- Despite recent price troubles, the BTC market remained euphoric.

- Readings from the coin’s MVRV ratio and Realized Loss metrics suggested that a local bottom may soon be discovered.

Bitcoin’s [BTC] Net Unrealized Profit & Loss (NUPL) metric has shown that the coin’s market remains within the euphoria phase with significant unrealized gains among investors, Glassnode found in a new report.

The BTC market is said to be euphoric when there is widespread optimism and belief that the coin’s price will continue to rise indefinitely.

During this period, the market witnesses rapid price growth and increased trading activity fueled by the excitement.

According to Glassnode, although this phase has cooled off since the market correction began, the value of the coin’s NUPL above 0.5 showed that euphoric elements remained within the BTC market.

Santiment said,

“By this metric, the Euphoria phase (NUPL>0.5) of this bull market has been in effect for (the) last seven months. Even the mightiest up-trends experience corrections, however, and these events offer valuable information about investor positioning and sentiment.”

Is the local bottom in?

According to Glassnode, the recent correction in BTC’s price has caused its short-term holders (STHs), particularly those who have held their coins for periods between one week and one month, to intensify distribution.

Their distribution activity during periods of market correction such as this becomes noteworthy as it can help identify potential buying opportunities (local lows).

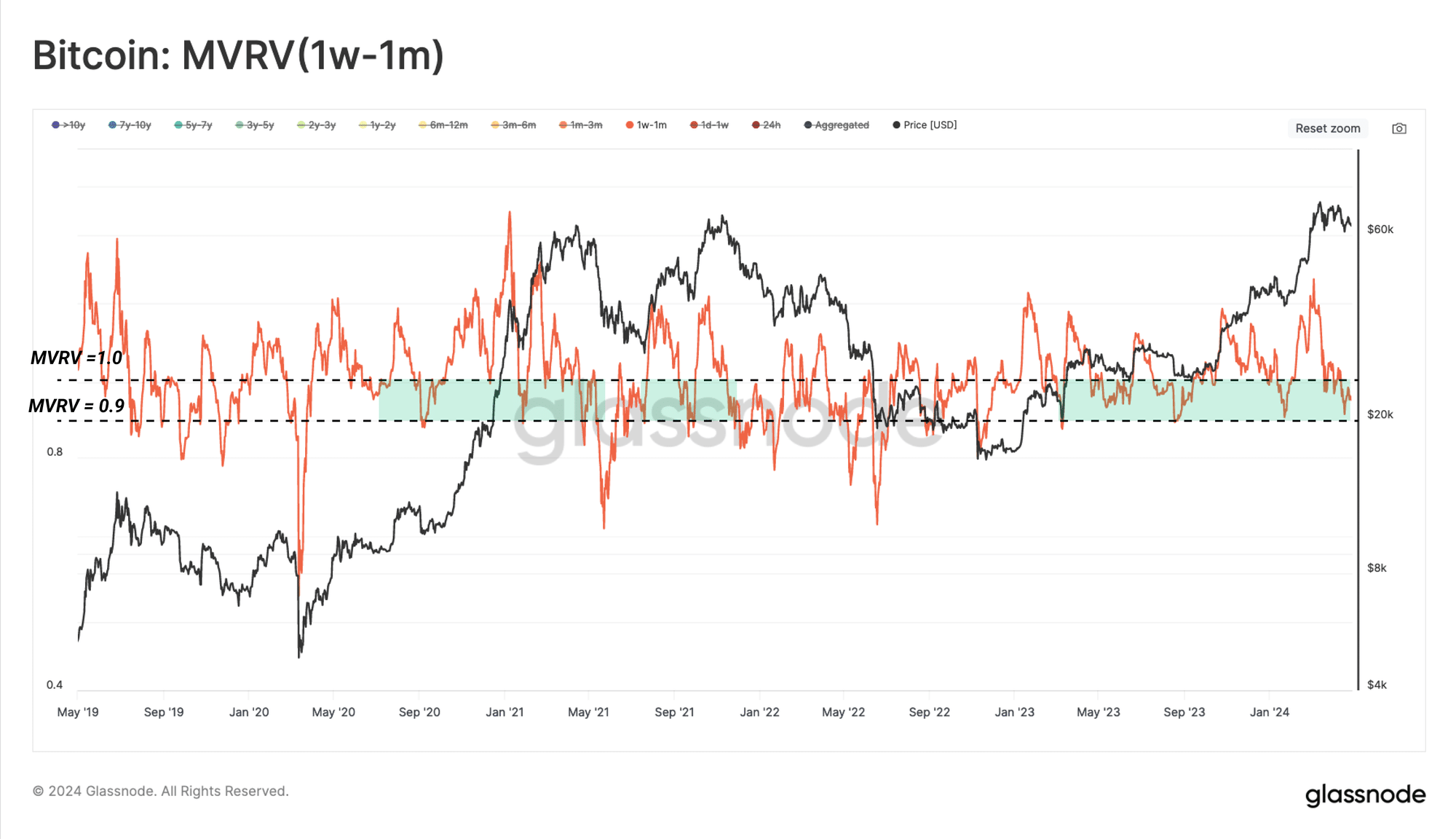

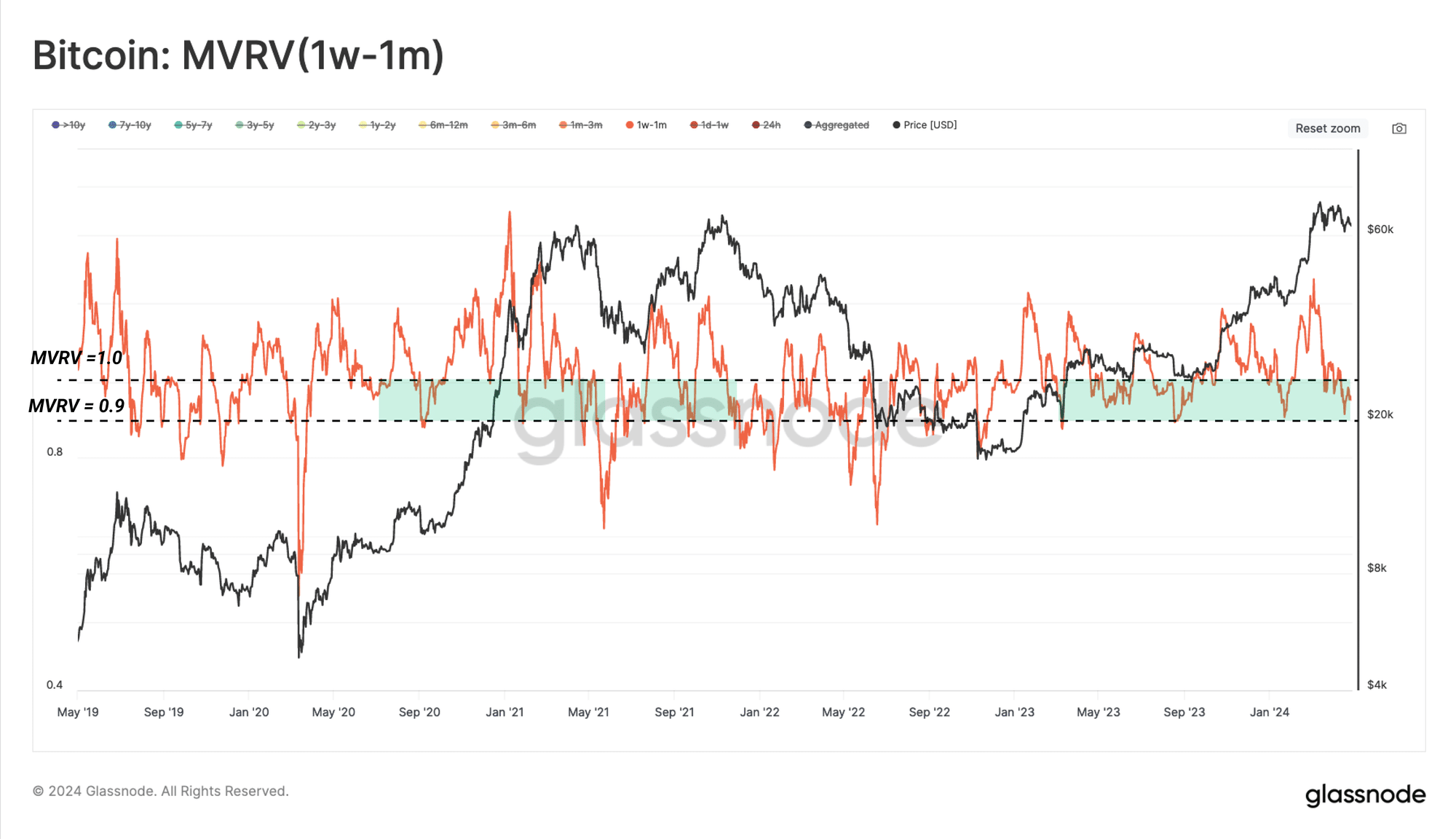

Glassnode assessed the historical pattern of the MVRV ratio of coins held between one week and one month and found that during bull market corrections like this, the value of the ratio “drops into the 0.9-1 range.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This means that investors who have held their coins for periods between one week and one month would usually witness around 0% to 10% decline in their assets, causing them to sell.

