- AVAX’s instability caused many long liquidations.

- If the price hit $58.23, another decline might occur.

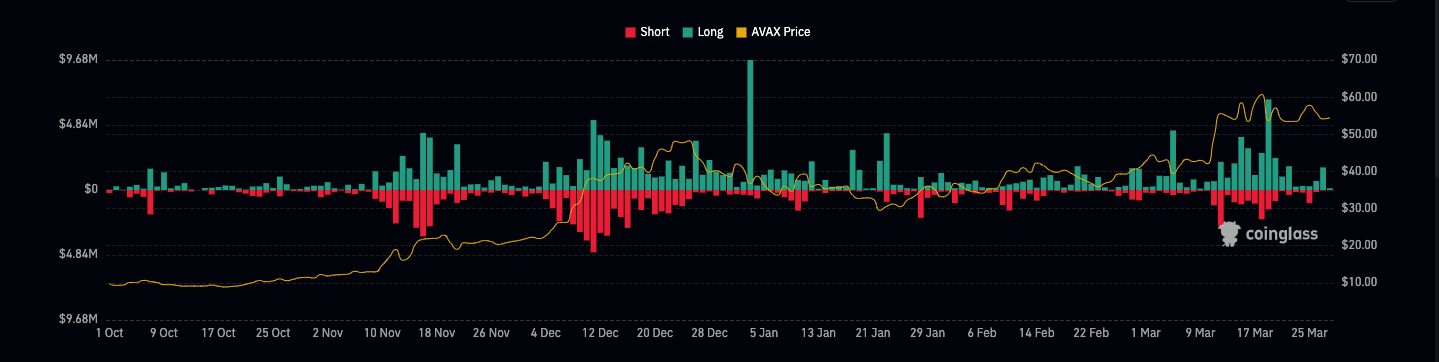

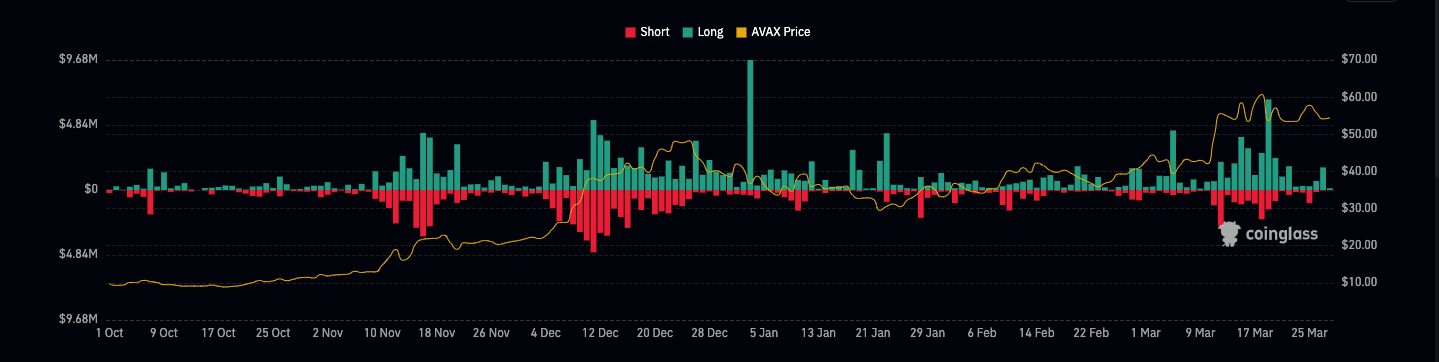

It was not good news for traders who opened long Avalanche [AVAX] positions on the 27th of March. According to data from Coinglass, contracts valued at $316,200 were wiped out in the last 24 hours.

Out of these positions, longs accounted for $277,890 while short liquidations stood at $38,310. Liquidation occurs when an exchange forcefully closes a trader’s position.

Source: Coinglass

This happens when the trader does not have the minimum collateral to keep the position open. Other times, the market moving in the opposite direction to the predicted one could trigger it.

Quick swings are bad

For AVAX, a large part of the extermination could be linked to its price action. At press time, AVAX changed hands at $54.60. But on the 27th of March, the price almost reached $55 before volatility hit the market and it retraced to $53.81 in less than two hours.

