- The ETH/USDT pair revealed a cumulative volume delta divergence.

- Ethereum is likely to bounce from crucial support.

Ethereum[ETH], the second-largest cryptocurrency, has become the focus of attention as traders and investors prepare for Q4 2024 amidst widespread market uncertainty.

Recent analysis of the ETH/USDT pair revealed a cumulative volume delta (CVD) divergence. As ETH prices make equal highs while CVD forms lower highs, this divergence suggests a potential reversal.

CVD divergence typically signals weak buying pressure, implying that Ethereum could see further price changes.

Source: Hyblock Capital

If the orderbook depth remains constant, ETH might create lower highs, but if the depth increases, higher prices are expected.

ETH/USDT at a key support

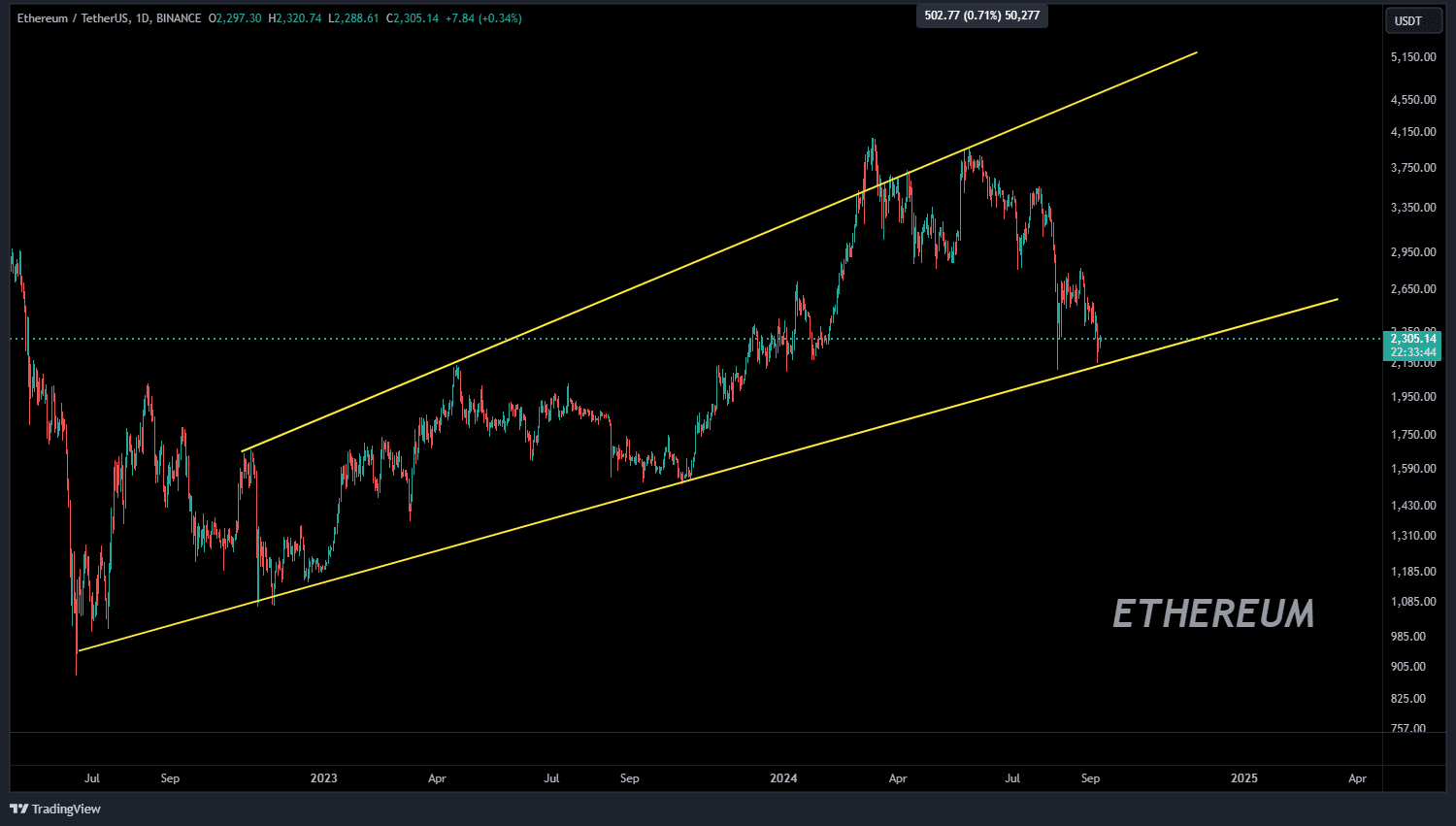

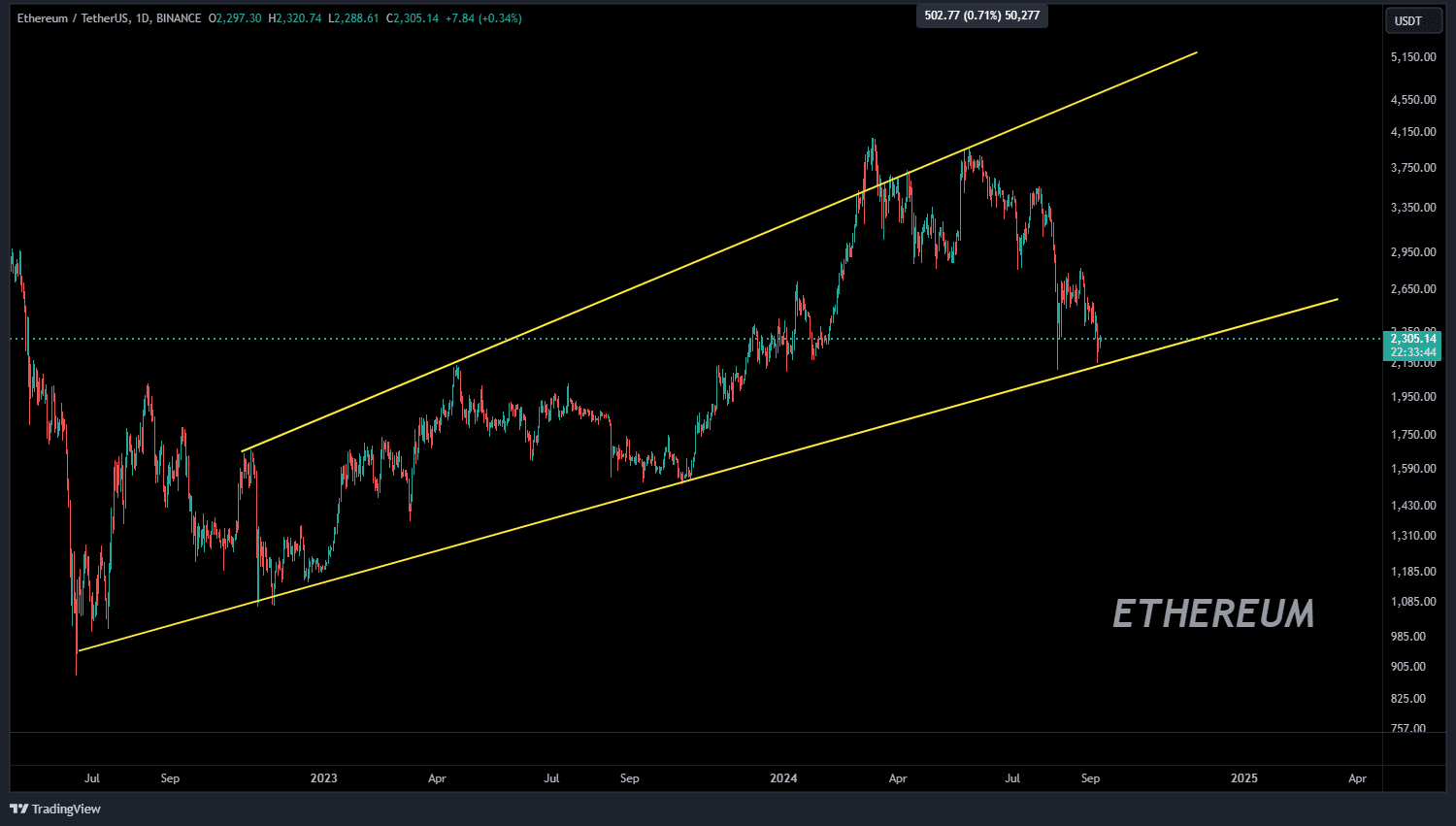

Analyzing Ethereum’s price action revealed that ETH/USDT was at a crucial support level at press time, forming a broadening ascending wedge on higher timeframes.

A double bottom pattern may form along the ascending trendline, potentially signaling an upward move. However, a break below this support level could lead to further price declines.

On the daily chart, ETH is also shaping a double bottom at the $2,100 mark, a key point for potential recovery.

Source: TradingView

A rate cut could catalyze Ethereum’s bounce in Q4, following the trend of other cryptocurrencies in recent years.

