- Evaluating the possibility of an extended Bitcoin downside as fear continues to grip the market.

- Bitcoin’s exchange flows suggest that there is strong demand every time BTC drops below $50k.

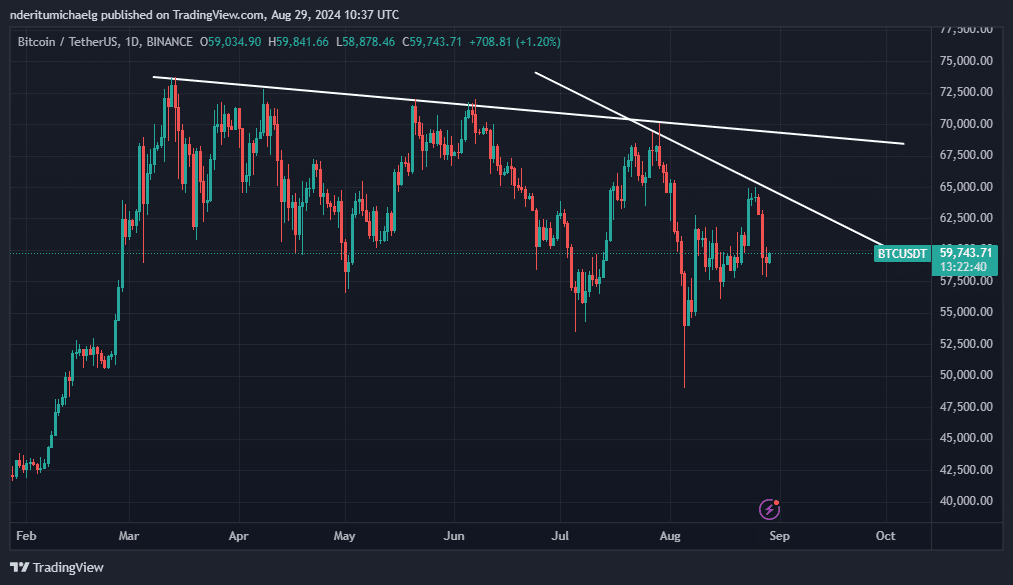

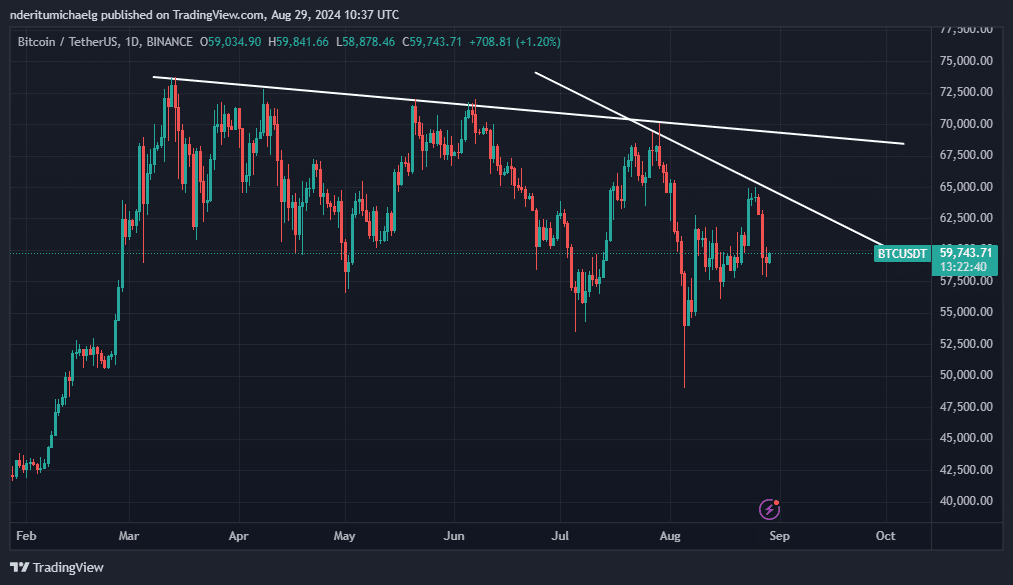

Bitcoin [BTC] is at the risk of bearish capitulation as investors, especially in the retail segment, lose confidence in the bulls.

