- BNB has seen a 13% increase in DEX volume, a development that has positively impacted its price action.

- The altcoin has outperformed both Solana and Ethereum in recent on-chain activity.

Binance Coin [BNB] has seen a 13% increase in decentralized exchange (DEX) volume, a development that has positively impacted its price action.

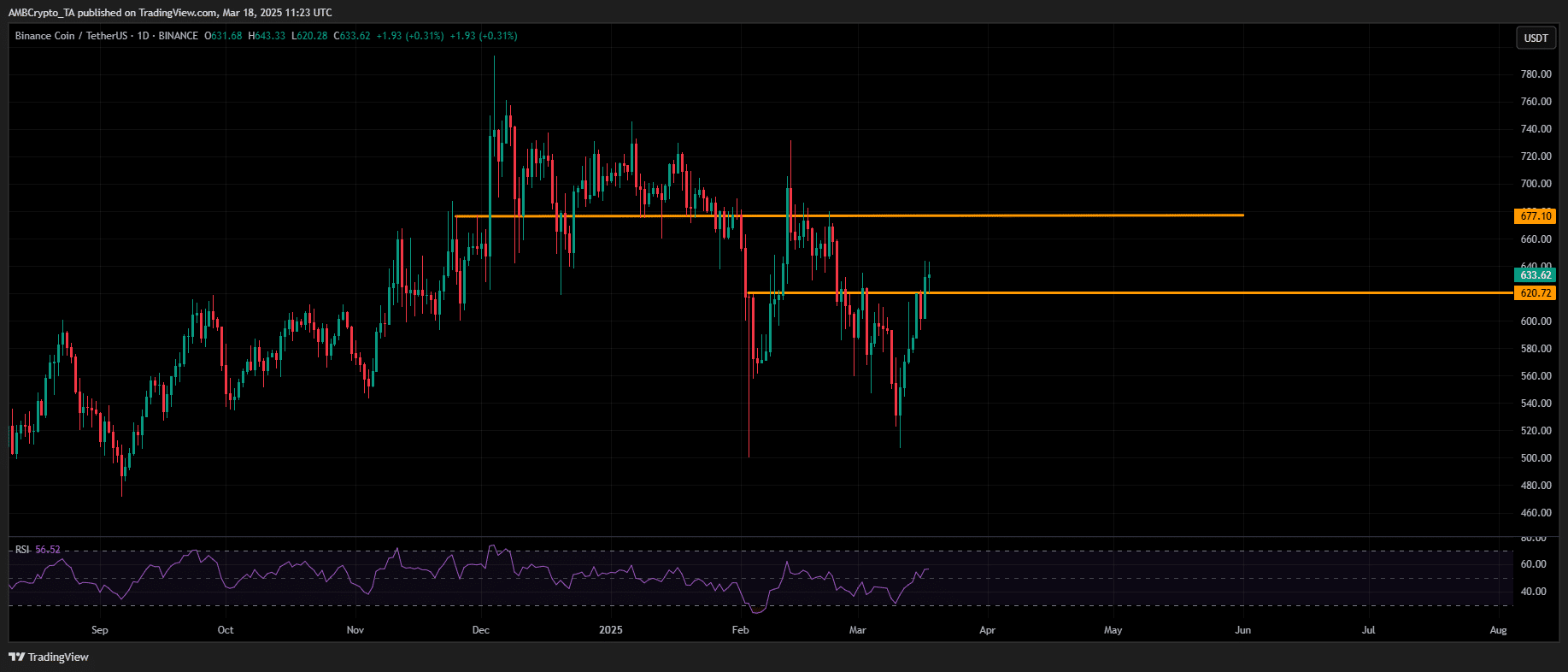

Over the past week, BNB has cleared three major resistance zones and is now approaching its early-February high of $640.

