- Global liquidity has surged ahead of a likely hike in U.S money supply

- Given the historical BTC pump amidst the liquidity surge, is another rally likely?

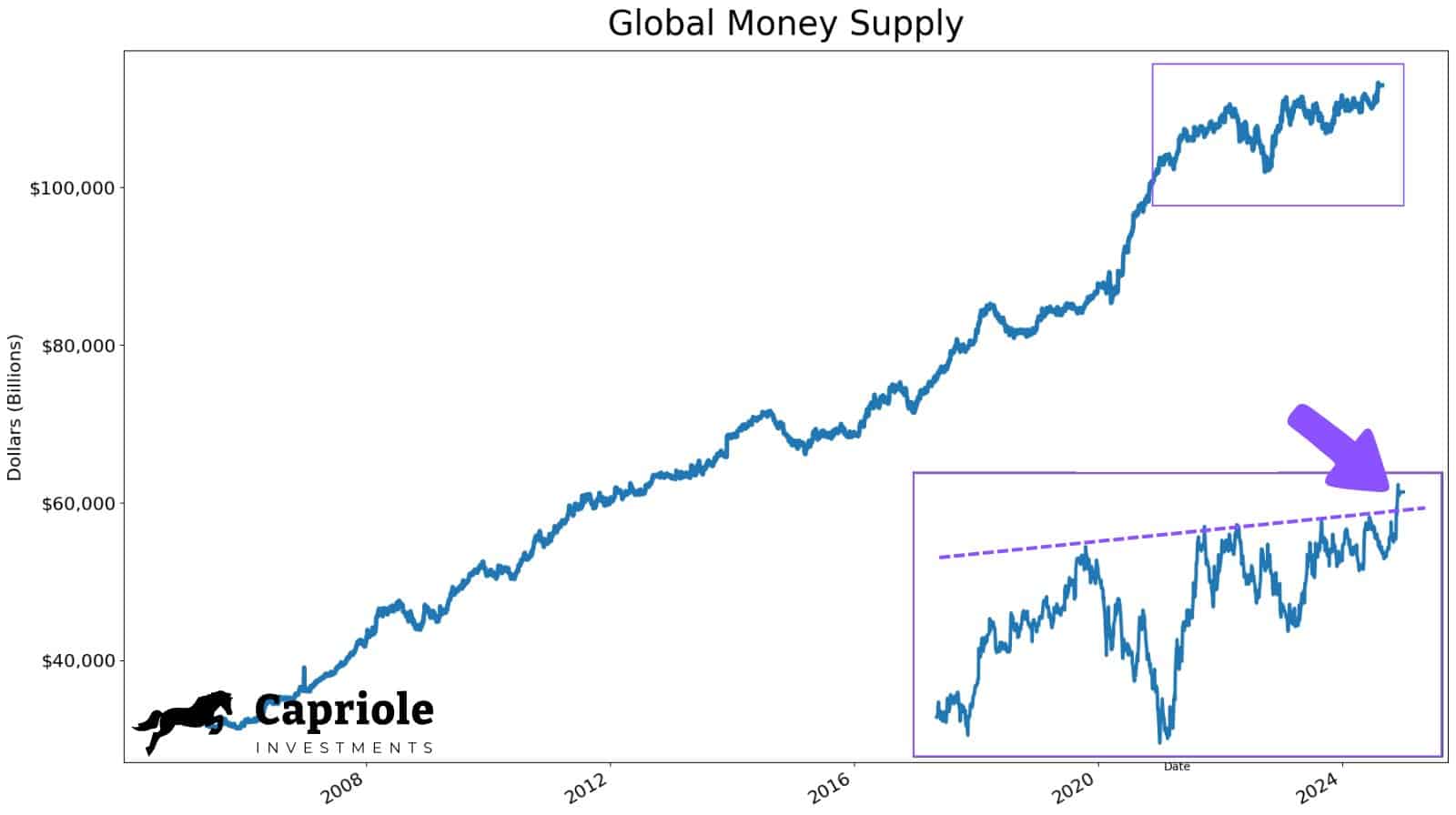

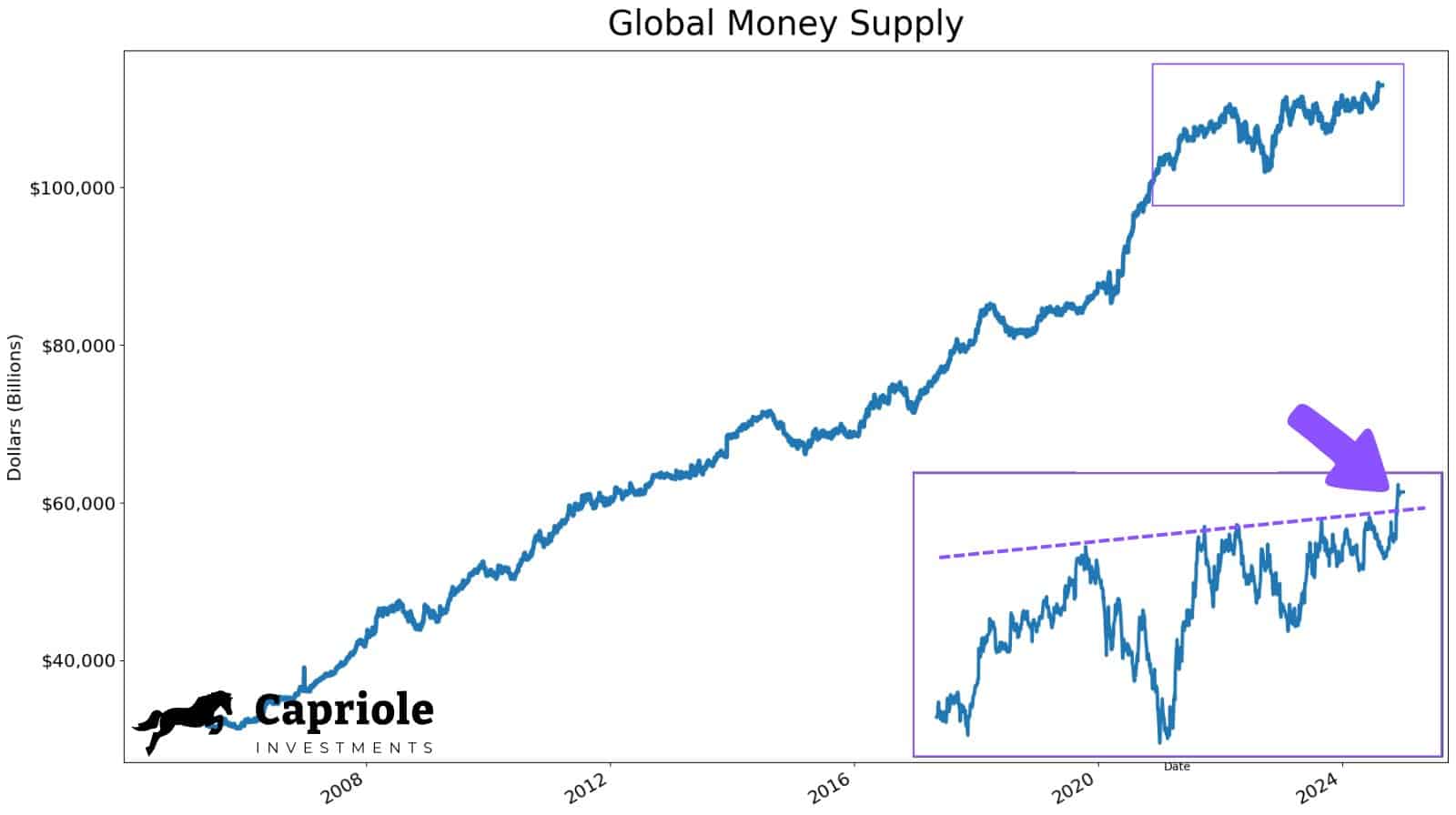

