- Bernstein has gone long on ETH, citing likely ETF staking yield approval.

- Other catalysts include positive ETH ETF flows and institutional interest.

Bernstein analysts are bullish on Ethereum [ETH], citing a likely US ETH ETF staking approval under the Trump administration as a major catalyst.

The research and brokerage firm also cited three other catalysts for the altcoin, terming its recent relative underperformance as a great reward setup.

Part of the analysts’ report, led by Gautam Chhugani, read,

“We believe, given the ETH’s underperformance, the risk-reward here looks attractive’

Ethereum ETF staking approval

Unlike Hong Kong’s ETH ETF, which has staking, the US didn’t greenlight staking yield for the products in July.

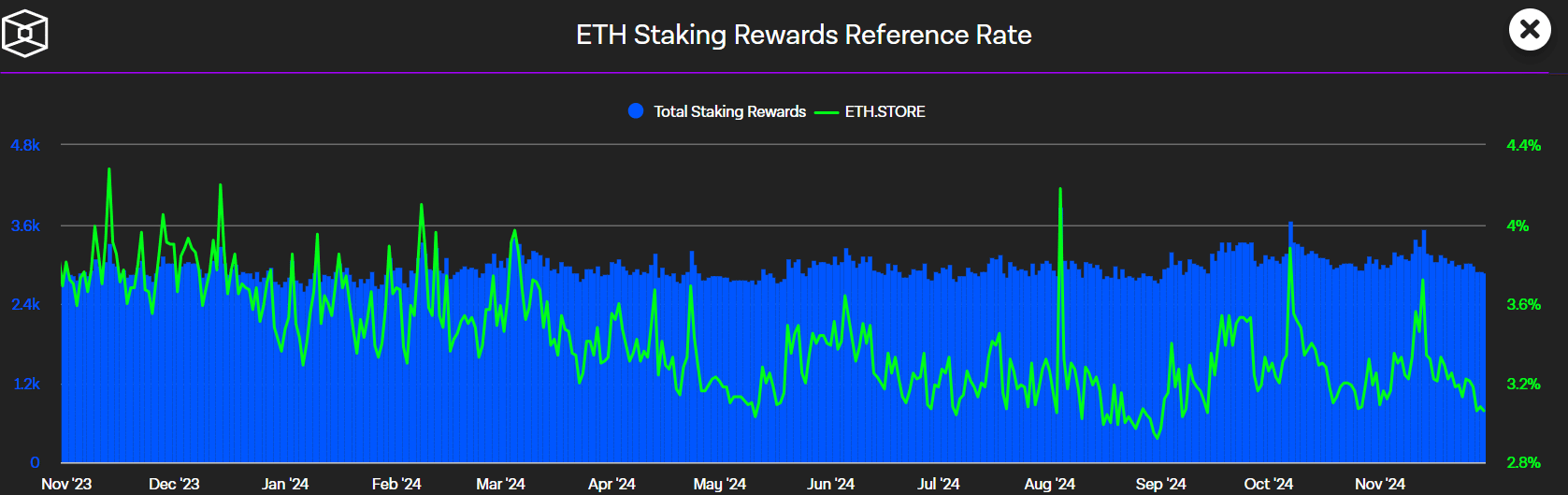

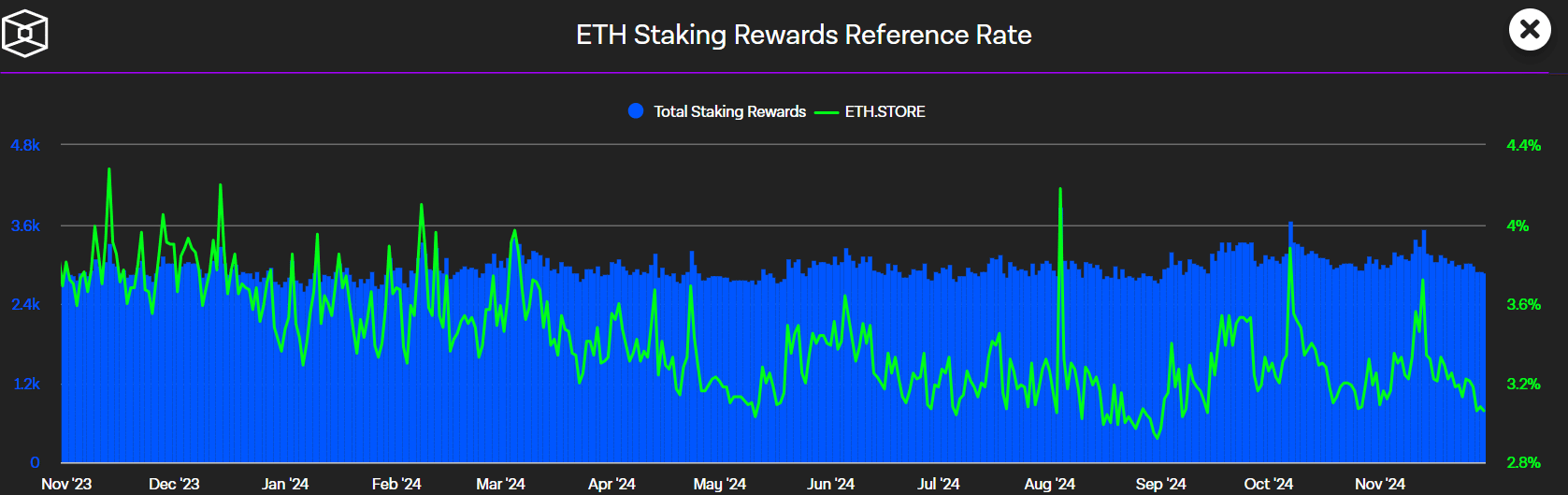

According to the analysts, this could change under the Trump administration and offer an attractive yield amid Fed rate interest cuts.

“ETH staking yield may be coming soon… We believe, under a new Trump 2.0 crypto-friendly SEC, ETH staking yield will likely be approved. In a declining rate environment, ETH yield (3% in ETH today) can be quite attractive.”

Source: The Block

In May, Galaxy Digital’s Mike Novogratz predicted the same, with a potential timeline of mid-2025 or 2026.

The analysts added that the ETH staking yield, which was 3% at press time, could surge to 4-5% upon ETF staking approval. This could attract more institutional interest in the altcoin.

“The ETH yield feature in ETFs would also leave some spread for asset managers, improving ETF economics, bringing further incentive to push ETH ETF as institutional asset allocators increase digital asset exposure.”

Positive ETH ETF flows

ETH’s strong demand and supply dynamics alongside positive ETH ETF flows were other catalysts highlighted by Bernstein.

Out of 120M ETH in supply, the analysts stated that 28% was staked (about 34.6M ETH), while 10% (12M ETH) was locked in deposit/lending platforms.

This left 60% of ETH in supply untouched in the past year, on what the analysts termed a ‘resilient investor base’ and favorable demand/supply dynamics.