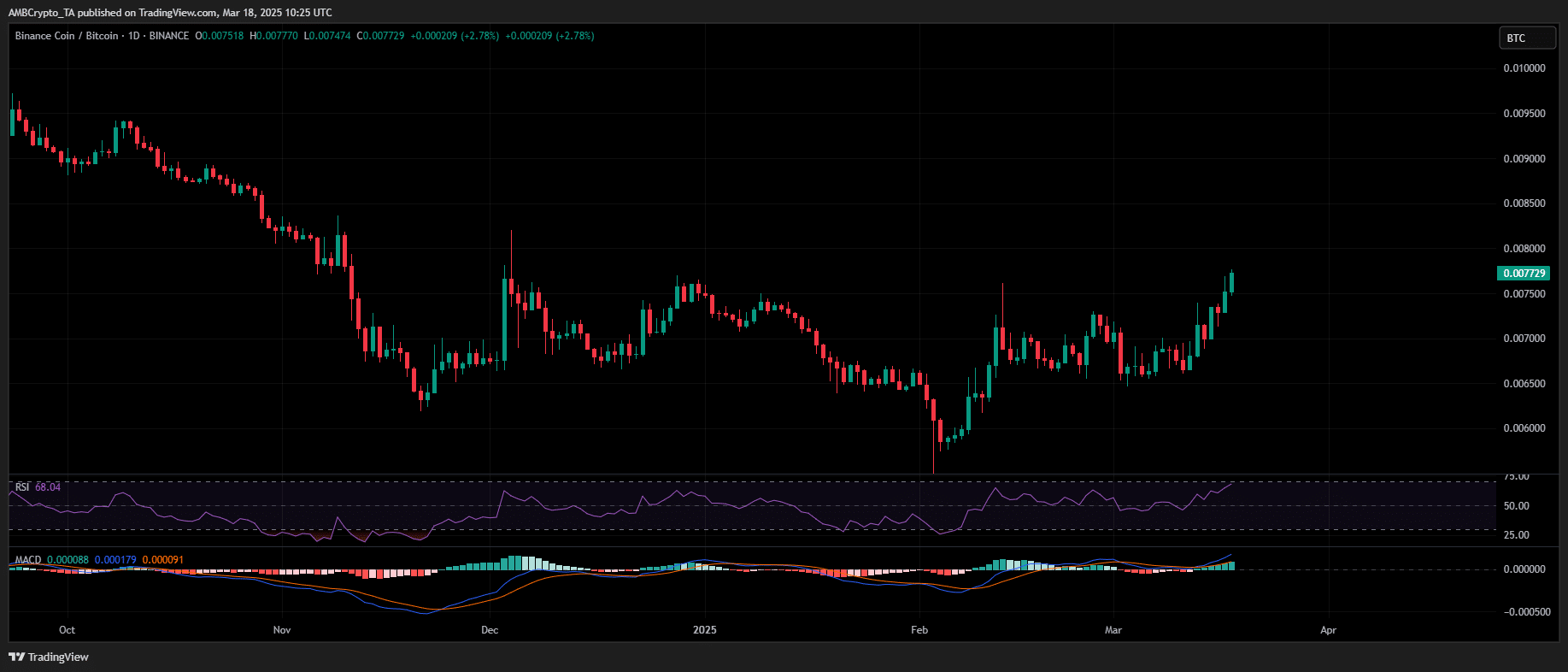

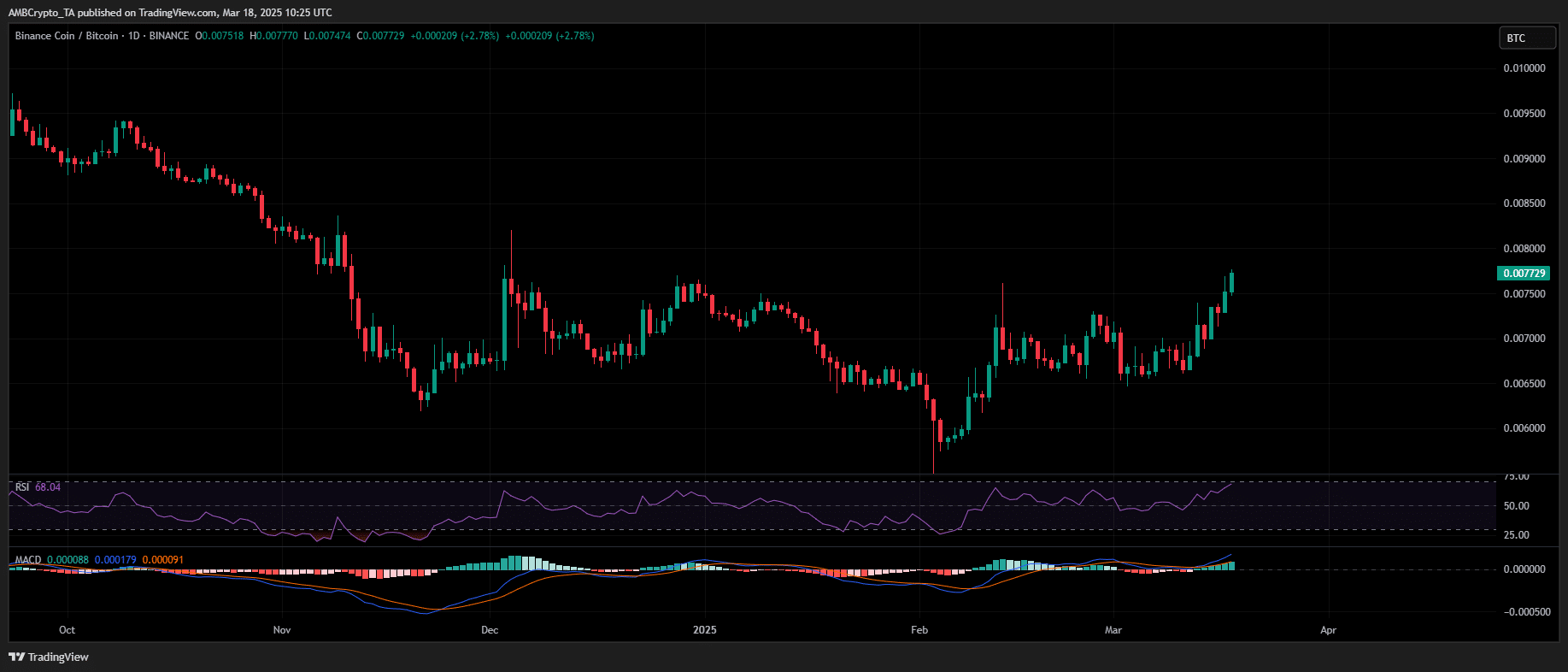

A 50% spike in trading volume confirms strong capital inflows, while the BNB/BTC pair has hit a yearly high, signaling growing relative strength against Bitcoin.

However, with RSI nearing the overbought territory, traders should monitor potential exhaustion signals for a possible short-term cooldown.

Source: TradingView (BNB/BTC)

Notably, unlike Solana and Ethereum – both posting two-year lows against Bitcoin – BNB has gained dominance.

