- BTC’s price has increased slightly in the last 24 hours.

- Over $17 billion BTC has been accumulated in the last few months.

Bitcoin [BTC] has entered a re-accumulation phase as long-term holders (LTH) have steadily increased their holdings of late. The move could affect BTC’s price as it struggles to reclaim the $60,000 price range.

LTHs back Bitcoin

AMBCrypto’s analysis of the long-term holders’ chart on Glassnode revealed notable trends in Bitcoin ownership.

At the beginning of 2024, long-term holders (LTH) controlled over 14 million BTC. However, this figure significantly dropped in the first quarter, declining to approximately 13.35 million BTC by March 2024.

This decline indicated that long-term holders were distributing or selling their Bitcoin, potentially reacting to market conditions or seizing profit-taking opportunities.

Source: Glassnode

By March 2024, the trend shifted as long-term holders began steadily increasing their Bitcoin holdings. Around 300,000 BTC were added to long-term holdings by August 2024, marking a re-accumulation phase.

This suggested that investors had renewed confidence in Bitcoin’s long-term value, as they chose to “HODL” rather than sell.

The trend demonstrated a clear upward movement in long-term holdings, reflecting a strong belief in Bitcoin’s prospects among seasoned investors despite short-term market fluctuations.

Possible implications for future moves

This upward trend in long-term Bitcoin holdings could significantly affect Bitcoin’s price.

As seasoned investors accumulate, the increased confidence in Bitcoin’s future value will likely contribute to greater price stability.

This renewed bullish sentiment, often seen among informed investors, might precede a potential price surge, reflecting their anticipation of future appreciation.

Also, The steady accumulation by long-term holders suggested a tightening of supply in the market, which could reduce volatility and create a more stable trading environment.

With fewer BTCs available for short-term trading, there may be less dramatic price swings, paving the way for a more sustained upward trajectory.

This behavior may indicate that the market has reached a bottom, with long-term holders positioning themselves for a recovery phase.

Historically, such accumulation phases have led to significant price increases as the supply-demand dynamics shifts in favor of higher prices.

