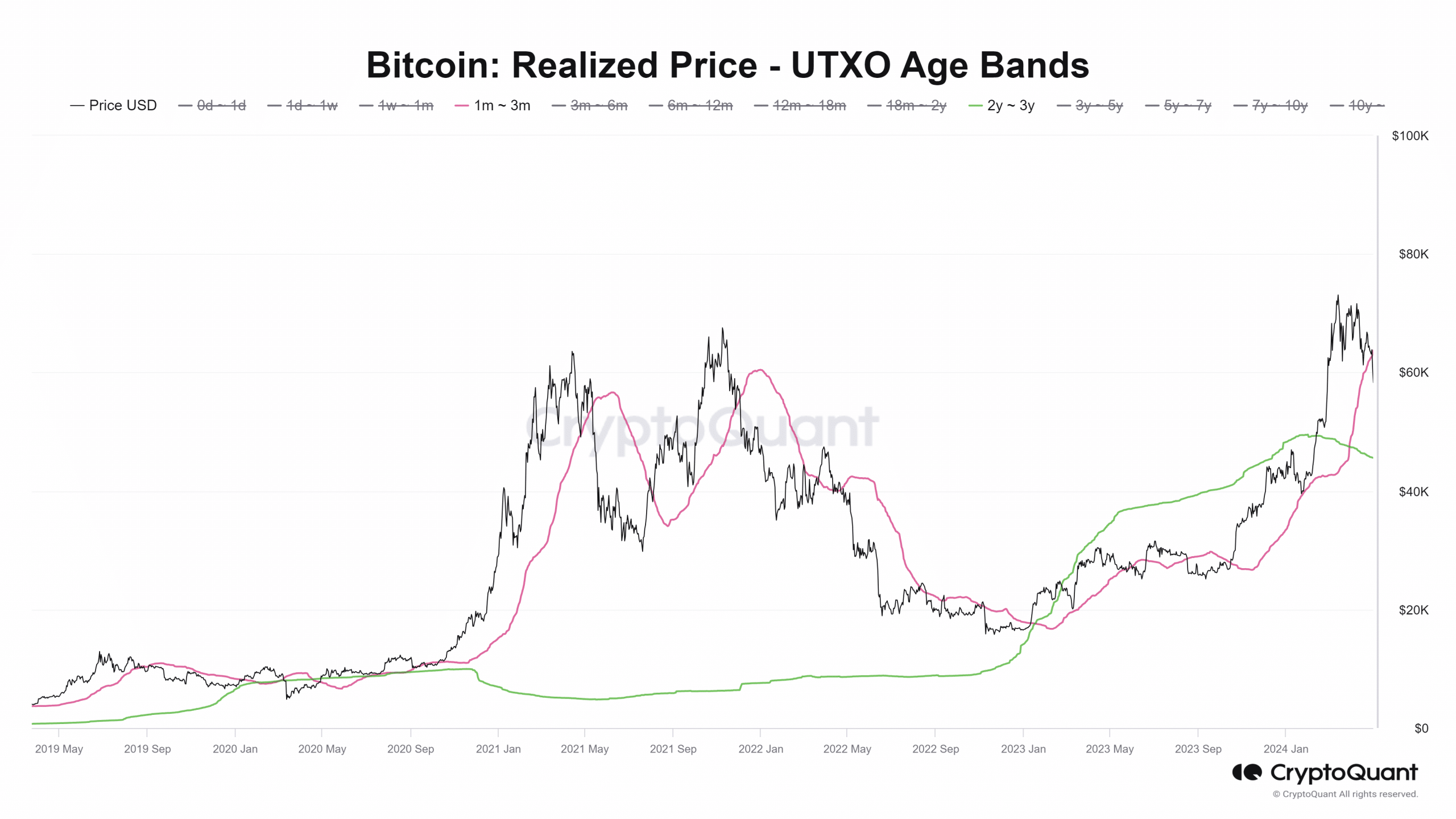

- Bitcoin short-term whales are underwater, which likely presented an ideal buying opportunity

