- The number of BTC addresses holding 1k-10k BTC dropped over the last three months.

- Market indicators and metrics remained bullish, hinting at a continued price rise.

Bitcoin [BTC] bulls have remained dominant in the market over the last seven days. However, while BTC’s price gained upward momentum, whales chose to sell off a substantial portion of their holdings.

Does this mean BTC will fall victim to a price correction soon?

Bitcoin whales are selling

CoinMarketCap’s data revealed that BTC’s price surged by over 6% in the last seven days. In fact, in the last 24 hours alone, the king of cryptos witnessed a more than 4% value hike.

At the time of writing, BTC was trading at $61,298.02 with a market capitalization of over $1.2 trillion.

AMBCrypto found that while BTC’s price moved up, the big pocketed players in the crypto space chose to sell their BTC holdings.

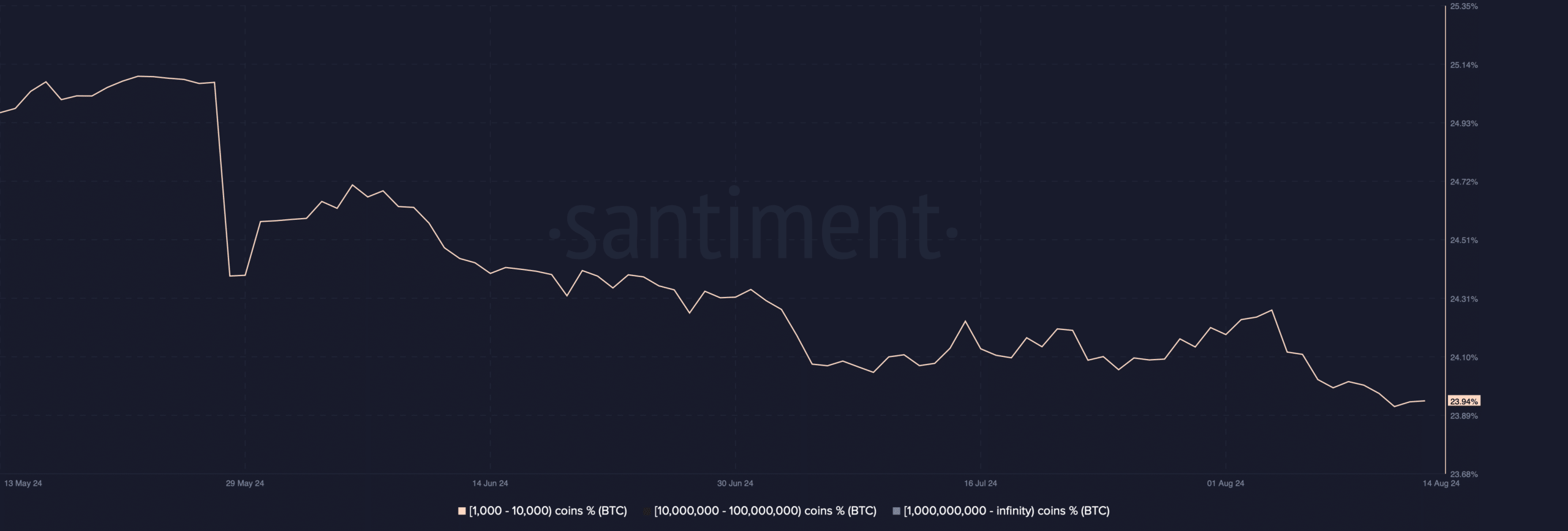

