- Trump has maintained a lead over Kamala across all prediction sites and models.

- BTC options traders were heavily bullish on the election outcome expectations.

All prediction sites and top models revealed that pro-Bitcoin [BTC] candidate Donald Trump has a higher chance of winning the upcoming US presidential elections.

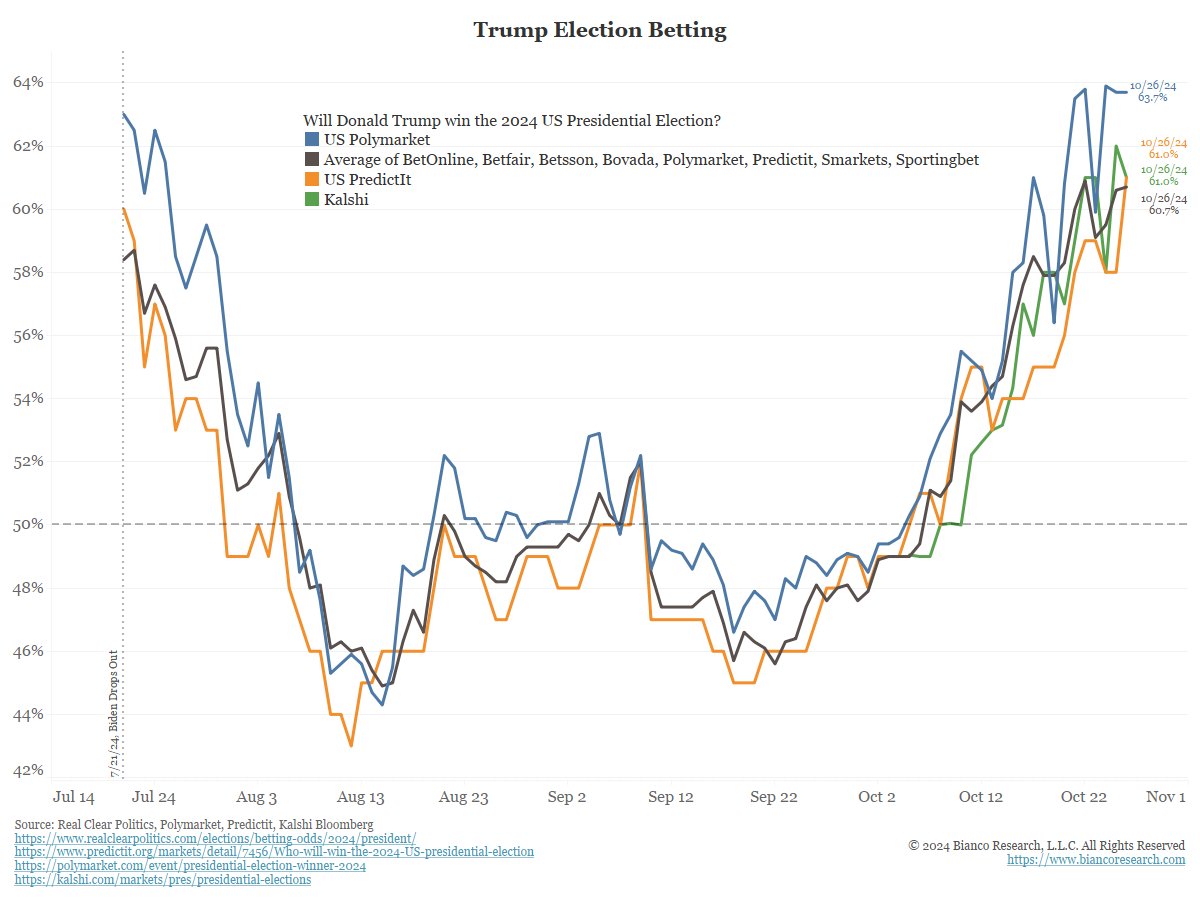

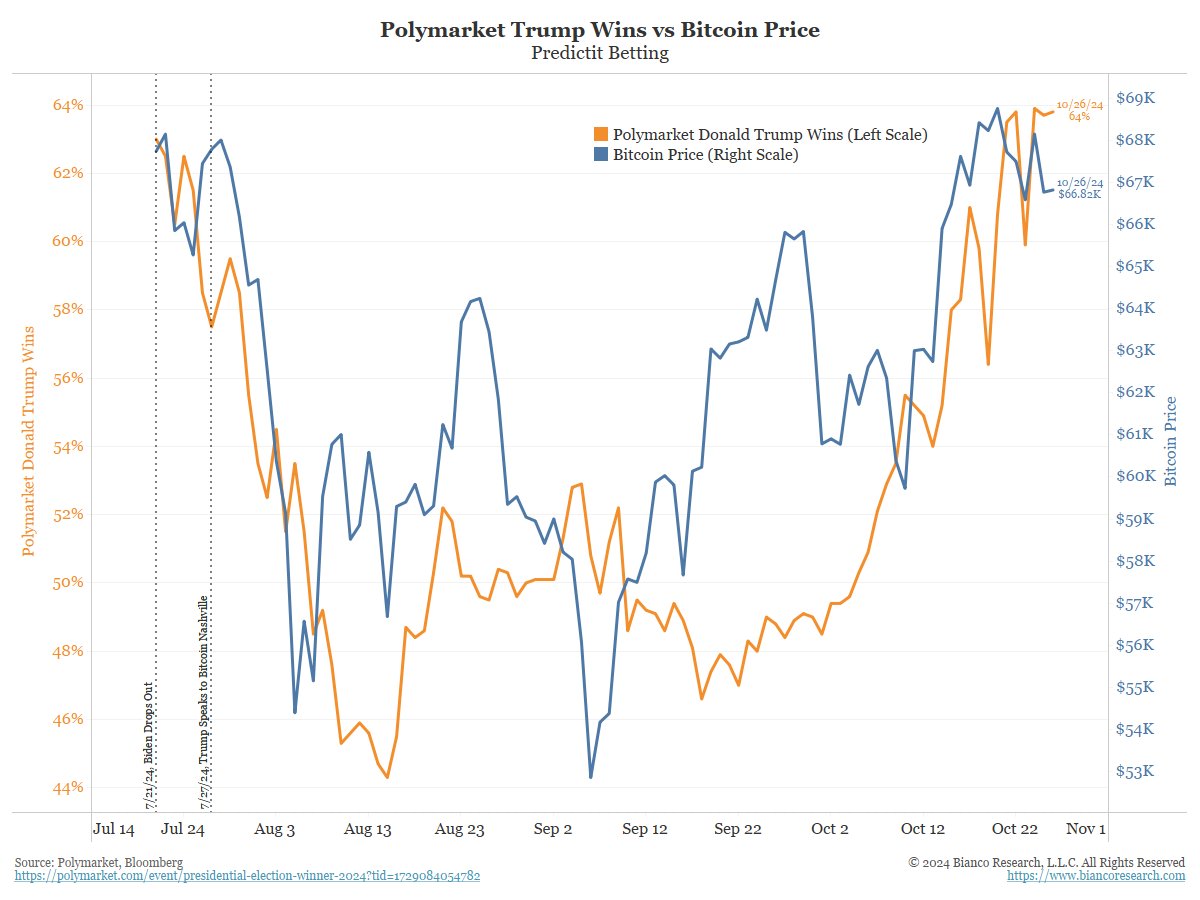

According to the latest review by analyst Jim Bianco of Bianco Research, prediction sites like Polymarket, Kalshi, PredictIt, and others were polling a +60% chance of Trump winning.

Source: Bianco Research

Potential impact on BTC

Although some platforms like Polymarket have recently faced criticism of alleged manipulation, other reliable models leaned towards Trump.

Bianco noted that top election models, such as Silver Bulletin and two other popular models, also showed a high probability of +50% of a Trump win.

“Silver is not the only one with an election model. Silver Bulletin, FiveThirtyEight, Economist Magazine. They all have Trump in an uptrend of over 50%.”

