- AVAX is consolidating, with its price between closely situated MA50 and MA200.

- Lack of strong momentum keeps it in a neutral zone, with potential lower supports if bearish pressure intensifies.

Once again, Avalanche [AVAX] has entered a slump with its price action. As the broader market faces a modest correction and Bitcoin and Ethereum lose some of their gains, AVAX barely made a move.

There was a balanced order between the bulls and the bears, with neither taking full control. However, the bears might slowly get the upper hand with the current trading activity.

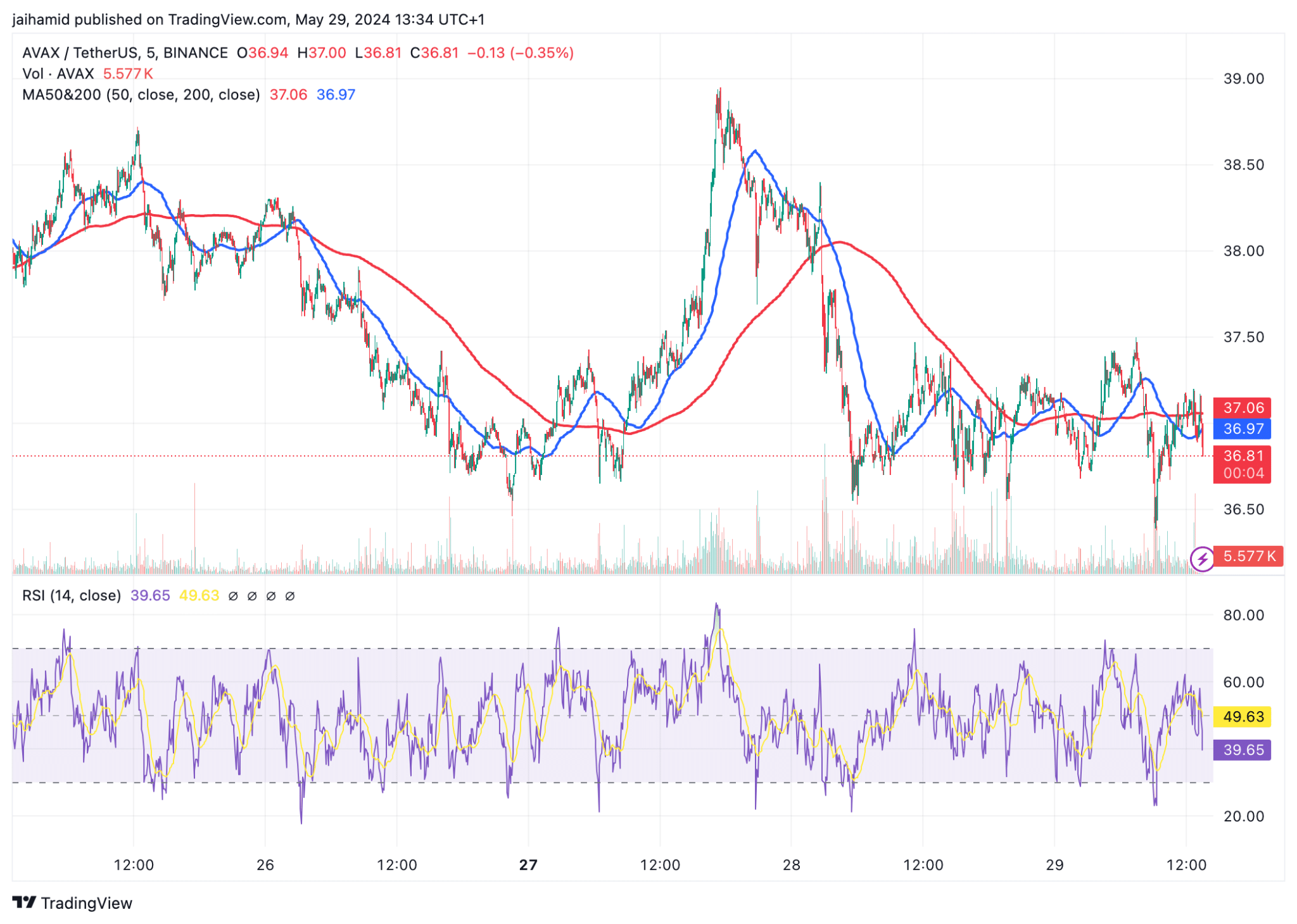

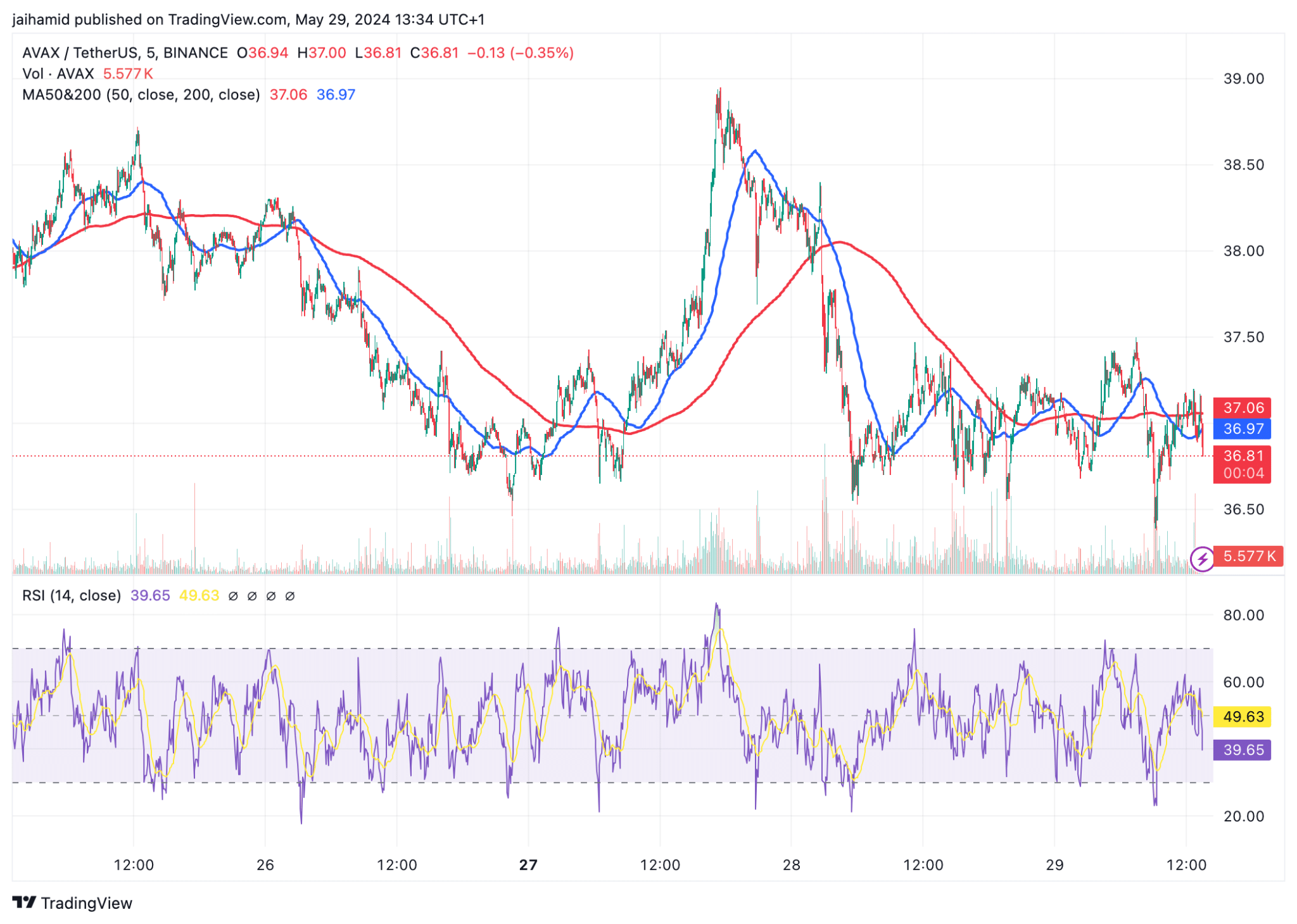

Analyzing the current trading activity on the AVAX/USDt chart, we observe Avalanche moving within a defined range marked by the interaction of its 50-day moving average (MA50) and 200-day moving average (MA200).

