- Decreasing net positions could fuel a rally for the token.

- While volatilty increased, the AO showed that AVAX might slip below $45 before a potential recovery.

Losing 8.83% of its value in the last 24 hours led Avalanche’s [AVAX] price to decline below $50. However, AMBCrypto’s analysis showed that the collapse might not last long.

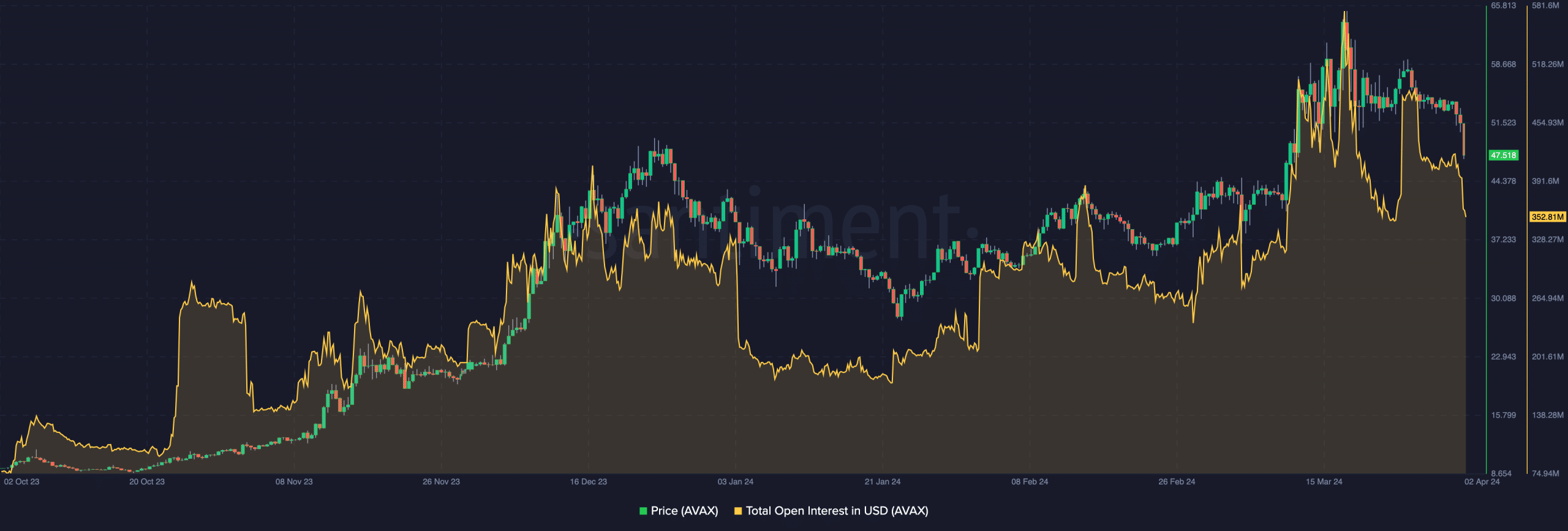

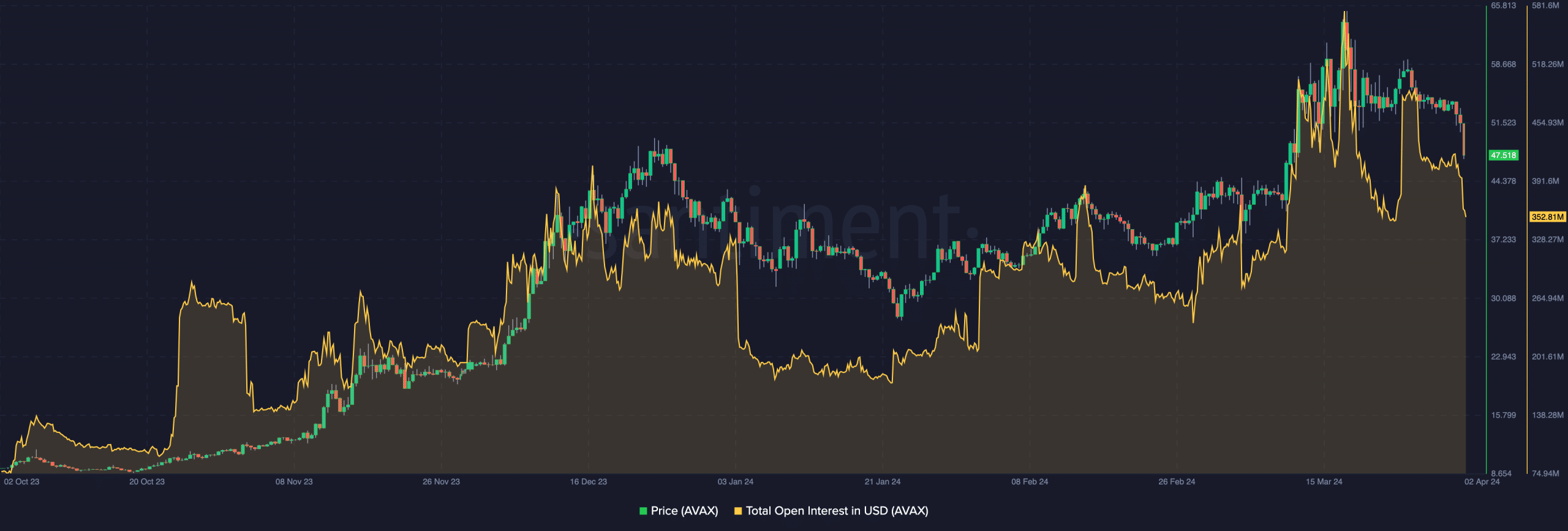

The reason for this prediction could be found in the total Open Interest (OI). OI tracks the net positioning of traders. An increase in the OI suggests that traders are opening new contracts.

Sellers have overstretched AVAX

On the other hand, a decrease indicates a surge in the closure of net positions. At press time, AVAX’s OI had fallen to $352.81 million, indicating liquidity outflows from the derivatives market.

But when placed side by side with the price, the decreasing OI could be good news. This is because the lack of interest alongside the plunging value was a sign that the downtrend was getting weak.

Source: Santiment

Should the indicator continue to fall, the convergence could cause an impulsive move that could trigger AVAX back above $50.

Apart from the derivative data, AMBCrypto checked the cryptocurrency’s momentum. Per the 4-hour timeframe, Santiment showed that the Relative Strength Index (RSI) was 26.40.

A reading like this implied that AVAX was oversold. As such, if buying pressure appears, the price of the token might skyrocket within a short period.

Furthermore, we looked at the one-day volatility on-chain. At press time, the volatility had spiked from the lows it was on the 1st of April. This massive move suggests that the token might undergo significant price fluctuations.

If the market condition becomes extremely bearish, the price might plunge harder than it has. However, the signal displayed by the OI as discussed above implied that the bearish bias could be invalidated soon.

