- ARB deposits to exchanges rose sharply after the unlock.

- Wallets holding between 100,00 to 100 million coins continued to accumulate.

Layer-2 (L2) token Arbitrum [ARB] crashed 14% shortly after more than a billion of its tokens were released into the market as part of the cliff unlock.

Fears come true

ARB was exchanging hands at $1.9 at 11 am UTC on the 16th of March, according to CoinMarketCap. However, prices started plunging dramatically after the scheduled supply unfreeze at 1 pm.

As of this writing, ARB was exchanging hands at $1.65.

About 76% of ARB’s total circulating supply, worth over $2 billion, was distributed to the team, future team, and investors, as per AMBCrypto’s analysis of Token Unlocks’ data.

Many of these recipients acted quickly to profit from these tokens.

According to Spot On Chain, six beneficiary wallets transferred 8.95 million ARBs to Binance within hours of the unlock.

These wallets still held over 32 million tokens and could likely deposit more tokens in the days to come, causing further downsides.

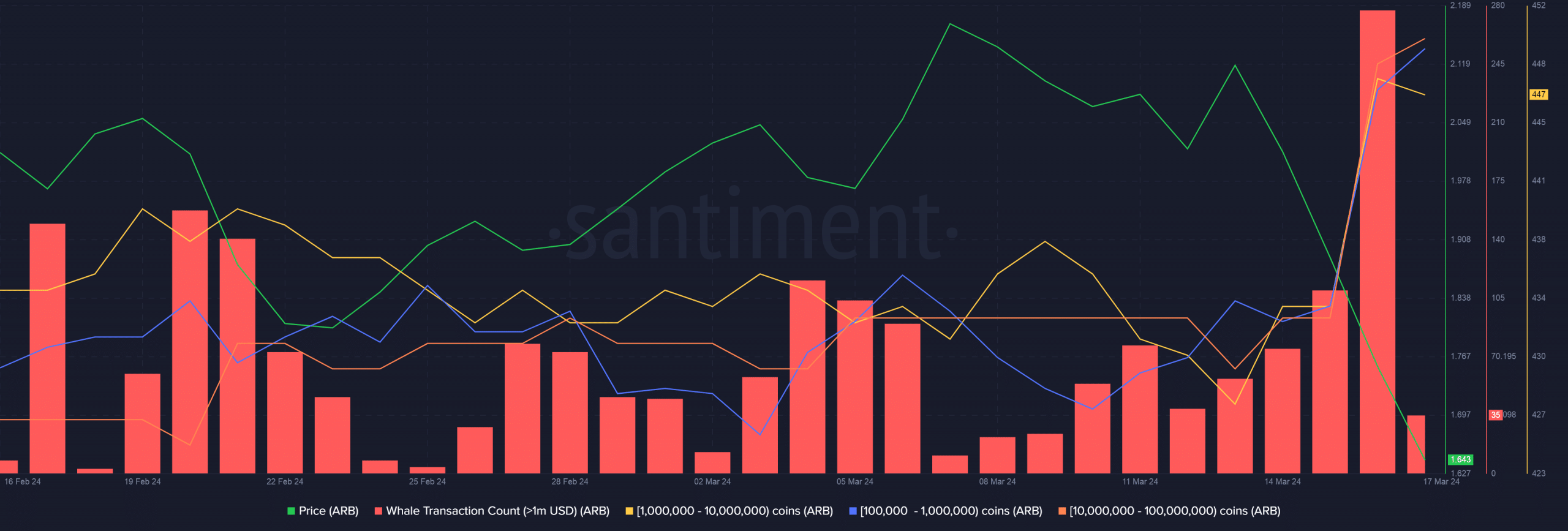

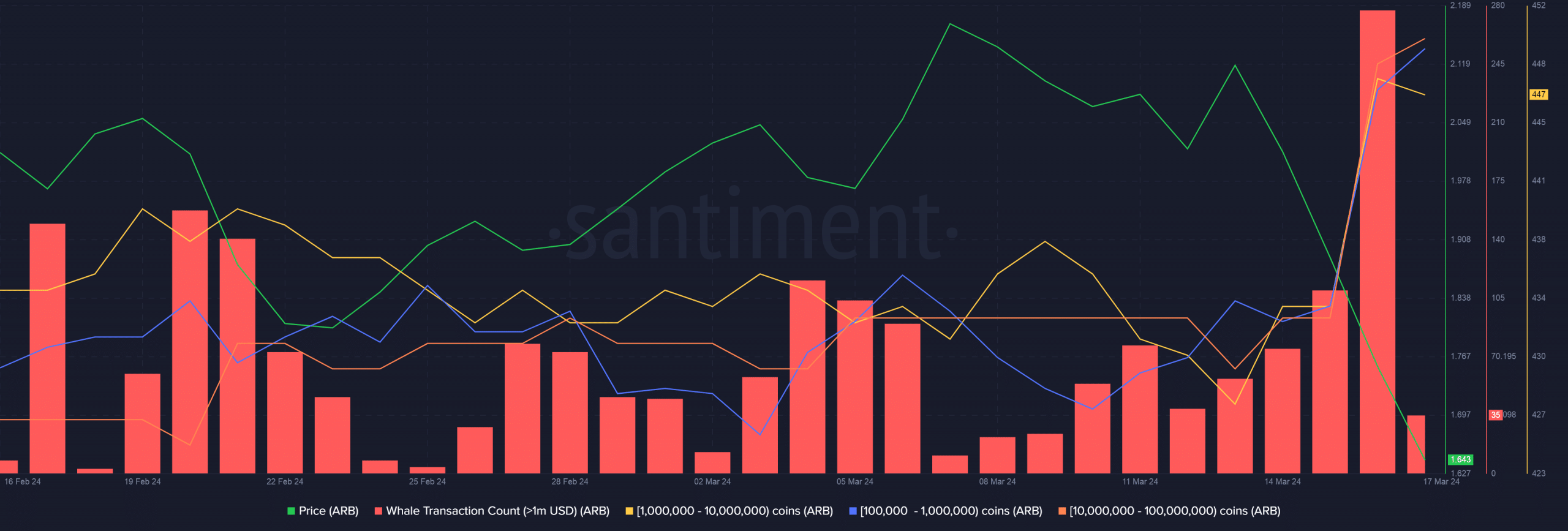

Large whales are bullish though

To gain additional insights, AMBCrypto investigated ARB whales’ behavior using Santiment data. Notably, transactions worth over $1 million spiked to their highest value ever on the 16th of March.

Source: Santiment

However, most large whales were seen to be accumulating ARBs as opposed to selling. As evident above, wallets holding between 100,00 to 100 million coins rose sharply on the same day.

Interestingly, these user cohorts started amassing tokens in the days leading to the unlock, suggesting that they were bullish on ARB’s prospects.

Now that the prices have plunged, it remains to be seen if these whales will continue to accumulate or dump their holdings.