- Metrics resembled how they were before the previous major bull run

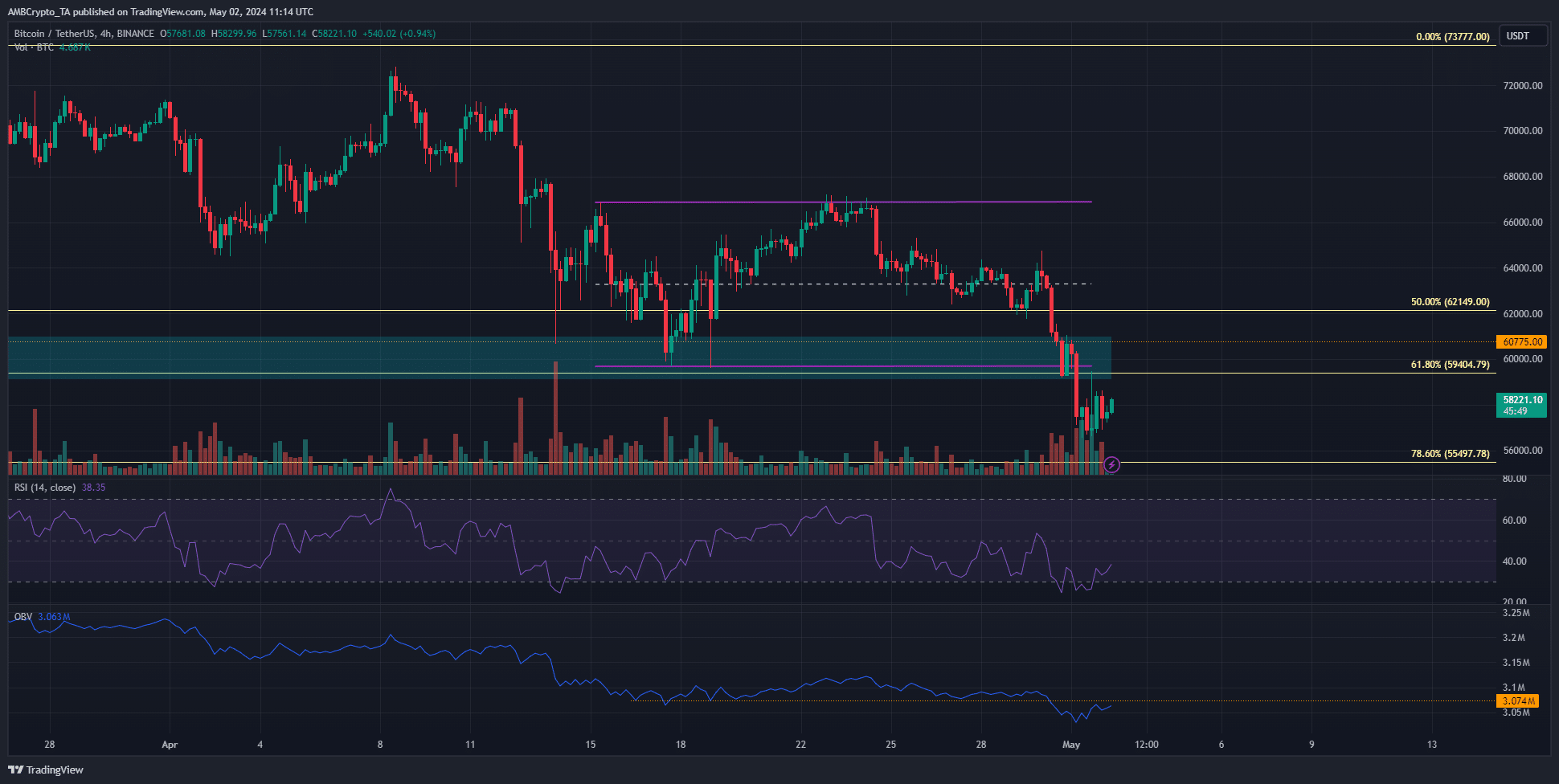

Bitcoin [BTC] sank below the key demand zone at $60k.

This region had held the sellers at bay but eventually gave way. Crypto technical analyst CrypNuevo highlighted that we might get a post-FOMC bounce to $61k in a post on X (formerly Twitter).

Should traders expect to see the $60k former support reclaimed? Alternatively, should they look to go short upon a retest? Here’s what market participants could watch out for before making their next move.

The current breakdown has been on a high trading volume

Source: BTC/USDT on TradingView

The key levels are $59.4k and $60.7k in the short term. A cluster of liquidity is likely present near these levels, marking them as critical areas where a bearish continuation could occur.

Such a continuation is expected because the OBV has fallen below two-week support, highlighting selling pressure dominance.