Source: Glassnode

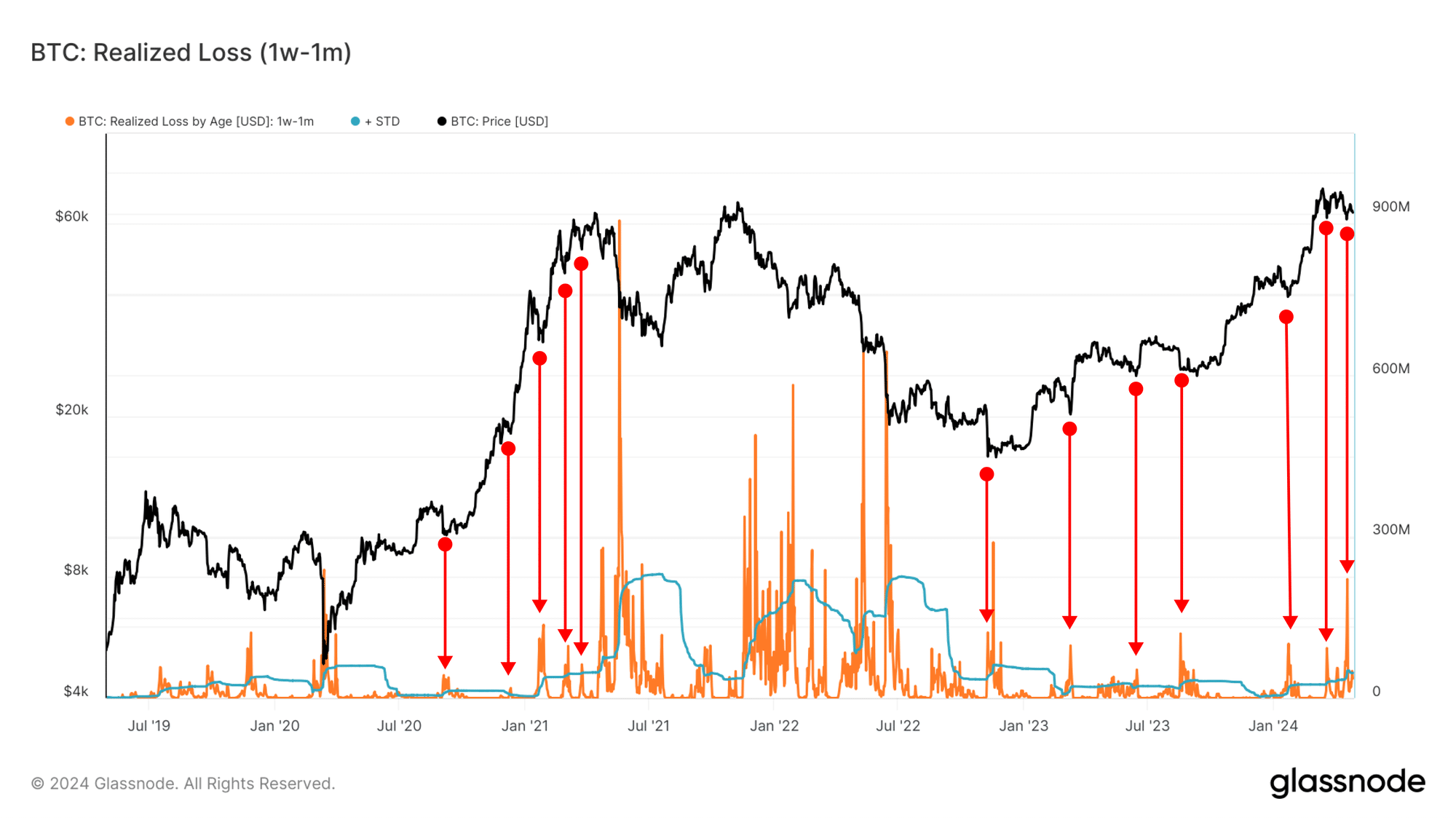

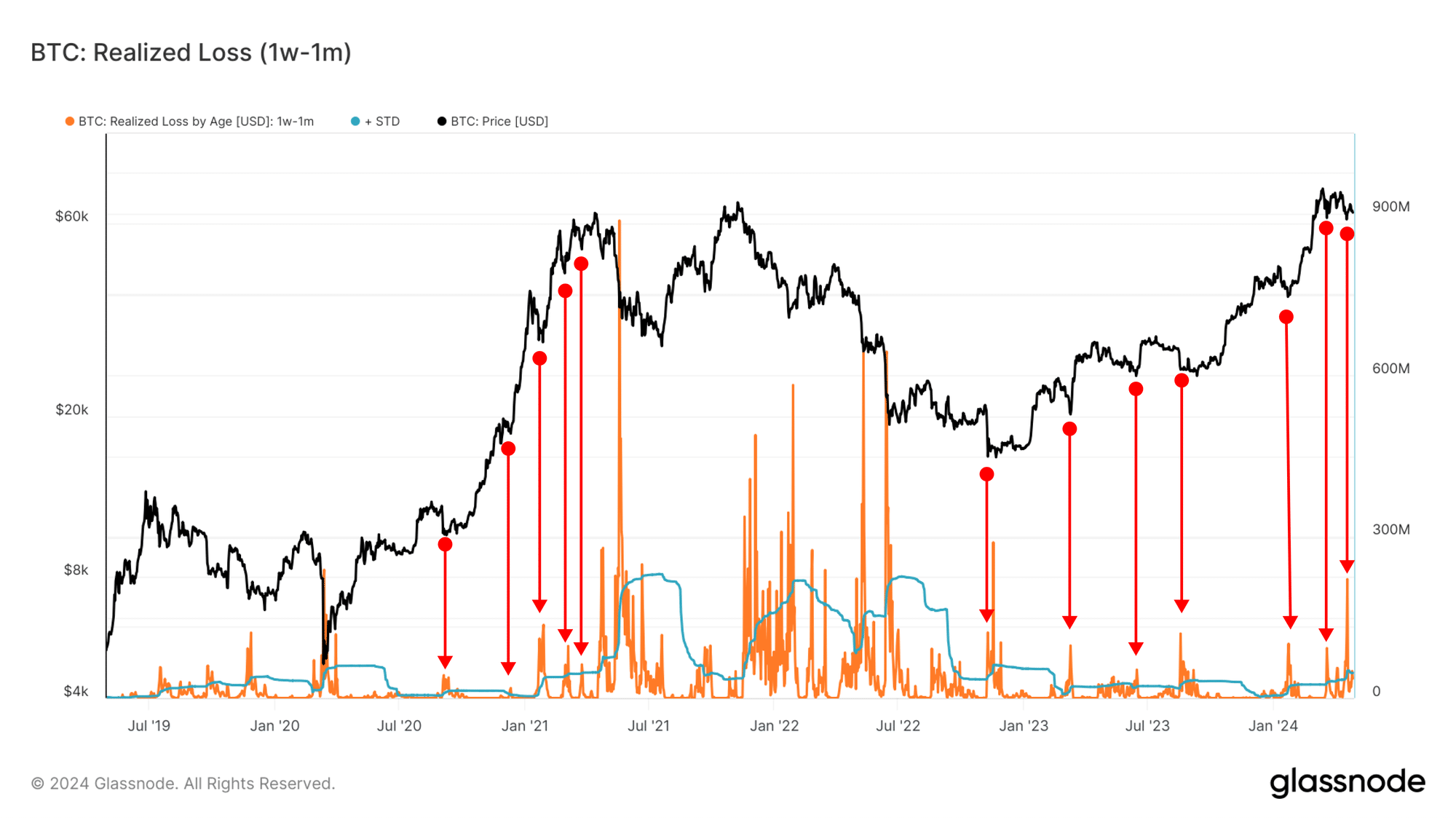

The on-chain data provider also considered the Realized Loss by one-week to one-month-old entities.

Historical precedents show that when this metric goes above 1, it suggests that STHs are panic selling at a loss.

Source: Glassnode

Glassnode combined its readings from both metrics and concluded:

“Since the price resides within the $60k to $66.7k range, the MVRV condition is met, and it could be argued that the market is hammering out a local bottom formation. That said, a sustained break below that MVRV level could create a cascade of panic and force a new equilibrium to be found and established.”

- Despite recent price troubles, the BTC market remained euphoric.

- Readings from the coin’s MVRV ratio and Realized Loss metrics suggested that a local bottom may soon be discovered.

