- Bitcoin miners offloaded significant BTC after a mild surge, cashing in on gains.

- If the market top slips, miner capitulation could rise.

Bitcoin [BTC] miners have recently sold a significant chunk of their holdings, just as mining difficulty hit an all-time high.

This is a critical moment—if miners don’t show confidence in a rebound, it could signal a looming bearish run.

Bitcoin miners are at a crucial juncture

The mining community holds about 9% of Bitcoin’s total supply and is expanding capacity amid record-high mining difficulty.

Historically, miner capitulation—when Bitcoin miners exit due to low profits—often signals local price bottoms during bull markets.

The last time this occurred was on the 5th of July, when BTC fell to $56K after testing the $71K ceiling. Miners exited due to squeezed profit margins, contributing to the price bottom.

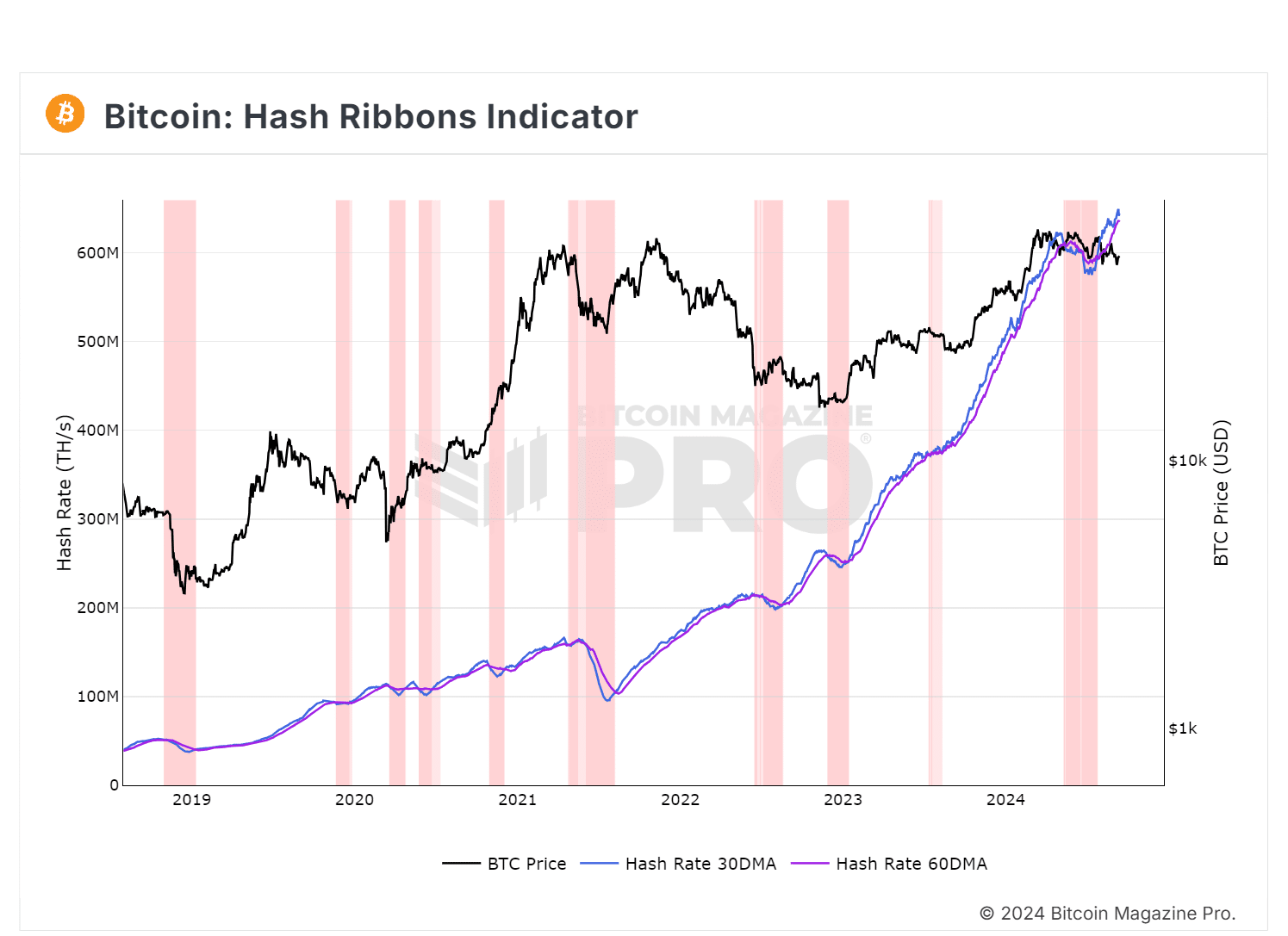

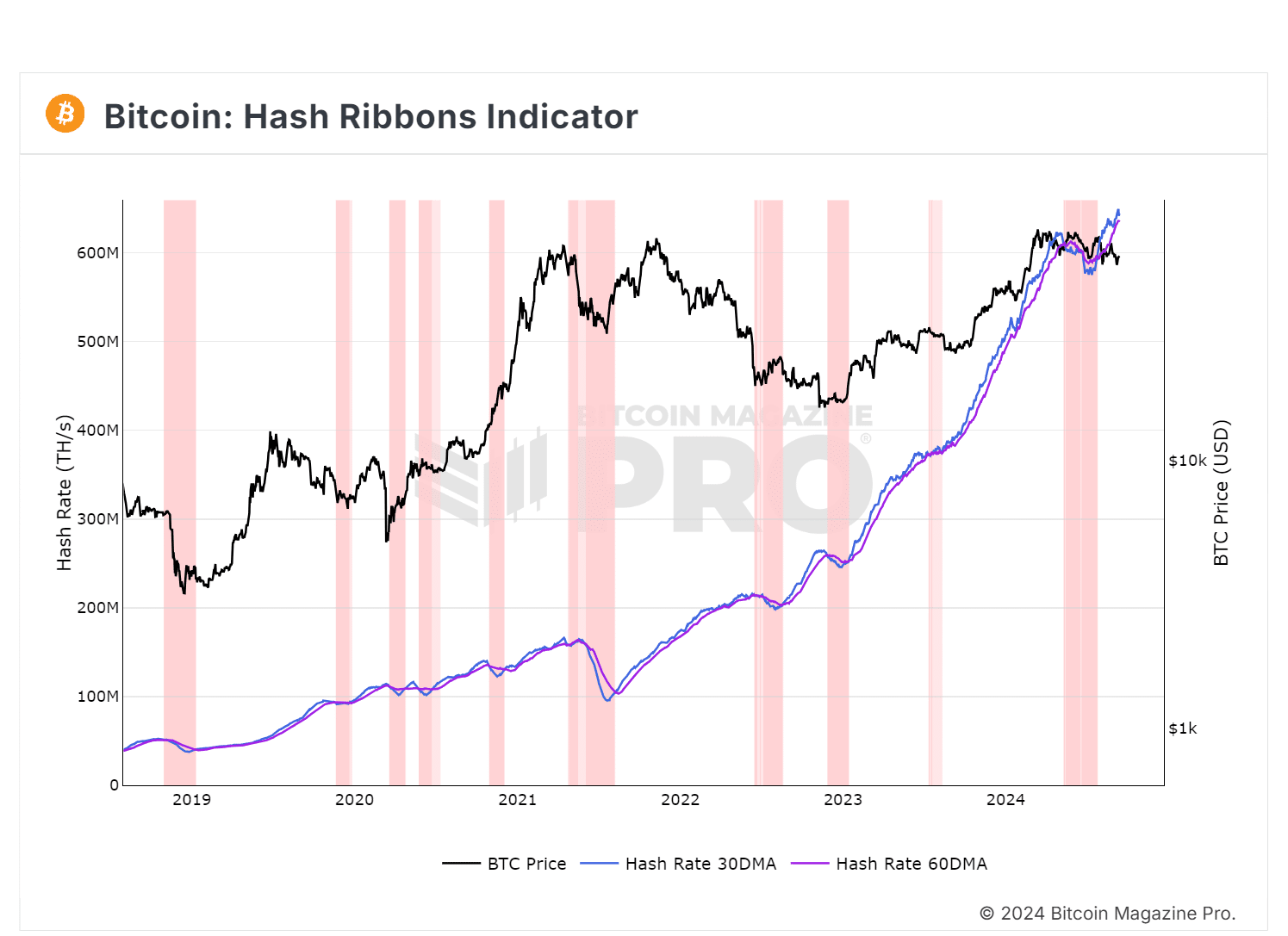

Source : Bitcoin Magazine Pro

The chart showed that the 30-day MA is above the 60-day MA, signaling a hash ribbon buy signal. This suggested mass miner capitulation may have ended, indicating miners are staying in despite volatility.