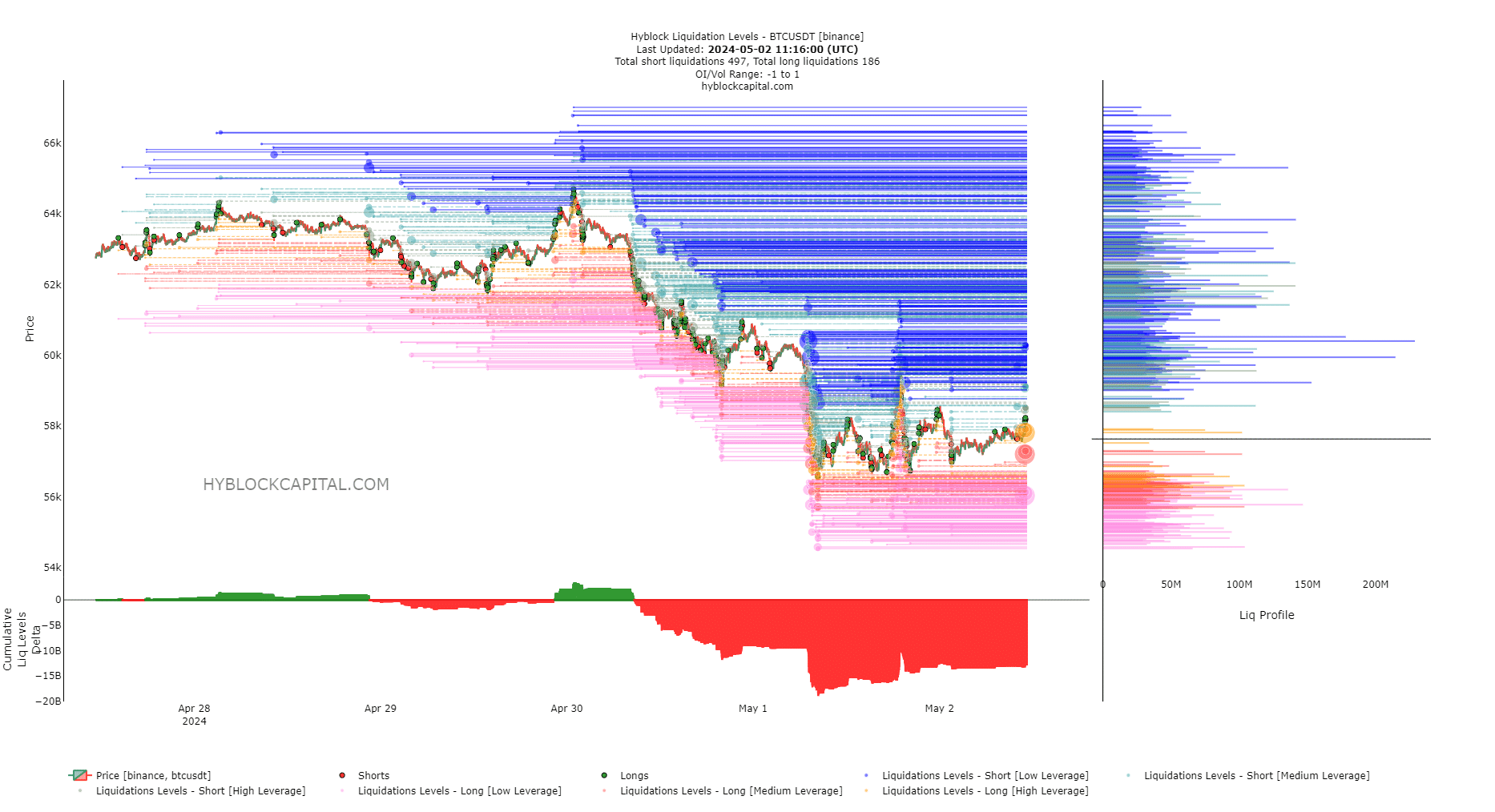

Source: Hyblock

The liquidation levels showed that the cumulative liq levels delta was vastly negative. Therefore, we can expect a move upward in the short-term to collect liquidity and wipe out the imbalance.

The $60.5k and the $63.8k levels had the highest cluster of liquidation levels. Hence, a move to these levels before a reversal southward is anticipated.

Of golden and death crosses

Source: CryptoQuant

In a CryptoQuant Insights post, user CoinLupin pointed out an interesting development.