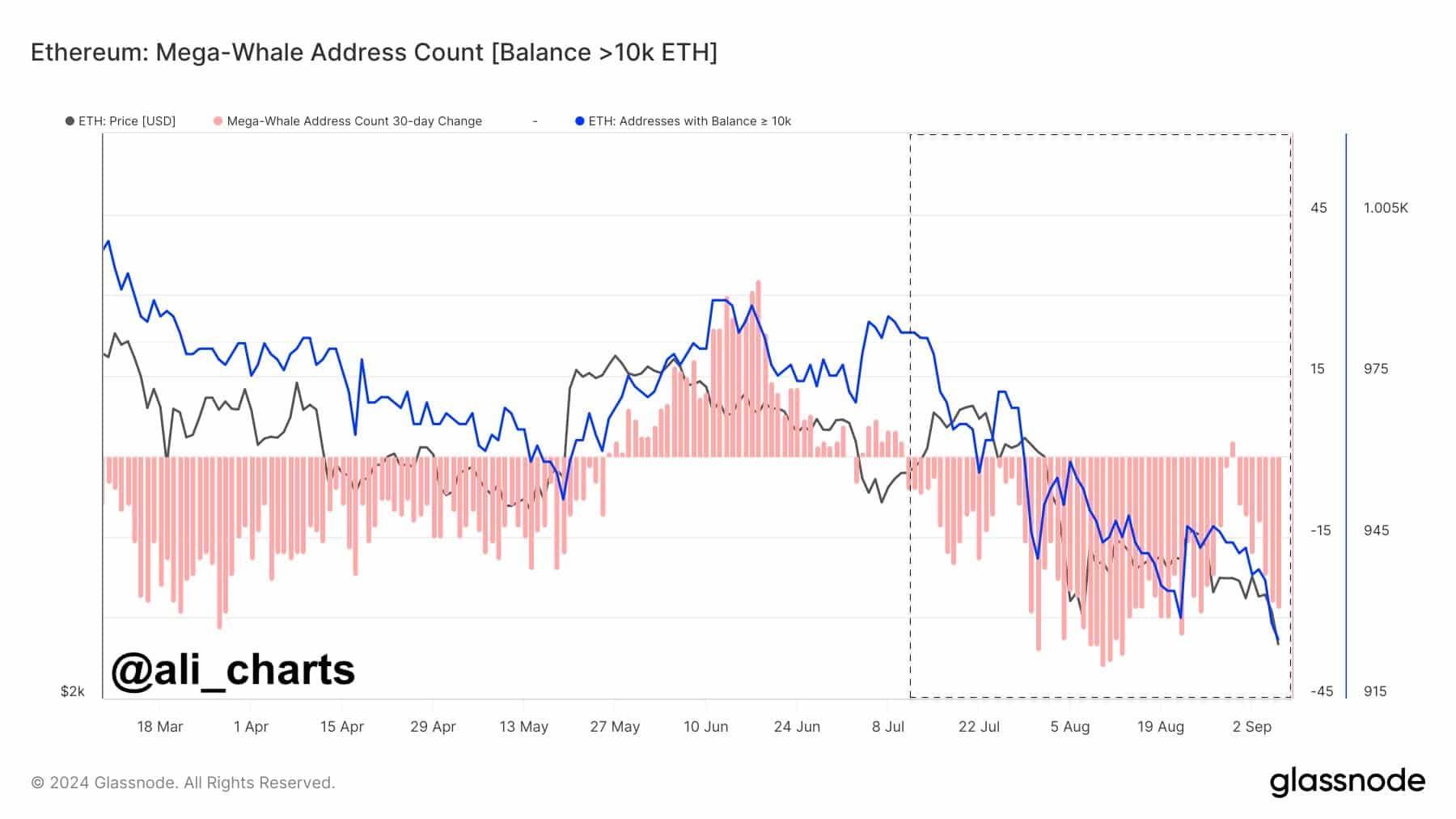

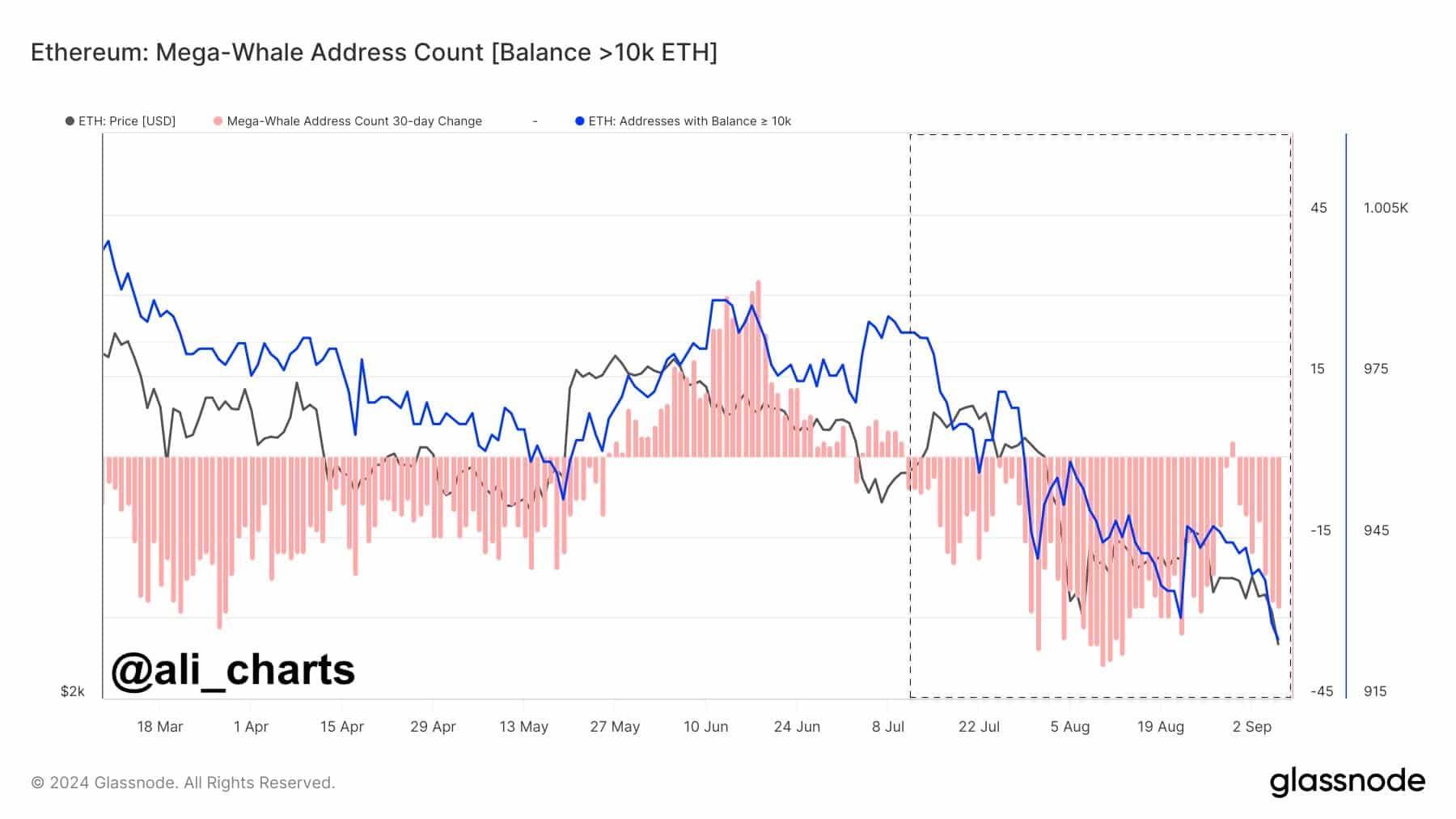

Mega whale address count

The mega whale address count, representing holders with over 10K ETH, has steadily declined, indicating weaker confidence from large investors.

Whales ceased accumulating ETH in early July, instead they chose to selling or redistributing their holdings.

Despite this, the CVD divergence suggests that the correction phase might be ending. However, doubts remain due to the continued decline in mega whale addresses, which could hamper any significant price reversal.

