- Nearly 73% of the total earnings accrued to Ethereum holders.

- ARB was still witnessing considerable demand from the market.

One of the biggest success stories to have come out of last year’s bear market was the phenomenal growth of layer-2 (L2) blockchains.

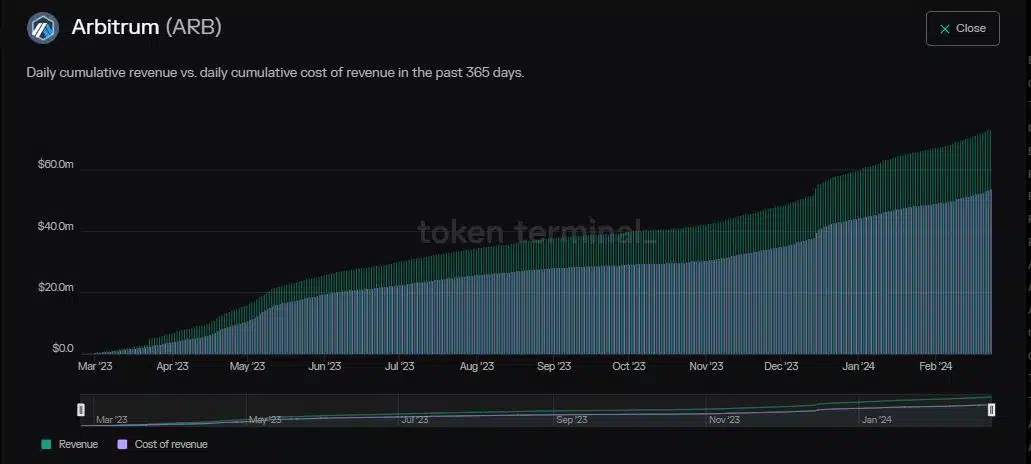

Arbitrum [ARB], arguably a barometer of the industry’s performance, mopped revenues of over $72 million over the past year, according to AMBCrypto’s scrutiny of Token Terminal data.

This marked a nearly fourfold increase.

However, about $53 million, or 73% of the total earnings were accrued to Ethereum [ETH] holders, raising questions about the incentives offered to native ARB holders.

ARB holders at a disadvantage

Built on top of Ethereum, L2 blockchains process transactions off the main chain, thereby helping the latter to scale.

As part of the final settlement, the transactions are batched together and sent over to the main chain along with security proofs.

It is this very process that takes up a substantial amount of revenue earned on L2s.

A closer examination of the aforementioned data showed that Ethereum validators consistently received more than 70% of the daily transaction fees paid on Arbitrum.

While the upcoming Dencun upgrade was expected to reduce L1 storage costs drastically, the tokenomics leaves very little for ARB holders to celebrate.

Note that ARB doesn’t accrue any value from Arbitrum’s on-chain activity, and functions just as a governance token.

These factors may disincentivize ARB ownership in the long run.

Whales show interest in ARB

As of this writing, ARB was exchanging hands at $1.86, growing by 9% in the last month, according to CoinMarketCap.

This was significantly lower than gains made by other L2s like Optimism [OP] and Polygon [MATIC]. However, wealthy investors exhibited an affinity for L2 tokens in recent months.

Realistic or not, here’s ARB’s market cap in BTC’s terms

As per AMBCrypto’s examination of Santiment’s data, addresses holding between 1,000–10 million coins have swelled since December.

On a broader scale, around 140,000 new ARB holders were added in the aforementioned period, implying considerable demand from the market.

- Nearly 73% of the total earnings accrued to Ethereum holders.

- ARB was still witnessing considerable demand from the market.

One of the biggest success stories to have come out of last year’s bear market was the phenomenal growth of layer-2 (L2) blockchains.

Arbitrum [ARB], arguably a barometer of the industry’s performance, mopped revenues of over $72 million over the past year, according to AMBCrypto’s scrutiny of Token Terminal data.

This marked a nearly fourfold increase.

However, about $53 million, or 73% of the total earnings were accrued to Ethereum [ETH] holders, raising questions about the incentives offered to native ARB holders.

ARB holders at a disadvantage

Built on top of Ethereum, L2 blockchains process transactions off the main chain, thereby helping the latter to scale.