Looking at the realized UTXO age bands, the onset of major bull runs came when the realized price of 1-3 month and 2-3 year bands saw a smoothing process.

This happened in 2020 from January to September, and prices tend to consolidate near the realized prices of these age bands.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In the current cycle, there were not as many golden and death crosses between these two age bands.

However, the recent pullback could be followed by deeper losses as savvy market participants buy from impatient BTC sellers. This could be followed by the true bull run, the analyst pointed out.

магазин аккаунтов социальных сетей магазин аккаунтов

услуги по продаже аккаунтов заработок на аккаунтах

продажа аккаунтов https://magazin-akkauntov-online.ru

магазин аккаунтов купить аккаунт с прокачкой

купить аккаунт купить аккаунт с прокачкой

перепродажа аккаунтов купить аккаунт с прокачкой

Account Exchange Service Secure Account Sales

Account Sale Account Selling Service

Verified Accounts for Sale Secure Account Purchasing Platform

Account trading platform Online Account Store

Account Buying Platform Sell Account

Guaranteed Accounts Account Catalog

Buy accounts Account Buying Platform

Account marketplace Account Market

Buy accounts Account Buying Platform

Buy Account Secure Account Purchasing Platform

Account Buying Service Buy and Sell Accounts

find accounts for sale account market

social media account marketplace account trading platform

account selling platform ready-made accounts for sale

buy pre-made account sell account

buy account guaranteed accounts

account store gaming account marketplace

sell accounts secure account sales

accounts for sale account market

gaming account marketplace marketplace for ready-made accounts

account acquisition sell accounts

account trading platform verified accounts for sale

account trading platform ready-made accounts for sale

account acquisition account trading platform

secure account purchasing platform account market

guaranteed accounts account catalog

account marketplace account market

accounts for sale social media account marketplace

account trading purchase ready-made accounts

account market account buying service

accounts marketplace https://account-buy.org/

account market account selling service

sell pre-made account account market

account trading account sale

database of accounts for sale website for buying accounts

gaming account marketplace buy accounts

account selling platform shop-social-accounts.org

find accounts for sale account store

social media account marketplace website for selling accounts

accounts for sale https://accounts-offer.org/

account selling platform https://accounts-marketplace.xyz

find accounts for sale https://buy-best-accounts.org

purchase ready-made accounts https://social-accounts-marketplaces.live/

purchase ready-made accounts https://accounts-marketplace.live/

purchase ready-made accounts https://social-accounts-marketplace.xyz/

secure account purchasing platform https://buy-accounts.space

buy and sell accounts https://buy-accounts-shop.pro

gaming account marketplace https://accounts-marketplace.art/

buy account https://social-accounts-marketplace.live

account exchange https://buy-accounts.live/

accounts marketplace https://accounts-marketplace.online

маркетплейс аккаунтов akkaunty-na-prodazhu.pro

магазин аккаунтов https://kupit-akkaunt.xyz

продать аккаунт https://rynok-akkauntov.top/

биржа аккаунтов akkaunt-magazin.online

площадка для продажи аккаунтов https://akkaunty-market.live/

маркетплейс аккаунтов https://kupit-akkaunty-market.xyz/

магазин аккаунтов https://akkaunty-optom.live

маркетплейс аккаунтов https://online-akkaunty-magazin.xyz/

купить аккаунт https://akkaunty-dlya-prodazhi.pro/

маркетплейс аккаунтов соцсетей https://kupit-akkaunt.online

cheap facebook advertising account https://buy-adsaccounts.work

buy facebook account buy facebook ads account

facebook ad account for sale buy aged facebook ads accounts

buy facebook ad account https://ad-account-buy.top

buy facebook ads manager https://buy-ads-account.work

facebook account buy buying facebook accounts

buy facebook ad accounts https://buy-ad-account.click

Этот информационный материал привлекает внимание множеством интересных деталей и необычных ракурсов. Мы предлагаем уникальные взгляды на привычные вещи и рассматриваем вопросы, которые волнуют общество. Будьте в курсе актуальных тем и расширяйте свои знания!