The MA50 at approximately $36.97 acts as a short-term resistance level, while the MA200 at $36.81 offers slight support. These closely nestled moving averages suggest a consolidation phase with tight trading conditions.

Source: TradingView

The Relative Strength Index (RSI) is at 49.63, indicating a neutral stance. There is a lack of strong bullish or bearish momentum.

AVAX must decisively close above the MA50 resistance to break out of its slump. A failure to do so could see it retest lower supports, potentially around the $36.50 area.

If the bearish pressure intensifies, particularly if broader market corrections deepen, AVAX could further test lower levels.

A movement below the $36.50 could see subsequent support near $36.00, which would be critical to prevent further declines toward the $35.50 region or below.

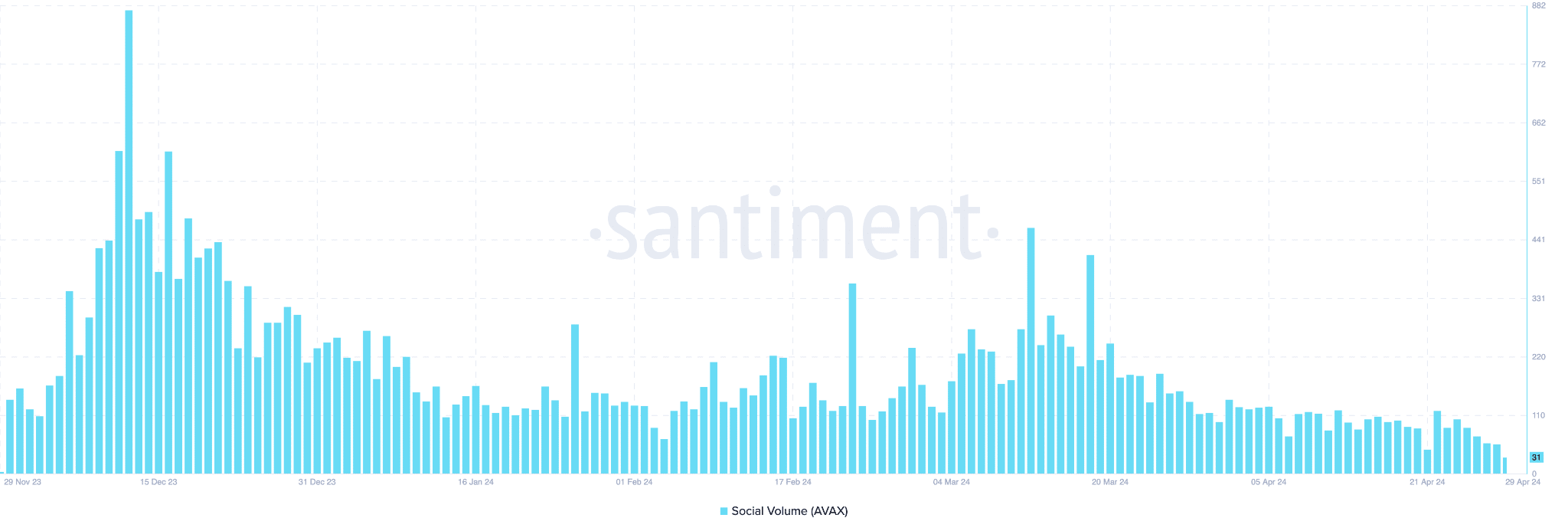

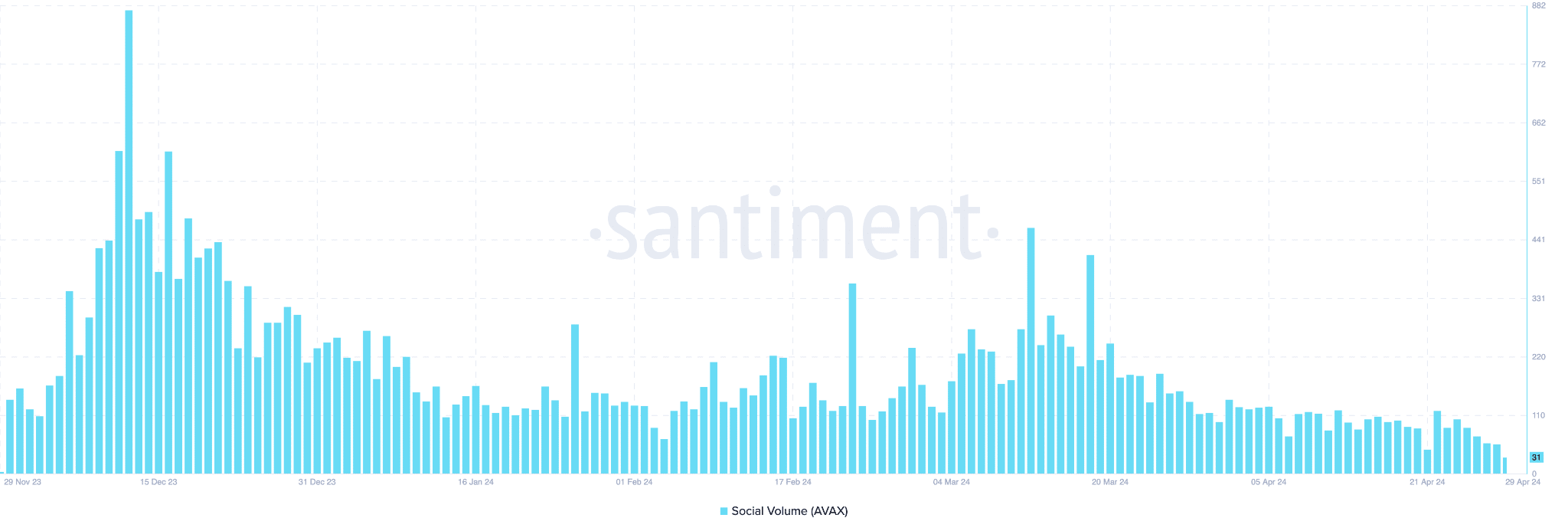

Meanwhile, AVAX’s overall trend in social volume has declined significantly, aligning with its struggle to sustain higher price levels or ignite major trading enthusiasm.

Source: Santiment

From a technical standpoint, this reduction in social engagement could imply a cooling-off period, where the bulls take a little break before pushing prices past short-term resistance levels.