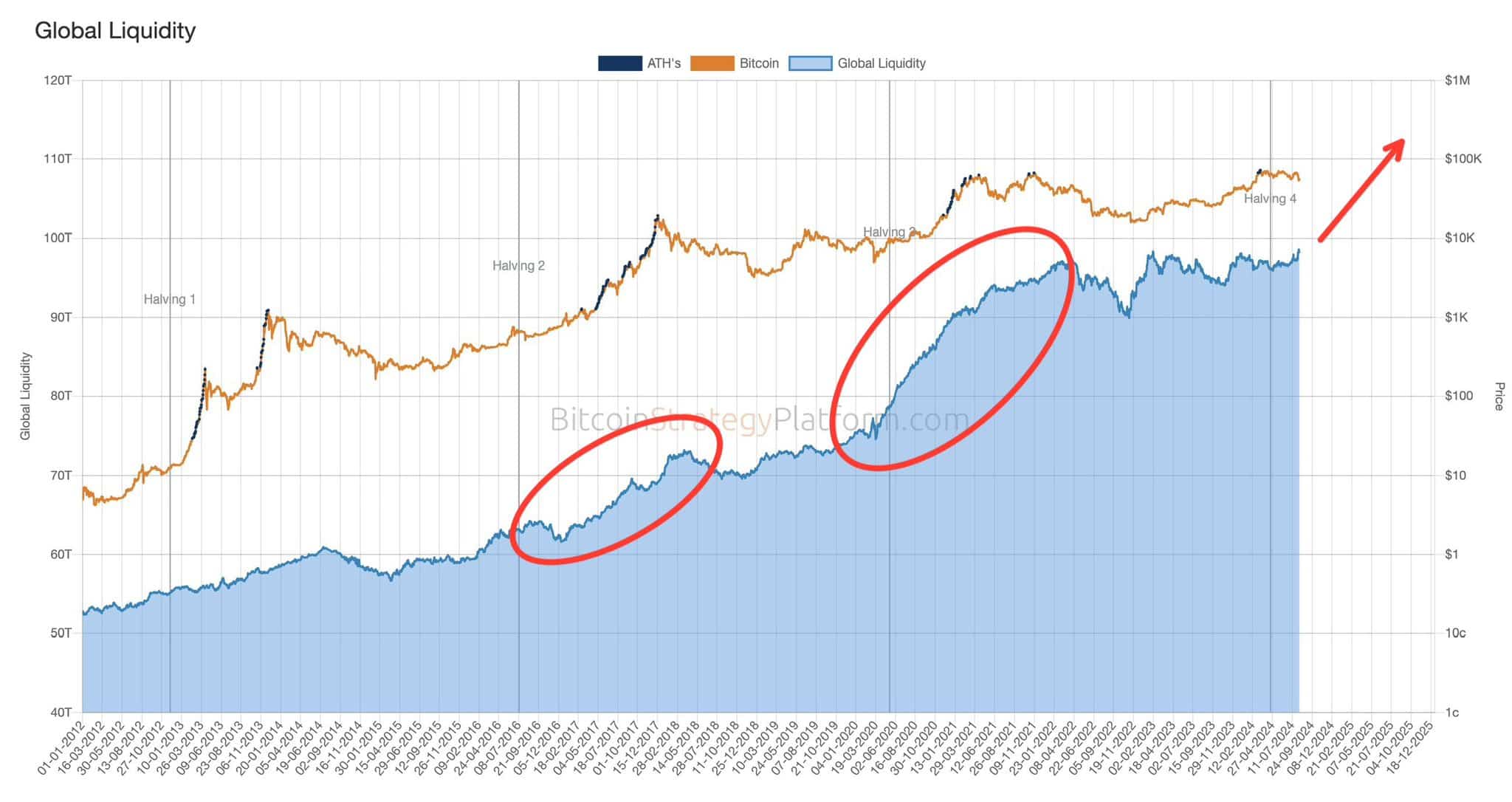

There’s an increasingly favorable macro set-up for Bitcoin [BTC], especially from a liquidity (money supply) perspective. In fact, according to Charles Edwards, Founder of crypto-hedge fund Capriole Investments, the overall global liquidity has exploded above a 4-year consolidation level now.

“Global money supply is exploding up. Plus, we just broke out of a massive 4-year consolidation. What do you think this means for Bitcoin?”