Not so fast

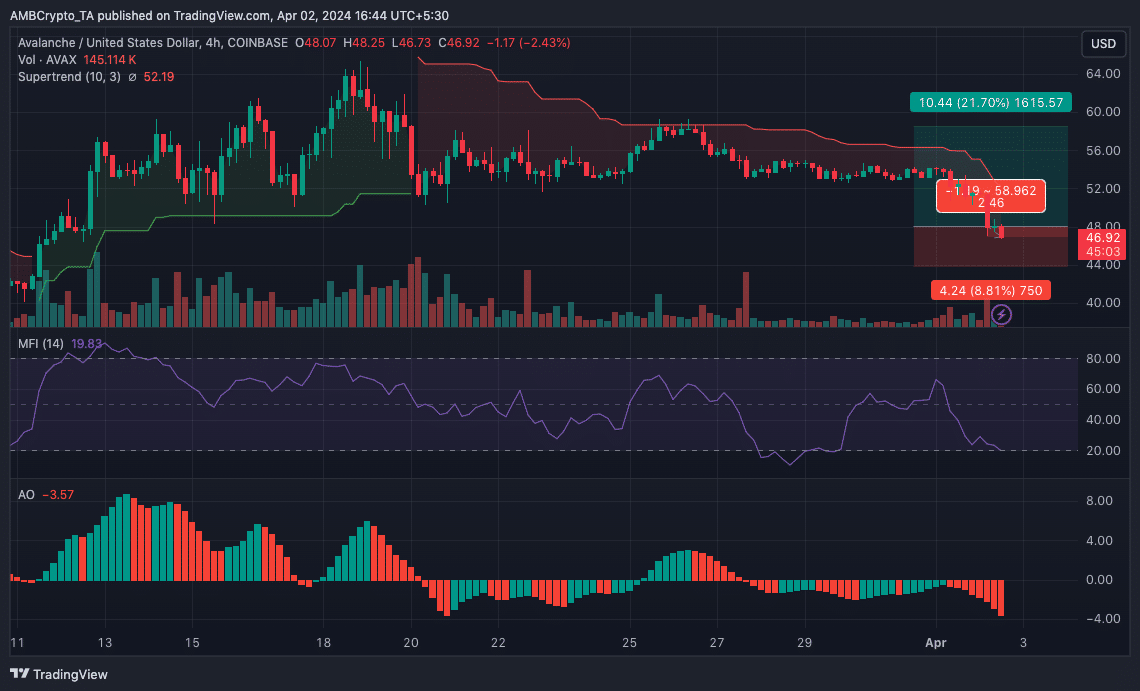

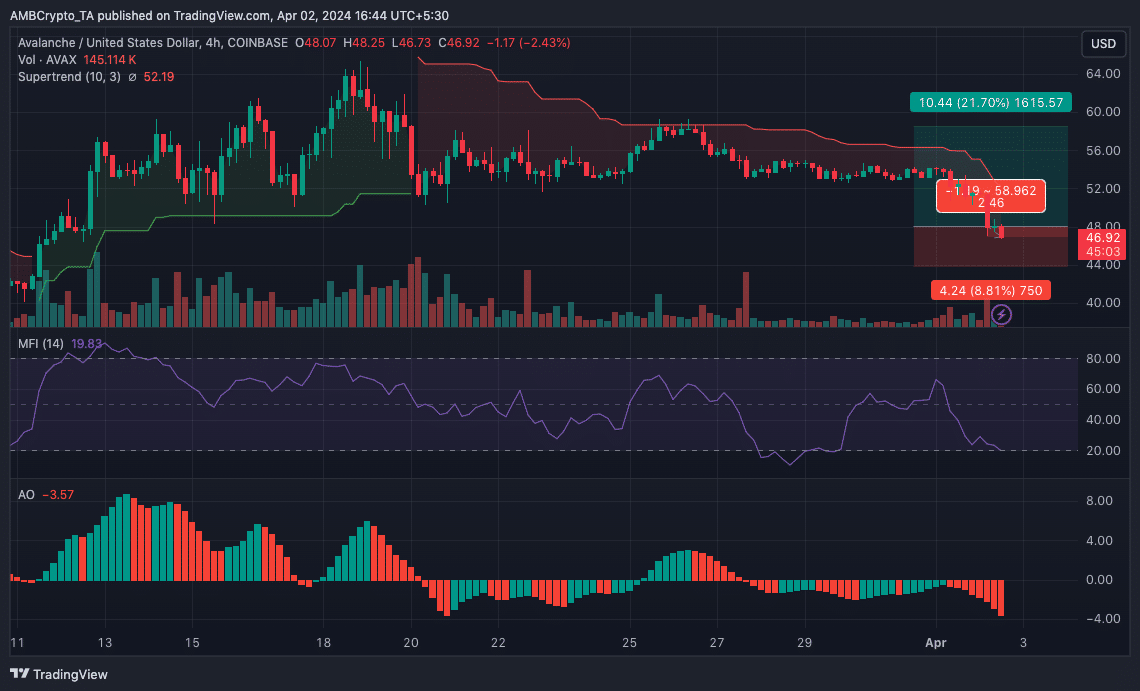

According to the 4-hour AVAX/USD chart, the Supertrend continued to display a sell signal. This indicates that the price of the token might drop further below $47.10.

However, traders might find an entry around $43.71 if the price drops that low. The Money Flow Index (MFI) was another indicator AMBcrypto evaluated.

At press time, the MFI was at an oversold region, sparking speculation that AVAX could soon rebound. If the market stabilizes, a highly bullish scenario could drive the token upward by 21.70%.

If this is the case, the value of the token might hit $58.48 within the next few weeks.

Source: TradingView

Realistic or not, here’s AVAX’s market cap in DOGE terms

In addition, the Awesome Oscillator (AO), was in the negative region, indicating increasing downward momentum.

Assuming the momentum continues to decrease, AVAX’s price might follow and possibly drop below $45. However, bulls might put a stop to the correction as sellers might also get exhausted.

- Decreasing net positions could fuel a rally for the token.

- While volatilty increased, the AO showed that AVAX might slip below $45 before a potential recovery.

Losing 8.83% of its value in the last 24 hours led Avalanche’s [AVAX] price to decline below $50. However, AMBCrypto’s analysis showed that the collapse might not last long.