Is your portfolio green? Check the AVAX Profit Calculator

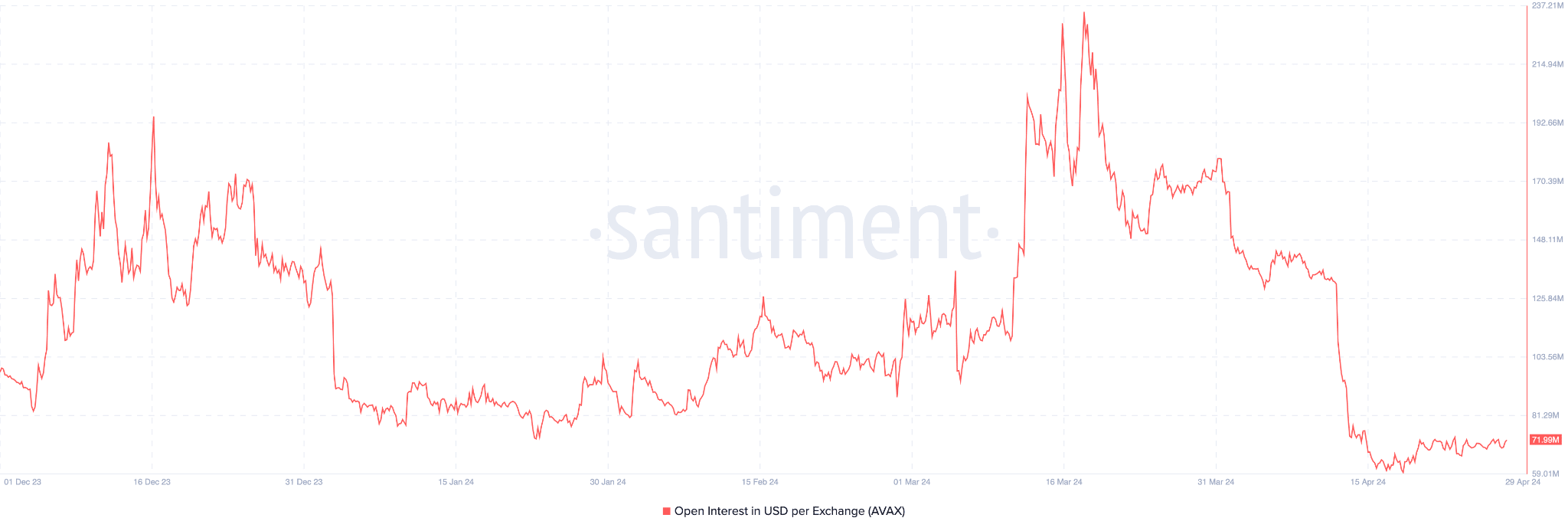

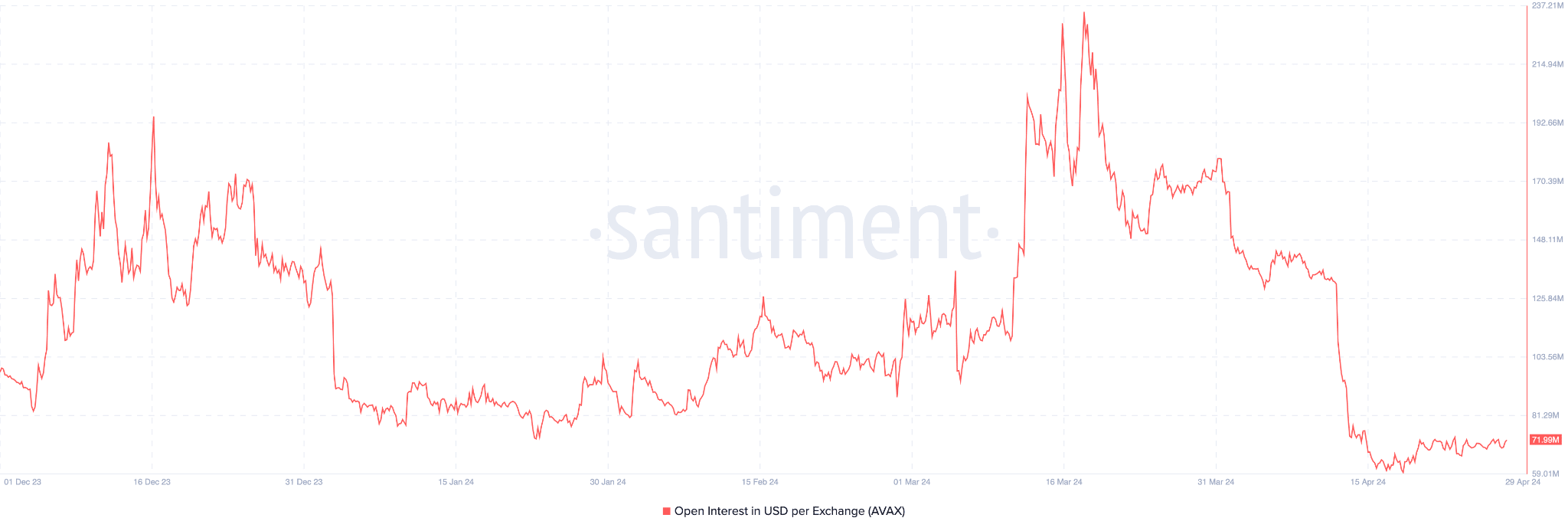

This same trend is reflected in the open interest level on multiple exchanges.

