- Base marketcap just soared to a new all-time high underpinned by sustained volumes.

- TVL and transaction growth complete a picture of a healthy DeFi ecosystem.

The Ethereum [ETH] layer 2 ecosystem has been expanding and Base has emerged as one of the L2 networks on the fast lane. Base recently achieved new milestones, including a new stablecoin marketcap all-time high.

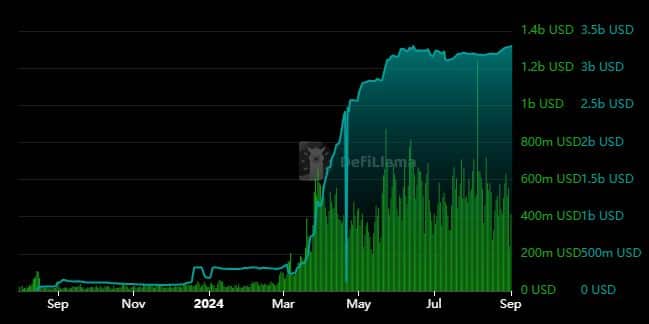

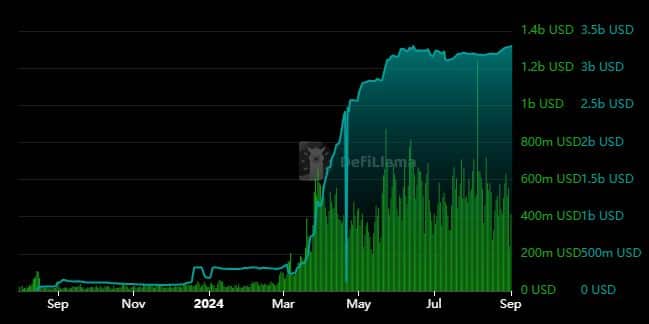

Base has been rising in the ranks of the existing Ethereum layer 2 networks. This was particularly evident in its stablecoin marketcap.

The latter recently reached a new all-time high of 3.28 billion. Base’s stablecoin marketcap experienced exponential growth between March and June. It continued to grow despite market headwinds in August.

Source: DeFiLlama

Stablecoin growth in DeFi usually accompanies robust utility. In the case of Base, the stablecoiin marketcap growth was accompanied by a surge in volume.

For perspective, the layer 2 network’s daily on-chain volume was below $50 million before March. However, daily volumes went over $600 million before the end of March.

Assessing the impact of Base stablecoin growth

Base has since then maintained healthy on-chain volume above $200 million even on the slowest Market days. This combination of stablecoins and robust volumes confirms the presence of robust demand and utility.

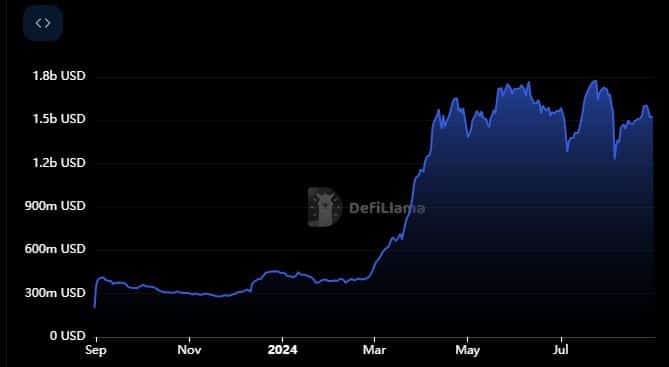

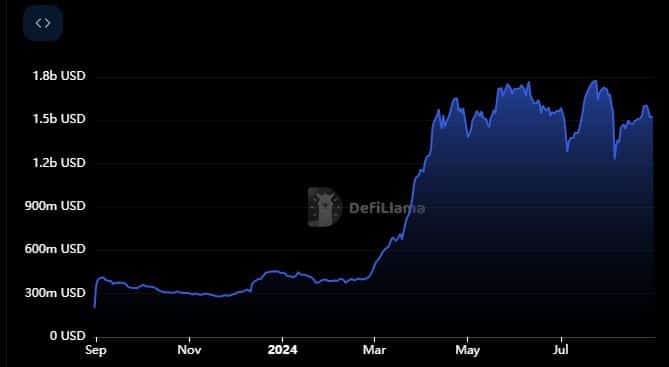

Consequently, the network’s TVL has been on the rise. It currently ranks as number 2 in the list of top Ethereum layer 2s by total value locked.