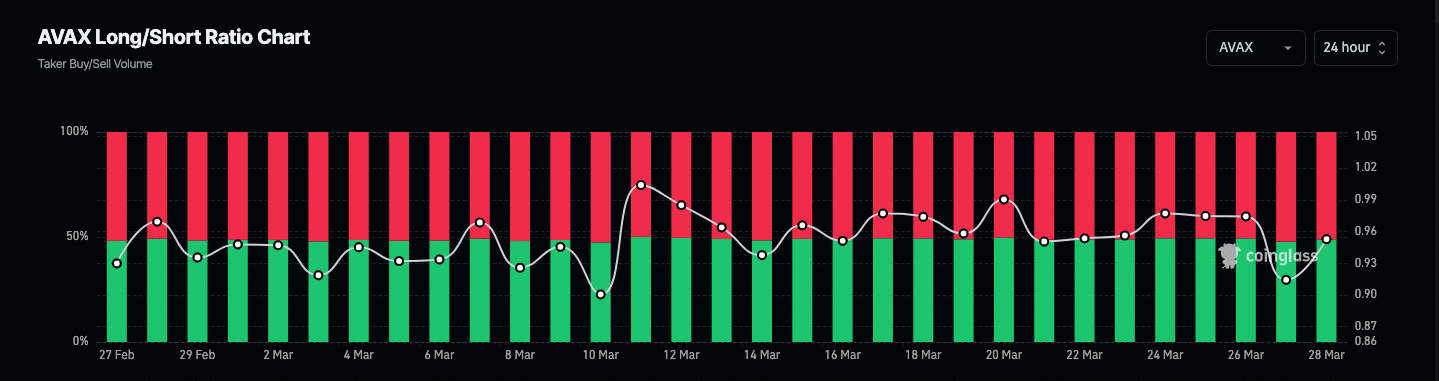

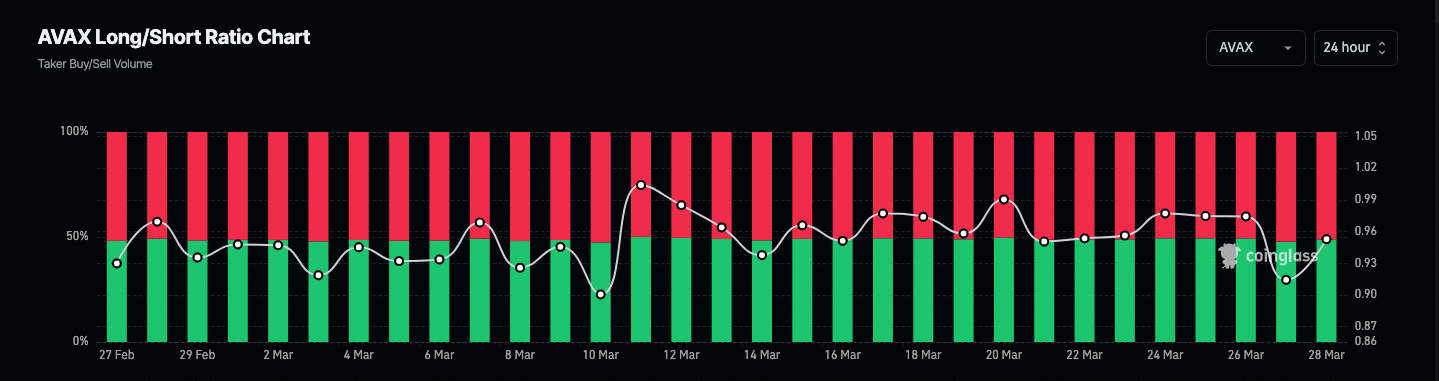

Furthermore, AMBCrypto evaluated the Long/Short Ratio. The metric indicates if investors have a positive or negative expectation about an asset’s price.

If the value is over 1, then the sentiment is largely positive and traders are expecting a price increase. However, values less than 1 indicate a negative sentiment.

At press time, AVAX’s Long/Short Ratio was 0.95, indicating that the average sentiment was bearish.

When we looked at the metric further, we discovered that only 8% of traders were very bullish on the cryptocurrency. However, a whopping 33% were betting on the price to decrease. The rest were either neutral, slightly bullish, or bearish.

Source: Coinglass

In addition, AMBCrypto analyzed AVAX’s Cumulative Volume Delta (CVD). Typically, the CVD is used to assess traders’ aggression in the market.

At press time, the spot CVD had formed a lower low as the reading was negative. Though CVD does not paint the full picture, the decline implied that perp sellers have become more aggressive.

If the indicator continues to remain negative while the token tries to hit a higher price, longs might not be rewarded. From the technical angle, the 20 EMA (blue) and 50 EMA (yellow) were around the same spot.

Entries appear below $54

This indicates that the price trend was neutral. Also, AVAX has slipped below both EMAs, suggesting that the trend had more chance to be bearish than bullish.

If buying pressure increase, then the token might climb. But the Supertrend flashed a sell signal at $58.23. Therefore, if AVAX rises that high, a pushback might occur.

Source: Coinalyze

Is your portfolio green? Check the AVAX Profit Calculator

Conversely, there was a buy signal at $53.96. If the price declines to this point, then it could be a good entry to open a long position.

Regardless of its short-term potential, the token remains one that could perform well this cycle. A major reason for this prediction is the buzzing Real World Assets (RWAs) narrative in which Avalanche’s fundamentals lie.

- AVAX’s instability caused many long liquidations.

- If the price hit $58.23, another decline might occur.

It was not good news for traders who opened long Avalanche [AVAX] positions on the 27th of March. According to data from Coinglass, contracts valued at $316,200 were wiped out in the last 24 hours.