Source: Santiment

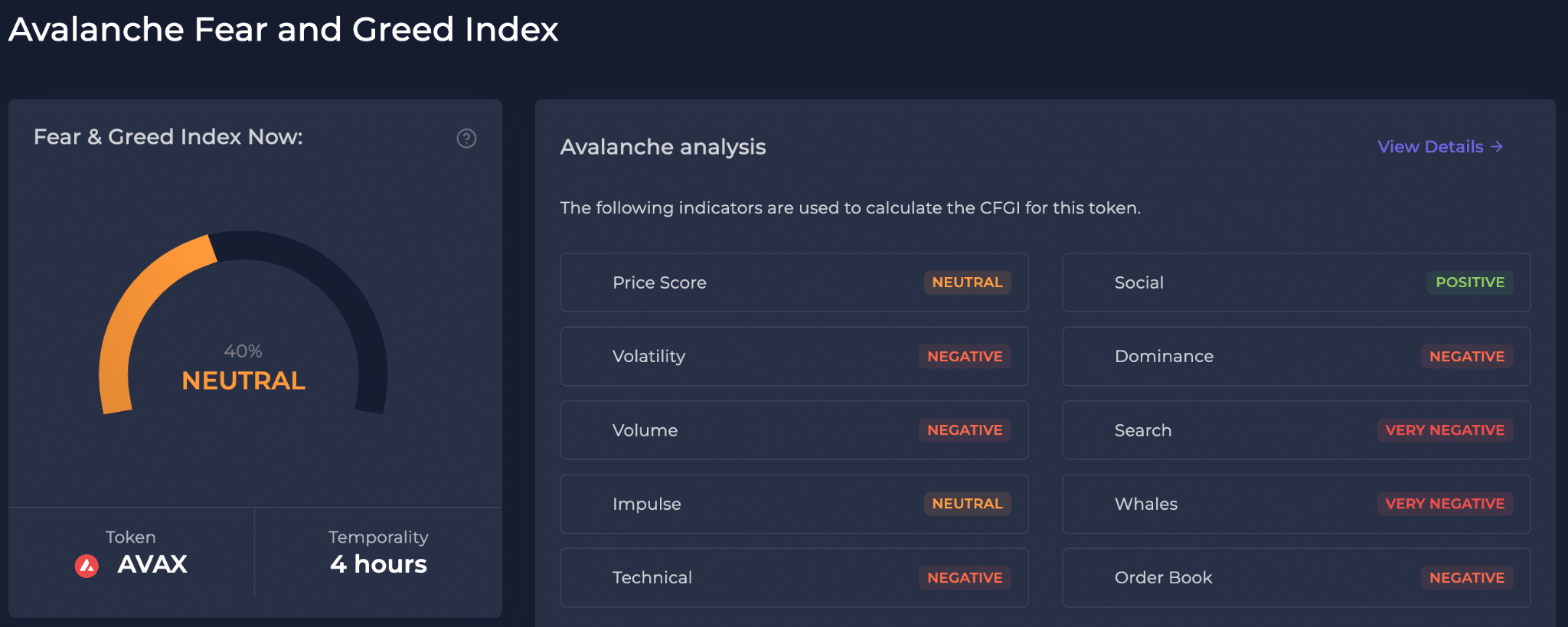

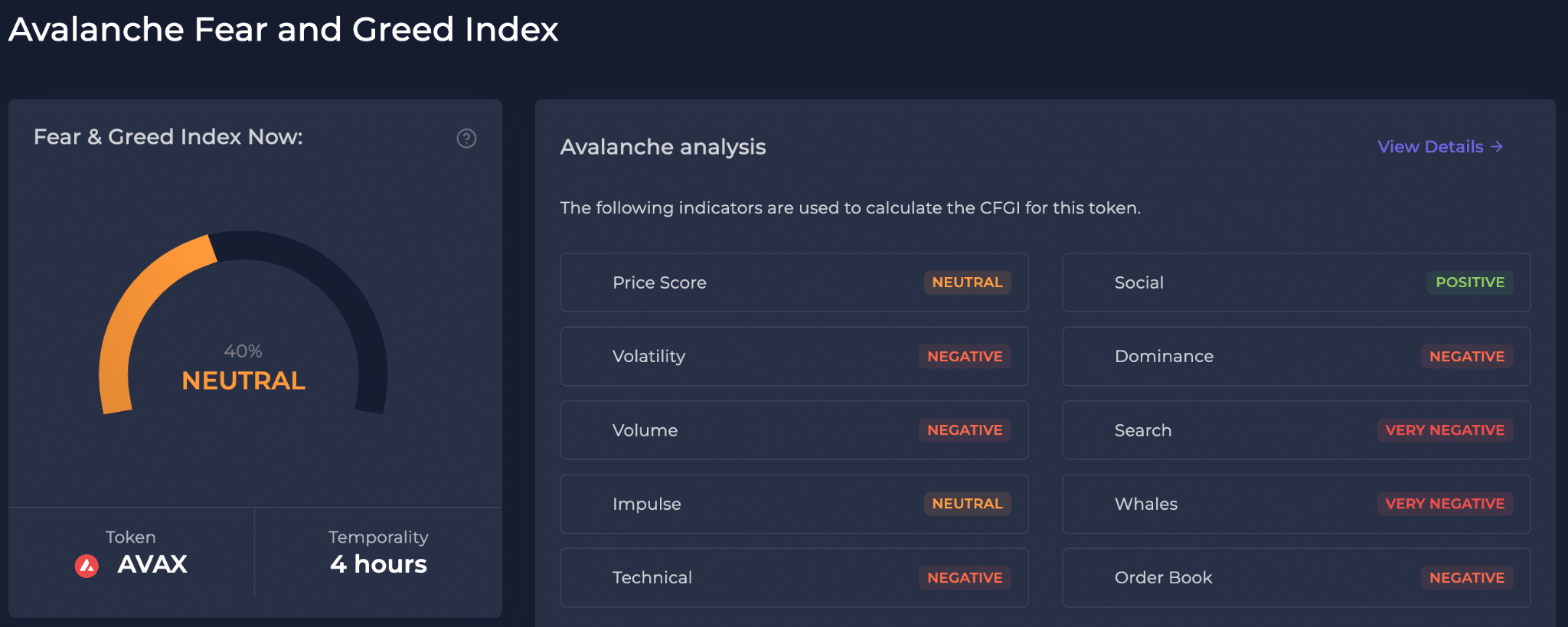

AVAX’s social sentiment reveals a market in flux with possible downward pressure due to negative views on volume and dominance. Overall, AVAX seems to have no clear path for the near future. The market will need stronger catalysts to go fully bullish.

Source: CFGI

- AVAX is consolidating, with its price between closely situated MA50 and MA200.

- Lack of strong momentum keeps it in a neutral zone, with potential lower supports if bearish pressure intensifies.

Once again, Avalanche [AVAX] has entered a slump with its price action. As the broader market faces a modest correction and Bitcoin and Ethereum lose some of their gains, AVAX barely made a move.

There was a balanced order between the bulls and the bears, with neither taking full control. However, the bears might slowly get the upper hand with the current trading activity.

