- 52.67% of top traders held short positions, while 47.33% held long positions

- A section of whales appeared to be accumulating ETH too

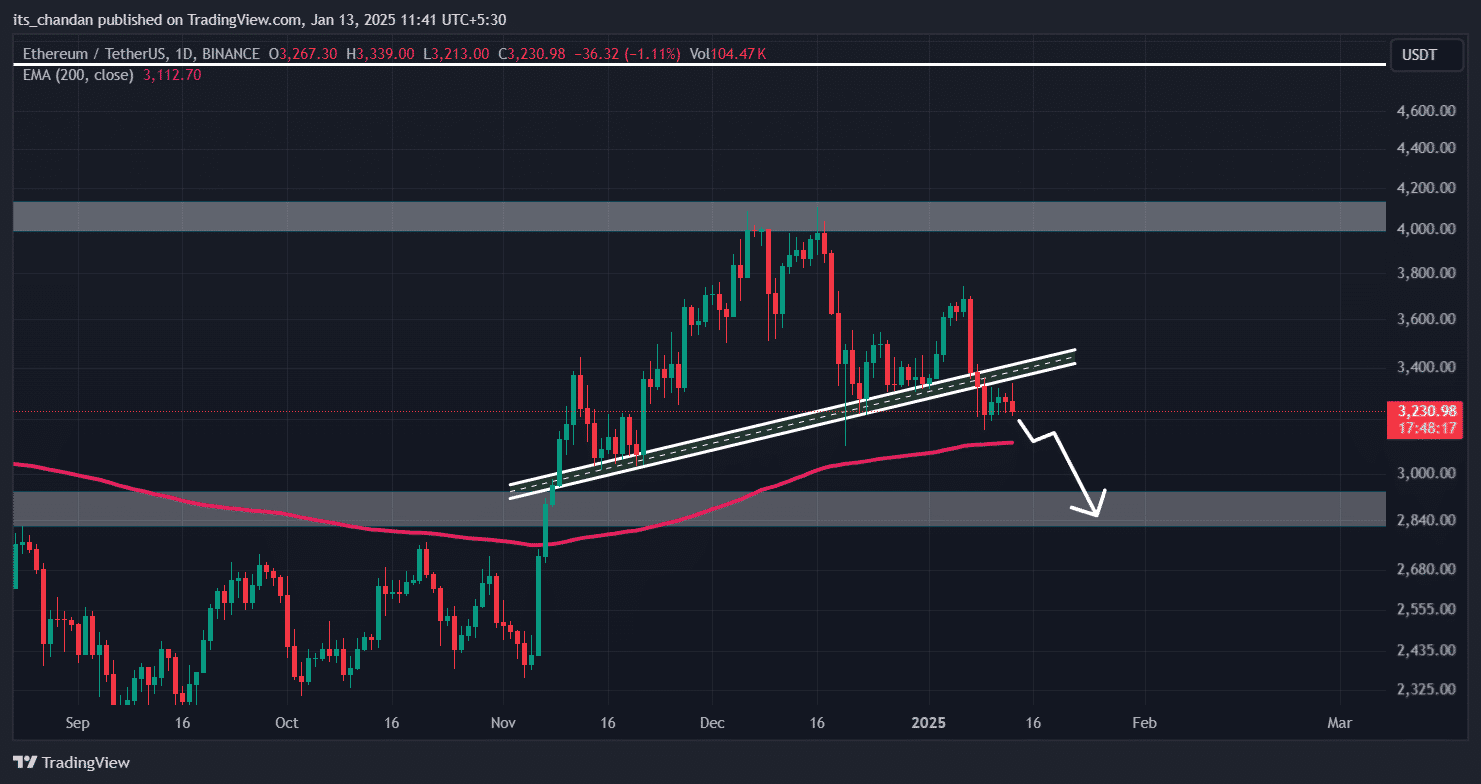

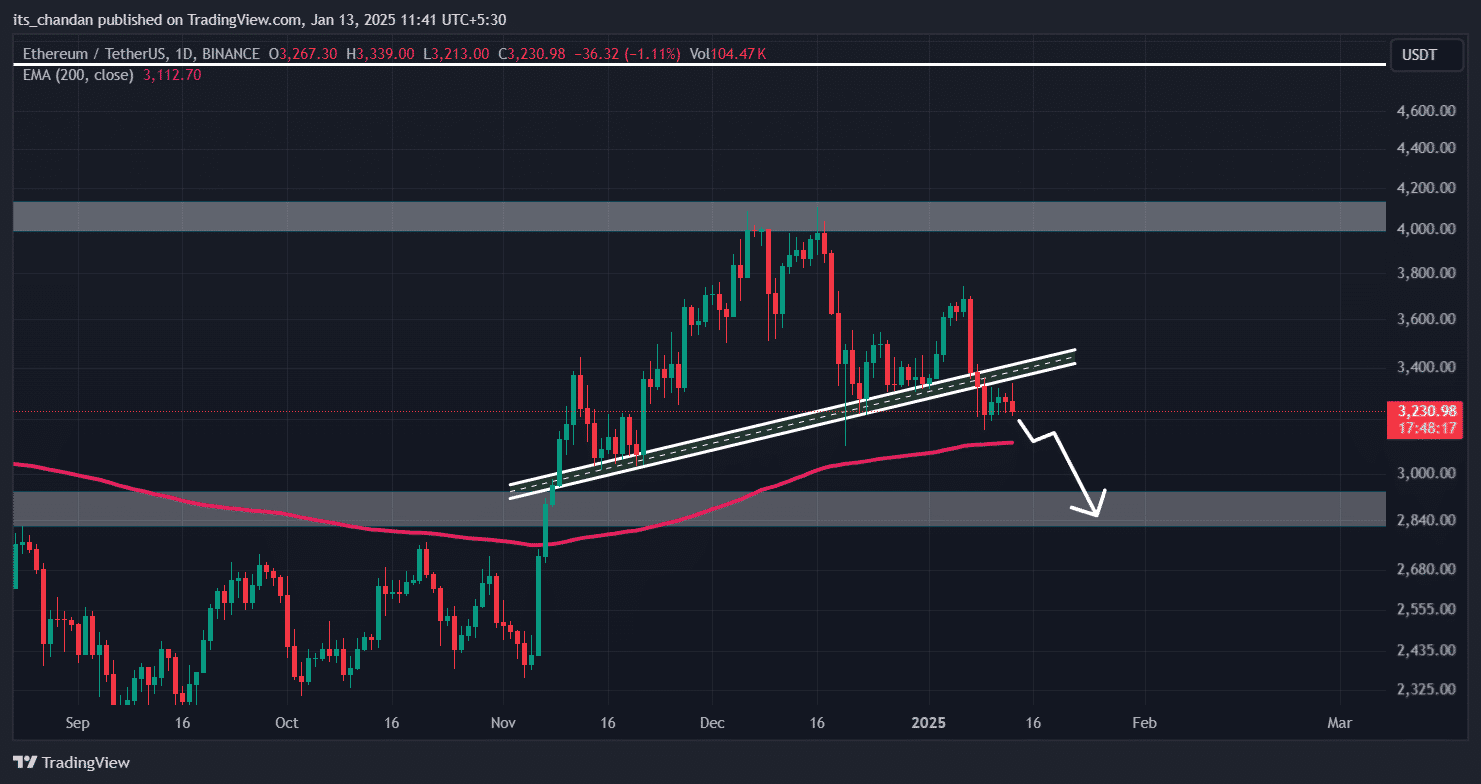

Ethereum (ETH), the second-largest cryptocurrency by market cap, seemed to be showing signs of a potential price decline after forming a bearish pattern on the charts, at press time.

Ethereum’s (ETH) bearish outlook

Worth noting, however, that parts of his bearish trend are not only evident in ETH, but also across major cryptocurrencies such as Bitcoin (BTC), XRP, and Solana (SOL).

Since December 2024, ETH has been on a downtrend and has broken down and successfully retested its breakdown level – Supporting the bearish sentiment.

Source: ETH/USDT, TradingView

ETH price prediction

Based on its recent price action and historical momentum, if this sentiment remains unchanged, there is a strong possibility that ETH could drop by 10% to hit the $2,850-level in the future. However, technical indicators still alluded to the possibility of a price rebound.

On the daily timeframe, for instance, ETH’s Relative Strength Index (RSI) was near the oversold area – Hinting at a potential recovery. This, while the 200 Exponential Moving Average (EMA) indicated that the asset was on an uptrend.