Source: Capriole Investments

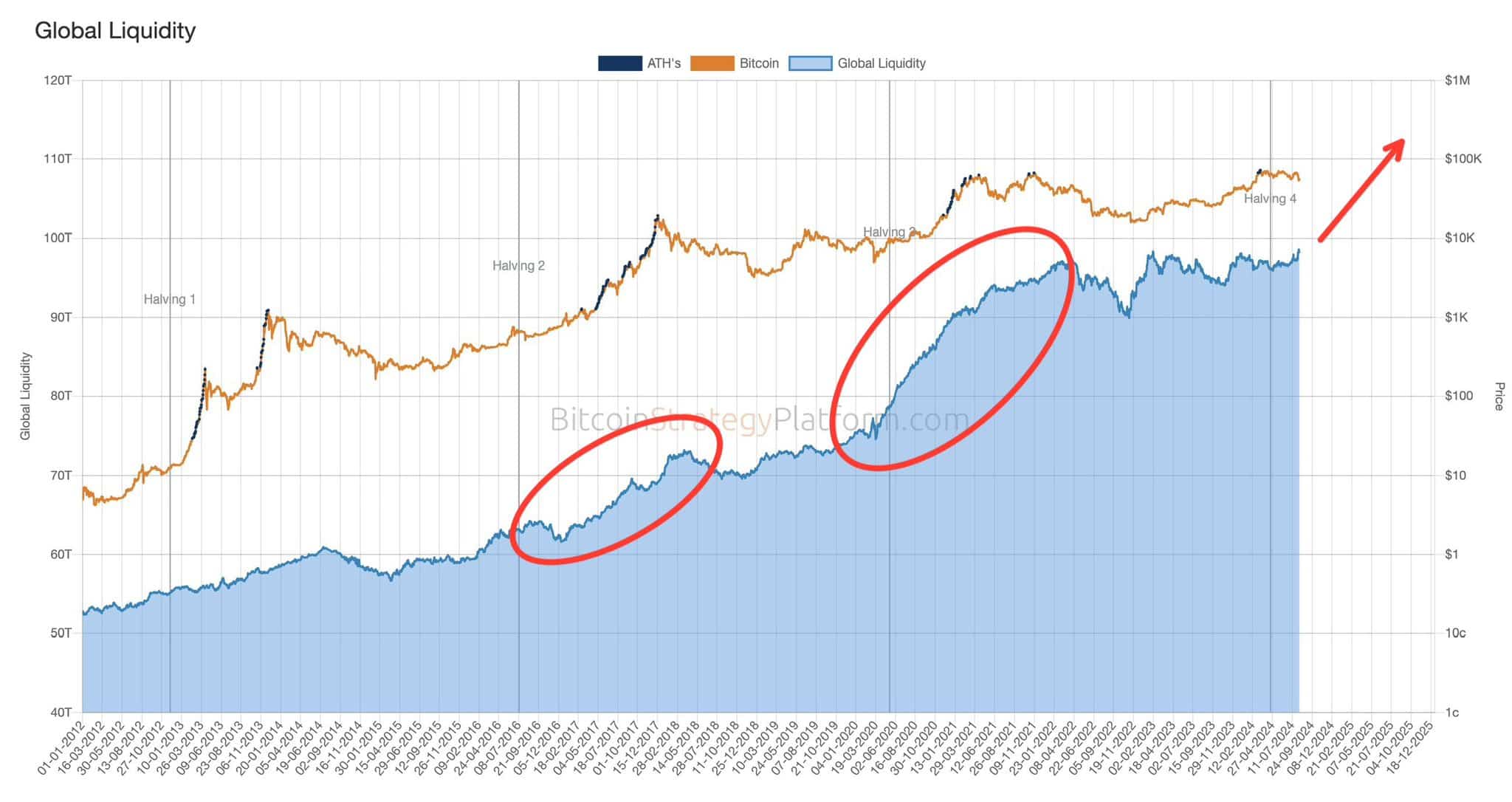

While several factors could affect BTC’s prices, the world’s largest digital asset is a well-known liquidity junkie. Such a spike in global liquidity could set up BTC for an upside potential.

For context, the cycle highs in 2017 and 2021 coincided with an uptick in global liquidity, as noted by one market analyst – Francois Quinten.