Source: Glassnode

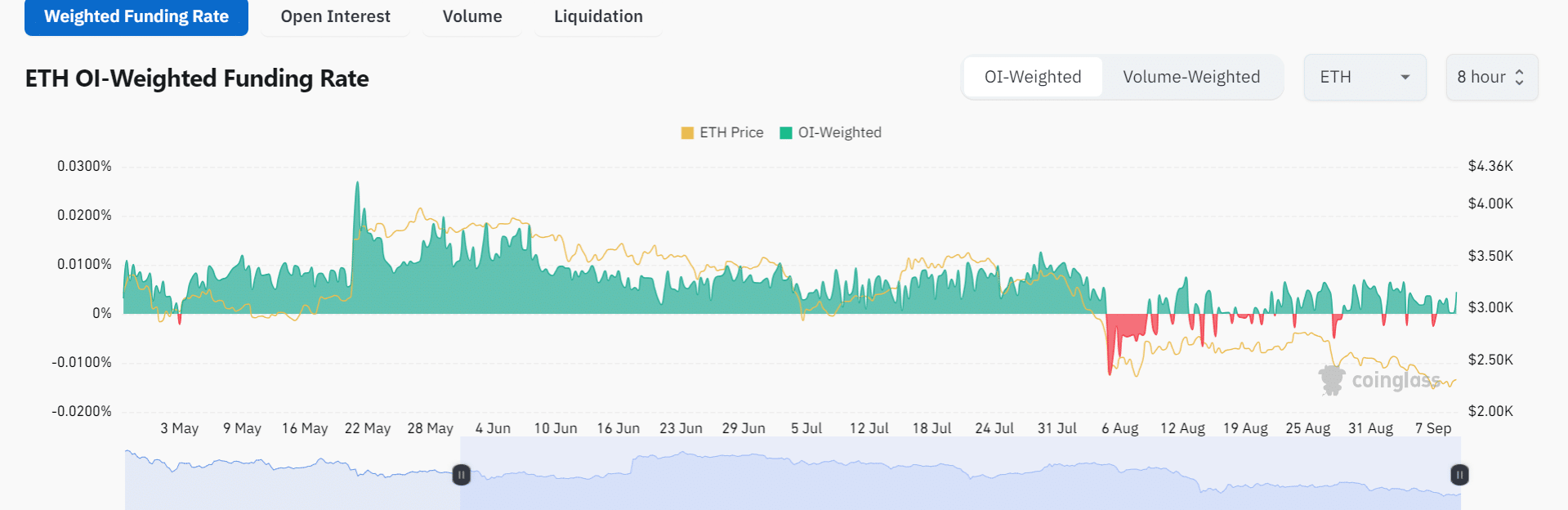

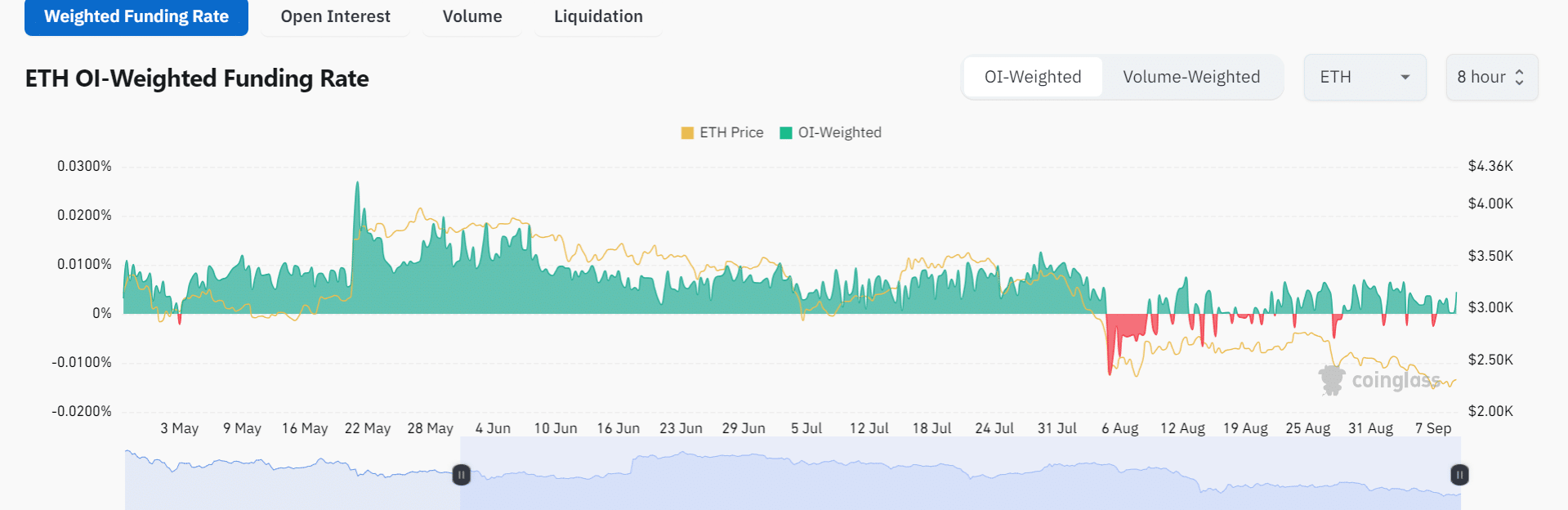

OI-Weighted Funding Rates

Open Interest-Weighted (OI-Weighted) Funding Rates for Ethereum, analyzed using Coinglass, showed rising green numbers, a positive sign for ETH.