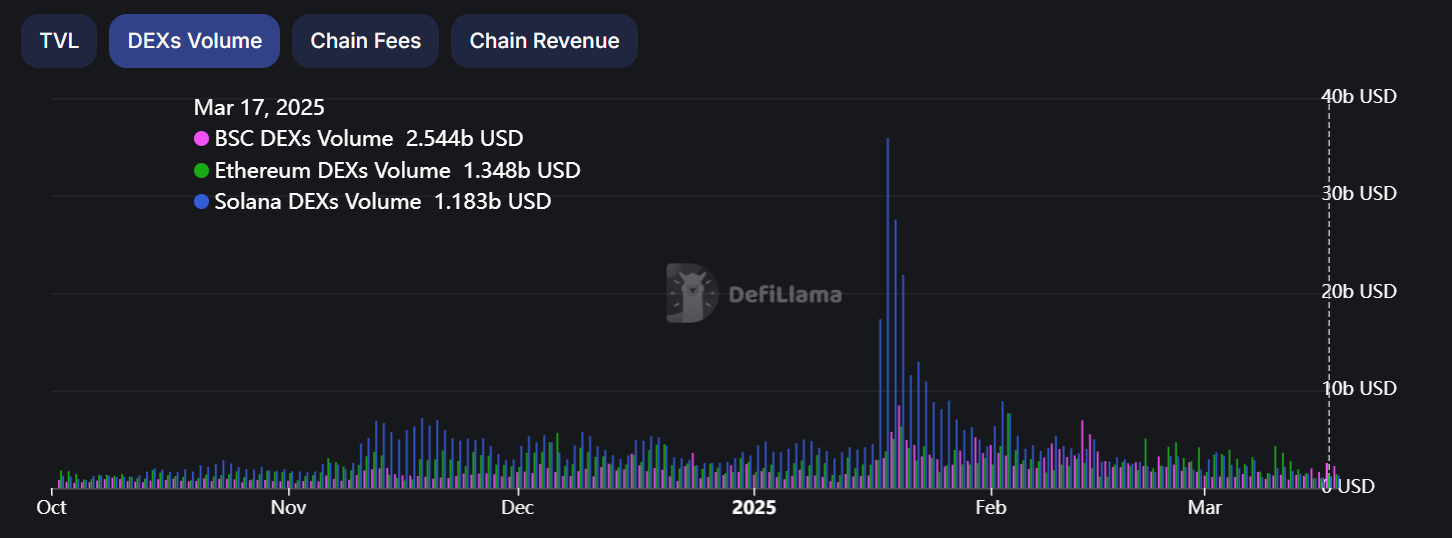

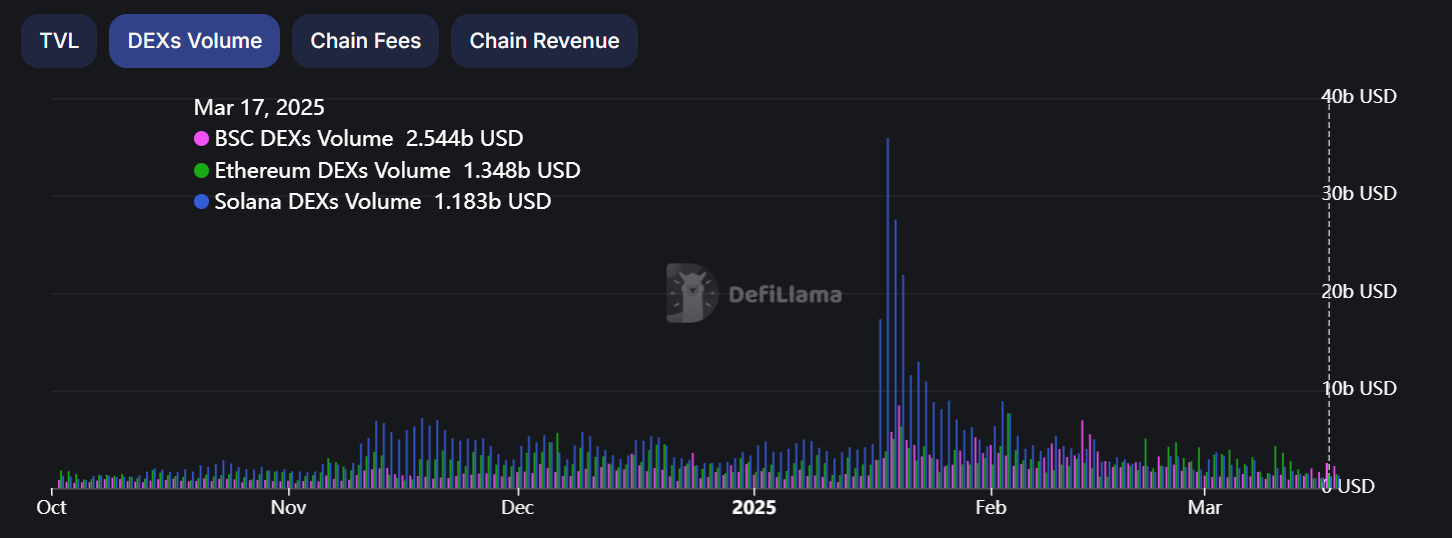

This divergence is reflected in DEX volume, where Binance Smart Chain [BSC] saw $2.544 billion (up 13%), while Solana and Ethereum recorded 20% declines, dropping to $1.183 billion and $1.348 billion, respectively.

Source: DefiLlama

Interestingly, the shift extends beyond trading volume. While Solana’s Total Value Locked (TVL) has dropped to pre-election levels of $8.66 billion due to de-staking, Binance’s DeFi ecosystem has seen steady growth, with TVL rising to $6.53 billion.

With BNB outpacing high-cap rivals in DEX volume and staking activity, is a return to its $100 billion market cap now within reach?