Its recent bullish attempt formed a lower high, adding to what we have observed in the king coin since its peak in March.

Every bullish attempt since Bitcoin’s historic ATH in March has resulted in lower highs, signaling weaker upside momentum.

This has been contributing a great deal to the erosion of confidence in BTC’s ability to soar into new highs.

Source: TradingView

The latest attempt at pushing above $60,000 resulted in a resurgence of sell pressure. Consequently, the market sentiment dipped further. The Bitcoin Fear and Greed Index fell from 39 a week ago to 29 at press time.

Source: Alternative.me

The prevalence of fear also aligned with the escalating concerns about the global economic condition, especially as recession fears took hold. These fears threatened to destabilize the global investment landscape.

Investors tend to be risk-averse in such scenarios, meaning risk-on assets such as Bitcoin may experience liquidity outflows.

Bitcoin indicators flash different signals

On the other hand, Bitcoin’s 2022 crash was largely fueled by liquidity drying up as governments raised interest rates. Recent developments suggest that rate cuts may favor a bullish outcome.

On-chain data also supported these expectations.

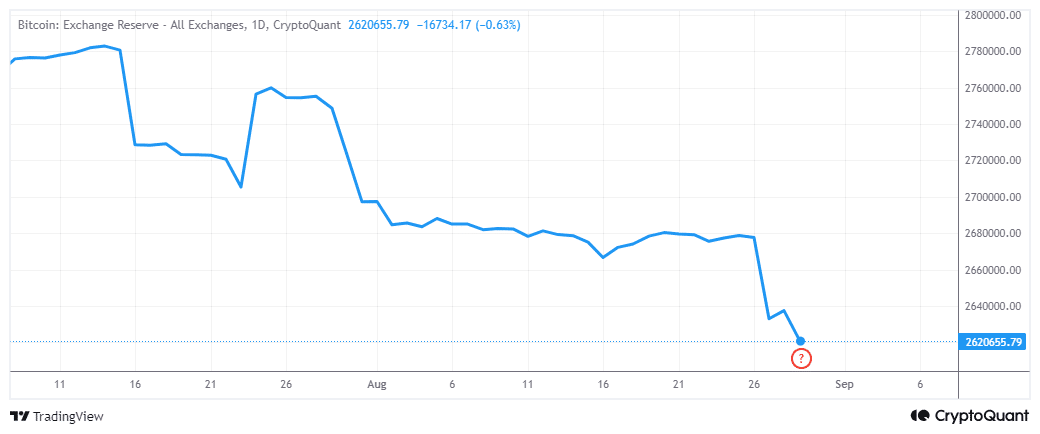

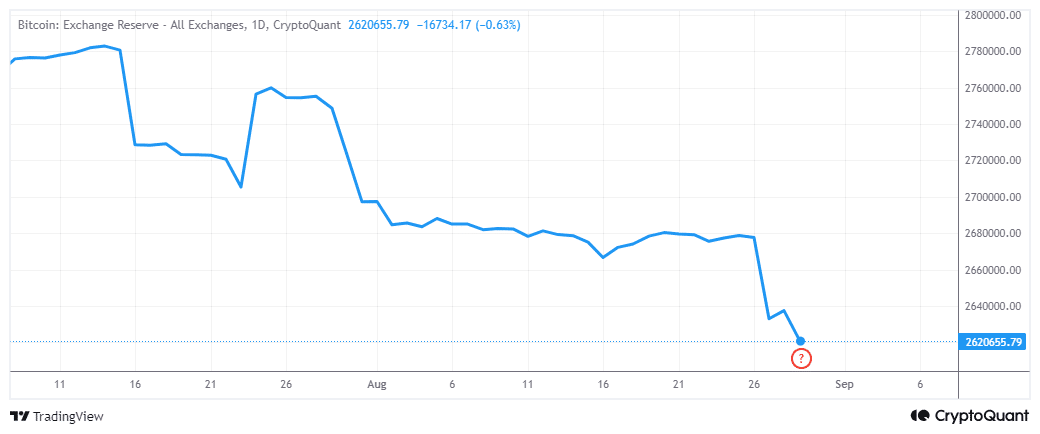

Bitcoin exchange reserves continued to drop despite the recent bearish outcome. This pointed to the fact that long-term demand was still high, and that recent market performance is largely a consequence of short-term volatility.