Increasing OI-Weighted Funding Rates typically indicate growing trader interest in Ethereum, implying a bullish outlook for the long term.

As traders return to the market, ETH may be poised for a price rebound, particularly as it approaches a critical zone that could dictate its next move.

Source: Coinglass

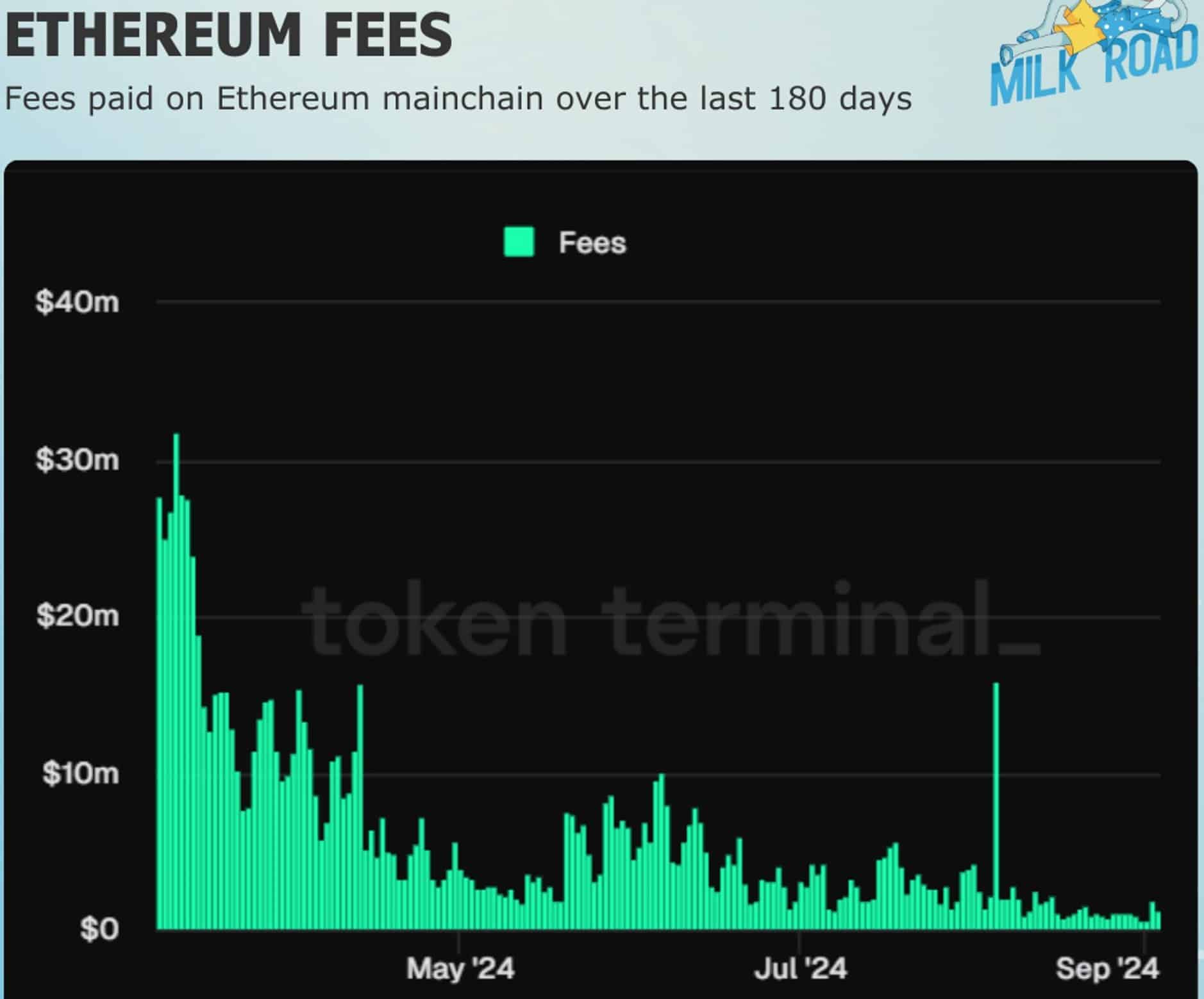

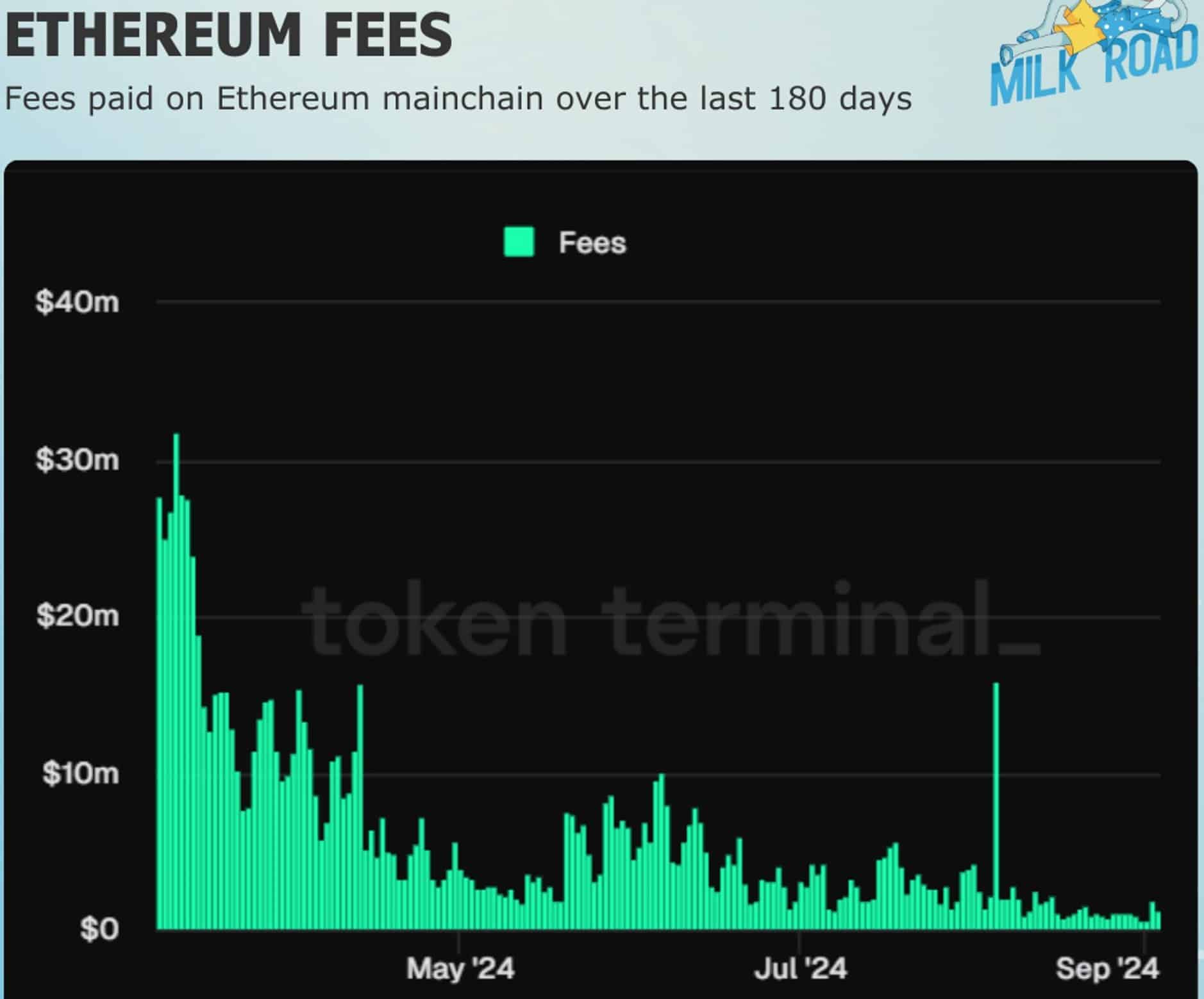

ETH fees on mainnet falling

Ethereum’s mainnet fees have significantly decreased, dropping over 30x in the past six months. This has sparked concerns about Ethereum’s long-term viability, but these worries are unfounded.

ETH collects a portion of fees from its Layer 2 solutions, which boosts its overall network activity. Lower mainnet fees benefit traders who previously avoided ETH due to high costs.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This change could attract more activity, especially in the memecoin space, a growing sector.

Source: Token Terminal

The launch of Ethervista, akin to Solana’s Pump.Fun, will also play a pivotal role in ETH’s price movement by boosting liquidity for ETH-based memecoins, positioning Ethereum for potential growth in Q4 2024.

- The ETH/USDT pair revealed a cumulative volume delta divergence.

- Ethereum is likely to bounce from crucial support.