Детальнее – https://medalkoblog.ru/

buy fb account facebook ad account for sale

google ads agency account buy https://buy-ads-account.top

sell google ads account https://buy-ads-accounts.click

facebook account sale https://buy-accounts.click

sell google ads account https://ads-account-for-sale.top

google ads account seller https://ads-account-buy.work

buy account google ads https://buy-ads-invoice-account.top

buy google ads threshold account https://buy-account-ads.work

buy verified google ads account https://buy-ads-agency-account.top/

google ads accounts for sale https://sell-ads-account.click

buy google ads invoice account buy google adwords accounts

buy verified business manager facebook facebook bm account

buy google ads threshold account buy google ads account

buy verified facebook business manager https://buy-business-manager-acc.org/

unlimited bm facebook buy-bm-account.org

buy verified business manager facebook buy-verified-business-manager-account.org

buy verified business manager facebook https://buy-verified-business-manager.org/

buy bm facebook https://buy-business-manager-verified.org

facebook business manager buy https://business-manager-for-sale.org/

verified business manager for sale https://buy-bm.org

verified facebook business manager for sale https://verified-business-manager-for-sale.org/

buy facebook bm https://buy-business-manager-accounts.org

buy tiktok ads account https://buy-tiktok-ads-account.org

buy tiktok business account https://tiktok-ads-account-buy.org

tiktok ad accounts https://tiktok-ads-account-for-sale.org

tiktok ads account for sale https://tiktok-agency-account-for-sale.org

buy tiktok ads account https://buy-tiktok-ad-account.org

tiktok ad accounts https://buy-tiktok-ads-accounts.org

buy tiktok ads accounts https://buy-tiktok-ads.org

tiktok ads agency account buy tiktok ads

tiktok agency account for sale https://tiktok-ads-agency-account.org

Обращение к наркологу позволяет избежать типичных ошибок самолечения и достичь стабильного результата. Квалифицированное вмешательство:

Детальнее – http://narko-zakodirovan2.ru/

Обращение к наркологу позволяет избежать типичных ошибок самолечения и достичь стабильного результата. Квалифицированное вмешательство:

Исследовать вопрос подробнее – http://narko-zakodirovan2.ru/vyvod-iz-zapoya-kruglosutochno-novosibirsk/

Решение обратиться к врачу должно быть принято, если:

Получить больше информации – вывод из запоя на дому круглосуточно новосибирск

Решение обратиться к врачу должно быть принято, если:

Подробнее тут – вывод из запоя анонимно новосибирск

Врач может приехать в течение 1–2 часов после обращения. В стационар возможна экстренная госпитализация в тот же день.

Получить дополнительную информацию – вывод из запоя клиника новосибирск

Показана в тяжёлых случаях или при наличии сопутствующих заболеваний. Лечение проходит под круглосуточным наблюдением врачей и медсестёр с постоянной корректировкой терапии.

Исследовать вопрос подробнее – наркология вывод из запоя в новосибирске

Решение обратиться к врачу должно быть принято, если:

Изучить вопрос глубже – вывод из запоя круглосуточно новосибирск

Обращение к наркологу позволяет избежать типичных ошибок самолечения и достичь стабильного результата. Квалифицированное вмешательство:

Получить больше информации – http://narko-zakodirovan2.ru

Решение обратиться к врачу должно быть принято, если:

Ознакомиться с деталями – вывод из запоя на дому круглосуточно

Затяжной запой — это состояние, при котором человек в течение нескольких дней не может прекратить употребление алкоголя без медицинской помощи. Такое состояние чревато тяжёлыми нарушениями в работе внутренних органов и психики. В Новосибирске и Новосибирской области доступен профессиональный вывод из запоя как на дому, так и в условиях стационара. Подход к лечению индивидуален, и основная цель — безопасно и эффективно устранить последствия интоксикации и предотвратить рецидив.

Изучить вопрос глубже – https://narko-zakodirovan2.ru/vyvod-iz-zapoya-na-domu-novosibirsk/

Решение обратиться к врачу должно быть принято, если:

Детальнее – http://narko-zakodirovan2.ru/

Затяжной запой — это состояние, при котором человек в течение нескольких дней не может прекратить употребление алкоголя без медицинской помощи. Такое состояние чревато тяжёлыми нарушениями в работе внутренних органов и психики. В Новосибирске и Новосибирской области доступен профессиональный вывод из запоя как на дому, так и в условиях стационара. Подход к лечению индивидуален, и основная цель — безопасно и эффективно устранить последствия интоксикации и предотвратить рецидив.