How BTC has trended

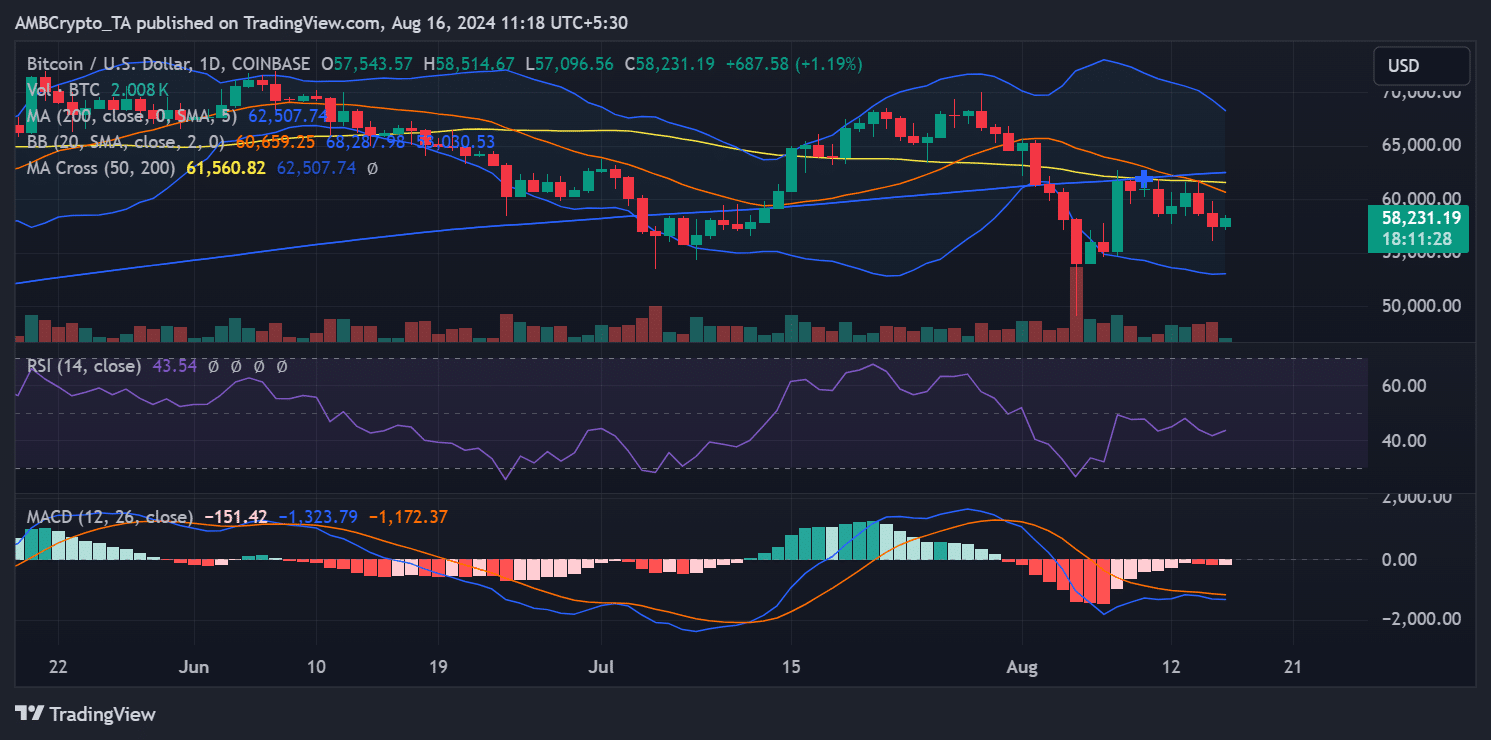

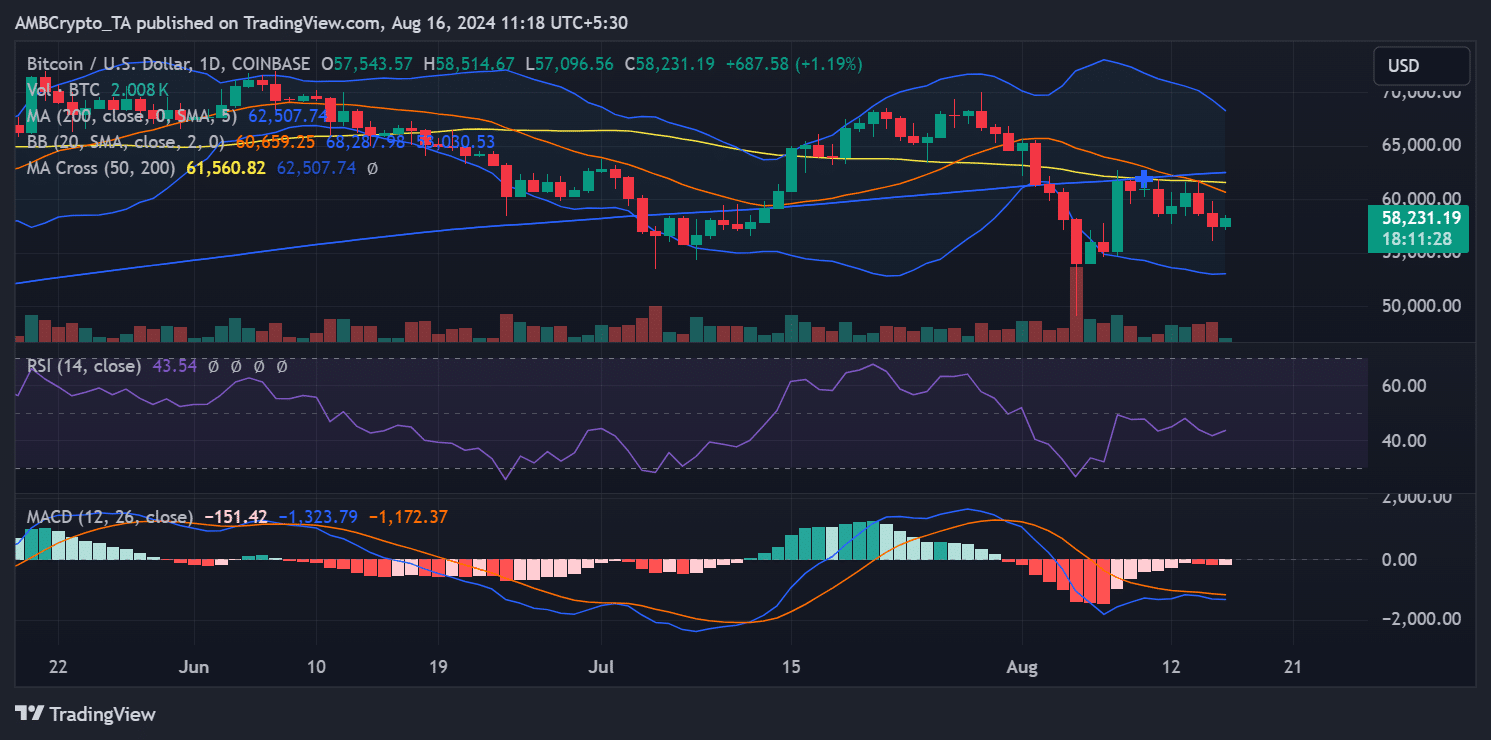

Bitcoin’s press time price was $58,231.19, marking a modest increase of over 1.19% in the latest trading session. The Bollinger Bands showed a contraction, indicating reduced market volatility.

At press time, the price was trending towards the middle band, suggesting the possibility of sideways movement or consolidation. The upper band was at $68,287.98, while the lower band was near $50,030.53.

Furthermore, the Relative Strength Index (RSI) was around 43.54, placing it in the neutral zone but edging closer to the oversold territory.