However, a prominent analyst noted that Bitcoin miners sold around 30K BTC after BTC briefly topped $58K, likely to lock in strong gains.

Maybe capitulation now signals both market tops and bottoms. The key is to watch who capitulates first.

Falling reserves can signal market top

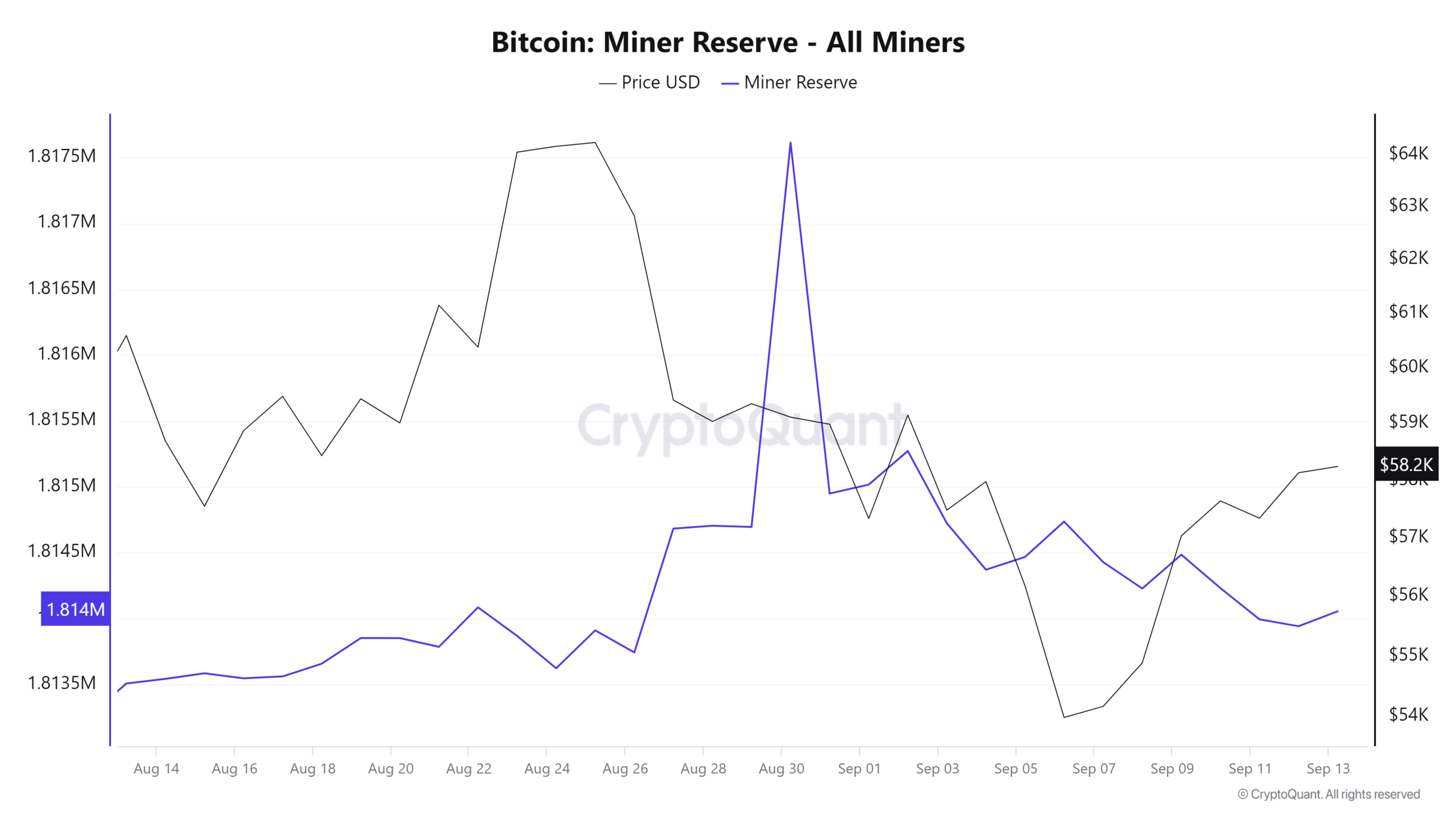

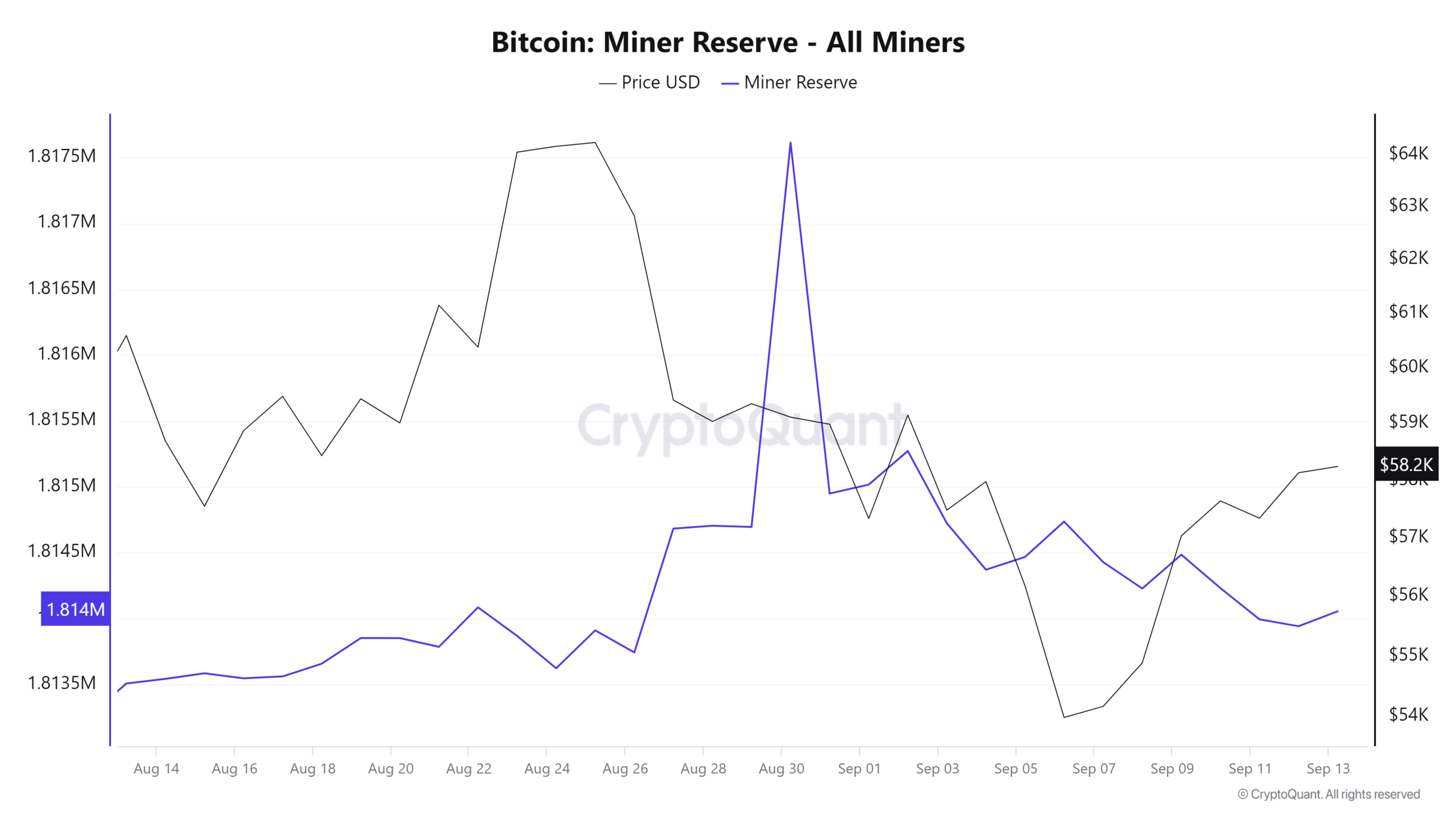

While the chart above suggested that miners exiting typically occurs at market bottoms, AMBCrypto examined whether approaching a price top could trigger miner exits.

Interestingly, as BTC nears $60K, Bitcoin miners are reducing their reserves, possibly to lock in profits, reinforcing this hypothesis.

Source : CryptoQuant

As mining difficulty hits an all-time high, many miners might be cashing in on gains to cover their expenses. This could create selling pressure as BTC approaches its next market top.