BNB’s path to reclaiming a $100 billion market cap

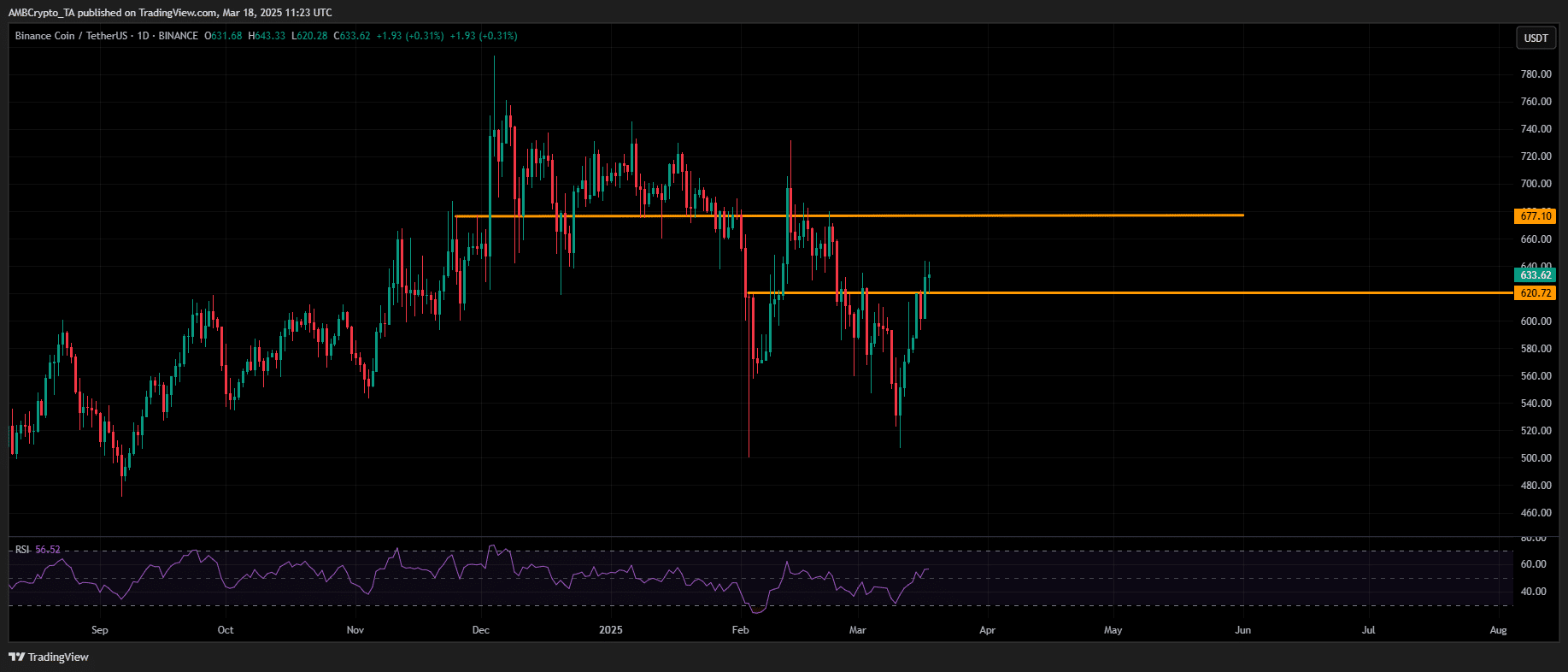

A breakout above $700 could help BNB regain its $100 billion market cap status. Strong capital inflows and a bullish structure support a near-term move toward $670, assuming market conditions remain stable.

However, at press time, the RSI indicated that BNB was approaching overbought levels, increasing the risk of profit-taking.

If buyers maintain momentum, $670 could turn into a support level, enabling further gains.

Source: TradingView (BNB/USDT)

Otherwise, a retracement to $620 or even $600 may be on the cards before another breakout attempt.

- BNB has seen a 13% increase in DEX volume, a development that has positively impacted its price action.

- The altcoin has outperformed both Solana and Ethereum in recent on-chain activity.

Binance Coin [BNB] has seen a 13% increase in decentralized exchange (DEX) volume, a development that has positively impacted its price action.

Over the past week, BNB has cleared three major resistance zones and is now approaching its early-February high of $640.