Analyzing the current trading activity on the AVAX/USDt chart, we observe Avalanche moving within a defined range marked by the interaction of its 50-day moving average (MA50) and 200-day moving average (MA200).

The MA50 at approximately $36.97 acts as a short-term resistance level, while the MA200 at $36.81 offers slight support. These closely nestled moving averages suggest a consolidation phase with tight trading conditions.

Source: TradingView

The Relative Strength Index (RSI) is at 49.63, indicating a neutral stance. There is a lack of strong bullish or bearish momentum.

AVAX must decisively close above the MA50 resistance to break out of its slump. A failure to do so could see it retest lower supports, potentially around the $36.50 area.

If the bearish pressure intensifies, particularly if broader market corrections deepen, AVAX could further test lower levels.

A movement below the $36.50 could see subsequent support near $36.00, which would be critical to prevent further declines toward the $35.50 region or below.

Meanwhile, AVAX’s overall trend in social volume has declined significantly, aligning with its struggle to sustain higher price levels or ignite major trading enthusiasm.

Source: Santiment

From a technical standpoint, this reduction in social engagement could imply a cooling-off period, where the bulls take a little break before pushing prices past short-term resistance levels.

Is your portfolio green? Check the AVAX Profit Calculator

This same trend is reflected in the open interest level on multiple exchanges.

Source: Santiment

AVAX’s social sentiment reveals a market in flux with possible downward pressure due to negative views on volume and dominance. Overall, AVAX seems to have no clear path for the near future. The market will need stronger catalysts to go fully bullish.

Source: CFGI

get cheap clomiphene without rx where to buy clomid get generic clomid for sale cost generic clomid prices can you buy generic clomiphene online how much does clomiphene cost without insurance clomiphene tablets

The depth in this tune is exceptional.

Greetings! Very gainful suggestion within this article! It’s the little changes which liking obtain the largest changes. Thanks a portion towards sharing!

azithromycin brand – tetracycline 500mg pills buy metronidazole cheap

order semaglutide for sale – order rybelsus 14 mg generic buy periactin 4mg generic

buy domperidone 10mg pills – flexeril 15mg cheap buy flexeril without a prescription

oral propranolol – methotrexate 10mg drug brand methotrexate 10mg

order amoxil generic – generic valsartan 160mg ipratropium 100mcg brand

zithromax 500mg pill – purchase nebivolol for sale buy bystolic paypal

buy augmentin pills for sale – https://atbioinfo.com/ ampicillin uk

esomeprazole 20mg over the counter – https://anexamate.com/ buy nexium 20mg

coumadin medication – blood thinner buy generic losartan

mobic 7.5mg for sale – swelling mobic order online

oral deltasone 5mg – allergic reactions order deltasone 10mg pill

buy generic ed pills – best pills for ed top ed drugs

cheap amoxil without prescription – amoxil for sale online amoxil tablet

diflucan 200mg drug – https://gpdifluca.com/ buy fluconazole 200mg generic

cost cenforce 100mg – buy cenforce 100mg pill buy cenforce 50mg pill

benefits of tadalafil over sidenafil – this cialis manufacturer coupon

how many mg of cialis should i take – generic tadalafil prices cialis generic versus brand name

zantac 300mg us – https://aranitidine.com/ generic zantac 300mg

viagra gel sale – https://strongvpls.com/ 100 mg viagra

The thoroughness in this draft is noteworthy. on this site

I couldn’t hold back commenting. Profoundly written! https://buyfastonl.com/azithromycin.html

This is a question which is virtually to my callousness… Many thanks! Unerringly where can I find the contact details an eye to questions? https://ursxdol.com/sildenafil-50-mg-in/

This website positively has all of the tidings and facts I needed about this participant and didn’t identify who to ask. https://prohnrg.com/product/acyclovir-pills/

This website really has all of the low-down and facts I needed about this thesis and didn’t identify who to ask. https://aranitidine.com/fr/sibelium/

The thoroughness in this section is noteworthy. https://ondactone.com/spironolactone/