However, those who can weather the volatility may continue to hold their Bitcoin, as indicated by the buy signal.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The real concern is if BTC hits a market bottom and fails to hold the $57K range; miner capitulation could intensify.

In this scenario, Bitcoin miners might offload large amounts of BTC, not due to low profits but to mitigate greater losses.

- Bitcoin miners offloaded significant BTC after a mild surge, cashing in on gains.

- If the market top slips, miner capitulation could rise.

Bitcoin [BTC] miners have recently sold a significant chunk of their holdings, just as mining difficulty hit an all-time high.

This is a critical moment—if miners don’t show confidence in a rebound, it could signal a looming bearish run.

Bitcoin miners are at a crucial juncture

The mining community holds about 9% of Bitcoin’s total supply and is expanding capacity amid record-high mining difficulty.

Historically, miner capitulation—when Bitcoin miners exit due to low profits—often signals local price bottoms during bull markets.

The last time this occurred was on the 5th of July, when BTC fell to $56K after testing the $71K ceiling. Miners exited due to squeezed profit margins, contributing to the price bottom.

Source : Bitcoin Magazine Pro

The chart showed that the 30-day MA is above the 60-day MA, signaling a hash ribbon buy signal. This suggested mass miner capitulation may have ended, indicating miners are staying in despite volatility.

However, a prominent analyst noted that Bitcoin miners sold around 30K BTC after BTC briefly topped $58K, likely to lock in strong gains.

Maybe capitulation now signals both market tops and bottoms. The key is to watch who capitulates first.

Falling reserves can signal market top

While the chart above suggested that miners exiting typically occurs at market bottoms, AMBCrypto examined whether approaching a price top could trigger miner exits.

Interestingly, as BTC nears $60K, Bitcoin miners are reducing their reserves, possibly to lock in profits, reinforcing this hypothesis.

Source : CryptoQuant

As mining difficulty hits an all-time high, many miners might be cashing in on gains to cover their expenses. This could create selling pressure as BTC approaches its next market top.

However, those who can weather the volatility may continue to hold their Bitcoin, as indicated by the buy signal.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The real concern is if BTC hits a market bottom and fails to hold the $57K range; miner capitulation could intensify.

In this scenario, Bitcoin miners might offload large amounts of BTC, not due to low profits but to mitigate greater losses.

cost clomiphene online cost generic clomiphene without insurance how can i get generic clomid pill where can i get clomid without dr prescription where to buy generic clomid how can i get generic clomid tablets cost of clomid without a prescription

More articles like this would pretence of the blogosphere richer.

This is a topic which is near to my callousness… Myriad thanks! Exactly where can I find the contact details an eye to questions?

generic azithromycin 250mg – flagyl cost order flagyl online cheap

buy domperidone without a prescription – purchase motilium without prescription cyclobenzaprine drug

azithromycin order online – azithromycin for sale order bystolic for sale

amoxiclav uk – https://atbioinfo.com/ ampicillin price

buy esomeprazole sale – https://anexamate.com/ purchase esomeprazole sale

buy medex generic – anticoagulant buy losartan 50mg without prescription

mobic buy online – https://moboxsin.com/ mobic 7.5mg without prescription

order prednisone generic – https://apreplson.com/ deltasone 5mg sale

erection problems – fastedtotake.com best over the counter ed pills

cheap amoxicillin pills – https://combamoxi.com/ order amoxicillin pill

diflucan over the counter – diflucan us diflucan without prescription

buy cenforce paypal – https://cenforcers.com/# buy cenforce without a prescription

no prescription cialis – what is cialis tadalafil used for cialis and alcohol

order generic zantac – on this site order ranitidine 300mg online cheap

viagra jelly for sale – order viagra without rx order viagra by mail

Palatable blog you be undergoing here.. It’s severely to assign elevated status script like yours these days. I honestly recognize individuals like you! Rent mindfulness!! click

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/gabapentin.html

This website absolutely has all of the information and facts I needed adjacent to this case and didn’t identify who to ask. https://ursxdol.com/prednisone-5mg-tablets/

This is the stripe of glad I have reading. https://prohnrg.com/product/priligy-dapoxetine-pills/

This is the big-hearted of criticism I in fact appreciate. https://aranitidine.com/fr/en_france_xenical/