Source: CryptoQuant

The declining exchange reserves were rather unusual in a time when the market was becoming more fearful. This suggested that HODLers were scooping BTC off exchanges and into private wallets.

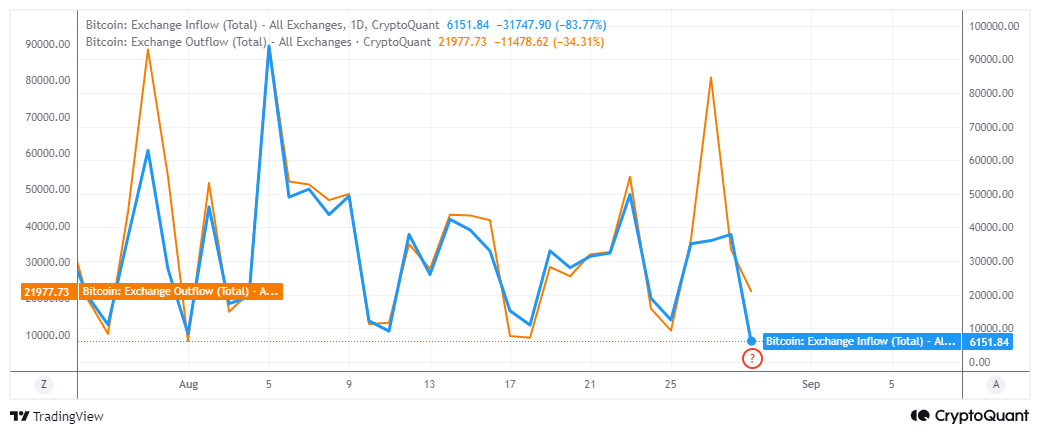

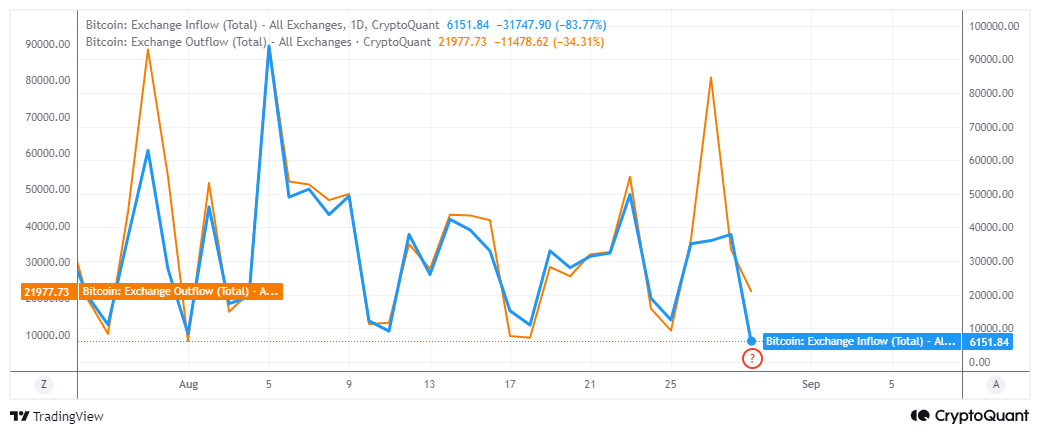

Exchange flow data collaborated with the above point. The latest exchange outflows have far outweighed inflows.

For example, the latest spike in exchange flows occurred on the 27th of August, during which outflows peaked at 80,740 BTC. Inflows peaked at 36,071 BTC during the same trading session.

Source: CryptoQuant

Bitcoin flows in the last 24 hours maintained a similar narrative. The exchange outflows were higher at 21,977 BTC compared to 6151 BTC exchange inflows.

This signaled a strong demand for Bitcoin every time it dips below $60,000.