“Global liquidity is about to spike up. So is #Bitcoin 💥”

Source: X/Quinten

U.S liquidity to fuel BTC prices

The recent surge in global liquidity isn’t surprising, given the beginning of quantitative easing as central banks cut interest rates. Canada and the U.K, among others, have reduced their interest rates too.

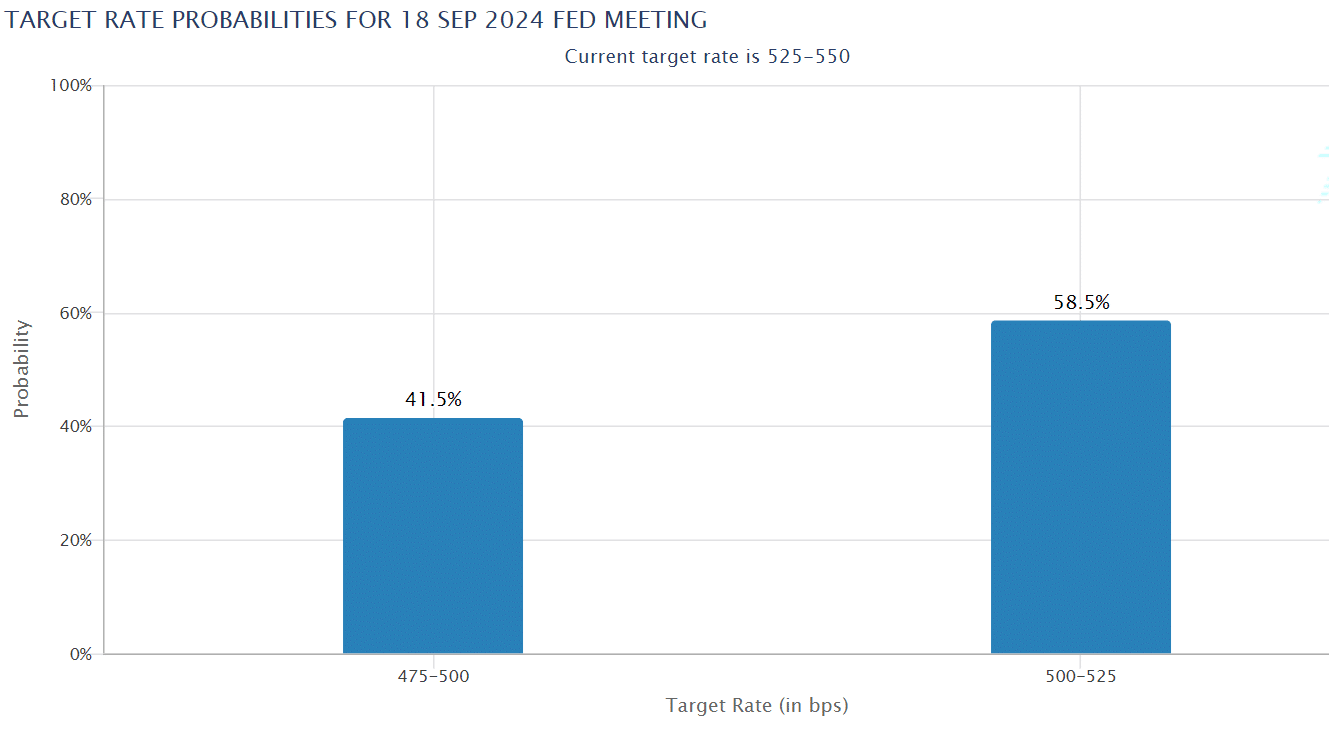

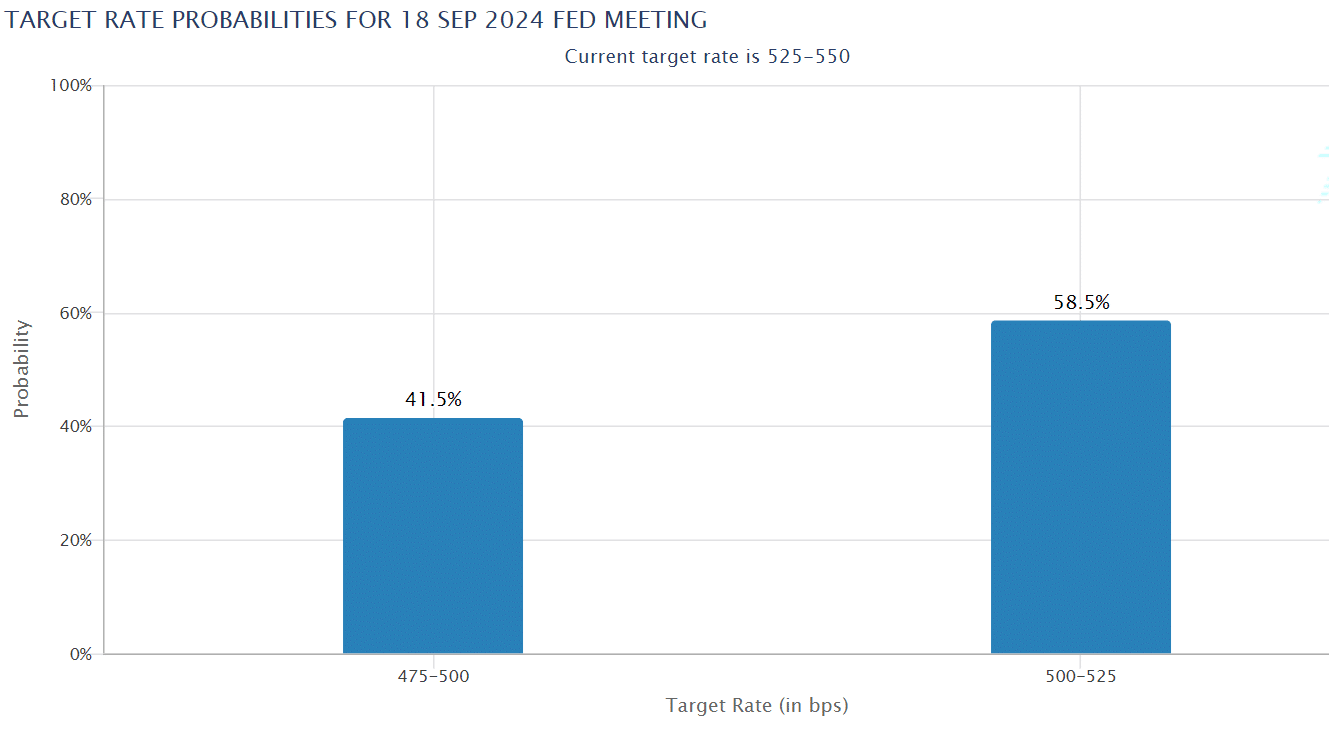

The U.S is expected to begin Fed rate cuts by September, which could further spike global liquidity and affect the cryptocurrency’s prices. At press time, interest rate traders were pricing a near 60%-40% Fed rate cut for 25 and 50 basis points, respectively.

Put differently, traders are now highly convinced of a September Fed rate cut.

Source: CME Fed Watch tool

Apart from the Fed rate cut, the U.S liquidity injection would come from the over $300 billion in T-bills (Treasury bills) the U.S Treasury Department will issue between now and the end of the year.

For the unfamiliar, T-bills are used by the government to raise funds to cover fiscal deficits needed for overall expenditure. In short, positive net issuance of T-bills will increase U.S liquidity.

According to BitMEX founder Arthur Hayes, this U.S liquidity setup would push BTC to $100k and break its sideways-downward trajectory.

“I expect that crypto will exit its sideways-to-downward trajectory starting in September”

In short, BTC could see massive price appreciation from September onwards.

Meanwhile, at the time of writing, the world’s largest cryptocurrency was trading at $60.8k, with BTC facing a short-term sell wall at $63k.

- Global liquidity has surged ahead of a likely hike in U.S money supply

- Given the historical BTC pump amidst the liquidity surge, is another rally likely?

There’s an increasingly favorable macro set-up for Bitcoin [BTC], especially from a liquidity (money supply) perspective. In fact, according to Charles Edwards, Founder of crypto-hedge fund Capriole Investments, the overall global liquidity has exploded above a 4-year consolidation level now.

“Global money supply is exploding up. Plus, we just broke out of a massive 4-year consolidation. What do you think this means for Bitcoin?”