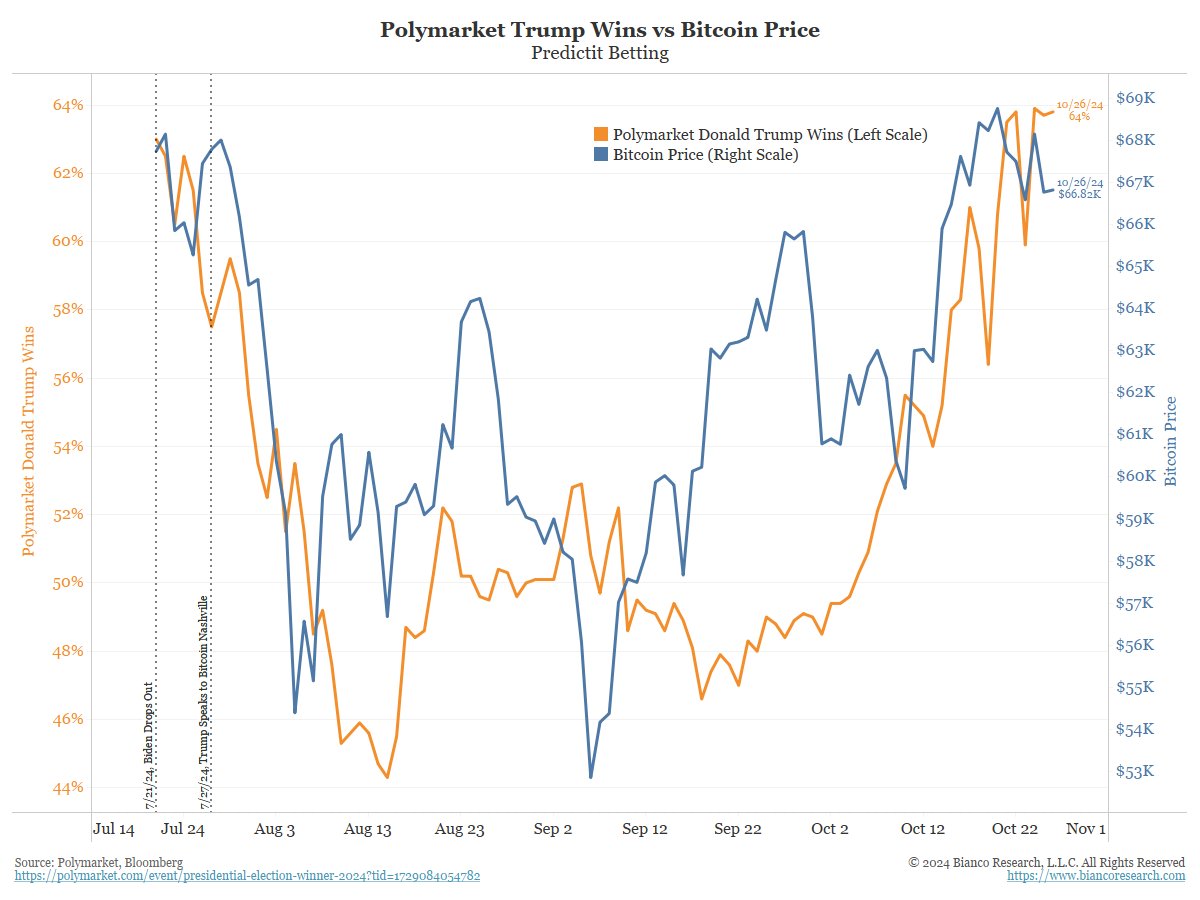

This above expectation has been deemed bullish by speculators in BTC markets.

Notably, BTC exploded in the past few weeks as Trump’s odds surged and crossed 60% on Polymarket. It pushed BTC to nearly $70K. Commenting on the correlation, Bianco termed it an ‘election play,’

“And another election play, although this relationship might be “fraying” in recent days.”

