 200mg generic – https://gpdifluca.com/ order fluconazole 200mg pill

purchase lexapro generic – order escitalopram 10mg online generic escitalopram 20mg

cenforce 50mg us – https://cenforcers.com/# buy generic cenforce 50mg

tadalafil tablets 20 mg side effects – https://ciltadgn.com/# us pharmacy prices for cialis

zantac order – https://aranitidine.com/# buy zantac 300mg online

how safe is it to order viagra online – 100 mg generic viagra order viagra thailand

With thanks. Loads of conception! https://gnolvade.com/

I am in truth enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://buyfastonl.com/azithromycin.html

This is the tolerant of delivery I turn up helpful. https://ursxdol.com/doxycycline-antibiotic/

More articles like this would make the blogosphere richer. https://prohnrg.com/

More posts like this would make the blogosphere more useful. https://aranitidine.com/fr/levitra_francaise/

More articles like this would make the blogosphere richer. https://ondactone.com/simvastatin/

Thanks for putting this up. It’s well done.

buy medex online

This is a question which is near to my callousness… Numberless thanks! Exactly where can I upon the phone details in the course of questions? http://www.dbgjjs.com/home.php?mod=space&uid=531848

order forxiga – https://janozin.com/# dapagliflozin uk

order orlistat sale – xenical tablet orlistat 120mg brand

This is the gentle of literature I positively appreciate. http://shiftdelete.10tl.net/member.php?action=profile&uid=205542