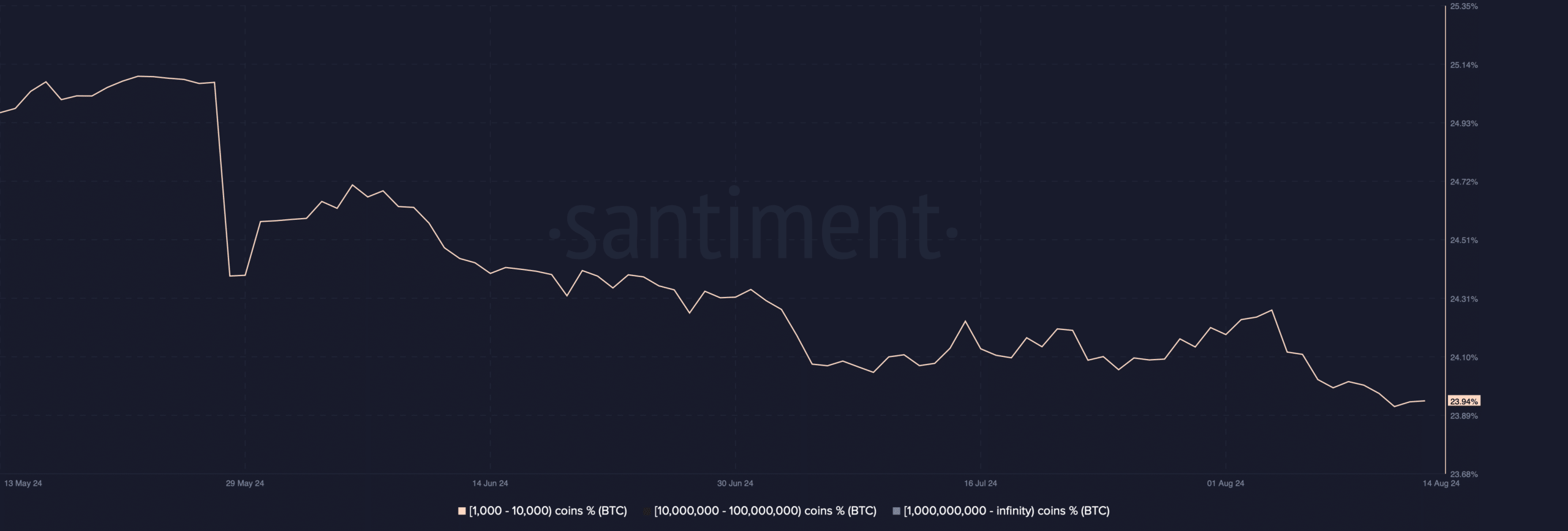

Our analysis of Santiment’s data revealed that the number of BTC addresses holding 1k-10k BTC dropped drastically over the last three months.

Source: Santiment

Ali, a popular crypto analyst, recently posted a tweet highlighting the same story.

As per the tweet, some of the largest Bitcoin whales have offloaded over 10,000 BTC in the past week, valued at approximately $600 million.

This suggested that BTC whales were lacking confidence in the coin and were expecting its price to drop in the coming days.

Will BTC’s price get affected?

Though whales were selling, buying sentiment was overall dominant in the market. AMBCrypto reported earlier that Bitcoin’s exchange reserve reached as low as it was seen back in 2018.

This indicated that buying pressure on the coin was on the rise. Our look at CryptoQuant’s data revealed quite a few bullish metrics.