Out of these positions, longs accounted for $277,890 while short liquidations stood at $38,310. Liquidation occurs when an exchange forcefully closes a trader’s position.

Source: Coinglass

This happens when the trader does not have the minimum collateral to keep the position open. Other times, the market moving in the opposite direction to the predicted one could trigger it.

Quick swings are bad

For AVAX, a large part of the extermination could be linked to its price action. At press time, AVAX changed hands at $54.60. But on the 27th of March, the price almost reached $55 before volatility hit the market and it retraced to $53.81 in less than two hours.

Furthermore, AMBCrypto evaluated the Long/Short Ratio. The metric indicates if investors have a positive or negative expectation about an asset’s price.

If the value is over 1, then the sentiment is largely positive and traders are expecting a price increase. However, values less than 1 indicate a negative sentiment.

At press time, AVAX’s Long/Short Ratio was 0.95, indicating that the average sentiment was bearish.

When we looked at the metric further, we discovered that only 8% of traders were very bullish on the cryptocurrency. However, a whopping 33% were betting on the price to decrease. The rest were either neutral, slightly bullish, or bearish.

Source: Coinglass

In addition, AMBCrypto analyzed AVAX’s Cumulative Volume Delta (CVD). Typically, the CVD is used to assess traders’ aggression in the market.

At press time, the spot CVD had formed a lower low as the reading was negative. Though CVD does not paint the full picture, the decline implied that perp sellers have become more aggressive.

If the indicator continues to remain negative while the token tries to hit a higher price, longs might not be rewarded. From the technical angle, the 20 EMA (blue) and 50 EMA (yellow) were around the same spot.

Entries appear below $54

This indicates that the price trend was neutral. Also, AVAX has slipped below both EMAs, suggesting that the trend had more chance to be bearish than bullish.

If buying pressure increase, then the token might climb. But the Supertrend flashed a sell signal at $58.23. Therefore, if AVAX rises that high, a pushback might occur.

Source: Coinalyze

Is your portfolio green? Check the AVAX Profit Calculator

Conversely, there was a buy signal at $53.96. If the price declines to this point, then it could be a good entry to open a long position.

Regardless of its short-term potential, the token remains one that could perform well this cycle. A major reason for this prediction is the buzzing Real World Assets (RWAs) narrative in which Avalanche’s fundamentals lie.

generic clomid c10m1d can i purchase cheap clomiphene without a prescription order clomiphene without rx how can i get generic clomiphene without dr prescription can i purchase clomid pills how can i get generic clomid cost of generic clomiphene without rx

The thoroughness in this draft is noteworthy.

This is the kind of criticism I in fact appreciate.

buy zithromax sale – buy metronidazole 200mg online cheap flagyl cheap

buy rybelsus sale – order cyproheptadine 4 mg pill buy generic periactin for sale

motilium 10mg us – buy domperidone 10mg pills cyclobenzaprine 15mg pills

inderal 10mg uk – methotrexate 2.5mg tablet buy methotrexate 2.5mg generic

buy amoxil medication – valsartan usa buy generic combivent 100mcg

zithromax cheap – zithromax cost order nebivolol 20mg online

buy augmentin online – https://atbioinfo.com/ brand acillin

nexium 40mg price – https://anexamate.com/ purchase nexium pills

order mobic – https://moboxsin.com/ mobic usa

buy prednisone 5mg without prescription – https://apreplson.com/ buy prednisone 40mg online cheap

medicine for erectile – site ed solutions

order amoxil for sale – combamoxi.com buy amoxicillin online

buy diflucan 200mg – flucoan diflucan 100mg generic

cenforce 50mg uk – https://cenforcers.com/# buy cenforce tablets

does cialis make you last longer in bed – cialis tadalafil 10 mg cialis from canada

side effects of cialis – https://strongtadafl.com/# where to buy cialis in canada

zantac 300mg cheap – https://aranitidine.com/ order ranitidine 300mg sale

cheap generic viagra uk online – on this site cheap quick viagra

I’ll certainly bring back to skim more. online

This website exceedingly has all of the information and facts I needed adjacent to this case and didn’t identify who to ask. https://buyfastonl.com/isotretinoin.html

This is the big-hearted of scribble literary works I positively appreciate. https://ursxdol.com/azithromycin-pill-online/

More posts like this would bring about the blogosphere more useful. https://prohnrg.com/product/atenolol-50-mg-online/

More posts like this would add up to the online time more useful. https://aranitidine.com/fr/lasix_en_ligne_achat/

The thoroughness in this break down is noteworthy. https://ondactone.com/product/domperidone/

Thanks recompense sharing. It’s outstrip quality.

buy flomax pills

This is the amicable of glad I get high on reading. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4712

order generic dapagliflozin 10mg – https://janozin.com/ dapagliflozin 10mg price

where can i buy xenical – https://asacostat.com/# order generic xenical

This is the tolerant of post I turn up helpful. https://myrsporta.ru/forums/users/ikwbj-2/