The prevailing demand does not negate the fact that Bitcoin has been hitting lower highs.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

There is significant risk that the macro-trend may weaken closer to $50,000 range and possibly below, especially if a strong capitulation event leads to big inflows in exchange reserves.

On the other hand, the current data suggests that a supply shock is still in play and could contribute to higher prices down the road.

- Evaluating the possibility of an extended Bitcoin downside as fear continues to grip the market.

- Bitcoin’s exchange flows suggest that there is strong demand every time BTC drops below $50k.

Bitcoin [BTC] is at the risk of bearish capitulation as investors, especially in the retail segment, lose confidence in the bulls.

Its recent bullish attempt formed a lower high, adding to what we have observed in the king coin since its peak in March.

Every bullish attempt since Bitcoin’s historic ATH in March has resulted in lower highs, signaling weaker upside momentum.

This has been contributing a great deal to the erosion of confidence in BTC’s ability to soar into new highs.

Source: TradingView

The latest attempt at pushing above $60,000 resulted in a resurgence of sell pressure. Consequently, the market sentiment dipped further. The Bitcoin Fear and Greed Index fell from 39 a week ago to 29 at press time.

Source: Alternative.me

The prevalence of fear also aligned with the escalating concerns about the global economic condition, especially as recession fears took hold. These fears threatened to destabilize the global investment landscape.

Investors tend to be risk-averse in such scenarios, meaning risk-on assets such as Bitcoin may experience liquidity outflows.

Bitcoin indicators flash different signals

On the other hand, Bitcoin’s 2022 crash was largely fueled by liquidity drying up as governments raised interest rates. Recent developments suggest that rate cuts may favor a bullish outcome.

On-chain data also supported these expectations.

Bitcoin exchange reserves continued to drop despite the recent bearish outcome. This pointed to the fact that long-term demand was still high, and that recent market performance is largely a consequence of short-term volatility.

Source: CryptoQuant

The declining exchange reserves were rather unusual in a time when the market was becoming more fearful. This suggested that HODLers were scooping BTC off exchanges and into private wallets.

Exchange flow data collaborated with the above point. The latest exchange outflows have far outweighed inflows.

For example, the latest spike in exchange flows occurred on the 27th of August, during which outflows peaked at 80,740 BTC. Inflows peaked at 36,071 BTC during the same trading session.

Source: CryptoQuant

Bitcoin flows in the last 24 hours maintained a similar narrative. The exchange outflows were higher at 21,977 BTC compared to 6151 BTC exchange inflows.

This signaled a strong demand for Bitcoin every time it dips below $60,000.

The prevailing demand does not negate the fact that Bitcoin has been hitting lower highs.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

There is significant risk that the macro-trend may weaken closer to $50,000 range and possibly below, especially if a strong capitulation event leads to big inflows in exchange reserves.

On the other hand, the current data suggests that a supply shock is still in play and could contribute to higher prices down the road.

clomiphene tablets price uk how to get clomiphene tablets can i order generic clomiphene without insurance clomiphene tablets price in pakistan where to get clomid tablets how to get generic clomid pill can i buy clomid without dr prescription

The vividness in this ruined is exceptional.

This is the amicable of content I get high on reading.

zithromax 500mg price – floxin 200mg usa metronidazole 200mg sale

how to buy rybelsus – generic rybelsus generic periactin 4 mg

buy motilium 10mg online cheap – where to buy sumycin without a prescription cyclobenzaprine online order

order augmentin 1000mg for sale – atbioinfo.com acillin us

esomeprazole for sale – nexium to us brand esomeprazole 20mg

cost coumadin 2mg – blood thinner losartan 50mg canada

meloxicam order online – https://moboxsin.com/ mobic 7.5mg uk

deltasone 40mg pills – https://apreplson.com/ prednisone 20mg sale

new ed pills – https://fastedtotake.com/ best pills for ed

purchase amoxil online – https://combamoxi.com/ amoxil drug

brand diflucan – https://gpdifluca.com/ forcan sale

buy cenforce 100mg pill – cenforcers.com buy cenforce for sale

cialis 10mg ireland – https://ciltadgn.com/ tadalafil prescribing information

purchase cialis online cheap – click cialis available in walgreens over counter??