Source: Bianco Research

Market positioning

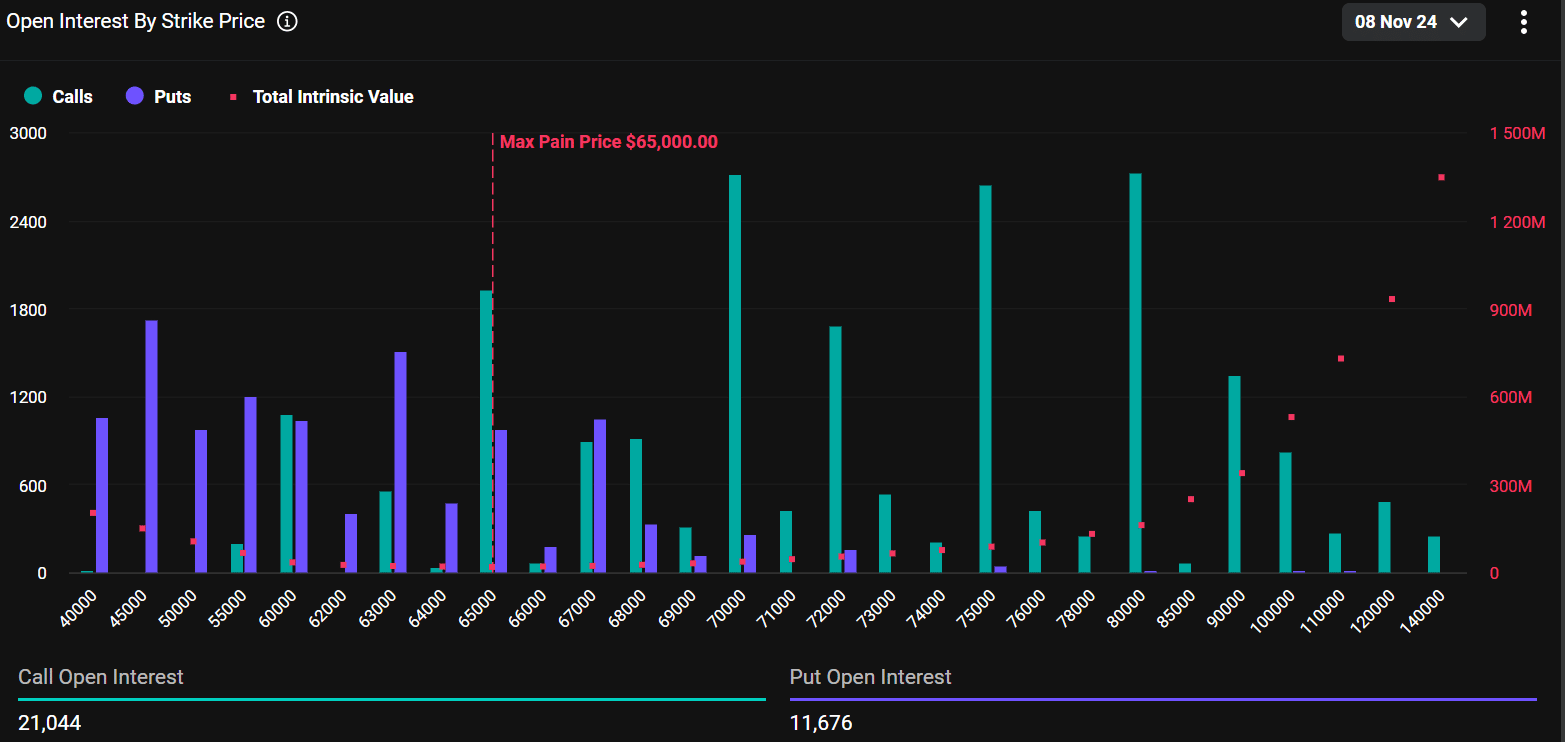

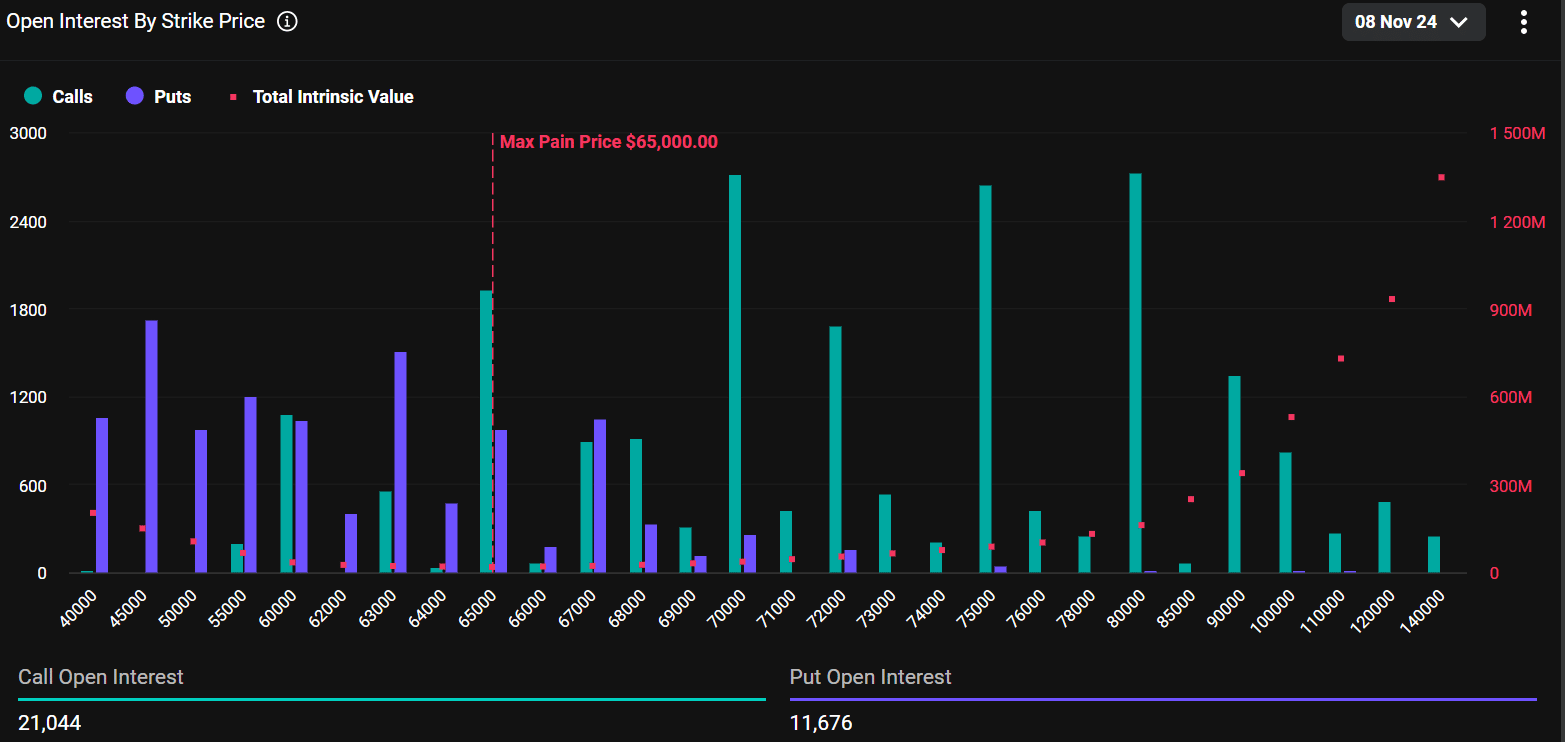

Perhaps the most evident impact of the above bullish expectation on Trump’s win was in the BTC options market. Last week, options traders were pricing a 20% chance of BTC hitting $80K by the end of November.

The sentiment was unchanged at press time. According to Deribit data, there was nearly twice as much Open Interest in call options (betting price rally) than in put options (price decline) for contracts expiring by 8th November.

Source: Deribit

Additionally, the put/call ratio (PCR), which tracks options market sentiment, was at 0.55.

For context, if the ratio is above 1, then there are more put options than calls, a bearish sentiment. On the other hand, a value below 1 means dominance of call options, underscoring bullish sentiment.

That said, the 0.55 PCR reading painted an extremely bullish sentiment in the options market, perhaps due to speculators’ assumption that Trump was likely to win.