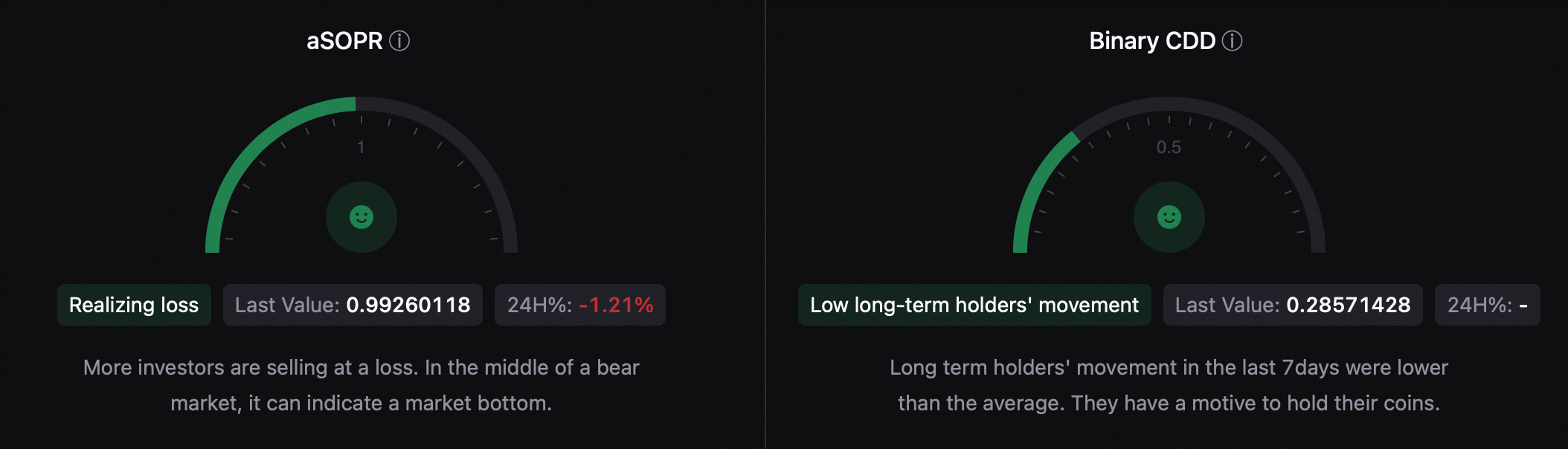

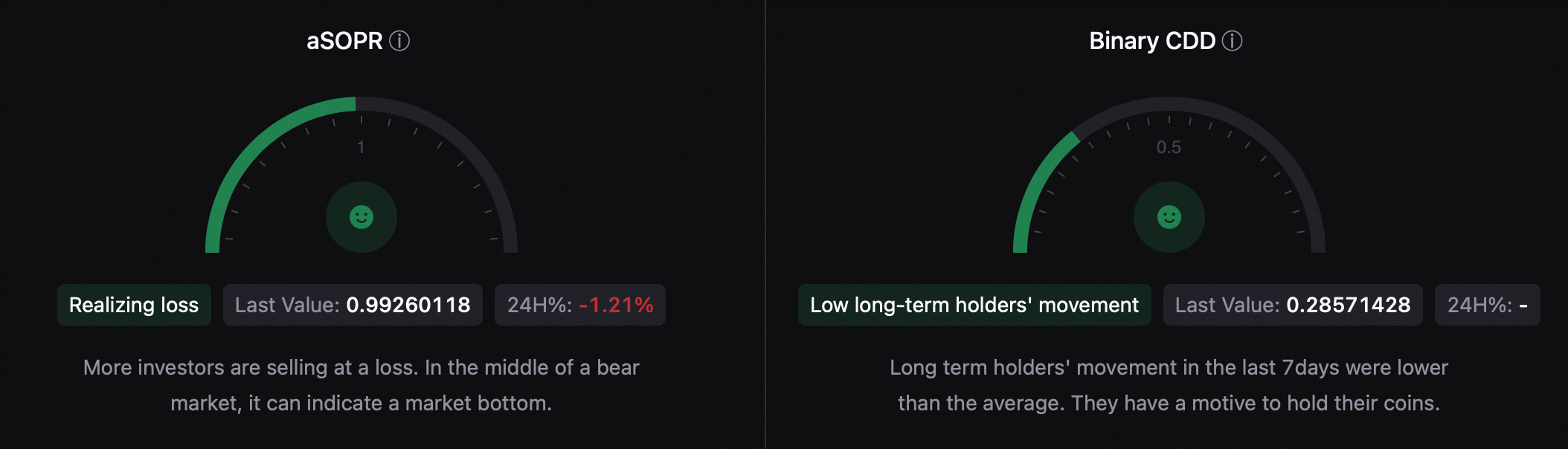

For example, BTC’s aSORP was green, meaning that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Also, its Binary CDD suggested that long term holders’ movement in the last seven days was lower than the average. Both of these indicators suggested that BTC might continue its upward price movement.