Traders maintain a bearish bias

Despite the bullish outlook of these indicators, however, traders remain hesitant to take long positions, as reported by the on-chain analytics firm CoinGlass. At press time, ETH’s long/short ratio stood at 0.94, indicating strong bearish sentiment among traders.

When assessed, 52.67% of top traders held short positions, while 47.33% held long positions.

However, traders’ positions have been rising significantly during this bearish period. Especially as ETH’s Open Interest increased by 4.5% in the last 24 hours. These metrics indicated that intraday traders are bearish, which could lead to a potential price drop in the coming days.

Whales’ recent activity

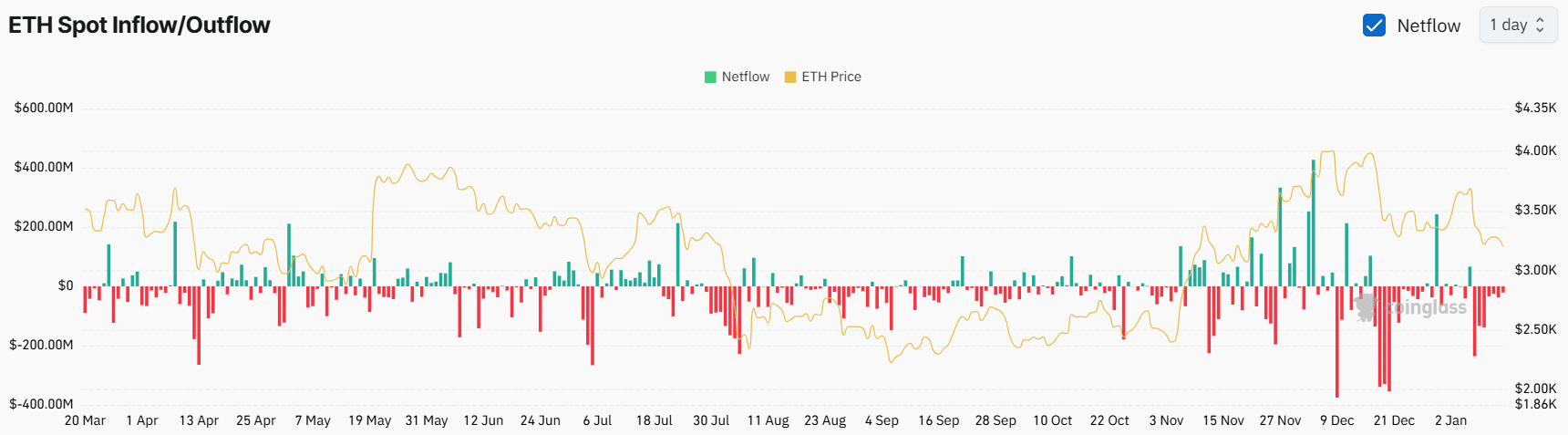

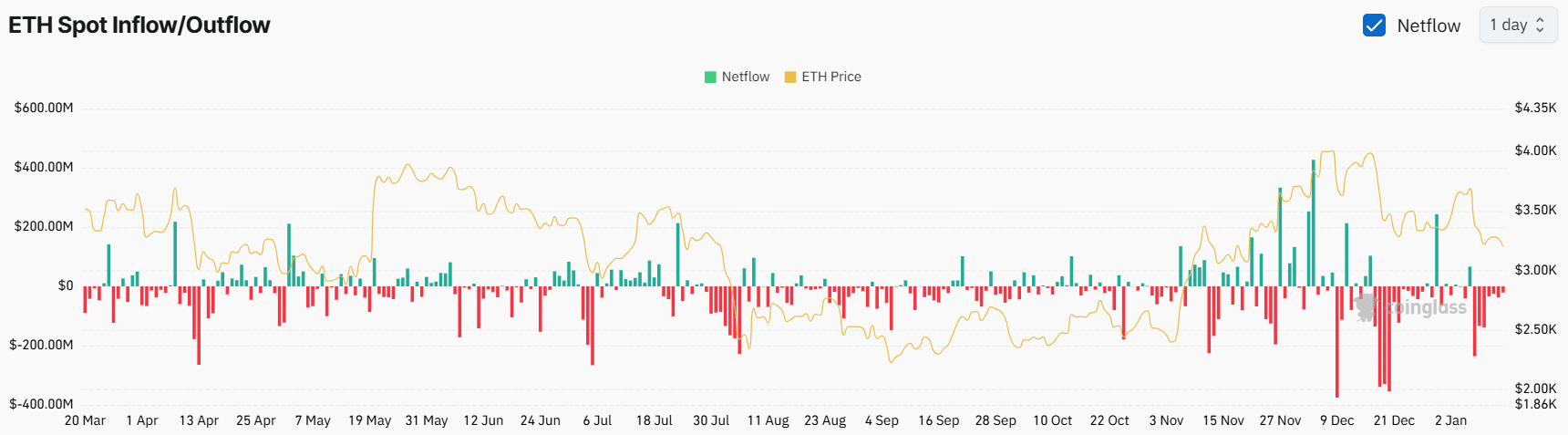

In addition to traders, long-term holders and whales appear to be accumulating ETH too, as revealed by CoinGlass’s spot inflow/outflow metric.

Source: CoinGlass

In fact, data revealed that exchanges have seen outflows of over $21 million worth of ETH in the last 24 hours, indicating potential accumulation that could create buying pressure and a buying opportunity.

- 52.67% of top traders held short positions, while 47.33% held long positions

- A section of whales appeared to be accumulating ETH too

Ethereum (ETH), the second-largest cryptocurrency by market cap, seemed to be showing signs of a potential price decline after forming a bearish pattern on the charts, at press time.

Ethereum’s (ETH) bearish outlook

Worth noting, however, that parts of his bearish trend are not only evident in ETH, but also across major cryptocurrencies such as Bitcoin (BTC), XRP, and Solana (SOL).

Since December 2024, ETH has been on a downtrend and has broken down and successfully retested its breakdown level – Supporting the bearish sentiment.

Source: ETH/USDT, TradingView

ETH price prediction

Based on its recent price action and historical momentum, if this sentiment remains unchanged, there is a strong possibility that ETH could drop by 10% to hit the $2,850-level in the future. However, technical indicators still alluded to the possibility of a price rebound.

On the daily timeframe, for instance, ETH’s Relative Strength Index (RSI) was near the oversold area – Hinting at a potential recovery. This, while the 200 Exponential Moving Average (EMA) indicated that the asset was on an uptrend.