Bitcoin’s [BTC] Net Unrealized Profit & Loss (NUPL) metric has shown that the coin’s market remains within the euphoria phase with significant unrealized gains among investors, Glassnode found in a new report.

The BTC market is said to be euphoric when there is widespread optimism and belief that the coin’s price will continue to rise indefinitely.

During this period, the market witnesses rapid price growth and increased trading activity fueled by the excitement.

According to Glassnode, although this phase has cooled off since the market correction began, the value of the coin’s NUPL above 0.5 showed that euphoric elements remained within the BTC market.

Santiment said,

“By this metric, the Euphoria phase (NUPL>0.5) of this bull market has been in effect for (the) last seven months. Even the mightiest up-trends experience corrections, however, and these events offer valuable information about investor positioning and sentiment.”

Is the local bottom in?

According to Glassnode, the recent correction in BTC’s price has caused its short-term holders (STHs), particularly those who have held their coins for periods between one week and one month, to intensify distribution.

Their distribution activity during periods of market correction such as this becomes noteworthy as it can help identify potential buying opportunities (local lows).

Glassnode assessed the historical pattern of the MVRV ratio of coins held between one week and one month and found that during bull market corrections like this, the value of the ratio “drops into the 0.9-1 range.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This means that investors who have held their coins for periods between one week and one month would usually witness around 0% to 10% decline in their assets, causing them to sell.

Source: Glassnode

The on-chain data provider also considered the Realized Loss by one-week to one-month-old entities.

Historical precedents show that when this metric goes above 1, it suggests that STHs are panic selling at a loss.

Source: Glassnode

Glassnode combined its readings from both metrics and concluded:

“Since the price resides within the $60k to $66.7k range, the MVRV condition is met, and it could be argued that the market is hammering out a local bottom formation. That said, a sustained break below that MVRV level could create a cascade of panic and force a new equilibrium to be found and established.”

where buy cheap clomid no prescription buy cheap clomiphene without prescription can you get generic clomiphene prices clomid medication uk get clomid without insurance where can i buy cheap clomid price can i order generic clomiphene without a prescription

This is the kind of delivery I find helpful.

Thanks towards putting this up. It’s okay done.

where to buy zithromax without a prescription – order ofloxacin 400mg online cheap buy flagyl 200mg pill

clavulanate ca – https://atbioinfo.com/ buy ampicillin generic

oral esomeprazole 40mg – anexamate.com purchase nexium

buy generic coumadin 2mg – https://coumamide.com/ hyzaar pill

order mobic 7.5mg – relieve pain purchase meloxicam online

buy prednisone 40mg online cheap – https://apreplson.com/ prednisone 5mg canada

red ed pill – https://fastedtotake.com/ medicine for impotence

amoxicillin price – combamoxi.com buy amoxil tablets

buy diflucan 100mg online cheap – https://gpdifluca.com/# diflucan for sale online

order cenforce 100mg online – cheap cenforce 100mg cenforce 100mg cheap

cialis for blood pressure – cheapest 10mg cialis mint pharmaceuticals tadalafil

cialis as generic – cialis free trial 2018 cialis brand no prescription 365

zantac medication – on this site purchase zantac generic

50mg of viagra – https://strongvpls.com/# viagra sale pakistan

I am in fact thrilled to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://gnolvade.com/

I couldn’t hold back commenting. Profoundly written! https://ursxdol.com/get-metformin-pills/

This website exceedingly has all of the low-down and facts I needed adjacent to this subject and didn’t know who to ask. https://prohnrg.com/product/diltiazem-online/

This is the kind of writing I positively appreciate. acheter du lasix en ligne

Greetings! Very gainful par‘nesis within this article! It’s the scarcely changes which wish turn the largest changes. Thanks a lot in the direction of sharing! https://ondactone.com/spironolactone/

Greetings! Extremely productive suggestion within this article! It’s the petty changes which will espy the largest changes. Thanks a a quantity quest of sharing!

https://doxycyclinege.com/pro/meloxicam/

Thanks an eye to sharing. It’s outstrip quality. http://zgyhsj.com/space-uid-977928.html

forxiga 10 mg pills – https://janozin.com/ forxiga sale

purchase orlistat generic – purchase orlistat generic where can i buy orlistat

Palatable blog you be undergoing here.. It’s severely to espy high quality script like yours these days. I really appreciate individuals like you! Take vigilance!! http://mi.minfish.com/home.php?mod=space&uid=1421095