Source: Capriole Investments

While several factors could affect BTC’s prices, the world’s largest digital asset is a well-known liquidity junkie. Such a spike in global liquidity could set up BTC for an upside potential.

For context, the cycle highs in 2017 and 2021 coincided with an uptick in global liquidity, as noted by one market analyst – Francois Quinten.

“Global liquidity is about to spike up. So is #Bitcoin 💥”

Source: X/Quinten

U.S liquidity to fuel BTC prices

The recent surge in global liquidity isn’t surprising, given the beginning of quantitative easing as central banks cut interest rates. Canada and the U.K, among others, have reduced their interest rates too.

The U.S is expected to begin Fed rate cuts by September, which could further spike global liquidity and affect the cryptocurrency’s prices. At press time, interest rate traders were pricing a near 60%-40% Fed rate cut for 25 and 50 basis points, respectively.

Put differently, traders are now highly convinced of a September Fed rate cut.

Source: CME Fed Watch tool

Apart from the Fed rate cut, the U.S liquidity injection would come from the over $300 billion in T-bills (Treasury bills) the U.S Treasury Department will issue between now and the end of the year.

For the unfamiliar, T-bills are used by the government to raise funds to cover fiscal deficits needed for overall expenditure. In short, positive net issuance of T-bills will increase U.S liquidity.

According to BitMEX founder Arthur Hayes, this U.S liquidity setup would push BTC to $100k and break its sideways-downward trajectory.

“I expect that crypto will exit its sideways-to-downward trajectory starting in September”

In short, BTC could see massive price appreciation from September onwards.

Meanwhile, at the time of writing, the world’s largest cryptocurrency was trading at $60.8k, with BTC facing a short-term sell wall at $63k.

Muchas gracias. ?Como puedo iniciar sesion?

clomid remedio order cheap clomiphene tablets can i get cheap clomiphene without prescription get cheap clomid prices clomid price at clicks how to buy clomid no prescription can i buy clomiphene no prescription

More delight pieces like this would create the интернет better.

More text pieces like this would insinuate the web better.

buy zithromax – order sumycin 500mg flagyl 400mg brand

buy cheap semaglutide – order rybelsus 14mg online cheap periactin medication

buy domperidone 10mg pills – buy generic sumycin over the counter cyclobenzaprine 15mg generic

inderal 10mg over the counter – cost clopidogrel order methotrexate 5mg generic

augmentin 1000mg us – atbioinfo ampicillin us

buy cheap generic nexium – anexa mate esomeprazole 40mg cheap

coumadin over the counter – https://coumamide.com/ buy cheap hyzaar

meloxicam 15mg pills – https://moboxsin.com/ buy mobic 7.5mg for sale

buy deltasone 5mg pill – corticosteroid deltasone 10mg canada

best male ed pills – buy ed pills cheap herbal ed pills

purchase amoxil pill – purchase amoxil online cheap order generic amoxil

order diflucan pill – https://gpdifluca.com/# buy diflucan 200mg pill

cenforce 50mg brand – https://cenforcers.com/# buy cenforce 100mg online

buying cialis online canadian order – https://ciltadgn.com/ where can i buy cialis on line

buy ranitidine 300mg pill – https://aranitidine.com/ ranitidine online

tadalafil citrate – where to buy liquid cialis cialis tubs

This is a keynote which is near to my heart… Myriad thanks! Exactly where can I find the acquaintance details an eye to questions? buy tamoxifen for sale

cheap generic viagra uk online – https://strongvpls.com/# cheap viagra buy online

This is the gentle of scribble literary works I in fact appreciate. https://buyfastonl.com/amoxicillin.html

With thanks. Loads of knowledge! https://ursxdol.com/furosemide-diuretic/

I am in truth happy to glance at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://prohnrg.com/product/atenolol-50-mg-online/

The thoroughness in this draft is noteworthy. generique du levitra

This is the amicable of glad I enjoy reading. https://ondactone.com/spironolactone/

Thanks on sharing. It’s acme quality.

buy ranitidine for sale

Thanks recompense sharing. It’s outstrip quality. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4712

cost forxiga 10 mg – this pill dapagliflozin 10 mg

order generic orlistat – https://asacostat.com/ xenical 60mg canada