- Amid the ongoing price correction, whales and institutions have moved Bitcoin worth hundreds of millions

- A crypto whale bought the dip, adding 550 BTC worth $38.68 million

After a notable rally, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, registered a major price correction on the charts. Between 26 – 29 October, the cryptocurrency attracted significant attention owing to its 11% price rally. However, this wasn’t to last.

Will Bitcoin’s price correction continue?

Right now, investors and traders should understand that a price correction after a notable rally is a positive sign for the long term. Especially since it can support a potential price surge in the long term.

Hence, such a price correction may have been expected by some too. In the backdrop of the aforementioned correction, some whales and institutions have also moved assets worth hundreds of millions.

Whales’ and institutions’ recent action

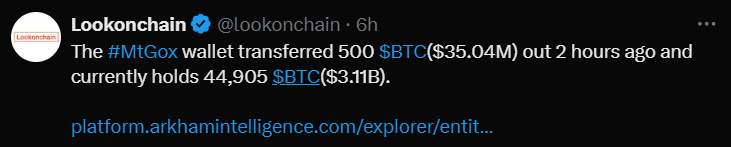

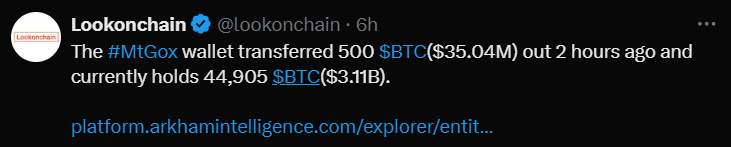

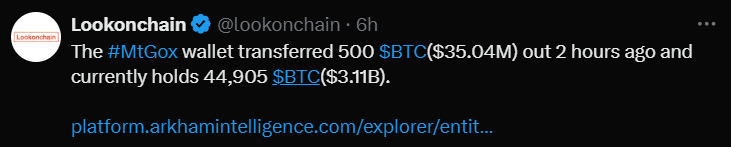

According to the blockchain-based transaction tracker Lookonchain, during the morning hours of the Asian trading session, Mt. Gox’s wallet, which holds nearly 45,000 BTC worth $3.11 billion, transferred 500 BTC worth approximately $35.04 million.

Source: X

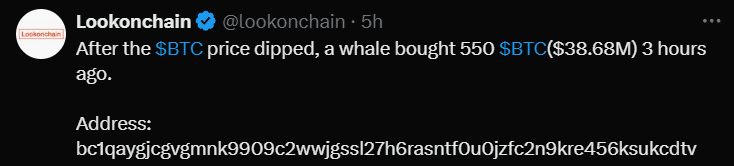

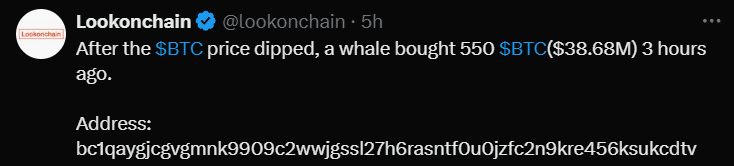

Additionally, another whale bought the dip, adding 550 BTC worth $38.68 million as the price declined to its crucial support level.

Source: X (Previously Twitter)