Source: DeFiLlama

Base managed to achieve a TVL all time high of $1.77 billion during the same March-June period that the stablecoin marketcap went parabolic. Its TVL has since retraced slightly over the last few months and to a $1.51 billion press time level.

The TVL is more likely to be influenced by market volatility, which would explain the dips in TVL from its peak. The TVL growth also reflects the robust flow of value within the BASE network.

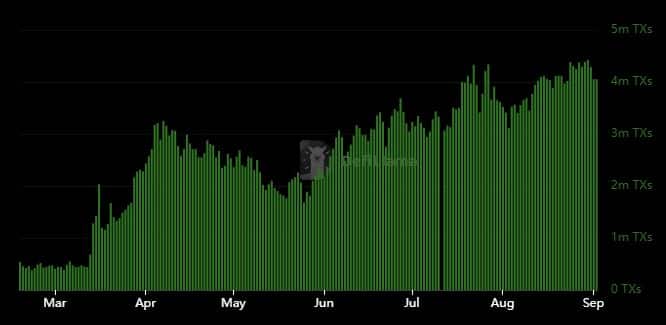

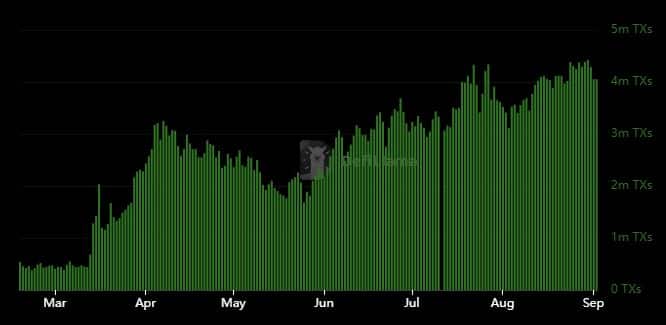

The Base layer 2 protocol backed its impressive growth with robust utility which is evident in user activity. According to DeFiLlama, Base concluded August with the highest recorded number of daily transactions.

Source: DeFiLlama

The network’s daily on-chain transactions peaked at 4.42 million TXs on 30 August. Zooming out reveals that the network experienced a surge in transactions from around mid-March.

On-chain activity has since been on a steady growth trajectory as underpinned by the transaction count.

Base is yet to roll out its own native token. However, would be one of the most anticipated airdrops if that were to happen. Meanwhile, the robust uptick reflects the state of the Ethereum ecosystem which is still highly active.

- Base marketcap just soared to a new all-time high underpinned by sustained volumes.

- TVL and transaction growth complete a picture of a healthy DeFi ecosystem.

The Ethereum [ETH] layer 2 ecosystem has been expanding and Base has emerged as one of the L2 networks on the fast lane. Base recently achieved new milestones, including a new stablecoin marketcap all-time high.

Base has been rising in the ranks of the existing Ethereum layer 2 networks. This was particularly evident in its stablecoin marketcap.

The latter recently reached a new all-time high of 3.28 billion. Base’s stablecoin marketcap experienced exponential growth between March and June. It continued to grow despite market headwinds in August.

Source: DeFiLlama

Stablecoin growth in DeFi usually accompanies robust utility. In the case of Base, the stablecoiin marketcap growth was accompanied by a surge in volume.

For perspective, the layer 2 network’s daily on-chain volume was below $50 million before March. However, daily volumes went over $600 million before the end of March.