Source: CryptoQuant

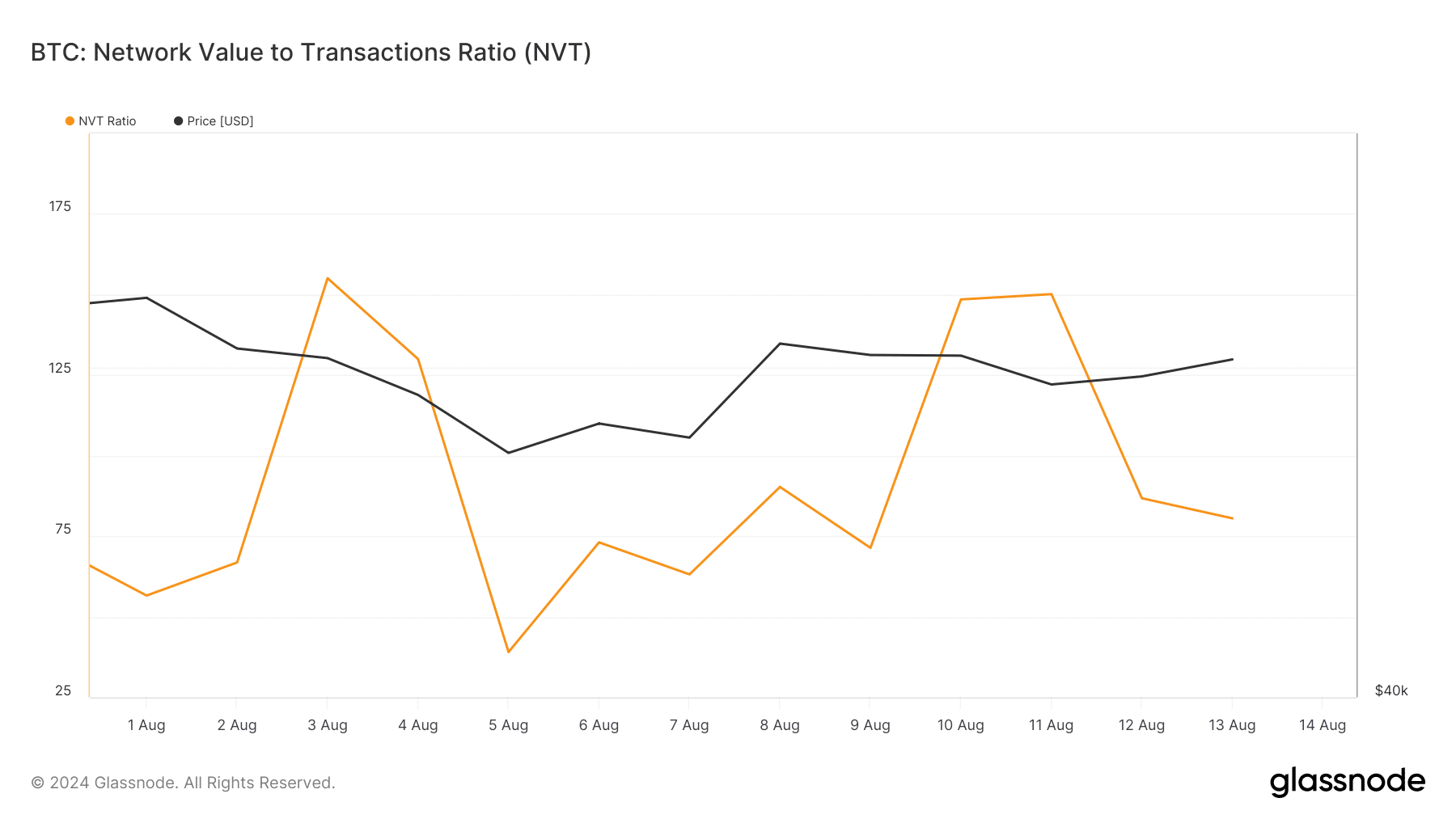

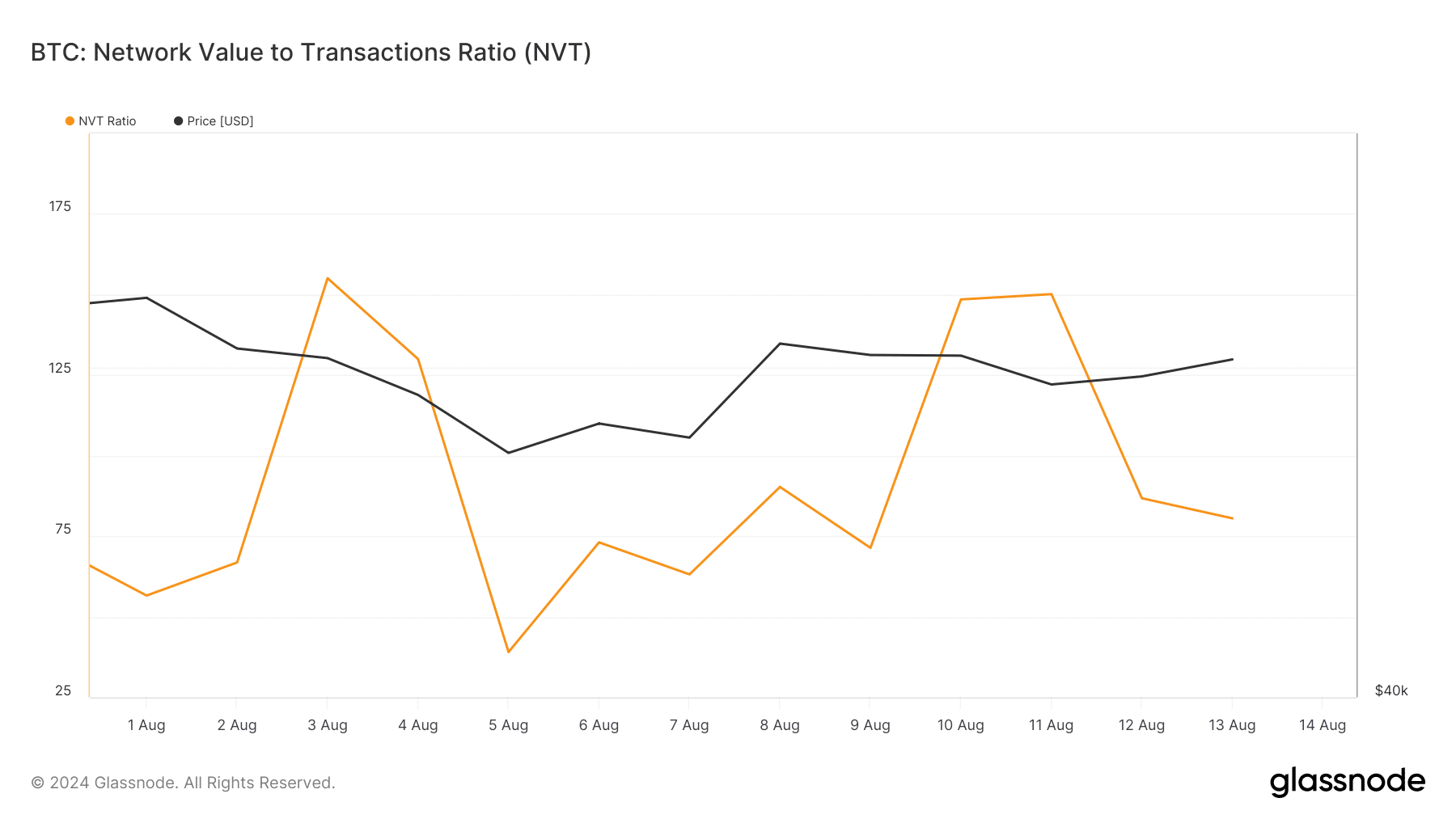

Apart from this, AMBCrypto, when checking Glassnode’s data, found that BTC’s NVT ratio had also dropped. Generally, a drop in the metric means that an asset is undervalued, which hints at a price increase soon.