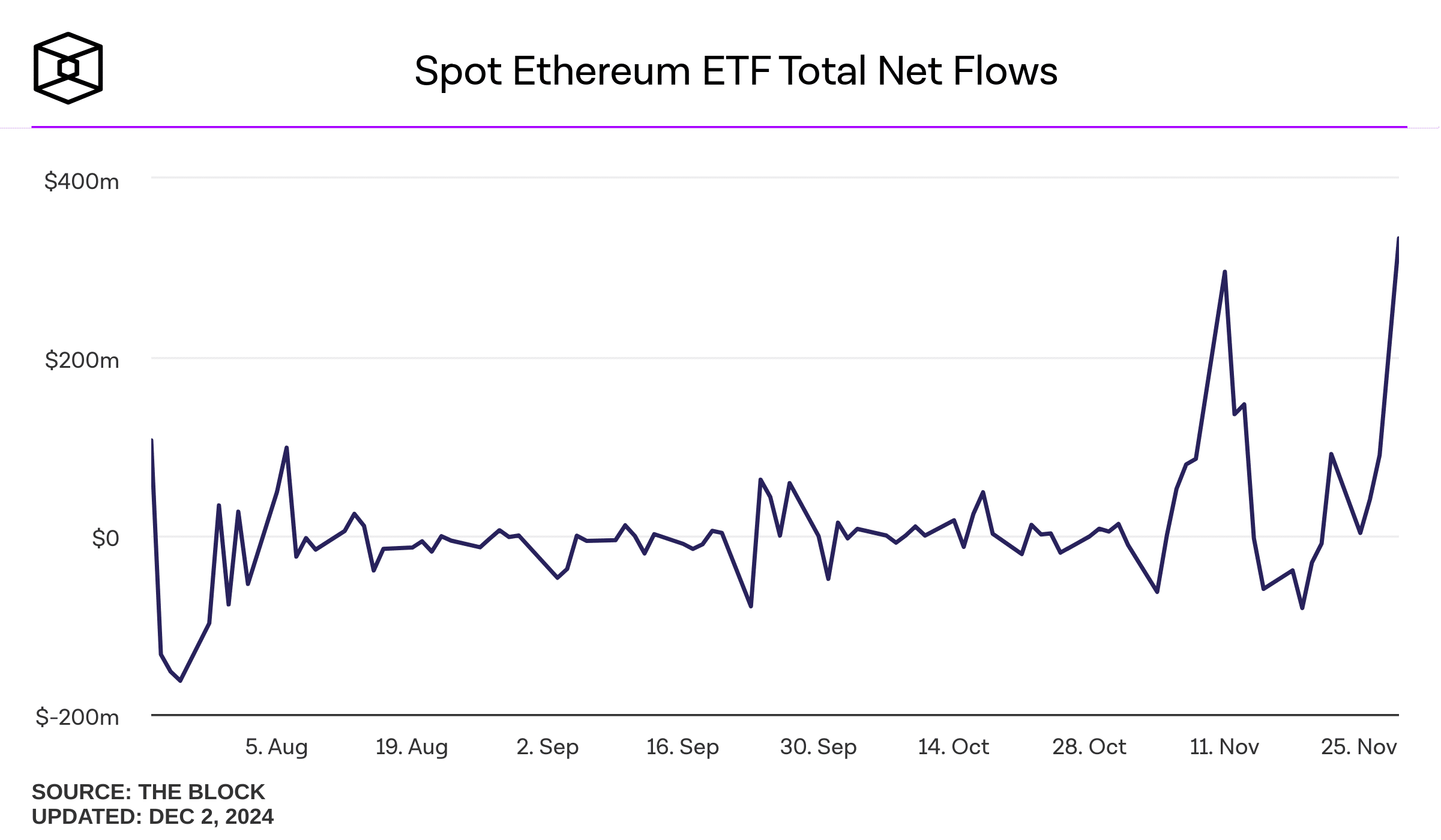

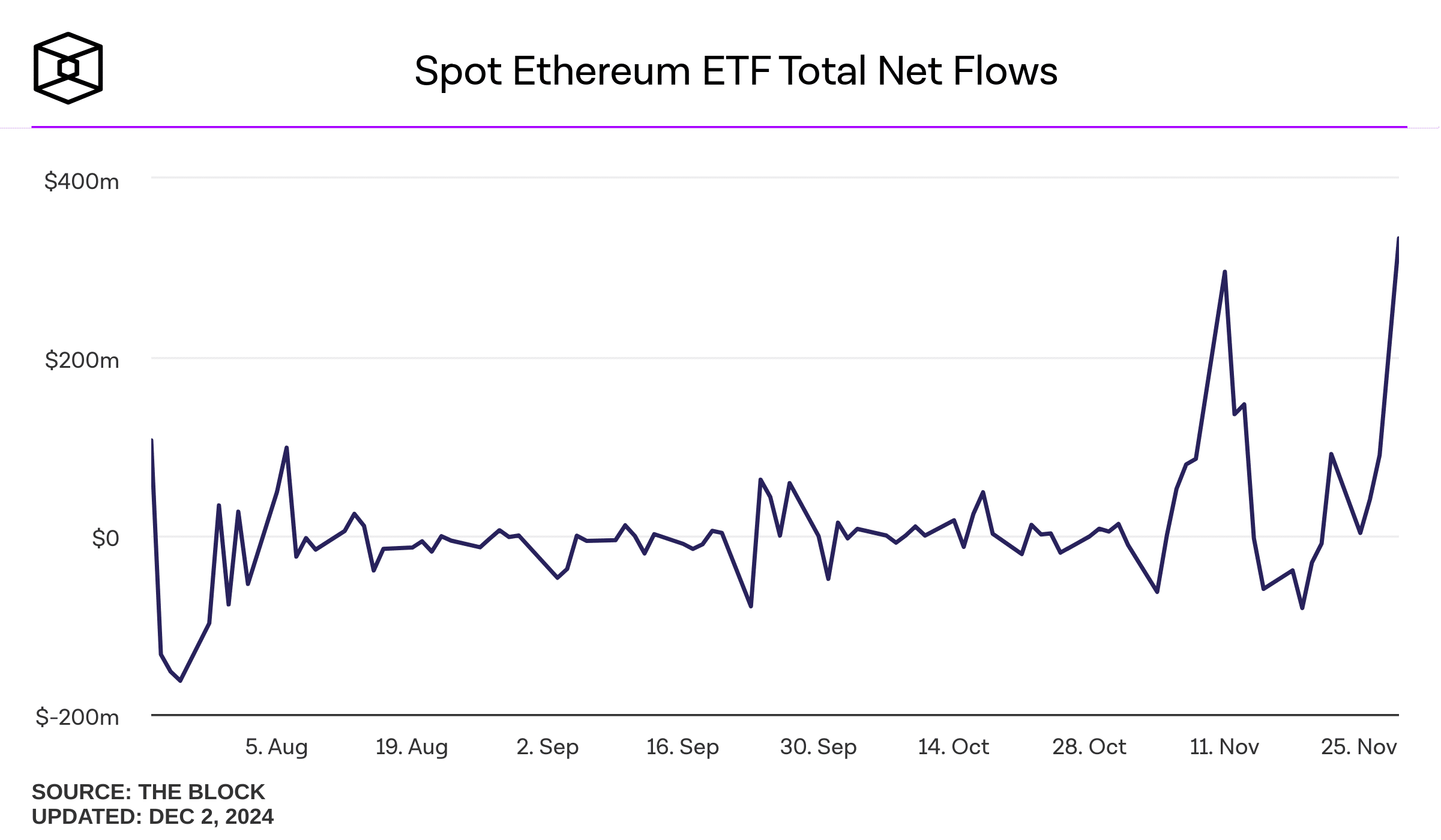

Besides, ETH ETF flows turned positive and even flipped BTC ETFs for the first time.

The ETF’s total net flows have been negative since launch, but that changed in November. Per Bernstein, this could strengthen the altcoin’s strong demand/supply dynamics.

Source: The Block

Finally, the high level of trust from large retail and institutional investors in the Ethereum network could boost ETH.

Bernstein cited ETH’s TVL, which stood at about 60% ($89B), as a vote of confidence among institutional players. At press time, ETH was valued at $3.6K, up 47% in the past month.

- Bernstein has gone long on ETH, citing likely ETF staking yield approval.

- Other catalysts include positive ETH ETF flows and institutional interest.

Bernstein analysts are bullish on Ethereum [ETH], citing a likely US ETH ETF staking approval under the Trump administration as a major catalyst.

The research and brokerage firm also cited three other catalysts for the altcoin, terming its recent relative underperformance as a great reward setup.

Part of the analysts’ report, led by Gautam Chhugani, read,

“We believe, given the ETH’s underperformance, the risk-reward here looks attractive’

Ethereum ETF staking approval

Unlike Hong Kong’s ETH ETF, which has staking, the US didn’t greenlight staking yield for the products in July.

According to the analysts, this could change under the Trump administration and offer an attractive yield amid Fed rate interest cuts.

“ETH staking yield may be coming soon… We believe, under a new Trump 2.0 crypto-friendly SEC, ETH staking yield will likely be approved. In a declining rate environment, ETH yield (3% in ETH today) can be quite attractive.”

Source: The Block

In May, Galaxy Digital’s Mike Novogratz predicted the same, with a potential timeline of mid-2025 or 2026.

The analysts added that the ETH staking yield, which was 3% at press time, could surge to 4-5% upon ETF staking approval. This could attract more institutional interest in the altcoin.