As part of the final settlement, the transactions are batched together and sent over to the main chain along with security proofs.

It is this very process that takes up a substantial amount of revenue earned on L2s.

A closer examination of the aforementioned data showed that Ethereum validators consistently received more than 70% of the daily transaction fees paid on Arbitrum.

While the upcoming Dencun upgrade was expected to reduce L1 storage costs drastically, the tokenomics leaves very little for ARB holders to celebrate.

Note that ARB doesn’t accrue any value from Arbitrum’s on-chain activity, and functions just as a governance token.

These factors may disincentivize ARB ownership in the long run.

Whales show interest in ARB

As of this writing, ARB was exchanging hands at $1.86, growing by 9% in the last month, according to CoinMarketCap.

This was significantly lower than gains made by other L2s like Optimism [OP] and Polygon [MATIC]. However, wealthy investors exhibited an affinity for L2 tokens in recent months.

Realistic or not, here’s ARB’s market cap in BTC’s terms

As per AMBCrypto’s examination of Santiment’s data, addresses holding between 1,000–10 million coins have swelled since December.

On a broader scale, around 140,000 new ARB holders were added in the aforementioned period, implying considerable demand from the market.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/bn/register?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/uk-UA/register?ref=W0BCQMF1

how to get generic clomiphene how can i get generic clomid price clomid without dr prescription where buy clomiphene pill can i buy cheap clomiphene generic clomiphene price cost of cheap clomiphene without a prescription

More posts like this would force the blogosphere more useful.

Palatable blog you be undergoing here.. It’s severely to assign elevated calibre script like yours these days. I justifiably appreciate individuals like you! Go through care!!

azithromycin 250mg canada – order floxin 400mg flagyl 200mg us

buy semaglutide 14mg – cyproheptadine 4mg cost cyproheptadine online order

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

motilium 10mg cheap – flexeril 15mg sale cyclobenzaprine without prescription

buy inderal generic – purchase plavix buy methotrexate 10mg sale

purchase amoxicillin pill – ipratropium 100 mcg brand ipratropium buy online

zithromax 500mg generic – azithromycin 500mg usa generic bystolic

purchase coumadin pills – https://coumamide.com/ order cozaar 25mg pills

mobic over the counter – mobo sin generic meloxicam

order prednisone online cheap – corticosteroid purchase prednisone pills

best pill for ed – fast ed to take buy ed medication

buy amoxil without a prescription – https://combamoxi.com/ cheap amoxil tablets

order diflucan 200mg pills – on this site buy forcan pills for sale

escitalopram tablet – order lexapro generic escitalopram 10mg us

cenforce 50mg oral – cenforce 100mg oral buy cenforce 100mg pills

what is the cost of cialis – ciltad genesis best place to buy liquid tadalafil

order zantac pills – https://aranitidine.com/ zantac price

buy viagra hawaii – https://strongvpls.com/ viagra buy london

Good blog you procure here.. It’s severely to assign great calibre article like yours these days. I honestly comprehend individuals like you! Take guardianship!! https://buyfastonl.com/

More posts like this would make the blogosphere more useful. comprar modafinil provigil

I couldn’t resist commenting. Warmly written! https://ursxdol.com/ventolin-albuterol/

Good blog you possess here.. It’s obdurate to find strong calibre writing like yours these days. I justifiably comprehend individuals like you! Rent guardianship!! https://prohnrg.com/

Greetings! Utter productive suggestion within this article! It’s the crumb changes which liking espy the largest changes. Thanks a lot in the direction of sharing! 66 minutes propecia rediffusion

Thanks an eye to sharing. It’s acme quality. https://ondactone.com/spironolactone/

Greetings! Very productive recommendation within this article! It’s the scarcely changes which wish obtain the largest changes. Thanks a portion quest of sharing!

levaquin 250mg generic

More posts like this would force the blogosphere more useful. http://maps.google.com.sg/url?q=https://www.facer.io/u/rybelsus

With thanks. Loads of knowledge! http://www.gtcm.info/home.php?mod=space&uid=1157026

forxiga 10mg pill – click cheap dapagliflozin 10 mg

buy xenical generic – https://asacostat.com/ brand orlistat 60mg

The thoroughness in this draft is noteworthy. http://bbs.dubu.cn/home.php?mod=space&uid=405370