Is your portfolio green? Check out the BTC Profit Calculator

This suggested that Bitcoin might be undervalued, though there has yet to be significant buying momentum.

Source: TradingView

Additionally, the RSI indicated that the selling pressure may be nearing exhaustion, with a potential price reversal on the horizon if Bitcoin breaks above the middle Bollinger Band or an uptick in trading volume.

- BTC’s price has increased slightly in the last 24 hours.

- Over $17 billion BTC has been accumulated in the last few months.

Bitcoin [BTC] has entered a re-accumulation phase as long-term holders (LTH) have steadily increased their holdings of late. The move could affect BTC’s price as it struggles to reclaim the $60,000 price range.

LTHs back Bitcoin

AMBCrypto’s analysis of the long-term holders’ chart on Glassnode revealed notable trends in Bitcoin ownership.

At the beginning of 2024, long-term holders (LTH) controlled over 14 million BTC. However, this figure significantly dropped in the first quarter, declining to approximately 13.35 million BTC by March 2024.

This decline indicated that long-term holders were distributing or selling their Bitcoin, potentially reacting to market conditions or seizing profit-taking opportunities.

Source: Glassnode

By March 2024, the trend shifted as long-term holders began steadily increasing their Bitcoin holdings. Around 300,000 BTC were added to long-term holdings by August 2024, marking a re-accumulation phase.

This suggested that investors had renewed confidence in Bitcoin’s long-term value, as they chose to “HODL” rather than sell.

The trend demonstrated a clear upward movement in long-term holdings, reflecting a strong belief in Bitcoin’s prospects among seasoned investors despite short-term market fluctuations.

Possible implications for future moves

This upward trend in long-term Bitcoin holdings could significantly affect Bitcoin’s price.

As seasoned investors accumulate, the increased confidence in Bitcoin’s future value will likely contribute to greater price stability.

This renewed bullish sentiment, often seen among informed investors, might precede a potential price surge, reflecting their anticipation of future appreciation.

Also, The steady accumulation by long-term holders suggested a tightening of supply in the market, which could reduce volatility and create a more stable trading environment.

With fewer BTCs available for short-term trading, there may be less dramatic price swings, paving the way for a more sustained upward trajectory.

This behavior may indicate that the market has reached a bottom, with long-term holders positioning themselves for a recovery phase.

Historically, such accumulation phases have led to significant price increases as the supply-demand dynamics shifts in favor of higher prices.

How BTC has trended

Bitcoin’s press time price was $58,231.19, marking a modest increase of over 1.19% in the latest trading session. The Bollinger Bands showed a contraction, indicating reduced market volatility.

At press time, the price was trending towards the middle band, suggesting the possibility of sideways movement or consolidation. The upper band was at $68,287.98, while the lower band was near $50,030.53.

Furthermore, the Relative Strength Index (RSI) was around 43.54, placing it in the neutral zone but edging closer to the oversold territory.

Is your portfolio green? Check out the BTC Profit Calculator

This suggested that Bitcoin might be undervalued, though there has yet to be significant buying momentum.

Source: TradingView

Additionally, the RSI indicated that the selling pressure may be nearing exhaustion, with a potential price reversal on the horizon if Bitcoin breaks above the middle Bollinger Band or an uptick in trading volume.

how to buy cheap clomiphene buy cheap clomid how can i get clomid price get generic clomiphene for sale buying cheap clomiphene without prescription buying clomiphene order generic clomiphene without rx

More articles like this would remedy the blogosphere richer.

I’ll certainly bring back to be familiar with more.

azithromycin 500mg cheap – zithromax cost order flagyl 200mg pill

cheap semaglutide 14 mg – generic periactin 4mg buy periactin generic

purchase motilium generic – how to buy domperidone order flexeril generic

buy generic inderal 10mg – buy inderal cheap buy methotrexate 5mg for sale

buy augmentin 375mg for sale – https://atbioinfo.com/ cheap acillin

order esomeprazole 40mg online cheap – https://anexamate.com/ order nexium 20mg generic

buy generic medex – https://coumamide.com/ generic losartan 25mg

buy generic meloxicam 7.5mg – mobo sin meloxicam 15mg pill

deltasone 20mg price – https://apreplson.com/ deltasone 20mg usa

cheap erectile dysfunction – erectile dysfunction pills over the counter buying ed pills online

buy generic diflucan online – buy cheap generic diflucan diflucan pill

cenforce medication – on this site cenforce pills

zantac 300mg for sale – https://aranitidine.com/# zantac drug

cialis canada – click where can i buy tadalafil online

Thanks towards putting this up. It’s understandably done. https://gnolvade.com/es/provigil-espana-comprar/

order viagra thailand – strong vpls viagra buy china

Thanks on putting this up. It’s okay done. https://ursxdol.com/furosemide-diuretic/

The thoroughness in this draft is noteworthy. amoxicillin ca

More text pieces like this would create the интернет better. https://prohnrg.com/product/acyclovir-pills/

I’ll certainly bring back to review more. on this site