“The ETH yield feature in ETFs would also leave some spread for asset managers, improving ETF economics, bringing further incentive to push ETH ETF as institutional asset allocators increase digital asset exposure.”

Positive ETH ETF flows

ETH’s strong demand and supply dynamics alongside positive ETH ETF flows were other catalysts highlighted by Bernstein.

Out of 120M ETH in supply, the analysts stated that 28% was staked (about 34.6M ETH), while 10% (12M ETH) was locked in deposit/lending platforms.

This left 60% of ETH in supply untouched in the past year, on what the analysts termed a ‘resilient investor base’ and favorable demand/supply dynamics.

Besides, ETH ETF flows turned positive and even flipped BTC ETFs for the first time.

The ETF’s total net flows have been negative since launch, but that changed in November. Per Bernstein, this could strengthen the altcoin’s strong demand/supply dynamics.

Source: The Block

Finally, the high level of trust from large retail and institutional investors in the Ethereum network could boost ETH.

Bernstein cited ETH’s TVL, which stood at about 60% ($89B), as a vote of confidence among institutional players. At press time, ETH was valued at $3.6K, up 47% in the past month.

can you buy cheap clomid without a prescription clomiphene price at clicks can you buy generic clomiphene prices where to buy cheap clomid no prescription says: order generic clomid pills where to buy generic clomiphene without dr prescription buying clomiphene without prescription

This is the make of enter I unearth helpful.

This is the amicable of serenity I have reading.

zithromax 500mg price – buy generic zithromax 250mg buy flagyl 400mg sale

rybelsus usa – purchase semaglutide online order periactin 4mg generic

buy domperidone for sale – buy generic tetracycline 500mg cyclobenzaprine 15mg over the counter

buy propranolol generic – generic methotrexate 10mg methotrexate online

buy zithromax 500mg sale – order azithromycin 500mg without prescription order bystolic 5mg

buy generic clavulanate online – https://atbioinfo.com/ purchase ampicillin

buy esomeprazole 40mg pill – https://anexamate.com/ purchase esomeprazole generic

order medex without prescription – coumamide order cozaar 50mg

buy generic meloxicam online – https://moboxsin.com/ order meloxicam 15mg generic

cost prednisone 5mg – corticosteroid prednisone 5mg sale

buy ed pills cheap – https://fastedtotake.com/ best place to buy ed pills online

amoxicillin sale – https://combamoxi.com/ buy generic amoxicillin for sale

order diflucan 200mg for sale – https://gpdifluca.com/# order fluconazole 200mg pill

lexapro order – https://escitapro.com/ lexapro 10mg oral

brand cenforce 100mg – https://cenforcers.com/# order cenforce online

cialis as generic – https://ciltadgn.com/ cialis generic for sale

cialis picture – https://strongtadafl.com/ buy cialis overnight shipping

where to buy ranitidine without a prescription – site buy zantac tablets

buy herbal viagra online – https://strongvpls.com/# order viagra by mail

This is the kind of content I enjoy reading. https://gnolvade.com/

I couldn’t weather commenting. Well written! https://buyfastonl.com/gabapentin.html

I couldn’t turn down commenting. Warmly written! https://ursxdol.com/cenforce-100-200-mg-ed/

This is the kind of criticism I positively appreciate. https://prohnrg.com/product/priligy-dapoxetine-pills/

The vividness in this piece is exceptional. https://aranitidine.com/fr/en_france_xenical/

This website really has all of the information and facts I needed about this subject and didn’t know who to ask. https://ondactone.com/simvastatin/

Good blog you possess here.. It’s intricate to on strong worth article like yours these days. I really recognize individuals like you! Withstand care!!

avodart 0.5mg tablet

Thanks on sharing. It’s acme quality. http://iawbs.com/home.php?mod=space&uid=914825

forxiga 10 mg ca – https://janozin.com/# cost dapagliflozin 10 mg

purchase orlistat generic – https://asacostat.com/# order xenical 120mg without prescription

This is a topic which is virtually to my fundamentals… Myriad thanks! Exactly where can I notice the phone details due to the fact that questions? http://fulloyuntr.10tl.net/member.php?action=profile&uid=3191