Ethereum[ETH], the second-largest cryptocurrency, has become the focus of attention as traders and investors prepare for Q4 2024 amidst widespread market uncertainty.

Recent analysis of the ETH/USDT pair revealed a cumulative volume delta (CVD) divergence. As ETH prices make equal highs while CVD forms lower highs, this divergence suggests a potential reversal.

CVD divergence typically signals weak buying pressure, implying that Ethereum could see further price changes.

Source: Hyblock Capital

If the orderbook depth remains constant, ETH might create lower highs, but if the depth increases, higher prices are expected.

ETH/USDT at a key support

Analyzing Ethereum’s price action revealed that ETH/USDT was at a crucial support level at press time, forming a broadening ascending wedge on higher timeframes.

A double bottom pattern may form along the ascending trendline, potentially signaling an upward move. However, a break below this support level could lead to further price declines.

On the daily chart, ETH is also shaping a double bottom at the $2,100 mark, a key point for potential recovery.

Source: TradingView

A rate cut could catalyze Ethereum’s bounce in Q4, following the trend of other cryptocurrencies in recent years.

Mega whale address count

The mega whale address count, representing holders with over 10K ETH, has steadily declined, indicating weaker confidence from large investors.

Whales ceased accumulating ETH in early July, instead they chose to selling or redistributing their holdings.

Despite this, the CVD divergence suggests that the correction phase might be ending. However, doubts remain due to the continued decline in mega whale addresses, which could hamper any significant price reversal.

Source: Glassnode

OI-Weighted Funding Rates

Open Interest-Weighted (OI-Weighted) Funding Rates for Ethereum, analyzed using Coinglass, showed rising green numbers, a positive sign for ETH.

Increasing OI-Weighted Funding Rates typically indicate growing trader interest in Ethereum, implying a bullish outlook for the long term.

As traders return to the market, ETH may be poised for a price rebound, particularly as it approaches a critical zone that could dictate its next move.

Source: Coinglass

ETH fees on mainnet falling

Ethereum’s mainnet fees have significantly decreased, dropping over 30x in the past six months. This has sparked concerns about Ethereum’s long-term viability, but these worries are unfounded.

ETH collects a portion of fees from its Layer 2 solutions, which boosts its overall network activity. Lower mainnet fees benefit traders who previously avoided ETH due to high costs.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This change could attract more activity, especially in the memecoin space, a growing sector.

Source: Token Terminal

The launch of Ethervista, akin to Solana’s Pump.Fun, will also play a pivotal role in ETH’s price movement by boosting liquidity for ETH-based memecoins, positioning Ethereum for potential growth in Q4 2024.

can you get generic clomiphene without insurance can i buy generic clomid without dr prescription can i buy clomid without prescription can i purchase cheap clomiphene online clomid chance of twins where to get cheap clomiphene buying clomiphene without dr prescription

Thanks on putting this up. It’s understandably done.

More posts like this would add up to the online play more useful.

buy zithromax 250mg for sale – ofloxacin 400mg without prescription order metronidazole 200mg sale

order rybelsus without prescription – semaglutide us purchase cyproheptadine for sale

motilium price – order cyclobenzaprine 15mg online cheap buy cyclobenzaprine 15mg generic

order azithromycin online cheap – azithromycin drug order nebivolol 20mg

clavulanate cost – atbio info brand acillin

nexium 40mg uk – anexa mate esomeprazole 20mg ca

order generic warfarin 2mg – https://coumamide.com/ losartan ca

mobic 15mg ca – https://moboxsin.com/ meloxicam 15mg drug

order prednisone 20mg without prescription – apreplson.com order prednisone 20mg pill

best drug for ed – https://fastedtotake.com/ can you buy ed pills online

buy amoxil medication – combamoxi buy generic amoxil

oral forcan – click order diflucan 200mg sale

cost escitalopram – https://escitapro.com/# buy lexapro cheap

cenforce online buy – https://cenforcers.com/ cenforce 100mg drug

cialis no prescription overnight delivery – https://strongtadafl.com/# best place to buy generic cialis online

how to buy zantac – on this site ranitidine sale

100 milligram viagra – strong vpls cheap viagra for sale

This is the compassionate of literature I in fact appreciate. gabapentin cheap

Thanks an eye to sharing. It’s outstrip quality. https://ursxdol.com/azithromycin-pill-online/

More posts like this would make the online elbow-room more useful. https://prohnrg.com/product/atenolol-50-mg-online/

This is a topic which is virtually to my verve… Numberless thanks! Unerringly where can I find the phone details for questions? achat kamagra en ligne