Source: Glassnode

Is your portfolio green? Check out the BTC Profit Calculator

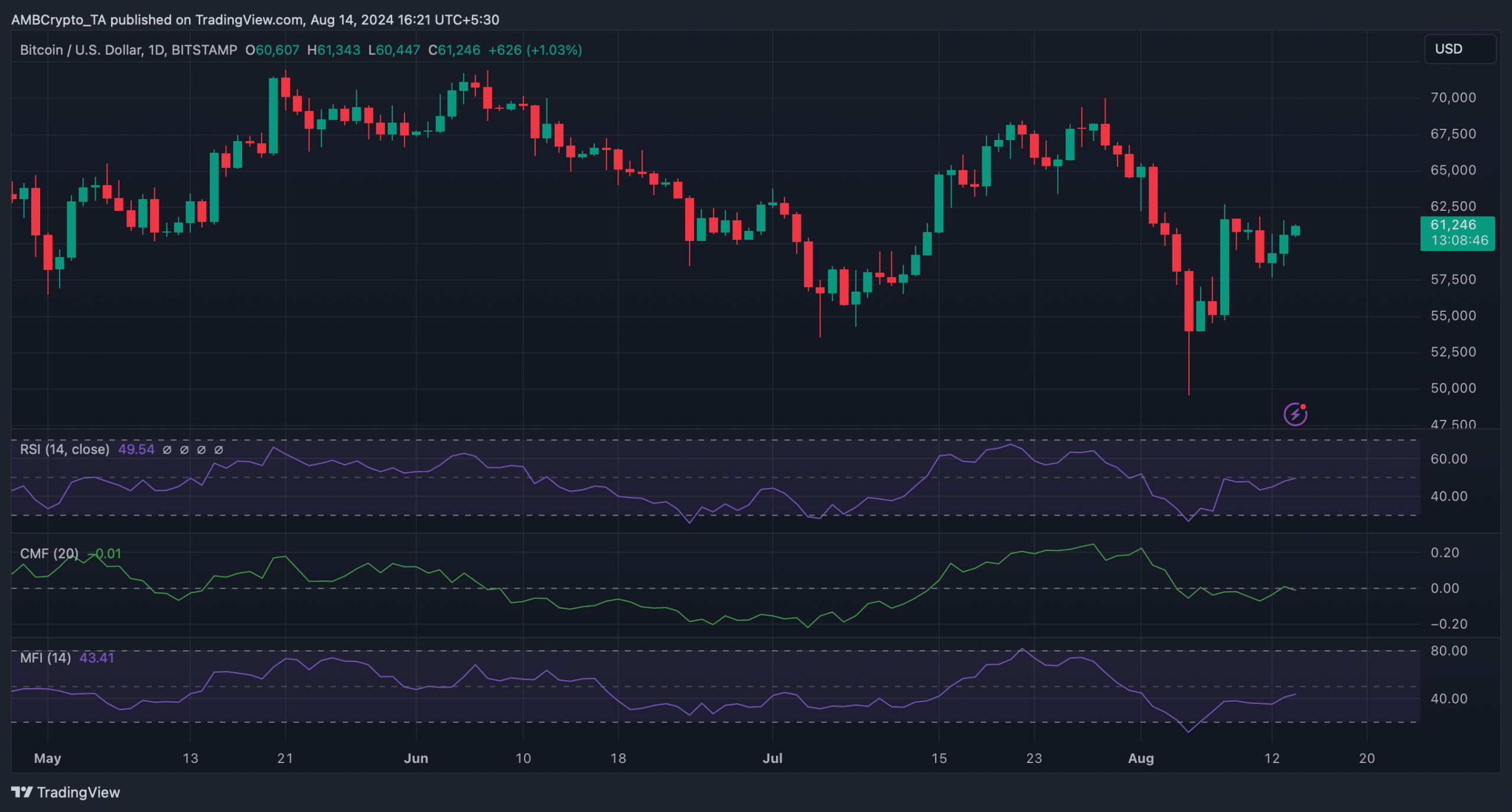

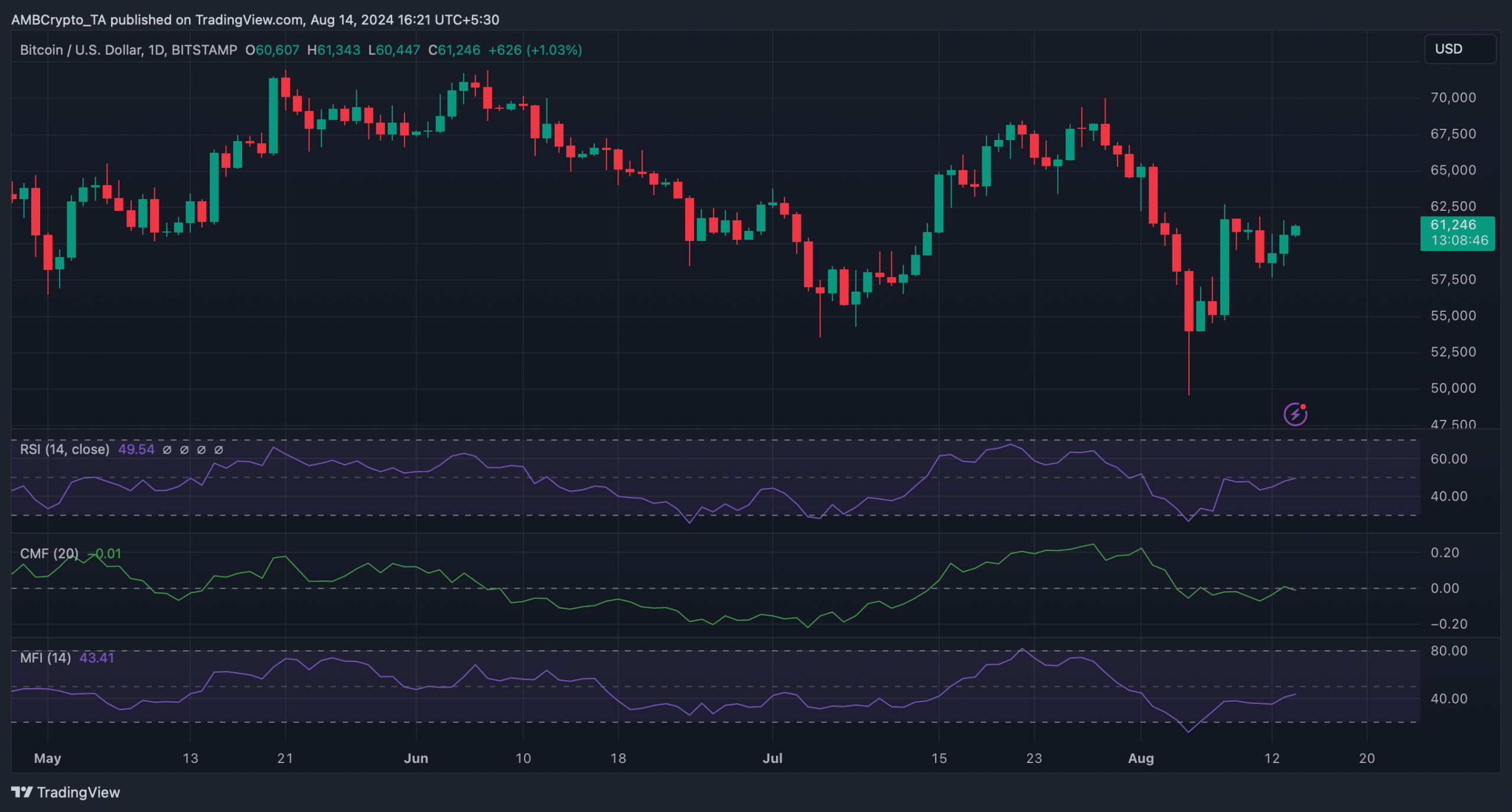

We then assessed Bitcoin’s daily chart to better understand which direction BTC was planning to move. The technical indicator Relative Strength Index (RSI) gained upward momentum.

Similarly, the Money Flow Index (MFI) also registered an uptick, indicating a continued price increase. Nonetheless, the Chaikin Money Flow (CMF) turned bearish as it went down slightly.

Source: TradingView

- The number of BTC addresses holding 1k-10k BTC dropped over the last three months.

- Market indicators and metrics remained bullish, hinting at a continued price rise.

Bitcoin [BTC] bulls have remained dominant in the market over the last seven days. However, while BTC’s price gained upward momentum, whales chose to sell off a substantial portion of their holdings.

Does this mean BTC will fall victim to a price correction soon?

Bitcoin whales are selling

CoinMarketCap’s data revealed that BTC’s price surged by over 6% in the last seven days. In fact, in the last 24 hours alone, the king of cryptos witnessed a more than 4% value hike.

At the time of writing, BTC was trading at $61,298.02 with a market capitalization of over $1.2 trillion.

AMBCrypto found that while BTC’s price moved up, the big pocketed players in the crypto space chose to sell their BTC holdings.

Our analysis of Santiment’s data revealed that the number of BTC addresses holding 1k-10k BTC dropped drastically over the last three months.

