- In the last few days, short positions have taken consecutive hits.

- The market could see more liquidations as more assets break into new price levels.

The crypto market experienced another round of significant liquidations in the last trading session on the 9th of November, driven by movements in major coins like Bitcoin [BTC] and Ethereum [ETH].

The market reacted strongly as these assets pushed into new price levels, leading to substantial liquidations, particularly for short positions.

With indicators like the Fear and Greed Index approaching extreme levels, market watchers are bracing for potential further liquidations.

Market liquidations surpass $280 million

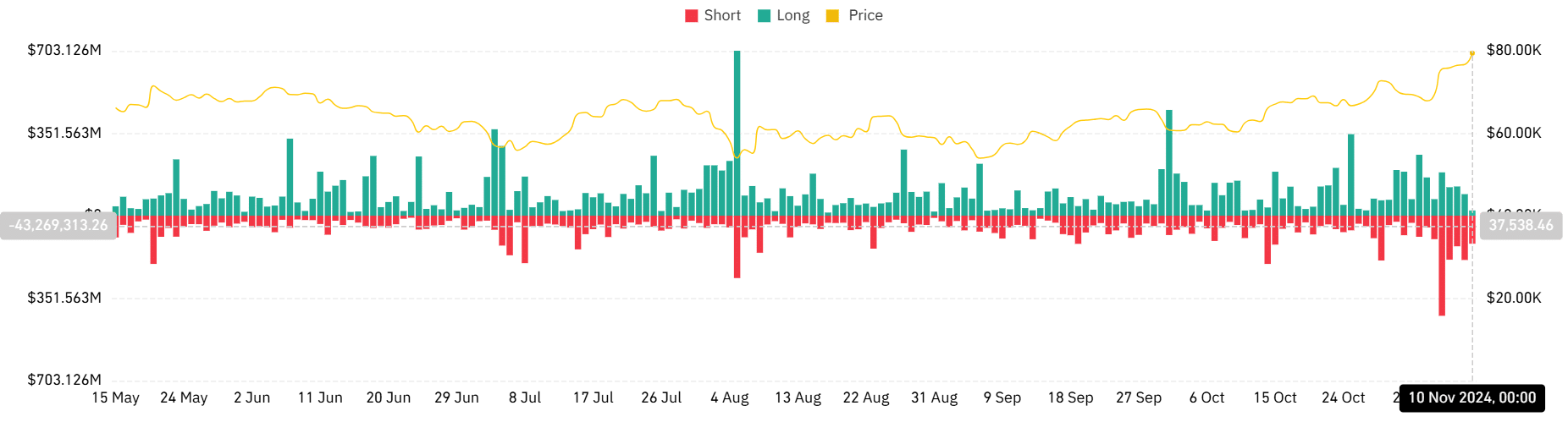

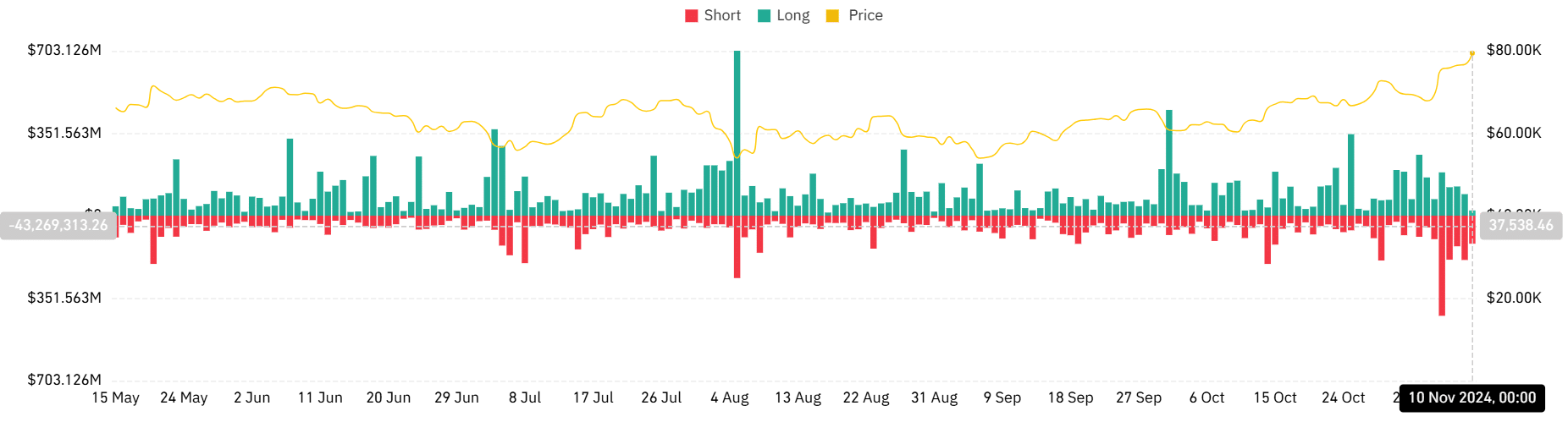

On the 6th of November, as Bitcoin reached a new all-time high of $76,000, market liquidations spiked, reaching over $600 million.

This included nearly $427 million in short liquidations, marking the highest short liquidation level in over six months. Long liquidations totaled approximately $184 million.

More recently, on the 9th of November, market liquidations remained elevated, surpassing $280 million.

According to data from Coinglass, short positions continued to bear the brunt, accounting for about $189 million of the total liquidation volume.

Source: Coinglass

In comparison, long liquidations stood at around $92 million. As of the latest update, short liquidation volume was close to $120 million, with long liquidation volume at approximately $22 million.

This pattern suggests that short traders are facing significant losses as they bet against the upward movement in major crypto assets.