Выяснить больше – vyvod-iz-zapoya-klinika novosibirsk

Затяжной запой — это состояние, при котором человек в течение нескольких дней не может прекратить употребление алкоголя без медицинской помощи. Такое состояние чревато тяжёлыми нарушениями в работе внутренних органов и психики. В Новосибирске и Новосибирской области доступен профессиональный вывод из запоя как на дому, так и в условиях стационара. Подход к лечению индивидуален, и основная цель — безопасно и эффективно устранить последствия интоксикации и предотвратить рецидив.

Узнать больше – http://narko-zakodirovan2.ru

Обращение к наркологу позволяет избежать типичных ошибок самолечения и достичь стабильного результата. Квалифицированное вмешательство:

Получить больше информации – https://narko-zakodirovan2.ru/vyvod-iz-zapoya-kruglosutochno-novosibirsk/

Обращение к наркологу позволяет избежать типичных ошибок самолечения и достичь стабильного результата. Квалифицированное вмешательство:

Получить больше информации – наркологический вывод из запоя новосибирск

Образовательные программы: Мы уверены, что знания о зависимости и её последствиях играют важную роль в реабилитации. Мы информируем пациентов о механизмах действия наркотиков и алкоголя на организм, что способствует изменению их отношения к терапии и жизни без зависимостей.

Выяснить больше – vyvod-iz-zapoya-kruglosutochno kazan’

Миссия нашего центра – оказание всесторонней помощи людям с зависимостями. Основные цели нашей работы:

Получить дополнительную информацию – вывод из запоя на дому казань.

Медикаментозное лечение: Мы применяем современные препараты, которые помогают облегчить симптомы абстиненции и улучшить состояние пациентов в первые дни лечения. Индивидуальный подбор лекарственных схем позволяет минимизировать побочные эффекты и достичь наилучших результатов.

Детальнее – вывод из запоя республика татарстан

Создание безопасной среды: Мы понимаем, насколько важна поддержка в сложные моменты. Наш центр предоставляет пространство, где пациенты могут открыто говорить о своих переживаниях без страха быть осужденными, что способствует доверию и успешному лечению.

Изучить вопрос глубже – вывод из запоя казань.

Образовательные программы: Мы уверены, что знания о зависимости и её последствиях играют важную роль в реабилитации. Мы информируем пациентов о механизмах действия наркотиков и алкоголя на организм, что способствует изменению их отношения к терапии и жизни без зависимостей.

Подробнее тут – вывод из запоя на дому круглосуточно казань

Миссия нашего центра – оказание всесторонней помощи людям с зависимостями. Основные цели нашей работы:

Разобраться лучше – http://srochnyj-vyvod-iz-zapoya.ru/

where can i buy cheap clomiphene tablets where can i buy generic clomid without dr prescription can i get clomid online how to buy generic clomiphene pill how to get cheap clomid no prescription clomid without dr prescription buy clomid without dr prescription

Good blog you possess here.. It’s hard to find high status article like yours these days. I honestly comprehend individuals like you! Take vigilance!!

Thanks towards putting this up. It’s okay done.

zithromax 500mg price – buy floxin pills for sale flagyl us

motilium oral – purchase flexeril online cheap purchase cyclobenzaprine sale

augmentin medication – atbioinfo buy acillin

brand nexium – anexamate nexium online buy

buy warfarin 5mg generic – https://coumamide.com/ cozaar 25mg usa

mobic pills – https://moboxsin.com/ buy meloxicam 15mg pills

order deltasone pill – https://apreplson.com/ brand deltasone 5mg

top ed pills – https://fastedtotake.com/ best ed pills non prescription uk

buy amoxil pills – https://combamoxi.com/ amoxicillin order online

where to buy forcan without a prescription – on this site order fluconazole

buy generic cenforce 50mg – cenforce 100mg tablet buy cheap cenforce

buy fb ads account account buying platform account selling platform

cialis no prescription – https://ciltadgn.com/ cialis prescription online

cheap facebook account ready-made accounts for sale account market

cialis patent expiration date – https://strongtadafl.com/# cialis from canadian pharmacy registerd

buy zantac no prescription – this buy zantac generic

buy cheap viagra thailand – https://strongvpls.com/ real viagra 100mg

More posts like this would bring about the blogosphere more useful. cenforce para que sirve

This is the amicable of glad I take advantage of reading. purchase furosemide for sale

More delight pieces like this would make the web better. https://ursxdol.com/cenforce-100-200-mg-ed/

More articles like this would remedy the blogosphere richer. acheter propecia generique pas cher