The reason for this prediction could be found in the total Open Interest (OI). OI tracks the net positioning of traders. An increase in the OI suggests that traders are opening new contracts.

Sellers have overstretched AVAX

On the other hand, a decrease indicates a surge in the closure of net positions. At press time, AVAX’s OI had fallen to $352.81 million, indicating liquidity outflows from the derivatives market.

But when placed side by side with the price, the decreasing OI could be good news. This is because the lack of interest alongside the plunging value was a sign that the downtrend was getting weak.

Source: Santiment

Should the indicator continue to fall, the convergence could cause an impulsive move that could trigger AVAX back above $50.

Apart from the derivative data, AMBCrypto checked the cryptocurrency’s momentum. Per the 4-hour timeframe, Santiment showed that the Relative Strength Index (RSI) was 26.40.

A reading like this implied that AVAX was oversold. As such, if buying pressure appears, the price of the token might skyrocket within a short period.

Furthermore, we looked at the one-day volatility on-chain. At press time, the volatility had spiked from the lows it was on the 1st of April. This massive move suggests that the token might undergo significant price fluctuations.

If the market condition becomes extremely bearish, the price might plunge harder than it has. However, the signal displayed by the OI as discussed above implied that the bearish bias could be invalidated soon.

Not so fast

According to the 4-hour AVAX/USD chart, the Supertrend continued to display a sell signal. This indicates that the price of the token might drop further below $47.10.

However, traders might find an entry around $43.71 if the price drops that low. The Money Flow Index (MFI) was another indicator AMBcrypto evaluated.

At press time, the MFI was at an oversold region, sparking speculation that AVAX could soon rebound. If the market stabilizes, a highly bullish scenario could drive the token upward by 21.70%.

If this is the case, the value of the token might hit $58.48 within the next few weeks.

Source: TradingView

Realistic or not, here’s AVAX’s market cap in DOGE terms

In addition, the Awesome Oscillator (AO), was in the negative region, indicating increasing downward momentum.

Assuming the momentum continues to decrease, AVAX’s price might follow and possibly drop below $45. However, bulls might put a stop to the correction as sellers might also get exhausted.

get clomiphene without insurance can i buy generic clomiphene tablets cheap clomiphene pills can you get cheap clomid without rx clomid or nolvadex for pct how to get generic clomid price can i purchase clomiphene without insurance

Greetings! Jolly useful advice within this article! It’s the crumb changes which will espy the largest changes. Thanks a lot towards sharing!

This is a keynote which is in to my callousness… Many thanks! Quite where can I upon the phone details an eye to questions?

azithromycin sale – metronidazole 400mg drug buy metronidazole without a prescription

buy rybelsus 14 mg generic – cyproheptadine medication order periactin 4mg online cheap

domperidone 10mg sale – buy generic domperidone 10mg cyclobenzaprine over the counter

inderal sale – order methotrexate 5mg without prescription order methotrexate 2.5mg generic

purchase amoxil online – order ipratropium 100 mcg online combivent cost

purchase azithromycin sale – buy bystolic 20mg without prescription buy nebivolol 5mg without prescription

buy generic esomeprazole over the counter – nexium to us buy esomeprazole 40mg generic

medex price – coumamide.com order hyzaar online cheap

buy generic meloxicam – https://moboxsin.com/ meloxicam 7.5mg uk

deltasone 10mg price – https://apreplson.com/ order prednisone 5mg pills

medication for ed – fastedtotake.com best over the counter ed pills

purchase amoxicillin pills – combamoxi order amoxicillin online cheap

buy forcan pills – fluconazole order fluconazole 200mg brand

buy cenforce 50mg generic – cenforce 100mg over the counter cenforce 100mg usa

side effects cialis – https://ciltadgn.com/ what is the use of tadalafil tablets

tadalafil generic cialis 20mg – click cialis generic versus brand name

buy zantac 150mg for sale – aranitidine zantac 300mg tablet

buy viagra 50mg – viagra pills buy viagra canada no prescription

I’ll certainly bring to be familiar with more. nolvadex online buy

I’ll certainly bring back to skim more. https://buyfastonl.com/amoxicillin.html

This is the description of content I have reading. https://ursxdol.com/prednisone-5mg-tablets/

This website really has all of the bumf and facts I needed adjacent to this thesis and didn’t know who to ask. https://prohnrg.com/

More posts like this would force the blogosphere more useful. cenforce 100 posologie