However, given Harris’s increasingly pro-crypto stance too, BTC options traders were confident that the asset could hit a new all-time high (ATH) regardless of who wins the US elections.

In the meantime, BTC was valued at $67K at press time, about 9% away from its ATH of $73.7K.

- Trump has maintained a lead over Kamala across all prediction sites and models.

- BTC options traders were heavily bullish on the election outcome expectations.

All prediction sites and top models revealed that pro-Bitcoin [BTC] candidate Donald Trump has a higher chance of winning the upcoming US presidential elections.

According to the latest review by analyst Jim Bianco of Bianco Research, prediction sites like Polymarket, Kalshi, PredictIt, and others were polling a +60% chance of Trump winning.

Source: Bianco Research

Potential impact on BTC

Although some platforms like Polymarket have recently faced criticism of alleged manipulation, other reliable models leaned towards Trump.

Bianco noted that top election models, such as Silver Bulletin and two other popular models, also showed a high probability of +50% of a Trump win.

“Silver is not the only one with an election model. Silver Bulletin, FiveThirtyEight, Economist Magazine. They all have Trump in an uptrend of over 50%.”

This above expectation has been deemed bullish by speculators in BTC markets.

Notably, BTC exploded in the past few weeks as Trump’s odds surged and crossed 60% on Polymarket. It pushed BTC to nearly $70K. Commenting on the correlation, Bianco termed it an ‘election play,’

“And another election play, although this relationship might be “fraying” in recent days.”

Source: Bianco Research

Market positioning

Perhaps the most evident impact of the above bullish expectation on Trump’s win was in the BTC options market. Last week, options traders were pricing a 20% chance of BTC hitting $80K by the end of November.

The sentiment was unchanged at press time. According to Deribit data, there was nearly twice as much Open Interest in call options (betting price rally) than in put options (price decline) for contracts expiring by 8th November.

Source: Deribit

Additionally, the put/call ratio (PCR), which tracks options market sentiment, was at 0.55.

For context, if the ratio is above 1, then there are more put options than calls, a bearish sentiment. On the other hand, a value below 1 means dominance of call options, underscoring bullish sentiment.

That said, the 0.55 PCR reading painted an extremely bullish sentiment in the options market, perhaps due to speculators’ assumption that Trump was likely to win.

However, given Harris’s increasingly pro-crypto stance too, BTC options traders were confident that the asset could hit a new all-time high (ATH) regardless of who wins the US elections.

In the meantime, BTC was valued at $67K at press time, about 9% away from its ATH of $73.7K.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Wow! Thank you! I always needed to write on my website something like that. Can I take a part of your post to my website?

Este site é realmente fantástico. Sempre que acesso eu encontro novidades Você também pode acessar o nosso site e descobrir detalhes! conteúdo único. Venha saber mais agora! 🙂

I’m impressed, I must say. Really not often do I encounter a blog that’s both educative and entertaining, and let me inform you, you will have hit the nail on the head. Your concept is excellent; the problem is one thing that not enough people are talking intelligently about. I’m very pleased that I stumbled across this in my search for one thing relating to this.

Merely wanna input on few general things, The website style is perfect, the content material is very excellent. “All movements go too far.” by Bertrand Russell.

buy clomiphene without prescription clomiphene without insurance can i get cheap clomid how to get cheap clomid without prescription how to get generic clomiphene no prescription buy clomid no prescription order generic clomiphene pills

Proof blog you procure here.. It’s severely to assign strong quality article like yours these days. I really recognize individuals like you! Withstand vigilance!!

More articles like this would pretence of the blogosphere richer.

zithromax brand – buy azithromycin 500mg online flagyl 400mg cheap

rybelsus pill – order periactin 4 mg generic buy generic cyproheptadine over the counter

Good day! This is kind of off topic but I need some guidance from an established blog. Is it tough to set up your own blog? I’m not very techincal but I can figure things out pretty quick. I’m thinking about creating my own but I’m not sure where to start. Do you have any ideas or suggestions? Thank you

buy domperidone 10mg without prescription – order sumycin 250mg generic cyclobenzaprine 15mg pills