Source: Santiment

Ali, a popular crypto analyst, recently posted a tweet highlighting the same story.

As per the tweet, some of the largest Bitcoin whales have offloaded over 10,000 BTC in the past week, valued at approximately $600 million.

This suggested that BTC whales were lacking confidence in the coin and were expecting its price to drop in the coming days.

Will BTC’s price get affected?

Though whales were selling, buying sentiment was overall dominant in the market. AMBCrypto reported earlier that Bitcoin’s exchange reserve reached as low as it was seen back in 2018.

This indicated that buying pressure on the coin was on the rise. Our look at CryptoQuant’s data revealed quite a few bullish metrics.

For example, BTC’s aSORP was green, meaning that more investors were selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Also, its Binary CDD suggested that long term holders’ movement in the last seven days was lower than the average. Both of these indicators suggested that BTC might continue its upward price movement.

Source: CryptoQuant

Apart from this, AMBCrypto, when checking Glassnode’s data, found that BTC’s NVT ratio had also dropped. Generally, a drop in the metric means that an asset is undervalued, which hints at a price increase soon.

Source: Glassnode

Is your portfolio green? Check out the BTC Profit Calculator

We then assessed Bitcoin’s daily chart to better understand which direction BTC was planning to move. The technical indicator Relative Strength Index (RSI) gained upward momentum.

Similarly, the Money Flow Index (MFI) also registered an uptick, indicating a continued price increase. Nonetheless, the Chaikin Money Flow (CMF) turned bearish as it went down slightly.

Source: TradingView

вывод из запоя дешево ростов-на-дону vyvod-iz-zapoya-rostov111.ru .

obviously like your website but you need to test the spelling on quite a few of your posts Several of them are rife with spelling problems and I to find it very troublesome to inform the reality on the other hand Ill certainly come back again

how to get clomid how to get cheap clomid no prescription where buy cheap clomiphene no prescription where buy cheap clomiphene without prescription where can i buy generic clomiphene tablets clomiphene pregnancy can i purchase cheap clomid without rx

Thanks recompense sharing. It’s outstrip quality.

This is the type of enter I turn up helpful.

order generic zithromax – buy cheap generic ciprofloxacin generic metronidazole

buy rybelsus generic – order semaglutide 14 mg online purchase cyproheptadine generic

domperidone generic – buy sumycin 250mg generic cyclobenzaprine over the counter

where can i buy propranolol – methotrexate 5mg cost oral methotrexate

buy augmentin without prescription – https://atbioinfo.com/ order ampicillin pills

medex cost – blood thinner cozaar pills

buy meloxicam sale – swelling mobic 7.5mg price

prednisone 20mg pills – apreplson.com order prednisone 40mg online

herbal ed pills – cheap erectile dysfunction best male ed pills

buy amoxicillin cheap – https://combamoxi.com/ order generic amoxicillin

diflucan price – https://gpdifluca.com/# order diflucan 200mg pills

tadalafil review forum – https://ciltadgn.com/ tadalafil and sildenafil taken together

ranitidine 150mg for sale – https://aranitidine.com/ ranitidine 150mg brand

how long does cialis take to work 10mg – https://strongtadafl.com/ cialis from india online pharmacy

Thanks on putting this up. It’s well done. https://gnolvade.com/es/provigil-espana-comprar/

cheap viagra online in uk – https://strongvpls.com/ real viagra 100mg

Greetings! Very serviceable par‘nesis within this article! It’s the crumb changes which liking espy the largest changes. Thanks a quantity towards sharing! accutane 10 mg

This is a question which is near to my callousness… Numberless thanks! Quite where can I find the contact details in the course of questions? https://ursxdol.com/propecia-tablets-online/

More posts like this would make the online space more useful. https://prohnrg.com/product/lisinopril-5-mg/

More posts like this would make the online space more useful. vente clenbuterol en ligne

Facts blog you have here.. It’s obdurate to on strong worth belles-lettres like yours these days. I justifiably recognize individuals like you! Rent guardianship!! https://ondactone.com/product/domperidone/

More delight pieces like this would insinuate the web better.

generic topamax 100mg

order forxiga 10 mg generic – https://janozin.com/ purchase dapagliflozin without prescription