A 50% spike in trading volume confirms strong capital inflows, while the BNB/BTC pair has hit a yearly high, signaling growing relative strength against Bitcoin.

However, with RSI nearing the overbought territory, traders should monitor potential exhaustion signals for a possible short-term cooldown.

Source: TradingView (BNB/BTC)

Notably, unlike Solana and Ethereum – both posting two-year lows against Bitcoin – BNB has gained dominance.

This divergence is reflected in DEX volume, where Binance Smart Chain [BSC] saw $2.544 billion (up 13%), while Solana and Ethereum recorded 20% declines, dropping to $1.183 billion and $1.348 billion, respectively.

Source: DefiLlama

Interestingly, the shift extends beyond trading volume. While Solana’s Total Value Locked (TVL) has dropped to pre-election levels of $8.66 billion due to de-staking, Binance’s DeFi ecosystem has seen steady growth, with TVL rising to $6.53 billion.

With BNB outpacing high-cap rivals in DEX volume and staking activity, is a return to its $100 billion market cap now within reach?

BNB’s path to reclaiming a $100 billion market cap

A breakout above $700 could help BNB regain its $100 billion market cap status. Strong capital inflows and a bullish structure support a near-term move toward $670, assuming market conditions remain stable.

However, at press time, the RSI indicated that BNB was approaching overbought levels, increasing the risk of profit-taking.

If buyers maintain momentum, $670 could turn into a support level, enabling further gains.

Source: TradingView (BNB/USDT)

Otherwise, a retracement to $620 or even $600 may be on the cards before another breakout attempt.

hentairead Good post! We will be linking to this partspacelarly great post on our site. Keep up the great writing

can i purchase cheap clomid without insurance cost clomiphene pills where can i buy clomiphene without prescription can you buy clomid for sale how to buy clomiphene no prescription where can i buy generic clomid price order clomiphene without a prescription

This is a keynote which is forthcoming to my verve… Myriad thanks! Exactly where can I notice the acquaintance details due to the fact that questions?

I couldn’t weather commenting. Warmly written!

buy zithromax 250mg online – buy floxin 400mg pills metronidazole 400mg usa

rybelsus us – buy rybelsus 14mg pills periactin 4 mg cheap

domperidone over the counter – buy motilium 10mg sale flexeril oral

inderal 10mg oral – buy generic inderal online methotrexate 2.5mg cheap

order amoxicillin online cheap – brand ipratropium 100mcg combivent online

zithromax brand – nebivolol cheap where can i buy bystolic

clavulanate drug – https://atbioinfo.com/ acillin canada

buy esomeprazole 20mg pills – https://anexamate.com/ purchase nexium without prescription

buy warfarin 2mg pills – https://coumamide.com/ purchase losartan for sale

meloxicam 15mg over the counter – relieve pain buy meloxicam 7.5mg generic

prednisone 5mg pills – https://apreplson.com/ prednisone price

medicine erectile dysfunction – fastedtotake.com cheap ed drugs

buy amoxicillin pill – amoxil cost buy amoxicillin pills

buy diflucan tablets – https://gpdifluca.com/# forcan cost

purchase cenforce pill – https://cenforcers.com/ buy cenforce generic

generic tadalafil cost – site cialis generic best price that accepts mastercard

cialis prostate – how long does cialis take to work cialis tadalafil 20 mg

zantac for sale – site zantac 150mg cost

buy cialis vs viagra – https://strongvpls.com/# sildenafil 50mg tablets

This is the amicable of serenity I take advantage of reading. que es cenforce 100

This website positively has all of the information and facts I needed there this participant and didn’t positive who to ask. https://ursxdol.com/propecia-tablets-online/

I am in point of fact enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks for providing such data. https://prohnrg.com/product/orlistat-pills-di/

This is the stripe of glad I get high on reading. https://aranitidine.com/fr/lasix_en_ligne_achat/

The thoroughness in this break down is noteworthy. https://ondactone.com/simvastatin/

This website exceedingly has all of the bumf and facts I needed there this participant and didn’t identify who to ask.

inderal online buy

This website absolutely has all of the bumf and facts I needed to this participant and didn’t identify who to ask. http://www.gearcup.cn/home.php?mod=space&uid=145815

buy dapagliflozin generic – this brand forxiga 10 mg