Major assets hit by market liquidation

Over the past 24 hours, Bitcoin’s price has risen by more than 3%, edging close to the $80,000 mark—a new all-time high.

Coinglass data shows that Bitcoin led the liquidation volumes, with over $100 million in total liquidations within the past day.

Short liquidations for Bitcoin alone reached $87 million, while long liquidations totaled around $13 million.

Ethereum also recorded substantial liquidation volumes, ranking second after Bitcoin. Ethereum saw more than $56 million in short liquidations and an additional $13 million in long liquidations.

Other assets affected by significant liquidation volumes included Dogecoin, which experienced around $16.7 million in short and $4 million in long liquidations.

Solana [SOL] and Sui [SUI] both faced substantial liquidation volumes as well, with short positions at $13 million and almost $13 million, respectively, while long liquidations were $3.7 million and $1.3 million.

What’s next for the market?

The current levels of market liquidation are influenced by heightened investor sentiment, as indicated by the crypto Fear and Greed Index. At the time of writing, the index stands at 78, reflecting a state of “extreme greed.”

This heightened positive sentiment, coupled with fear of missing out (FOMO), is pushing more traders into active positions, which, in turn, could lead to additional market liquidations.

As the market shows signs of overheating, traders and investors should remain cautious.

The increased activity could drive prices higher, but it also raises the likelihood of more liquidations if the market corrects or reverses.

With Bitcoin nearing record highs and other major assets following suit, the potential for volatility remains high.

If the Fear and Greed Index continues to climb, the crypto market may see even more substantial liquidations in the coming days, especially among leveraged positions.

- In the last few days, short positions have taken consecutive hits.

- The market could see more liquidations as more assets break into new price levels.

The crypto market experienced another round of significant liquidations in the last trading session on the 9th of November, driven by movements in major coins like Bitcoin [BTC] and Ethereum [ETH].

The market reacted strongly as these assets pushed into new price levels, leading to substantial liquidations, particularly for short positions.

With indicators like the Fear and Greed Index approaching extreme levels, market watchers are bracing for potential further liquidations.

Market liquidations surpass $280 million

On the 6th of November, as Bitcoin reached a new all-time high of $76,000, market liquidations spiked, reaching over $600 million.

This included nearly $427 million in short liquidations, marking the highest short liquidation level in over six months. Long liquidations totaled approximately $184 million.

More recently, on the 9th of November, market liquidations remained elevated, surpassing $280 million.

According to data from Coinglass, short positions continued to bear the brunt, accounting for about $189 million of the total liquidation volume.

Source: Coinglass

In comparison, long liquidations stood at around $92 million. As of the latest update, short liquidation volume was close to $120 million, with long liquidation volume at approximately $22 million.

This pattern suggests that short traders are facing significant losses as they bet against the upward movement in major crypto assets.

Major assets hit by market liquidation

Over the past 24 hours, Bitcoin’s price has risen by more than 3%, edging close to the $80,000 mark—a new all-time high.

Coinglass data shows that Bitcoin led the liquidation volumes, with over $100 million in total liquidations within the past day.

Short liquidations for Bitcoin alone reached $87 million, while long liquidations totaled around $13 million.

Ethereum also recorded substantial liquidation volumes, ranking second after Bitcoin. Ethereum saw more than $56 million in short liquidations and an additional $13 million in long liquidations.

Other assets affected by significant liquidation volumes included Dogecoin, which experienced around $16.7 million in short and $4 million in long liquidations.

Solana [SOL] and Sui [SUI] both faced substantial liquidation volumes as well, with short positions at $13 million and almost $13 million, respectively, while long liquidations were $3.7 million and $1.3 million.

What’s next for the market?

The current levels of market liquidation are influenced by heightened investor sentiment, as indicated by the crypto Fear and Greed Index. At the time of writing, the index stands at 78, reflecting a state of “extreme greed.”

This heightened positive sentiment, coupled with fear of missing out (FOMO), is pushing more traders into active positions, which, in turn, could lead to additional market liquidations.

As the market shows signs of overheating, traders and investors should remain cautious.

The increased activity could drive prices higher, but it also raises the likelihood of more liquidations if the market corrects or reverses.

With Bitcoin nearing record highs and other major assets following suit, the potential for volatility remains high.

If the Fear and Greed Index continues to climb, the crypto market may see even more substantial liquidations in the coming days, especially among leveraged positions.

get clomiphene online clomid pills at dischem price clomiphene cost australia where can i buy generic clomiphene can you buy clomiphene online where can i buy clomiphene without prescription can i get cheap clomid no prescription

This is a keynote which is forthcoming to my verve… Numberless thanks! Unerringly where can I upon the acquaintance details in the course of questions?

More posts like this would add up to the online play more useful.

zithromax buy online – purchase ciprofloxacin pill order flagyl 200mg online

buy cheap generic rybelsus – semaglutide 14 mg us periactin 4 mg generic

motilium 10mg uk – motilium for sale online flexeril cost

brand amoxil – order valsartan 160mg sale buy ipratropium for sale

augmentin 625mg ca – atbioinfo buy generic ampicillin

where to buy nexium without a prescription – https://anexamate.com/ order generic esomeprazole

buy generic medex over the counter – https://coumamide.com/ buy cheap hyzaar

order meloxicam pill – https://moboxsin.com/ buy meloxicam 15mg pills

brand prednisone 10mg – https://apreplson.com/ buy prednisone 10mg

pills for ed – fast ed to take site buy erectile dysfunction drugs

amoxicillin cheap – amoxil uk cheap amoxil without prescription

buy generic forcan over the counter – diflucan 100mg cheap order diflucan 100mg sale

cost lexapro 10mg – buy lexapro 20mg generic buy escitalopram generic

cenforce sale – https://cenforcers.com/ buy cenforce pill