Realistic or not, here’s ARB’s market cap in BTC’s terms

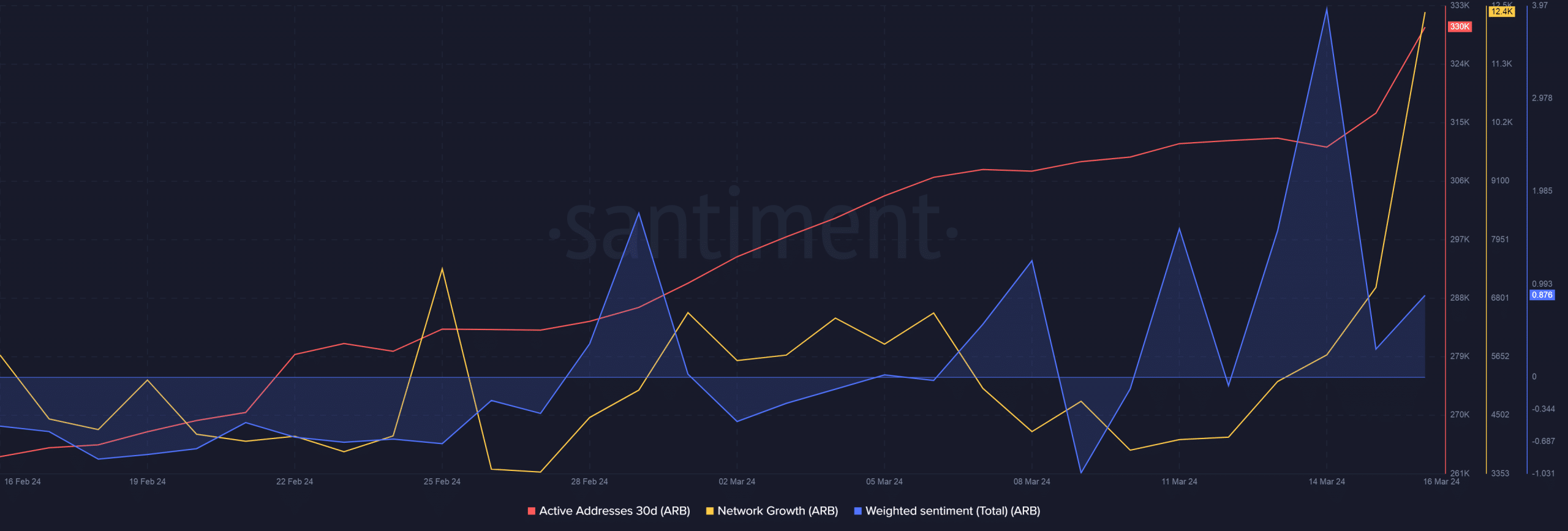

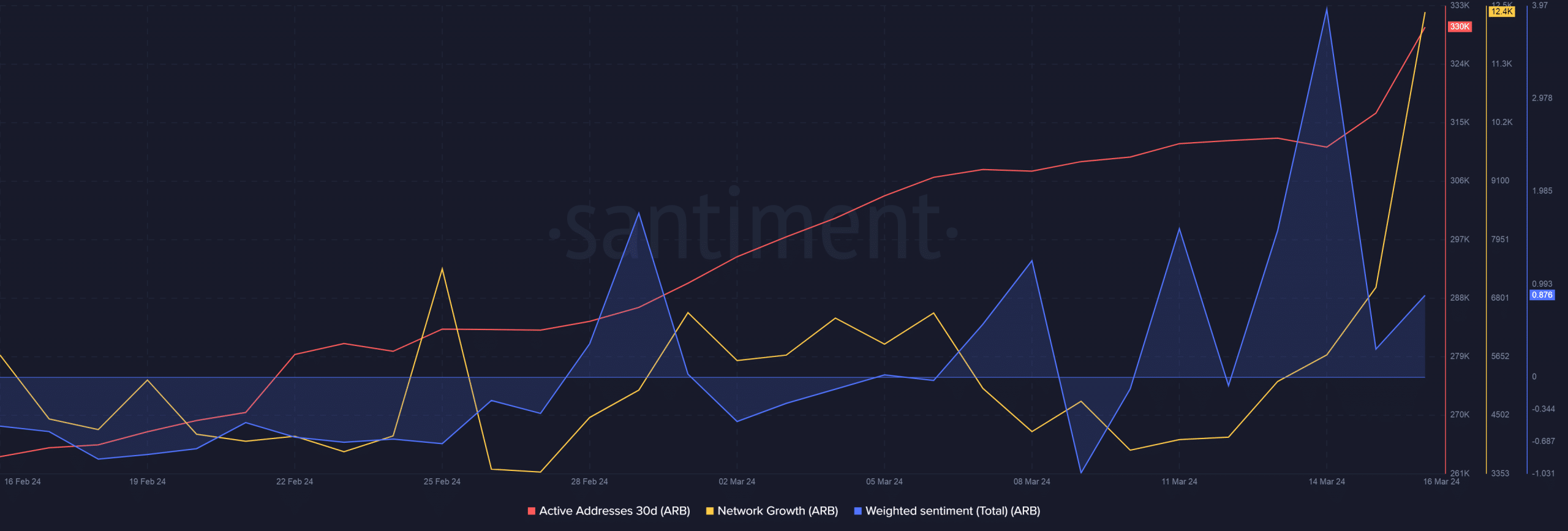

Meanwhile, ARB’s on-chain activity increased significantly due to the unlock. About 330k unique addresses were active on the 16th of March, 13k more than the previous day.

Moreover, the number of new addresses on the network jumped 77%, indicating retail excitement and mainstream adoption of the token.

Source: Santiment

- ARB deposits to exchanges rose sharply after the unlock.

- Wallets holding between 100,00 to 100 million coins continued to accumulate.

Layer-2 (L2) token Arbitrum [ARB] crashed 14% shortly after more than a billion of its tokens were released into the market as part of the cliff unlock.