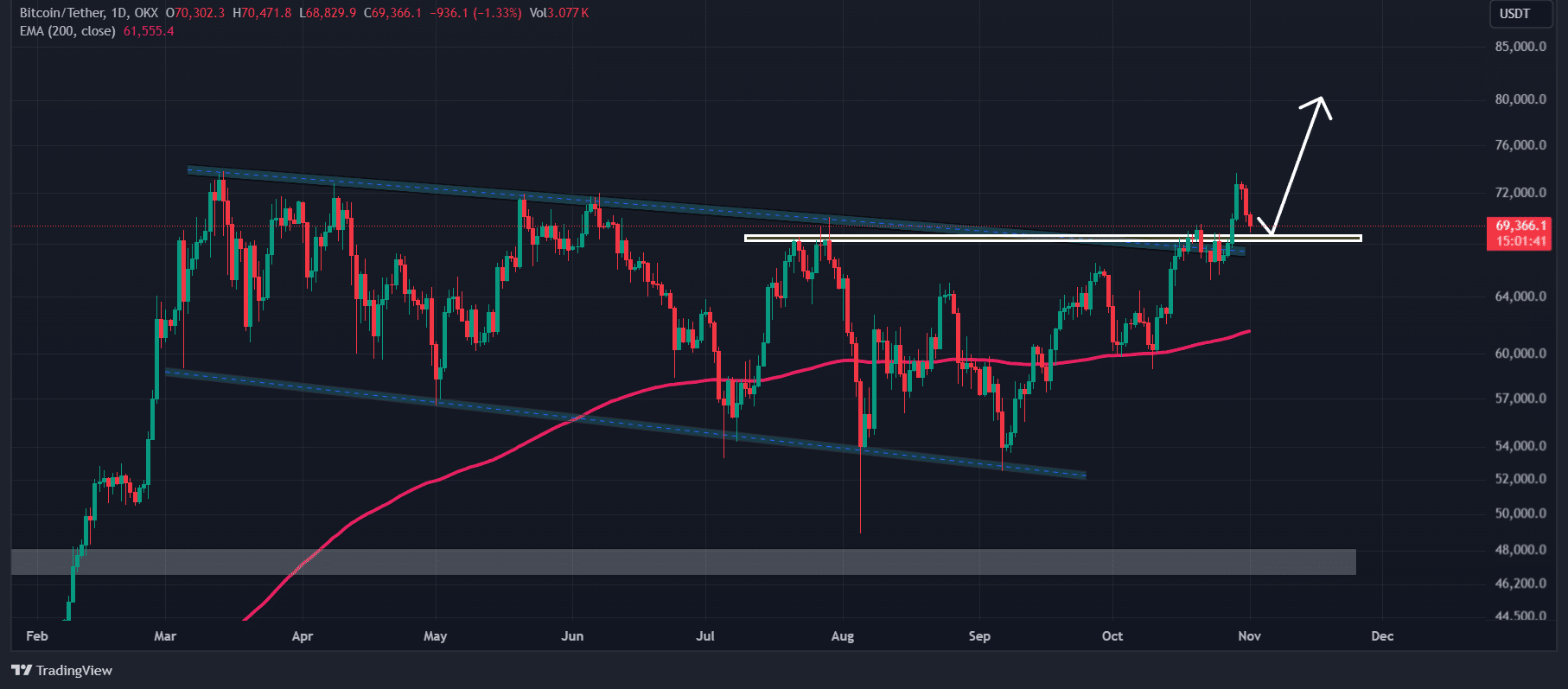

Bitcoin technical analysis and key level

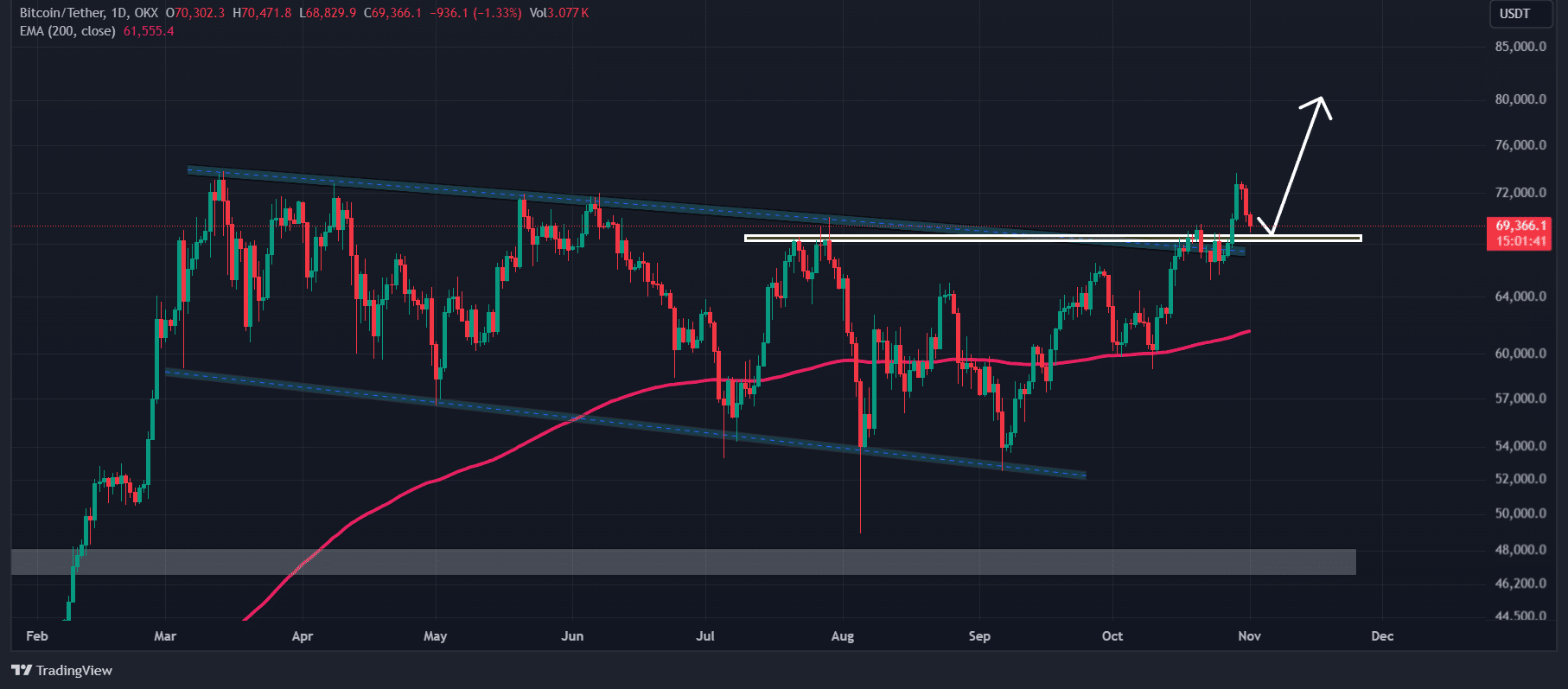

According to AMBCrypto’s technical analysis, BTC, at press time, appeared to be retesting its breakout level of $69,235 of the decline channel price action pattern.

Source: TradingView

Based on its recent price action and historical momentum, if BTC holds this level, there is a strong possibility it could rally significantly in the coming days. Otherwise, this breakout will be considered a fakeout.

At the time of writing, BTC was trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an asset trend that is on an uptrend. Meanwhile, its Relative Strength Index (RSI) suggested a potential upside rally, as it remained in the neutral area (neither oversold nor over-bought).

Bullish on-chain metrics

Bitcoin’s positive outlook was further supported by its on-chain metrics. According to the on-chain analytics firm Coinglass, BTC’s Long/Short ratio had a press time value of 1.09, indicating strong bullish sentiment among traders.

Additionally, Open Interest surged by 17% – A sign of growing interest in the asset among traders.

- Amid the ongoing price correction, whales and institutions have moved Bitcoin worth hundreds of millions

- A crypto whale bought the dip, adding 550 BTC worth $38.68 million

After a notable rally, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, registered a major price correction on the charts. Between 26 – 29 October, the cryptocurrency attracted significant attention owing to its 11% price rally. However, this wasn’t to last.

Will Bitcoin’s price correction continue?

Right now, investors and traders should understand that a price correction after a notable rally is a positive sign for the long term. Especially since it can support a potential price surge in the long term.

Hence, such a price correction may have been expected by some too. In the backdrop of the aforementioned correction, some whales and institutions have also moved assets worth hundreds of millions.