Traders maintain a bearish bias

Despite the bullish outlook of these indicators, however, traders remain hesitant to take long positions, as reported by the on-chain analytics firm CoinGlass. At press time, ETH’s long/short ratio stood at 0.94, indicating strong bearish sentiment among traders.

When assessed, 52.67% of top traders held short positions, while 47.33% held long positions.

However, traders’ positions have been rising significantly during this bearish period. Especially as ETH’s Open Interest increased by 4.5% in the last 24 hours. These metrics indicated that intraday traders are bearish, which could lead to a potential price drop in the coming days.

Whales’ recent activity

In addition to traders, long-term holders and whales appear to be accumulating ETH too, as revealed by CoinGlass’s spot inflow/outflow metric.

Source: CoinGlass

In fact, data revealed that exchanges have seen outflows of over $21 million worth of ETH in the last 24 hours, indicating potential accumulation that could create buying pressure and a buying opportunity.

how to get clomiphene without dr prescription can i order generic clomid without rx where to buy generic clomiphene tablets can i purchase clomiphene online how to buy clomiphene tablets cost of clomid clomiphene pills for sale

This is a question which is virtually to my heart… Myriad thanks! Exactly where can I upon the contact details for questions?

With thanks. Loads of conception!

buy zithromax 250mg for sale – floxin 400mg generic metronidazole 200mg without prescription

semaglutide 14 mg for sale – order semaglutide 14 mg online cyproheptadine online buy

buy motilium 10mg pills – motilium us cyclobenzaprine 15mg usa

purchase amoxiclav pills – atbioinfo generic acillin

buy warfarin 5mg generic – coumamide.com order cozaar 25mg without prescription

mobic 15mg canada – https://moboxsin.com/ mobic 15mg cost

brand deltasone 20mg – https://apreplson.com/ buy deltasone 10mg without prescription

generic ed drugs – https://fastedtotake.com/ top rated ed pills

buy amoxicillin generic – cheap generic amoxicillin amoxicillin for sale online

forcan sale – this diflucan 100mg without prescription