Fears come true

ARB was exchanging hands at $1.9 at 11 am UTC on the 16th of March, according to CoinMarketCap. However, prices started plunging dramatically after the scheduled supply unfreeze at 1 pm.

As of this writing, ARB was exchanging hands at $1.65.

About 76% of ARB’s total circulating supply, worth over $2 billion, was distributed to the team, future team, and investors, as per AMBCrypto’s analysis of Token Unlocks’ data.

Many of these recipients acted quickly to profit from these tokens.

According to Spot On Chain, six beneficiary wallets transferred 8.95 million ARBs to Binance within hours of the unlock.

These wallets still held over 32 million tokens and could likely deposit more tokens in the days to come, causing further downsides.

Large whales are bullish though

To gain additional insights, AMBCrypto investigated ARB whales’ behavior using Santiment data. Notably, transactions worth over $1 million spiked to their highest value ever on the 16th of March.

Source: Santiment

However, most large whales were seen to be accumulating ARBs as opposed to selling. As evident above, wallets holding between 100,00 to 100 million coins rose sharply on the same day.

Interestingly, these user cohorts started amassing tokens in the days leading to the unlock, suggesting that they were bullish on ARB’s prospects.

Now that the prices have plunged, it remains to be seen if these whales will continue to accumulate or dump their holdings.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Meanwhile, ARB’s on-chain activity increased significantly due to the unlock. About 330k unique addresses were active on the 16th of March, 13k more than the previous day.

Moreover, the number of new addresses on the network jumped 77%, indicating retail excitement and mainstream adoption of the token.

Source: Santiment

![Arbitrum [ARB] falls 14% after 1.1B token unlock, but is a rise coming?](https://coininsights.com/wp-content/uploads/2024/03/arb-whale-interest-750x254.png)

clomid cost where can i buy cheap clomiphene no prescription cost generic clomid pills where to buy cheap clomid no prescription says: can you buy cheap clomiphene without insurance cost of clomiphene for men clomid chance of twins

More posts like this would prosper the blogosphere more useful.

I’ll certainly carry back to review more.

order zithromax for sale – floxin 400mg tablet generic metronidazole 400mg

buy rybelsus 14mg generic – rybelsus sale buy periactin 4mg online cheap

buy domperidone paypal – buy cyclobenzaprine 15mg order cyclobenzaprine 15mg for sale

inderal 10mg oral – buy propranolol pill buy methotrexate 2.5mg pills

oral augmentin – https://atbioinfo.com/ buy acillin pills

order generic nexium – anexa mate esomeprazole order online

cheap coumadin – coumamide order generic hyzaar

order mobic 7.5mg online – https://moboxsin.com/ buy meloxicam 15mg for sale

buy deltasone 10mg – https://apreplson.com/ cost prednisone 40mg

gnc ed pills – fast ed to take site over the counter erectile dysfunction pills

buy cheap generic amoxicillin – combamoxi buy amoxil

purchase forcan generic – flucoan diflucan ca

generic escitalopram 10mg – https://escitapro.com/# escitalopram us

buy cenforce 100mg sale – cenforce over the counter buy cenforce 50mg online cheap

is there a generic cialis available? – https://ciltadgn.com/ cialis daily dose

mint pharmaceuticals tadalafil – https://strongtadafl.com/# generic tadalafil prices

how to get cheap viagra – order viagra thailand genuine pfizer-viagra for sale

The thoroughness in this draft is noteworthy. https://gnolvade.com/es/prednisona/

I couldn’t hold back commenting. Adequately written! accutane generic

Greetings! Jolly serviceable suggestion within this article! It’s the little changes which liking turn the largest changes. Thanks a portion in the direction of sharing! https://ursxdol.com/provigil-gn-pill-cnt/

Thanks for putting this up. It’s well done. https://prohnrg.com/product/atenolol-50-mg-online/

The thoroughness in this section is noteworthy. prix du viagra en pharmacie

Good blog you have here.. It’s hard to assign high status script like yours these days. I honestly respect individuals like you! Go through guardianship!! https://ondactone.com/product/domperidone/

With thanks. Loads of expertise!

ondansetron over the counter

More posts like this would bring about the blogosphere more useful. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7053881

buy generic forxiga online – https://janozin.com/# forxiga 10 mg cheap

purchase orlistat pill – site order orlistat 120mg pill

More peace pieces like this would create the интернет better. http://seafishzone.com/home.php?mod=space&uid=2331703