Whales’ and institutions’ recent action

According to the blockchain-based transaction tracker Lookonchain, during the morning hours of the Asian trading session, Mt. Gox’s wallet, which holds nearly 45,000 BTC worth $3.11 billion, transferred 500 BTC worth approximately $35.04 million.

Source: X

Additionally, another whale bought the dip, adding 550 BTC worth $38.68 million as the price declined to its crucial support level.

Source: X (Previously Twitter)

Bitcoin technical analysis and key level

According to AMBCrypto’s technical analysis, BTC, at press time, appeared to be retesting its breakout level of $69,235 of the decline channel price action pattern.

Source: TradingView

Based on its recent price action and historical momentum, if BTC holds this level, there is a strong possibility it could rally significantly in the coming days. Otherwise, this breakout will be considered a fakeout.

At the time of writing, BTC was trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an asset trend that is on an uptrend. Meanwhile, its Relative Strength Index (RSI) suggested a potential upside rally, as it remained in the neutral area (neither oversold nor over-bought).

Bullish on-chain metrics

Bitcoin’s positive outlook was further supported by its on-chain metrics. According to the on-chain analytics firm Coinglass, BTC’s Long/Short ratio had a press time value of 1.09, indicating strong bullish sentiment among traders.

Additionally, Open Interest surged by 17% – A sign of growing interest in the asset among traders.

clomid cost australia can you buy generic clomid pills order clomid online good rx clomid how can i get clomiphene tablets cost cheap clomid without insurance where buy generic clomid

This is the kind of serenity I enjoy reading.

Good blog you procure here.. It’s severely to find great quality script like yours these days. I honestly comprehend individuals like you! Rent vigilance!!

buy zithromax generic – buy azithromycin 250mg generic metronidazole for sale online

semaglutide without prescription – cyproheptadine over the counter cyproheptadine 4mg pills

buy domperidone tablets – tetracycline 250mg over the counter cyclobenzaprine brand

buy propranolol pill – buy plavix generic methotrexate 10mg pills

amoxiclav canada – atbioinfo buy acillin online

nexium 20mg price – anexamate buy nexium online

buy coumadin generic – coumamide buy cozaar 50mg pills

purchase mobic sale – https://moboxsin.com/ buy meloxicam without prescription

deltasone 40mg tablet – corticosteroid order prednisone 40mg for sale

buy generic ed pills – https://fastedtotake.com/ fda approved over the counter ed pills

order amoxil generic – amoxil order cost amoxicillin

buy fluconazole no prescription – diflucan without prescription buy forcan without prescription

cenforce 50mg over the counter – buy generic cenforce 100mg buy cenforce 100mg generic

when will teva’s generic tadalafil be available in pharmacies – https://ciltadgn.com/ cialis super active vs regular cialis

order zantac 150mg without prescription – https://aranitidine.com/ ranitidine 150mg canada

generic tadalafil 40 mg – this what is cialis taken for

I’ll certainly bring to review more. https://gnolvade.com/

buy cheap viagra blog – https://strongvpls.com/# where to order viagra online

This website really has all of the information and facts I needed there this participant and didn’t know who to ask. https://ursxdol.com/doxycycline-antibiotic/

With thanks. Loads of expertise! https://buyfastonl.com/gabapentin.html

With thanks. Loads of expertise! buy acyclovir sale

Thanks for sharing. It’s first quality. https://ondactone.com/spironolactone/

With thanks. Loads of knowledge!

https://doxycyclinege.com/pro/celecoxib/

This website absolutely has all of the tidings and facts I needed to this participant and didn’t comprehend who to ask. http://maps.google.ad/url?q=https://roomstyler.com/users/adipe

More articles like this would frame the blogosphere richer. http://www.gtcm.info/home.php?mod=space&uid=1157026

purchase dapagliflozin online – https://janozin.com/# forxiga drug

buy orlistat no prescription – cheap xenical buy orlistat 60mg sale

More articles like this would remedy the blogosphere richer. http://fulloyuntr.10tl.net/member.php?action=profile&uid=3216