Assessing the impact of Base stablecoin growth

Base has since then maintained healthy on-chain volume above $200 million even on the slowest Market days. This combination of stablecoins and robust volumes confirms the presence of robust demand and utility.

Consequently, the network’s TVL has been on the rise. It currently ranks as number 2 in the list of top Ethereum layer 2s by total value locked.

Source: DeFiLlama

Base managed to achieve a TVL all time high of $1.77 billion during the same March-June period that the stablecoin marketcap went parabolic. Its TVL has since retraced slightly over the last few months and to a $1.51 billion press time level.

The TVL is more likely to be influenced by market volatility, which would explain the dips in TVL from its peak. The TVL growth also reflects the robust flow of value within the BASE network.

The Base layer 2 protocol backed its impressive growth with robust utility which is evident in user activity. According to DeFiLlama, Base concluded August with the highest recorded number of daily transactions.

Source: DeFiLlama

The network’s daily on-chain transactions peaked at 4.42 million TXs on 30 August. Zooming out reveals that the network experienced a surge in transactions from around mid-March.

On-chain activity has since been on a steady growth trajectory as underpinned by the transaction count.

Base is yet to roll out its own native token. However, would be one of the most anticipated airdrops if that were to happen. Meanwhile, the robust uptick reflects the state of the Ethereum ecosystem which is still highly active.

clomiphene sleep apnea cost of cheap clomiphene online where buy generic clomiphene without dr prescription can you buy generic clomiphene online order cheap clomid tablets clomiphene price cvs can you get cheap clomiphene prices

This is the amicable of serenity I get high on reading.

Greetings! Very serviceable recommendation within this article! It’s the petty changes which liking turn the largest changes. Thanks a a quantity in the direction of sharing!

rybelsus 14 mg generic – order rybelsus 14mg online cheap order periactin pill

motilium drug – flexeril order where to buy cyclobenzaprine without a prescription

amoxil online buy – buy diovan online buy combivent generic

azithromycin 500mg drug – nebivolol 20mg sale bystolic 5mg over the counter

order augmentin pill – https://atbioinfo.com/ buy cheap generic ampicillin

purchase nexium pill – anexa mate nexium oral

warfarin 5mg sale – blood thinner buy losartan pill

buy meloxicam cheap – moboxsin buy meloxicam 15mg online cheap

deltasone 20mg pills – https://apreplson.com/ buy prednisone paypal

buy ed pills usa – red ed pill cheap erectile dysfunction

buy amoxil sale – buy amoxil pill purchase amoxil

forcan where to buy – flucoan purchase diflucan online cheap

order cenforce 50mg online – cenforce 100mg price oral cenforce

generic tadalafil tablet or pill photo or shape – why does tadalafil say do not cut pile cialis substitute

cialis strength – tadalafil tablets erectafil 20 cialis for sale online in canada

zantac 150mg uk – https://aranitidine.com/ purchase ranitidine sale

where can i buy viagra from – https://strongvpls.com/# buy generic viagra new zealand

Thanks on putting this up. It’s evidently done. generic prednisone names

More content pieces like this would insinuate the интернет better. https://gnolvade.com/es/lasix-comprar-espana/

I couldn’t hold back commenting. Warmly written! order generic glucophage

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/metoprolol-25-mg-tablets/

Proof blog you possess here.. It’s intricate to on great quality article like yours these days. I really comprehend individuals like you! Take care!! https://aranitidine.com/fr/lasix_en_ligne_achat/

Greetings! Very gainful par‘nesis within this article! It’s the crumb changes which choice espy the largest changes. Thanks a portion quest of sharing! https://ondactone.com/spironolactone/

I couldn’t weather commenting. Adequately written!

https://doxycyclinege.com/pro/warfarin/

More posts like this would persuade the online elbow-room more useful. http://zgyhsj.com/space-uid-978087.html

forxiga for sale – forxiga where to buy buy forxiga 10 mg pills

xenical over the counter – https://asacostat.com/ buy xenical without prescription